NCERT Solutions (Part - 2) - Analysis of Financial Statements | Accountancy Class 12 - Commerce PDF Download

Numerical Questions:

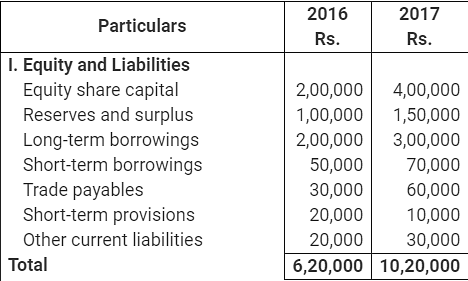

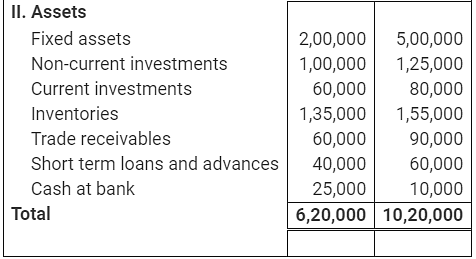

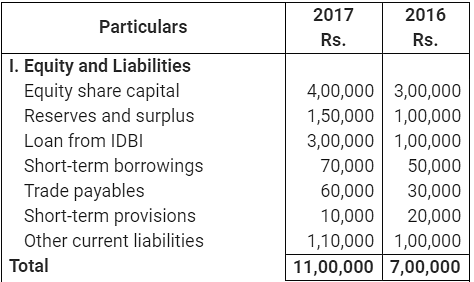

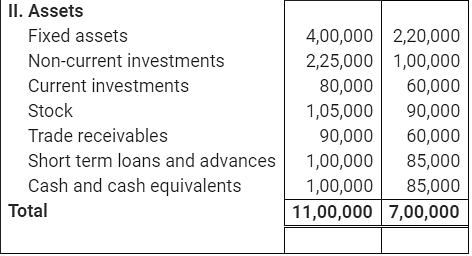

Question 1: Following are the balance sheets of Alpha Ltd. as at March 31st, 2016 and 2017:

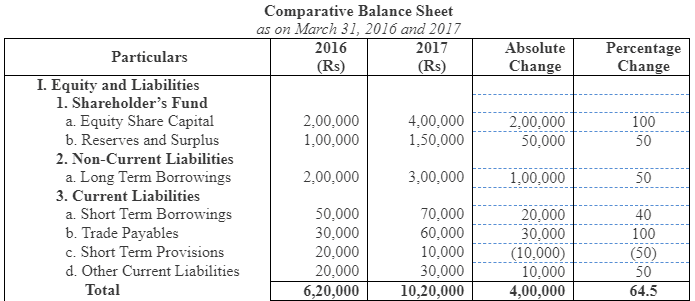

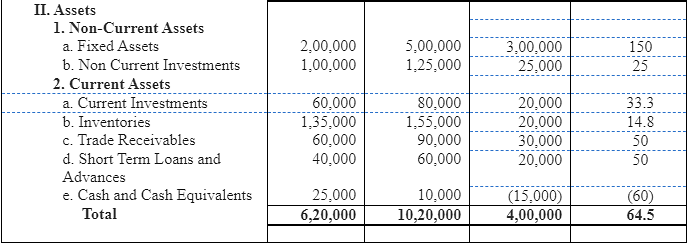

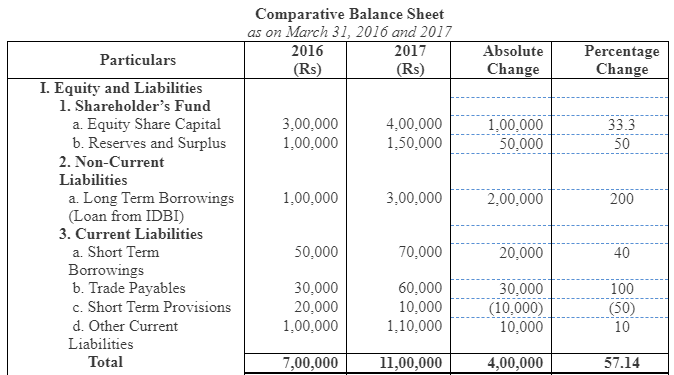

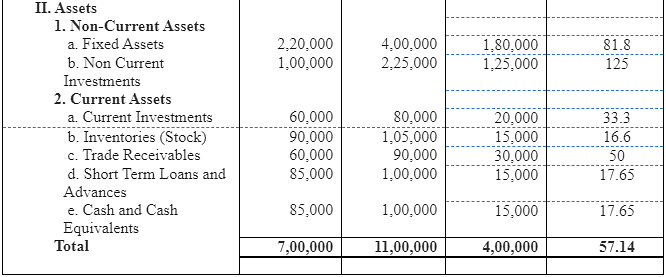

ANSWER:

Page No 195:

Question 2: Following are the balance sheets of Beta Ltd. at March 31st, 2016 and 2017:

ANSWER:

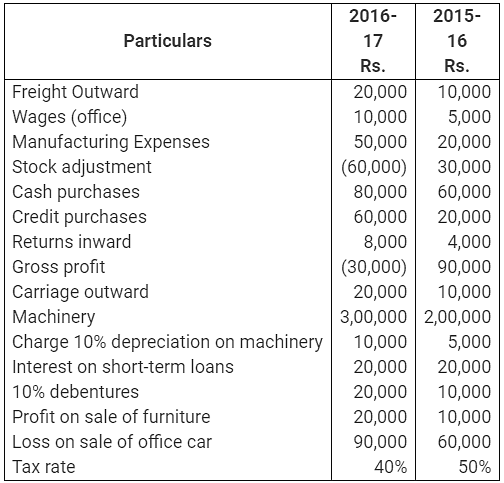

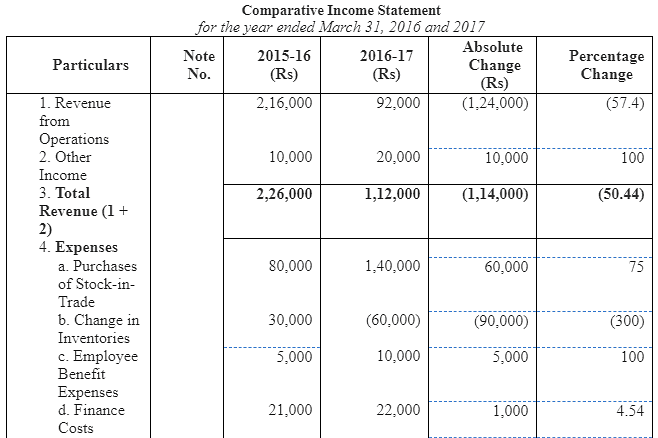

Question 3: Prepare Comparative Income Statement from the following information:

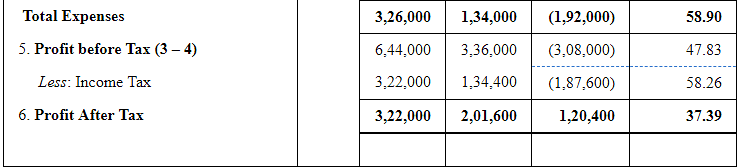

ANSWER:

Working Notes:

1. Calculation of Net Sales

Net Sales = Cost of Goods Sold + Gross Profit - Sales Return

or, Net Sales = Purchases + Manufacturing Expenses + Change in Inventory + Gross Profit - Sales Return

Net Sales (2016) = 80,000 + 20,000 +30,000 + 90,000 - 4,000 = Rs 2,16,000

Net Sales (2017) = 1,40,000 + 50,000 - 60,000 - 30,000 - 80,000 = Rs 92,000

2. Calculation of Finance Cost

Finance Cost = Interest on short-term loans + Interest on 10% Debentures

Finance Cost (2016) = 20,000 + 1,000 = Rs 21,000

Finance Cost (2017) = 20,000 + 2,000 = Rs 22,000

3. Calculation of Other Expenses

Other Expenses = Freight Outward + Carriage Outward + Loss on sale of office car

Other Expenses (2016) = 10,000 + 10,000 + 60,000 = Rs 80,000

Other Expenses (2017) = 20,000 + 20,000 + 90,000 = Rs 1,30,000

Page No 196:

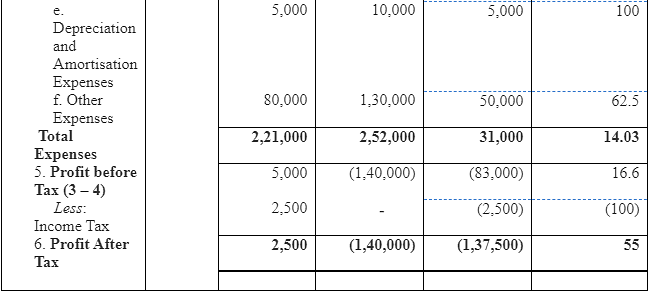

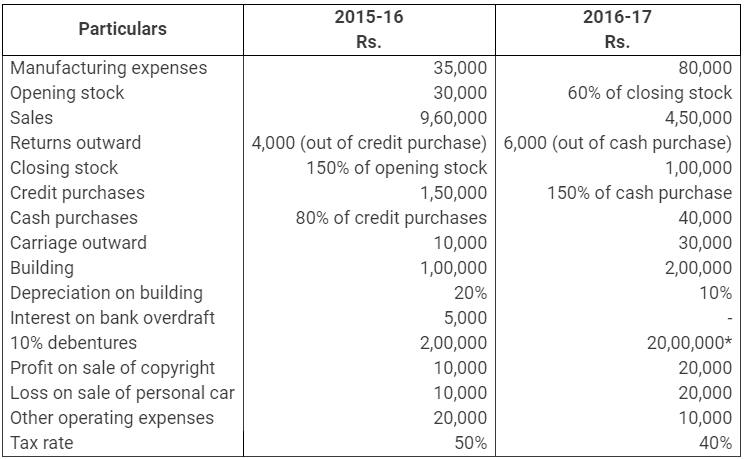

Question 4:

Prepare Comparative Income Statement from the following information:

*There is a misprint in the book, this should be 2,00,000

ANSWER:

Working Notes:

1. Calculation of Net Purchases and Change in Inventory

2. Calculation of Finance Cost

Finance Cost = Interest on Bank Overdraft + Interest on Debentures

Finance Cost (2016) = 5,000 + 20,000 = Rs 25,000

Finance Cost (2017) = 0 + 20,000 = Rs 20,000

3. Calculation of Other Expenses

Other Expenses = Carriage outward + Other operating expenses

Other Expenses (2016) = 10,000 + 20,000 = Rs 30,000

Other Expenses (2017) = 30,000 + 10,000 = Rs 40,000

Page No 197:

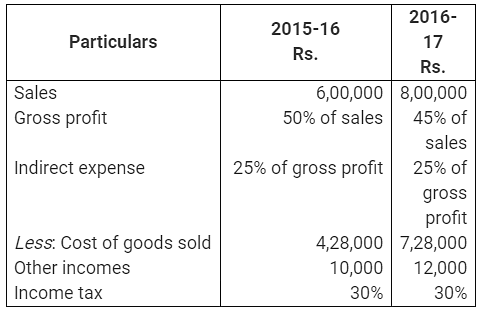

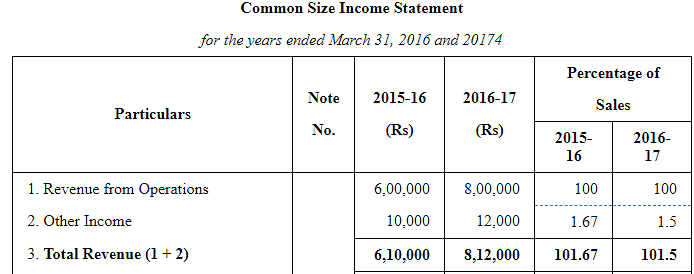

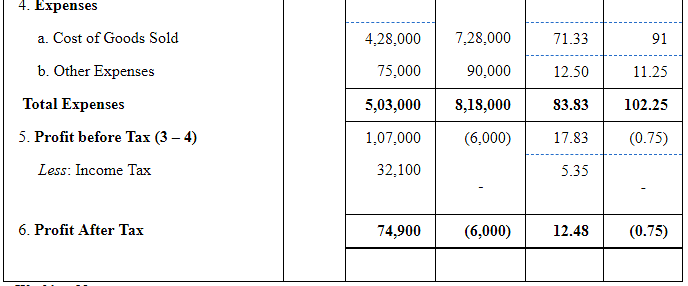

Question 5: Prepare a Common-size income statement of Shefali Ltd. with the help of following information:

ANSWER:

Working Notes:

1. Calculation of Other Expenses

Other Expenses = Indirect Expenses = % of Gross Profit

2016=6,00,000×50%×25%=Rs 75,000

2017=8,00,000×45%×25%=Rs 90,000

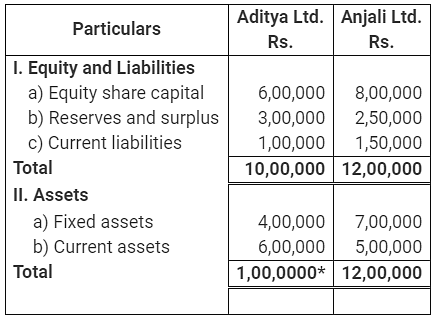

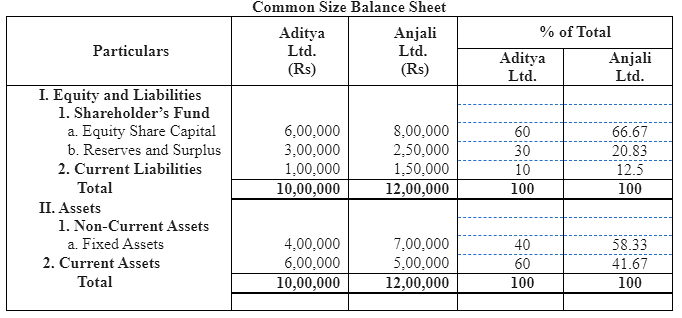

Question 6: Prepare a Common Size balance sheet from the following balance sheet of Aditya Ltd. and Anjali Ltd.:

*The total of Liabilities side must be equal to the total of Assets side, therefore, it should be 10,00,000.

ANSWER:

|

47 videos|180 docs|56 tests

|

FAQs on NCERT Solutions (Part - 2) - Analysis of Financial Statements - Accountancy Class 12 - Commerce

| 1. What is the purpose of analyzing financial statements? |  |

| 2. What are the key components of financial statements? |  |

| 3. How can financial ratios be used to analyze financial statements? |  |

| 4. What are the limitations of analyzing financial statements? |  |

| 5. How can trend analysis be used in financial statement analysis? |  |

|

Explore Courses for Commerce exam

|

|