Trial Balance - (Part-2) | Accountancy Class 11 - Commerce PDF Download

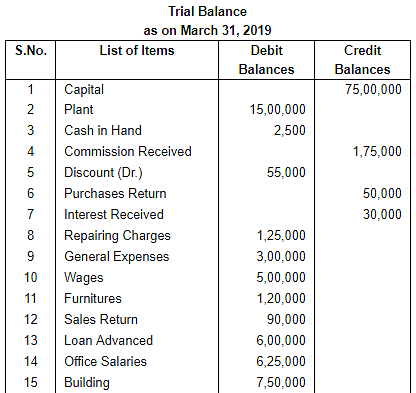

Page No 13.24:

Question 6: From the following information, prepare a Trial Balance of M/s. Prayag for the year ended 31st March, 2019: ANSWER:

ANSWER:

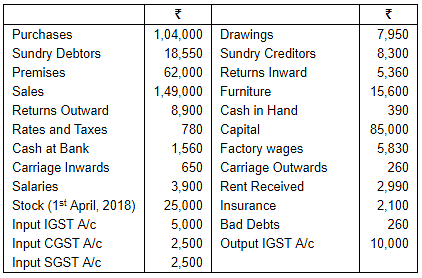

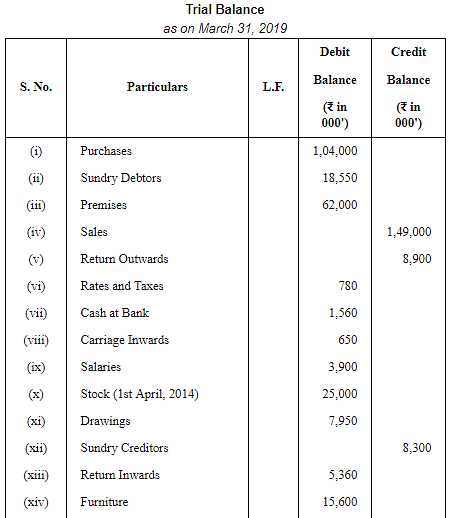

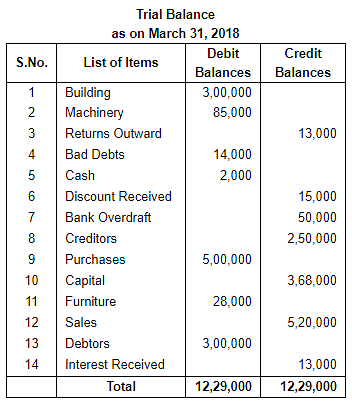

Question 7: Following are the Ledger Balances of Sri Paul on 31st March, 2018: You are required to prepare Trial Balance as on 31st March, 2018.

You are required to prepare Trial Balance as on 31st March, 2018.

ANSWER:

STATEMENT OF TRIAL BALANCE

Trial Balance

as on March 31, 2018

Page No 13.24:

Question 8: From the following balances extracted from the Ledger of Sri Narugopal, prepare Trial Balance as on 31st March, 2019: ANSWER:

ANSWER:

Page No 13.25:

Question 9: From the following Ledger account balances extracted from the books of R.J. Gupta, prepare a Trial Balance as on 31st March, 2019: ANSWER:

ANSWER:

Page No 13.25:

Question 10: Following Trial Balance is given but it is not correct. Prepare correct Trial Balance. ANSWER:

ANSWER:

Page No 13.25:

Question 11: Redraft correctly the Trial Balance given below:  ANSWER:

ANSWER:

Trial Balance

as on March 31, 2018

Page No 13.26:

Question 12: Correct the following Trial Balance: ANSWER:

ANSWER:

Page No 13.26:

Question 13: Prepare correct Trial Balance from the following Trial Balance in which there are certain mistakes: ANSWER:

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on Trial Balance - (Part-2) - Accountancy Class 11 - Commerce

| 1. What is a trial balance in commerce? |  |

| 2. Why is a trial balance important in commerce? |  |

| 3. How is a trial balance prepared in commerce? |  |

| 4. What are the limitations of a trial balance in commerce? |  |

| 5. How often should a trial balance be prepared in commerce? |  |

|

Explore Courses for Commerce exam

|

|