Tax Invoice | Taxation for CA Intermediate PDF Download

Tax Invoice (section 31 of GST law)

Sub-section (1): A registered person supplying taxable goods shall, before or at the time of – (a) removal of goods for supply to the recipient, where the supply involves movement of goods; or (b) delivery of goods or making available thereof to the recipient, in any other case, issue a tax invoice showing the description, quantity and value of goods, the tax charged thereon and such other particulars as may be prescribed:

Sub-section (2): A registered person supplying taxable services shall, before or after the provision of service but within a prescribed period, issue a tax invoice, showing the description, value, tax charged thereon and such other particulars as may be prescribed:

A tax invoice referred to in section 31 shall be issued by the registered person containing the following particulars

- Name, address and GSTIN of the supplier;

- a consecutive serial number, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolized as “-” and “/” respectively, and any combination thereof, unique for a financial year;

- Date of its issue;

- Name, address and GSTIN, if registered, of the recipient;

- Name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered and where the value of taxable supply is fifty thousand rupees or more;

- HSN code of goods or Accounting Code of services;

- Description of goods or services;

- Quantity in case of goods and unit or Unique Quantity Code thereof;

- Total value of supply of goods or services or both;

- Taxable value of supply of goods or services or both taking into account discount or abatement, if any;

- Rate of tax (central tax, state tax, integrated tax, union territory tax or cess);

- Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

- Place of supply along with the name of State, in case of a supply in the course of inter-State trade or commerce;

- Address of delivery where the same is different from the place of supply;

- Whether the tax is payable on reverse charge basis; and

- Signature or digital signature of the supplier or his authorized representative:

Provided that the Commissioner may, on the recommendations of the Council, by notification, specify -

- the number of digits of HSN code for goods or the Accounting Code for services, that a class of registered persons shall be required to mention, for such period as may be specified in the said notification, and

- the class of registered persons that would not be required to mention the HSN code for goods or the Accounting Code for services, for such period as may be specified in the said notification:

Time limit for issuing tax invoice

- The invoice referred to in rule 1, in case of taxable supply of services, shall be issued within a period of thirty days from the date of supply of service:

- Provided that where the supplier of services is an insurer or a banking company or a financial institution, including a non-banking financial company, the period within which the invoice or any document in lieu thereof is to be issued shall be forty five days from the date of supply of service:

- Provided further that where the supplier of services is an insurer or a banking company or a financial institution, including a non-banking financial company, or a telecom operator, or any other class of supplier of services as may be notified by the Government on the recommendations of the Council, making taxable supplies of services between distinct persons as specified in section 25 of Schedule I, may issue the invoice before or at the time such supplier records the same in his books of account or before the expiry of the quarter during which the supply was made.

Manner of issuing invoice

- The invoice shall be prepared in triplicate, in case of supply of goods, in the following manner

- The original copy being marked as ORIGINAL FOR RECIPIENT;

- The duplicate copy being marked as DUPLICATE FOR TRANSPORTER; and

- The triplicate copy being marked as TRIPLICATE FOR SUPPLIER.

- The invoice shall be prepared in duplicate, in case of supply of services, in the following manner

- The original copy being marked as ORIGINAL FOR RECIPIENT; and

- The duplicate copy being marked as DUPLICATE FOR SUPPLIER.

- The serial number of invoices issued during a tax period shall be furnished electronically through the Common Portal in FORM GSTR-1.

Bill of supply

A bill of supply referred to in sub-section (3) of section 31 shall be issued by the supplier containing the following details

- Name, address and GSTIN of the supplier;

- A consecutive serial number, containing alphabets or numerals or special characters;

- Date of its issue;

- Name, address and GSTIN or UIN, if registered, of the recipient;

- HSN Code of goods or Accounting Code for services;

- Description of goods or services or both;

- Value of supply of goods or services or both taking into account discount or abatement, if any; and

- Signature or digital signature of the supplier or his authorized representative:

Revised Invoice under GST

Under GST, all the taxable dealers will have to apply for provisional registration and carry out all the formalities post which they will get the permanent registration certificate.

For all the invoices issued between the period –

- Date of implementation of GST

- Date of issue of Registration Certificate

The dealers will have to issue a revised invoice against the invoice already issued between the said periods. The revised invoice will have to be issued within one month from the date of issue of the registration certificate.

What are supplementary invoices and their uses?

Supplementary tax invoice is a type of invoice that is issued by a taxable person in case where any deficiency is found in a tax invoice already issued by a taxable person. It can be in form of a debit note or a credit note.

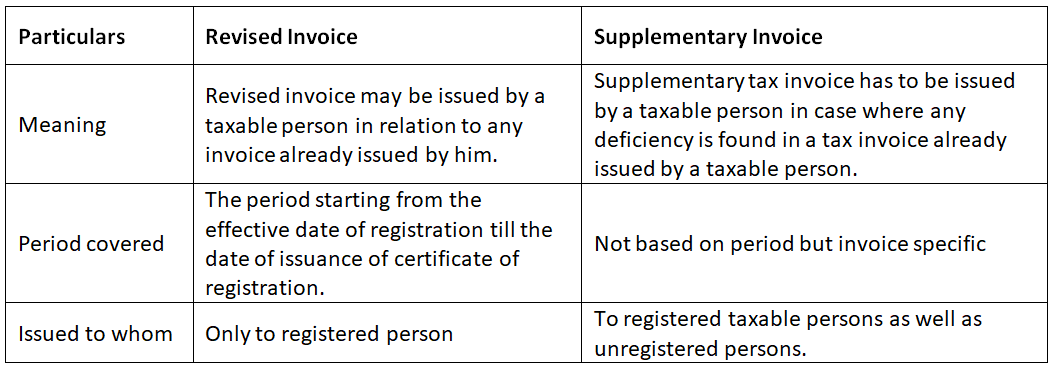

What is the difference between revised invoice and supplementary invoice?

The difference between a revised invoice and a supplementary invoice can be enumerated as follows:

Transportation of goods without issue of invoice

1. For the purposes of

- Supply of liquid gas where the quantity at the time of removal from the place of business of the supplier is not known,

- Transportation of goods for job work,

- Transportation of goods for reasons other than by way of supply, or

- Such other supplies as may be notified by the Board, The consigner may issue a delivery challan, serially numbered, in lieu of invoice at the time of removal of goods for transportation, containing following details:

- Date and number of the delivery challan,

- Name, address and GSTIN of the consigner, if registered,

- Name, address and GSTIN or UIN of the consignee, if registered,

- HSN code and description of goods,

- Quantity (provisional, where the exact quantity being supplied is not known),

- Taxable value,

- Tax rate and tax amount – central tax, State tax, integrated tax, Union territory tax or cess, were the transportation is for supply to the consignee,

- Place of supply, in case of inter-State movement, and

- Signature

2. The delivery challan shall be prepared in triplicate, in case of supply of goods, in the following manner

- The original copy being marked as ORIGINAL FOR CONSIGNEE;

- The duplicate copy being marked as DUPLICATE FOR TRANSPORTER; and

- The triplicate copy being marked as TRIPLICATE FOR CONSIGNER.

3. Where goods are being transported on a delivery challan in lieu of invoice, the same shall be declared in FORM [WAYBILL].

4. Where the goods being transported are for the purpose of supply to the recipient but the tax invoice could not be issued at the time of removal of goods for the purpose of supply, the supplier shall issue a tax invoice after delivery of goods.

|

42 videos|98 docs|12 tests

|

|

Explore Courses for CA Intermediate exam

|

|