Scanner Chapter 3 & 4 - (Macro Economics) | Economics Class 12 - Commerce PDF Download

C.B.S.E. PAPER 2013

(Q1) Give two examples of intermediate goods. (1 M)

(Q2) Distinguish between “real” gross domestic product and “nominal” gross domestic product. Which of these is a better index of welfare of the people and why? (4 M)

(Q3) Calculate ‘Sales’ from the following data : (4 M)

Ans : 5000

(Q4) Calculate “Gross National Product at Market Price” from the following data : (6 M)

Ans :: 5700

(Q5) Calculate “Gross National Disposable Income” from the following data :

Ans : 3500

(Q6) Calculate ‘Sales’ from the following data : (4 M)

Ans : 1710

C. B. S. E. PAPER 2014 & SAMPLE PAPER

(Q1) What are externalities? Give an example of a positive externality and its impact on welfare of the people.

Ans : Use of public park for pleasure , Increases welfare

(Q2) What are externalities ? Give an example of a Negative externality and its impact on welfare of the people.

(Q3) What are non-monetary exchanges? Give an example . Explain the impact on use of GDP as an index of welfare of the people?

Ans : It refers to the goods and services produced but not exchanged through money like the domestic services rendered by family memebers to each other . These are difficult to estmate and so it escapes national income estimation . These exchanges however have positive effect on the welfare of the people

(Q4) Explain the difference between final good and intermediate good. Give one example of each.

(Q5) Increase in per capita real income means increase in per capita availability of goods and services. Does it necessarily mean rise in the welfare of the people of the country ? Give any one argument in support of your answer and explain the same.(3 marks)

Ans. Increase in per capita availability of goods and services does raise the standard of living and consequently welfare. But it may not necessarily always be so. For example, manufacturing etc. does raise output but at the same time also leads to water pollution and air pollution which reduces welfare of the people. Such a reduction in welfare may outweigh the increase in welfare and thus lead to overall reduction in welfare.

(Q6) During a given year nominal national income increased by 14 per cent while the real national income increased by only 6 per cent. Population increased by 2 per cent. What has caused the difference between nominal income and real income ? What is real per capital income? (3 marks)

Ans. Change in nominal income over a year is on account of

(a) change in quantity of goods and services and

(b) change in price level. However, change in real income refers to change in quantity of goods and services only. Therefore, a change of 14 percent in nominal income over the year is partly on account of 6 percent change in quantity of goods and services and the remaining 8 per cent must be on account of rise in general price level.

Real per capita income rise = Rise in real national income - Rise in population

= 6 - 2 = 4 per cent

(Q7) How should the following be treated in estimating national income of a country ? You must give reason for your answer.

(i) Taking care of aged parents

(ii) Payment of corporate tax

(iii) Expenditure on providing police services by the government. (6 marks)

Ans : yes , no , yes

(Q8) Giving reasons explain how the following are treated while estimating national income :

(i) Payment of fees to a lawyer engaged by a firm;

(ii) Rent free house to an employee by an employer;

(iii) addition to stock during year

(iv) Purchase of taxi by taxi driver

Ans : No , Yes, Yes , yes

(Q9) How should the following be treated in estimating national income ? Give reason :

(i) Free medical facilities to employees.

(ii) Pension to senior citizens.

(iii) Interest payment by a government owned firm. (6 marks)

(Q10) How should the following be treated in estimating national income?

Give reason :

(a) Exp. by a firm on payment of government fees to a chartered accountant

(b) Payment of corporate tax by firm

(c) Purchase of regrigerator by a firm for own use

(Q11) Calculate ‘Net National Product at Factor Cost’ and ‘Gross National Disposable Income’ from the following : (4, 2 marks)

Ans : 2050 , 2530

(Q12) Calculate ‘National Income’ and ‘Net National Disposable Income’ from the following :

Ans : 630 , 720

(Q13) Calculate ‘Net National Product at Market Price’ and ‘Gross National Disposable Income’ from the following : (Rs. in Arab)

Ans : 730 , 780

(Q14) Find (a) National Income and (b) Gross National Disposable Income.

Ans. Rs. 315 crore.

(Q15) Calculate ‘Net National Product at Market Price’ and ‘Gross National Disposable

Income’ form the following data : (Rs. in Arab)

(Q16) Find Net Value Added at Factor Cost : (3 marks)

(Rs. in Lakh)

(i) Sales 100

(ii) Closing Stock 20

(iii) Excise 15

(iv) Opening Stock 10

(v) Depreciation 12

(vi) Intermediate Consumption 50

Ans. Rs. 33 Lakh

C. B. S. E. PAPER 2015 & SAMPLE PAPER

(Q1) Which of the following is a characteristic of a good?

(a) Intangible (b) Can be stored

(c) Production and consumption must happen simultaneously

(d) Cannot be transferred

Ans : (b)

(Q2) State the various components of the Expenditure Method that are used to calculate national income.

Ans : Components of Expenditure method :-

(a) Private Final Consumption Expenditure

(b) Government Final Consumption Expenditure

(c) Investment Expenditure

(d) Net Exports ( 1X 4)

(Q3) Discuss any two differences between GDP at constant prices and GDP at current Prices.

Ans : Two main difference between GDP at current prices and at constant price are:

(1) GDP at current prices are measured at Current Year’s Prices whereas GDP at constant prices are measured at base year’s prices. (2m)

(2) GDP at current prices may increase even if there is no flow of goods and services whereas GDP at constant prices will only increase when there is an increase in the flow of goods and services. (2m)

(Q4) Explain any four limitations of using GDP as a measure/index of welfare of a country

Ans : Four limitations of using GDP as a measure/index of welfare of a Country are:

(I) Distribution of GDP

(II) Composition of GDP

(III) Non-Monetary Exchanges

(IV) Externalities.

(Q5) State the various components of the Income Method that are used to calculate national income. (4M)

Ans : COE + OS + MI + NFIA

(Q6) State any four precautions that need to be kept in mind when using the value added method for calculating national income.

(Q7) Giving reason explain how the following should be treated in estimation of national income

(i) Payment of interest by a firm to a bank (6 M)

(ii) Payment of interest by a bank to an individual

(iii) Payment of interest by an individual to a bank

Ans : Yes , Yes , NO (No marks if reason is not given)

(Q8) If the Real GDP is Rs. 500 and Price Index (base = 100) is 125, calculate the Nominal GDP. (3 M)

Ans : 625

(Q9) If the Nominal GDP is Rs. 600 and Price Index (base = 100) is 120, calculate the Real GDP.

Ans : 500

(Q10) If the Real GDP is Rs. 400 and Nominal GDP is Rs. 450, calculate Price Index (base = 100).

Ans :

(Q11) Calculate the ‘National Income’ and ‘Private Income’ :

Ans : N.I. = (iv + ix) + i + viii + (vi + vii + xii) – ii (11/2M)

= 700 + 100 + 200 + 150 + 20 + 30 + 50 – 10 (1M)

= Rs. 1240 Crore. (1/2M)

Private Income = N.I. – x + iii – xi + v (11/2M)

= 1240 – 250 + 15 – 5 + 10 (1M)

= Rs. 1010 Crore. (1/2M)

(No marks if only the final answer is given

(Q12) Calculate ‘Net National Product at Market Price’ and ‘Personal Income’ : (6 M)

Ans :: Rs.425 Crore. ,Personal Income = Rs.200 Crore.

(Q13) Calculate ‘Net Domestic Product at Market Price’ and ‘Gross National Disposable Income’: (6 M)

Ans : 550 crore , 575 crore

(Q14) Compute (a) Domestic Income and (b) Net National Disposable Income. (6M)

Ans :: 4755 ,5450

(Q15) Find (a) National Income and (b) Gross National Disposable Income.(in Crore )

Ans : 250 , 315

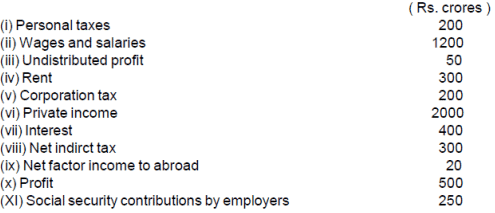

(Q16) Find (a) Private Income and (b) National Income.

Ans : (a) Private Income (i) + (iv) + (viii) + (ix) (1½m)

= 350 + 10 + 15 + 25(1M)

= Rs 400 crores(½m)

(b) National Income

= Private income + (vii) – (x) + (ii) + (iii)(1½m)

= 400 + 20 - 30 + 25 + 50(1M)

= Rs 465 crores(½m)

(Q17) Suppose in an imaginary economy GDP at Market Price in a particular fiscal year was Rs. 4,000 crores, National Income was Rs.2,500 crores, Net Factor Income paid by the economy to Rest of the World was Rs.400 crores and the value of Net Indirect Taxes is Rs.450 Crores. Estimate the value of consumption of fixed capital for the economy from the given data.(4M)

Ans : CFC = 650 (in Rs. crores)

CBSE 2016

(Q1 National income is the sum of factor incomes accruing to :

(a) Nationals

(b) Economic territory

(c) Residents

(d) Both residents and non-residents

(Q2) Depreciation of fixed capital assets refers to : (Choose the correct alternative) (1M)

(a) Normal wear and tear

(b) Foreseen obsolescence

(c) Normal wear and tear and foreseen obsolescence

(d) Unforeseen obsolescence

Ans : (c)

(Q3) Unforseen obsolescene of fixed capital assets during production is ::

(a) Consumption of Fixed Capital

(b) Capital Loss

(c) Income Loss

(d) None

Ans :(b)

(Q4) Define Gross Investment

(Q5) Sale of petrol and diesel cars is rising particularly in big cities. Analyse its impact on gross domestic product and welfare.(4M)

(Q6) Government incurs expenditure to popularize yoga among the masses. Analyse its

impact on gross domestic product and welfare of the people.(4M)

(Q7) Governments spends on child immunization programme . Analyse its impact on GDP and welfare of the people

(Q8) Giving reason explain how the following should be treated in estimation of national income

(a) Payment of Corporate taxes by firm

(b) Purchase of Machinery by factory for own Use

(c) Purchase of Uniforms for nurses by a hospital

Ans : No , Yes , No

(Q 9) Assuming real income to be Rs. 200 crore and price index to be 135, calculate nominal income.

Ans : 270

(Q10) If real income is Rs. 400 and price index is 105, calculate nominal income.

(3M)

Ans : 420

(Q11) If nominal income is Rs. 500 and price index is 125, calculate real income.(3M)

Ans : 400

(Q12) Find gross value added at market price :(3M) (Rs. Lacs)

(i) Depreciation 20

(ii) Domestic sales 200

(iii) Net change in stocks (-) 10

(iv) Exports 10

(v) Single use producer goods 120

Ans : 80 lakh

(Q13) Find net value added at Factor Cost ( in lakhs)

(a) Durable Use producer goods with a life span of 10 years 10

(b) Single use producer goods 5

(c) Sales 20

(d) Unsold output produced during the year 2

(e) Taxes on production 1

Ans : 15

(Q14) Find net value added at Factor Cost ( in lakhs)

(a) Fixed Capital cost with a life span of 5 years 15

(b) Raw Material 6

(c) Sales 25

(d) Net Change in Stock (-) 2

(e) Taxes on production 1

Ans: 14

(Q15) Find Gross National Product at Market Price and Private Income : (4, 2M)

Ans : 1380 , 1110

(Q16) Find Gross National Product at Market Price and Private Income : (4, 2M)

Ans : 640 , 550

(Q17) Calculate National Income and Personal Disposable Income : (4, 2M)

Ans : 1030 , 730

(Q18) Find net national product at market price and personal disposable income : (4, 2 M)

Ans : 2930 , 1550

|

64 videos|275 docs|52 tests

|

FAQs on Scanner Chapter 3 & 4 - (Macro Economics) - Economics Class 12 - Commerce

| 1. What is the concept of scarcity in macroeconomics? |  |

| 2. What is the difference between microeconomics and macroeconomics? |  |

| 3. How does inflation affect the economy? |  |

| 4. What are the main goals of macroeconomic policy? |  |

| 5. How does fiscal policy influence the economy? |  |

|

Explore Courses for Commerce exam

|

|