Solved Questions: Cash Budget | Cost Accounting - B Com PDF Download

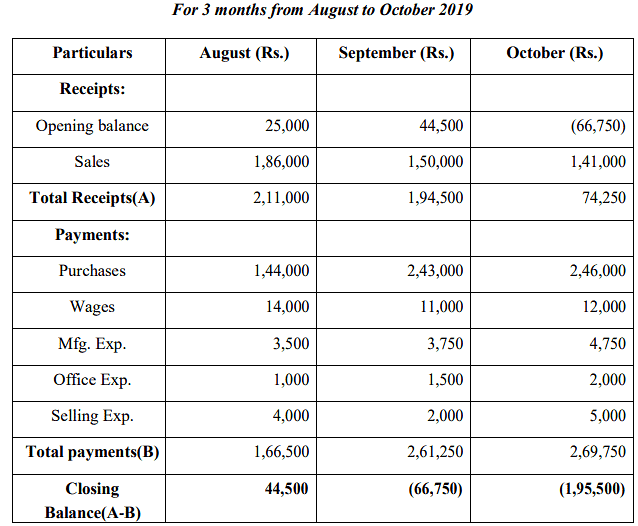

Q1: Saurashtra Co. Ltd. wishes to arrange overdraft facilities with its bankers from the period August to October 2019 when it will be manufacturing mostly for stock. Prepare a cash budget for the above period from the following data given below:

Additional Information:

(a) Cash on hand 1‐08‐2010 Rs.25,000.

(b) 50% of credit sales are realized in the month following the sale and the remaining 50% in the second month following. Creditors are paid in the month following the month of purchase.

(c) Lag in payment of manufacturing expenses half month.

(d) Lag in payment of other expenses one month.

Sol:

CASH BUDGET

Working Note:

1. Manufacturing Expense:

2. Sales

Q2: S. K. Brothers wish to approach the bankers for temporary overdraft facility for the period from October 2019 to December 2019. During the period of this period of these three months, the firm will be manufacturing mostly for stock. You are required to prepare a cash budget for the above period.

(a) 50% of credit sales are realized in the month following the sales and remaining 50% in the second following. (b) Creditors are paid in the month following the month of purchase (c) Estimated cash as on 1‐10‐2019 is Rs.50,000.

Working Note: Collection from debtors

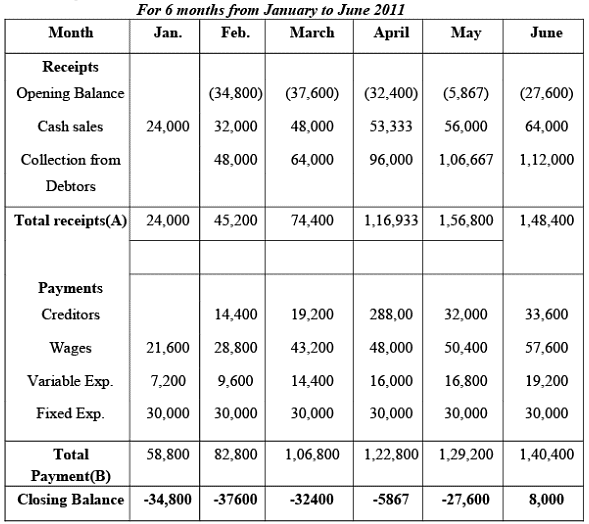

Q3: TATA Co. Ltd. is to start production on 1st January 2019. The prime cost of a unit is expected to be Rs. 40 (Rs. 16 per materials and Rs. 24 for labour). In addition, variable expenses per unit are expected to be Rs. 8 and fixed expenses per month Rs. 30,000. Payment for materials is to be made in the month following the purchase. One‐third of sales will be for cash and the rest on credit for settlement in the following month. Expenses are payable in the month in which they are incurred. The selling price is fixed at Rs. 80 per unit. The number of units to be produced and sold is expected to be: January 900; February 1200; March 1800; April 2000; May 2,100; June 2400 Draw a Cash Budget indicating cash requirements from month to month.

Sol:

CASH BUDGET of TATA LTD.

Q4: Prepare a Cash Budget from the data given below for a period of six months (July to December)

(2) Collect ion est imates:

- Within the month of sale: 5%

- During the month following the sale: 80%

- During the second month following the sale: 15%

(3) Payment for raw materials is made in the next month.

(4)Salary Rs. 11,250, Lease payment Rs. 3750, Misc. Exp. Rs. 1150, are paid each month

(5) Monthly Depreciation Rs. 15,000

(6) Income tax Rs. 26,250 each in September and December.

(7) Payment for research in October Rs.75,000

(8) Opening Balance on 1st July Rs.55,000.

CASH BUDGET

Note: Depreciation is a non‐cash item. It does not involve cash flow. Hence, depreciation will not be considered as payment through cash.

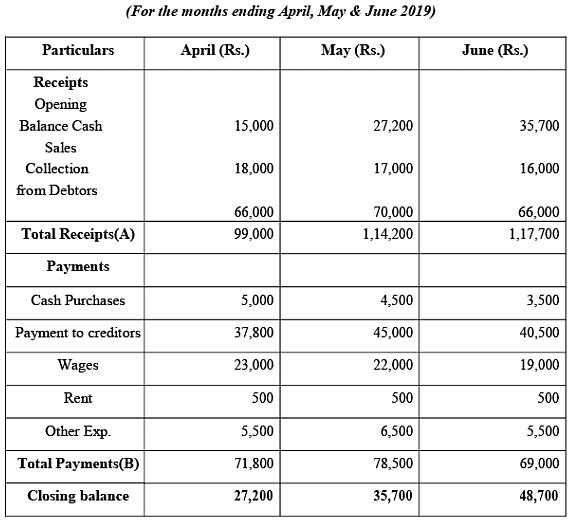

Q5: Prepare a cash Budget of R.M.C. LTD. for April, May and June 2019:

Additional Information:

(i) 10% of the purchases and 20% of sales are for cash.

(ii) The average collection period of the company is ½ month and the credit purchases are paid regularly after one month.

(iii) Wages are paid half monthly and the rent of Rs. 500 included in expenses is paid monthly and other expenses are paid after one month lag.

(iv) Cash balance on April 1,2019 may be assumed to be Rs.15,000

Sol:

CASH BUDGET

|

106 videos|173 docs|18 tests

|

FAQs on Solved Questions: Cash Budget - Cost Accounting - B Com

| 1. What is a cash budget? |  |

| 2. Why is a cash budget important for businesses? |  |

| 3. How is a cash budget prepared? |  |

| 4. What are the benefits of using a cash budget? |  |

| 5. Can a cash budget be revised or updated? |  |

|

Explore Courses for B Com exam

|

|