Risk Classification and Management | Crash Course for UGC NET Commerce PDF Download

What is Risk Classification?

Risk refers to the likelihood or chance of an unfavorable event occurring, which can result in financial loss for an individual. Examples include being involved in an accident or losing valuable items like jewelry.

Risk classification in insurance involves categorizing various events that could cause financial harm to individuals, allowing insurance companies to offer appropriate policies. To effectively provide monetary compensation, the risks must be measurable. This measurement enables insurance companies to determine and assign monetary values to potential losses.

Key Aspects of Risk Classification:

Policy Division: Insurance companies use risk classification to segment their policies based on different types of risks. This segmentation influences the cost of insurance premiums.

Premium Determination: Policyholders are required to make regular premium payments, which are influenced by the type and level of risk associated with their policy. Higher-risk individuals typically pay higher premiums, while lower-risk individuals benefit from lower costs.

Financial Loss Estimation: Risk classification helps in calculating the potential financial loss for various events. For instance, a health insurance policy might estimate hospital expenses for specific illnesses, ensuring the policy provides adequate coverage for those costs.

Replacement Costs: Insurance policies must cover the replacement costs of damaged or lost assets. For example, a car insurance policy should have sufficient funds to replace parts or the entire vehicle in the event of an accident.

Grouping Similar Risks: Individuals or entities with similar risks and characteristics are grouped together. This grouping allows insurance companies to efficiently evaluate coverage options and determine premium rates. For example, senior citizens might be categorized differently in life insurance policies, and other groups may be formed based on individual health conditions.

Application in Life Insurance: Risk classification is particularly prevalent in life insurance, where it simplifies the process of categorizing individuals based on current health and other relevant factors.

Importance for Insurance Companies

Risk classification is crucial for insurance companies as it ensures accurate pricing of policies. Individuals with lower risk profiles are charged lower premiums, while those with higher risks pay more. These classifications directly impact the coverage provided and the premium costs, ensuring that insurance companies can offer fair and financially viable policies to all policyholders.

Classification of Risk in Insurance

classification is especially prevalent in life insurance, though it can also apply to other policies with multiple categories. For instance, older drivers or those with older vehicles might face higher premiums. Here’s an overview of how risk is classified in life insurance policies:

Preferred Plus: This category is for individuals in excellent health, typically young and without any health issues. These policyholders pay the lowest premiums. Taking out a policy at a young age can help one qualify for such benefits.

Preferred: This is just below the Preferred Plus category. People in this group are still in very good health and pay low premiums, but they may have minor health concerns that could arise in the future.

Standard Plus: Individuals in this category have above-average health but might be outside the normal range in some health metrics, such as slightly elevated blood pressure or BMI. They generally pay higher premiums than those in the Preferred categories.

Standard: This group represents the average risk category, with individuals having an average life expectancy. They pay more than those in the Preferred categories, often due to previous health concerns or a family history of medical issues.

Substandard/Rated: This category has several sub-classifications based on varying degrees of health risks. Individuals with significant health concerns fall into this group and face the highest premiums, sometimes 25% higher than those in the Standard category. Different insurers may use different metrics for classification.

Smokers: Regular smokers are at a higher risk of health issues. Insurance companies may test for smoking habits before issuing a policy, and smokers typically face higher premiums.

Risk classification in insurance directly influences premium costs. However, individuals can improve their health and potentially move to a lower risk category, leading to reduced premiums. For example, quitting smoking or losing weight could result in lower insurance costs.

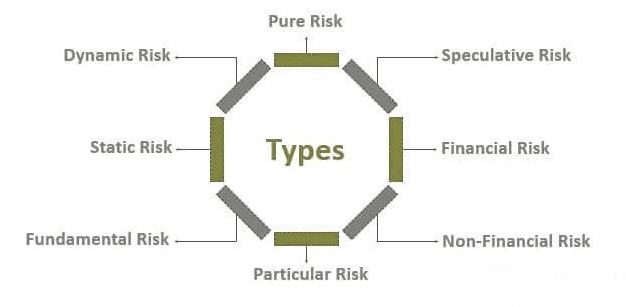

Types of Risk in Insurance

Insurance covers various types of risks, each with different implications for policyholders and insurers. Understanding these risk types is crucial for ensuring financial protection. Below are the main classifications:

Pure Risk: This type of risk involves situations where the only possible outcomes are a loss or no change in status. There is no potential for gain. For example, a natural disaster might destroy a home, but if it doesn’t occur, the homeowner simply retains their property as is. Pure risks are typically insurable because they don’t involve the possibility of profit.

Speculative Risk: In speculative risk, there is the potential for either loss, no change, or gain. This type of risk is associated with activities like investing in stocks, where the value can increase, decrease, or stay the same. Speculative risks are generally not insurable because they involve the possibility of gain.

Financial Risk: Financial risks involve the possibility of monetary loss, which is the primary focus of insurance. For instance, a company might face financial loss if its goods are destroyed in a warehouse fire. Insurance can cover such losses.

Non-Financial Risk: These risks involve losses that cannot be quantified in monetary terms, making them uninsurable. For example, if someone chooses a disappointing phone brand, the dissatisfaction doesn’t translate into a measurable financial loss.

Particular Risk: This risk type affects specific individuals or groups due to their actions. For instance, a car accident typically impacts only the involved parties. Insurance policies are available to cover such particular risks.

Fundamental Risk: This type of risk affects large groups or populations and is often beyond individual control. Examples include natural disasters like earthquakes, which impact many people. Insurance policies can be designed to cover such fundamental risks.

Static Risk: Static risks are consistent over time and are usually the result of human actions rather than changes in the business environment. An example is employee fraud within an organization. Such risks are often insurable.

Dynamic Risk: These risks arise from changes in the market environment and are often unpredictable. They can affect numerous market participants. For instance, the introduction of a new product that shifts consumer preferences can have widespread effects on other companies.

Conclusion

Understanding the classification of risk in insurance is essential for both individuals and businesses. It helps in determining whether insurance is available for specific events and understanding the various risks to which one is exposed. For businesses, these classifications assist in designing appropriate insurance policies. For insurance companies, risk classification is vital for grouping policyholders and determining fair premium rates.

|

157 videos|236 docs|166 tests

|

FAQs on Risk Classification and Management - Crash Course for UGC NET Commerce

| 1. What is risk classification in insurance? |  |

| 2. How does risk classification and management impact insurance premiums? |  |

| 3. What are the different types of risks considered in insurance classification? |  |

| 4. How can individuals manage their risk classification to lower insurance premiums? |  |

| 5. How does UGC NET address risk classification and management in insurance-related exams? |  |