Treatment of Normal & Abnormal losses - Methods of Costing, Cost Accounting | Cost Accounting - B Com PDF Download

Treatment of Normal and Abnormal Loss in Process Costing

When we start the production of goods through different processes, normal loss and abnormal loss will happen with this. Due to this our total cost of production will increase.

If we do not treat the normal and abnormal loss, our total cost of production will less than exact cost of production. Due to this, our sale price will not estimate correctly. So, for making good plan of selling and controlling our losses, we need to treat the normal loss and abnormal loss in process accounts.

1. Treatment of Normal Loss in Process Accounts

Normal losses are those which we can not stop. These are natural wastage.

For example, if you doing the business of timber on the basis of their weight. It is sure that after cutting of tree, weight of wood will decrease. So, this loss is normal loss. In process account’s credit side, we just show the normal loss’s units. Now, our total produced units will decrease. This will decrease our cost of production in any process. For example: If total cost of process A is Rs. 10,000. When we produce 100 units in A process, we have checked that due to natural reasons, we have just 90 units. Now, in A Process Account, we will show 100 units in debit side and 10 units of normal loss in credit side without writing its amount. Due to this our total cost of Rs. 10,000 will of 90 units. It means, cost per unit has increased from Rs. 100 per unit to Rs. 111 per unit.

2. Treatment of Abnormal Loss in Process Accounts

All those losses which happen due to abnormal reasons are called abnormal losses.

Following are its main example.

- If you use bad quality raw material in the production, there is big risk of wastage in production. So, use of bad quality raw material is the reason of abnormal loss.

- Careless is also reason of abnormal loss. For example, due to the careless of worker, 5 units waste the products during production. So, loss of 5 units is the abnormal loss.

- All those losses which are not normal will be the abnormal loss. For treating the abnormal loss in the process account, we need to calculate the value of abnormal loss.

(a) When there is not any normal loss

Abnormal loss = Normal cost at normal production / normal output X units of abnormal loss

(b) When there is normal loss

Abnormal loss = {Normal cost at normal production / (Total output – normal loss units)} X Units of abnormal loss. Example : In process A 100 units of raw materials were introduced at a cost of Rs. 1000. The other expenditure incurred by the process was Rs. 602 of the units introduced 10% are normally lost in the course of manufacture and they possess a scrap value of Rs. 3 each. The output of process A was only 75 units. Prepare process A account.

Process A Account

Debit Side | Units | Amount in Rs. | Credit Side | Units | Amount in Rs. |

Raw material | 100 | 1000 | Normal Loss | 10 | - |

Other Expenses | - | 602 | Sale of Scrap of normal wastage 10 units X Rs. 3 each | - | 30 |

*Abnormal Loss | 15 | 262 | |||

Process B ( Output ) - balancing figure | 75 | 1310 | |||

100 | 1602 | 100 | 1602 |

* Calculation of Abnormal loss in units and in value

Total input========== 100 units

Less normal loss in units== 10 units

--------------------------------------

Normal Output ======== 90 units

actual output of A process = 75 units

--------------------------------------

Abnormal loss in units ==== 15 units

==========================

Value of Abnormal Loss

= Cost of Total Output - scrap sale of normal loss/ Normal Output X Units of Abnormal loss

= 1602 - 30 / 90 X 15 = Rs. 262

Journal Entries

1. When the loss is irrecoverable:

Date | Particulars | Amount (Dr) | Amount (Cr) | |

1. | Abnormal loss a/c | Dr. | xxx | |

To Consignment a/c | xxx | |||

(Being value of abnormal loss) | ||||

2 | Profit and Loss A/c | Dr | xxx | |

To Abnormal loss | xxx | |||

(Being loss transferred) |

2. When the loss is insured and is recoverable:

(a) When full amount is recoverable

Date | Particulars | Amount (Dr) | Amount (Cr) | |

1. | Abnormal loss a/c | Dr. | xxx | |

To Consignment a/c | xxx | |||

(Being abnormal loss valued) | ||||

2. | Insurance company a/c | Dr. | xxx | |

To Abnormal loss a/c | xxx | |||

(Being abnormal loss transferred to insurance co.) |

(b) When the loss is partly recoverable

Date | Particulars | Amount (Dr) | Amount (Cr) | |

1. | Abnormal loss a/c | Dr. | xxx | |

To Consignment a/c | xxx | |||

(Being abnormal loss valued) | ||||

2. | Insurance company a/c | Dr. | xxx | |

Profit & loss a/c | xxx | |||

To Abnormal loss a/c | xxx | |||

(Being loss partly recoverable by insurance co. and the balance transferred to profit and loss a/c) |

Solved Example For You

Ques. On 1st June 2018, Mr. A sent a consignment of 5,000kg of sugar, costing Rs 50 per kg to an agent Mr. B on a commission of 5% on gross sales. Expenses incurred by Mr. A are freight and insurance of Rs 1,000 and Dock charges and sundry expenses of Rs 400. Expenses incurred by Mr. B, are godown rent and insurance of Rs 400 and miscellaneous expenses of Rs 700.

Some packages containing 1000kg of sugar were damaged in transit and the contents had to be destroyed on landing as having become unfit for sale. 3,500kg of sugar was sold at Rs 60 per kg and on 30th June 2018, the date of closing accounts, the balance of the consignment remained unsold in the stock. You are required to make consignment account and Mr. B’s account in the books of Mr. A, showing the amount due from Mr. B on 30th June 2018.

Ans.

In the books of Mr. A

Consignment A/C

Date | Particulars | Amount | Date | Particulars | Amount | |

1.06.18 | To Goods sent on consignment | 2,50,000 | 30.06.18 | By Mr.B a/c- sale | 2,10,000 | |

(Rs 3,500 x Rs 60) | ||||||

To Bank a/c | 1400 | By profit and loss a/c | 50,280 | |||

(Loss in transit) | ||||||

30.06.18 | To Mr.B a/c | 11,600 | By consignment stock a/c | 25,140 | ||

To profit and loss a/c | 22,420 | |||||

2,85,420 | 2,85,420 |

Mr. B’s A/c

Date | Particulars | Amount | Date | Particulars | Amount | |

30.06.18 | To consignment a/c | 2,10,000 | 30.06.18 | By consignment a/c | 11,600 | |

2,10,000 | 2,10,000 |

Working note:

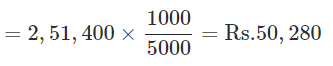

Calculation of unsold stock and lost in transit: Rs.

Cost of 5,000 kg @ Rs 50 2,50,000

Add: non-recurring expenses: 14,00

Cost for 5,000 kg 2,51,400

Value of unsold stock

Value of goods lost in transit

|

106 videos|173 docs|18 tests

|

FAQs on Treatment of Normal & Abnormal losses - Methods of Costing, Cost Accounting - Cost Accounting - B Com

| 1. What are normal losses in cost accounting? |  |

| 2. How are abnormal losses treated in cost accounting? |  |

| 3. What is the difference between normal and abnormal losses in cost accounting? |  |

| 4. What are the methods of costing used in cost accounting? |  |

| 5. What is the importance of cost accounting in business? |  |

|

Explore Courses for B Com exam

|

|