Tax Related Practice Questions | Quantitative Reasoning for UCAT PDF Download

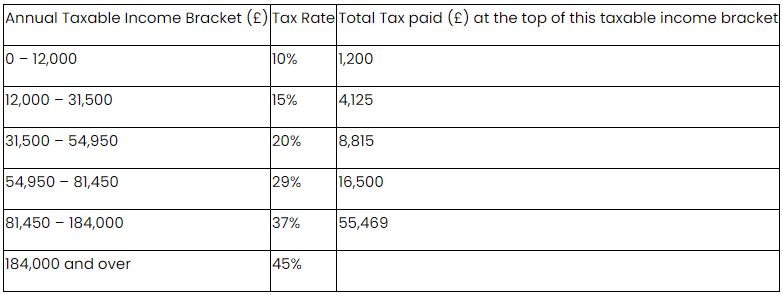

Q.1. The table shows the total tax paid (£) on annual taxable income.

For example, a person with an annual taxable income of £45,000 will pay £4,125 plus 20% of (£45,000 – £31,500).

Q. Ruoxuan has an annual taxable income of £23,330. The income tax, to the nearest £, he has to pay is:

(a) £1,700

(b) £2,333

(c) £2,900

(d) £3,466

(e) £5,825

Correct Answer is Option (c)

£23,300 fits into the second tax bracket… £12,000 gets taxed at 10%, yielding £1,200 (as shown in the RH column)

The remaining (£23,330 – £12,000) = £11,330 gets taxed at 15%, yielding £1,699.50 – adding this to £1,200 makes £2,900 (4sf)

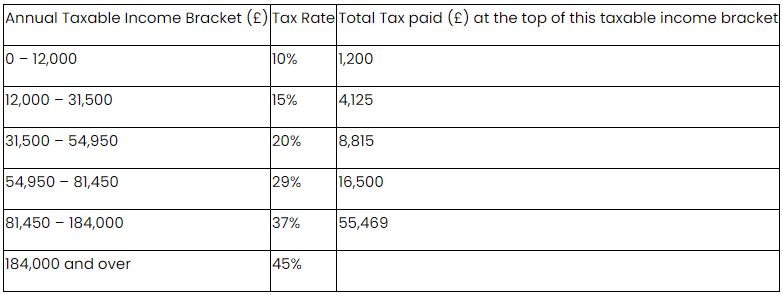

Q.2. The table shows the total tax paid (£) on annual taxable income.

For example, a person with an annual taxable income of £45,000 will pay £4,125 plus 20% of (£45,000 – £31,500).

Q. Olenka has an annual taxable income of £114,050. The income tax she has to pay is:

(a) £25,954

(b) £28,562

(c) £31,170

(d) £38,367

(e) £5,825

Correct Answer is Option (b)

£114,050 fits into the fifth tax bracket:

The RH column shows that the first £81,450 yields £16,500 tax;

Then, the remaining (£114,050 – £81,450) = £32,600 gets taxed at 37%, yielding £12,062 and thus a total of £28,562

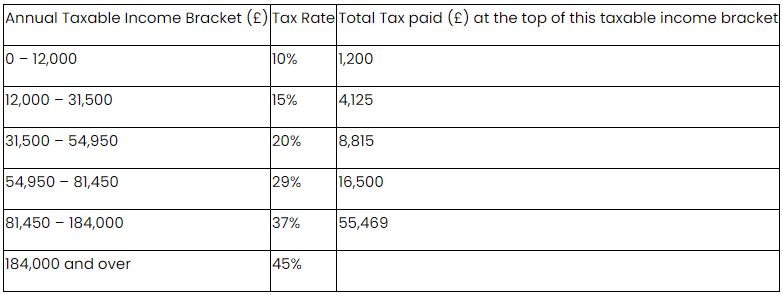

Q.3. The table shows the total tax paid (£) on annual taxable income.

For example, a person with an annual taxable income of £45,000 will pay £4,125 plus 20% of (£45,000 – £31,500).

Q. Ruoxuan has an annual taxable income of £23,330. The income tax, to the nearest £, he has to pay is:

(a) £49,040

(b) £55,290

(c) £58,150

(d) £59,040

(e) £60,880

Correct Answer is Option (d)

If Max pays £10,000 tax per year, his income must lie in the fourth tax bracket (i.e. he earns £54,950 to £81,450).

£10,000 – £8,815 = £1,185, which must have come from £1,185/0.29 = £4,086.21 (2dp). Adding this to £54,950 gives £59,040 (5sf)

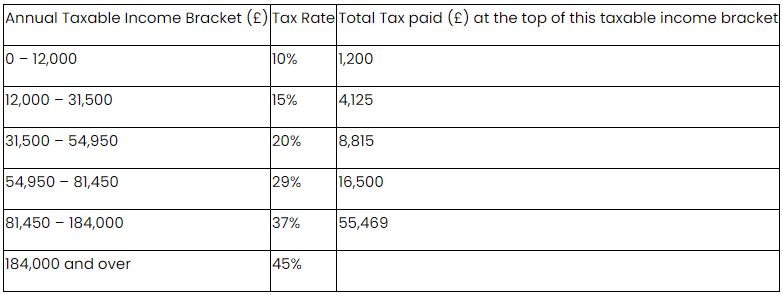

Q.4. The table shows the total tax paid (£) on annual taxable income.

For example, a person with an annual taxable income of £45,000 will pay £4,125 plus 20% of (£45,000 – £31,500).

Q. Marie-Jo has an annual taxable income equivalent to £4,000 per month. If she wants to save enough money each month to cover her tax for the year, how much must she save as a rough percentage of her monthly income?

(a) 7.7%

(b) 9.4%

(c) 12.1%

(d) 15.5%

(e) 15.5%

Correct Answer is Option (d)

£4,000 per month = £48,000 per year, i.e. 3rd tax bracket

Tax for the year = £4,125 + [ 20% x (£48,000 – £31,500) ] = £4,125 + 20% x 16,500 = £4,125 + 3,300 = £7,425

Percentage of income = (£7,425 / £48,000) x 100 = 15.5% (3sf)

Q.5. The table shows the total tax paid (£) on annual taxable income.

For example, a person with an annual taxable income of £30,000 will pay £895 plus 15% of (£30,000 – £8,950).

Q. Lucia pays £1,900 per month in income tax. To the nearest £10, what is her annual salary, after tax is deducted?

(a) £82,590

(b) £83,590

(c) £84,590

(d) £85,590

(e) £86,590

Correct Answer is Option (a)

Annual tax paid within 4th bracket = (£1,900 x 12) – £17,890 = £4,910

Income within 4th bracket = £4,910 / 0.28 = £17,535.71 (2dp)

Post-tax Salary = (£87,850 + £17,535.71) – £22,800 = £82,585.71 (2dp) = £82,590 to the nearest £10

Q.6. The table shows the total tax paid (£) on annual taxable income.

For example, a person with an annual taxable income of £30,000 will pay £895 plus 15% of (£30,000 – £8,950).

Q. Ezra pays £1,450 per month in income tax. What is his annual taxable income?

(a) £68,490

(b) £72,840

(c) £77,190

(d) £81,540

(e) £85,890

Correct Answer is Option (e)

Annual tax = £1,450 x 12 = £17,400, i.e. in 3rd tax bracket

Tax paid within 3rd bracket = £17,400 – £4,990 = £12,410

Income within 3rd bracket = £12,410 / 0.25 = £49,640

Total income = £36,250 + £49,640 = £85,890

Q.7. The table shows the total tax paid (£) on annual taxable income.

For example, a person with an annual taxable income of £30,000 will pay £895 plus 15% of (£30,000 – £8,950).

Q. Delilah is promoted at work, and her salary rises from £80,000 to £90,000 pre-tax. By how much does the amount of tax she pays change?

(a) £1359.50

(b) £2500.00

(c) £2564.50

(d) £2672.00

(e) £10335.50

Correct Answer is Option (c)

Old tax = £4,990 + [ 25% x (£80,000 – £36,250) ] = £15,927.50

New tax = £17,890 + [ 28% x (£90,000 – £87,850) ] = £18492

Increase = £18492 – £15927.50 = £2564.50

Q.8. The table shows the total tax paid (£) on annual taxable income.

For example, a person with an annual taxable income of £30,000 will pay £895 plus 15% of (£30,000 – £8,950).

Q. Last year, Helga paid £9,166 per month in income tax. After tax deductions, how much did she earn in the year, to the nearest £?

(a) £54,661

(b) £204,289

(c) £234,910

(d) £238,384

(e) £271,410

Correct Answer is Option (e)

Annual Tax within 5th bracket = (£9,166 x 12) – £44,602 = £65,390

Income within 5th bracket = £65,390 / 0.33 = £198,151.52

Post-tax income = (£183,250 + £198,151.52) – (£9,166 x 12) = £271,409.52 (2dp) = £271,410 to the nearest £

Q.9. The table shows the total tax paid ($) on annual taxable income.

For example, a person with an annual taxable income of $30,000 will pay $1,440 plus 16% of ($30,000 – $12,000).

Q. Leanne earns $63,000 a year. How much income tax does she pay?

(a) $5,593.60

(b) $9,600.00

(c) $10,732.80

(d) $12,660.00

(e) $13,187.20

Correct Answer is Option (c)

Total Tax = $6,579.20 + [ 22% x ($63,000 – $44,120) ]

= $6,579.20 + (22% x $1,880) = $6,579.20 + $4,154

= $10,732.80

Q.10. The table shows the total tax paid ($) on annual taxable income.

For example, a person with an annual taxable income of $30,000 will pay $1,440 plus 16% of ($30,000 – $12,000).

Q. Symala earns $23,158 a year. How much income tax does she pay?

(a) $2,778.96

(b) $3,225.28

(c) $3,241.28

(d) $4,096.28

(e) $5,145.28

Correct Answer is Option (b)

Total Tax = $1,440 + [ 16% x ($23,158 – $12,000) ]

= $1,440 + (16% x $11,158) = $1,440 + $1,785.28

= $3,225.28

|

34 videos|17 docs|16 tests

|

|

Explore Courses for UCAT exam

|

|