Secondary Distribution of Overheads | Cost Accounting - B Com PDF Download

Meaning of Secondary Distribution of Overheads

Secondary distribution of overheads means the apportionment of overheads of service departments among the production departments on some suitable basis.

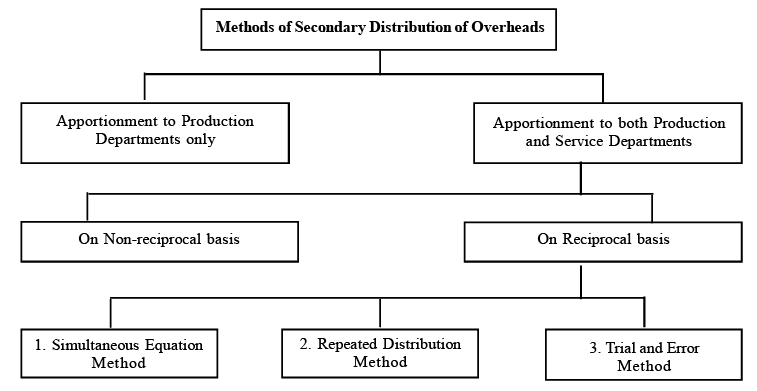

Methods of Secondary Distribution of Overheads

Apportionment to Production Departments Only

Under this method, the costs of service departments are directly apportioned to production department only, ignoring the service rendered by one service departmentto another service department.

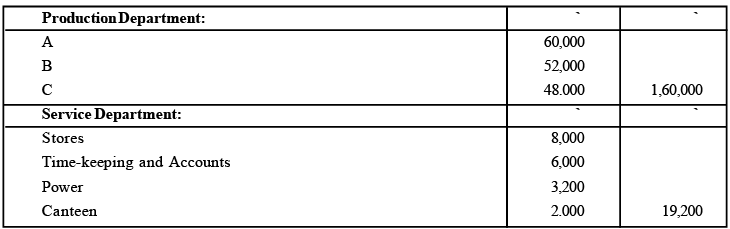

Example1: CAS Ltd., has three production departments and four service departments. The expenses for departments as per Primary Distribution Summary are as follows:

The following information is also available in respect of the production departments:

Required: Apportion the costs of service departments over the production departments.

Sol:

Statement showing the Secondary Distribution of Overheads

Apportionment to Both Production and Service Departments

In this approach, the expenses of a service department are allocated to both production departments and other service departments using a fair and equitable method. This allocation can be carried out either reciprocally or non-reciprocally.

Apportionment on Non-reciprocal basis/Step Ladder Method

This method involves the following three steps:

Practical Steps Invoved in the Step Ladder Method

- Step1: Apportion the cost of first service department which serves the largest number of departments to production departments and other service departments.

- Step 2: Apportion the cost of second service department which serves the next largest number of departments.

- Step 3: Continue this process till the cost of last service department is apportioned. Thus, the cost of last service department is apportioned only to the production departments.

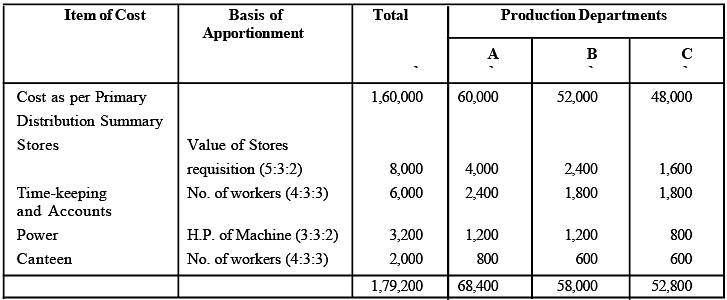

Example 2: BT Ltd. has two production departments P1 and P2 and three service departments S1, S2 and S3. The overheads of various departments for a period are given below:

P1 ₹ 53000, P2 ₹ 7000, S1 ₹17000, S2 ₹ 30000, S3 ₹ 13000

The costs of service departments are to be apportioned as follows.

Required: Prepare Overhead Distribution Statement according to Step Ladder Method.

Sol:

Overheads Distribution Statement

Apportionment on Reciprocal basis: This approach acknowledges the principle that when two or more service departments provide services to each other, each department receiving such services should bear the cost of the services rendered by the others. Reciprocal service methods are conceptually more favorable. One of the following three methods may be employed for inter-service distribution:

(i) Simultaneous Equation Method

(ii) Repeated Distribution Method

(iii) Trial and Error

Method Let us discuss these methods one by one.

(i) Simultaneous Equation Method

This method involves the following steps:

Practical Steps Involved in the Simultaneous Equation Method

- Step 1 - Calculate the Total Costs of each service department by forming and solving simultaneous equations.

- Step 2 - Re-apportion the total costs of each service department only to Production Department on the basis of given percentages.

Example 3: TT Ltd. has two production departments P1 and P2 and two service departments S1 and S2 Expenses of these departments are as follows:

P1 – ₹51,837, P2 – ₹12,163, S1 – ₹ 40,000, S2 – ₹16,000

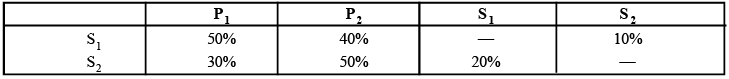

The expenses of service departments are to be apportioned are as follows:

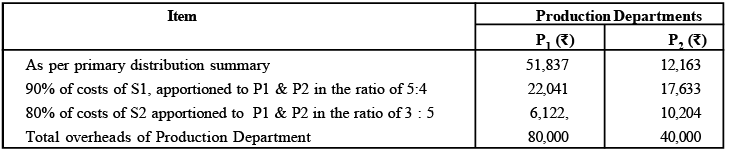

Required: Apportion the cost of service departments by using Simultaneous Equation Method.

Sol:

Step 1 - Formation of simuitaneous equations

Let X = Total expenses of S1,

Let Y = Total expenses of S2

X = ₹ 40,000 + 20% of Y

Y = 16,000 + 10% of X

Step 2 - Solving simultaneous equations

X = 40,000 + .20Y

Y = 16,000 + .10X

Putting the value of X in equation II

Y = 16000 + .10(40,000 + .20Y)

= 16000 + 4000 + .02Y

Y – .01Y = 20,000

Y = 20,000/.98 = ₹ 20,408

Putting value of Y is equation I

X = 40,000 + .20 × 20,408

X = 44,082

Step 3 - Overheads Distribution Summary

(ii) Repeated Distribution Method

This method involves the following steps:

Practical Steps involved in the Repeated Distribution Method

- Step 1- Apportion the costs of first service department (say S1) over other service departments and production departments on agreed percentages.

- Step 2 - Apportion the costs of second service department (Say S2) plus the share received from S1 over other departments on agreed percentages.

- Step 3 - Apportion the costs of third service department (Say S3) plus the share received from S1 and S2 over other departments on agreed percentages.

- Step 4 - Repeat this process of distribution again beginning with S1 until the total costs of the service departments are exhausted or reduced to too small figure. The small figure should be apportioned over production departments and not over other service departments.

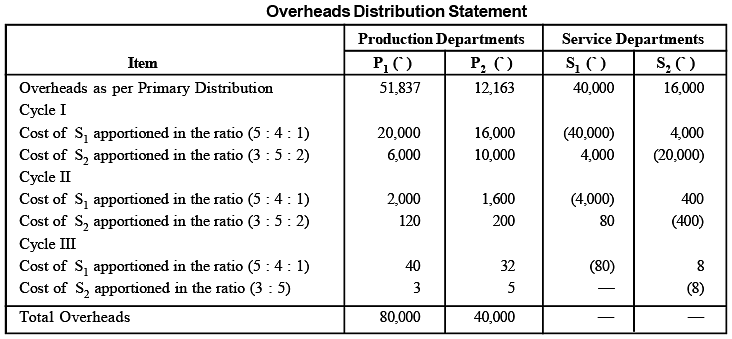

Example 4: Taking the same figure of Example 3, apportion the expenses of service departments using Repeated Distribution Method.

Sol:

|

106 videos|173 docs|18 tests

|

|

Explore Courses for B Com exam

|

|