Admission of a Partner NCERT Solutions | Accountancy Class 12 - Commerce PDF Download

Short Answer Questions

Q1: Identify various matters that need adjustments at the time of admission of a new partner.Ans:The following are the various items that need to be adjusted at the time of admission of a new partner.

1. Profit Sharing Ratio: Calculation of new profit sharing ratio.

2. Goodwill:Valuation and adjustment of goodwill among the sacrificing old partners.

3. Revaluation of Assets and Liabilities: Assets and liabilities are revalued to ascertain the current value of the assets and liabilities of the partnership firm. Moreover, the profit or loss due to the revaluation need to be distributed among the old partners.

4. Accumulated profits, losses and reserves are distributed among the old partners in their old ratio.

5. Adjustment of capital of the partners.

Q2: Why it is necessary to ascertain new profit sharing ratio even for old partners when a new partner is admitted?

Ans:When new partner/s is/are admitted, then the old partners in the partnership firm need to sacrifice their share of profit in favour of the new partner/s. This reduces the share of profit of the old partners ,hence, it is necessary to ascertain the new profit sharing ratio even for the old partners in the event of admission of new partner/s.

Q3: What is sacrificing ratio? Why is it calculated?

Ans: Sacrificing ratio refers to the ratio in which the old partners of a partnership firm surrender their share of profit in favour of the new partner/s. It is calculated as a difference between the old ratio and the new ratio of the old partners.

Sacrificing Ratio = Old Ratio − New Ratio

It is very important to calculate this ratio, as the new partner need to compensate the old partners for sacrificing their share of profit. The new partner compensates the old partners by making payment to them in the form of goodwill that is transferred among the old partners in their sacrificing ratio.

Q4: On what occasions sacrificing ratio is used?

Ans:The following are the different situations when sacrificing ratio is used.

1. When the existing partners of a partnership firm agree to change the share of profit among themselves.

2. When a new partner is admitted in the partnership firm and the amount of the goodwill brought by him/her is transferred among the old partners in sacrificing ratio of the old partners.

Q5: If some goodwill already exists in the books and the new partner brings in his share of goodwill in cash, how will you deal with existing amount of goodwill?

Ans:If goodwill already appears in the books of old firm (before the admission of new partner), then this should be written off among the old partners in their old profit sharing ratio. The following Journal entry is passed.

Old Partner’s Capital A/c Dr.

To Goodwill A/c

(Goodwill written off in old ratio among the old partners)

Q6: Why is there need for the revaluation of assets and liabilities on the admission of a partner?

Ans:At the time of admission of a new partner, it becomes very necessary to revalue the assets and liabilities of a partnership firm for ascertaining its true and fair values. This is done because the value of assets and liabilities may have increased or decreased and consequently their corresponding figures in the old balance sheet may either be understated or overstated. Moreover, it may also be possible that some of the assets and liabilities are left unrecorded. Thus, in order to record the increase and decrease in the market value of the assets and liabilities, Revaluation Account is prepared and any profits or losses associated with this increase or decrease are distributed among the old partners of the firm.

Long Answer Questions

Q1: Do you advise that assets and liabilities must be revalued at the time of admission of a partner? If so, why? Also describe how is this treated in the book of account?Ans: Yes, it is advisable to revalue the assets and liabilities at the time of admission of a new partner for ascertaining the true and fair value of the assets and liabilities. This is done because the value of assets and liabilities may have increased or decreased and consequently their corresponding figures in the old balance sheet may either be understated or overstated. Moreover, it may also be possible that some of the assets and liabilities are left unrecorded. Thus, in order to record the increase and decrease in the market value of the assets and liabilities, Revaluation Account is prepared and any profits or losses associated with this increase or decrease are distributed among the old partners of the firm.

Accounting Entries in the Books of Accounts:

The following Journal entries are recorded in the Revaluation Account on the date of admission of a new partner.

(i) For increase in value of assets:

Assets A/c Dr.

To Revaluation A/c

(Increase in the value of assets)

(ii) For decrease in value of assets:

Revaluation A/c Dr.

To Asset A/c

(Decrease in the value of assets)

(iii) For increase in liabilities:

Revaluation A/c Dr.

To Liabilities

(Increase in the value of liabilities)

(iv) For decrease in liabilities:

Liability A/c Dr.

To Revaluation A/c

(Decrease in the value of liabilities)

(v) For recording of unrecorded assets:

Unrecorded Assets A/c Dr.

To Revaluation A/c

(Recording of unrecorded assets)

vi) For recording of unrecorded liabilities:

Revaluation A/c Dr.

To Unrecorded Liabilities A/c

(Recording of unrecorded liabilities)

(vii) For transfer of credit balance of Revaluation Account:

Revaluation Dr.

To Old Partner’s Capital A/c

(Profit on revaluation is transferred to the Old Partner’s Capital Account in their old profit sharing ratio)

Or,

(vii) For transfer of debit balance of Revaluation Account:

Old Partner’s Capital A/c Dr.

To Revaluation A/c

(Loss on revaluation is transferred to the Old Partner’s Capital Account in their old profit sharing ratio)

Q2: What is goodwill? What factors affect goodwill ?

Ans: Goodwill is an intangible asset of a firm. It is the value of a firm’s reputation and its good brand name in the market. A firm earns goodwill by its hard work thereby winning the blind trust and faith of the customers by fulfilling their demands in both qualitative and quantitative aspects. A positive goodwill helps a firm to earn supernormal profits compared to its competitors which earn normal profits (as their goodwill is zero). In other words, goodwill ensures greater future profits as there will be a greater number of satisfied customers in the future. As in the words of Lord Eldon, “Goodwill is nothing more than the probability, that the old customers will resort to the old place.”

Characteristics of Goodwill

The following are the characteristics of goodwill.

(1) It is an intangible asset.

(2) It is not a fictitious asset.

(3) It is difficult to ascertain the exact value of goodwill.

(4) It enhances the future as well as the present earning capacity of a business.

(5) It helps in earning supernormal profits against the normal profits.

(6) It assists the business in enjoying its upper hand over its counterparts.

Factors Affecting Goodwill

The following are the important factors that affect the goodwill of a firm.

(1) Quality Products: If a company produces products of the best quality and in a large scale, then automatically the company earns more goodwill.

(2) Location: If a business is located at an easily reachable and convenient place, then more consumers will be attracted again and again which will lead to an increase in sales and, therefore, the firm will earn higher goodwill.

(3) Management: Efficient management leads to cost efficiency and increases productivity. If a firm’s management is efficient, then superior quality products can be produced at lower cost . These can be sold at a lower price. Superior quality at a lower price enables a firm to earn higher goodwill.

(4) Market Structure: If a firm is operating in a monopoly market with no close substitutes, then there will be more goodwill for the firm.

(5) Economies of Scale: If a firm enjoys special advantages like a continuous supply of power, fuel and raw materials at a low price and produces quality products at a large scale, then the firm enjoys a higher value of goodwill.

Q3: Explain various methods of valuation of goodwill.

Ans: The following are the various methods of valuation of goodwill.

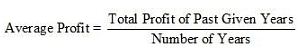

1. Average Profit Method: Under this method, goodwill is calculated on the average basis of the profits of the past few years. The formula for calculating goodwill is:

Goodwill = Average Profit × No. of Years Purchase

The number of Years Purchased implies a number of years for which the firm expects to earn the same amount of profits.

Steps to Calculate Goodwill by Average Profit Method:

Step 1: Ascertain the total profit of past given years.

Step 2: Add all abnormal losses like, loss by fire, theft etc.

Step 3: Add all normal income, if not added previously.

Step 4: Less all non-business incomes and all abnormal gains and incomes like, speculation, lottery etc.

Step 5: Less all normal expenses, if not deducted previously.

Step 6: Calculate Average Profit, by dividing the total profit ascertained in Step 5 by number of years.

Step 7: Multiply the Average Profit to the Number of Year’s Purchases to calculate the value of goodwill.

Example:

The profits for last 5 years are 1,00,000, 3,00,000, (2,00,000), 5,00,000, 8,00,000.

Calculate goodwill on the basis of 4 years purchase

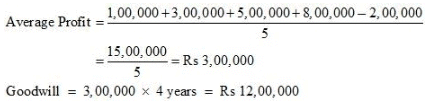

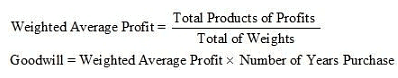

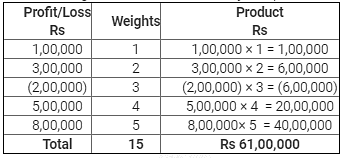

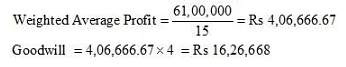

2. Weight Average Method: It is a modified version of the Average Profit Method. Under this method, the weights are assigned for each year’s profit. The highest weights are assigned to the recent year’s profit and lower weights are assigned to the past year’s profits. The products of the profits and the weights are added and divided by the total weights to calculate Weighted Average Profits. The formula for calculating goodwill by this method is:

Steps to Calculate Goodwill by Weight Average Method:

Step 1: Assign the highest weights to the recent year’s profit and lower weights to the past year’s profits, like 4,3,2,1.

Step 2: Multiply the weights with the corresponding year’s profits.

Step 3:Calculate the total of the products

Step 4: Divide the total of the product by the total of the eight in order to calculate Weighted Average Profit.

Step 5: Multiply the Weighted Average Profit by the number of years purchased.

For example:

The profits for the last 5 years are Rs 1,00,000, Rs 3,00,000, Rs (2,00,000), Rs 5,00,000, Rs 8,00,000.

Calculate goodwill on the basis of 4 years purchase

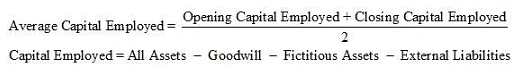

3. Super Profit Method: Under this method, goodwill is calculated on the basis of excess profit earned by a firm over the normal profit earned by its counterparts in the same industry. The excess profit over the normal profit is termed as Super Normal Profit.

Steps to Calculate Goodwill by Super Profit Method:

Step 1: Calculate Average Profit

Step 2: Calculate Average Capital Employed as:

Step 3:Calculate Normal Profit by the formula:

Step 4: Calculate Super Normal Profit by the formula:

Super Normal Profit = Average Profit – Normal Profit

Step 5: Multiply the Super Normal Profit by the Number of Years Purchase to calculate goodwill.

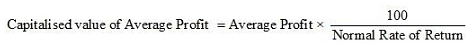

4. Capitalisation Method: Under this method, goodwill is calculated by the following two methods :

a) By capitalisation of Average Profit.

b) By capitalisation of Super Profit.

(a) Capitalisation of Average Profit

Step 1: Calculate Average Profit

Step 2: Calculate Capitalised value of Average Profit by the following formula:

Step 3: Ascertain Actual Capital Employed

Step 4: Deduct Actual Capital Employed from Capitalised Average Profit to calculate goodwill.

Goodwill = Capitalised Average Profit – Actual Capital Employed

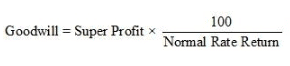

(b) Capitalisation of Super Profit

Step 1: Calculate the Capital Employed

Step 2: Calculate Normal Profit by the following formula:

Step 3: Calculate Average Profit.

Step 4: Calculate Super Normal Profit by the following formula:

Super Normal Profit = Average Profit – Normal Profit

Step 5: Calculate goodwill by the following formula:

Q4: If it is agreed that the capital of all the partners be proportionate to the new profit sharing ratio, how will you work out the new capital of each partner? Give examples and state how necessary adjustments will be made.

Ans: When a new partner is admitted, sometimes it is agreed that the capital of all the partners should be proportionate to the new profit sharing ratio. The calculation of the new capital of each partner depends on the following situations:

1) When the capital of the new partner is given

2) When the total capital of the firm is given.

(1) When the capital of the new partner is given

In this situation, the calculation of the new capital of all the partners involves the following steps:

Step 1: The total capital of the new firm is calculated on the basis of new partner’s capital.

Step 2: The new capital of each partner is calculated by dividing the total capital of the firm by their individual new profit share.

Step 3: After posting all adjustments and items in the Partners’ Capital Account, calculate credit minus debit side of the old Partners’ Capital Account.

Step 4: The new capital ascertained in the Step 2 is written as ‘Balance c/d’ on the credit side of the Partner’s Capital Account.

Step 5: If the amount ascertained in Step 2 (New capital) exceeds the capital amount ascertained in Step 3 (Old Capital), then it is termed as ‘Deficit’ and the difference amount is to be brought in by the old partners. On the contrast, if the amount ascertained in the Step 2 (New Capital) is lesser than the capital amount ascertained in the Step 3 (old Capital), then it is termed as ‘Surplus’ and the difference amount is returned to the old partners.

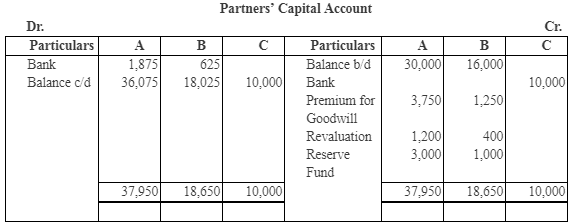

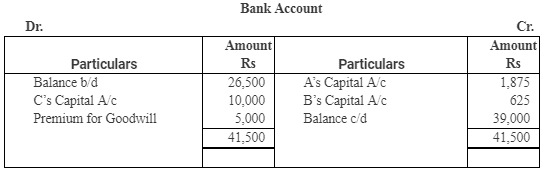

Let us understand the above steps with the help of an example.

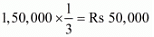

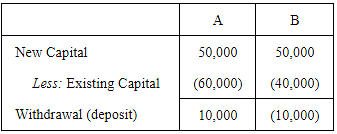

A and B are partners sharing profit and loss equally. They agree to admit C  for share in profit. C brings Rs 50,000 as capital. The old capitals of A and B are Rs 60,000 and Rs 40,000 respectively, at the time admission of C.

for share in profit. C brings Rs 50,000 as capital. The old capitals of A and B are Rs 60,000 and Rs 40,000 respectively, at the time admission of C.

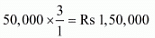

Step 1: The total capital of the new firm on the basis of C =

Step 2: A’s new capital =

B’s share in new firm =

Step 3:

(2) When the total capital of the new firm is given:

When the capital of new partner is not mentioned then his/her capital is ascertained on the proportionate basis of total capital of the firm. The amount ascertained is to be brought in by the new partner in the form of his/her portion of capital. In order to ascertain the proportionate capital of the new partner, the following steps are to be followed.

Step 1:Ascertain the total old capital of the old partners (after making all adjustments)

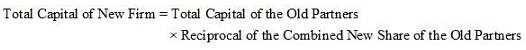

Step 2: Ascertain the total capital of the new firm by multiplying the total of old capitals of the old partners (ascertained in the Step 1) with reciprocal of total share of old partners. That is,

Step 3: Calculate New Capital of each partner on the basis of Total Capital ascertained in Step 2. That is, multiplying the Total Capital by the new profit sharing ratio individually for all the partners (including the new partner).

Let us understand the above steps with the help of an example.

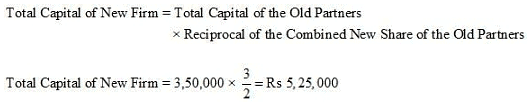

X and Y are partners in a firm sharing profit and loss equally. They agree to admit Z for  share in profit and decided to share future profit and loss equally. X’s capital is Rs 2,00,000 and Y’s capital is Rs 1,50,000. Z brings sufficient capital for his share in profit.

share in profit and decided to share future profit and loss equally. X’s capital is Rs 2,00,000 and Y’s capital is Rs 1,50,000. Z brings sufficient capital for his share in profit.

Step 1: Calculation of Total Capital of Old Partners (after all adjustments)

The total capital of the old partners = Rs 2,00,000 + Rs 1,50,000 = Rs 3,50,000

Step 2: Calculation of Total Capital of New Firm

Step 3: Calculation of New Capital of Each Partner

Q5: Explain how will you deal with goodwill when new partner is not in a position to bring his share of goodwill in cash.?

Ans: When the new partner is not in a position to bring his share of goodwill in cash, then goodwill account is adjusted through the old Partners’ Capital Account. New Partner’s Capital Account or Current Account is debited with his/her share of goodwill and the partners who sacrifice their share in favour of the new partner are credited in their sacrificing ratio. The following Journal entry is passed in the books of accounts.

New Partner’s Capital A/c Dr.

To Old Partners’ Capital A/c

(New partner capital account is debited with his/her share of goodwill and sacrificing Partners’ Capital Account are credited in their sacrificing ratio)

Note: As per the Para 16 of Accounting Standard 10, goodwill is recorded in the books only when some consideration in money or money’s worth has been paid for it. This practice is mandatory to follow. In the case of admission, retirement, death or change in profit sharing ratio among existing partners, Goodwill Account cannot be raised as no consideration is paid for it.

Q6: Explain various methods for the treatment of goodwill on the admission of a new partner.

Ans: The methods for the treatment of goodwill on the admission of a new partner are given below.

1. Premium Method

2. Revaluation Method

It should be noted that before following any of the below mentioned methods of goodwill, if goodwill already appears in the old books (old Balance Sheet) of the firm, then first of all, this goodwill should be written off among all the old partners in their old profit sharing ratio. The following Journal entry is passed to distribute the goodwill.

Old Partners’ Capital A/c Dr.

To Goodwill A/c

(Goodwill written off among the old partners in their old profit sharing ratio)

1. Premium Method- This method is used when a new partner pays his/her share of goodwill in cash. The following are the different situations under this method.

(i) When the new partner privately pays his/her share of goodwill to the old partners.

In this case, there is no need to pass any Journal entry in the books of accounts as the goodwill is privately paid.

(ii) When the new partner brings his/her share of goodwill in cash and the goodwill is retained in the business.

Accounting Entries

(a) For premium or goodwill brought in cash by the new partner

Cash/Bank A/c Dr.

To Premium for Goodwill A/c

(Amount of goodwill brought in by the new partner)

(b) For transferring of new partner’s goodwill among the old partners, i.e. if goodwill is retained in the business.

Premium for Goodwill A/c Dr

To Sacrificing Partners’ Capital A/c

(Goodwill brought in by the new partner is distributed among the old partners in their sacrificing ratio)

(c) If the new partner’s share of goodwill is withdrawn by the old partner, then

Sacrificing Partner’s Capital A/c Dr.

To Cash A/c

(Amount of goodwill withdrawn by the old partners)

(iii) If the new partner partly brings his/her share of goodwill

(a) For bringing goodwill in cash

Cash A/c Dr.

To Premium for Goodwill A/c

(Amount of goodwill brought in cash by the new partner)

(b) For transferring of goodwill to the old partners

Goodwill A/c Dr.

(With the amount of goodwill brought in by the new partner)

New Partner’s Capital A/c Dr.

(With the amount of goodwill not brought in by the new partner)

To Sacrificing Partners’ Capital A/c

(Goodwill amount of the new partner distributed among the old partners in their sacrificing ratio)

2. Revaluation Method- When the new partner is not able to bring goodwill in cash at all.

New Partner’s Capital A/c Dr.

(With the whole amount of goodwill that is not brought in by the new partner)

To Old Partners’ Capital A/c

(Goodwill amount of the new partner distributed among the old partners in their sacrificing ratio)

Note:As per the Para 16 of Accounting Standard 10, goodwill is recorded in the books only when some consideration in money or money’s worth has been paid for it. This practice is mandatory to follow. In case of admission, retirement, death or change in profit sharing ratio among existing partners, Goodwill Account cannot be raised as no consideration is paid for it.

Q7: How will you deal with the accumulated profit and losses and reserves on the admission of a new partner?

Ans: When a new partner is admitted in a partnership firm, then all past accumulated profits or losses and reserves are distributed among all the old partners in their old profit-sharing ratio. This is because these profits and losses are attributable to the hard work and labour of the old partners and consequently, the old partners are liable to bear past losses or profits, if any. The new partner is not entitled for a share in these profits as he/she did not contribute anything for the past performance of the business.

Accounting Treatment of Accumulated Profits and Losses

(i)For distributing accumulated profits and reserves

Profit and Loss A/c Dr.

General Reserve A/c Dr.

Reserve Fund A/c Dr.

Workmen’s Compensation Fund A/c Dr.

Contingency Reserve A/ Dr.

To Old Partners’ Capital A/c

(Undistributed profits and reserves are distributed among old partners in their old profit sharing ratio)

(ii) For distributing accumulated losses

Old Partners’ Capital A/c Dr.

To Profit and Loss (Debit balance) A/c

To Deferred Advertisement Expenses A/c

To Preliminary Expenses A/c

(Undistributed losses are distributed among old partners in their old profit sharing ratio)

Q8: At what figures the value of assets and liabilities appear in the books of the firm after revaluation has been done? Show with the help of an imaginary balance sheet.

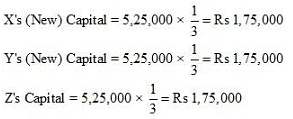

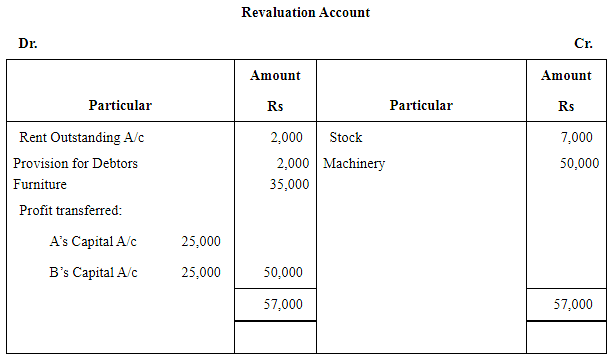

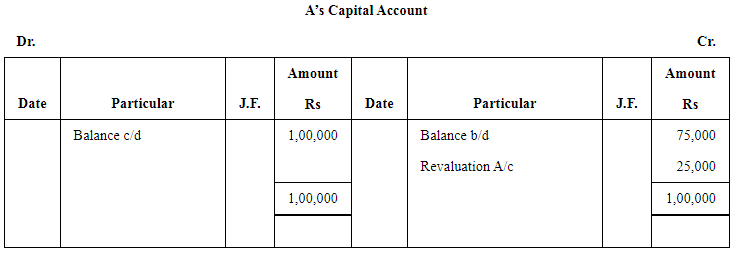

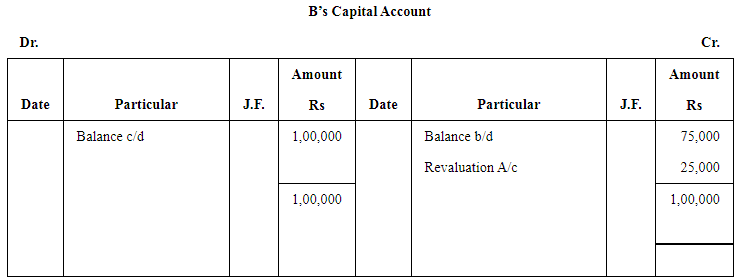

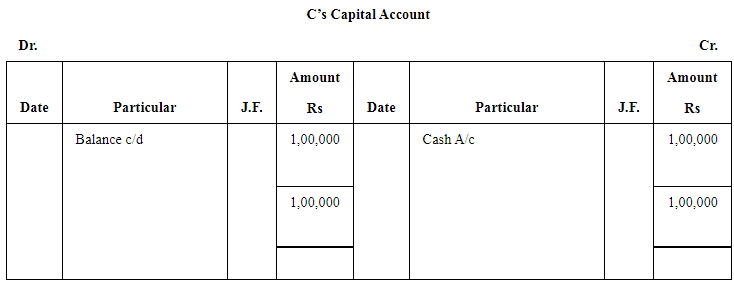

Ans: After revaluation has been done, the assets and liabilities appear at their current market values in the Balance Sheet of the reconstituted firm. This can be better explained with the help of the below-explained example.

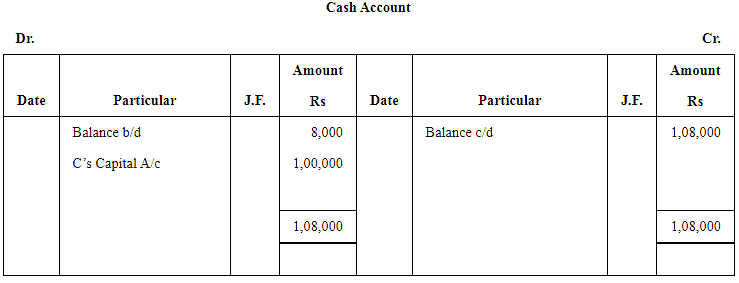

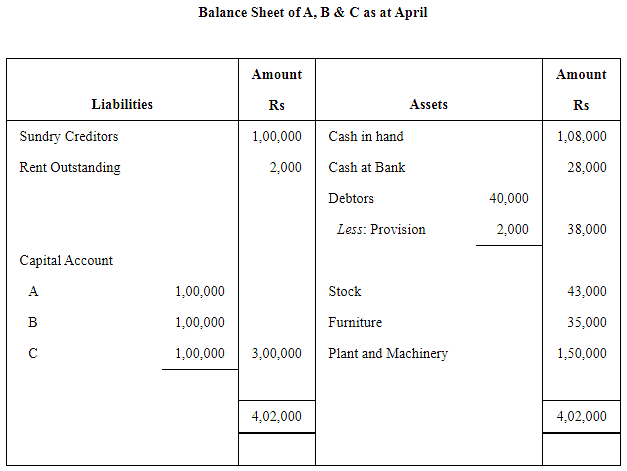

A and B shares profit and loss equally. (1) On that date C is admitted for 1/3rd share and brings 1,00,000 as capital.

(1) On that date C is admitted for 1/3rd share and brings 1,00,000 as capital.

(2) The value of stock is increased by Rs 7,000.

(3) A provision of Rs 2,000 has been created against Debtors.

(4)Furniture revalued at Rs 35,000.

(5) A machinery costing Rs 50,000 purchased is not recorded in books.

(6)Rent outstanding Rs 2,000.

Prepare Revaluation Account, Partners’ Capital Account, Cash Account and Balance Sheet.

Numerical Questions

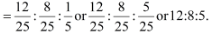

Q1: A and B were partners in a firm sharing profits and losses in the ratio of 3:2. They admit C into the partnership with 1/6 share in the profits. Calculate the new profit sharing ratio.Ans: A: B

Old Ratio 3 : 2

OR

3/5 : 2/5

C admits for 1/6 share of new profit in new firm.

Let new firm profit = 1

The remaining share of A and B in the new firm = 1 − C’s share

= 1 − 1/6

= 5/6

New Ratio = Old Ratio × Remaining Share of A and B

New Ratio = A : B : C

= 15:10:5

= 3 : 2 :1

Q2: A, B, C were partners in a firm sharing profits in 3:2:1 ratio. They admitted D for 10% profits. Calculate the new profit sharing ratio?

D admits for 10/100 share in the new firm

Let new firm profit = 1

Remaining share of A, B and C in new firm = 1 − D’s share

New Ratio = Old Ratio × Remaining Share of A, B and C in new firm

New Ration+ A : B : C : D

= = 9 : 6 : 3 : 2

Q3: X and Y are partners sharing profits in 5:3 ratio admitted Z for 1/10 share which he acquired equally for X and Y. Calculate new profit sharing ratio?

Ans:

Z admits for  share in the new firm.

share in the new firm.

X and Y each sacrifice =

New Ratio = Old Ratio − Sacrificing Ratio

Q4: A, B and C are partners sharing profits in 2:2:1 ratio admitted D for 1/8 share which he acquired entirely from A. Calculate new profit sharing ratio?

Ans:

D admits for 1/8 share in new firm, which he takes from A.

Here only A will sacrifice.

New Ratio = Old Ratio - Sacrificing Ratio

Q5: P and Q are partners sharing profits in 2:1 ratio. They admitted R into partnership giving him 1/5 share which he acquired from P and Q in 1:2 ratio. Calculate new profit sharing ratio?

Ans:

R admits for 1/5 share in the new firm which he takes from 1/3 from P and 2/3 from Q.

P's sacrifice = R's share × 1/3

Q's sacrifice = R's share × 2/3

New Ratio = Old Ratio - Sacrificing Ratio

Q6: A, B and C are partners sharing profits in 3:2:2 ratio. They admitted D as a new partner for 1/5 share which he acquired from A, B and C in 2:2:1 ratio respectively. Calculate new profit sharing ratio?

Ans:

D admits for 1/5 share in the new firm which he takes (1/5) in the ratio 2:2:1 from A, B and C.

A's sacrifice = D's share × 2/5

B's sacrifice = D's share × 2/5

C's sacrifice = D's share × 1/5

New Ratio = Old Ratio - Sacrificing Ratio

Q7: A and B were partners in a firm sharing profits in 3:2 ratio. They admitted C for 3/7 share which he took 2/7 from A and 1/7 from B. Calculate new profit sharing ratio?

Ans:

C admitted for 3/7 share in the new firm

A's sacrifice = 2/7

B's sacrifice = 1/7

New Ratio = Old Ratio - Sacrificing Ratio

Q8: A, B and C were partners in a firm sharing profits in 3 : 3 : 2 ratio. They admitted D as a new partner for 4/7 profit. D acquired his share 2/7 from A. 1/7 from B and 1/7 from C. Calculate new profit sharing ratio?

Ans:

D admitted for 4/7 share of profit in new firm.

D's share = A's sacrifice + B's Sacrifice + C's sacrifice

=

=  +

+  +

+

New Ratio = Old Ratio - Sacrificing Ratio

Q9: Radha and Rukmani are partners in a firm sharing profits in 3:2 ratio. They admitted Gopi as a new partner. Radha surrendered 1/3 of her share in favour of Gopi and Rukmani surrendered 1/4 of her share in favour of Gopi. Calculate new profit sharing ratio?

Ans:

Radha surrendered in favour of Gopi = 1/3 of his share

Rukmani surrendered in favour of Gopi =1/4 of his share

Sacrificing Ratio = Old Ratio × Surrender Ratio

Radha =

Rukmani =

New Ratio = Old Ratio - Sacrificing Ratio

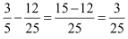

Radha =

Rukmani =

Gopi's Share = Radha's Sacrificing Ratio + Rukmani's Sacrificing Ratio

Q10: Singh, Gupta and Khan are partners in a firm sharing profits in 3:2:3 ratio. They admitted Jain as a new partner. Singh surrendered 1/3 of his share in favour of Jain: Gupta surrendered 1/4 of his share in favour of Jain and Khan surrendered 1/5 in favour of Jain. Calculate new profit sharing ratio?

Ans:

Singh Surrender = 1/3 of his share

Gupta Surrender = 1/4 of his share

Khan Surrender = 1/5 of his share

Sacrificing Ratio = Old Ratio × Surrender Ratio

Singh's =

Gupta's =

Khan's =

New Ratio = Old Ratio - Sacrificing Ratio

Singh's =

Gupta's =

Khan's =

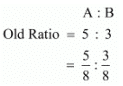

Q11: Sandeep and Navdeep are partners in a firm sharing profits in 5:3 ratio. They admit C into the firm and the new profit sharing ratio was agreed at 4:2:1. Calculate the sacrificing ratio?

Ans:

Sacrificing Ratio = Old Ratio - New Ratio

Therefore, the new ratio is 3 : 5.

Q12: Rao and Swami are partners in a firm sharing profits and losses in 3:2 ratio. They admit Ravi as a new partner for 1/8 share in the profits. The new profit sharing ratio between Rao and Swami is 4:3. Calculate new profit sharing ratio and sacrificing ratio?

Ans:

Ravi admits for 1/8 share of profit in the new firm.

Let the New Firm Profit = 1

Combined share of Rao and Swami in the new firm

= 1 - Ravi's share of profit

= 1 - 1/8

=7/8

New Ratio = Combined Share of Rao and Swami × Proportion of Rao and Swami in the combined share

4:3:1

Sacrificing Ratio = Old Ratio - New Ratio

Q13: Compute the value of goodwill on the basis of four years' purchase of the average profits based on the last five years? The profits for the last five years were as follows: Ans:

Ans:

Average Profit =

Average Profit = 2,60,000 / 5 = 52,000

Goodwill = Average Profit × Number of Year's Purchases = 52,000 × 4 = Rs 2,08,000

Q14: Capital employed in a business is Rs. 2,00,000. The normal rate of return on capital employed is 15%. During the year 2002 the firm earned a profit of Rs. 48,000. Calculate goodwill on the basis of 3 years purchase of super profit?

Ans:

Capital Employed = Rs 2,00,000

Actual Profit = 48,000

Normal Rate of Return = 15%

Normal Profit = Capital Employed × Normal Rate of Return / 100

= 2,00,000 x 5/100

= Rs 30,000

Super profit = Actual Profit - Normal Profit

= 48,000 - 30,000

= Rs 18,000

Goodwill = Super Profit × Number of Years Purchase

= 18,000 × 3

= Rs 54,000

Q15: The books of Ram and Bharat showed that the capital employed on 31.12.2002 was Rs. 5,00,000 and the profits for the last 5 years : 2002 Rs. 40,000; 2003 Rs. 50,000; 2004 Rs. 55,000; 2005 Rs. 70,000 and 2006 Rs. 85,000. Calculate the value of goodwill on the basis of 3 years purchase of the average super profits of the last 5 years assuming that the normal rate of return is 10%?

Ans:

Average Actual Profit =

Average Super Profit = 3,00,000 / 5 = Rs. 60,000

Normal Profit = Capital Employed × Normal Rate of Return / 100

= 5,00, 000 x 10/100

Average Actual Profit - Normal Profit

= 60,000 - 50,000

= Rs 10,000

Goodwill = Average Super Profit × Number of year purchase

= 10,000 × 3

= Rs 30,000

Q16: Rajan and Rajani are partners in a firm. Their capitals were Rajan Rs. 3,00,000; Rajani Rs. 2,00,000. During the year 2002 the firm earned a profit of Rs. 1,50,000. Calculate the value of goodwill of the firm assuming that the normal rate of return is 20%?

Ans:

Normal Rate of Return = 20%

Capitalised Valued = Actual Profit x 100 / Normal Rate of Return

= 1,50,000 × (100/20)

= Rs 7,50,000

Goodwill = Capitalised Value - Capital Employed

= 7,50,000 - 5,00,000

= Rs 2,50,000

Alternative Method

Capital Employed × Normal Rate of Return / 100

= 5,00,000 ×(20/100)

= Rs 1,00,000

Super profit = Actual Profit - Normal Profit

= 1,50,000 - 1,00,000

= Rs 50,000

Goodwill = Super Profit × 100 / Normal Rate of Return

= 50,000 × (100/20)

= Rs 2,50,000

Q17: A business has earned average profits of Rs. 1,00,000 during the last few years. Find out the value of goodwill by capitalisation method, given that the assets of the business are Rs. 10,00,000 and its external liabilities are Rs. 1,80,000. The normal rate of return is 10%?

Ans:

Capital Employed = Assets - External Liabilities

= 10,00,000 - 1,80,000

= Rs 8,20,000

Capital Employed × Normal Rate of Return / 100

= 8,20,000 x(10 / 100)

= Rs 82,000

Super Profit = Actual Profit - Normal Profit

= 1,00,000 - 82,000

= Rs 18,000

Goodwill = Super Profit × 100/Normal Rate of Return

= 18,000 x (10 /100)

= Rs 1,80,000

Alternative Method

Capitalised Value = Actual Profit × 100/Normal Rate of Return

Capitalised value = 1,00,000 * 10 / 100

= Rs 1,00,000

Goodwill = Capitalised Value - Capital Employed

= 10,00,000 - 8,20,000

= Rs 1,80,000

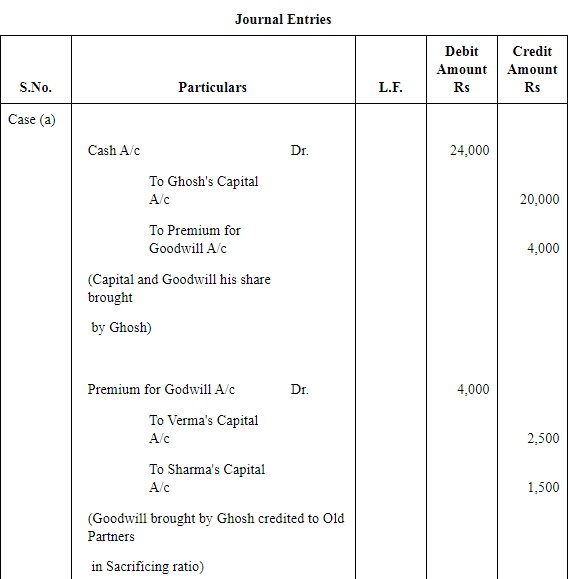

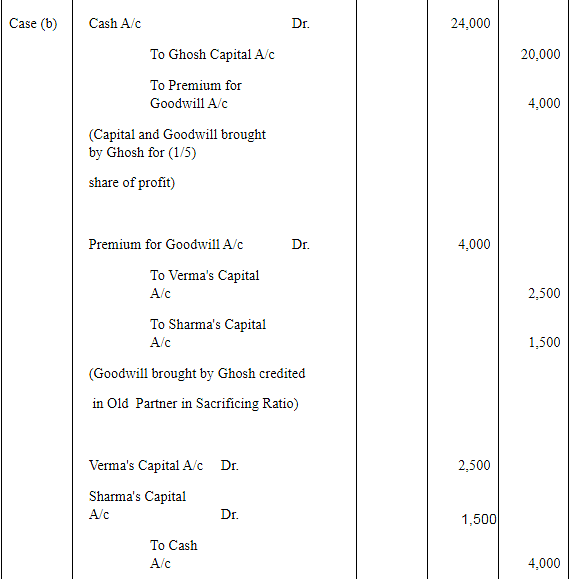

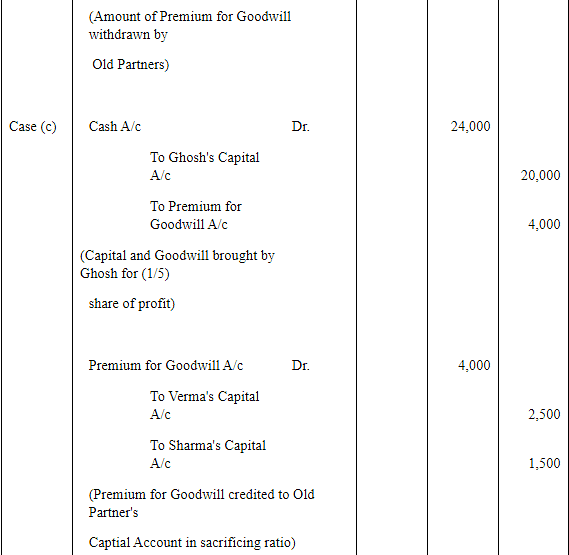

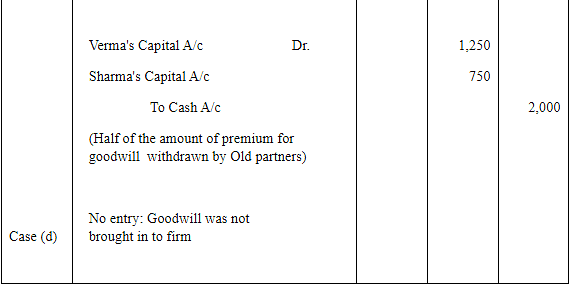

Q18: Verma and Sharma are partners in a firm sharing profits and losses in the ratio of 5:3. They admitted Ghosh as a new partner for 1/5 share of profits. Ghosh is to bring in Rs. 20,000 as capital and Rs. 4,000 as his share of goodwill premium. Give the necessary journal entries:

(a) When the amount of goodwill is retained in the business.

(b) When the amount of goodwill is fully withdrawn.

(c) When 50% of the amount of goodwill is withdrawn.

(d) When goodwill is paid privately.

Ans:

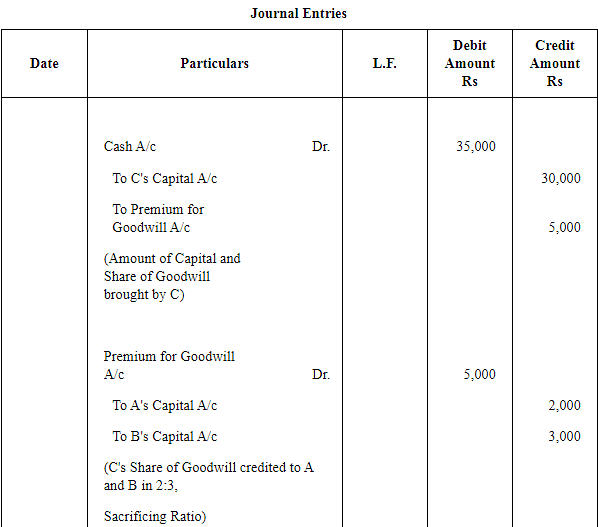

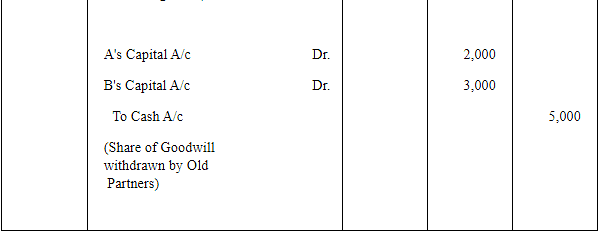

Q19: A and B are partners in a firm sharing profits and losses in the ratio of 3:2. They decide to admit C into partnership with 1/4 share in profits. C will bring in Rs. 30,000 for capital and the requisite amount of goodwill premium in cash. The goodwill of the firm is valued at Rs, 20,000. The new profit-sharing ratio is 2:1:1. A and B withdraw their share of goodwill. Give necessary journal entries?

Ans:

Sacrificing Ratio = Old Ratio - New Ratio

Sacrificing Ratio = A : B

= 2/20 : 3/20

= 2 : 3

Goodwill of the firm = Rs 20,000

C’s share of Goodwill = 20,000 x 1/4

A will receive = 5,000 x 2/5

Or 20,000 x 2/20

B will receive = 5,000 x

Or 20,000 x 3/20

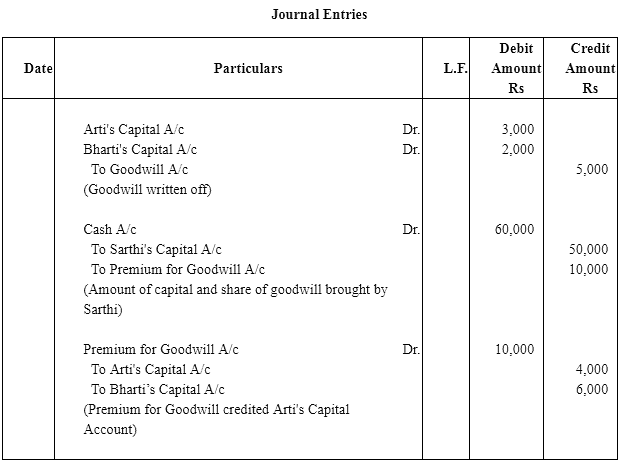

Q20: Arti and Bharti are partners in a firm sharing profits in 3 : 2 ratio, They admitted Sarthi for 1/4 share in the profits of the firm. Sarthi brings Rs. 50,000 for his capital and Rs. 10,000 for his 1/4 share of goodwill. Goodwill already appears in the books of Arti and Bharti at Rs. 5,000. the new profit sharing ratio between Arti, Bharti and Sarthi will be 2:1:1. Record the necessary journal entries in the books of the new firm?

Ans:

Old Ratio = Arti : Bharti

= 3 : 2

Sarthi admitted for 1/4

New Ratio = Arti : Bharti : Sarthi

= 2 : 1 : 1

Sacrificing Ratio = Old Ratio − New Ratio

Arti will receive = 10,000 x

Bharti will receive = 10,000 x 3/5

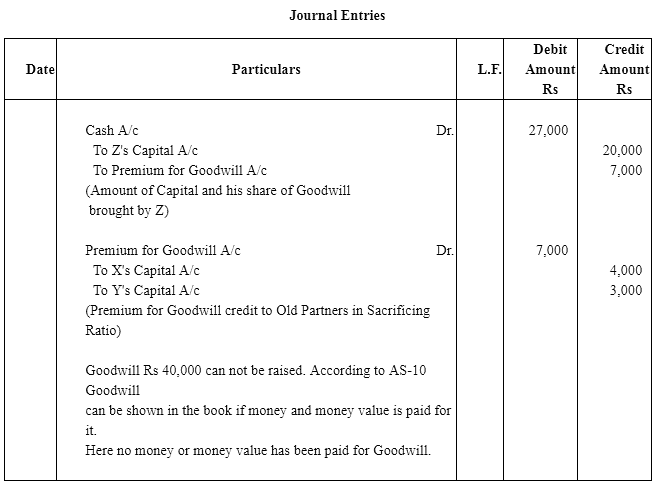

Q21: X and Y are partners in a firm sharing profits and losses in 4:3 ratio. They admitted Z for 1/8 share. Z brought Rs. 20,000 for his capital and Rs. 7,000 for his 1/8 share of goodwill. Subsequently, X, Y and Z decided to show goodwill in their books at Rs. 40,000. Show necessary journal entries in the books of X, Y and Z?

Ans:

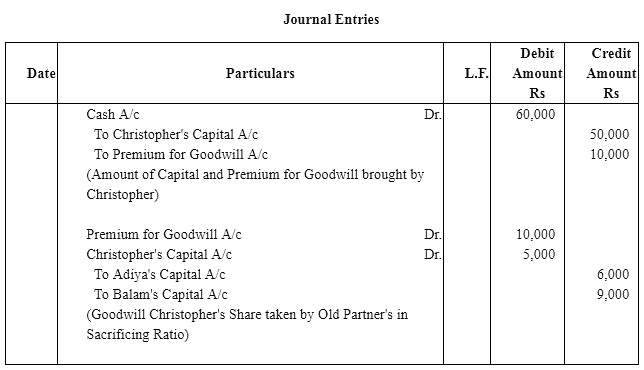

Q22: Aditya and Balan are partners sharing profits and losses in 3:2 ratio. They admitted Christopher for 1/4 share in the profits. The new profit sharing ratio agreed was 2:1:1. Christopher brought Rs. 50,000 for his capital. His share of goodwill was agreed to at Rs. 15,000. Christopher could bring only Rs. 10,000 out of his share of goodwill. Record necessary journal entries in the books of the firm?

Ans:

Sacrificing Ratio = Old Ratio - New Ratio

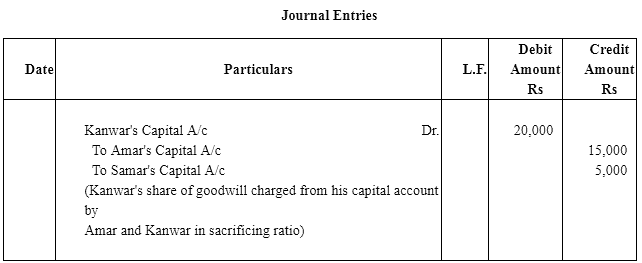

Q23: Amar and Samar were partners in a firm sharing profits and losses in 3:1 ratio. They admitted Kanwar for 1/4 share of profits. Kanwar could not bring his share of goodwill premium in cash. The Goodwill of the firm was valued at Rs. 80,000 on Kanwar's admission. Record necessary journal entry for goodwill on Kanwar's admission.

Ans:

Old Ratio = Amar : Samar

= 3 : 1

Kanwar admitted for 1/4 share of profit

New Firm's Goodwill = Rs 80,000

Kanwar's Share of Goodwill = 80,000 x (1/4) = 20,000

Kanwar's Goodwill will be taken by Amar and Samar in their sacrificing ratio here. Sacrificing Ratio will be equal to the old ratio because the new and sacrificing ratio is not given,

if sacrificing and new ratio is not given it is assumed that the old partners sacrificed in their old ratio.

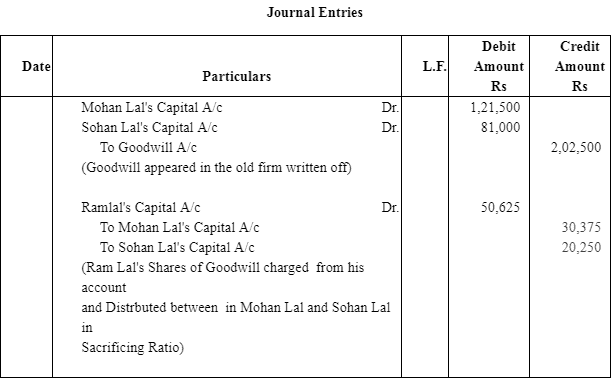

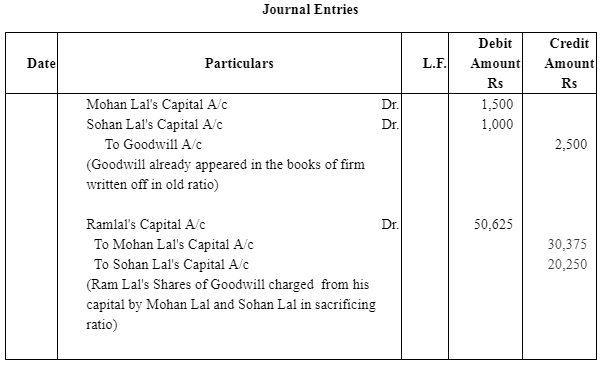

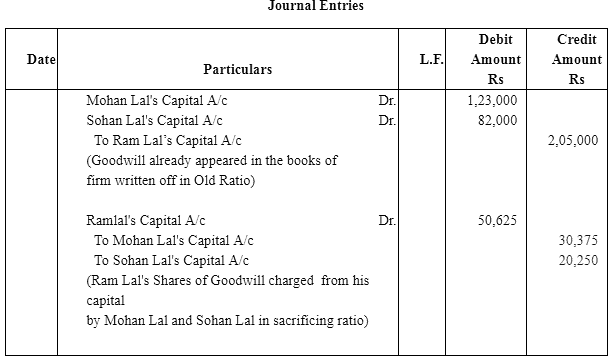

Q24: Mohan Lal and Sohan Lal were partners in a firm sharing profits and losses in 3:2 ratio. They admitted Ram Lal for 1/4 share on 1.1.2013. It was agreed that goodwill of the firm will be valued at 3 years purchase of the average profits of last 4 years which were Rs. 50,000 for 2014, Rs. 60,000 for 2014, Rs. 90,000 for 2015 and Rs. 70,000 for 2016. Ram Lal did not bring his share of goodwill premium in cash. Record the necessary journal entries in the books of the firm on Ram Lal's admission when:

(a) Goodwill already appears in the books at Rs. 2,02,500.

(b) Goodwill appears in the books at Rs. 2,500.

(c) Goodwill appears in the books at Rs. 2,05,000.

Ans: Average Profit =2,70,000 /4= Rs 67,500

Average Profit =2,70,000 /4= Rs 67,500

Goodwill = Average Profit × No. of Years Purchases = 67,500 × 3 = 2,02,500

Ram Lal entered into the firm for 1/4 share of Profit.

Ram Lal's share of goodwill = 2,02, 500 × (1/4) = Rs 50,625

Here sacrificing ratio of Mohan Lal and Sohan Lal will be equal to the old ratio because the new and

sacrificing ratio is not given.

Mohan Lal will get = Ram Lal's Share of Goodwill × (3/5) = 50,625 × (3/5) = 10,125 × 3 = Rs

30,375

Sohan Lal will = Ramlal Share of Goodwill × (1/5) = 50,625 × (1/5) = Rs 10,125 × 2 = Rs 20,250

Case (a) Case (b)

Case (b)

Case (c)

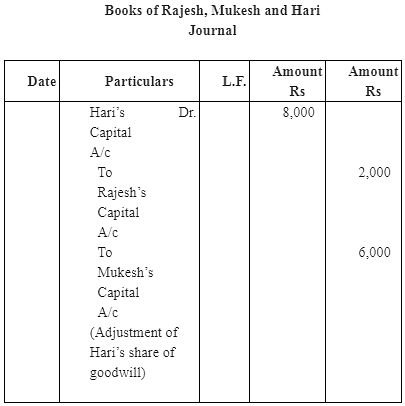

Q25: Rajesh and Mukesh are equal partners in a firm. They admit Hari into partnership and the new profit sharing ratio between Rajesh, Mukesh and Hari is 4:3:2. On Hari's admission goodwill of the firm is valued at Rs 36,000. Hari is unable to bring his share of goodwill premium in cash. Rajesh, Mukesh and Hari decided not to show goodwill in their balance sheet. Record necessary journal entries for the treatment of goodwill on Hari's admission.

Ans: Working Notes:

Working Notes:

(1) Goodwill of a firm = 36,000

Hari's share in goodwill

= Goodwill of firm × admitting Partner Share

(2) Sacrificing Ratio = Old Ratio - New Ratio

Sacrificing Ratio between Rajesh and Mukesh 1:3.

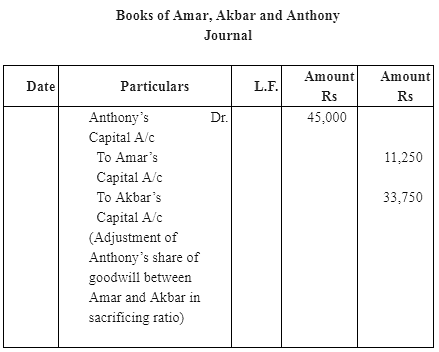

Q26: Amar and Akbar are equal partners in a firm. They admitted Anthony as a new partner and the new profit sharing ratio is 4:3:2. Anthony could not bring this share of goodwill Rs 45,000 in cash. It is decided to do adjustment for goodwill without opening goodwill account. Pass the necessary journal entry for the treatment of goodwill?

Ans:

Working Notes:

(1) Sacrificing Ratio = Old Ratio - New Ratio

Sacrificing Ratio between Amar and Akbar = 1:3.

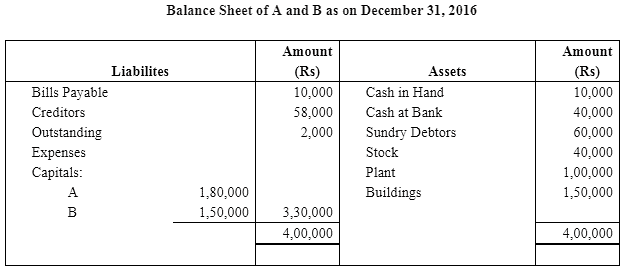

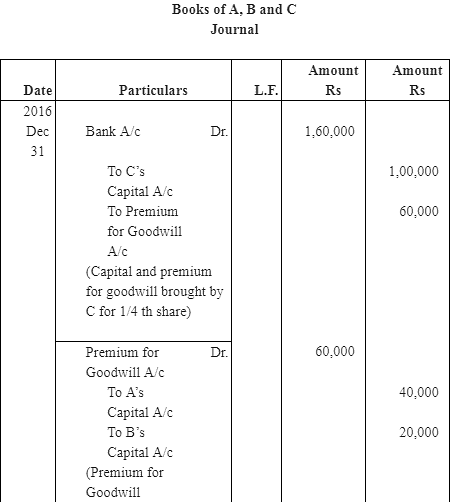

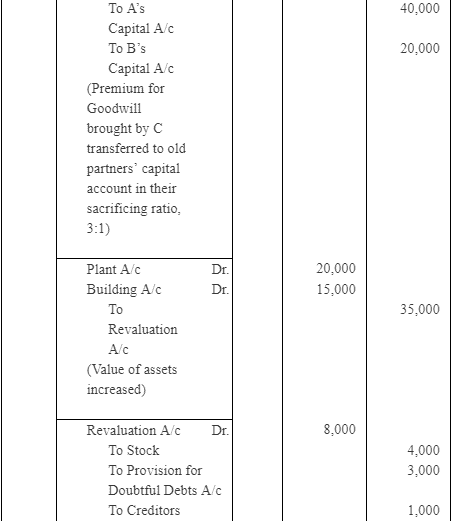

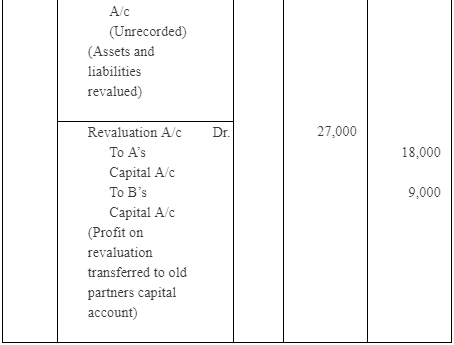

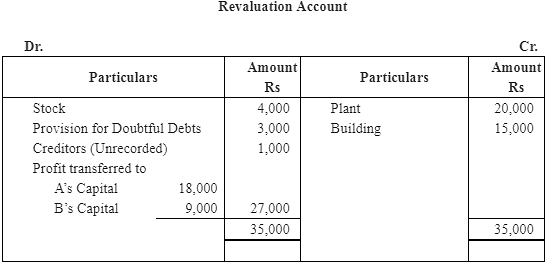

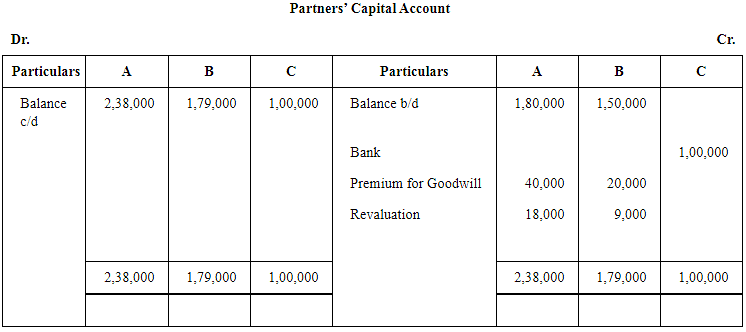

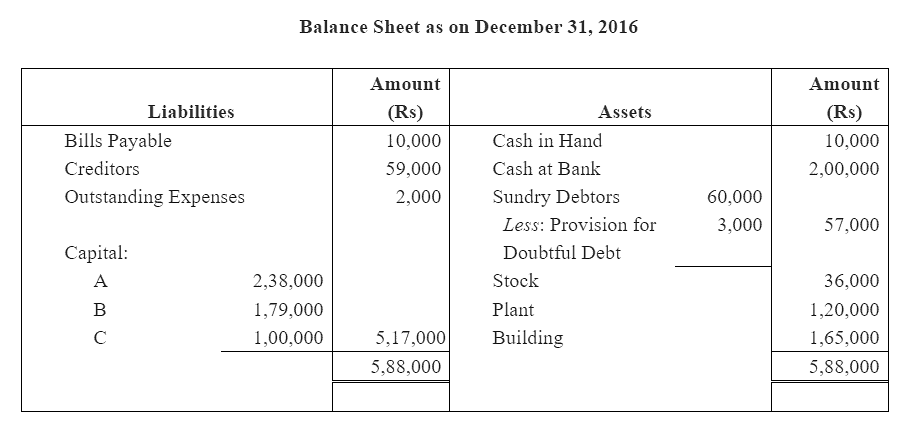

Q27: Given below is the Balance Sheet of A and B, who are carrying on partnership business on 31.12.2016. A and B share profits and losses in the ratio of 2:1. C is admitted as a partner on the date of the balance sheet on the following terms:

C is admitted as a partner on the date of the balance sheet on the following terms:

(i) C will bring in Rs 1,00,000 as his capital and Rs 60,000 as his share of goodwill for 1/4 share in the profits.

(ii) Plant is to be appreciated to Rs 1,20,000 and the value of buildings is to be appreciated by 10%.

(iii) Stock is found over valued by Rs 4,000.

(iv) A provision for bad and doubtful debts is to be created at 5% of debtors.

(v) Creditors were unrecorded to the extent of Rs 1,000.

Pass the necessary journal entries, prepare the revaluation account and partners' capital accounts, and show the Balance Sheet after the admission of C.

Ans:

Working Note:

(1) Sacrificing ratio = Old Ratio − New Ratio

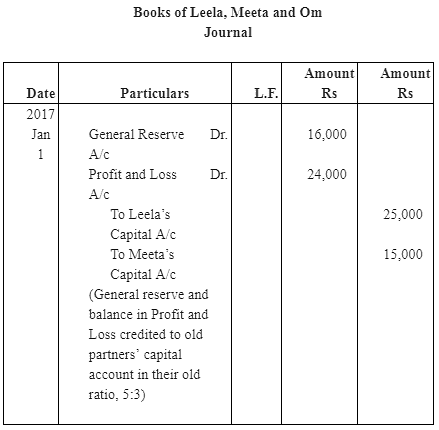

Q28: Leela and Meeta were partners in a firm sharing profits and losses in the ratio of 5:3. In April 2017 they admitted Om as a new partner. On the date of Om’s admission the balance sheet of Leela and Meeta showed a balance of Rs. 16,000 in general reserve and Rs. 24,000 (Cr) in Profit and Loss Account. Record necessary journal entries for the treatment of these items on Om’s admission.

The new profit sharing ratio between Leela, Meeta and Om was 5:3:2.

Ans:

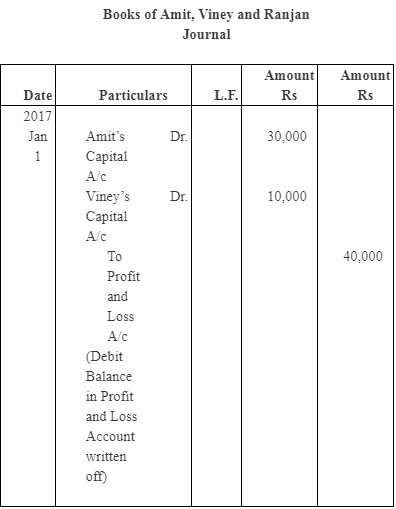

Q29: Amit and Viney are partners in a firm sharing profits and losses in 3:1 ratio. On 1.1.2017 they admitted Ranjan as a partner. On Ranjan’s admission the profit and loss account of Amit and Viney showed a debit balance of Rs 40,000. Record necessary journal entry for the treatment of the same.

Ans:

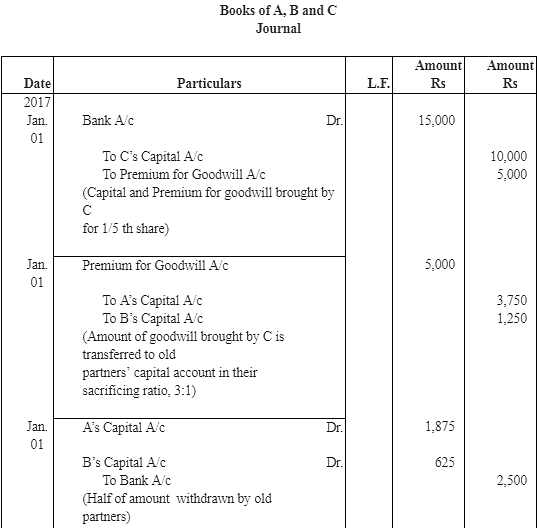

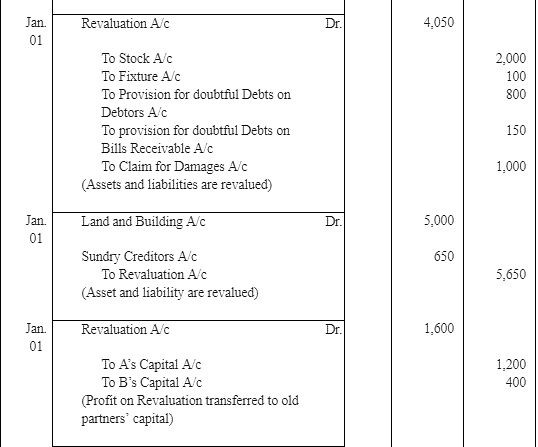

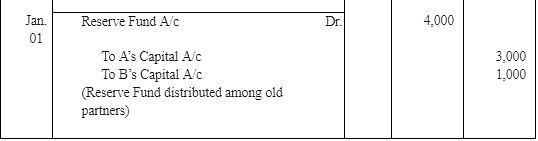

Q 30: A and B share profits in the proportions of 3/4 and 1/4. Their Balance Sheet on March 31, 2016 was as follows: On Jan. 1, 2017, C was admitted into partnership on the following terms:

On Jan. 1, 2017, C was admitted into partnership on the following terms:

(a) That C pays Rs 10,000 as his capital.(b) That C pays Rs 5,000 for goodwill. Half of this sum is to be withdrawn by A and B.

(c) That stock and fixtures be reduced by 10% and a 5%, provision for doubtful debts be created on Sundry Debtos and Bills Receivable.

(d) That the value of land and buildings be appreciated by 20%.

(e) There being a claim against the firm for damages, a liability to the extent of Rs 1,000 should be created.

(f) An item of Rs 650 included in sundry creditors is not likely to be claimed and hence should be written back.

Record the above transactions (journal entries) in the books of the firm assuming that the profit-sharing ratio between A and B has not changed. Prepare the new Balance Sheet on the admission of C.

Ans:

Working Note:

(1)

(2)

(2)

(3) Sacrificing ratio = Old Ratio − New Ratio

(3) Sacrificing ratio = Old Ratio − New Ratio

Note: Assuming that ratio between A and B has not change hence sacrificing ratio should be same as old ratio.

Q31: A and B are partners sharing profits and losses in the ratio of 3:1. On 1st April. 2017 they admitted C as a new partner for 1/4 share in the profits of the firm.

C brings Rs. 20,000 as for his 1/4 share in the profits of the firm. The capitals of A and B after all adjustments in respect of goodwill, revaluation of assets and liabilities, etc. has been worked out at Rs. 50,000 for A and Rs. 12,000 for B. It is agreed that partner’s capitals will be according to new profit sharing ratio.

Calculate the new capitals of A and B and pass the necessary journal entries assuming that A and B brought in or withdrew the necessary cash as the case may be for making their capitals in proportion to their profit sharing ratio?

Ans:

(1) Calculation of New Profit sharing Ratio

New Profit sharing ratio of A, B and C will be 9:3:4

(2) New Capital of A and B.

C bring Rs 20,000 for 1/4th share of profit in the new firm.

Thus, total capital of firm on the basis of C’s share= 20,000 x 4/ 1 = 80,000

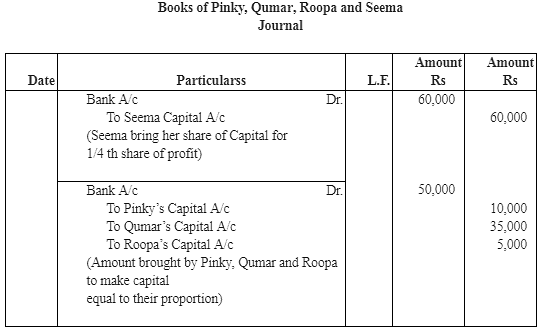

Q32: Pinky, Qumar and Roopa partners in a firm sharing profits and losses in the ratio of 3:2:1. S is admitted as a new partner for 1/4 share in the profits of the firm, whichs he gets 1/8 from Pinky, and 1/16 each from Qmar and Roopa. The total capital of the new firm after Seema’s admission will be Rs 2,40,000. Seema is required to bring in cash equal to 1/4 of the total capital of the new firm. The capitals of the old partners also have to be adjusted in proportion of their profit sharing ratio. The capitals of Pinky, Qumar and Roopa after all adjustments in respect of goodwill and revaluation of assets and liabilities have been made are Pinky Rs 80,000, Qumar Rs 30,000 and Roopa Rs 20,000. Calculate the capitals of all the partners and record the necessary journal entries for doing adjustments in respect of capitals according to the agreement between the partners?

Ans:

(1) Calculation of new profit sharing Ratio = Old Ratio − Sacrificing Ratio

New profit-sharing ratio between Pinky, Qumar, Roopa and Seema

= 18 : 13 : 5 : 12

(2) Required capital of all partners in the new firm

Pinky's Capital = 2,40,000 x

Qumar's Capital = 2,40,000 x 13/48

Roopa's Capital = 2,40,000 x 5/48

Seema's Capital = 2,40,000 x 12/48

(3) Amount to be brought by each partner

Pinky = 90,000 − 80,000 = 10,000

Qumar = 65,000 − 30,000 = 35,000

Roopa = 25,000 − 20,000 = 5,000

Seema = 2,40,000 x

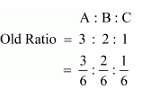

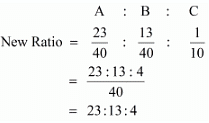

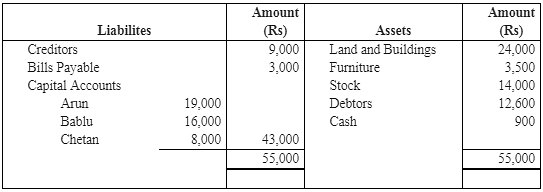

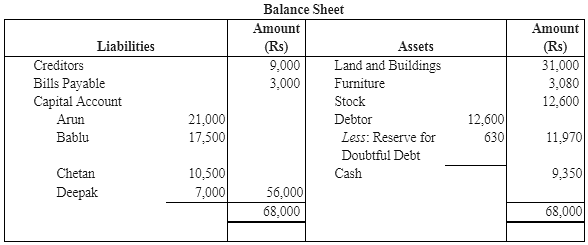

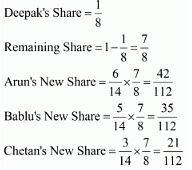

Q33: The following was the Balance Sheet of Arun, Bablu and Chetan sharing profits and losses in the ratio of  respectively.

respectively. They agreed to take Deepak into partnership and give him a share of 1/8 on the following terms:

They agreed to take Deepak into partnership and give him a share of 1/8 on the following terms:

(a) that Deepak should bring in Rs 4,200 as goodwill and Rs 7,000 as his Capital;

(b) that furniture be depreciated by 12%;

(c) that stock be depreciated by 10% ;

(d) that a Reserve of 5% be created for doubtful debts;

(e) that the value of land and buildings having appreciated be brought upto Rs 31,000;

(f) that after making the adjustments the capital accounts of the old partners (who continue to share in the same proportion as before) be adjusted on the basis of the proportion of Deepak’s Capital to his share in the business, i.e., actual cash to be paid off to, or brought in by the old partners as the case may be.

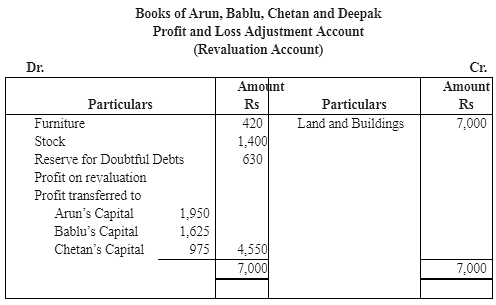

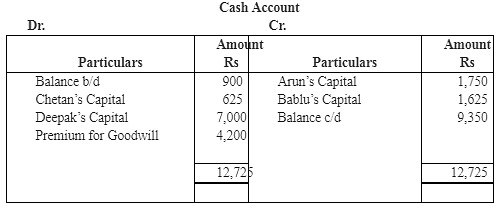

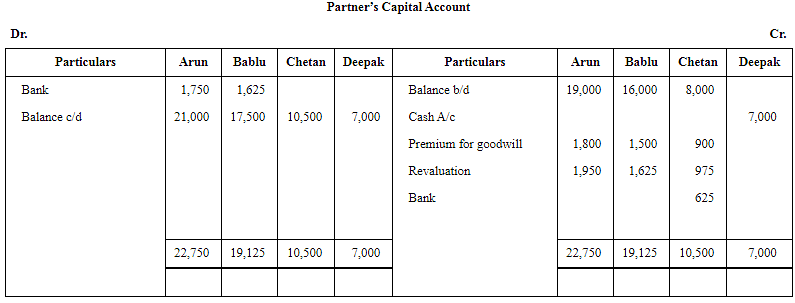

Prepare Cash Account, Profit and Loss Adjustment Account (Revaluation Account) and the Opening Balance Sheet of the new firm.

Ans:

Working Note: (1) (2) Calculation of New Profit Sharing Ratio

(2) Calculation of New Profit Sharing Ratio

New Profit sharing ratio of Arun, Bablu, Chetan and Deepak

= 42 : 35 : 21 : 14 or 6 : 5 : 3 : 23)

(3) Calculation of capital of Arun, Bablu, and Chetan in the new firm

Deepak brings Rs 7,000 for 1/8th share of profit.

Hence total capital of the new firm = 7,000 x 8/1

Arun's Capital = 56,000 x

Bablu's Capital = 56,000 x

Chetan's Capital = 56,000 x 3/16

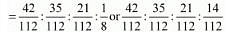

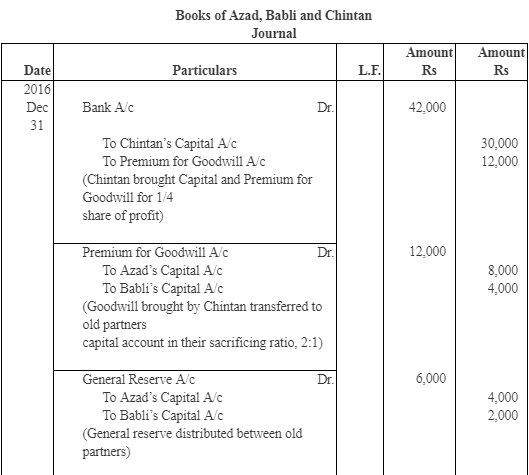

Q34: Azad and Babli are partners in a firm sharing profits and losses in the ratio of 2:1. Chintan is admitted into the firm with 1/4 share in profits. Chintan will bring in Rs. 30,000 as his capital and the capitals of Azad and Babli are to be adjusted in the profit sharing ratio. The Balance Sheet of Azad and Babli as on March 31, 2016 (before Chintan’s admission) was as follows:

It was agreed that:

It was agreed that:

(i) Chintan will bring in Rs 12,000 as his share of goodwill premium.

(ii) Buildings were valued at Rs 45,000 and Machinery at Rs 23,000.

(iii) A provision for doubtful debts is to be created @ 6% on debtors.

(iv) The capital accounts of Azad and Babli are to be adjusted by opening current accounts.

Record necessary journal entries, show necessary ledger accounts and prepare the Balance Sheet after admission.

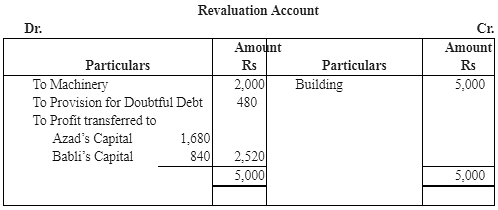

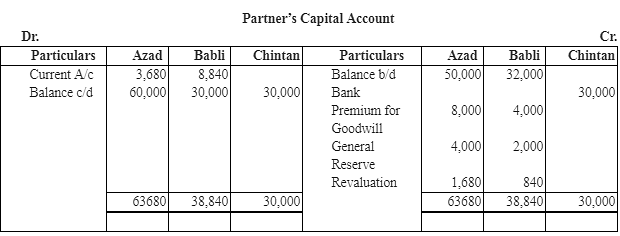

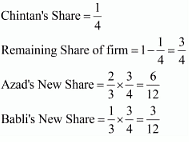

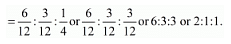

Ans:

Working Note:

(1) Calculation of New Profit Sharing Ratio

New Profit sharing ratio of Azad, Babli and Chintan

(2) New Capital of Azad, and Babli

Chintan brings Rs 30,000 for1/4share of profit.

Hence total capital of a firm = 30,000 x 4/1=1,20,000

Azad’s Capital = 1,20,000 x 2/4 = 60, 000

Babli’s Capital = 1,20,000 x 1/4 = 30, 000

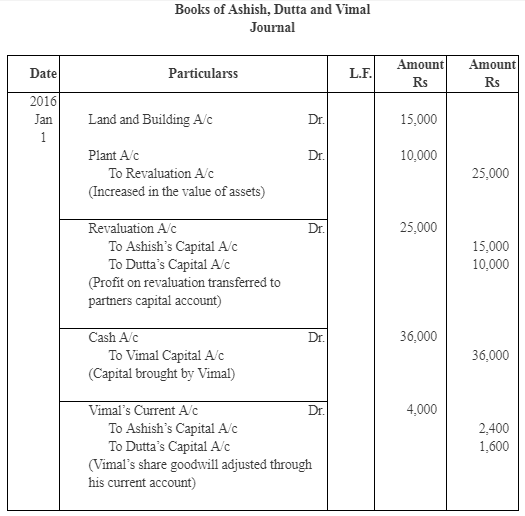

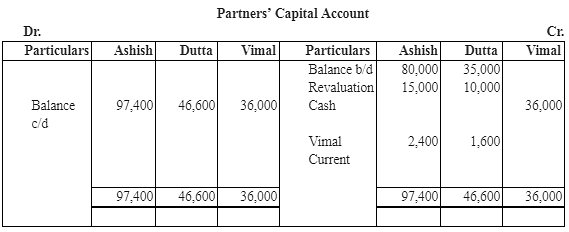

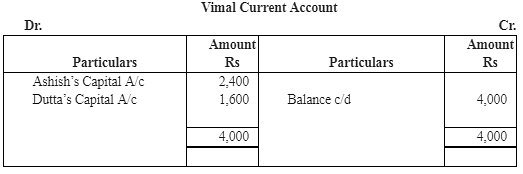

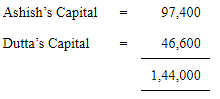

Q35: Ashish and Dutta were partners in a firm sharing profits in 3:2 ratio. On Jan. 01, 2015 they admitted Vimal for 1/5 share in the profits. The Balance Sheet of Ashish and Dutta as on March 31, 2016 was as follows:

It was agreed that:

(i) The value of Land and Building be increased by Rs 15,000.

(ii) The value of plant be increased by 10,000.

(iii) Goodwill of the firm be valued at Rs 20,000.

(iv) Vimal to bring in capital to the extent of 1/5th of the total capital of the new firm.

Record the necessary journal entries and prepare the Balance Sheet of the firm after Vimal’s admission.

Ans:

Working Note: (1)

Working Note: (1)

(2)

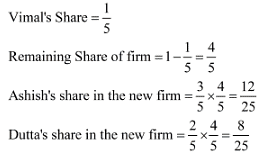

(2) (3) Calculation of New Profit Sharing Ratio

(3) Calculation of New Profit Sharing Ratio

New Profit-sharing ratio of Ashish, Dutta and Vimal

(4) Sacrificing Ratio = Old Ratio – New Ratio

Ashish’s Sacrificing Share =

Dutta’s Sacrificing Share =

Sacrificing Ratio between Ashish and Dutta is 3:2

Note: Here, Goodwill has been adjusted through current account because Vimal has not brought his share of goodwill and he is to bring capital in proportion to total capital of the new firm after adjustment.

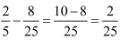

(5) Capital of new firm on the basis of old partners adjusted capital:

Total adjusted capital of old partners

Remaining Shares of Ashish and Dutta (old partners) in the new firm = 4/5

Capital of the new firm = 1,44,000 x 5/4 = 1,80,000

Vimal’s share in the capital of the new firm = 1,80,000 x 1/5 = 36,000.

|

42 videos|168 docs|43 tests

|

FAQs on Admission of a Partner NCERT Solutions - Accountancy Class 12 - Commerce

| 1. What is the process of admitting a new partner into a partnership? |  |

| 2. How is the goodwill of a partnership determined when a new partner is admitted? |  |

| 3. What entries are required in the books of accounts when a new partner is admitted? |  |

| 4. What changes occur in the profit-sharing ratio upon admitting a new partner? |  |

| 5. What are the rights and duties of a new partner in a partnership? |  |

|

Explore Courses for Commerce exam

|

|