Year 11 Exam > Year 11 Notes > Business Studies for GCSE/IGCSE > The Limitations of Break-even Analysis

The Limitations of Break-even Analysis | Business Studies for GCSE/IGCSE - Year 11 PDF Download

The Limitations of Break-Even Analysis

- Break-even analysis offers valuable insights into a business's financial health and effectiveness.

- A business's ability to reach the break-even point quickly enhances its chances of survival and profitability.

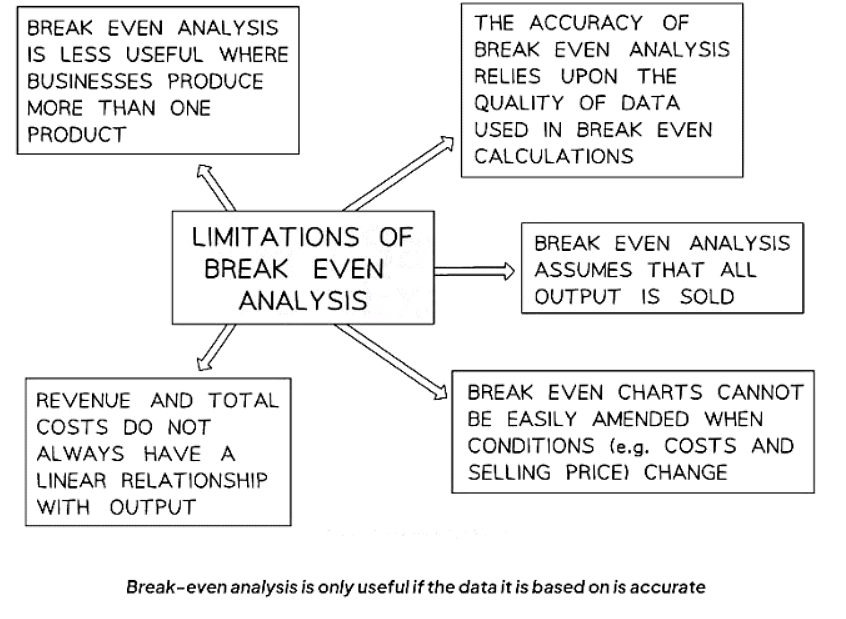

- Despite its benefits, break-even analysis has various constraints that can affect its applicability and reliability.

Diagram Explaining the Limitations of Break-even Analysis

- Assessing the drawbacks of break-even analysis can help determine its applicability to startups or expanding businesses.

- The primary limitation of break-even analysis lies in its complete reliance on the precision of the data employed in its formulation.

- Obtaining accurate data may pose challenges.

- Data fluctuations can greatly influence the break-even output threshold.

- Specialized expertise might be necessary to gather the data, possibly making accuracy easier to achieve in larger enterprises compared to smaller ones.

Question for The Limitations of Break-even AnalysisTry yourself: What is the primary limitation of break-even analysis?View Solution

The document The Limitations of Break-even Analysis | Business Studies for GCSE/IGCSE - Year 11 is a part of the Year 11 Course Business Studies for GCSE/IGCSE.

All you need of Year 11 at this link: Year 11

|

70 videos|94 docs|25 tests

|

FAQs on The Limitations of Break-even Analysis - Business Studies for GCSE/IGCSE - Year 11

| 1. What are the limitations of break-even analysis? |  |

Ans. Break-even analysis has limitations such as assuming constant prices and costs, not considering market demand fluctuations, and not accounting for non-linear cost functions.

| 2. How does break-even analysis fail to account for changes in market demand? |  |

Ans. Break-even analysis assumes a constant level of sales, but in reality, market demand can fluctuate due to various factors such as changes in consumer preferences, competition, and economic conditions.

| 3. Why is break-even analysis not suitable for businesses with complex cost structures? |  |

Ans. Break-even analysis assumes a linear relationship between costs and sales, which may not be accurate for businesses with complex cost structures that involve fixed, variable, and semi-variable costs.

| 4. Can break-even analysis accurately predict profitability in the long run? |  |

Ans. Break-even analysis is a short-term tool and may not accurately predict profitability in the long run, as it does not consider factors such as changes in technology, inflation, or strategic decisions that can impact a business's financial performance.

| 5. How can businesses overcome the limitations of break-even analysis? |  |

Ans. Businesses can overcome the limitations of break-even analysis by conducting sensitivity analysis, considering different scenarios, using other financial tools in conjunction with break-even analysis, and regularly reviewing and updating their cost and pricing strategies.

Related Searches