NCERT Solution (Part - 1) - Accounting for Not for Profit Organisation | SSC CGL Tier 2 - Study Material, Online Tests, Previous Year PDF Download

Page Number 474

Short answers:

Q1: State the meaning of 'Not-for-Profit' Organisations.

Answer: Not-for-Profit Organisations (NPO) are set up with the prime objective of providing services and not to earn profit thereby enhancing the welfare of society. Such organisations include schools, hospitals, trade unions, religious organisations, etc. The person/s or the groups of individuals who govern and manage the working of an NPO are known as trustees. NPO's main sources of income are donations, subscriptions, life membership fees, grants etc. As these organisations are not set up with profit motive, they do not prepare Trading and Profit and Loss Account. Instead, they maintain Receipt and Payments Account, Income and Expenditure Account and Balance Sheet.

Q2: State the meaning of Receipt and Payment Account.

Answer: Receipts and Payments Account is a summary of the Cash Book. All cash receipts are recorded on the Receipts side (i.e. Debit side) and all cash payments are recorded on the Payments side (i.e. Credit side) of Receipts and Payments Account. It is prepared on the basis of cash and bank transactions recorded in the Cash Book. It begins with the opening balance of cash and bank and ends with the closing balances of cash and bank (balancing figure) at the end of the accounting period. It records all cash and bank transactions both of capital and revenue nature. It not only records the cash and bank transactions relating to the current accounting period, but also the cash and bank receipts (or payments) received during the current accounting period that may be related to the previous or next accounting period. This account only helps us to ascertain the closing balance of the cash and bank and helps in assessing the cash position of an NPO.

Q3: State the meaning of Income and Expenditure Account.

Answer: Income and Expenditure Account (I&E) is similar to the Profit and Loss Account in the sense that while the former is prepared to ascertain surplus or deficit during an accounting period, the latter is prepared to ascertain net profit or net loss incurred during an accounting period. I&E Account is a nominal account and is prepared on the accrual basis. It records all transactions of revenue nature that are related to the current accounting period (whether outstanding or prepaid) for which the books are maintained. All expenses and losses are recorded on the debit side (Expenditure side) and all income and gains are recorded on the credit side (Income side) of I&E Account. The closing balance or the balancing figure of I&E Account is termed as surplus (or deficit), if the sum total of the Income side exceeds (is lesser than) the sum total of the Expenditure side.

Q4: What are the features of Receipt and Payment Account?

Answer: The following are the features of Receipt and Payment Account:

- Nature: It is a Real Account. It is a summarised version of Cash Book.

- Nature of Transactions: It records only cash and bank transactions. Transactions other than cash and bank like depreciation, loss/ profit on sale of assets, etc. are not

recorded in this account. - No distinction between Capital and Revenue items: It records all cash and bank receipts and payments of both capital and revenue nature.

- Opening and closing balance: It begins with the opening balance of cash and bank and ends with the closing balance of the cash and bank (balancing figure) at the end of the accounting period.

- Purpose: It reveals the cash position of an organisation. It helps to ascertain the total amount paid and received during an accounting period.

Q5: What steps are taken to prepare Income and Expenditure Account from a Receipt and Payment Account?

Answer: The following steps are taken to prepare Income and Expenditure Account (I&E) from Receipts and Payment Account (R&P).

Step 1: All the revenue expenditures paid for the current accounting period are transferred from the Payments side of R&P to the Expenditure side of I&E.

Step 2: All the revenue receipts for the current accounting period are transferred from the Receipts side of R&P to the Income side of I&E.

Step 3: Expenses outstanding for the current period and expenses paid in advance (prepaid expenses) for the current period in the preceding accounting periods are to be

added (adjusted) to their related expenses in the Step 1.

Step 4: Income outstanding (accrued income) for the current period and income received in advance for the current period in the preceding accounting periods are to be

added (adjusted) to their related incomes in Step 2.

Step 5: Non-cash items like depreciation, appreciation for the current accounting period are to be adjusted in the I&E.

Step 6: After adjusting all the revenue items for the current accounting period, the Income and the Expenditure sides are totaled. If the sum total of the Income side exceeds (or is lesser than) the sum total of the Expenditure side, then the balancing figure is termed as surplus (or deficit).

Q6: What is subscription? How is it calculated?

Answer: Subscription is the main source of income for an NPO besides entrance fees, donations, grants, etc. Subscriptions refer to the amount of money paid by the members on periodic basis for keeping their membership with the organisation alive. It is paid monthly, quarterly, half yearly or annually by the members. It is shown in the debit side of the Receipt and Payment Account with the total amount received during the year that may be related to the current period and to the previous and next accounting period.

While calculating subscription for the current period, advance subscription received for the current period in the previous period and outstanding subscription for the current period are added to the subscription received during the current period. Whereas, on the other hand, advance subscription received for the next accounting period during the current period and outstanding subscription for the preceding period are deducted from the subscription received during the current period.

Calculation of Subscription

Subscription received during the year

Add: Subscription received (in advance) during previous year for current year

Add: Subscription outstanding at the end of the year

Less: Subscription received in advance for the next year

Less: Subscription outstanding for the previous year

## Subscription shown in Income and Expenditure Account

## This subscription is related to the current accounting period and is shown in the Income side

of the Income and Expenditure Account.

Q7: What is Capital Fund? How is it calculated?

Answer: Capital fund is the excess of NPOs' assets over its liabilities. In other words, the excess of assets over the liabilities for a profit earning organisation is termed as capital and the same for an NPO is termed as capital fund. Any surplus or deficit ascertained from Income and Expenditure account is added to (deducted from) the capital fund. It is also termed as Accumulated Fund.

Calculation of Capital Fund

Page Number 474

Numerical questions:

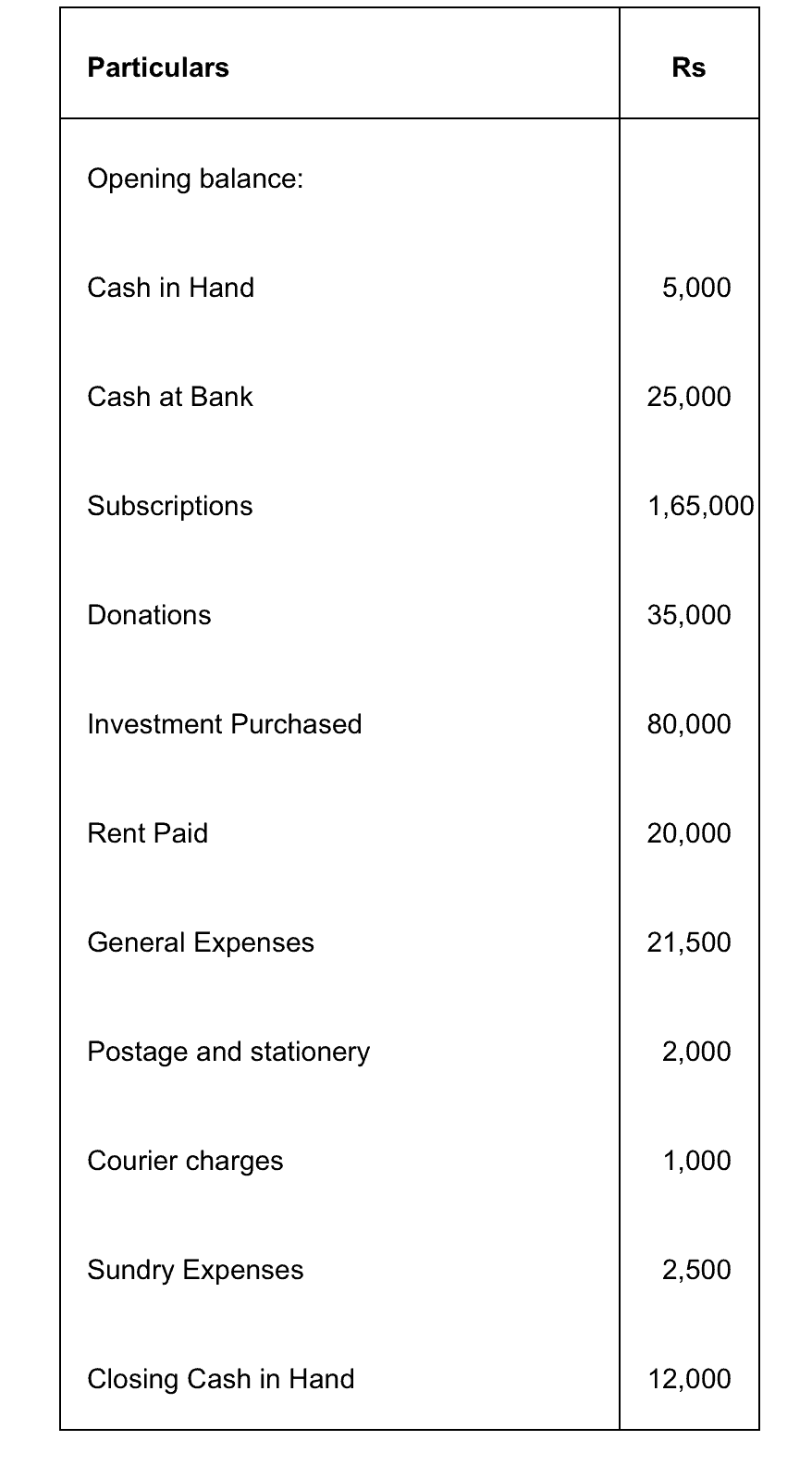

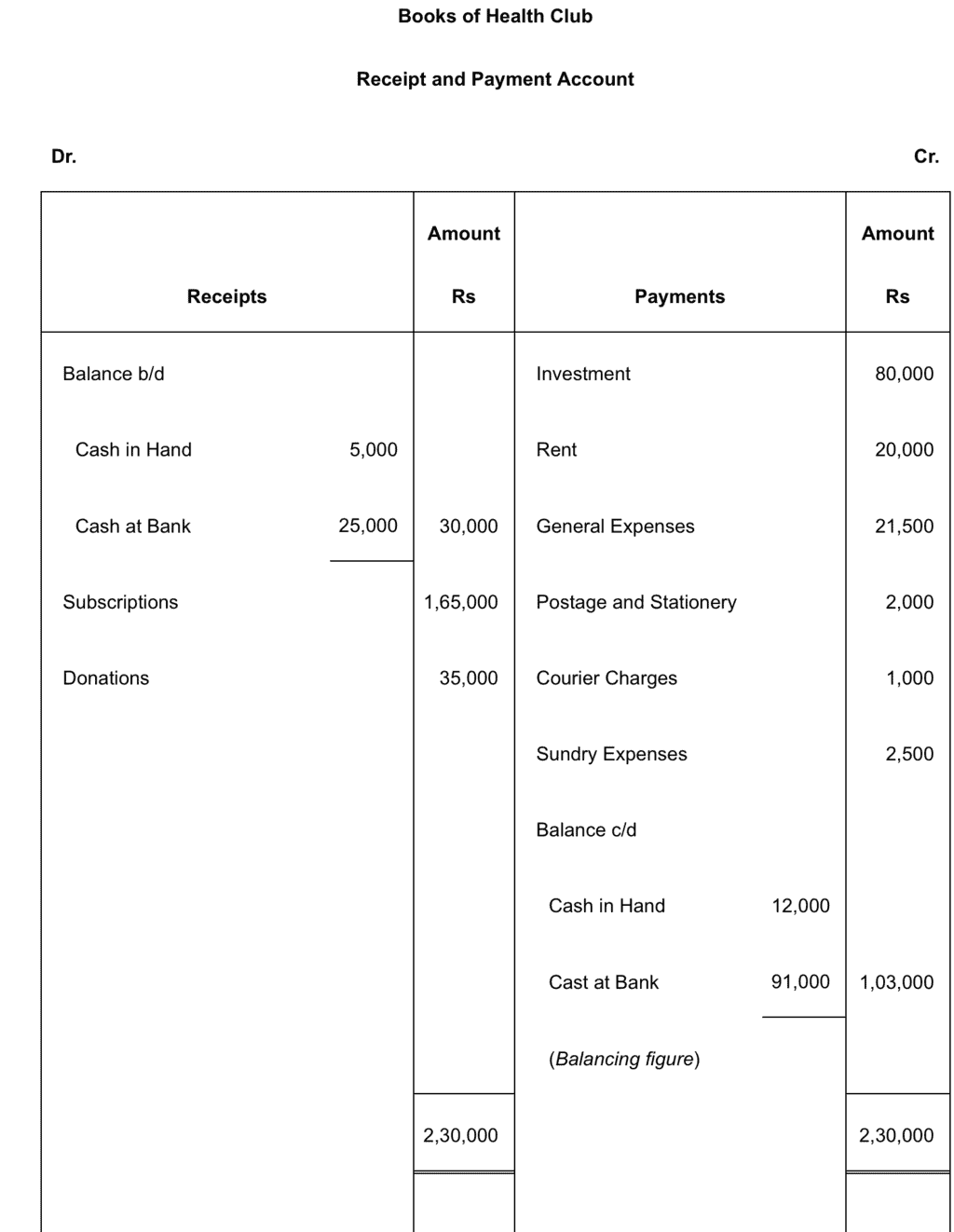

Q1: From the following particulars taken from the Cash Book of a health club, prepare a Receipts and Payments Account.

Answer:

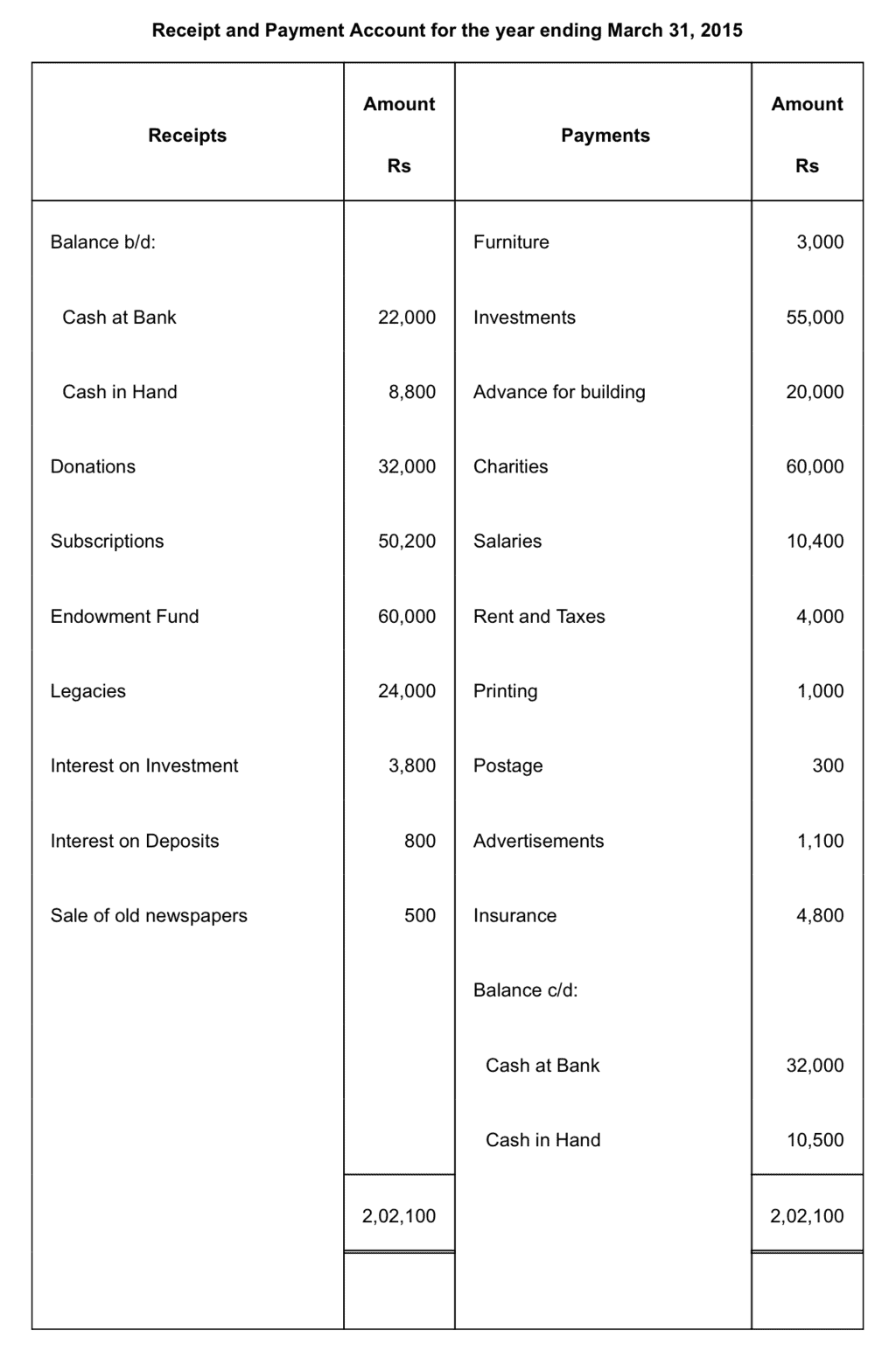

Q2: The Receipt and Payment Account of Harimohan charitable institution is given:

Receipt and Payment Account for the year ending March 31, 2007.

Prepare the Income and Expenditure Account for the Year ended on March 31, 2007 after considering the following:

- It was decided to treat Fifty per cent of the amount received on account of Legacies and Donations as income.

- Liabilities to be provided for are: Rent Rs 800; Salaries Rs 1,200; advertisement Rs 200.

- Rs 2,000 due for interest on investment was not actually received.

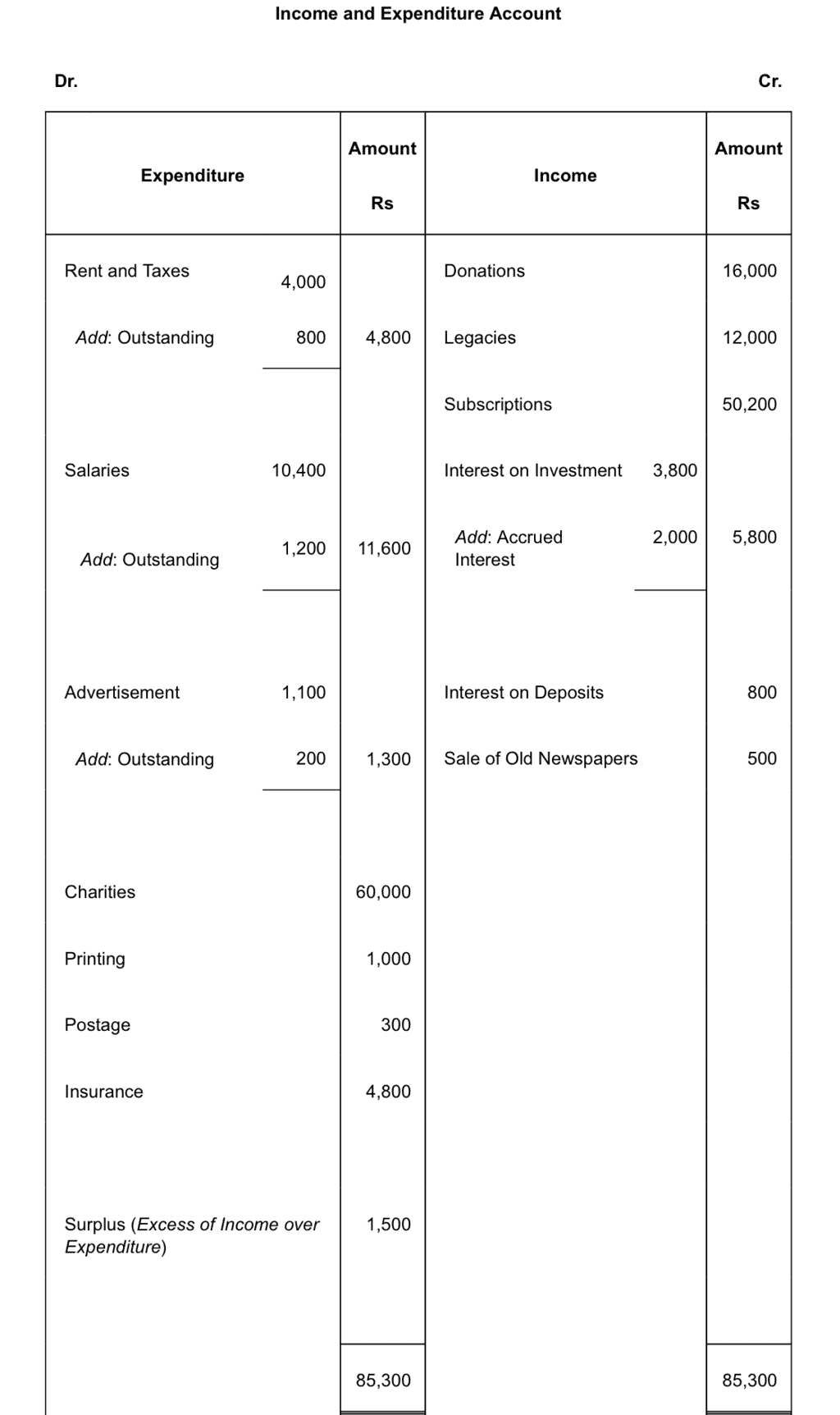

Answer :

NOTE: As per the solution, Excess of Income over Expenditure is Rs 1,500; however, as per the book, it is Rs 2,500.

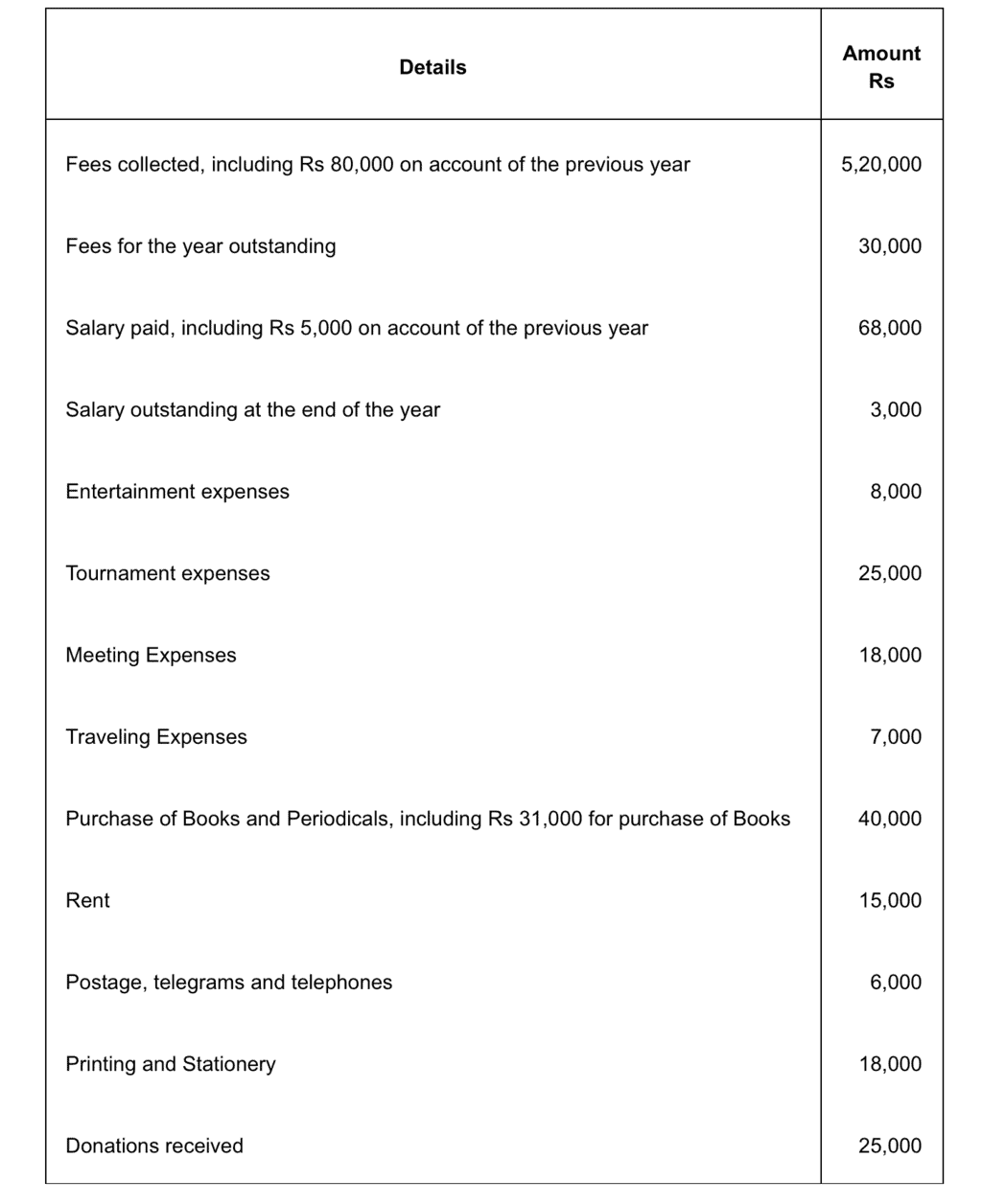

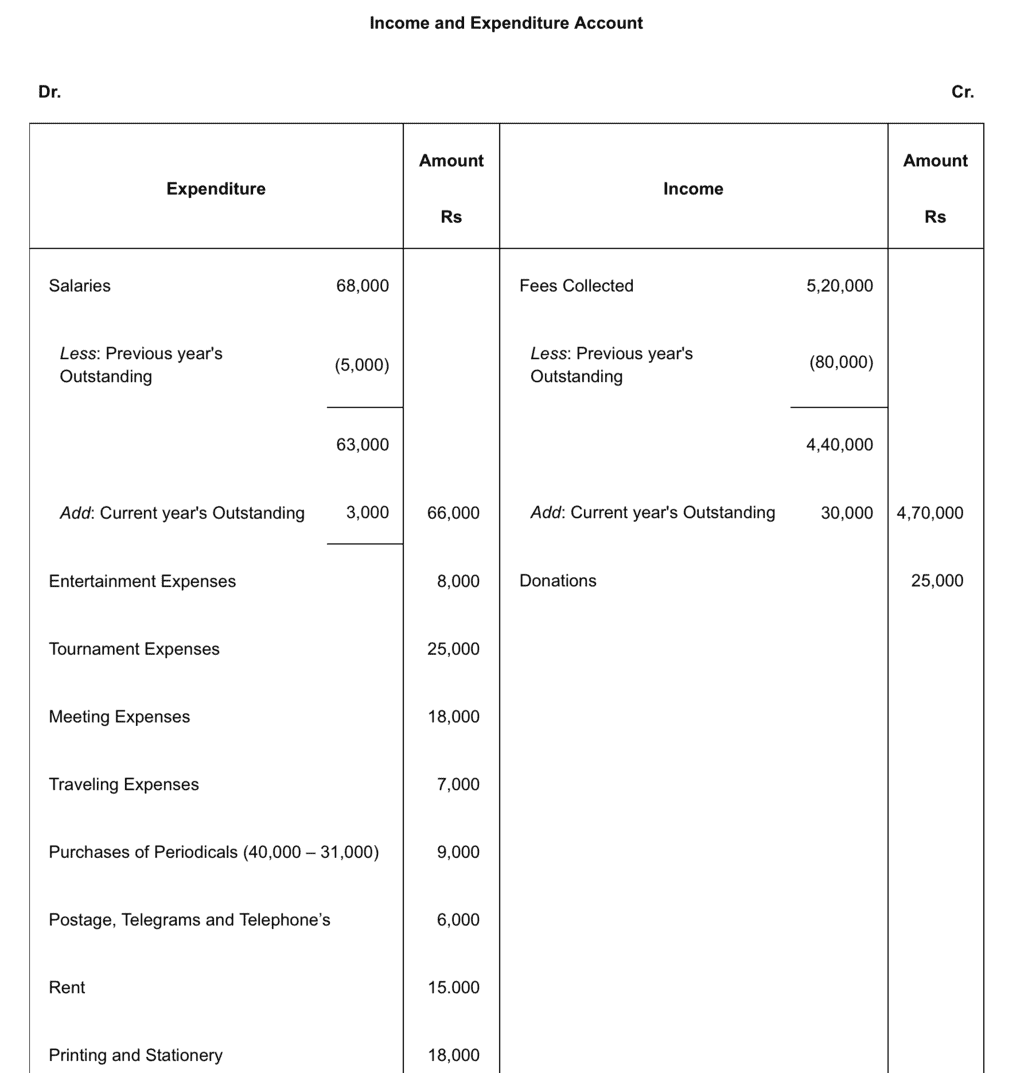

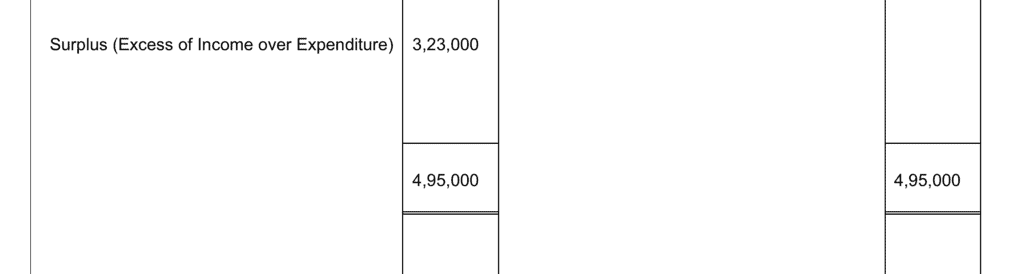

Q3: From the following particulars, prepare Income and Expenditure account:

Answer:

NOTE: As per the solution, Excess of Income over Expenditure is Rs 3,23,000; however, as per the book, it is Rs 3,07,000.

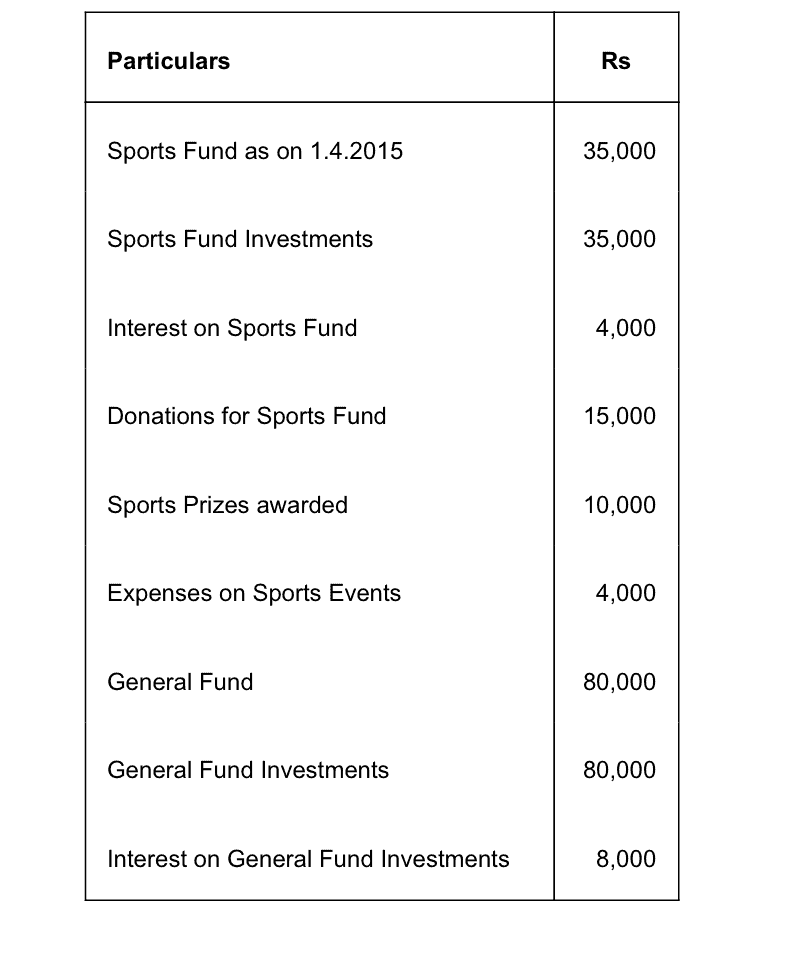

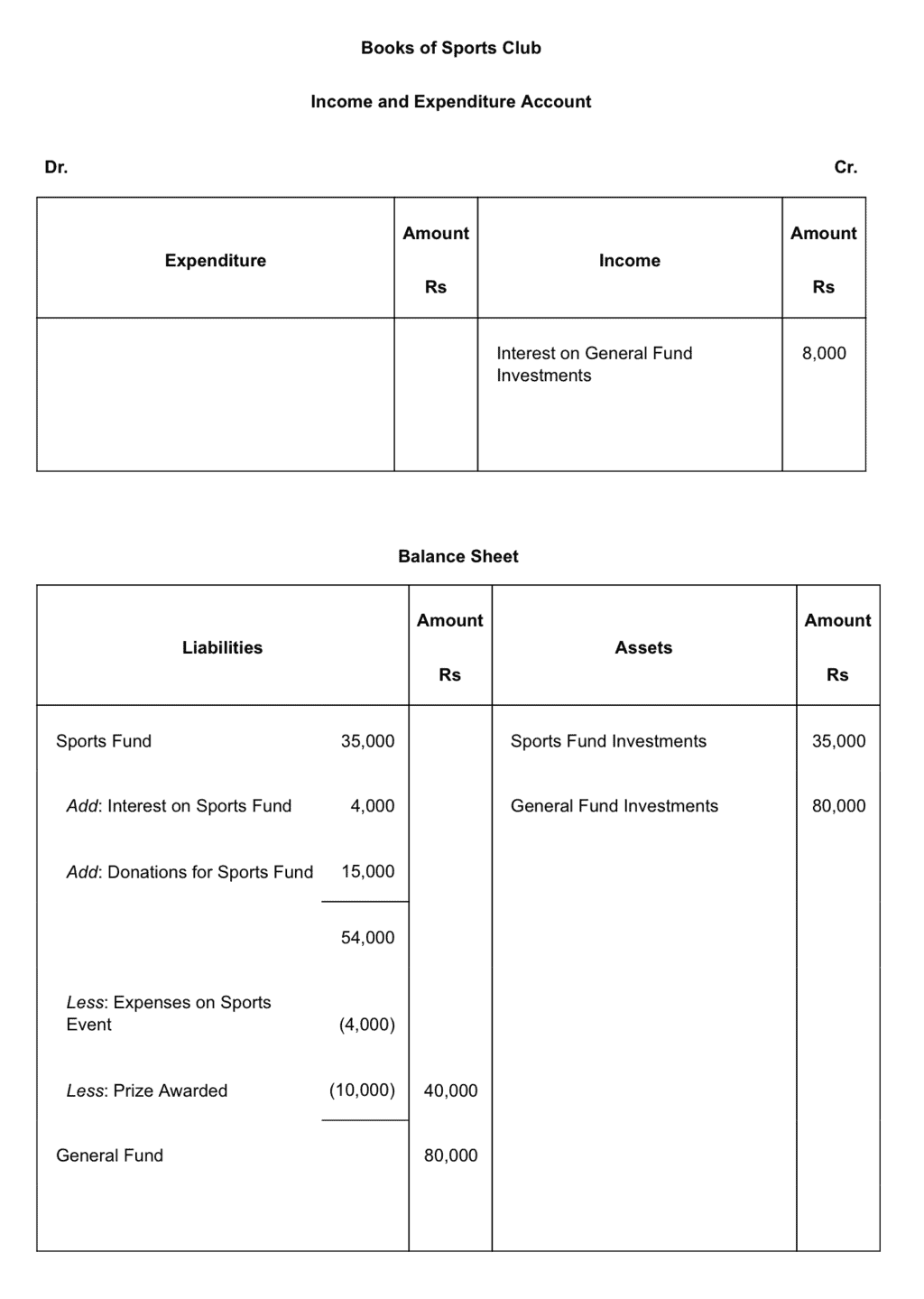

Q4: Following is the information given in respect of certain items of a Sports Club. Show these items in the Income and Expenditure Account and the Balance Sheet of the Club:

Answer :

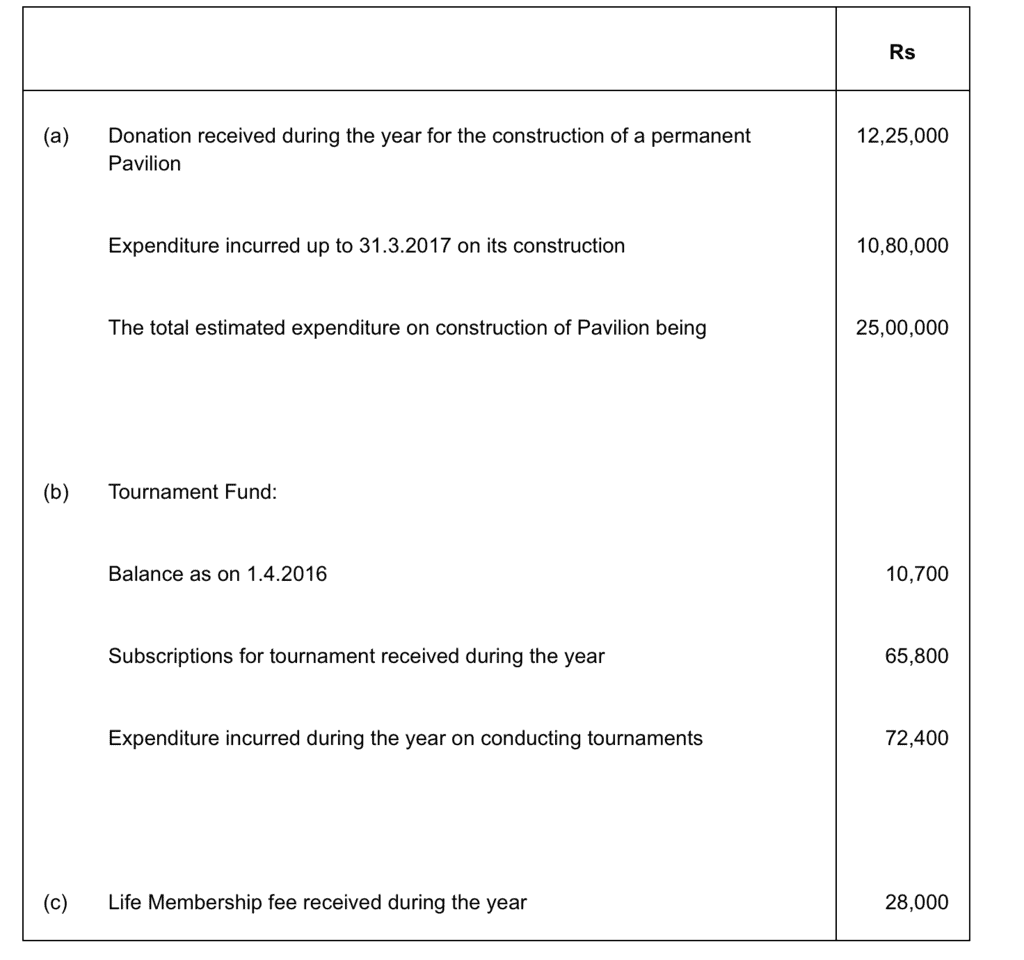

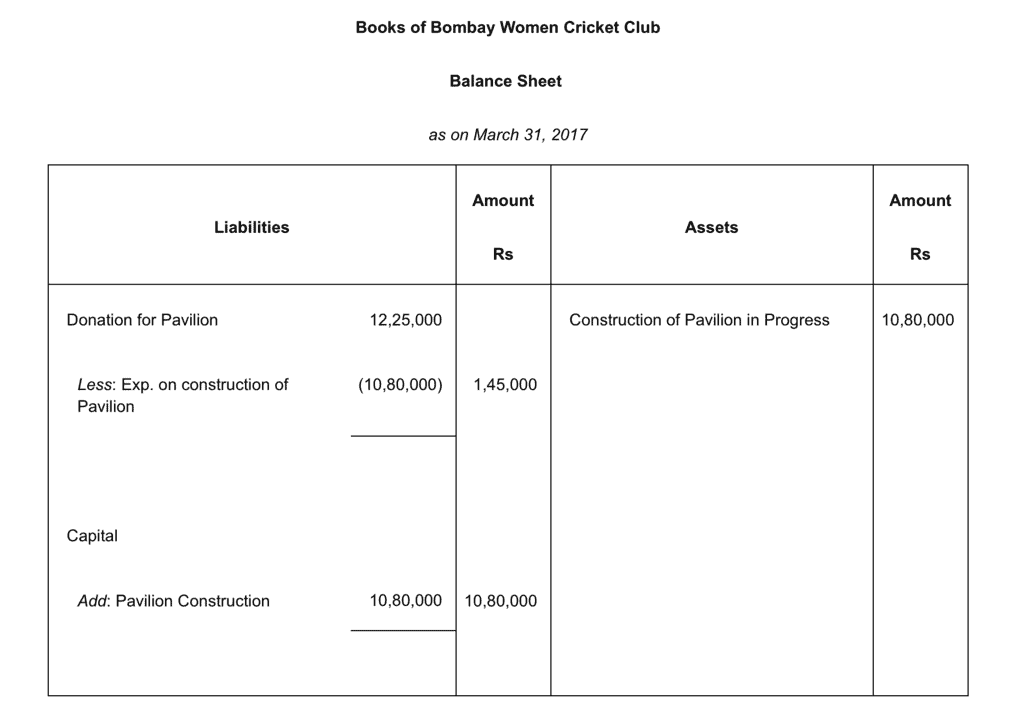

Q5: How will you deal with the following items while preparing for the Bombay Women Cricket Club its income and expenditure account for the year ending 31.3.2007 and its Balance Sheet as on 31.3.2007:

Give reasons for your answer.

Answer :

(a)

Reason:

Donation for construction of Pavilion is a donation for specific purpose.

Expenses on construction on Pavilion is a capital expenditure.

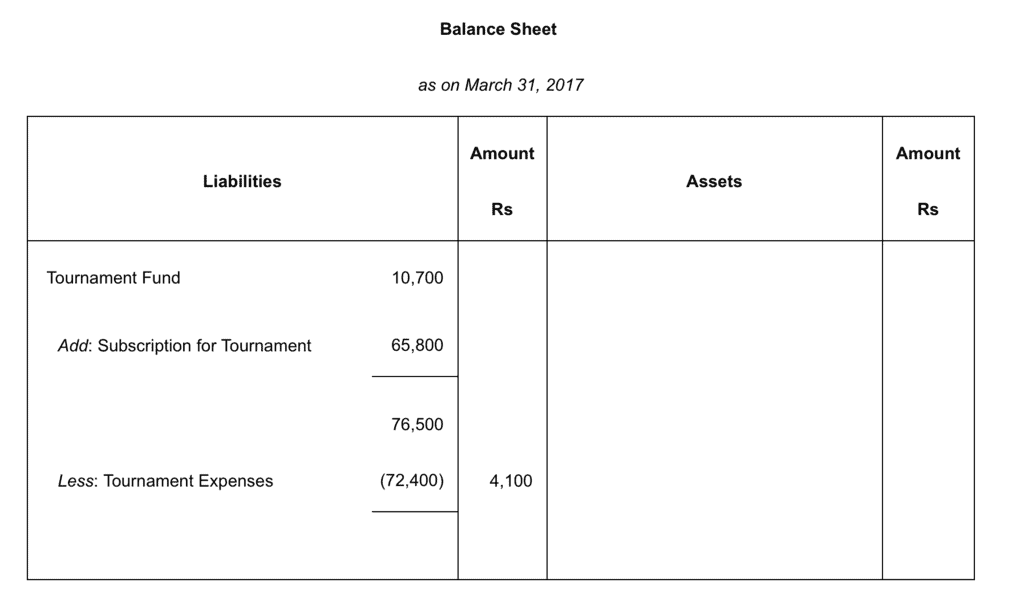

(b)

Reason:

All funds received are treated as capital receipts and expenses related to any fund are deduced from the concerned funds.

(c)

Reason:

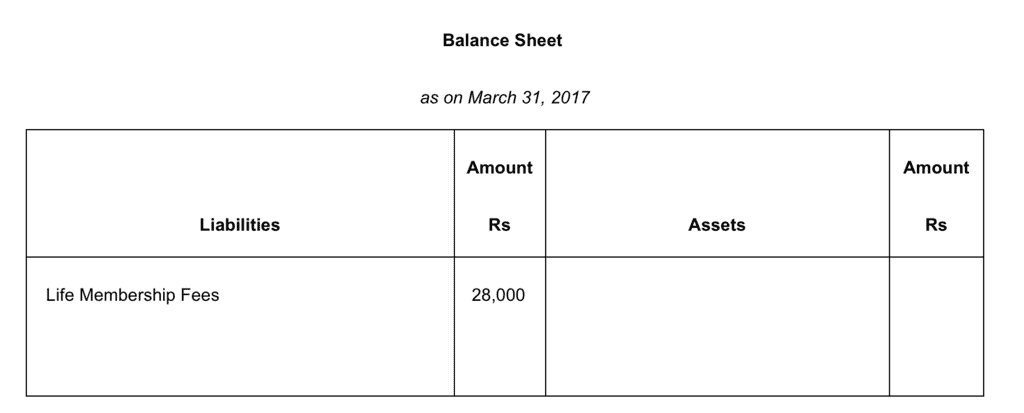

Life Membership Fees are considered as capital receipts and are shown on the Liabilities side of the Balance Sheet, if nothing is specified about its treatment. But if it is to be treated as revenue item, then it is shown on the credit side of the Income and Expenditure Account.

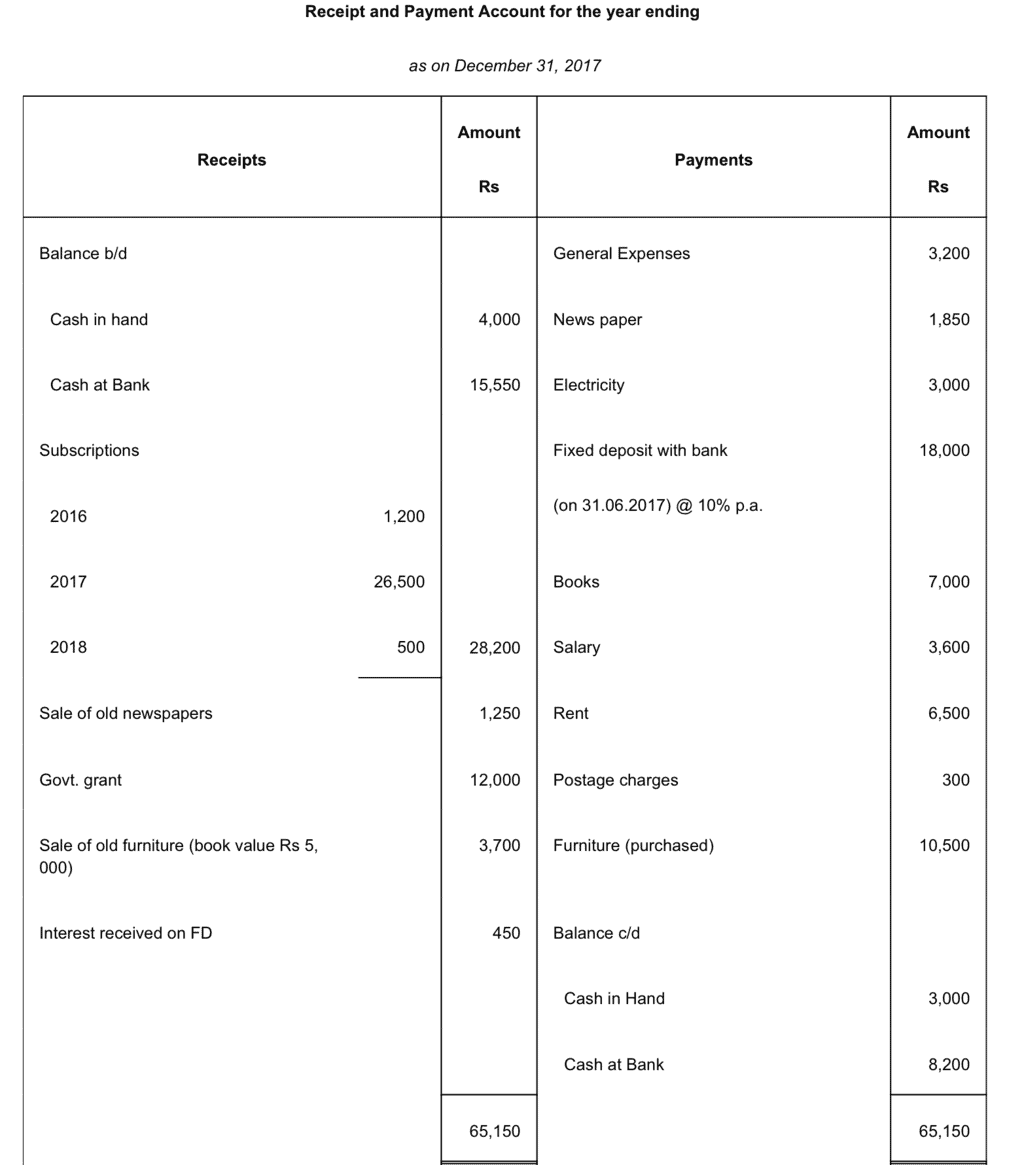

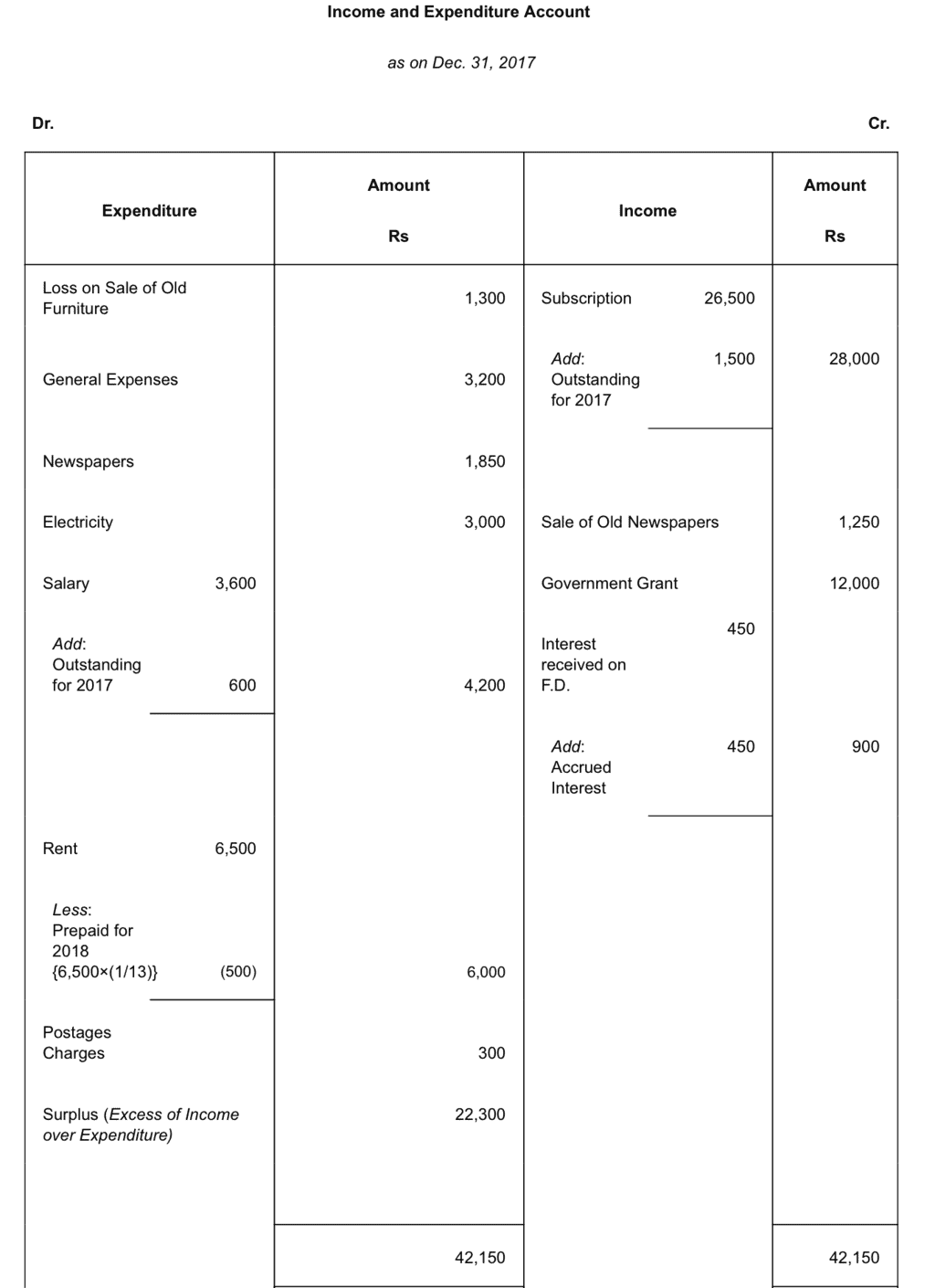

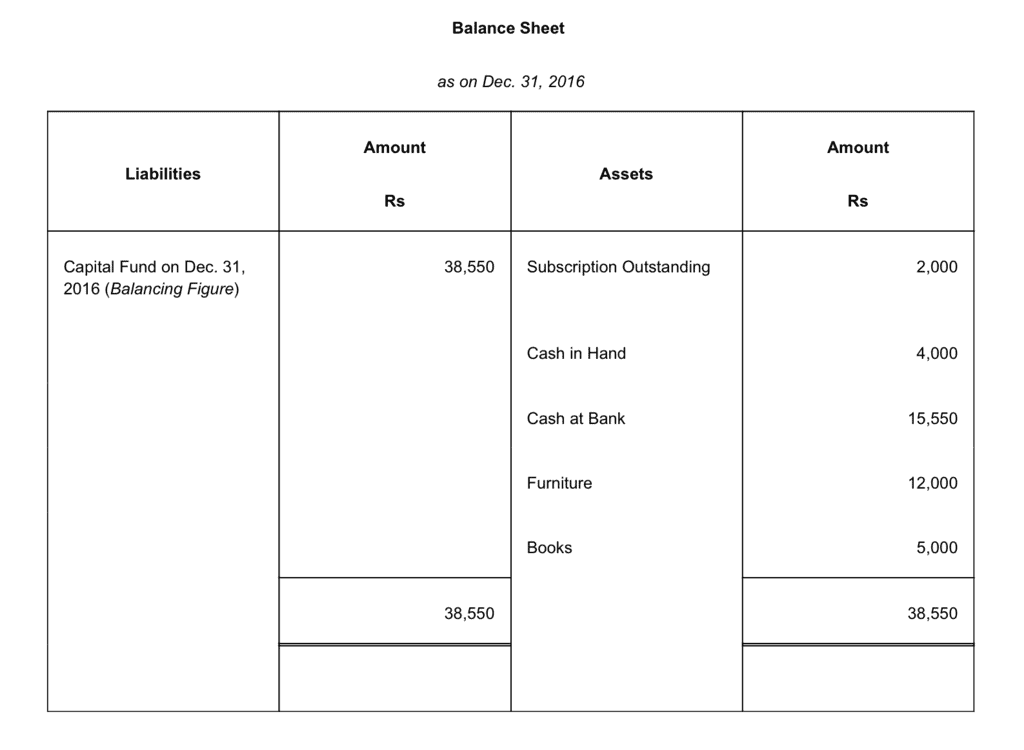

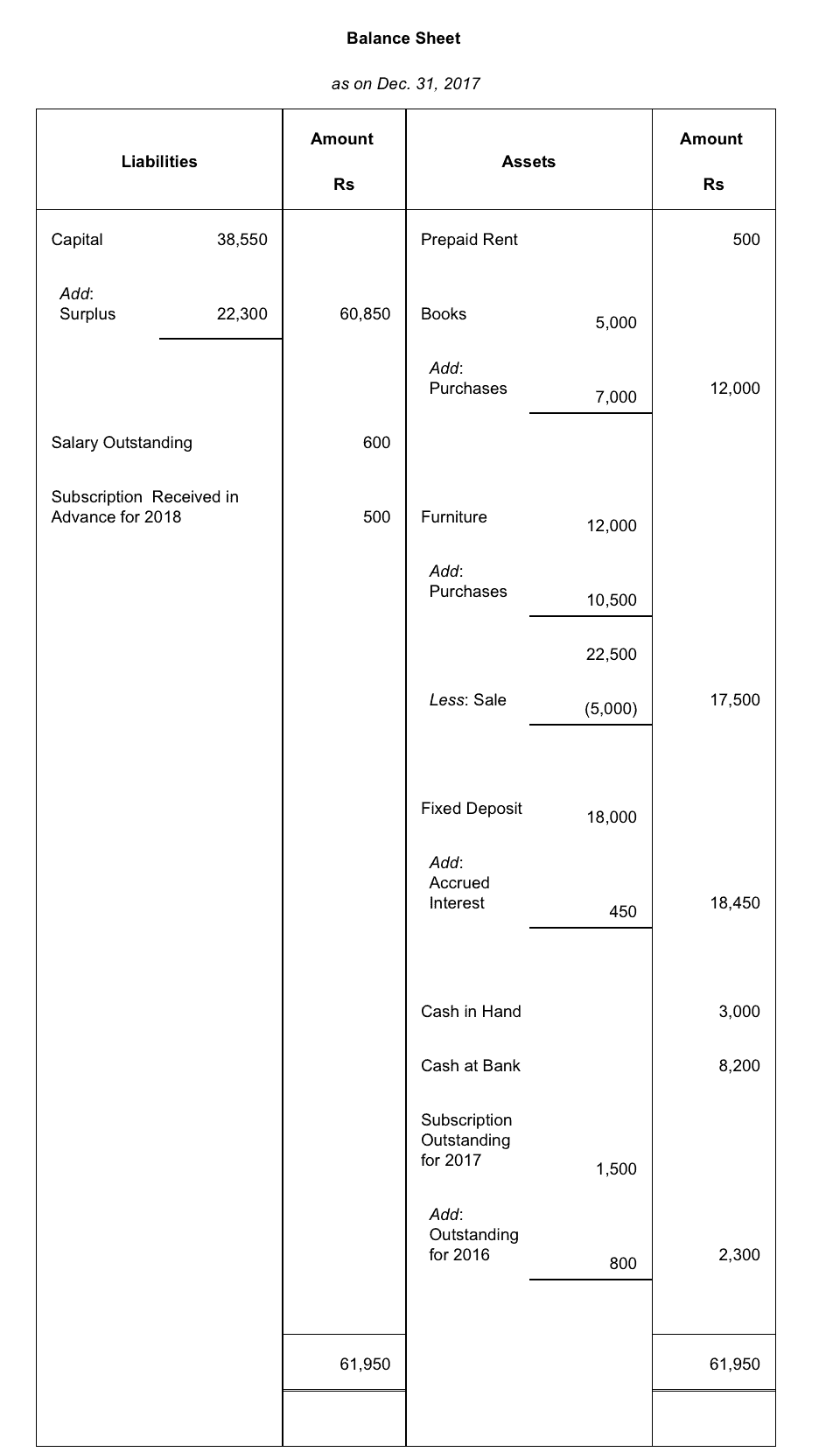

Q6: From the following receipts and payments and information given below, Prepare Income and Expenditure Account and opening Balance Sheet of Adult Literacy Organisation as on December 31, 2006.

Information:

(i) Subscription outstanding as on 31.12.2005 Rs 2,000 and on December 31, 2006 Rs 1,500.

(ii) On December 31, 2006 Salary outstanding Rs 600, and one month Rent paid in advance.

(iii) On Jan. 01, 2005 organisation owned Furniture Rs 12,000, Books Rs 5,000.

Answer :

Books of Adult Literacy Organisation

|

1365 videos|1312 docs|1010 tests

|

FAQs on NCERT Solution (Part - 1) - Accounting for Not for Profit Organisation - SSC CGL Tier 2 - Study Material, Online Tests, Previous Year

| 1. What is meant by "Not for Profit Organisation"? |  |

| 2. What is the accounting treatment for donations received by a not for profit organisation? |  |

| 3. How is surplus or deficit calculated in a not for profit organisation? |  |

| 4. Can a not for profit organisation distribute its surplus among its members? |  |

| 5. What is the difference between receipts and payments account and income and expenditure account? |  |

|

1365 videos|1312 docs|1010 tests

|

|

Explore Courses for SSC CGL exam

|

|