Rules of Debit and Credit -Accountancy, Class 11 - Commerce PDF Download

Rules of debit and credit type numerical. questions plz explain?

Ref: https://edurev.in/question/593836/Rules-of-debit-and-credit-type-numerical-questions-plz-explain-

Rules of debit and credit

(1). Asset accounts:

Normal balance: Debit

Rule: An increase is recorded on the debit side and a decrease is recorded on the credit side of all asset accounts.

(2). Expense accounts:

Normal balance: Debit

Rule: An increase is recorded on the debit side and a decrease is recorded on the credit side of all expense accounts.

(3). Liability accounts:

Normal balance: Credit

Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all liability accounts.

(4). Revenue/Income accounts:

Normal balance: Credit

Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all revenue accounts.

(5). Capital/Equity accounts:

Normal balance: Credit

Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all equity accounts.

(6) Contra accounts:

Normal balance: Opposite to the normal account.

An example: Accounts receivable is an asset account that normally has a debit balance. The allowance for doubtful accounts is a contra account to the accounts receivable and normally has a credit (opposite) balance.

Rule: If the normal balance of the contra account is debit, the increase will be recorded on the debit side and the decrease will be recorded on the credit side. If the normal balance of the contra account is credit, the increase is recorded on the credit side and the decrease is recorded on the debit side.

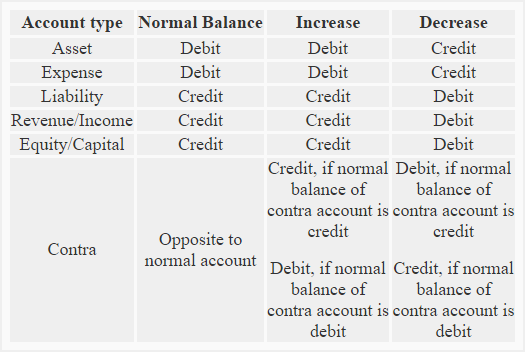

A summary of the whole discussion about rules of debit and credit is given below:

Example:

The following transactions are related to Small Traders:

- Started business with cash $95,000.

- Purchased furniture for cash $8,000.

- Purchased goods for cash $40,000.

- Purchased goods on credit from Big Traders $57,000.

- Sold goods for cash $5,000.

- Purchased equipment for business $4,000.

- Sold goods on credit to John Retailers $15,000.

- Paid salary to employees $1,200

Required: Identify the accounts involved in above transactions and state the nature of each account. Also mention how increases or decreases in accounts resulting from above transactions should be recorded.

Solution:

FAQs on Rules of Debit and Credit -Accountancy, Class 11 - Commerce

| 1. What are the rules of debit and credit in accountancy? |  |

| 2. How do you apply the rules of debit and credit in accountancy? |  |

| 3. What is the significance of the rules of debit and credit in accountancy? |  |

| 4. Can the rules of debit and credit be applied in any situation? |  |

| 5. Are there any exceptions to the rules of debit and credit? |  |

|

Explore Courses for Commerce exam

|

|