Rectification Of Errors - (Part - 1) | Accountancy Class 11 - Commerce PDF Download

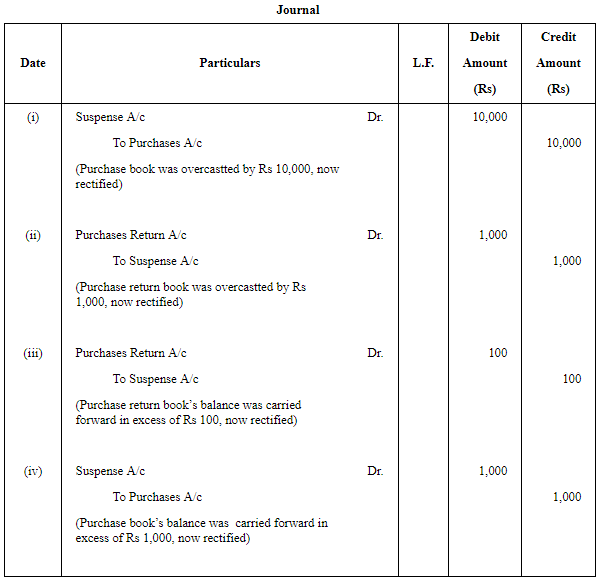

Page No 17.35:

Question 1: How will be the following errors rectified?

(i) Purchases Book is overcasted by ₹ 10,000.

(ii) Purchases Return Book is overcasted by ₹ 1,000.

(iii) Purchases Return Book’s balance is carried forward in excess by ₹ 100.

(iv) Purchases Book’s balance is carried forward in excess by ₹ 1,000.

ANSWER:

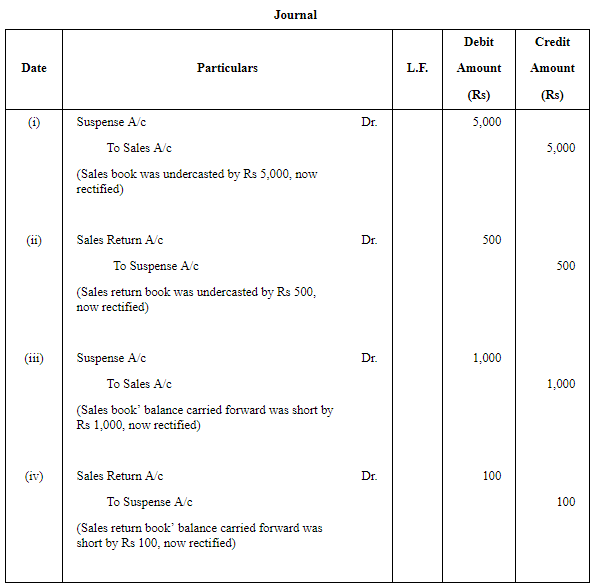

Page No 17.35:

Question 2: How will be the following errors rectified?

(i) Sales Book is short casted by ₹ 5,000.

(ii) Sales Return Book is short casted by ₹ 500.

(iii) Balance of Sales Book is carried forward short by ₹ 1,000.

(iv) Balance of Sales Return Book is carried forward short by ₹ 100.

ANSWER:

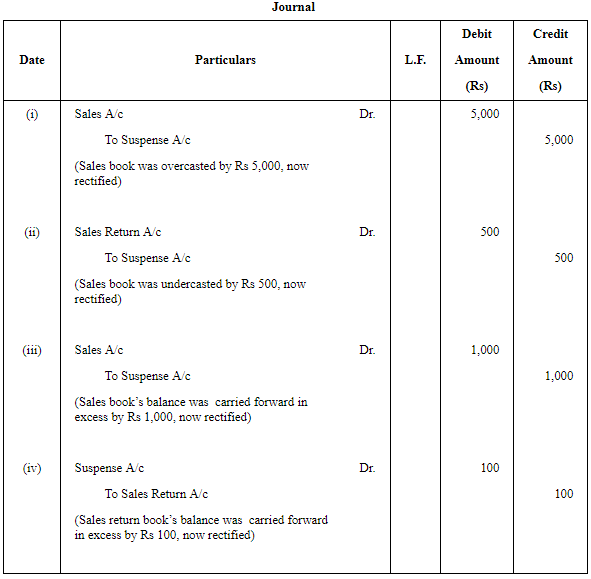

Page No 17.35:

Question 3: How will you rectify the following errors?

(i) Sales Book is overcasted by ₹ 5,000.

(ii) Sales Return Book is short casted by ₹ 500.

(iii) Balance of Sales Book is carried forward in excess by ₹ 1,000.

(iv) Balance of Sales Return Book is carried forward in excess by ₹ 100.

ANSWER:

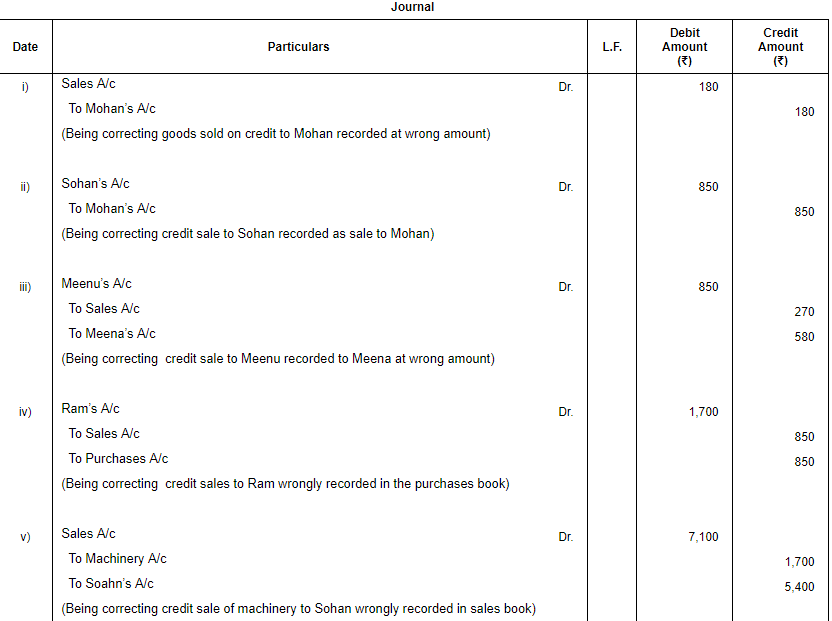

Page No 17.35:

Question 4: Pass the necessary Journal entries to rectify the following errors:

(i) Credit sale of ₹ 570 to Mohan was recorded as ₹ 750.

(ii) Credit sale of ₹ 850 to Sohan was recorded as sale to Mohan.

(iii) Credit sale of ₹ 850 to Meenu was recorded as sale to Meena as ₹ 580.

(iv) Credit sale of ₹ 850 to Ram was recorded in the Purchases Book.

(v) Credit sale of old machinery to Sohan for ₹ 1,700 was entered in the Sales Book as ₹ 7,100.

(vi) Bill Receivable for ₹ 5,000 accepted by Mahinder recorded as acceptance given to Mahinder for ₹ 6,000.

ANSWER:

Page No 17.35:

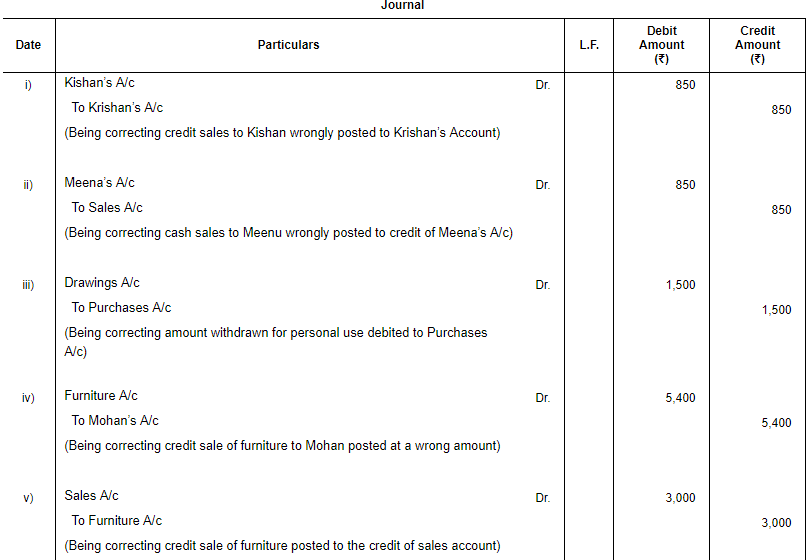

Question 5: Pass the necessary Journal entries to rectify the following errors:

(i) Credit sale of ₹ 850 to Kishan was posted to Krishan's Account.

(ii) Cash sale of ₹ 850 to Meenu was posted to the credit of Meena.

(iii) Amount of ₹ 1,500 withdrawn from bank by the proprietor for his personal use was debited to Purchases Account.

(iv) Credit sale of old furniture to Mohan for ₹ 1,700 was posted as ₹ 7,100.

(v) Credit sale of old furniture to Babu Ram for ₹ 3,000 was credited to Sales Account.

(vi) Cheque of ₹ 1,280 received from Farid was dishonoured and has been posted to the debit of Sales Return Account.

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on Rectification Of Errors - (Part - 1) - Accountancy Class 11 - Commerce

| 1. What is the meaning of rectification of errors in commerce? |  |

| 2. Why is it important to rectify errors in commerce? |  |

| 3. What are the common types of errors in commerce that require rectification? |  |

| 4. How can errors in commerce be rectified? |  |

| 5. Is rectification of errors a one-time process in commerce? |  |

|

Explore Courses for Commerce exam

|

|