NCERT Solutions (Part - 2) - Admission of a Partner | Additional Study Material for Commerce PDF Download

Page No. 168

Question 4: A, B and C are partners sharing profits in 2:2:1 ratio admitted D for 1/8 share which he acquired entirely from A. Calculate new profit sharing ratio?

Answer:

D admits for 1/8 share in new firm, which he takes from A.

Here only A will sacrifice.

New Ratio = Old Ratio - Sacrificing Ratio

Question 5: P and Q are partners sharing profits in 2:1 ratio. They admitted R into partnership giving him 1/5 share which he acquired from P and Q in 1:2 ratio. Calculate new profit sharing ratio?

Answer:

R admits for 1/5 share in the new firm which he takes from 1/3 from P and 2/3 from Q.

P's sacrifice = R's share × 1/3

Q's sacrifice = R's share × 2/3

New Ratio = Old Ratio - Sacrificing Ratio

Question 6: A, B and C are partners sharing profits in 3:2:2 ratio. They admitted D as a new partner for 1/5 share which he acquired from A, B and C in 2:2:1 ratio respectively. Calculate new profit sharing ratio?

Answer:

D admits for 1/5 share in the new firm which he takes (1/5) in the ratio 2:2:1 from A, B and C.

A's sacrifice = D's share × 2/5

B's sacrifice = D's share × 2/5

C's sacrifice = D's share × 1/5

New Ratio = Old Ratio - Sacrificing Ratio

Question 7: A and B were partners in a firm sharing profits in 3:2 ratio. They admitted C for 3/7 share which he took 2/7 from A and 1/7 from B. Calculate new profit sharing ratio?

Answer:

C admitted for 3/7 share in the new firm

A's sacrifice = 2/7

B's sacrifice = 1/7

New Ratio = Old Ratio - Sacrificing Ratio

Question 8: A, B and C were partners in a firm sharing profits in 3:3:2 ratio. They admitted D as a new partner for 4/7 profit. D acquired his share 2/7 from A. 1/7 from B and 1/7 from C. Calculate new profit sharing ratio?

Answer:

D admitted for 4/7 share of profit in new firm.

D's share = A's sacrifice + B's Sacrifice + C's sacrifice

=

=  +

+  +

+

New Ratio = Old Ratio - Sacrificing Ratio

Question 9: Radha and Rukmani are partners in a firm sharing profits in 3:2 ratio. They admitted Gopi as a new partner. Radha surrendered 1/3 of her share in favour of Gopi and Rukmani surrendered 1/4 of her share in favour of Gopi. Calculate new profit sharing ratio?

Answer:

Radha surrendered in favour of Gopi = 1/3 of his share

Rukmani surrendered in favour of Gopi =1/4 of his share

Sacrificing Ratio = Old Ratio × Surrender Ratio

Radha =

Rukmani =

New Ratio = Old Ratio - Sacrificing Ratio

Radha =

Rukmani =

Gopi's Share = Radha's Sacrificing Ratio + Rukmani's Sacrificing Ratio

Question 10: Singh, Gupta and Khan are partners in a firm sharing profits in 3:2:3 ratio. They admitted Jain as a new partner. Singh surrendered 1/3 of his share in favour of Jain: Gupta surrendered 1/4 of his share in favour of Jain and Khan surrendered 1/5 in favour of Jain. Calculate new profit sharing ratio?

Answer:

Singh Surrender = 1/3 of his share

Gupta Surrender = 1/4 of his share

Khan Surrender = 1/5 of his share

Sacrificing Ratio = Old Ratio × Surrender Ratio

Singh's =

Gupta's =

Khan's =

New Ratio = Old Ratio - Sacrificing Ratio

Singh's =

Gupta's =

Khan's =

Question 11: Sandeep and Navdeep are partners in a firm sharing profits in 5:3 ratio. They admit C into the firm and the new profit sharing ratio was agreed at 4:2:1. Calculate the sacrificing ratio?

Answer:

Sacrificing Ratio = Old Ratio - New Ratio

Note: As solution sacrificing ratio is 3:5,. However answer given the book is different.

Question 12: Rao and Swami are partners in a firm sharing profits and losses in 3:2 ratio. They admit Ravi as a new partner for 1/8 share in the profits. The new profit sharing ratio between Rao and Swami is 4:3. Calculate new profit sharing ratio and sacrificing ratio?

Answer:

Ravi admits for 1/8 share of profit in the new firm.

Let the New Firm Profit = 1

Combined share of Rao and Swami in the new firm

= 1 - Ravi's share of profit

= 1 - 1/8

=7/8

New Ratio = Combined Share of Rao and Swami × Proportion of Rao and Swami in the combined share

4:3:1

Sacrificing Ratio = Old Ratio - New Ratio

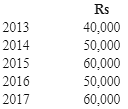

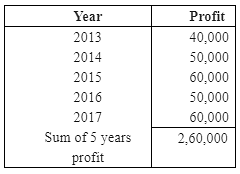

Question 13: Compute the value of goodwill on the basis of four years' purchase of the average profits based on the last five years? The profits for the last five years were as follows:

Answer:

Average Profit =

Average Profit =  = 52,000

= 52,000

Goodwill = Average Profit × Number of Year's Purchases = 52,000 × 4 = Rs 2,08,000

Page No. 169

Question 14: Capital employed in a business is Rs. 2,00,000. The normal rate of return on capital employed is 15%. During the year 2002 the firm earned a profit of Rs. 48,000. Calculate goodwill on the basis of 3 years purchase of super profit?

Answer:

Capital Employed = Rs 2,00,000

Actual Profit = 48,000

Normal Rate of Return = 15%

Normal Profit = Capital Employed ×

= Rs 30,000

Super profit = Actual Profit - Normal Profit

= 48,000 - 30,000

= Rs 18,000

Goodwill = Super Profit × Number of Years Purchase

= 18,000 × 3

= Rs 54,000

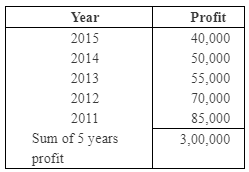

Question 15: The books of Ram and Bharat showed that the capital employed on 31.12.2002 was Rs. 5,00,000 and the profits for the last 5 years : 2002 Rs. 40,000; 2003 Rs. 50,000; 2004 Rs. 55,000; 2005 Rs. 70,000 and 2006 Rs. 85,000. Calculate the value of goodwill on the basis of 3 years purchase of the average super profits of the last 5 years assuming that the normal rate of return is 10%?

Answer:

Average Actual Profit =

Average Super Profit =  = Rs. 60,000

= Rs. 60,000

Normal Profit = Capital Employed ×

Average Actual Profit - Normal Profit

= 60,000 - 50,000

= Rs 10,000

Goodwill = Average Super Profit × Number of year purchase

= 10,000 × 3

= Rs 30,000

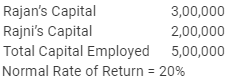

Question 16: Rajan and Rajani are partners in a firm. Their capitals were Rajan Rs. 3,00,000; Rajani Rs. 2,00,000. During the year 2002 the firm earned a profit of Rs. 1,50,000. Calculate the value of goodwill of the firm assuming that the normal rate of return is 20%?

Answer:

Normal Rate of Return = 20%

Capitalised Valued = Actual Profit ×

= 1,50,000 × (100/20)

= Rs 7,50,000

Goodwill = Capitalised Value - Capital Employed

= 7,50,000 - 5,00,000

= Rs 2,50,000

Alternative Method

Normal Profit = Capital Employed ×

= 5,00,000 ×(20/100)

= Rs 1,00,000

Super profit = Actual Profit - Normal Profit

= 1,50,000 - 1,00,000

= Rs 50,000

Goodwill = Super Profit ×

= 50,000 × (100/20)

= Rs 2,50,000

Page No. 169

Question 17: A business has earned average profits of Rs. 1,00,000 during the last few years. Find out the value of goodwill by capitalisation method, given that the assets of the business are Rs. 10,00,000 and its external liabilities are Rs. 1,80,000. The normal rate of return is 10%?

Answer:

Capital Employed = Assets - External Liabilities

= 10,00,000 - 1,80,000

= Rs 8,20,000

Normal Profit = Capital Employed ×

== 8,20,000 x(10 / 100)

= Rs 82,000

Super Profit = Actual Profit - Normal Profit

= 1,00,000 - 82,000

= Rs 18,000

Goodwill = Super Profit ×

= 18,000 x (10 /100)

= Rs 1,80,000

Alternative Method

Capitalised Value = Actual Profit ×

Capitalised value = 1,00,000 * 10 / 100

= Rs 1,00,000

Goodwill = Capitalised Value - Capital Employed

= 10,00,000 - 8,20,000

= Rs 1,80,000

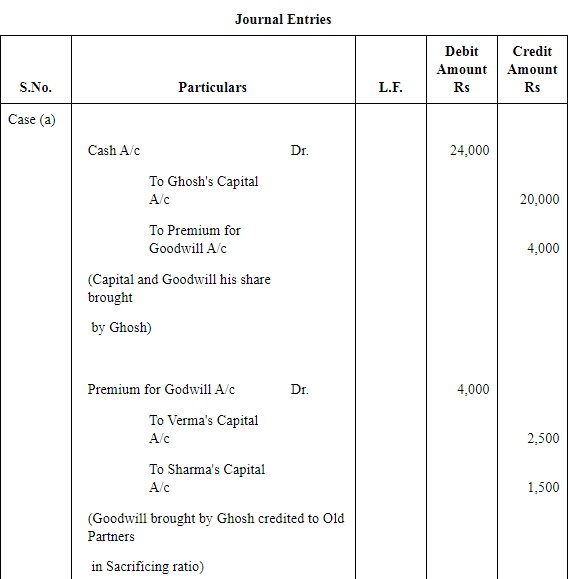

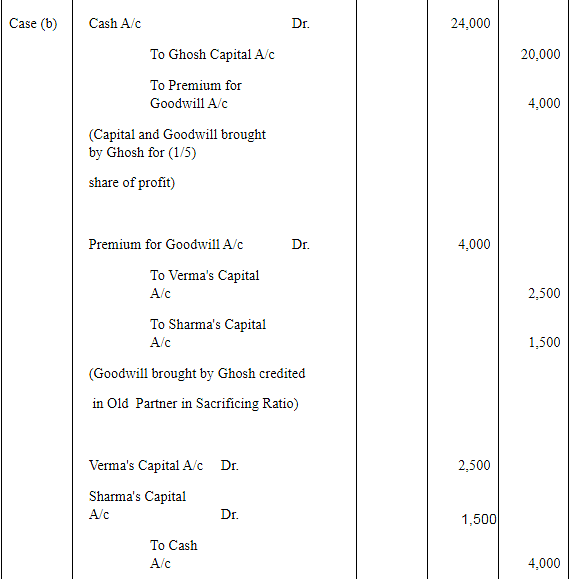

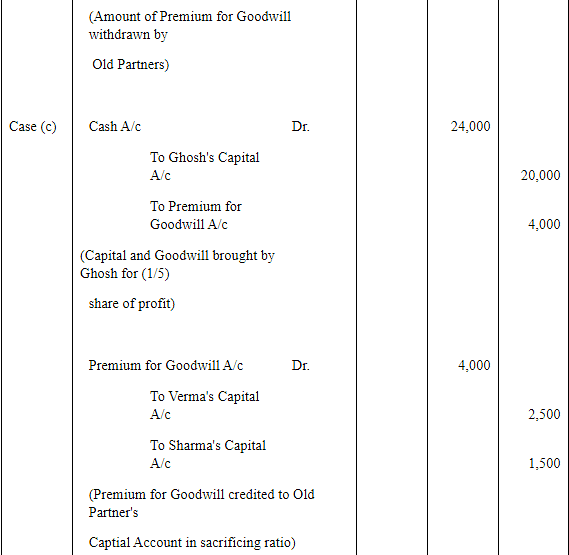

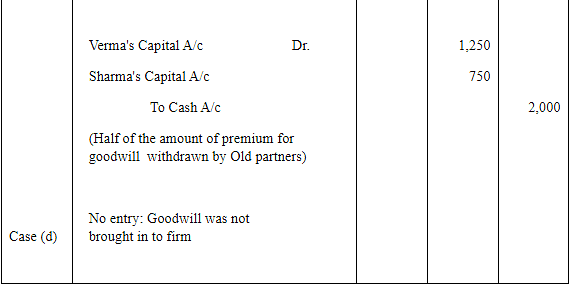

Question 18: Verma and Sharma are partners in a firm sharing profits and losses in the ratio of 5:3. They admitted Ghosh as a new partner for 1/5 share of profits. Ghosh is to bring in Rs. 20,000 as capital and Rs. 4,000 as his share of goodwill premium. Give the necessary journal entries:

a) When the amount of goodwill is retained in the business.

b) When the amount of goodwill is fully withdrawn.

c) When 50% of the amount of goodwill is withdrawn.

d) When goodwill is paid privately.

Answer:

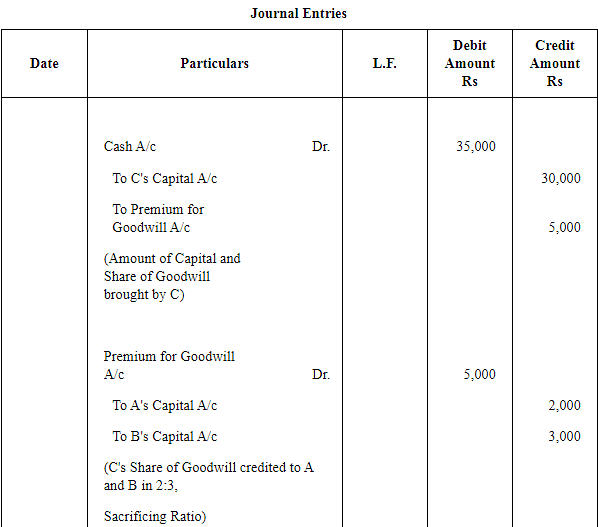

Q19: A and B are partners in a firm sharing profits and losses in the ratio of 3:2. They decide to admit C into partnership with 1/4 share in profits. C will bring in Rs. 30,000 for capital and the requisite amount of goodwill premium in cash. The goodwill of the firm is valued at Rs, 20,000. The new profit sharing ratio is 2:1:1. A and B withdraw their share of goodwill. Give necessary journal entries?

Answer:

Sacrificing Ratio = Old Ratio - New Ratio

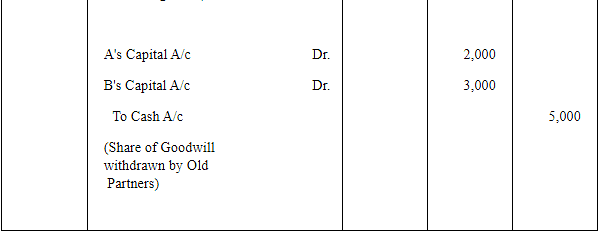

Question 20: Arti and Bharti are partners in a firm sharing profits in 3:2 ratio, They admitted Sarthi for 1/4 share in the profits of the firm. Sarthi brings Rs. 50,000 for his capital and Rs. 10,000 for his 1/4 share of goodwill. Goodwill already appears in the books of Arti and Bharti at Rs. 5,000. the new profit sharing ratio between Arti, Bharti and Sarthi will be 2:1:1. Record the necessary journal entries in the books of the new firm?

Answer:

Sarthi admitted for  share in new firm.

share in new firm.

Sacrificing Ratio = Old Ratio - New Ratio

Arti will receive

Bharti will receive

Page No. 170

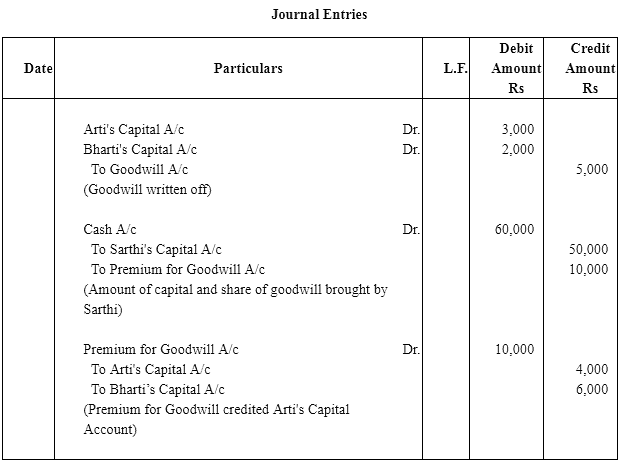

Question 21: X and Y are partners in a firm sharing profits and losses in 4:3 ratio. They admitted Z for 1/8 share. Z brought Rs. 20,000 for his capital and Rs. 7,000 for his 1/8 share of goodwill. Subsequently X, Y and Z decided to show goodwill in their books at Rs. 40,000. Show necessary journal entries in the books of X, Y and Z?

Answer:

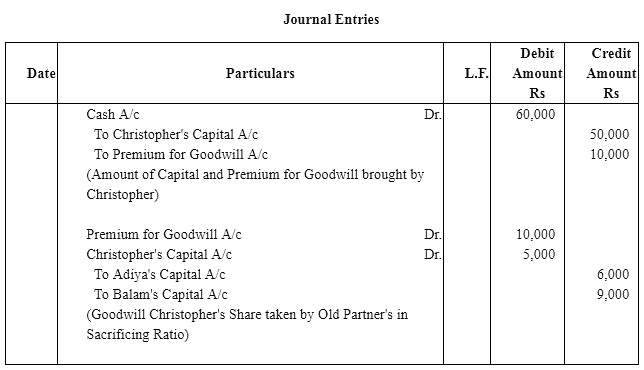

Question 22: Aditya and Balan are partners sharing profits and losses in 3:2 ratio. They admitted Christopher for 1/4 share in the profits. The new profit sharing ratio agreed was 2:1:1. Christopher brought Rs. 50,000 for his capital. His share of goodwill was agreed to at Rs. 15,000. Christopher could bring only Rs. 10,000 out of his share of goodwill. Record necessary journal entries in the books of the firm?

Answer:

Sacrificing Ratio = Old Ratio - New Ratio

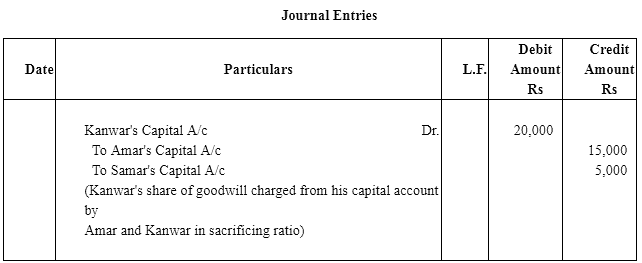

Question 23: Amar and Samar were partners in a firm sharing profits and losses in 3:1 ratio. They admitted Kanwar for 1/4 share of profits. Kanwar could not bring his share of goodwill premium in cash. The Goodwill of the firm was valued at Rs. 80,000 on Kanwar's admission. Record necessary journal entry for goodwill on Kanwar's admission.

Answer:

Kanwar admitted for 1/4 share of profit.

New Firm's Goodwill = Rs 80,000

Kanwar's Share of Goodwill = 80,000 x (1/4) = 20,000

Kanwar's Goodwill will be taken by Amar and Samar in their sacrificing ratio here. Sacrificing Ratio will be equal to old ratio because new and sacrificing ratio is not given,

if sacrificing and new ratio is not given it is assumed that old partners sacrificed in their old ratio.

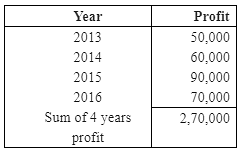

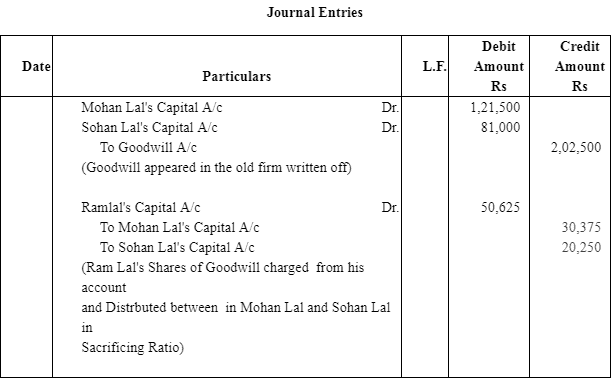

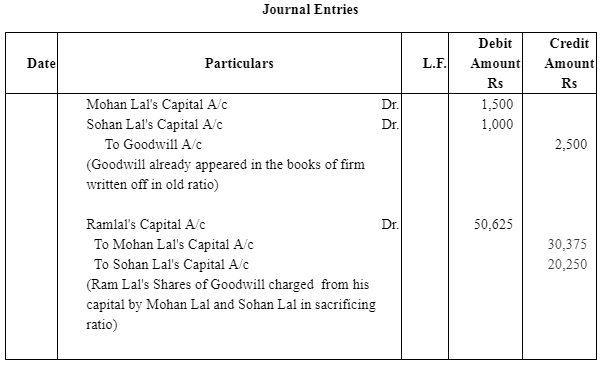

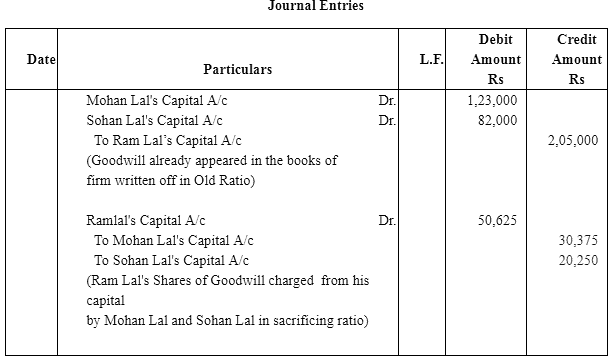

Question 24: Mohan Lal and Sohan Lal were partners in a firm sharing profits and losses in 3:2 ratio. They admitted Ram Lal for 1/4 share on 1.1.2013. It was agreed that goodwill of the firm will be valued at 3 years purchase of the average profits of last 4 years which were Rs. 50,000 for 2014, Rs. 60,000 for 2014, Rs. 90,000 for 2015 and Rs. 70,000 for 2016. Ram Lal did not bring his share of goodwill premium in cash. Record the necessary journal entries in the books of the firm on Ram Lal's admission when:

a) Goodwill already appears in the books at Rs. 2,02,500.

b) Goodwill appears in the books at Rs. 2,500.

c) Goodwill appears in the books at Rs. 2,05,000.

Answer:

Average Profit =2,70,000 /4= Rs 67,500

Goodwill = Average Profit × No. of Years Purchases = 67,500 × 3 = 2,02,500

Ram Lal entered into the firm for 1/4 share of Profit.

Ram Lal's share of goodwill = 2,02, 500 × (1/4) = Rs 50,625

Here sacrificing ratio of Mohan Lal and Sohan Lal will be equal to old ratio because new and

sacrificing ratio is not given.

Mohan Lal will get = Ram Lal's Share of Goodwill × (3/5) = 50,625 × (3/5) = 10,125 × 3 = Rs

30,375

Sohan Lal will = Ramlal Share of Goodwill × (1/5) = 50,625 × (1/5) = Rs 10,125 × 2 = Rs 20,250

Case (a)

Case (c)

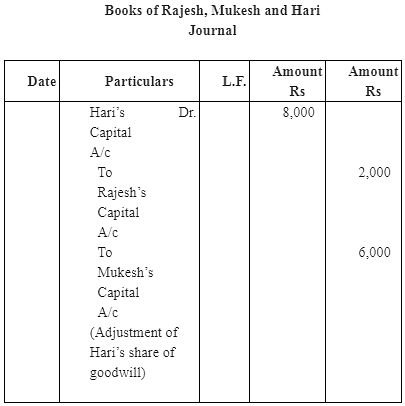

Question 25: Rajesh and Mukesh are equal partners in a firm. They admit Hari into partnership and the new profit sharing ratio between Rajesh, Mukesh and Hari is 4:3:2. On Hari's admission goodwill of the firm is valued at Rs 36,000. Hari is unable to bring his share of goodwill premium in cash. Rajesh, Mukesh and Hari decided not to show goodwill in their balance sheet. Record necessary journal entries for the treatment of goodwill on Hari's admission.

Answer:

Working Notes:

1) Goodwill of a firm = 36,000

Hari's share in goodwill

= Goodwill of firm × admitting Partner Share

2) Sacrificing Ratio = Old Ratio - New Ratio

Sacrificing Ratio between Rajesh and Mukesh 1:3.

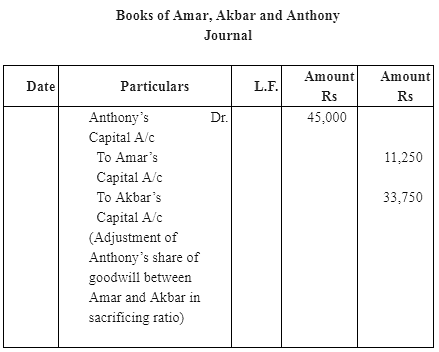

Question 26: Amar and Akbar are equal partners in a firm. They admitted Anthony as a new partner and the new profit sharing ratio is 4:3:2. Anthony could not bring this share of goodwill Rs 45,000 in cash. It is decided to do adjustment for goodwill without opening goodwill account. Pass the necessary journal entry for the treatment of goodwill?

Answer:

Working Notes:

1) Sacrificing Ratio = Old Ratio - New Ratio

Sacrificing Ratio between Amar and Akbar = 1:3.

Page No. 171

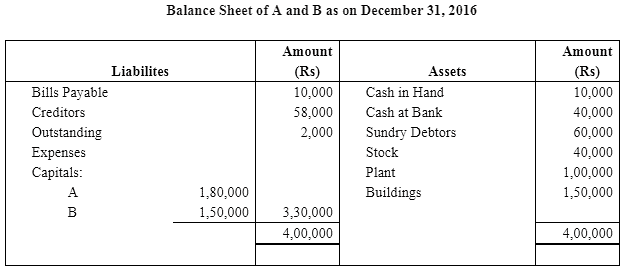

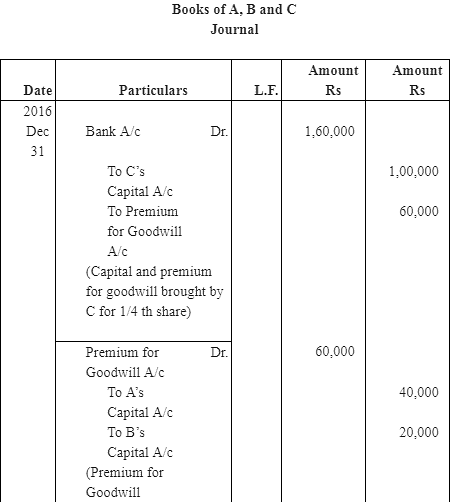

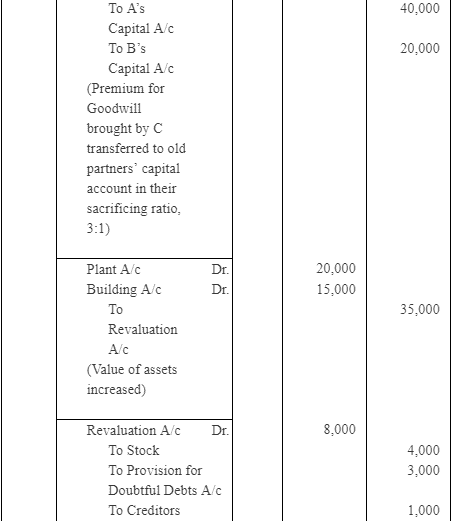

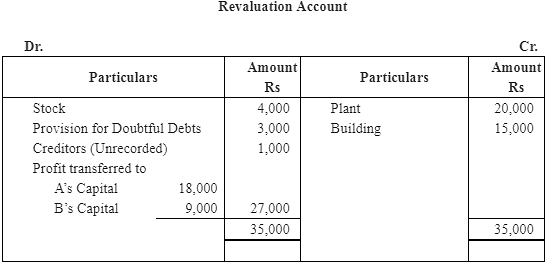

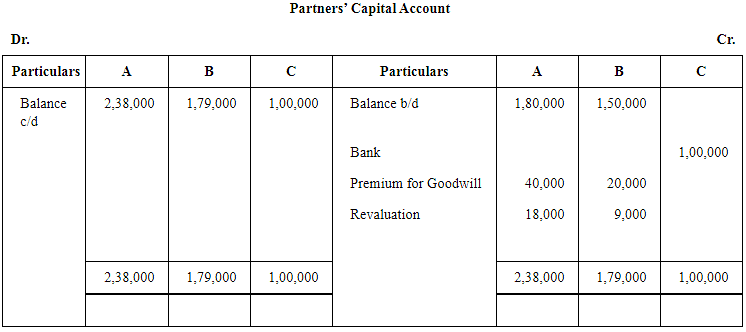

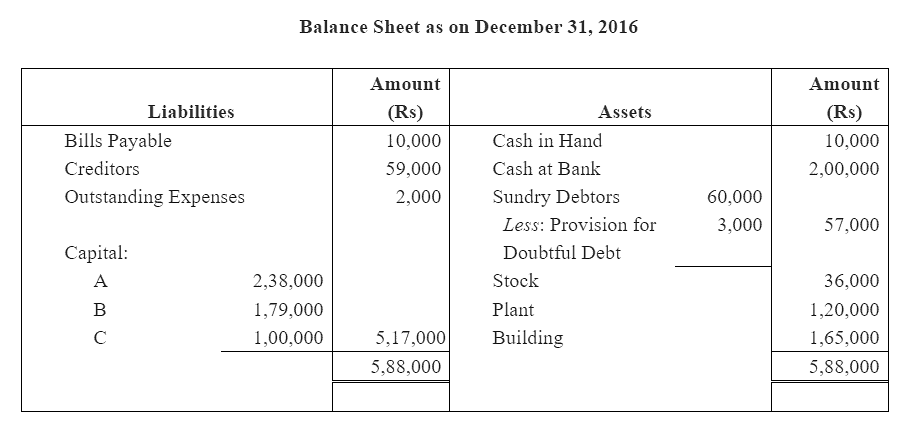

Question 27: Given below is the Balance Sheet of A and B, who are carrying on partnership business on 31.12.2016. A and B share profits and losses in the ratio of 2:1.

C is admitted as a partner on the date of the balance sheet on the following terms:

(i) C will bring in Rs 1,00,000 as his capital and Rs 60,000 as his share of goodwill for 1/4 share in the profits.

(ii) Plant is to be appreciated to Rs 1,20,000 and the value of buildings is to be appreciated by 10%.

(iii) Stock is found over valued by Rs 4,000.

(iv) A provision for bad and doubtful debts is to be created at 5% of debtors.

(v) Creditors were unrecorded to the extent of Rs 1,000.

Pass the necessary journal entries, prepare the revaluation account and partners' capital accounts, and show the Balance Sheet after the admission of C.

Answer:

Working Note:

1) Sacrificing ratio = Old Ratio − New Ratio

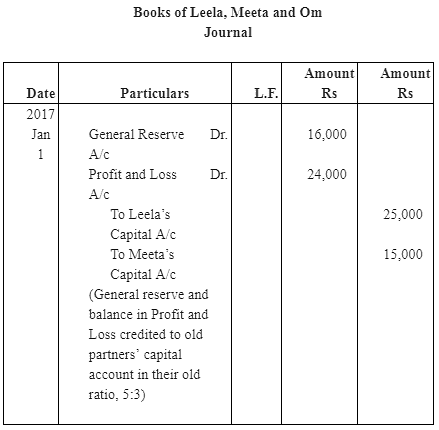

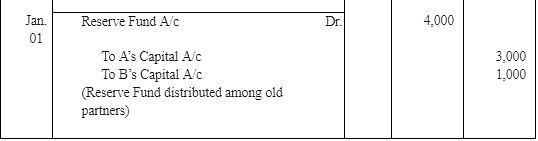

Question 28: Leela and Meeta were partners in a firm sharing profits and losses in the ratio of 5:3. On Is Jan. 2017 they admitted Om as a new partner. On the date of Om's admission the balance sheet of Leela and Meeta showed a balance of Rs 16,000 in general reserve and Rs 24,000 (Cr) in Profit and Loss Account. Record necessary journal entries for the treatment of these items on Om's admission. The new profit sharing ratio between Leela, Meeta and Om was 5:3:2.

Answer:

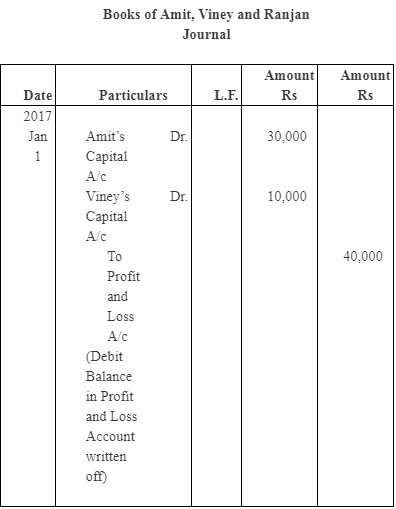

Question 29: Amit and Viney are partners in a firm sharing profits and losses in 3:1 ratio. On 1.1.2017 they admitted Ranjan as a partner. On Ranjan’s admission the profit and loss account of Amit and Viney showed a debit balance of Rs 40,000. Record necessary journal entry for the treatment of the same.

Answer:

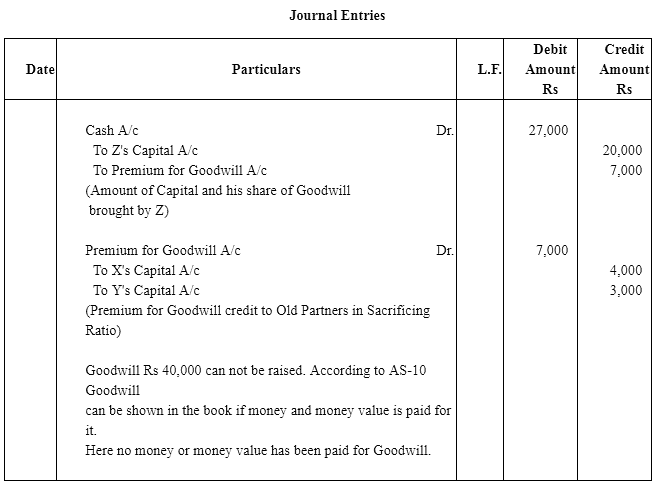

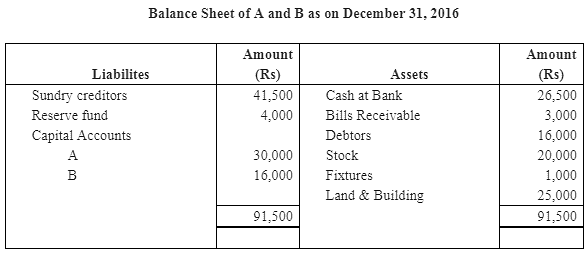

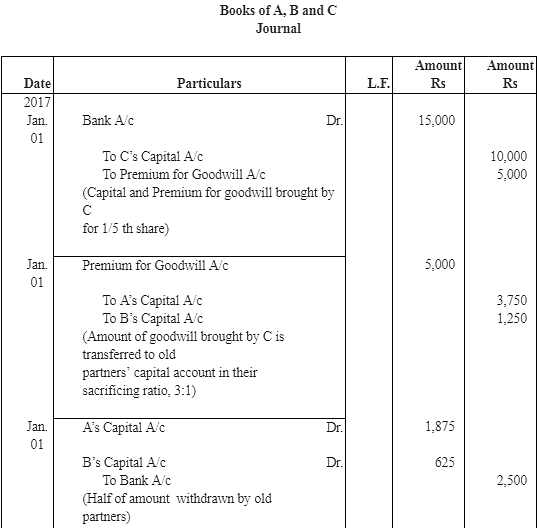

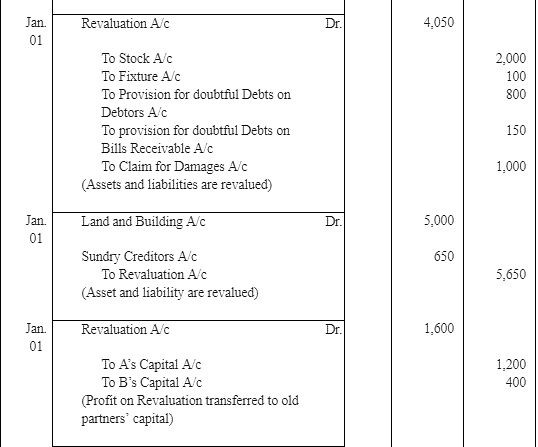

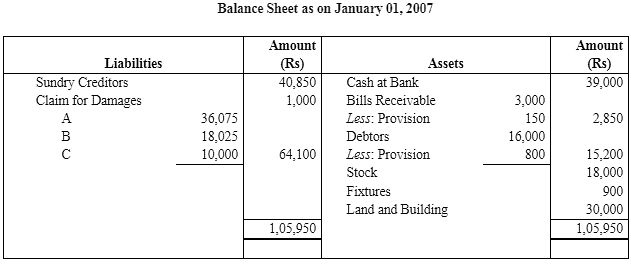

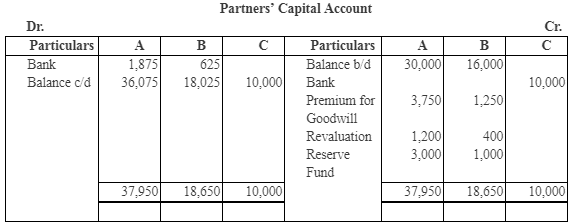

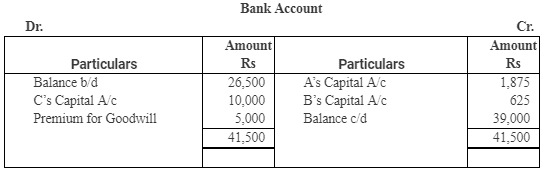

Q 30: A and B share profits in the proportions of 3/4 and 1/4. Their Balance Sheet on Dec. 31, 2016 was as follows:

On Jan. 1,2017, C was admitted into partnership on the following terms:

(a) That C pays Rs 10,000 as his capital.

(b) That C pays Rs 5,000 for goodwill. Half of this sum is to be withdrawn by A and B.

(c) That stock and fixtures be reduced by 10% and a 5%, provision for doubtful debts be created on Sundry Debtors and Bills Receivable.

(d) That the value of land and buildings be appreciated by 20%.

(e) There being a claim against the firm for damages, a liability to the extent of Rs 1,000 should be created.

(f) An item of Rs 650 included in sundry creditors is not likely to be claimed and hence should be written back.

Record the above transactions (journal entries) in the books of the firm assuming that the profit sharing ratio between A and B has not changed. Prepare the new Balance Sheet on the admission of C.

Answer:

Working Note:

1)

2)

3)

Sacrificing ratio = Old Ratio − New Ratio

Note: Assuming that ratio between A and B has not change hence sacrificing ratio should be same as old ratio.

Page No. 172

Question 31: A and B are partners sharing profits and losses in the ratio of 3:1. On Ist Jan. 2017 they admitted C as a new partner for 1/4 share in the profits of the firm. C brings Rs 20,000 as for his 1/4 share in the profits of the firm. The capitals of A and B after all adjustments in respect of goodwill, revaluation of assets and liabilities, etc. has been worked out at Rs 50,000 for A and Rs 12,000 for B. It is agreed that partner’s capitals will be according to new profit sharing ratio. Calculate the new capitals of A and B and pass the necessary journal entries assuming that A and B brought in or withdrew the necessary cash as the case may be for making their capitals in proportion to their profit sharing ratio?

Answer:

1) Calculation of New Profit sharing Ratio

New Profit sharing ratio of A, B and C will be 9:3:4

2) New Capital of A and B.

C bring Rs 20,000 for 1/4th share of profit in the new firm.

Thus, total capital of firm on the basis of C’s share= 20,000 * 4/ 1 = 80,000

|

4 videos|168 docs

|

FAQs on NCERT Solutions (Part - 2) - Admission of a Partner - Additional Study Material for Commerce

| 1. What is admission of a partner in commerce? |  |

| 2. What are the reasons for admitting a new partner in a partnership firm? |  |

| 3. What are the legal formalities involved in admitting a new partner in a partnership firm? |  |

| 4. How is the new partner's share of profits and losses determined in a partnership firm? |  |

| 5. What are the tax implications of admitting a new partner in a partnership firm? |  |

|

Explore Courses for Commerce exam

|

|