NCERT Solution (Part - 3) - Reconstitution - Retirement/Death of a Partner - Commerce PDF Download

Page No. 223

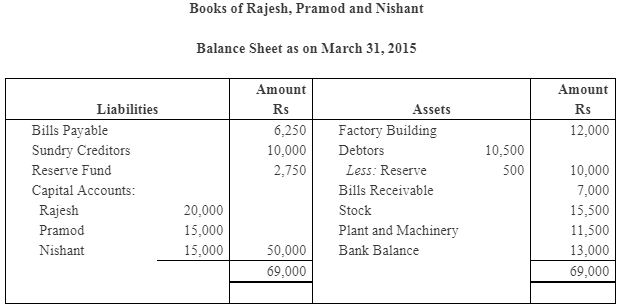

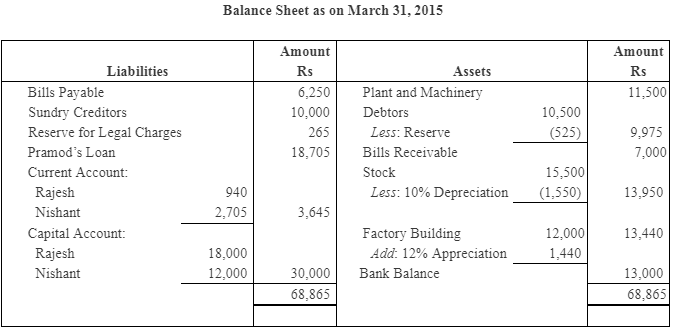

Question 11: The Balance Sheet of Rajesh, Pramod and Nishant who were sharing profits in proportion to their capitals stood as on March 31, 2015:

Pramod retired on the date of Balance Sheet and the following adjustments were made:

a) Stock was valued at 10% less than the book value.

b) Factory buildings were appreciated by 12%.

c) Reserve for doubtful debts be created up to 5%.

d) Reserve for legal charges to be made at Rs 265.

e) The goodwill of the firm be fixed at Rs 10,000.

f) The capital of the new firm be fixed at Rs 30,000. The continuing partners decide to keep their capitals in the new profit sharing ratio of 3:2.

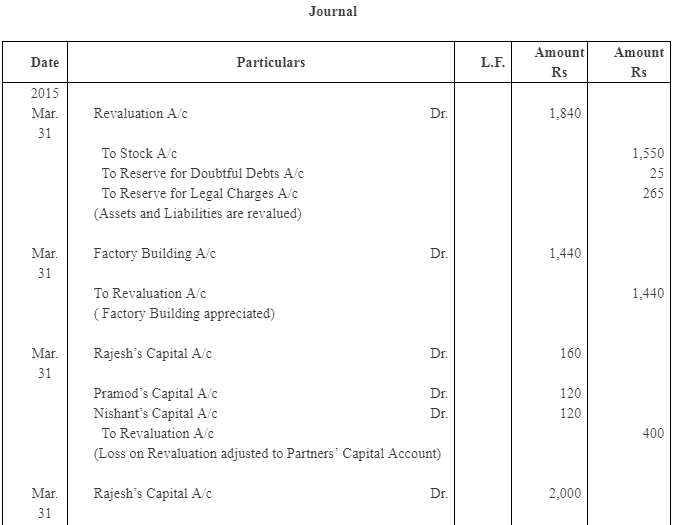

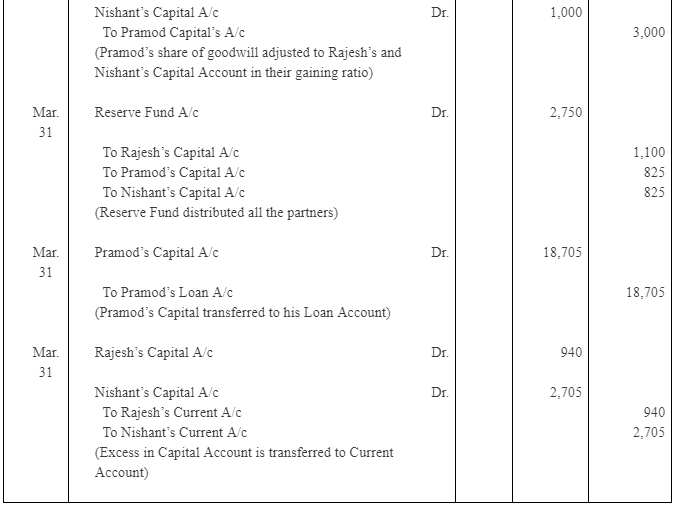

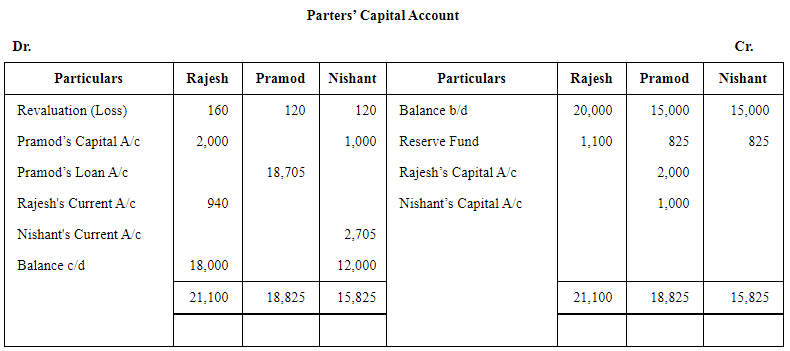

Pass journal entries and prepare the balance sheet of the reconstituted firm after transferring the balance in Pramod’s Capital account to his loan account.

Answer :

Working Notes:

1) Pramod’s share of goodwill = Total goodwill of the firm × Retiring Partner’s Share =

2) Gaining Ratio = New Ratio − Old Ratio

Gaining Ratio between Rajesh and Nishant = 2:1

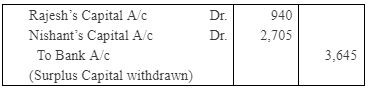

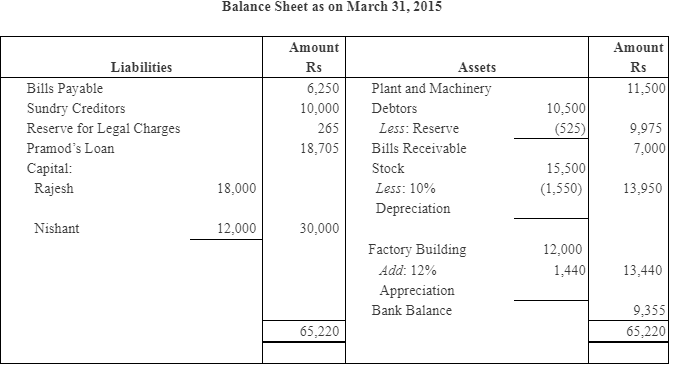

NOTE: In the above solution, in order to adjust the capital of remaining partners in the new firm according to their new profit sharing ratio, the surplus or the deficit of Capital Account is transferred to their Current Account. But, in order to match the answer with that of given in the book, the surplus or the deficit amount of the Partners' Capital Account, will either be withdrawn or brought in by the old partners. This treatment will be shown in the Partners’ Capital itself and no need to transfer the surplus or deficit capital balance to their Current Accounts. The following Journal entry is passed to record the withdrawal of surplus capital by the partners.

If existing partners withdraw their excess capital

Journal entry

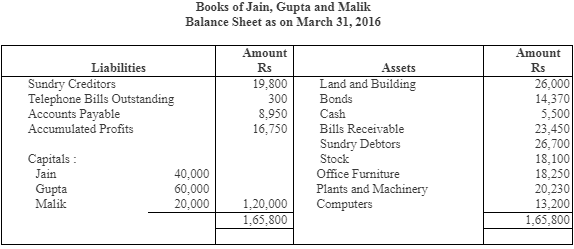

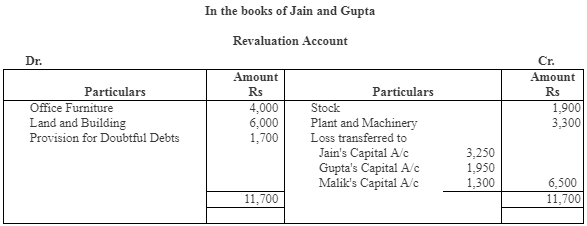

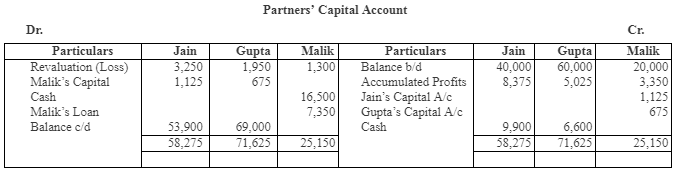

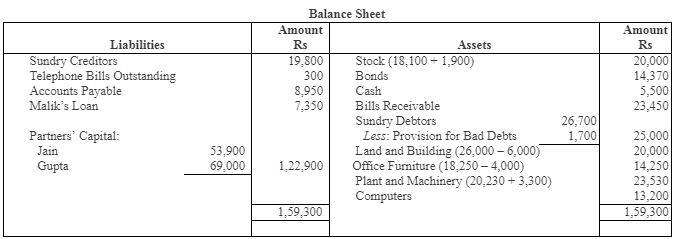

Question 12: Following is the Balance Sheet of Jain, Gupta and Malik as on March 31, 2016.

The partners have been sharing profits in the ratio of 5:3:2. Malik decides to retire from business on April 1, 2002 and his share in the business is to be calculated as per the following terms of revaluation of assets and liabilities : Stock, Rs 20,000; Office furniture, Rs 14,250; Plant and Machinery Rs 23,530; Land and Building Rs 20,000.

A provision of Rs 1,700 to be created for doubtful debts. The goodwill of the firm is valued at Rs 9,000.

The continuing partners agreed to pay Rs 16,500 as cash on retirement of Malik, to be contributed by continuing partners in the ratio of 3:2. The balance in the capital account of Malik will be treated as loan.

Prepare Revaluation account, capital accounts, and Balance Sheet of the reconstituted firm.

Answer 12:

Working Note:

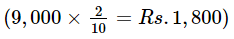

1) Malik’s share of goodwill = Total Goodwill × Retiring Partner Share =

2) Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio between Jain and Gupta = 10:6 or 5:3

Page No. 224

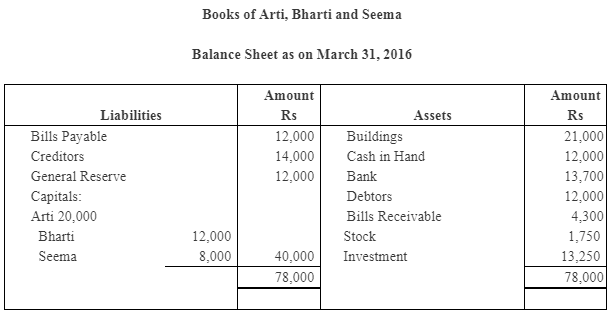

Question 13 : Arti, Bharti and Seema are partners sharing profits in the proportion of 3:2:1 and their Balance Sheet as on March 31, 2016 stood as follows:

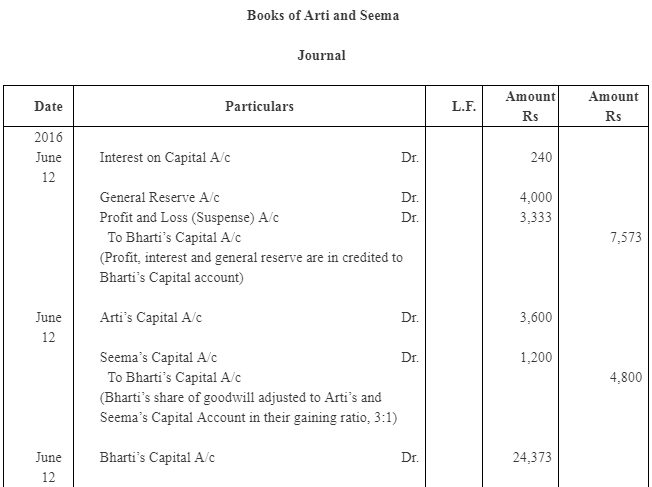

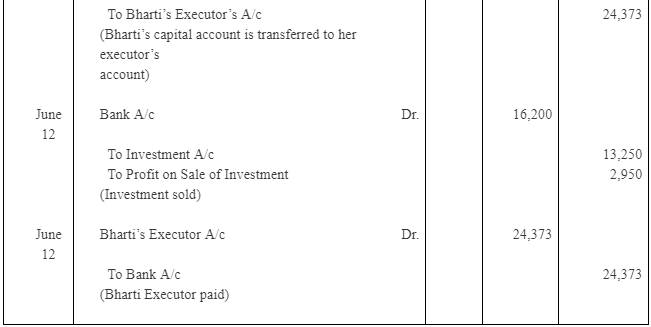

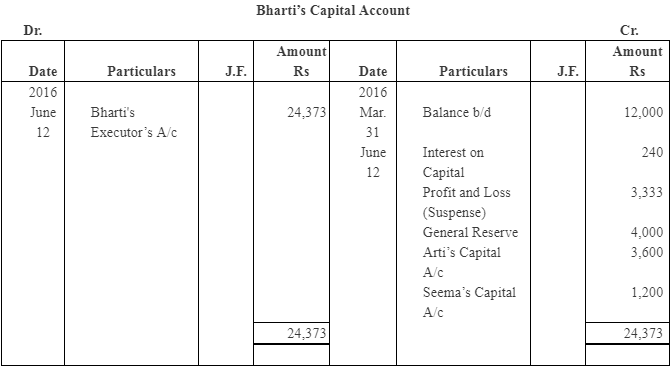

Bharti died on June 12, 2003 and according to the deed of the said partnership, her executors are entitled to be paid as under:

(a) The capital to her credit at the time of her death and interest thereon @ 10% per annum.

(b) Her proportionate share of reserve fund.

(c) Her share of profits for the intervening period will be based on the sales during that period, which were calculated as Rs 1,00,000. The rate of profit during past three years had been 10% on sales.

(d) Goodwill according to her share of profit to be calculated by taking twice the amount of the average profit of the last three years less 20%. The profits of the previous years were:

2013 – Rs 8,200

2014 – Rs 9,000

2015 – Rs 9,800

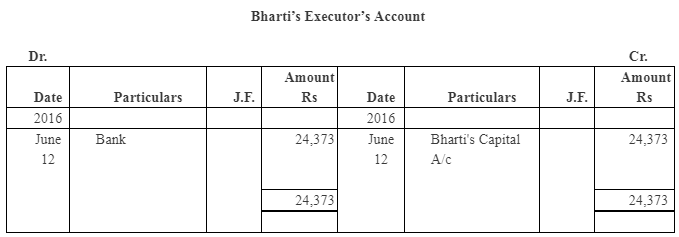

The investments were sold for Rs 16,200 and her executors were paid out. Pass the necessary journal entries and write the account of the executors of Bharti.

Answer :

Working Notes:

1. Bharti’s share of profit = Profit is 10% of sales

Sales during the last year for that period were Rs 1,00,000

If sales are Rs 1,00,000, then the profit is Rs 10,000

2. Bharti’s Share of Goodwill

Goodwill of the firm = Average Profit × Number of Years Purchase

Or, 9,000 − 20% of 9,000 = 9,000 − 1,800 = Rs 7,200

Goodwill of the firm = 7,200 × 2 = Rs 14,400

3. Gaining Ratio = New Ratio − Old Ratio

Gaining ratio between Arti and Seema = 3:1

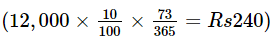

4. Interest on Capital for 73 days, i.e. from April 1, 2003 to June 12, 2003

Interest on capital = Amount of Capital × Ratio of Interest × Period =

Page No. 225

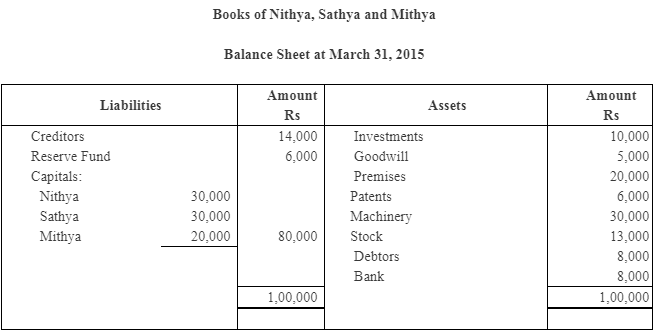

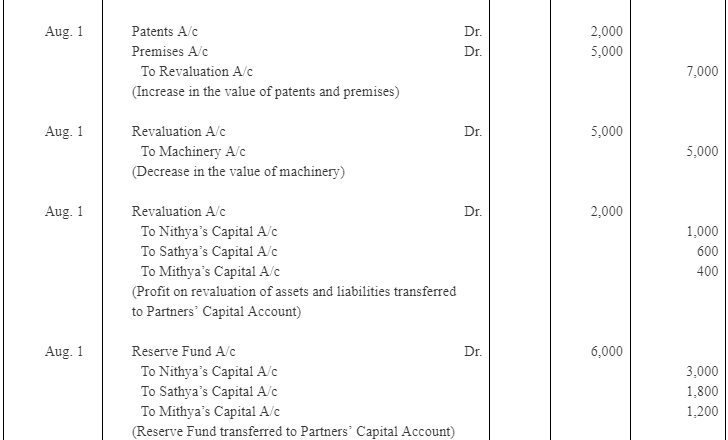

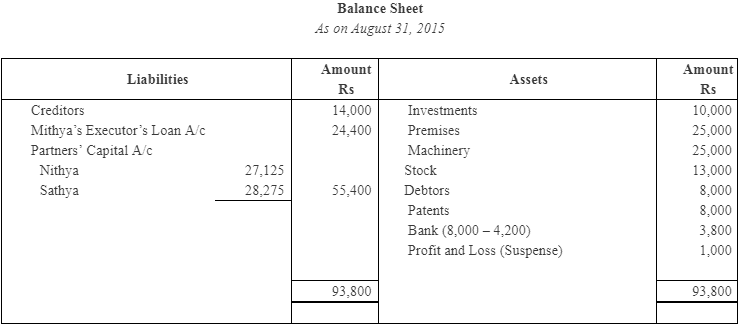

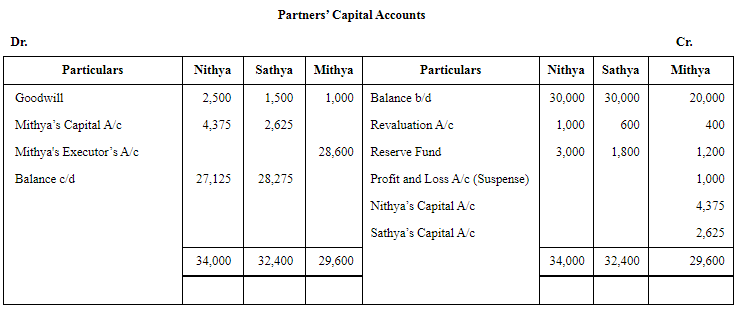

Question 14: Nithya, Sathya and Mithya were partners sharing profits and losses in the ratio of 5:3:2. Their Balance Sheet as on December 31, 2015 was as follows:

Mithya dies on August 1, 2015. The agreement between the executors of Mithya and the partners stated that:

(a) Goodwill of the firm be valued at  times the average profits of last four years. The profits of four years were : in 2011-12, Rs 13,000; in 2012-13, Rs 12,000; in 2013-14, Rs 16,000; and in 2014-15, Rs 15,000.

times the average profits of last four years. The profits of four years were : in 2011-12, Rs 13,000; in 2012-13, Rs 12,000; in 2013-14, Rs 16,000; and in 2014-15, Rs 15,000.

(b) The patents are to be valued at Rs 8,000, Machinery at Rs 25,000 and Premises at Rs 25,000.

(c) The share of profit of Mithya should be calculated on the basis of the profit of 2014-15.

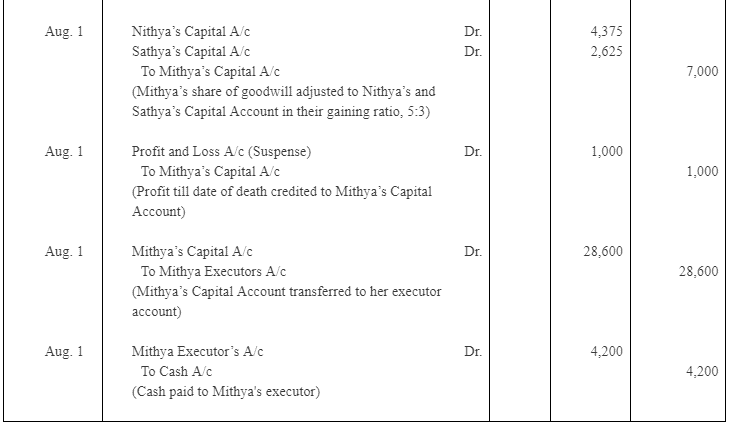

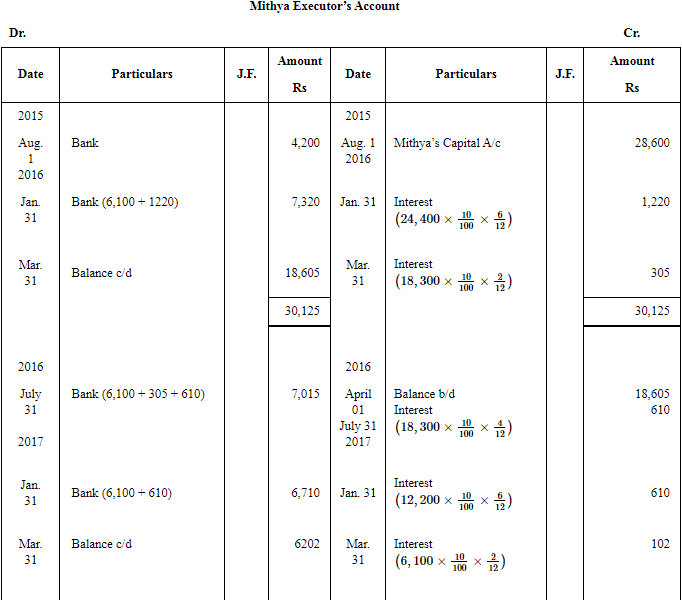

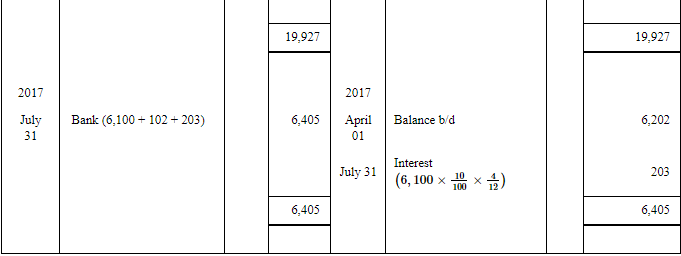

(d) Rs 4,200 should be paid immediately and the balance should be paid in 4 equal half-yearly instalments carrying interest @ 10%.

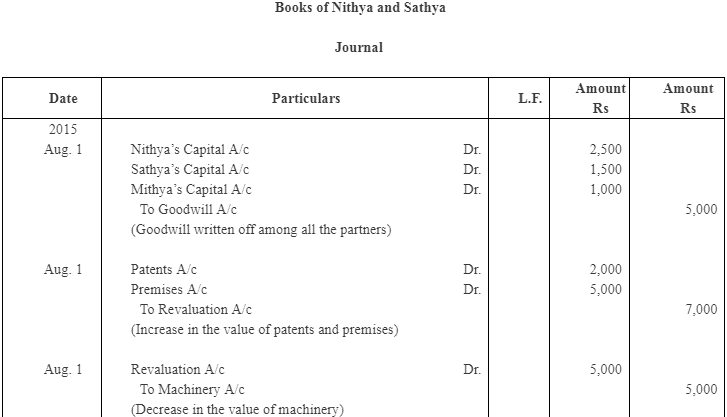

Record the necessary journal entries to give effect to the above and write the executor’s account till the amount is fully paid. Also prepare the Balance Sheet of Nithya and Sathya as it would appear on August 1, 2015 after giving effect to the adjustments.

Answer :

Working Notes:

1.

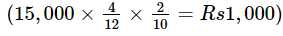

2. Mithya’s Share of Profit:

Previous year’s profit × Proportionate Period × Share of Profit =

3. Mithya’s share of Goodwill

Goodwill of a firm = Average Profit × Number of Year’s Purchase

4. Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio between Nithya and Sathya = 5:3

FAQs on NCERT Solution (Part - 3) - Reconstitution - Retirement/Death of a Partner - Commerce

| 1. What is reconstitution in the context of partnership accounting? |  |

| 2. How does retirement of a partner affect the partnership firm? |  |

| 3. What happens to the deceased partner's share in the firm upon his death? |  |

| 4. How is the retirement or death of a partner accounted for in the partnership books? |  |

| 5. What are the implications of reconstitution on the financial statements of a partnership firm? |  |

|

Explore Courses for Commerce exam

|

|