NCERT Solution: Financial Statements- I | Accountancy Class 11 - Commerce PDF Download

Short Question Answers

Q1: What are the objectives of preparing financial statements ?

Ans: The objectives of preparing financial statements are as follows:

- Recording: To record and summarize the routine transactions of the business in the routine manner is one of the primary objectives of accounting. This process is known as book keeping and it is important to ensure that an entity keeps track of its financial information which can thus be used by the users of the financial statements.

- Planning: The preparation of the financial statements allows the business to make the plans to direct their resources and take necessary actions in order to ensure the growth objectives of the business.

- Decision-making: The financial statements allows the business and the managers to take necessary decisions and exercise control over the activities of the business as the financial statements allows the business to take relevant decisions and strategies.

- Accountability: The financial statements is helpful for the business in terms of analyzing their performance over the period of time which thus creates a sense of accountability in the organization.

Q2: What is the purpose of preparing trading and profit and loss account?

Ans: The preparation of the trading account is done in order to record the gross profit or loss of the concerned business organization for a particular accounting period. The profit and loss account on the other hand helps the business to calculate the net profit or net loss incurred by the business for a particular accounting period. This thus helps the business to compare their business performance and the necessary actions in this regard.

Q3: Explain the concept of cost of goods sold?

Ans: The cost of goods is considered to be the direct cost that the company incurs in order to produce the goods. This cost encompass of the cost of the material required and the labor cost to produce the goods and the service of the organization. This cost further deducts all kinds of indirect costs and hence the formula to determine the cost of goods sold is as follows: COGS (cost of goods sold) = Beginning inventory + purchases during the period – ending inventory.

Q4: What is a balance sheet. What are its characteristics?

Ans: Balance sheet is referred to as the statement which tells about the position of the assets and the liabilities and the owner’s equity on the given particular date.

Following are the characteristics of the balance sheet:

- Balance sheet is not prepared for an entire period and thus it depicts the situation of the business of a particular date.

- Balance sheet is prepared only after the completion of the profit and loss statement for the accounting period in order to tell about the financial position of the business.

- Balance comprises of two sides – Assets &Liabilities. The figure of both the sides should tally with each other in the balance sheet.

- Balance sheets establish the value of the position of the business on a particular date by discussing the position of the assets and liabilities of the business.

Q5: Distinguish between capital and revenue expenditure and state whether the following statements are items of capital or revenue expenditure :

(a) Expenditure incurred on repairs and whitewashing at the time of purchase of an old building in order to make it usable.

(b) Expenditure incurred to provide one more exit in a cinema hall in compliance with a government order.

(c) Registration fees paid at the time of purchase of a building

(d) Expenditure incurred in the maintenance of a tea garden which will produce tea after four years.

(e) Depreciation charged on a plant.

(f) The expenditure incurred in erecting a platform on which a machine will be fixed.

(g) Advertising expenditure, the benefits of which will last for four years.

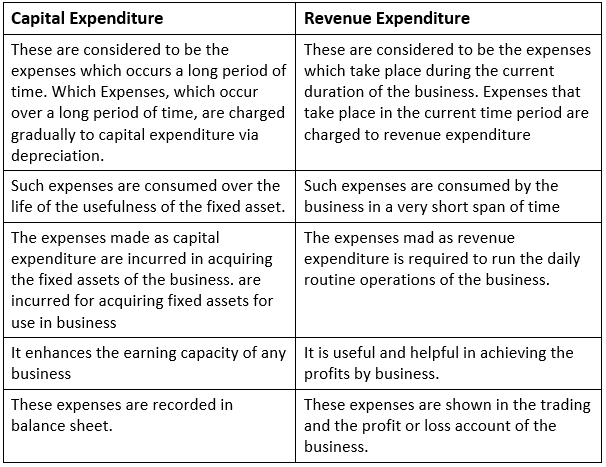

Ans: The following are the differences between capital and revenue expenditures:

Following is the answer to the question of the categories of the expenditure for the aforementioned expenses. (a) Capital expenditure (b) Capital expenditure

(a) Capital expenditure

(b) Revenue expenditure

(c) Capital expenditure

(d) Capital expenditure

(e) Revenue expenditure

Q6: What is an operating profit?

Ans: The operating profit are considered to be the profit which is earned by the business from its core business operations. The calculation of the operating profit thus excludes interest and the taxes. The operating profit is thus determined by the following formula:

Operating profit = Gross profit – operating expenses – depreciation – amortization

Long Question Answers

Q1: What are financial statements? What information do they provide.

Ans:

- The financial statements are considered to be the records which reflect the financial position and the condition of ay business activity.

- The financial statements are thus helpful in determining the financial standing of the company and the outcomes of the business process and the cash flows of the company.

- The information of the financial statements is used by the financial users of the business who determine the profitability of the business and determine their approach and the policies towards the business.

- It comprises of the Income Statements and the Statement of Financial Position

- Income Statements or the Trading Profit and Loss Account: It represents the direct and the indirect expenses made by the entity in order to generate the revenues it made in the any accounting period. The trading account is prepared in order to determine the gross profit or the gross loss of the business and the Profit and Loss Account helps the business to determine the net profit or the loss incurred by the business for the given accounting period.

- Statement of financial position or the Balance Sheet is helpful in determining the true financial position of the business by disclosing the book value of the assets and the liabilities of the business. This thus is helpful in determining the profitability of the business at any given particular date.

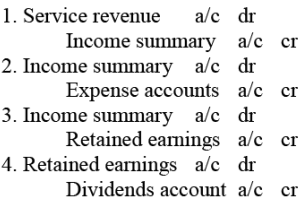

Q2: What are closing entries? Give four examples of closing entries.

Ans: The closing entries are referred to the journal entries which are done in the end of the accounting period in order to zero the temporary accounts of the accounting period in order to move into the permanent accounts in the balance sheet. The temporary account records the balances of any specific period while on the other hand the permanent account records the balances of over a the long period of the time. Here are the four examples of the closing entries.

Q3: Discuss the need of preparing a balance sheet.

Ans: Balance sheet reflects the financial situation of the business by telling about the assets and the liabilities of the business at any given particular date. It is necessary to prepare a balance sheet as it helps in determining the understanding of the financial situation of the business which is used by the users of the financial information to take the relevant course of actions. The needs of preparing a Balance Sheet are as follows:

- The balance sheet helps in determining the book value and the nature of the various assets at the end of each accounting period.

- The balance sheet helps the business to determine the liabilities of the organization which includes both ling term and the current liabilities.

- The balance sheet is helpful for any business as it allows it to determine the solvency of it.

- The balance sheet is helpful in disclosing the important information such as drawings made, capital invested, loans deducted, investments made etc.

- The balance sheet thus depicts the true financial position of the business at any particular part of time.

- The balance sheet thus lays down the basis for maintaining the books of accounts for the further accounting period.

Q4: What is meant by Grouping and Marshalling of assets and liabilities. Explain the ways in which a balance sheet may be marshalled.

Ans: Grouping is referred to as the combining of the similar items of the financial statement as a single item.

Marshalling on the other hand implies the presentation of the items in any particular order. There are two ways of marshalling the balance sheet:

- Marshalling by liquidity, in which the assets and liabilities are listed on the basis of the liquidity in the descending order.

- Marshalling by permanence, in which the assets and the liabilities are listed on the basis of the permanence in the descending order. Thus the asset which last long will be listed first.

Numerical Question Answers

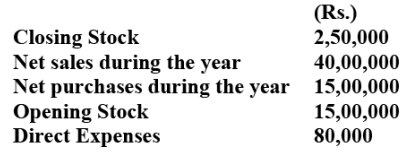

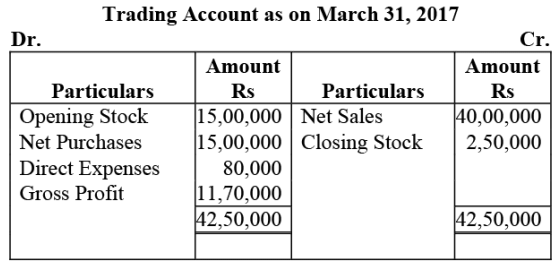

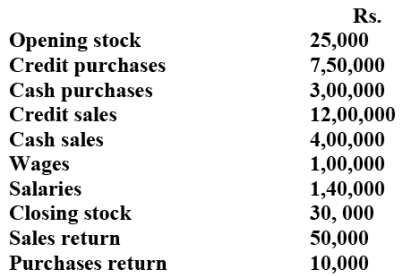

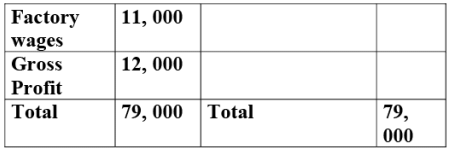

Q1: From the following balances taken from the books of Simmi and Vimmi Ltd. for the year ending March 31, 2017, calculate the gross profit.

Ans:

Q2: From the following balances extracted from the books of M/s Ahuja and Nanda. Calculate the amount of:

(a) Cost of goods available for sale

(b) Cost of goods sold during the year

(c) Gross Profit  Ans:

Ans:

(a) Cost of goods available for sale = opening stock + net purchases + wages

= 25, 000 + 10, 4000 + 1, 00, 000 = 11, 65000

(Net purchases = credit purchases + cash purchases – purchase returns)

= 7, 50, 000 + 3, 00, 000 - 10, 000 = 10, 40, 000

(b)Cost of goods sold = opening stock + net purchases + wages – closing stock

= 25, 000 + 10, 40, 000 + 1, 00, 000 - 30, 000

= 11, 65, 000- 30, 000

=11,35,000

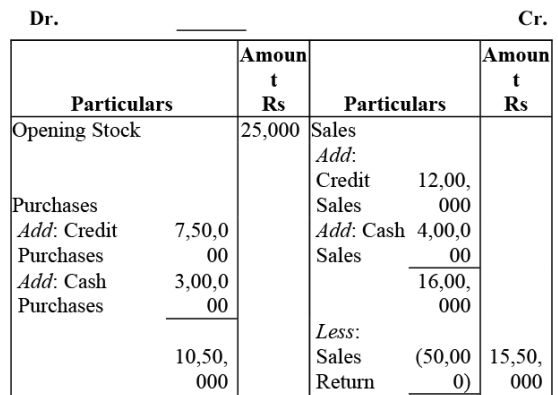

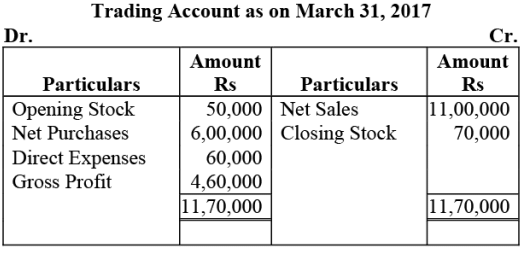

Trading Account

Gross Profit Rs 4,15,000

Gross Profit Rs 4,15,000

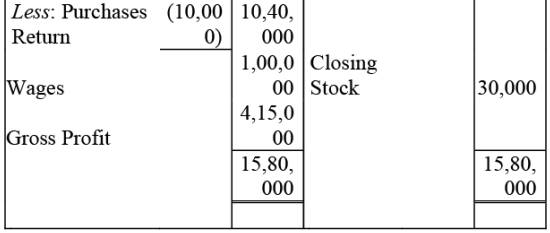

Q3: Calculate the amount of gross profit and operating profit on the basis of the following balances extracted from the books of M/s Rajiv & Sons for the year ended March 31, 2017.

Ans:

Ans:

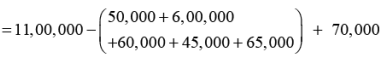

Operating Profit = Sales – (Opening Stock + Net Purchases + Direct Expenses + Administration Expenses + Selling and Distribution Expenses) + Closing Stock

Q4: Operating profit earned by M/s Arora & Sachdeva in 2016-17 was Rs. 17,00,000. Its non-operating incomes were Rs. 1,50,000 and non-operating expenses were Rs. 3,75,000. Calculate the amount of net profit earned by the firm.

Ans:

Net profit = operating profit + non-operating income – non operating expenses

= 17, 00, 000 + 1, 50, 000 - 3, 75, 000

= 18, 50, 000 - 3, 75, 000

= 14,75,000

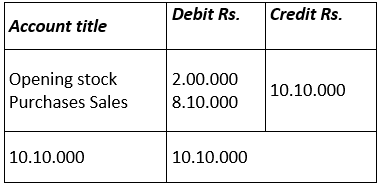

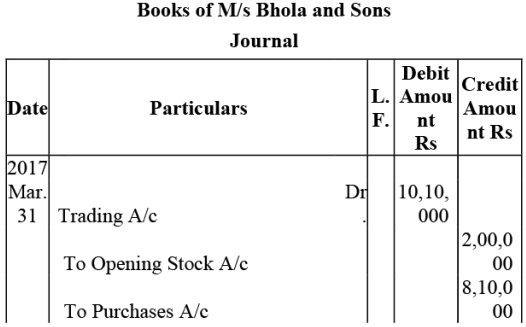

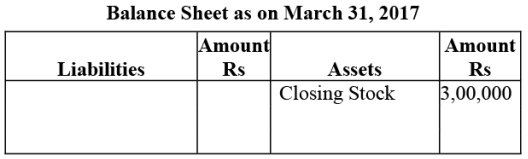

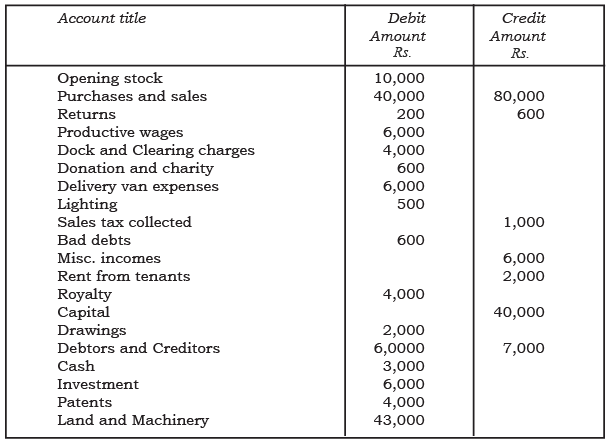

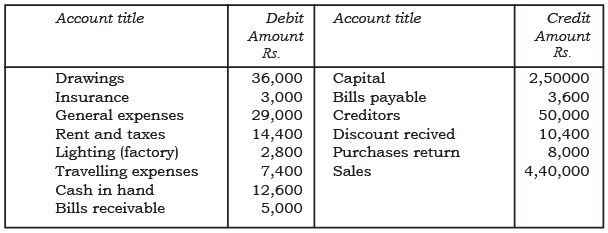

Q5: The following are the extracts from the trial balance of M/s Bhola & Sons as on March 31, 2017

(only relevant Items) Closing as on date was valued at Rs.3,00.000.

(only relevant Items) Closing as on date was valued at Rs.3,00.000.

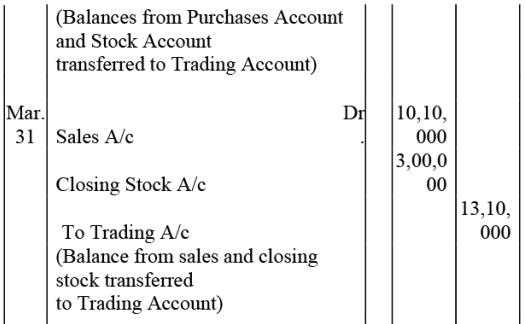

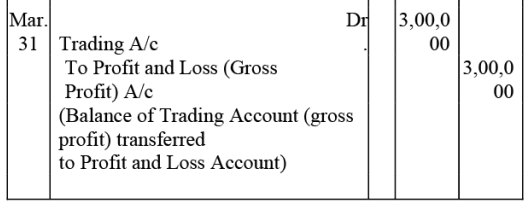

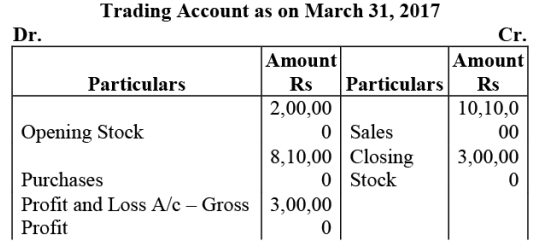

You are required to record the necessary journal entries and show how the above items will appear in the trading and profit and loss account and balance sheet of M/s Bhola & Sons Stock.

Ans:

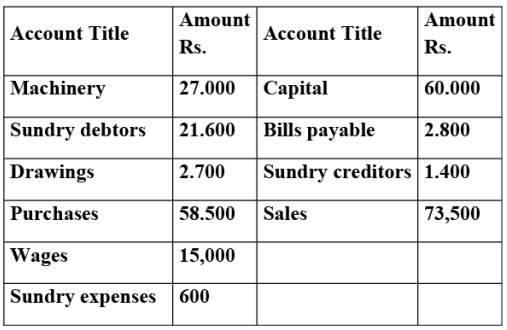

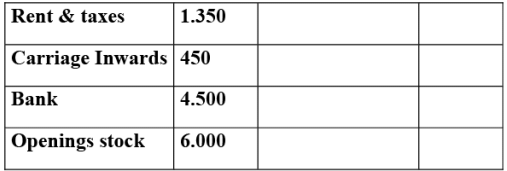

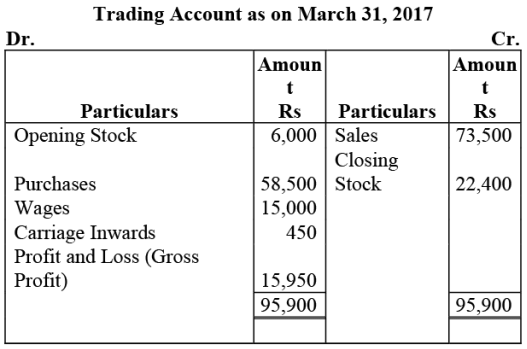

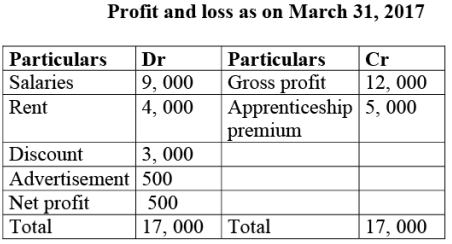

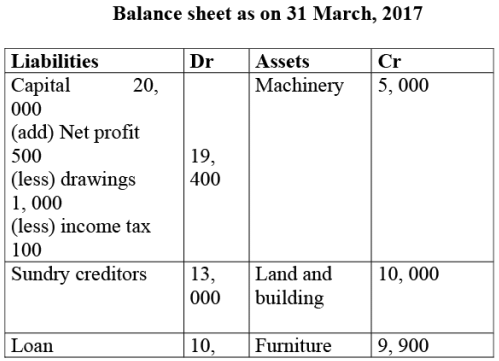

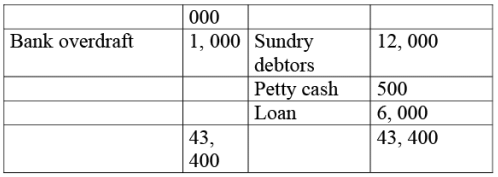

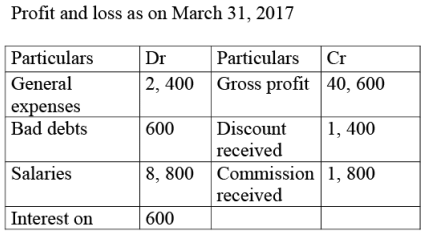

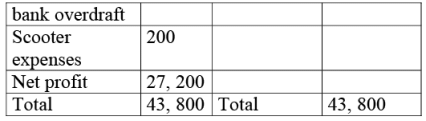

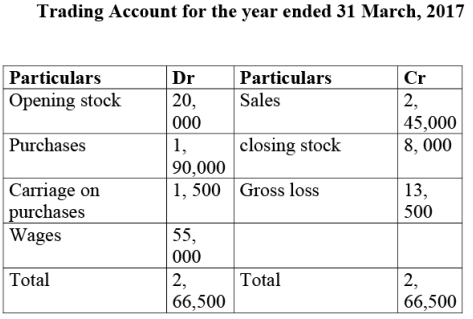

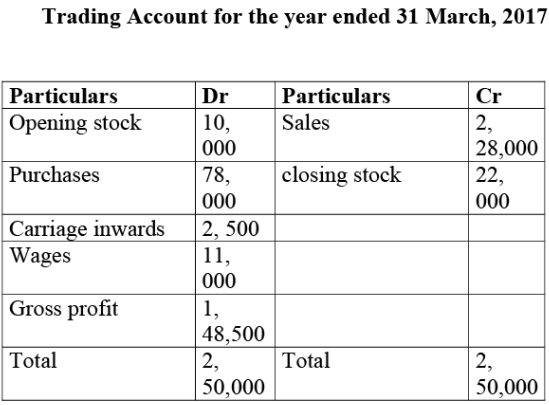

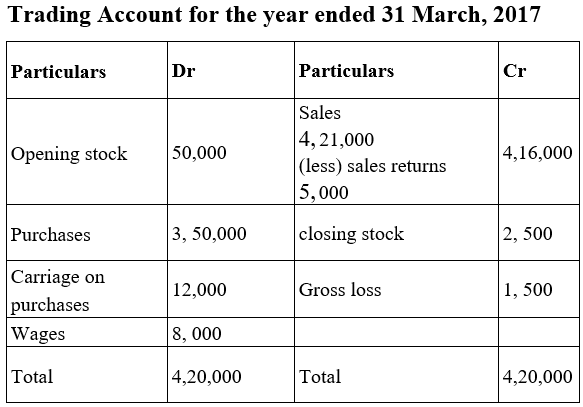

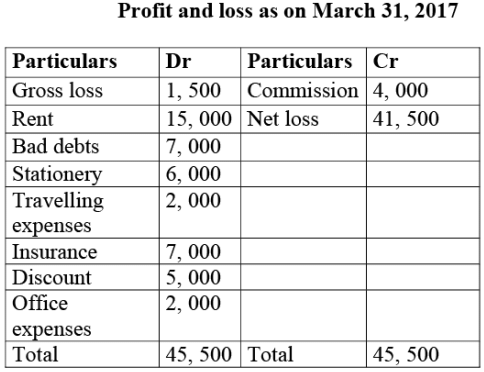

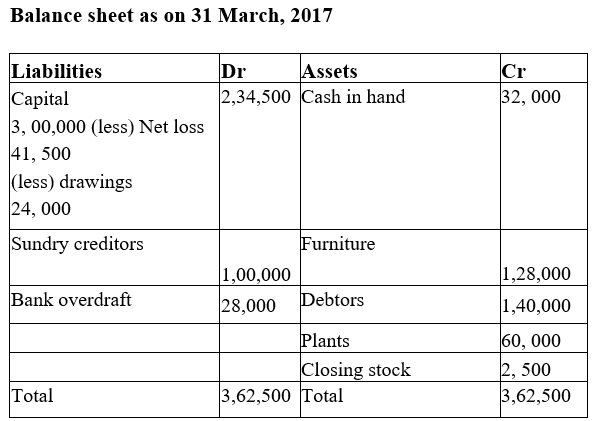

Q6: Prepare trading and profit and loss account and balance sheet as on March 31, 2017 :

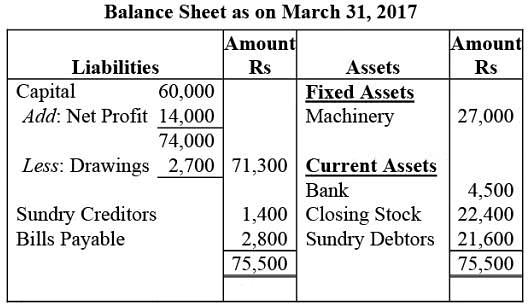

Closing stock as on March 31. 2017 Rs.22,400

Closing stock as on March 31. 2017 Rs.22,400

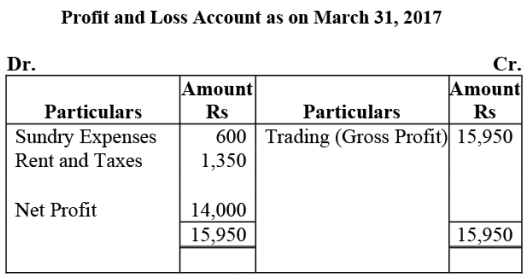

Ans:

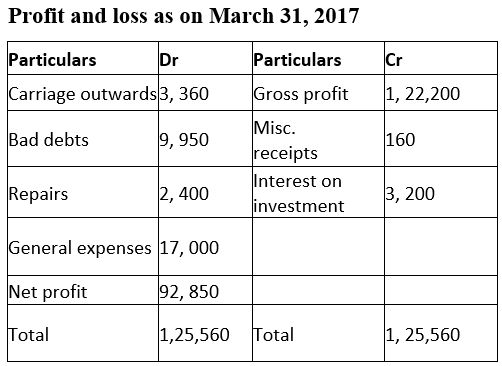

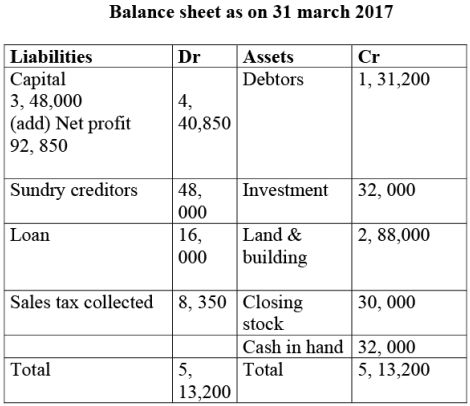

Q7: The following trial balance is extracted from the books of M/s Ram on March 31. 2017. You are required to prepare trading and profit and loss account and the balance sheet as on date:

Ans:

Ans:

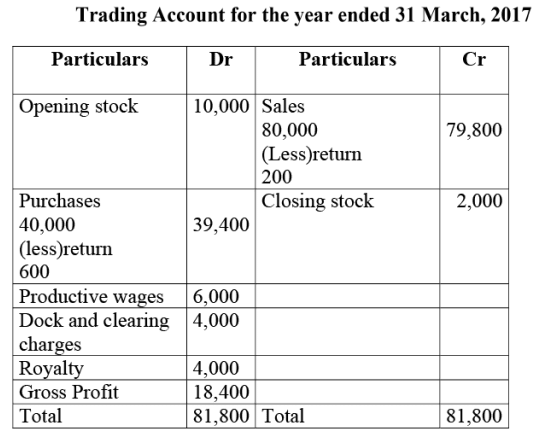

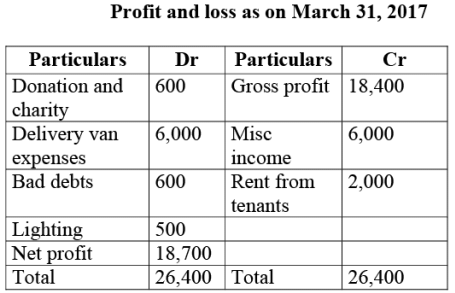

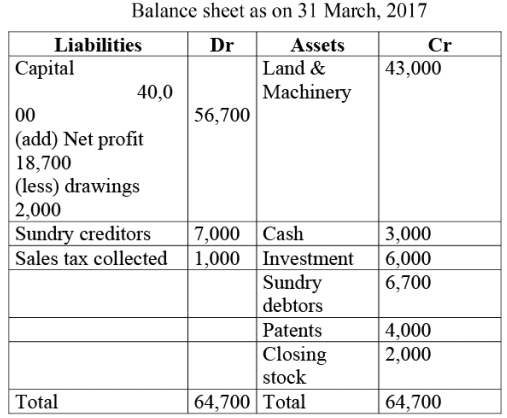

Q8: The following is the trial balance of Manju Chawla on March 31,2017. You are required to prepare the trading and profit loss account and a balance sheet as on date:

Closing stock Rs. 2,000.

Ans:

Note: There is a misprint in the trial balance given in the question. In order to match the trial balance, debtors have been taken as Rs.6,700. However, the debtors given in the trial balance is Rs.60,000.

Note: There is a misprint in the trial balance given in the question. In order to match the trial balance, debtors have been taken as Rs.6,700. However, the debtors given in the trial balance is Rs.60,000.

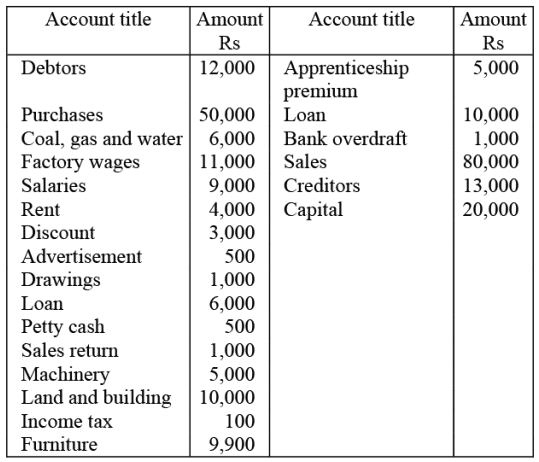

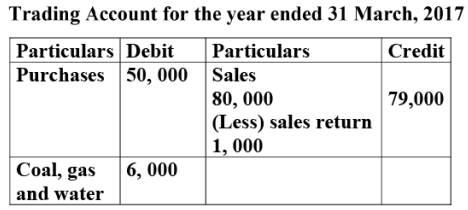

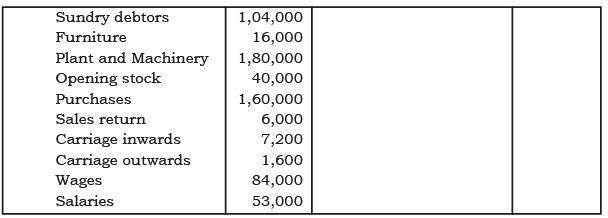

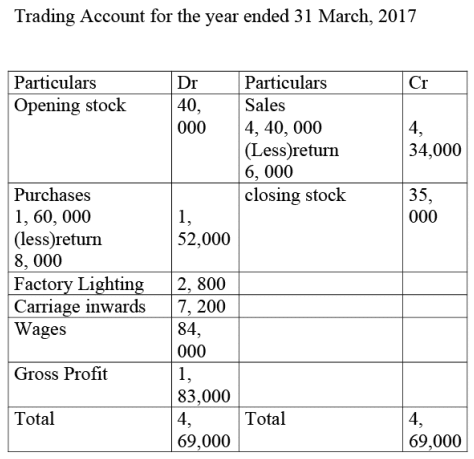

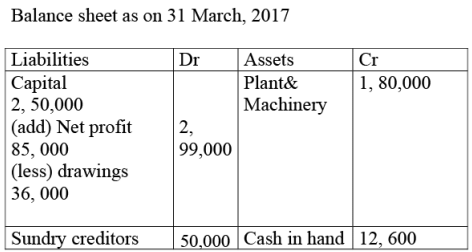

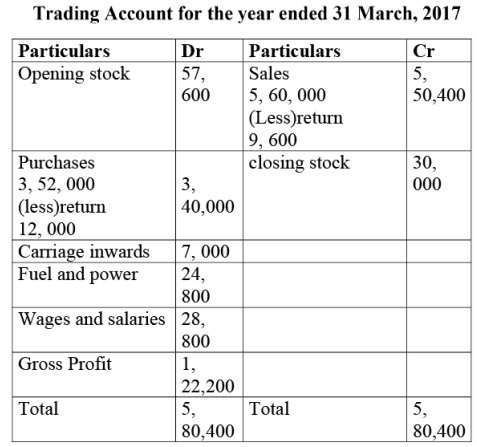

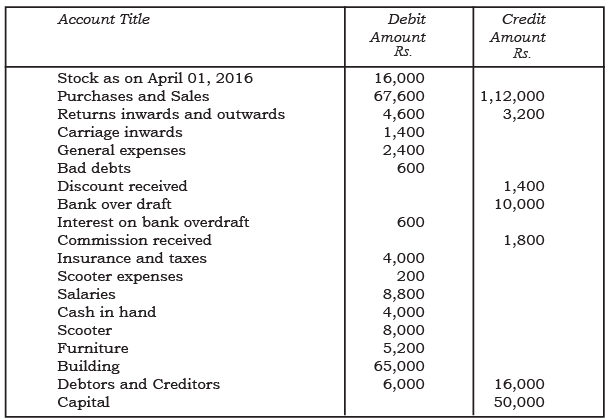

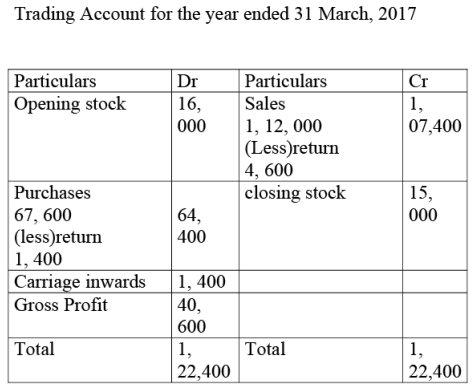

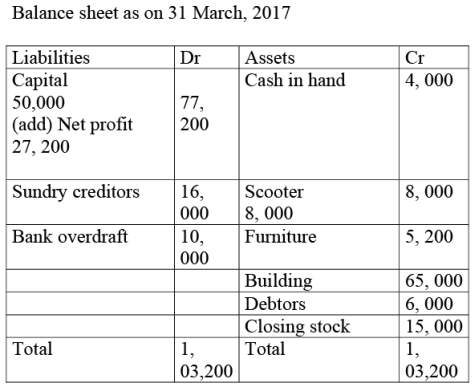

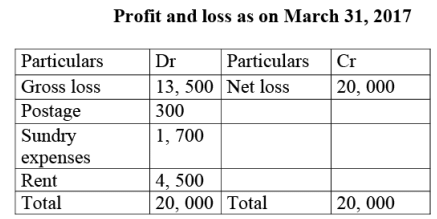

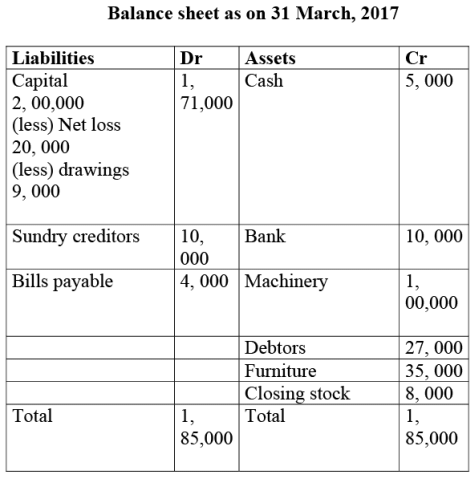

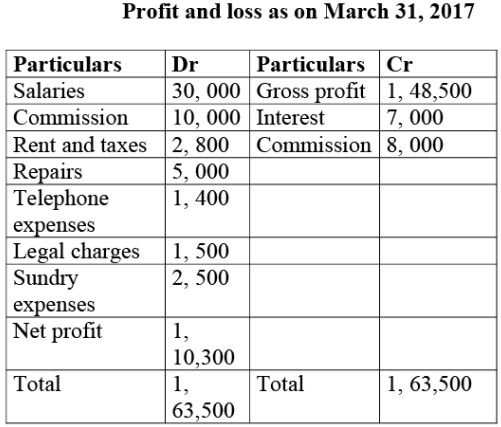

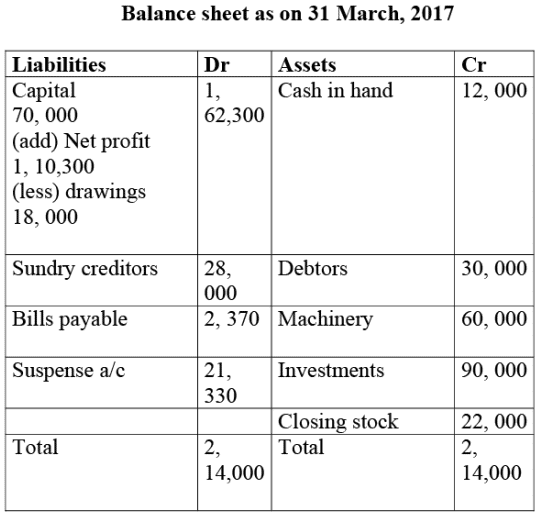

Q9: The following is the trial balance of Mr. Deepak as on March 31, 2017. You are required to prepare trading account, profit and loss account and a balance sheet as on date :

Closing stock Rs. 35,000

Ans:

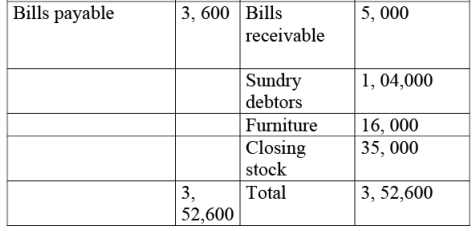

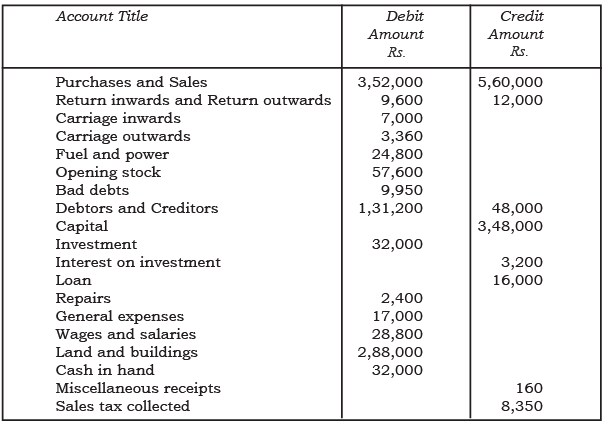

Q10: Prepare trading and profit and loss account and balance sheet from the following particulars as on March 31, 2017.

Closing stock Rs. 30,000.

Ans:

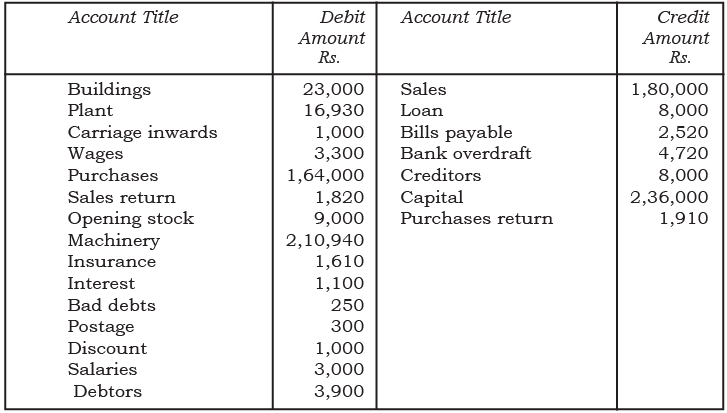

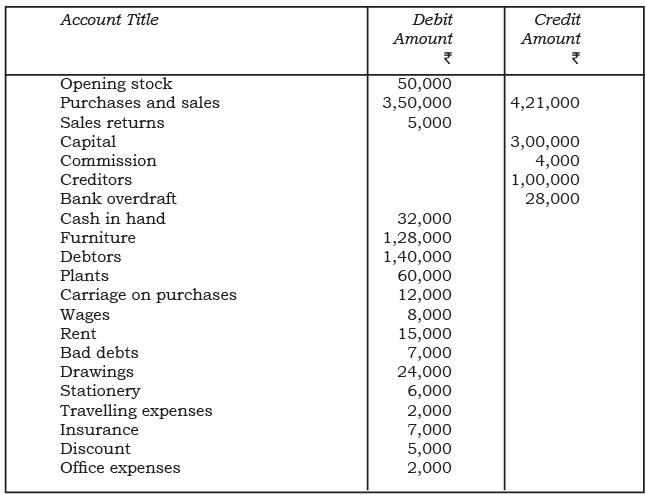

Q11: From the following trial balance of Mr. A. Lal, prepare trading, profit and loss account and balance sheet as on March 31, 2017.

Closing stock Rs. 15,000.

Ans:

Q12: Prepare trading and profit and loss account and balance sheet of M/s Royal Traders from the following balances as on March 31, 2017.

Closing stock Rs 8,000

Closing stock Rs 8,000

Ans:

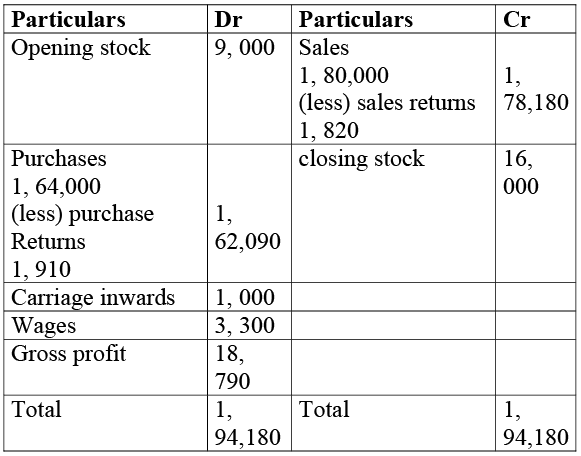

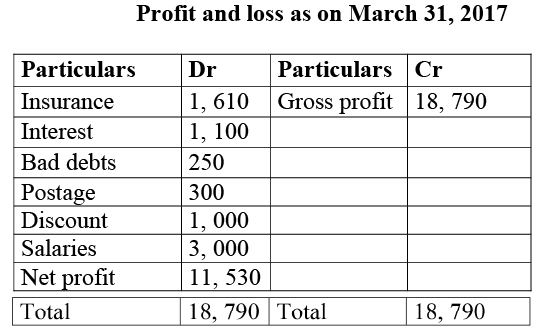

Q13: Prepare trading and profit and loss account from the following particulars of M/s Neema Traders as on March 31, 2017.

Stock on March 31, 2017 Rs.16,000.

Ans:

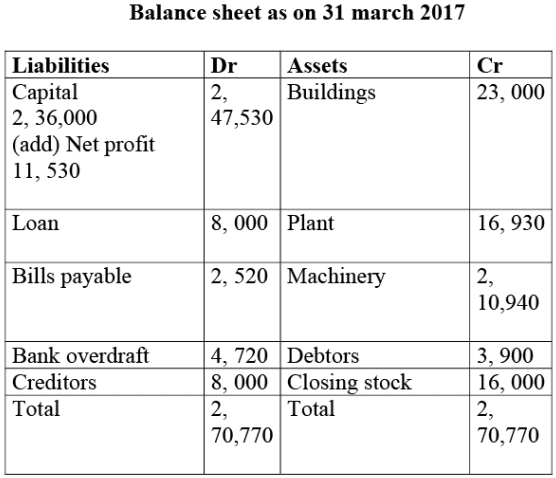

Q14: From the following balances of M/s Nilu Sarees as on March 31, 2017. Prepare trading and profit and loss account and balance sheet as on date.

Closing stock as on March 31, 2017 Rs.22,000.

Ans:

Q15: Prepare trading and profit and loss account of M/s Sports Equipments for the year ended March 31, 2017 and balance sheet as on that date:

Closing stock as on March 31, 2017 Rs 2,500

Ans:

|

61 videos|154 docs|35 tests

|

FAQs on NCERT Solution: Financial Statements- I - Accountancy Class 11 - Commerce

| 1. What are the key components of financial statements in commerce? |  |

| 2. How do financial statements aid in decision-making for businesses? |  |

| 3. What is the significance of the Income Statement in financial analysis? |  |

| 4. How is the Balance Sheet structured, and what does it represent? |  |

| 5. What role does the Cash Flow Statement play in evaluating a business's financial health? |  |