NCERT Solution (Part - 2) - Cash Flow Statement | Accountancy Class 12 - Commerce PDF Download

Page No. 282:

Long Answers:

Question 1: Describe the procedure to prepare Cash Flow Statement.

Answer: The procedure to prepare Cash Flow Statement is described in the following steps in their chronological order.

Step 1: Ascertain the cash flows from operating activities

Step 2: Ascertain the cash flows from investing activities

Step 3: Ascertain the cash flows from financing activities

Step 4: Ascertain net increase or decrease by summing up the amounts of Steps 1, 2, and 3.

Step 5: Write the opening balance of cash and cash equivalents and deduct it from the amount ascertained in Step 4. The resulting figure arrived is the Closing Balance of Cash and Cash Equivalents.

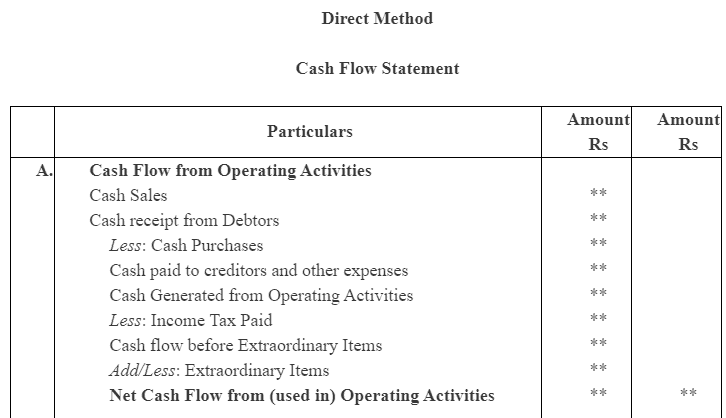

There are two methods viz. Direct Method and Indirect Method for the preparation of Cash Flow Statement.

Note: Preparation of Cash Flow Statement using Direct Method has been excluded from the prescribed syllabus. The format is given since the question has not specified the method explicitly. Students can refer to the direct method for the knowledge purpose.

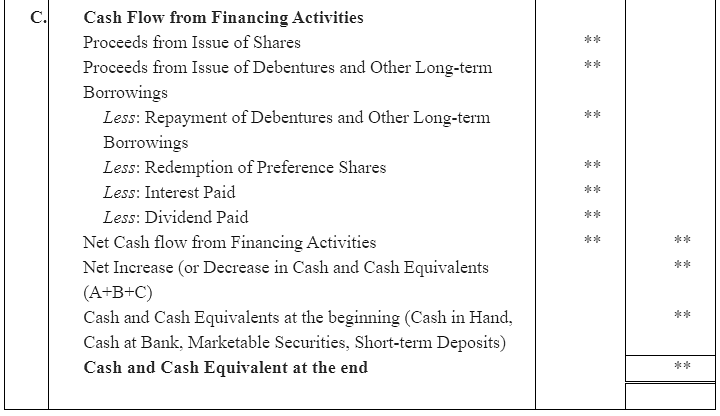

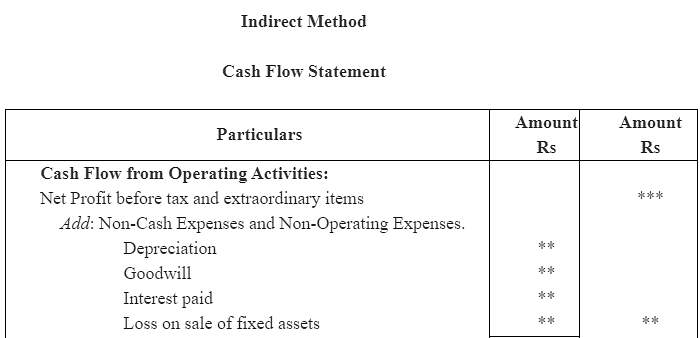

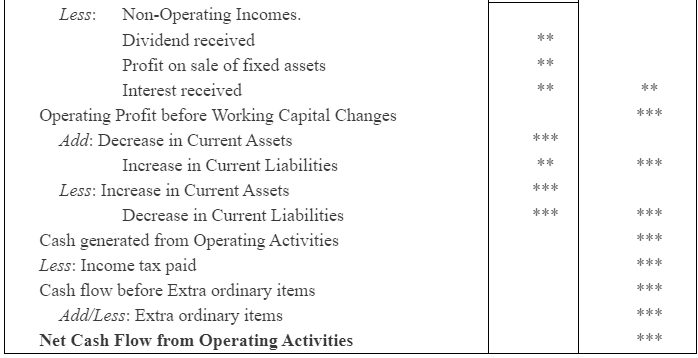

Question 2: Describe 'Indirect' methods of ascertaining Cash Flow from Operating Activities.

Answer: Indirect Method: This method starts with the Net Profit before tax and extraordinary items. For this purpose, the Net Profit as revealed by the Profit and Loss Account cannot be taken into consideration as there exists some items which do not leads to outflow of cash. The following are those items that need to be added back to the Net Profit of the Profit and Loss Account.

a. Non-cash items like, depreciation goodwill written off, etc are added to the Net Profit.

b. Non-operating expenses like loss on sale of fixed assets, transfers to reserves, loss on sale of fixed assets are added back to the Net Profit.

c. Provisions like, provisions for doubtful debts and discount for debtors, proposed dividends etc. should be added back to the Net Profit.

d. Decrease in current assets and increase in current liabilities should be added to the operating profit.

The following are those items that need to deduct from the Net Profit of the Profit and Loss Account.

a. Non-operating incomes like profit on sale of fixed assets, etc. are deducted from the Net Profit.

b. Non-trading Incomes like dividend received, interest received, tax refund, etc. are to be deducted from the Net Profit.

c. Increase in current assets and decrease in current liabilities should be deducted from the operating profit.

Question 3: Explain the major Cash Inflow and outflows from investing activities.

Answer: Investing activities are those activities that are related to sales and purchases of long-term fixed assets like, land and building, plant and machinery, furniture, etc. These fixed assets are not held for resale. The activities like sale and purchase of investments that are not included in the cash equivalents are also included in Investing activities. Any income arising from such investments (assets) are regarded a part of investing activities.

As per the AS3, the major cash inflows and outflows from investing activities are as follows:

a. Cash payments to acquire fixed assets (including intangibles like, goodwill). These payments include capitalised cost of research and development and self constructed fixed assets.

b. Cash receipts from disposal of fixed assets (including intangible assets).

c. Cash payments to acquire shares, warrants, or debt instruments of other enterprises and interest in joint venture (other than payments of those instruments consider as cash equivalents and are held for the trading purposes).

d. Cash receipts from disposal of shares, warrants or debt instruments of other enterprises and interest from joint ventures (other than receipts from those held for trading purposes).

e. Cash advances and loans made to third parties (other than advances, and loans made by financial enterprises). These will be treated as cash flows from the operating activities.

f. Cash receipts from repayment of advances and loans made to third parties (other than advances and loans of financial enterprises). These will be treated as

cash flows from operating activities.

g. Cash receipts from insurance company for any property involved in accident.

h. Any income arising from fixed assets or investments like interest, dividend, rent etc. In case of financial enterprises interest and dividend is treated as operating activities.

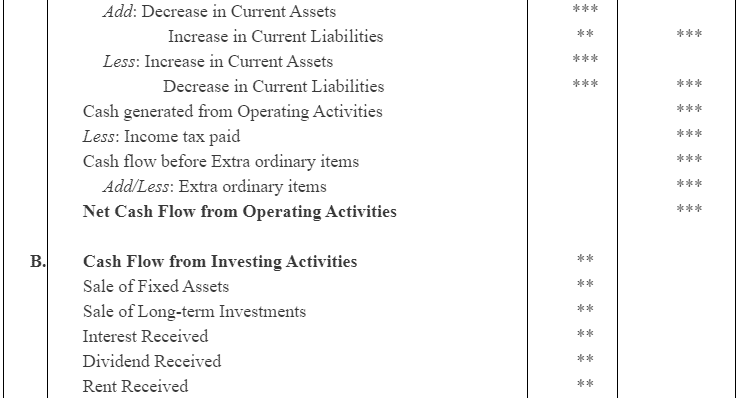

Direct Method Cash Flow Statement | ||||

| Particulars | Amount Rs | Amount Rs | |

| Net Cash Flow from (used in) Operating Activities | ** | ** | |

|

|

|

| |

B. | Cash Flow from Investing Activities | ** |

| |

| Sale of Fixed Assets | ** |

| |

| Sale of long-term Investments | ** |

| |

| Interest Received | ** |

| |

| Dividend Received | ** |

| |

| Rent Received | ** |

| |

|

| Less: Purchase of Fixed Assets | ** |

|

|

| Less: Purchase of long-term Investments | ** |

|

| Net Cash Flow from Investing Activities | ** | ** | |

Indirect Method Cash Flow Statement | ||||

Particulars | Amount Rs | Amount Rs | ||

Net Cash Flow from Operating Activities |

| *** | ||

|

|

| ||

Cash Flow from Investing Activities | ** |

| ||

Sale of Fixed Assets | ** |

| ||

Sale of Long-term Investments | ** |

| ||

Interest Received | ** |

| ||

Dividend Received | ** |

| ||

Rent Received | ** |

| ||

| Less: Purchase of Fixed Assets | ** |

| |

| Less: Purchase of long term Investment | ** |

| |

Net Cash Flow from Investing Activities | ** | ** | ||

|

|

|

|

|

Note: Preparation of Cash Flow Statement using Direct Method has been excluded from the prescribed syllabus. The format is given since the question has not specified the method explicitly. Students can refer to the direct method for the knowledge purpose.

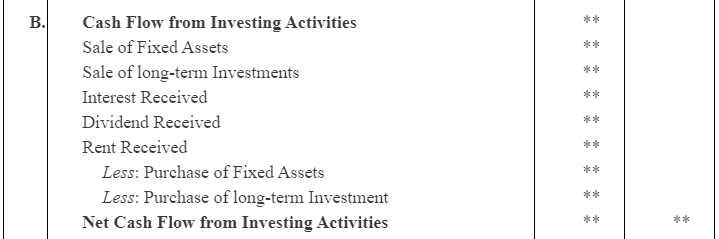

Question 4: Explain the major Cash Inflows and outflows from financing activities.

Answer: Financing activities are those activities that are related to capital or long term funds of an enterprise. These activities results in the change in the capital and borrowed funds.

As per the AS3, the major cash inflows from financing activities are as follows:

a. Cash proceeds from issue of shares and other similar instruments.

b. Cash proceeds from issue of debentures, loans, notes, bonds, and other short and long-term borrowings.

As per the AS3, the major cash outflows from financing activities are as follows:

a. Cash repayments of the amount borrowed in form of debentures, loans, notes bonds, and other short and long-term borrowings.

b. Buy-back of shares and debentures.

c. Interest paid on debentures, loans, and advances.

d. Dividend paid to the preference shareholders and equity shareholders.

An important point that must be noted is that the purchase and sale of securities, interest paid or received and dividend received is treated as cash flow from operating activities for an investment company. But dividend paid is treated as cash flow from financing activities.

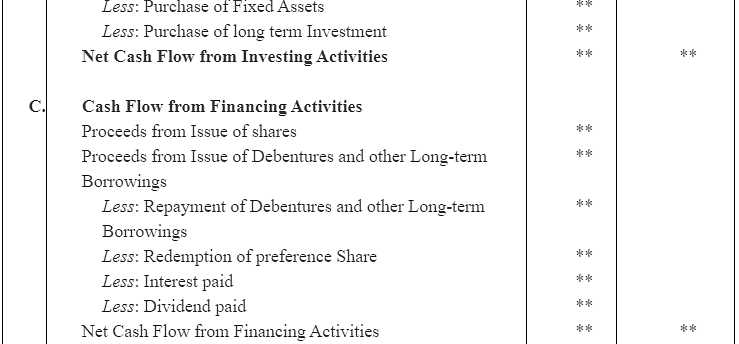

Direct Method Cash Flow Statement | |||||

| Particulars | Amount Rs | Amount Rs | ||

| Net Cash Flow from Investing Activities | ** | ** | ||

| Cash Flow from Financing Activities |

|

| ||

| Proceeds from Issue of Shares | ** |

| ||

| Proceeds from Issue of Debentures and Other Long-term Borrowings | ** |

| ||

|

| Less: Repayment of Debentures and Other Long-term Borrowings | ** |

| |

|

| Less: Redemption of Preference Shares | ** |

| |

|

| Less: Interest Paid | ** |

| |

|

| Less: Dividend Paid | ** |

| |

| Net Cash flow from Financing Activities | ** | ** | ||

| Net Increase (or Decrease in Cash and Cash Equivalents (A+B+C) |

| ** | ||

| Cash and Cash Equivalents at the beginning (Cash in Hand, Cash at Bank, Marketable Securities, Short-term Deposits) |

| ** | ||

| Cash and Cash Equivalent at the end |

| ** | ||

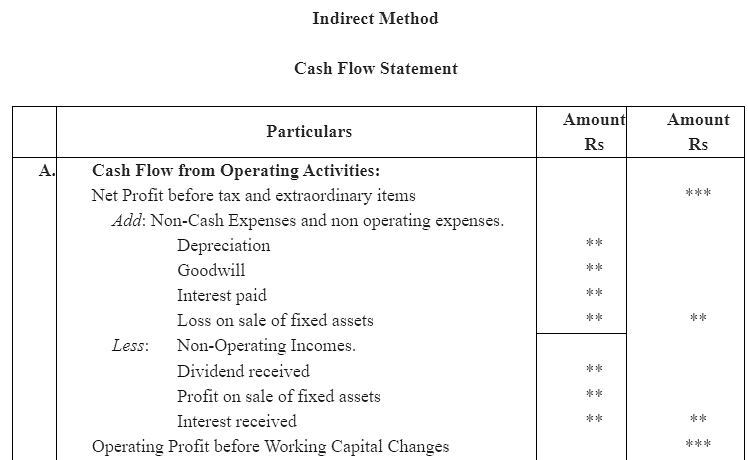

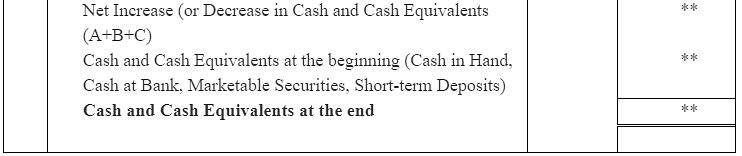

Indirect Method | |||

Cash Flow Statement | |||

Particulars | Amount Rs | Amount Rs | |

Net Cash Flow from Investing Activities | ** | ** | |

Cash Flow from Financing Activities |

|

| |

Proceeds from Issue of shares | ** |

| |

Proceeds from Issue of Debentures and other Long-term Borrowings | ** |

| |

| Less: Repayment of Debentures and other Long-term Borrowings | ** |

|

| Less: Redemption of preference Share | ** |

|

| Less: Interest paid | ** |

|

| Less: Dividend paid | ** |

|

Net Cash Flow from Financing Activities | ** | ** | |

Net Increase (or Decrease in Cash and Cash Equivalents (A+B+C) |

| ** | |

Cash and Cash Equivalents at the beginning (Cash in Hand, Cash at Bank, Marketable Securities, Short-term Deposits) |

| ** | |

Cash and Cash Equivalents at the end |

| ** | |

Note: Preparation of Cash Flow Statement using Direct Method has been excluded from the prescribed syllabus. The format is given since the question has not specified the method explicitly. Students can refer to the direct method for the knowledge purpose.

Page No 282:

Numerical Question:

Question 1: Anand Ltd. arrived at a net income of Rs 5,00,000 for the year ended March 31, 2007. Depreciation for the year was Rs 2,00,000. There was a gain of Rs 50,000 on assets sold which was credited to profit and loss account. Bills Receivables increased during the year Rs 40,000 and Bills Payables also increased by Rs 60,000. Compute the cash flow operating activities by the indirect approach.

Answer:

Cash Flow from Operating Activities as on March 31, 2007 | |||

Particulars | Amount Rs | Amount Rs | |

|

|

| |

Net Profit during the year |

| 5,00,000 | |

Items to be adjusted: |

|

| |

| Add: Depreciation | 2,00,000 |

|

| Less: Gain on sale of assets | (50,000) | 1,50,000 |

Operating Profit before Working Capital changes |

| 6,50,000 | |

| Add: Increase in Bills Payable | 60,000 |

|

| Less: Increase in Bills Receivable | (40,000) | 20,000 |

Net Cash from Operations |

| 6,70,000 | |

Page No 283:

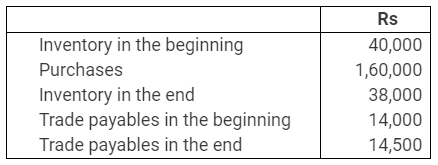

Question 2: From the information given below you are required to prepare the cash paid for the inventory:

Answer:

Cash paid for Inventory amounts to Rs 1,59,500

Question 3: For each of the following transactions, calculate the resulting cash flow and state the nature of cash flow viz., operating, investing and financing.

(a) Acquired machinery for Rs 2,50,000 paying 20% drawn and executing a bond for the balance payable.

(b) Paid Rs 2,50,000 to acquire shares in Informa Tech. and received a dividend of Rs 50,000 after acquisition.

(c) Sold machinery of original cost Rs 2,00,000 with an accumulated depreciation of Rs 1,60,000 for Rs 60,000.

Answer:

(a) Amount Paid for Machinery =

Part payment Rs 50,000 for acquiring machinery Rs 2,50,000 is related with Investing Activities

(b)

| Rs |

Amount paid for acquiring shares | (2,50,000) |

Dividend received | 50,000 |

Net Cash used in Investing Activities | (2,00,000) |

Amount paid to acquire assets and dividend received is a part of Investing Activities.

(c) Inflow of cash of Rs 60,000 on sale of machinery is a part Investing Activities.

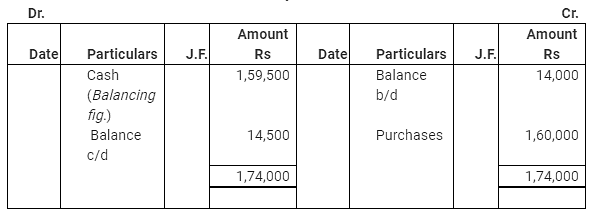

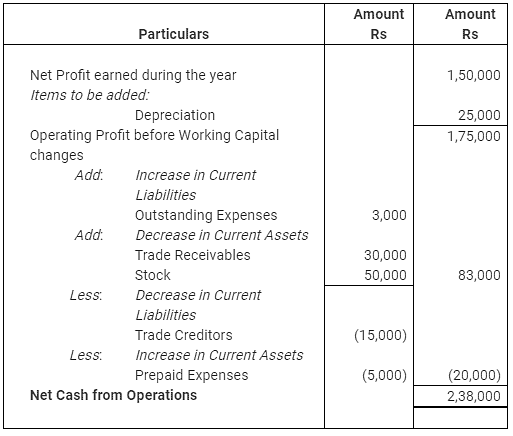

Question 4: The following is the Profit and Loss Account of Yamuna Limited:

Statement of Profit and Loss of Yamuna Ltd. for the Year ended March 31, 2007 | |||

Particulars | Note No. | Amount (Rs) | |

i) | Revenue from Operations |

| 10,00,000 |

ii) | Expenses |

|

|

| Cost of Material Consumed | 1 | 50,000 |

| Purchase of Stock-in-trade |

| 5,00,000 |

| Other Expenses | 2 | 3,00,000 |

| Total Expenses |

| 8,50,000 |

iii) | Profit before Tax (I – ii) |

| 1,50,000 |

Additional information:

(i) Trade debtors decrease by Rs 30,000 during the year.

(ii) Prepaid expenses increase by Rs 5,000 during the year.

(iii) Trade creditors decrease by Rs 15,000 during the year.

(iv) Outstanding expenses increased by Rs 3,000 during the year.

(v) Operating expenses included depreciation of Rs 25,000. Compute net cash provided by operations for the year ended March 31, 2007 by the indirect method.

Answer: Cash Flow from Operating Activities of Yamuna Limited as on March 31, 2017

Note: As per the solution, the Net Cash from Operating Activities is Rs 2,38,000, however, as per the answer given in the book is Rs 2,18,000.

|

47 videos|180 docs|56 tests

|

FAQs on NCERT Solution (Part - 2) - Cash Flow Statement - Accountancy Class 12 - Commerce

| 1. What is a cash flow statement and why is it important? |  |

| 2. How is a cash flow statement different from an income statement? |  |

| 3. How can a cash flow statement be used by investors? |  |

| 4. How does a cash flow statement help in assessing the liquidity position of a company? |  |

| 5. How can a cash flow statement be used to detect financial irregularities or manipulation? |  |

|

Explore Courses for Commerce exam

|

|