Rectification of Errors - (Part - 5) | Accountancy Class 11 - Commerce PDF Download

Page No 17.39:

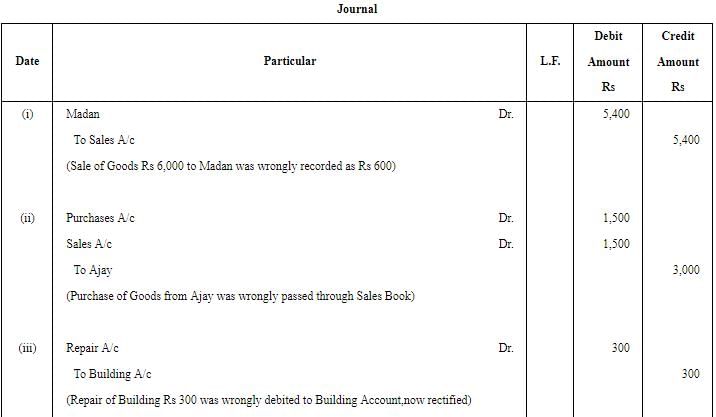

Question 24: Give rectifying Journal entries for the following errors:

(i) Sales of goods to Madan ₹ 6,000 were entered in the Sales Book as ₹ 600.

(ii) Credit purchase of ₹ 1,500 from Ajay has been wrongly passed through the Sales Book.

(iii) Repairs to building ₹ 300 were debited to Building Account.

(iv) ₹ 2,050 paid to Rohit is posted to the debit of Mohit’s Account as ₹ 5,020.(v) Purchases Return Book is overcasted by ₹ 400.

ANSWER:

Page No 17.39:

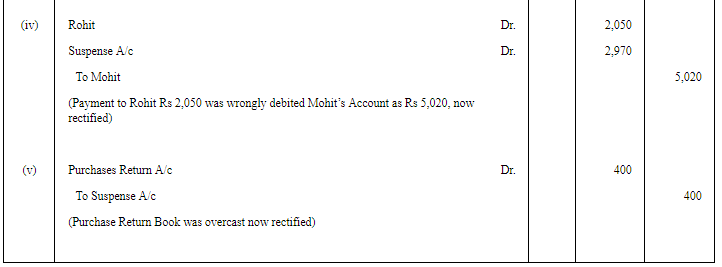

Question 25: Give rectifying entries for the following:

(i) ₹ 5,400 received from Mr. A was posted to the debit of his account.

(ii) The total of Sales Return Book overcasted by ₹ 800.

(iii) ₹ 2,740 paid for repairs to motor car was debited to Motor Car Account as ₹ 1,740.

(iv) Returned goods to Shyam ₹ 1,500 were passed through Returns Inward Book.

ANSWER:

Page No 17.39:

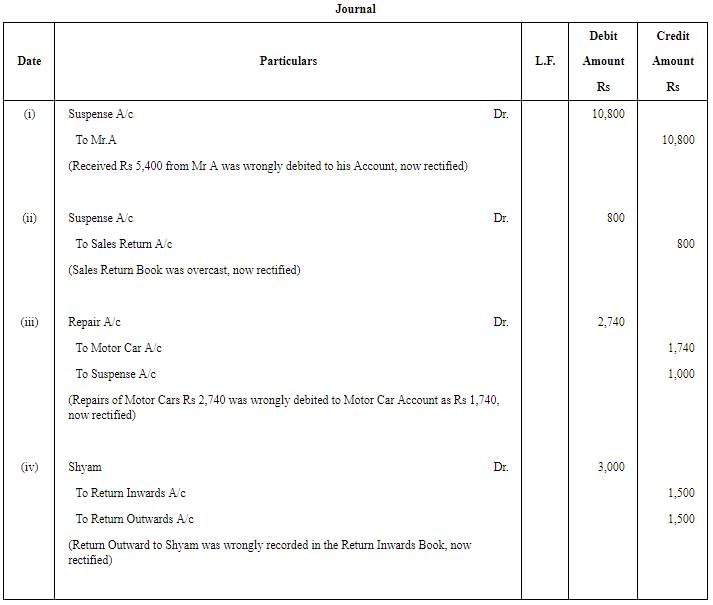

Question 26: Pass Journal entries rectifying the following errors:

(i) A cheque for ₹ 10,000 was received from Ranjan on which ₹ 200 Cash Discount was allowed. The cheque was not honoured on due date and the amount of discount was credited to Discount Received Account.

(ii) ₹ 2,000 paid as wages for machinery installation was debited to Wages Account.

(iii) ₹ 5,000 received from Rakesh were credited to his Personal Account. The amount had been written off as bad debts earlier.

(iv) Repair bill of machinery was recorded as ₹ 100 against the bill amount of ₹ 1,000.

ANSWER:

Page No 17.40:

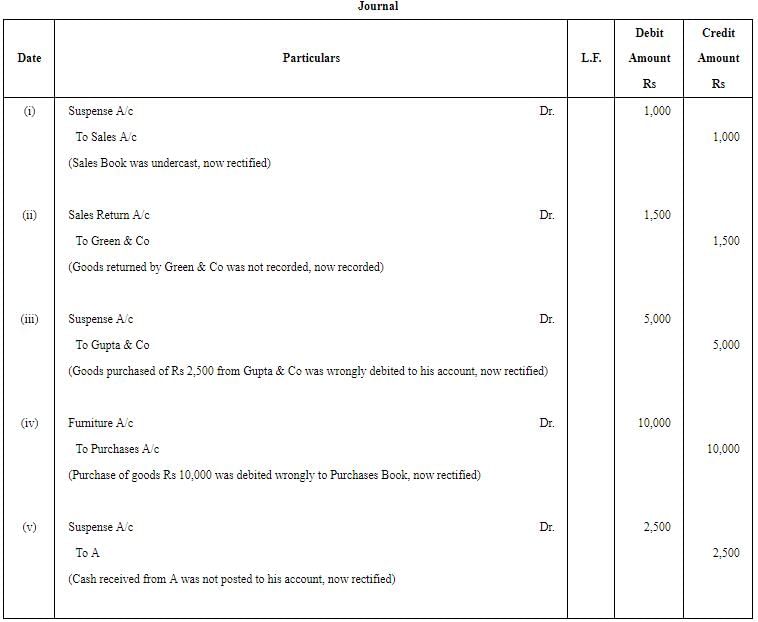

Question 27: Rectifying the following errors:

(i) Sales Book has been totalled ₹ 1,000 short.

(ii) Goods worth ₹ 1,500 returned by Green & Co. have not been recorded anywhere.

(iii) Goods purchased worth ₹ 2,500 have been posted to the debit of the supplier, Gupta & Co.

(iv) Furniture purchased from Gulab & Co. worth ₹ 10,000 has been entered in Purchases Book.

(v) Cash received from A ₹ 2,500 has not been posted in his account.

ANSWER:

Page No 17.40:

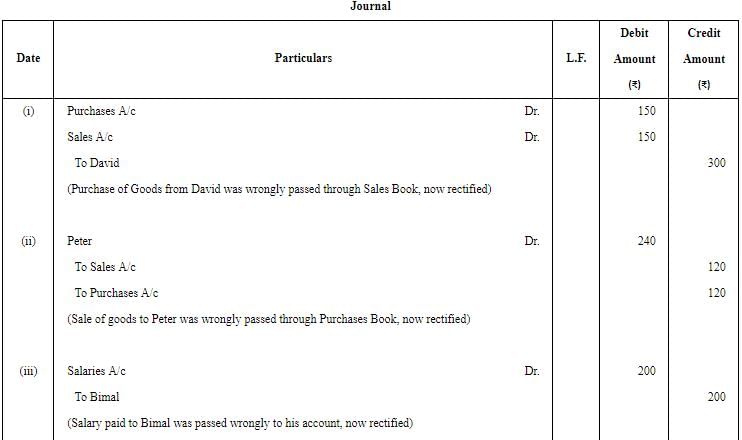

Question 28: Pass Journal entries to rectify the errors in the following cases:

(i) A purchase of goods from David amounting to ₹ 150 has been wrongly passed through the Sales Book.

(ii) A credit sale of goods of ₹ 120 to Peter has been wrongly passed through the Purchases Book.

(iii) ₹ 200, salary paid to Cashier, Bimal, stands wrongly debited to his Personal Account.

(iv) A credit sale of ₹ 4,230 to Krishan entered as purchase from Kishan ₹ 4,320.

(v) Ramesh's Account was credited with ₹ 840 twice instead of once.

ANSWER:

Page No 17.40:

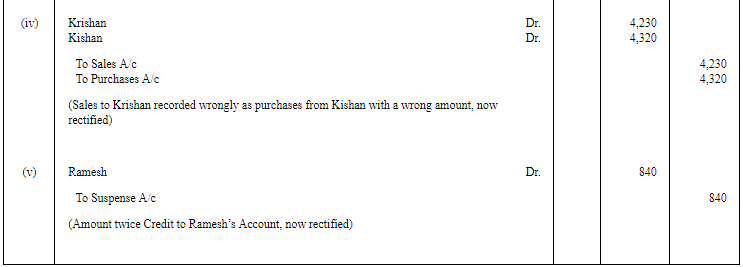

Question 29:

(i) What are the different causes that make a Trial Balance incorrect?

(ii) Pass the rectifying Journal entries:

(a) A credit sale of goods for ₹ 2,500 to Krishna has been wrongly passed through the Purchases Book.

(b) ₹ 5,000 paid for freight on machinery purchased was debited to the Freight Account as ₹ 500.|

(c) The Returns Inward Book has been wrongly overcasted by ₹ 100.

(d) An amount of ₹ 500 due from Ramesh which had been written off as bad debt in previous year was recovered and had been posted to the Personal Account of Ramesh.

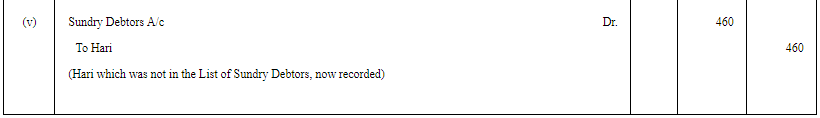

(e) A sum of ₹ 460 owed by Hari had not been included in the list of debtors.

ANSWER:

(i) The following are the causes that make a Trial Balance incorrect.

1) Incomplete posting of Journal Entry

2) Posting in the wrong side of Account.

3) Wrong totalling of Subsidiary Books

4) Wrong balance of Account

5) Omission of total of Subsidiary book into Account

6) Wrong totalling of the Trial Balance

(ii)

|

64 videos|152 docs|35 tests

|

FAQs on Rectification of Errors - (Part - 5) - Accountancy Class 11 - Commerce

| 1. What is the purpose of rectification of errors in commerce? |  |

| 2. How can errors be rectified in commerce? |  |

| 3. What are the common types of errors in commerce? |  |

| 4. Can errors in commerce have a significant impact on financial statements? |  |

| 5. Are there any legal implications of errors in commerce? |  |

|

Explore Courses for Commerce exam

|

|