NCERT Solution: Cash Flow Statement- 1 | Accountancy Class 12 - Commerce PDF Download

Short Answer Questions

Q1: What is a Cash Flow Statement?

Ans: Cash flow statement is the statement which shows the inflow and the outflow of the cash and the cash equivalents from the operating, financing and the investing activities of the company. It records the receipts and the payments of the cash and the cash equivalents that any business incurs during the particular accounting year. The statement of the cash flow helps to establish the ability and the position of the business to generate the cash for its varying needs.

Q2: How are the various activities classified (as per AS-3 revised) while preparing cash flow statement?

Ans: As per AS-3 the following are the various activities classified while preparing cash flow statement: Operating activity – Operating Activity includes all the activities which creates and generate the revenue for any business. For example, for a company dealing with the garments will have its operating activity in the form of procurement of the raw materials, expenses made for manufacturing the garments, etc.

Investing activity: It includes of all the transactions which are related to the long-term investments made by the company. The examples of this can include the sale and he purchase of the fixed asset such as Plant and Machinery.

Financing activities: The financing activity includes of all the transactions which are related to the acquiring of the capital or the long-term funds for any business. The examples of this can be the cash proceeds by the business from the issue of the equity shares and debentures etc.

Q3: State the objectives of cash flow statement.

Ans: The uses of the cash flow statement are as follows:

- Cash flow statement is useful in providing information about the changes in the financial structure and the net assets and the amount which is generated with the inflows of the cash.

- Cash flows are useful in providing information about the cash-generating capacity of the business by indicating the position of the business in terms of the cash and the cash equivalents.

- Cash flows help the business to make comparisons about the operating performance of the business as the accounting treatments and practices might be different in the different enterprises and the cash flow statement will thus help the businesses to determine the cash generating capacity of them.

- The cash flow records the transactions at their historical cost which can help the users to determine important information about the transactions as and when they require.

Q4: What are the objectives of preparing cash flow statement?

Ans: The important objectives for preparing Cash Flow Statement are as follows:

- The most important objective that is fulfilled by preparing Cash Flow Statement is to ascertain the gross inflows and outflows of cash and cash equivalents from various activities.

- Secondly, Cash Flow Statement helps in analysing various reasons responsible for change in the cash balances during an accounting year.

- This statement helps in analysing and understanding the liquidity and solvency of a company , thereby, depicting the true liquidity position to the creditors and the investors.

- Cash Flow Statement also helps in ascertaining the requirement and availability of cash in near future.

Q5: State the meaning of the terms:

(i) Cash Equivalents,

(ii) Cash flows.

Ans:

(i) The short-term liquid investments that are made by any business which are not subjected to any change in their values are referred to as cash equivalents. The cash equivalents are held by the business to meet their short-term needs and commitments for investment purposes.

(ii) Cash flows are referred to as the movement of the cash inside and outside the business from the non-cash items. Thus when the cash is generated from the transaction of any noncash item, then it is referred to as the cash inflow; on the other hand when the cash goes out of the business to meet the requirements for the transactions of any non-cash item, then it is referred to as the cash outflows.

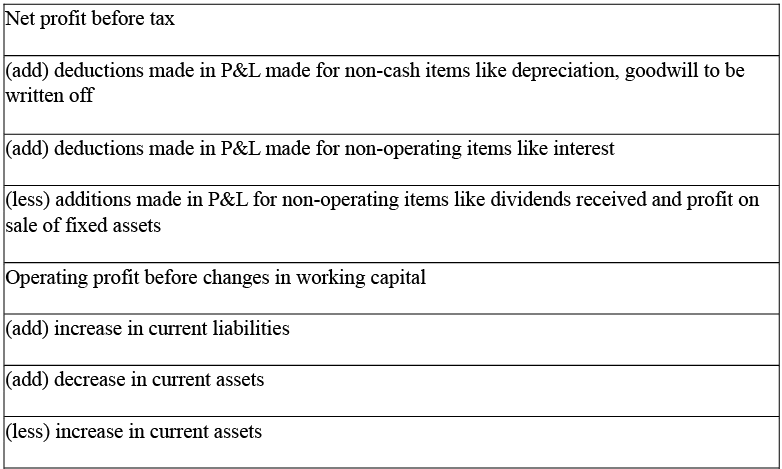

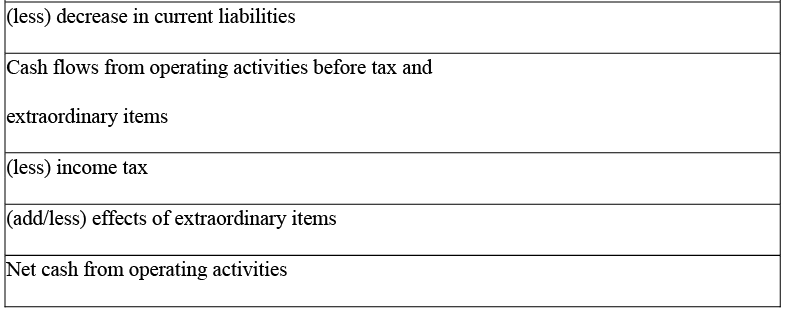

Q6: Prepare a format of cash flow from operating activities.

Ans: The following is the format of the cash flows from operating activities.

Q 7: State clearly what would constitute the operating activities for each of the following enterprises:

(i) Hotel

(ii) Film production house

(iii) Financial enterprise

(iv) Media enterprise

(v) Steel manufacturing unit

(vi) Software development business unit

Ans: The following are the operating activities of the following enterprises:

(i) Hotel: The receipt that comes from the sales made to the customers will be the cash inflows and the expenses such as salaries, rent, groceries, etc. will be regarded as the cash outflows.

(ii) Film production house: The sale of the film rights to the distributors will be regarded as the inflows, while the salaries paid to the actors, rent paid for the location, etc. will be regarded as the outflows.

(iii) Financial enterprise: The receipts that are received on the repayments of the loan and the interest on the loans will be the inflows and on the other hand, the outflows will be the salaries, loan recovery expenses, etc. (iv) Media enterprise – Receipts which are generated from the advertisements will be regarded as the inflows and expenses which are made in the form of the payment of the salaries will be regarded as the outflows.

(v) Steel manufacturing unit: The sale of steel sheets, steel rods, etc. will be regarded as the inflows while the outflows that occur due to the purchase of the raw materials, wages, etc. will be the outflows.

(vi) Software business unit: The receipt is generated from the sale of software and the renewal of licences will be regarded as the inflows and the payment of salaries etc. will be regarded as the outflows.

Q8: “The nature/type of enterprise can change altogether the category into which a particular activity may be classified.” Do you agree? Illustrate your answer.

Ans: Yes, the nature or type of an enterprise can change the category into which a particular activity may be classified. This can be better understood with the help of an example of two firms. One engaged in financial services and the other engaged in manufacturing services. For the firm that is engaged in financial services, interests received or paid are classified under operating activities whereas for the firm that is engaged in manufacturing business, interests paid are classified under financing activities and interest received as investing activities. Therefore, the classification of activities depends on the nature and type of enterprise.

Long Answer Questions

Q1: Describe the procedure to prepare Cash Flow Statement.

Ans: The procedure to make the cash flow is as follows:

- Firstly, determine the flows of the cash from the operating activities of the business.

- Next, the business shall determine the flows of the cash from its investing activities.

- Then it must determine the flows of the cash from its financing activities.

- The next step involves the total of the sum of all the three activities.

- The final step involved the deduction of the opening balance of the cash and the cash equivalents from the resulting sum of all the three activities which will result the figure which is the closing the balance of the cash and the equivalents of the cash.

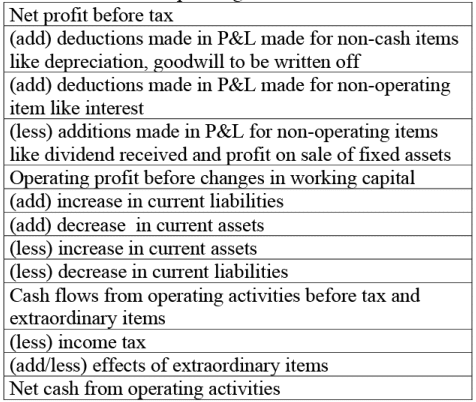

Q2: Describe “Indirect” method of ascertaining Cash Flow from operating activities.

Ans: The indirect method of ascertaining the cash flow from the operating activities involve all the non-operating and the non-cash items. Under this method, cash flow is ascertained from the flow of the cash of the operating activities begin with the net profit or the net loss. The income statement in this method is on the accrual basis which hence includes both non-operating items such as interest paid, loss or the profit made on the sale of any fixed assets ; and the non-cash items such as write off of the goodwill, depreciation. Following is the sample of the nest cash flows from the operating activities:

Q3: Explain the major Cash Inflows and outflows from investing activities.

Ans: Cash flows are referred to as the movement of the non-cash items of the business in and outside the business. Thus the cash inflow is referred to as the situation in which the cash comes from a non-cash item and on the other hand when the cash is used by the business to get the noncash item it is referred to as cash outflow. The transactions of the business which are related to the long-term investments in the business are called the investing activities.

The example of the cash flow from the investing activities is as follows:

Sale of machinery – Cash inflows

Purchase of machinery – Cash outflows

Q4: Explain the major Cash Inflows and outflows from financing activities.

Ans: Cash flows are referred to as the movement of the non-cash items of the business in and outside the business. Thus the cash inflow is referred to as the situation in which the cash comes from a non-cash item and on the other hand when the cash is used by the business to get the noncash item it is referred to as cash outflow. For instance, the sale of the computer of the business generates cash for the business and hence is cash inflow and on the other hand the cash spent on the purchase of the new computer is the cash outflow. The financing activity refers to all those transactions that are related to the acquiring of long-term capital or funds for the business. Thus, the cash flow from the financing activities can be in the following forms:

Proceed from long-term borrowings – Cash inflows

Repayment of long-term borrowings – Cash outflows

|

51 videos|270 docs|51 tests

|

FAQs on NCERT Solution: Cash Flow Statement- 1 - Accountancy Class 12 - Commerce

| 1. What is a cash flow statement and why is it important? |  |

| 2. What are the main components of a cash flow statement? |  |

| 3. How do you prepare a cash flow statement using the indirect method? |  |

| 4. How can cash flow analysis help in business decision-making? |  |

| 5. What are some common challenges in preparing a cash flow statement? |  |