NCERT Solutions for Class 12 Economics - Liberalisation, Privatisation and Globalisation: An Appraisal

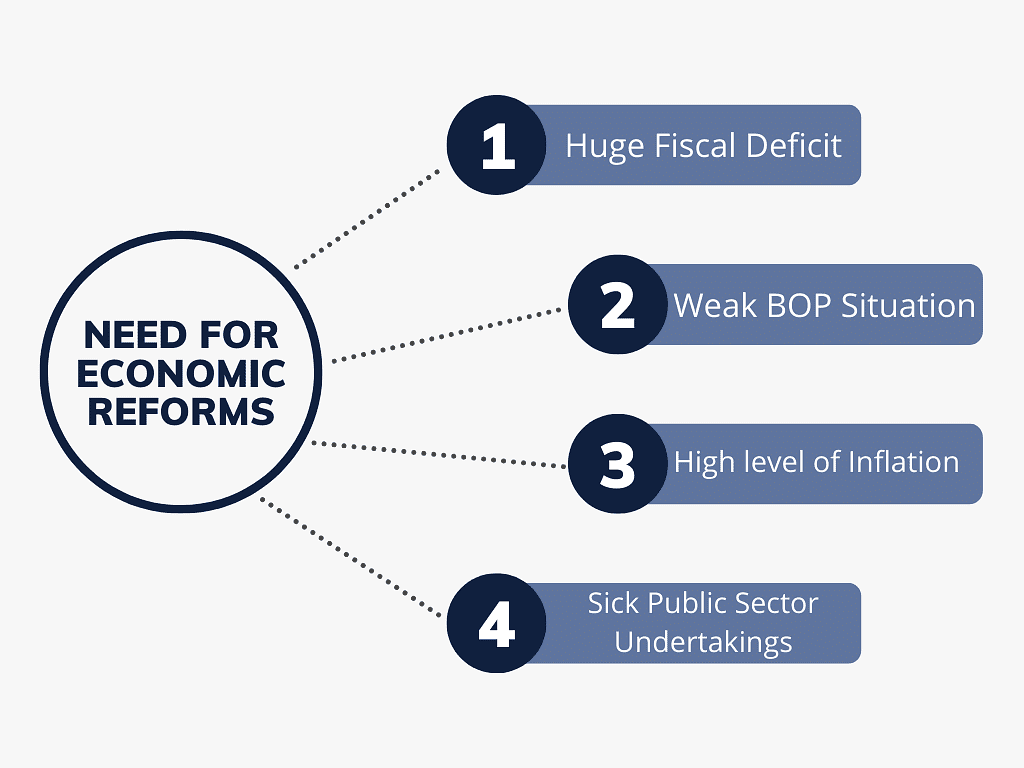

Q1: Why were reforms introduced in India?

Ans: Economic reforms were introduced in the year 1991 in India to combat the economic crisis.

- The Economic Crisis of 1991 was a culminated outcome of the policy failure in the preceding years. It was in that year, that the Indian government was experiencing huge fiscal deficits, large balance of payment deficits, high inflation levels, and an acute fall in the foreign exchange reserves.

- Moreover, the gulf crisis of 1990-91 led to an acute rise in the prices of fuel which further pushed up the inflation level.

- Because of the combined effect of all these factors, economic reforms became inevitable and were the only way to move the Indian economy out of this crisis.

The following are the factors that necessitated the need for economic reforms.

1. Huge Fiscal Deficit: Throughout the 1980s, the fiscal deficit was getting worse due to huge non-development expenditures.

1. Huge Fiscal Deficit: Throughout the 1980s, the fiscal deficit was getting worse due to huge non-development expenditures.

- As a result, the gross fiscal deficit rose from 5.7% of GDP to 6.6% of GDP during 1980-81 to 1990-91.

- Subsequently, a major portion of this deficit was financed by borrowings (both from external and domestic sources).

- The increased borrowings resulted in increased public debt and mounting interest payment obligations.

- The domestic borrowings by the government increased from 35% to 49.8% of GDP during 1980-81 to 1990-91.

- Moreover, the interest payments obligations accounted for 39.1% of the total fiscal deficit.

- Consequently, India lost its financial worthiness in the international market and fell into a debt trap. Thus, economic reforms were needed urgently.

2. Weak BOP Situation: BOP represents the excess of the total amount of exports over the total amount of imports.

- Due to the lack of competitiveness of Indian products, India was not able to earn enough foreign exchange through exports to finance our imports.

- The current account deficit rose from 1.35% to 3.69% of GDP during 1980-81 to 1990-91.

- In order to finance this huge current account deficit, the Indian government borrowed a huge amount from the international market.

- Consequently, the external debt increased from 12% to 23% of GDP during the same period.

- On the other hand, Indian exports were not potent enough to earn sufficient foreign exchange to repay these external debt obligations.

- This BOP crisis compelled the need for economic reforms.

3. High level of Inflation: The high fiscal deficits forced the central government to monetize the fiscal deficits by borrowings from RBI.

- RBI printed new money that pushed up the inflation level, thereby making domestic goods more expensive.

- The rate of inflation rose from 6.7% p.a. to 10.3% p.a. during the 1980s to 1990-91.

- In order to lower the inflation rate, the government 1991 had to opt for economic reforms.

4. Sick PSUs: Public Sector Undertakings were assigned the prime role of industrialization and removal of inequality of income and poverty.

- But the subsequent years witnessed the failure of PSUs to perform these roles efficiently and effectively.

- Instead of being a revenue generator for the central government, these became a liability.

- The sick PSUs added an extra financial burden on the government’s budget.

Thus, because of all the above reasons existing concomitantly, economic reforms became inevitable.

Q2: Why is it necessary to become a member of the WTO?

Ans: It is important for any country to become a member of WTO (World Trade Organisation) for the following reasons:

- WTO provides equal opportunities to all its member countries to trade in the international market.

- It provides its member countries with larger scope to produce at a large scale to cater to the needs of people across international boundaries. This provides ample scope to utilize world resources optimally and provides greater market accessibility.

- It advocates for the removal of tariff and non-tariff barriers, thereby promoting healthier and fairer competition among different producers of different countries.

- Countries with similar economic conditions being members of WTO can raise their voices to safeguard their common interests.

Q3: Why did RBI have to change its role from controller to facilitator of the financial sector in India?

Ans: Prior to liberalization, RBI used to regulate and control the financial sector that including financial institutions like commercial banks, investment banks, stock exchange operations, and the foreign exchange market.

- With the economic liberalization and financial sector reforms, RBI needed to shift its role from a controller to a facilitator of the financial sector.

- This implies that the financial organizations were free to make their own decisions on many matters without consulting the RBI.

- This opened up the gates of financial sectors for the private players.

- The main objective behind the financial reforms was to encourage private sector participation, increase competition and allow market forces to operate in the financial sector.

Thus, it can be said that before liberalization, RBI was controlling the financial sector operations whereas, in the post-liberalization period, the financial sector operations were mostly based on the market forces.

Q4: How is RBI controlling commercial banks?

Ans: RBI controls the commercial bank's via various instruments like Statutory Liquidity Ratio (SLR), Cash Reserve Ratio (CRR), Bank Rate, Prime Lending (PLR), Repo Rate, Reverse Repo Rate, and fixing the interest rates and deciding the nature of lending to various sectors. These are those ratios and rates that are fixed by RBI, and it is mandatory for all commercial banks to follow or maintain these rates. All these measures control the commercial banks' operations and also control the money supply in the Indian economy.

Q5: What do you understand by the devaluation of the rupee?

Ans: Devaluation of the Rupee refers to the fall in the value of the rupee in terms of foreign currency.

- Specifically, it implies a deliberate official lowering of the value of the country's currency with respect to foreign currency.

- Devaluation prevails under the fixed exchange rate regime.

- This implies that the value of the rupee has fallen and the value of the foreign currency has risen. It means that now (after devaluation) one US$ can be exchanged for more rupees.

- This encourages exports and discourages imports as the former is cheaper now for foreign countries, and the latter is expensive for Indians.

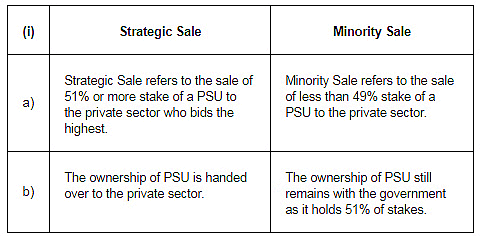

Q6: Distinguish between the following

(i) Strategic and Minority sale

Ans:

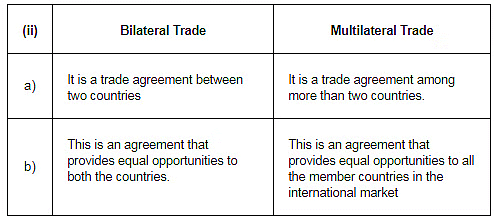

(ii) Bilateral and Multi-lateral trade

(ii) Bilateral and Multi-lateral trade

Ans:

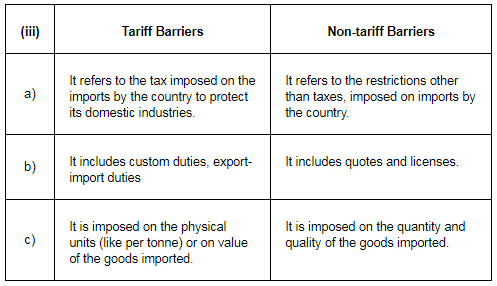

(iii) Tariff and Non-tariff barriers.

(iii) Tariff and Non-tariff barriers.

Ans:

Q7: Why are tariffs imposed?

Ans: Tariffs are imposed to make imports from foreign countries relatively more expensive than domestic goods, thereby, discouraging imports indirectly.

- These are imposed to provide a safe and protective environment to the infant domestic firms from their technologically advanced foreign counterparts.

- Tariffs facilitate domestic firms to survive and grow.

- Tariffs are also imposed on those goods that the government thinks to be socially unwanted and imports that will exert an unnecessary burden on the scarce foreign exchange reserves.

Q8: What is the meaning of quantitative restrictions?

Ans: Quantitative Restrictions (QRs) refer to restrictions in the form of limits or quotas on the number of commodities that can either be imported or exported. QRs, usually on imports (refers to non-tariff measures), are imposed to discourage imports of foreign goods and to reduce Balance of Payment (BOP) deficits. The imposition of QRs provides the impetus for domestic firms to survive, grow and expand in a protective and lesser competitive environment.

Q9: Those public sector undertakings which are making profits should be privatized. Do you agree with this view? Why?

Ans: An efficient and profit-earning PSU is a revenue generator for the government. But, if a PSU is an inefficient and loss-making one, then the same PSU exerts an unnecessary burden on the government's scarce revenues and may further lead to a budget deficit.

- The loss-making PSUs should be privatized, whereas it would not be fair to privatize a profit-making PSU.

- Privatizing a PSU may lead to the concentration of monopoly power in the private hands.

- Further, some of the PSUs like water, railways, etc. enhance the welfare of the nation and are meant to serve the general public at a very nominal cost.

- Privatization of such important PSUs will lead to the loss of welfare for poor people.

- Hence, only less important PSUs should be privatized while leaving the core and important PSUs to be owned by the public sector.

- Instead of privatization of profit-making PSUs, the government can allow more degree of autonomy and accountability in their operations, which will not only increase their productivity and efficiency but also enhance their competitiveness with their private counterparts.

Q10: Do you think outsourcing is good for India? Why are developed countries opposing it?

Ans: Yes, outsourcing is good for India. The following points suggest that outsourcing is good for India.

- Employment: For a developing country like India, employment generation is an important objective, and outsourcing proves to be a boon for creating more employment opportunities. It leads to the generation of newer and higher-paying jobs.

- Exchange of technical know-how: Outsourcing enables the exchange of ideas and technical know-how of sophisticated and advanced technology from developed to developing countries.

- International worthiness: Outsourcing to India also enhances India’s international worthiness credibility. This increases the inflow of investment to India.

- Encourages other sectors: Outsourcing not only benefits the service sector but also affects other related sectors like the industrial and agricultural sectors through various backward and forward linkages.

- Contributes to human capital formation: Outsourcing helps in the development and formation of human capital by training and imparting them with advanced skills, thereby increasing their future scope and their suitability for high-ranked jobs.

- Better standard of living and eradication of poverty: By creating more and higher paying jobs, outsourcing improves the standard and quality of living of the people in developing countries. It also helps in reducing poverty.

- Greater infrastructural investment: Outsourcing to India requires better quality infrastructure. This leads to the modernization of the economy and larger investment by the government to develop quality infrastructure and develop quality human capital.

However, Outsourcing to India is good, but developed countries oppose this because outsourcing leads to the outflow of investments and funds from developed countries to less developed countries. Also, the MNCs contribute more to the development of the host country than the home country. Further, outsourcing reduces the employment generation in developed countries as the same jobs can be done in less developed countries at relatively cheap wages. Moreover, this leads to job insecurity in the developed countries as, at a point time, jobs can be outsourced to the developing countries.

Q11: India has certain advantages which make it a favorite outsourcing destination. What are these advantages?

Ans: The following points qualify India to be the favorite spot for outsourcing by various MNCs.

- Easy Availability of Cheap Labour: As the wage rates in India are comparatively lower than that of developed countries, MNCs find it economically feasible to outsource their business in India.

- Reasonable Degree of Skills: Indians have a fairly reasonable degree of skills and techniques that need a low training period and, thus, a low cost of training.

- International worthiness: India has fair international worthiness and also credibility. This enhances the faith of foreign investors in India.

- Virgin Market: India has a virgin market for produced goods and services. This not only helps the MNCs to explore the wide domestic market of India but also conquer the international market as the cost of production in India is relatively cheaper.

- Stable Political Environment: The democratic political environment in India provides a stable and secure environment for the MNCs to expand and grow.

- Favourable Government Policies: The most important point that makes India the favorite spot for outsourcing is the favorable government and tax policies. MNCs gets various types of lucrative offers from the Indian government like tax holidays, low rate of tax, easy tax policies, etc. All these policies enable the MNCs to retain a major portion of their earnings in the form of savings that they can invest in growing and expanding their business.

- Lack of Competitive Competitors: The most important for the MNCs in India is that they don’t face stiff competition from the Indian domestic industries. This almost enables them to enjoy a monopoly status in the Indian markets.

- Reasonable Degree of Infrastructural Investment: Indian government has invested heavily in the past two decades in the infrastructural sector. Various steps have been taken to connect remote and rural areas to metropolitan and other major cities. This has not only reduced the cost of production of the MNCs but also helped them operate efficiently and effectively.

- Cheap and Abundant Availability of Raw Materials: India is well enriched in natural resources. This ensures the MNC's cheap availability of raw materials and undisturbed and perennial supply of raw materials. This enables proper and smooth operation of MNCs.

Q12: Do you think the navaratna policy of the government helps in improving the performance of public sector undertakings in India? How?

Ans: To improve efficiency, infuse professionalism, and to enable PSUs to compete effectively in the market, the government awarded the status of ‘navaratnas’ to the following nine PSUs:

- Indian Oil Corporation Ltd (IOCL)

- Bharat Petroleum Corporation Ltd (BPCL)

- Hindustan Petroleum Corporation Ltd (HPCL)

- Oil and Natural Gas Corporation Ltd (ONGC)

- Steel Authority of India Ltd (SAIL)

- India Petro-chemicals Corporations Ltd (IPCL)

- Bharat Heavy Electricals Ltd (BHEL)

- National Thermal Power Corporation (NTPC)

- Videsh Sanchar Nigam Ltd (VSNL)

These corporations were granted a greater degree of financial, managerial, and operational autonomy. This boosted their efficiency and effectiveness. They have also become highly competitive, and some of them are becoming giant global players. Consequent to their better performance, the government retained them under the public sector and enabled them to grow themselves not only in the domestic market but also in the international market. These corporations are self-reliant and financially self-sufficient. Thus, the navaratna policy has certainly improved the performance of these PSUs.

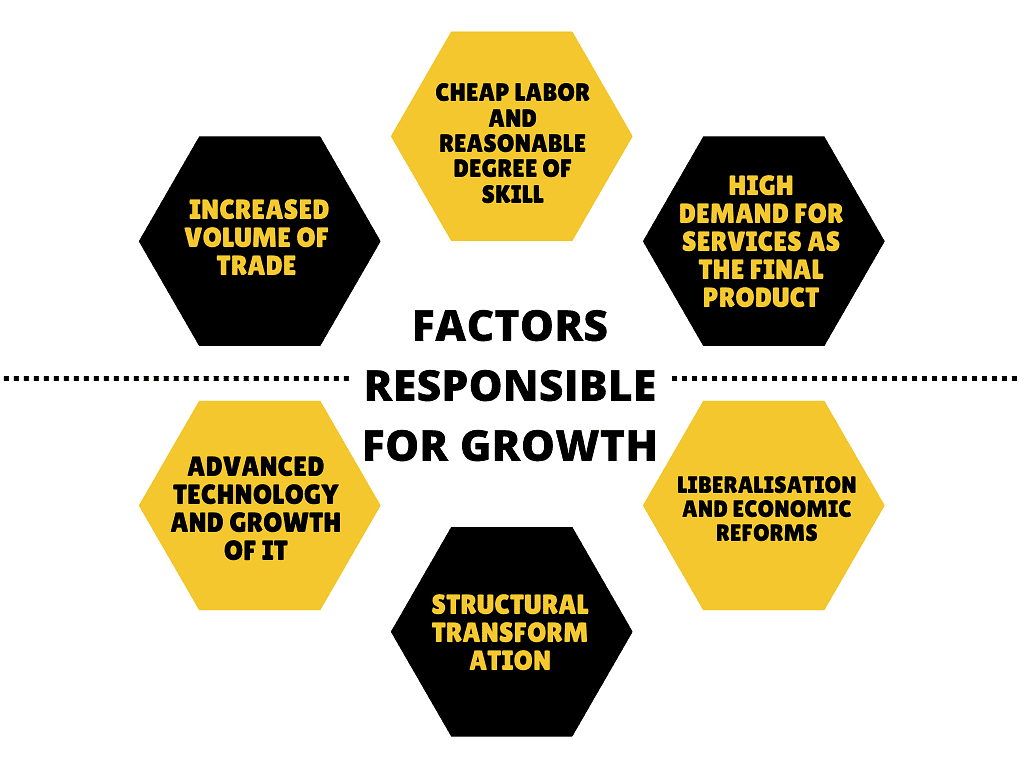

Q13: What are the major factors responsible for the high growth of the service sector?

Ans: The major factors that led to the growth of service sectors in India are as follows;

High demand for services as the final product: India was a virgin market for the service sector. So, when the service sector started booming due to business outsourcing from the developed countries to India, there was a very high demand for these services, especially for banking, computer service, advertisement, and communication. This high demand, in turn, led to a high growth rate in the service sector.

High demand for services as the final product: India was a virgin market for the service sector. So, when the service sector started booming due to business outsourcing from the developed countries to India, there was a very high demand for these services, especially for banking, computer service, advertisement, and communication. This high demand, in turn, led to a high growth rate in the service sector.- Liberalisation and economic reforms: The growth of the Indian service sector is also attributable to the liberalization and various economic reforms that were initiated in 1991. Due to these reforms, various restrictions on the movement of international finance were minimized. This led to a huge inflow of foreign capital, foreign direct investments, and outsourcing to India. This encouraged the service sector growth.

- Structural transformation: Indian economy is experiencing a structural transformation that implies a shift of economic dependence from the primary to the tertiary sector. Due to this transformation, there was increased demand for services by other sectors, which y boosted the service sector.

- Advanced technology and growth of IT: The advancements and innovations in the IT sector enabled the use of the internet, telecommunication, mobile phone, and electronic transactions across different countries. All these contributed to the growth of the service sector in India.

- Increased volume of trade: Low tariff and non-tariff barriers on imports by India are also responsible for a high growth rate of the service sector. The foreign trade reforms enabled domestic products to interact and compete in international markets.

- Cheap labor and reasonable degree of skill in India: Due to the availability of cheap labor and a reasonable degree of skilled manpower in India, developed countries found outsourcing to India feasible and profitable. Business outsourcing in itself provides substantial encouragements (like the development of human capital that requires services like good coaching centers and reputed institutions, etc.) to the growth of the service sector.

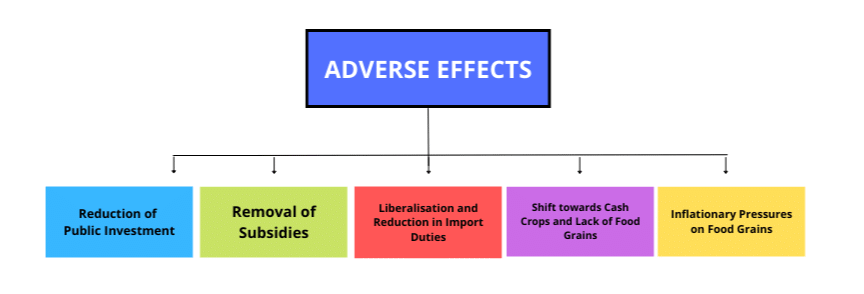

Q14: Agriculture sector appears to be adversely affected by the reform process. Why?

Ans: The economic reforms of 1991 did not benefit the agricultural sector significantly. The following are the reasons that explain the adverse effects of the economic reforms on India’s agriculture sector:

Reduction of Public Investment: There has been a drastic decrease in the volume of public investment in the agricultural sector. There has been an acute cutback from the Indian government to provide sufficient irrigation facilities, electricity, information system, market linkages, and roads. Moreover, investment in agricultural research and development was not as extensive as it was during the green revolution phase.

Reduction of Public Investment: There has been a drastic decrease in the volume of public investment in the agricultural sector. There has been an acute cutback from the Indian government to provide sufficient irrigation facilities, electricity, information system, market linkages, and roads. Moreover, investment in agricultural research and development was not as extensive as it was during the green revolution phase.- Removal of Subsidies: Removal of subsidies on fertilizers pushed up the cost of production of agriculture. This made farming more expensive, thereby adversely affecting the poor and marginal farmers.

- Liberalisation and Reduction in Import Duties on Agricultural Products: Due to adherence to the WTO commitments, the Indian government reduced import duties on agricultural products that forced the poor and marginal farmers to compete with their foreign counterparts in the international markets. Stiff competition in the international market along with traditional techniques of farming badly affected the poor farmers.

- Shift towards Cash Crops and Lack of Food Grains: The export-oriented production strategies led to the shift of agricultural production from food grains to the production of cash crops like cotton, jute, etc. This led to reduced availability of food grains and, consequently, lower nutritional values, which further reduced their productivity.

- Inflationary Pressures on Food Grains: The shift toward cash crop production along with the removal of subsidies exerted inflationary pressures on the prices of food grains. This, in turn, adversely affected the agricultural sector’s performance by making the cost of producing food grains more expensive.

Q15: Why has the industrial sector performed poorly in the reform period?

Ans: Similar to the agricultural sector, the industrial sector’s performance was also poor. The poor performance of the industrial sector may be attributable to the following reasons:

- Cheaper Imports: The demand for the industrial output was reduced due to the cheaper imports. The imports from the developed countries were cheaper due to the removal of import tariffs. These cheaper and quality foreign imports led to a fall in the demand for domestic goods.

- Lack of Investment: Due to the lack of investment in infrastructure facilities (including power supply) the domestic firms could not compete with their developed foreign counterparts in terms of cost of production and quality of goods. The inadequate infrastructural investment pushed up the cost of production of the domestic producers and, consequently, led to the non-feasibility of their growth prospectus.

- High Non-tariffs Barriers by the Developed Countries: It was very difficult to access the developed country's market due to high non-tariff barriers maintained by the developed countries. For instance, the US did not remove quota restrictions on imports of textiles from India and China.

- Vulnerable and Infant Domestic Industries: During the pre-liberalized period, domestic industries were provided a protective environment to grow and expand. But at the time of liberalization, the domestic industries were still not developed up to the extent it was thought, and consequently, they could not compete with the multinational companies. The dependence of domestic industries on traditional technologies, which were neither cost-effective nor quality-effective, was an important reason for their poor growth. Thus, the domestic industries were adversely affected by liberalization.

Q16: Discuss economic reforms in India in the light of social justice and welfare.

Ans: The economic reforms have enabled India to access and compete in international markets. This facilitated the movement of goods and services across international boundaries.

- Further, the increased inflows of foreign capital and investment to India have eliminated the shortage of foreign exchange to finance the imports of sophisticated and advanced technologies to India.

- Moreover, the boom in the outsourcing and the service sector led India’s economic growth and GDP to increase by many folds.

- But on the other side, agriculture that employed a significant proportion of population, failed to be benefited by these economic reforms.

- Also the reforms favoured the high income group population at the cost of their poor counterparts. This resulted in wide and still increasing economic and social inequalities among different section of population.

- Further, the economic reforms developed the areas that were well connected with the metropolitan cities leaving the remote and rural area undeveloped. Consequently, there were wide regional disparities.

- The boom in the service sector, especially in the form of quality education, superior health care facilities, IT, tourism, multiplex cinemas, etc. were out of the reach of the poor section of the population.

- The population engaged in the agricultural and allied sectors has still not been able to share the fruits of advanced technology and modern techniques.

- Further, the high income group has experienced increase in income, thereby, appreciating the quality of their consumption basket, leaving the low and middle income group to fight hard to earn their livelihood.

Thus, it can be concluded that the economic reforms failed to provide social justice and enhance welfare of the general public of India.

|

64 videos|308 docs|51 tests

|

FAQs on NCERT Solutions for Class 12 Economics - Liberalisation, Privatisation and Globalisation: An Appraisal

| 1. What is liberalisation, privatisation, and globalisation? |  |

| 2. How has liberalisation impacted the Indian economy? |  |

| 3. What are the criticisms of privatisation in India? |  |

| 4. How has globalisation affected developing countries like India? |  |

| 5. What are the measures taken by the Indian government to mitigate the negative effects of liberalisation, privatisation, and globalisation? |  |