Trial Balance and Errors (Part - 1) - Commerce PDF Download

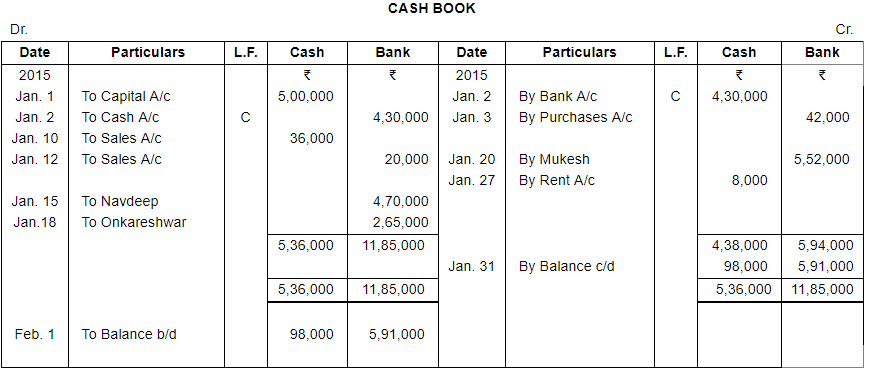

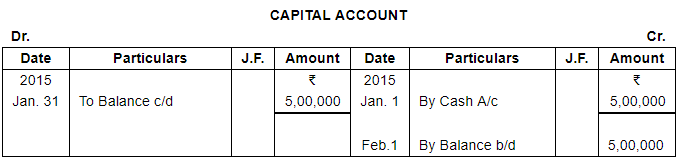

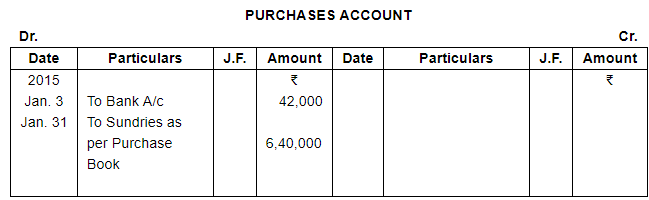

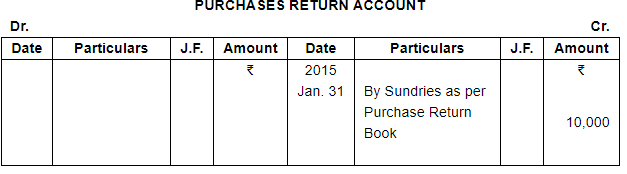

Page No 14.25:

Question 1:

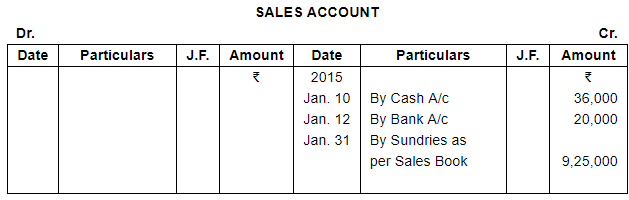

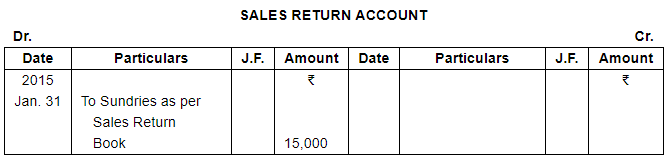

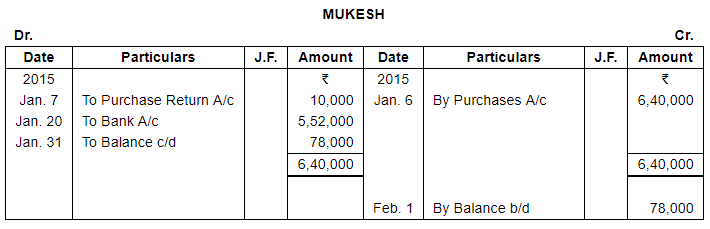

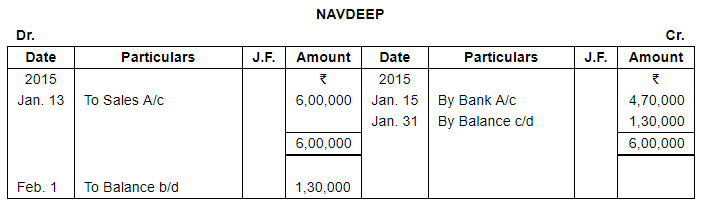

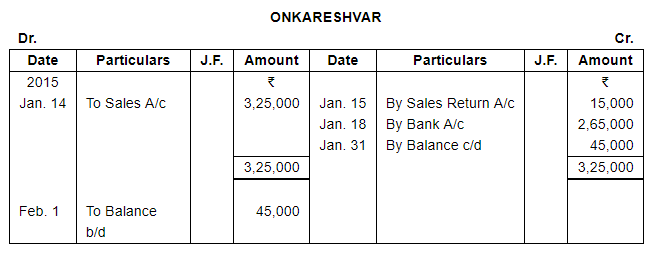

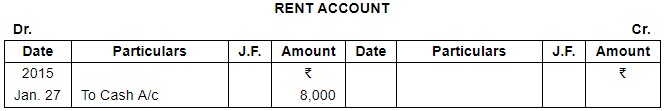

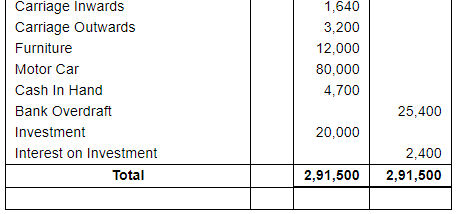

Given below is a Cash Book and Ledger extracts relating to the books of M/s Ram Chander & Sons as at 31st January 2015. You are required to prepare a Trial Balance.

ANSWER:

Page No 14.27:

Question 2:

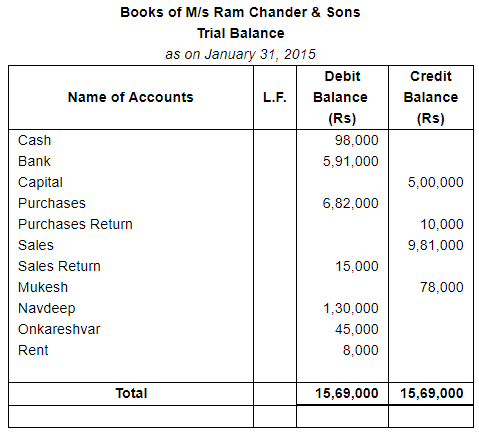

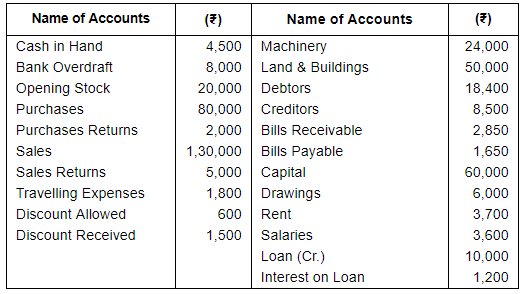

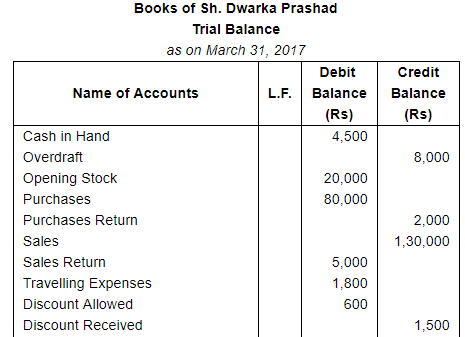

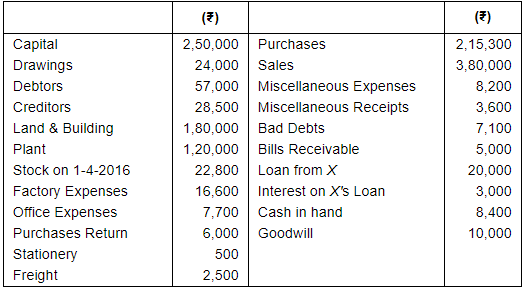

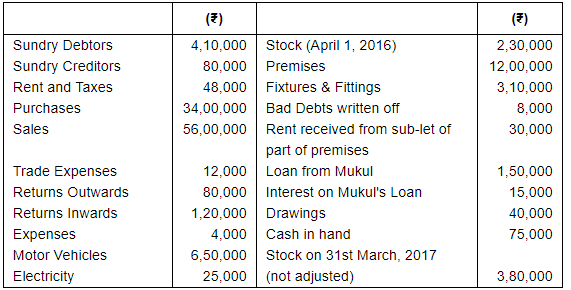

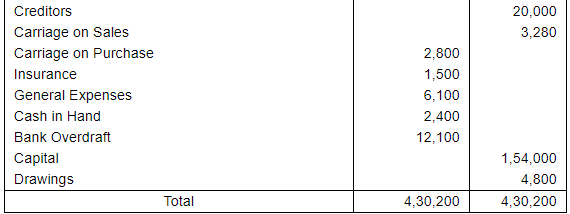

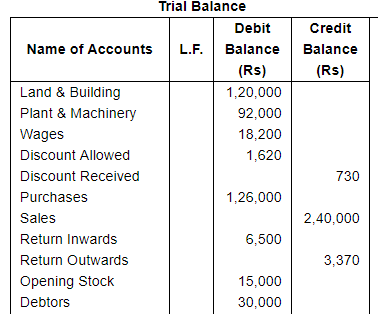

From the following balances, taken from the books of M/s Dwarka Parshad & Sons as at 31st March 2017, prepare a Trial Balance in proper form:−

ANSWER:

Page No 14.27:

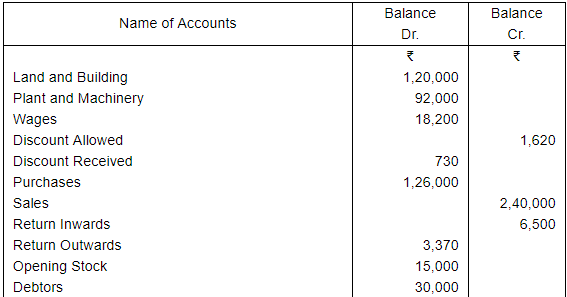

Question 3(A):

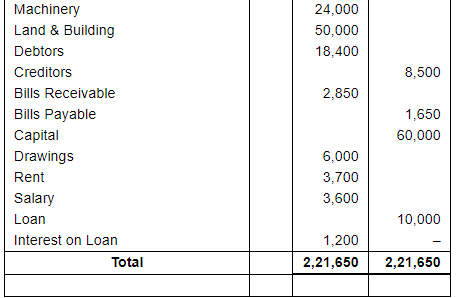

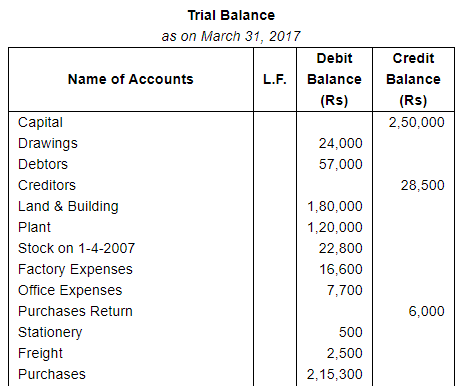

Prepare a Trial Balance from the following balances as at 31st March 2017:−

Page No 14.28:

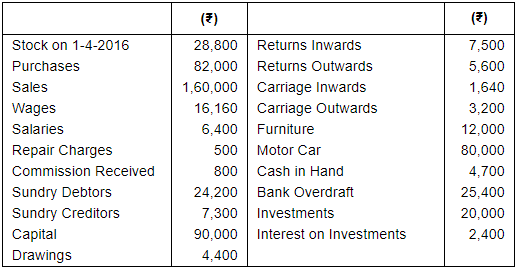

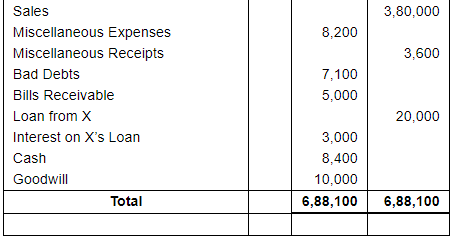

Question 3(B):

Prepare a Trial Balance from the following balances taken as at 31st March 2017:−

ANSWER:

Page No 14.28:

Question 4:

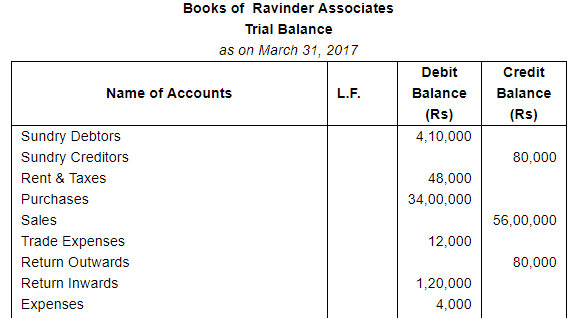

Following balances were extracted from the books of Ravinder Associates as at 31st March, 2017:

You are required to prepare the trial balance treating the difference as his capital.

ANSWER:

Note: Closing Stock of Rs 3,80,000 will not appear in Trial Balance, because it has not been accounted yet.

Page No 14.28:

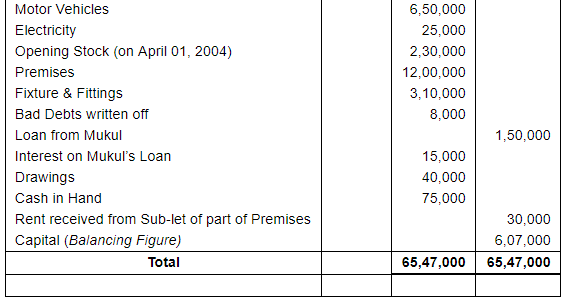

Question 5:

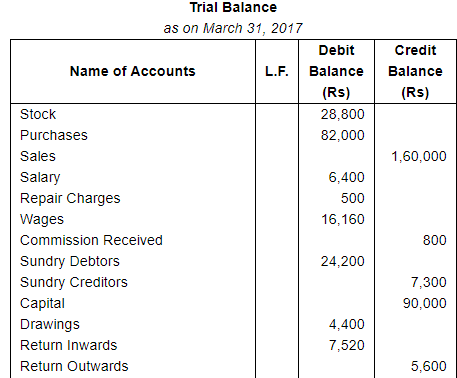

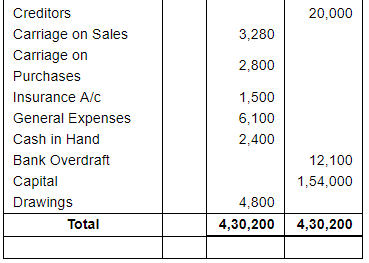

The following trial balance has been prepared by an inexperienced accountant. Redraft it in a correct form:−

ANSWER:

FAQs on Trial Balance and Errors (Part - 1) - Commerce

| 1. What is a trial balance and why is it important in commerce? |  |

| 2. What are the common types of errors that can be identified through a trial balance? |  |

| 3. How can errors be rectified after they are identified in a trial balance? |  |

| 4. Can a trial balance guarantee that there are no errors in the accounting records? |  |

| 5. How often should a trial balance be prepared in commerce? |  |

|

Explore Courses for Commerce exam

|

|