Types of Financing: Notes | Financial Management & Economics Finance: CA Intermediate (Old Scheme) PDF Download

Chapter Overview

Financial Needs and Sources of Finance of a Business

Financial Needs of a Business

Business enterprises need funds to meet their different types of requirements. All the financial needs of a business may be grouped into the following three categories:

- Long-term financial needs: Such needs generally refer to those requirements of funds which are for a period exceeding 5-10 years. All investments in plant, machinery, land, buildings, etc., are considered as long-term financial needs. Funds required to finance permanent or hard-core working capital should also be procured from long term sources.

- Medium- term financial needs: Such requirements refer to those funds which are required for a period exceeding one year but not exceeding 5 years. For example, if a company resorts to extensive publicity and advertisement campaign then such type of expenses may be written off over a period of 3 to 5 years. These are called deferred revenue expenses and funds required for these are classified in the category of medium-term financial needs.

- Short- term financial needs: Such type of financial needs arise to finance current assets such as stock, debtors, cash, etc. Investment in these assets are known as meeting of working capital requirements of the concern. The main characteristic of short-term financial needs is that they arise for a short period of time not exceeding the accounting period. i.e., one year.

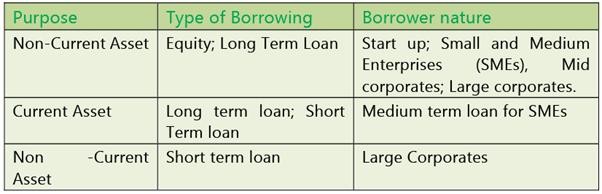

Basic Principle for Funding Various Needs: The basic principle for meeting the shortterm financial needs of a concern is that such needs should be met from short term sources, and medium-term financial needs from medium term sources and long term financial needs from long term sources. Accordingly, the method of raising funds is to be decided with reference to the period for which funds are required.

General rule for financing of different assets would take place. These rules can be changed depending on the nature of borrower i.e. depending on the borrower’s level of operation.

Besides, the stage of development of the business and nature of business would also decide the type of borrowing. Generally, it can be as follows:

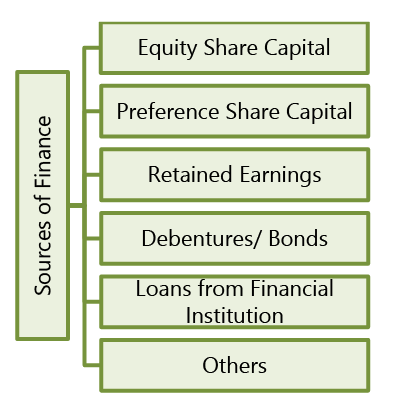

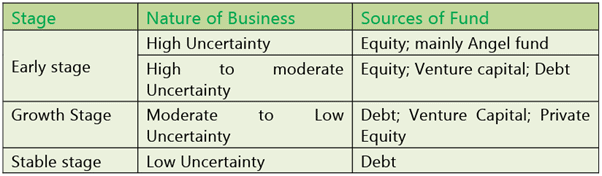

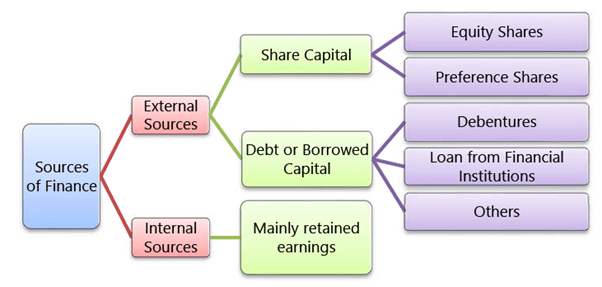

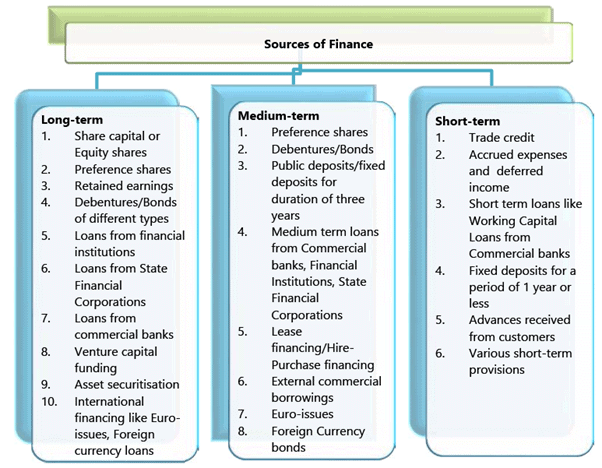

Classification of Financial Sources

There are mainly two ways of classifying various financial sources (i) Based on basic Sources (ii) Based on Maturity of repayment period

Sources of Finance based on Basic Sources

Based on basic sources of finance, types of financing can be classified as below:

Sources of Finance based on Maturity of Payment

Sources of finance based on maturity of payment can be classified as below:

Long-Term Sources of Finance

There are different sources of funds available to meet long term financial needs of the business. These sources may be broadly classified into:

- Share capital (both equity and preference) &

- Debt (including debentures, long term borrowings or other debt instruments).

The different sources of long-term finance has been discussed as follows:

Owners Capital or Equity Capital

A public limited company may raise funds from promoters or from the investing public by way of owner’s capital or equity capital by issuing ordinary equity shares. Some of the characteristics of Owners/Equity Share Capital are:-

- It is a source of permanent capital. The holders of such share capital in the company are called equity shareholders or ordinary shareholders.

- Equity shareholders are practically owners of the company as they undertake the highest risk.

- Equity shareholders are entitled to dividends after the income claims of other stakeholders are satisfied. The dividend payable to them is an appropriation of profits and not a charge against profits.

- In the event of winding up, ordinary shareholders can exercise their claim on assets after the claims of the other suppliers of capital have been met.

- The cost of ordinary shares is usually the highest. This is due to the fact that such shareholders expect a higher rate of return (as their risk is the highest) on their investment as compared to other suppliers of long-term funds.

- Ordinary share capital also provides a security to other suppliers of funds. Any institution giving loan to a company would make sure the debt-equity ratio is comfortable to cover the debt. There can be various types of equity shares like New issue, Rights issue, Bonus Shares, Sweat Equity.

Advantages of raising funds by issue of equity shares are:

- It is a permanent source of finance. Since such shares are not redeemable, the company has no liability for cash outflows associated with its redemption. In other words, once the company has issued equity shares, they are tradable i.e. they can be purchased and sold. So, a company is in no way responsible for any cash outflows of investors by which they become the shareholders of the company by purchasing the shares of existing shareholders.

- Equity capital increases the company’s financial base and thus helps to further the borrowing powers of the company. In other words, by issuing equity shares, a company manage to raise some money for its capital expenditures and this helps it to raise more funds with the help of debt. This is because; debt will enable the company to increase its earnings per share and consequently, its share prices.

- A company is not obliged legally to pay dividends. Hence in times of uncertainties or when the company is not performing well, dividend payments can be reduced or even suspended.

- A company can make further increase its share capital by initiating a right issue.

Disadvantages of raising funds by issue of equity shares are:

Apart from the above mentioned advantages, raising of funds through equity share capital has some disadvantages in comparison to other sources of finance. These are as follows:

- Dividend income is taxable in the hands of the recipient of dividend.

- Investors find ordinary shares riskier because of uncertain dividend payments and capital gains.

- The issue of new equity shares reduces the earning per share of the existing shareholders until and unless the profits are proportionately increased.

- The issue of new equity shares can also reduce the ownership and control of the existing shareholders.

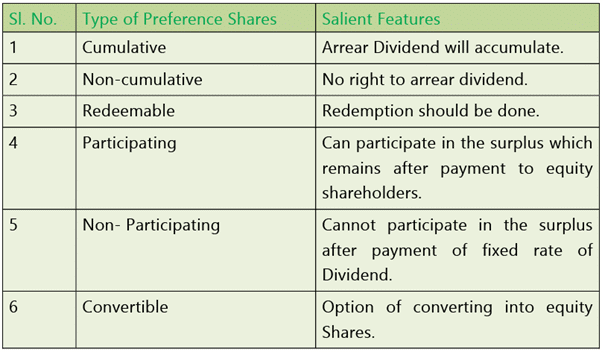

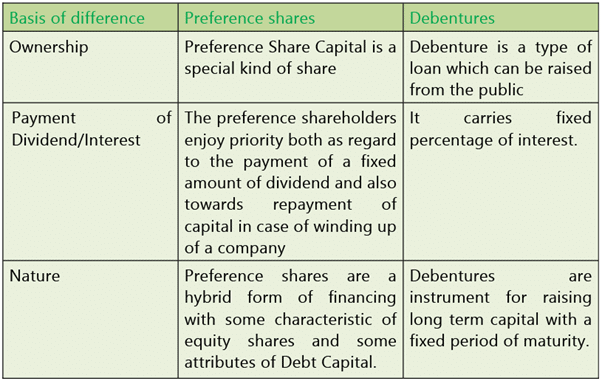

Preference Share Capital

These are special kind of shares; the holders of such shares enjoy priority, both as regard to the payment of a fixed amount of dividend and also towards repayment of capital on winding up of the company. Some of the characteristics of Preference Share Capital are as follows:

- Long-term funds from preference shares can be raised through a public issue of shares.

- Such shares are normally cumulative, i.e., the dividend payable in a year of loss gets carried over to the next year till there are adequate profits to pay the cumulative dividends.

- The rate of dividend on preference shares is normally higher than the rate of interest on debentures, loans etc.

- Most of preference shares these days carry a stipulation of period and the funds have to be repaid at the end of a stipulated period.

- Preference share capital is a hybrid form of financing which imbibes within itself some characteristics of equity capital and some attributes of debt capital. It is similar to equity because preference dividend, like equity dividend is not a taxdeductible payment. It resembles debt capital because the rate of preference dividend is fixed.

- Cumulative Convertible Preference Shares (CCPs) may also be offered, under which the shares would carry a cumulative dividend of specified limit for a period of say three years after which the shares are converted into equity shares. These shares are attractive for projects with a long gestation period.

- Preference share capital may be redeemed at a pre decided future date or at an earlier stage inter alia out of the profits of the company. This enables the promoters to withdraw their capital from the company which is now selfsufficient, and the withdrawn capital may be reinvested in other profitable ventures.

Various types of Preference shares can be as below:

Advantages and disadvantages of raising funds by issue of preference shares Advantages

- No dilution in EPS on enlarged capital base – On the other hand if equity shares are issued it reduces EPS, thus affecting the market perception about the company.

- There is also the advantage of leverage as it bears a fixed charge (because companies are required to pay a fixed rate of dividend in case of a issue of preference shares). Non-payment of preference dividends does not force a company into liquidity.

- There is no risk of takeover as the preference shareholders do not have voting rights except where dividend payment are in arrears.

- The preference dividends are fixed and pre-decided. Hence preference shareholders cannot participate in surplus profits as the ordinary shareholders can except in case of participating preference shareholders.

- Preference capital can be redeemed after a specified period.

Disadvantages

- One of the major disadvantages of preference shares is that preference dividend is not tax deductible and so does not provide a tax shield to the company. Hence preference shares are costlier to the company than debt e.g. debenture.

- Preference dividends are cumulative in nature. This means that if in a particular year preference dividends are not paid they shall be accumulated and paid later. Also, if these dividends are not paid, no dividend can be paid to ordinary shareholders. The non-payment of dividend to ordinary shareholders could seriously impair the reputation of the concerned company.

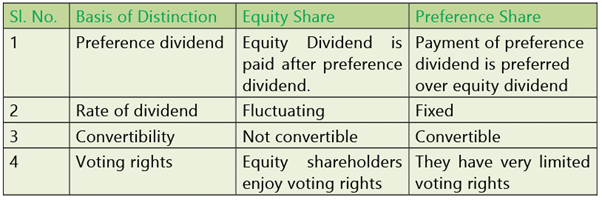

Difference between Equity Shares and Preference Shares are as follows:

Retained Earnings

Long-term funds may also be provided by accumulating the profits of the company and by ploughing them back into business. Such funds belong to the ordinary shareholders and increase the net worth of the company. A public limited company must plough back a reasonable amount of profit every year keeping in view the legal requirements in this regard and also for its own expansion plans. Such funds also entail almost no risk. Further, control of present owners is also not diluted by retaining profits.

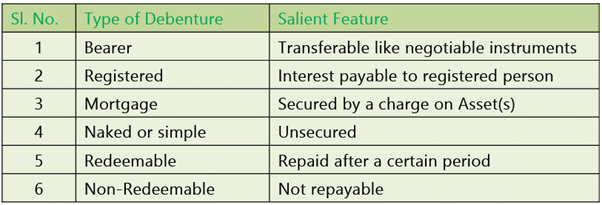

Debentures

Loans can be raised from public by issuing debentures or bonds by public limited companies. Some of the characteristics of debentures are:

- Debentures are normally issued in different denominations ranging from ₹ 100 to ₹ 1,000 and carry different rates of interest.

- Normally, debentures are issued on the basis of a debenture trust deed which lists the terms and conditions on which the debentures are floated.

- Debentures are basically instruments for raising long-term debt capital.

- The period of maturity normally varies from 3 to 10 years and may also increase for projects having high gestation period.

- Debentures are either secured or unsecured.

- They may or may not be listed on the stock exchange.

- The cost of capital raised through debentures is quite low since the interest payable on debentures can be charged as an expense before tax.

- From the investors' point of view, debentures offer a more attractive prospect than the preference shares since interest on debentures is payable whether or not the company makes profits.

Debentures can be divided into the following three categories based on their convertibility:

- Non-convertible debentures – These types of debentures do not have any feature of conversion and are repayable on maturity.

- Fully convertible debentures – Such debentures are converted into equity shares as per the terms of issue in relation to price and the time of conversion. Interest rates on such debentures are generally less than the non-convertible debentures because they carry an attractive feature of getting themselves converted into shares at a later time.

- Partly convertible debentures – These debentures carry features of both convertible and non-convertible debentures. The investor has the advantage of having both the features in one debenture.

Other types of Debentures with their features are as follows:

Advantages of raising finance by issue of debentures are:

- The cost of debentures is much lower than the cost of preference or equity capital as the interest is tax-deductible. Also, investors consider debenture investment safer than equity or preferred investment and, hence, may require a lower return on debenture investment.

- Debenture financing does not result in dilution of control.

- In a period of rising prices, debenture issue is advantageous. The fixed monetary outgo decreases in real terms as the price level increases. In other words, the company has to pay a fixed rate of interest.

The disadvantages of debenture financing are:

- Debenture interest and the repayment of its principal amount is an obligatory payment.

- The protective covenants associated with a debenture issue may be restrictive.

- Debenture financing enhances the financial risk associated with the firm because of the reasons given in point (i).

- Since debentures need to be paid at the time of maturity, a large amount of cash outflow is needed at that time.

Public issue of debentures and private placement to mutual funds now require that a debenture issue must be rated by a credit rating agency like CRISIL (Credit Rating and Information Services of India Ltd.). The credit rating is given after evaluating factors like track record of the company, profitability, debt servicing capacity, credit worthiness and the perceived risk of lending.

Difference between Preference Shares and Debentures:

Bond

Bond is fixed income security created to raise fund. Bonds can be raised through Public Issue and through Private Placement.

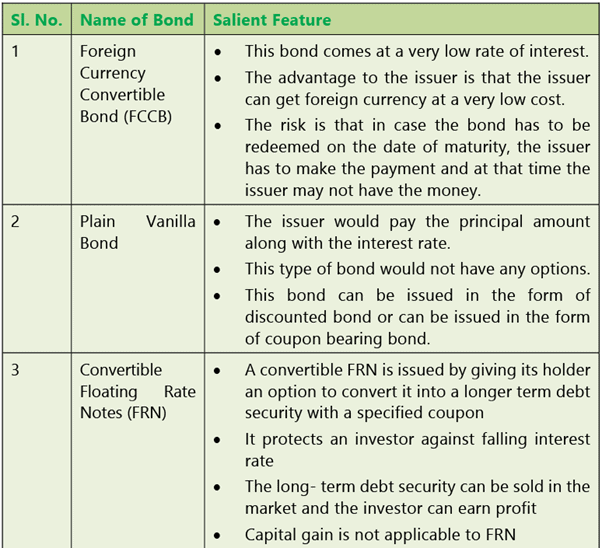

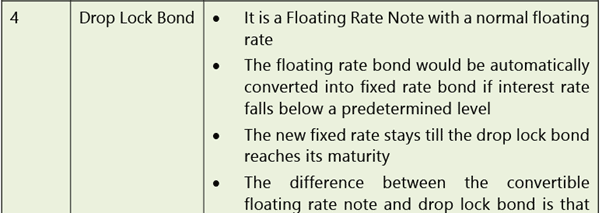

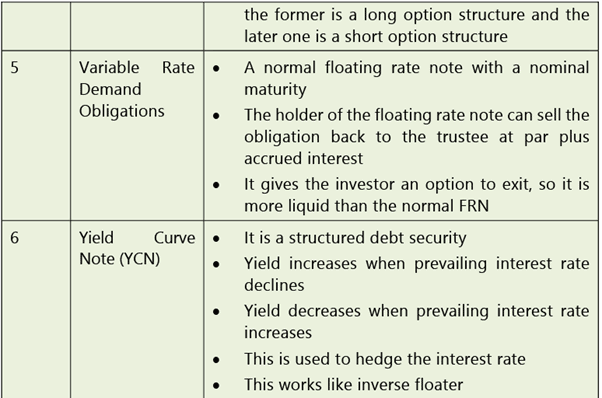

Types of Bond

Based on call Bond can be divided as

- Callable bonds: A callable bond has a call option which gives the issuer the right to redeem the bond before maturity at a predetermined price known as the call price (Generally at a premium).

- Puttable bonds: Puttable bonds give the investor a put option (i.e. the right to sell the bond) back to the company before maturity.

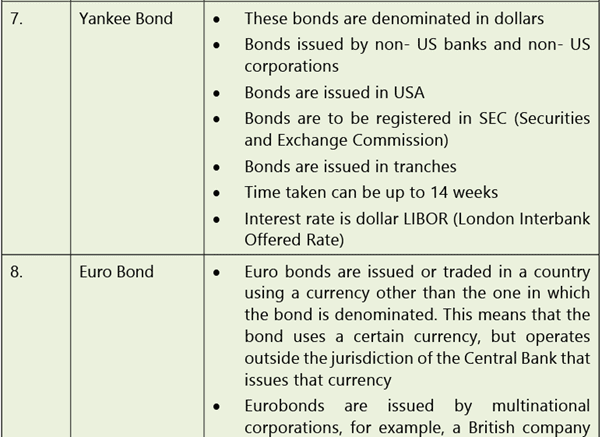

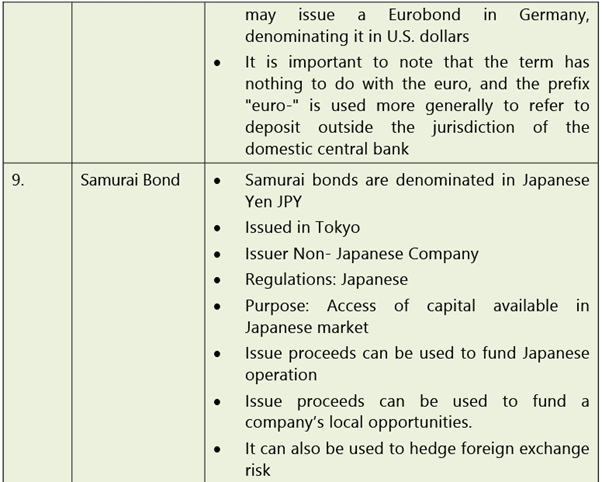

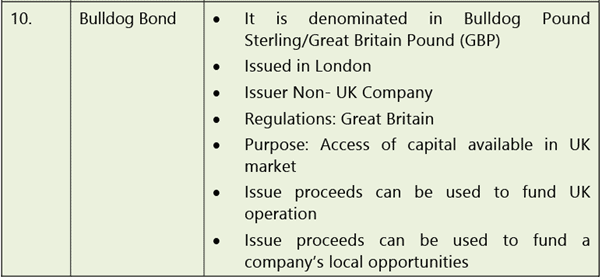

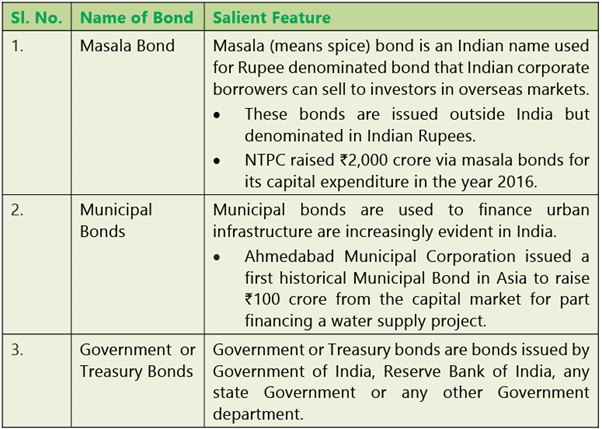

Various Bonds with their salient feature are as follow:

(i) Foreign Bonds

(ii) Indian Bonds

(ii) Indian Bonds

Some other bonds are included in other source of Financing (para 2.8)

Loans from Financial Institutions

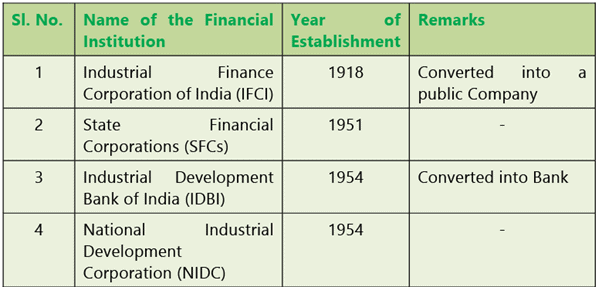

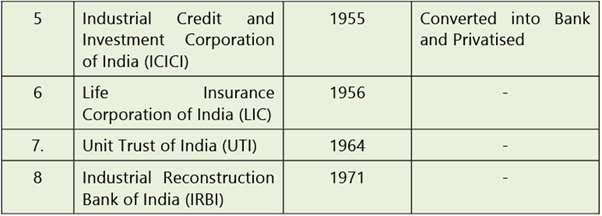

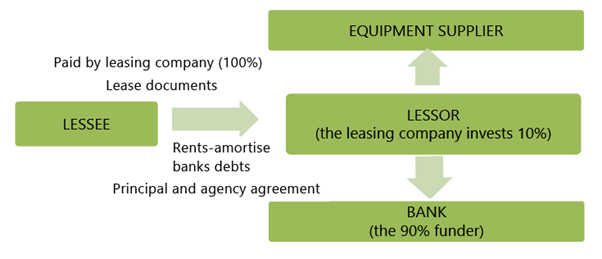

(i) Financial Institution: National

(ii) Financial Institution: International Institutions

Loans from Commercial Banks

The primary role of the commercial banks is to cater to the short-term requirements of industry. Of late, however, banks have started taking an interest in long term financing of industries in several ways.

- The banks provide long term loans for the purpose of expansion or setting up of new units. Their repayment is usually scheduled over a long period of time. The liquidity of such loans is said to depend on the anticipated income of the borrowers.

- As part of the long-term funding for a company, the banks also fund the long term working capital requirement (it is also called WCTL i.e. working capital term loan). It is funding of that portion of working capital which is always required (the minimum level) and is not impacted by seasonal requirement of the company.

Bridge Finance: Bridge finance refers to loans taken by a company normally from commercial banks for a short period because of pending disbursement of loans sanctioned by financial institutions. Though it is of short-term nature but since it is an important step in the facilitation of long-term loan, therefore it is being discussed along with the long term sources of funds. Normally, it takes time for financial institutions to disburse loans to companies. However, once the loans are approved by the term lending institutions, companies, in order not to lose further time in starting their projects, arrange short term loans from commercial banks. The bridge loans are repaid/ adjusted out of the term loans as and when disbursed by the concerned institutions. Bridge loans are normally secured by hypothecating movable assets, personal guarantees and demand promissory notes. Generally, the rate of interest on bridge finance is higher as compared with that on term loans.

Having discussed funding from share capital (equity/preference), raising of debt from financial institutions and banks, we will now discuss some other important sources of long-term finance.

Venture Capital Financing

Meaning of Venture Capital Financing

The venture capital financing refers to financing of new high risky venture promoted by qualified entrepreneurs who lack experience and funds to give shape to their ideas. In broad sense, under venture capital financing, venture capitalist make investment to purchase equity or debt securities from inexperienced entrepreneurs who undertake highly risky ventures with potential to succeed in future.

Characteristics of Venture Capital Financing

Some of the characteristics of Venture Capital Funding are:

- It is basically an equity finance in new companies.

- It can be viewed as a long-term investment in growth-oriented small/medium firms.

- Apart from providing funds, the investor also provides support in form of sales strategy, business networking and management expertise, enabling the growth of the entrepreneur.

Methods of Venture Capital Financing

Some common methods of venture capital financing are as follows:

- Equity financing: The venture capital undertakings generally require funds for a longer period but may not be able to provide returns to the investors during the initial stages. Therefore, the venture capital finance is generally provided by way of equity share capital. The equity contribution of venture capital firm does not exceed 49% of the total equity capital of venture capital undertakings so that the effective control and ownership remains with the entrepreneur.

- Conditional loan: A conditional loan is repayable in the form of a royalty after the venture is able to generate sales. No interest is paid on such loans. In India venture capital financiers charge royalty ranging between 2 and 15 per cent; actual rate depends on other factors of the venture such as gestation period, cash flow patterns, risk and other factors of the enterprise. Some Venture capital financiers give a choice to the enterprise of paying a high rate of interest (which could be well above 20 per cent) instead of royalty on sales once it becomes commercially sound.

- Income note: It is a hybrid security which combines the features of both conventional loan and conditional loan. The entrepreneur has to pay both interest and royalty on sales but at substantially low rates. IDBI’s VCF provides funding equal to 80 – 87.50% of the projects cost for commercial application of indigenous technology.

- Participating debenture: Such security carries charges in three phases — in the start-up phase no interest is charged, next stage a low rate of interest is charged up to a particular level of operation, after that, a high rate of interest is required to be paid.

Debt Securitisation

Meaning of Debt Securitisation

Securitisation is a process in which illiquid assets are pooled into marketable securities that can be sold to investors. The process leads to the creation of financial instruments that represent ownership interest in, or are secured by a segregated income producing asset or pool of assets. These assets are generally secured by personal or real property such as automobiles, real estate, or equipment loans but in some cases are unsecured.

Example of Debt Securitisation:

A finance company has given a large number of car loans. It needs more money so that it is in a position to give more loans. One way to achieve this is to sell all the existing loans. But, in the absence of a liquid secondary market for individual car loans, this is not feasible.

However, a practical option is debt securitisation, in which the finance company sells its existing car loans already given to borrowers to the Special Purpose Vehicle (SPV). The SPV, in return pays to the company, which in turn continue to lend with this money. On the other hand, the SPV pools these loans and convert these into marketable securities. It means that now these converted securities can be issued to investors.

So, this process of debt securitization helps the finance company to raise funds and get the loans off its Balance Sheet. These funds also help the company disburse further loans. Similarly, the process is beneficial to the investors also as it creates a liquid investment in a diversified pool of car loans, which may be an attractive option to other fixed income instruments. The whole process is carried out in such a way that the original debtors i.e. the car loan borrowers may not be aware of the transaction. They might have continued making payments the way they are already doing. However, these payments shall now be made to the new investors who have emerged out of this securitization process.

Lease Financing

Leasing is a general contract between the owner and user of the asset over a specified period of time. The asset is purchased initially by the lessor (leasing company) and thereafter leased to the user (lessee company) which pays a specified rent at periodical intervals. Thus, leasing is an alternative to the purchase of an asset out of own or borrowed funds. Moreover, lease finance can be arranged much faster as compared to term loans from financial institutions.

Types of Lease Contracts: Broadly lease contracts can be divided into following two categories:

(a) Operating Lease: An operating lease is a form of lease in which the right to use the asset is given by the lessor to the lessee. However, the ownership right of the asset remains with the lessor. The lessee gives a fixed amount of periodic lease rentals to the lessor for using the asset. Further, the lessor also bears the insurance, maintenance and repair costs etc. of the asset. In operating lease, the lease period is short. So, the lessor may not be able to recover the cost of the asset during the initial lease period and tend to lease the asset to more than one lessee. Normally, these are callable lease and are cancelable with proper notice.

The term of this type of lease is shorter than the asset’s economic life. The lessee is obliged to make payment until the lease expiration, which approaches useful life of the asset.

An operating lease is particularly attractive to companies that continually update or replace equipment and want to use equipment without ownership, but also want to return equipment at lease end and avoid technological obsolescence.

Note: The above diagram may be summarized in a short paragraph

(b) Financial Lease: In contrast to an operating lease, a financial lease is long term in nature and non-cancelable i.e. the lessee cannot terminate the lease agreement subsequently So, the period of lease is generally the full economic life of the leased asset. In other words, a financial lease can be regarded as any leasing arrangement that is to finance the use of equipment for the major parts of its useful life. The lessee has the right to use the equipment while the lessor retains legal title. Further, in such lease, the lessee has to bear the insurance, maintenance and other related costs. It is also called capital lease, which is nothing but a loan in disguise.

Thus, it can be said that a financial lease is a contract involving payments over an obligatory period of specified sums sufficient in total to amortise the capital outlay of the lessor and give some profit.

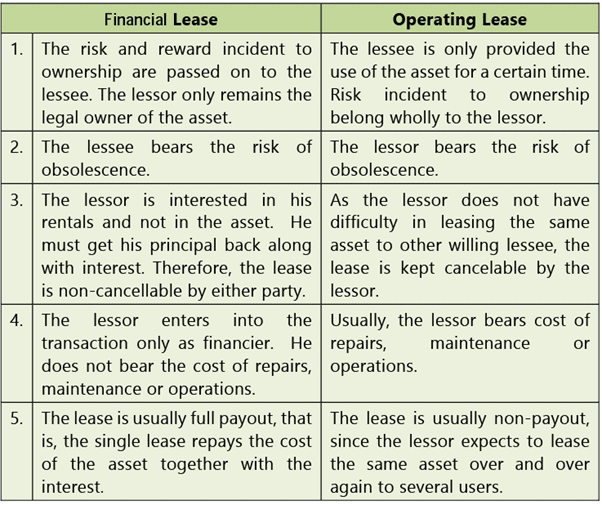

Comparison between Financial Lease and Operating Lease

Other Types of Leases

(a) Sales and Lease Back: Under this type of lease, the owner of an asset sells the asset to a party (the buyer), who in turn leases back the same asset to the owner in consideration of a lease rentals. Under this arrangement, the asset is not physically exchanged but it all happen in records only. The main advantage of this method is that the lessee can satisfy himself completely regarding the quality of an asset and after possession of the asset convert the sale into a lease agreement.

Under this transaction, the seller assumes the role of lessee (as the same asset which he has sold came back to him in the form of lease) and the buyer assumes the role of a lessor (as asset purchased by him was leased back to the seller). So, the seller gets the agreed selling price and the buyer gets the lease rentals.

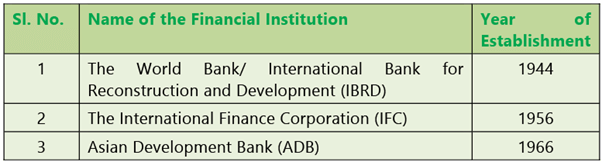

(b) Leveraged Lease: Under this lease, a third party is involved besides lessor and the lessee. The lessor borrows a part of the purchase cost (say 80%) of the asset from the third party i.e., lender and asset so purchased is held as security against the loan. The lender is paid off from the lease rentals directly by the lessee and the surplus after meeting the claims of the lender goes to the lessor. The lessor is entitled to claim depreciation allowance.

(c) Sales-aid Lease: Under this lease contract, the lessor enters into a tie up with a manufacturer for marketing the latter’s product through his own leasing operations, it is called a sales-aid lease. In consideration of the aid in sales, the manufacturer may grant either credit or a commission to the lessor. Thus, the lessor earns from both sources i.e. from lessee as well as the manufacturer.

(d) Close-ended and Open-ended Leases: In the close-ended lease, the assets get transferred to the lessor at the end of lease, the risk of obsolescence, residual value etc., remain with the lessor being the legal owner of the asset. In the openended lease, the lessee has the option of purchasing the asset at the end of the lease period.

In recent years, leasing has become a popular source of financing in India. From the lessee's point of view, leasing has the attraction of eliminating immediate cash outflow, and the lease rentals can be deducted for computing the total income under the Income tax Act. As against this, buying has the advantages of depreciation allowance (including additional depreciation) and interest on borrowed capital being tax-deductible. Thus, an evaluation of the two alternatives is to be made in order to take a decision. Practical problems for lease financing are covered at Final level in paper -Financial Services and Capital Markets.

Short Term Sources of Finance

There are various sources available to meet short- term needs of finance. The different sources are discussed below:

- Trade Credit: It represents credit granted by suppliers of goods, etc., as an incident of sale. The usual duration of such credit is 15 to 90 days. It generates automatically in the course of business and is common to almost all business operations. It can be in the form of an 'open account' or 'bills payable'. Trade credit is preferred as a source of finance because it is without any explicit cost and till a business is a going concern it keeps on rotating. Another very important characteristic of trade credit is that it enhances automatically with the increase in the volume of business.

- Accrued Expenses and Deferred (Unearned) Income: Accrued expenses represent liabilities which a company has to pay for the services which it has already received like wages, taxes, interest and dividends. Such expenses arise out of the day-to-day activities of the company and hence represent a spontaneous source of finance. Deferred income, on the other hand, reflects the amount of funds received by a company in lieu of goods and services to be provided in the future. Since these receipts increase a company’s liquidity, they are also considered to be an important source of spontaneous finance.

- Advances from Customers: Manufacturers and contractors engaged in producing or constructing costly goods involving considerable length of manufacturing or construction time usually demand advance money from their customers at the time of accepting their orders for executing their contracts or supplying the goods. This is a cost free source of finance and really useful.

- Commercial Paper: A Commercial Paper is an unsecured money market instrument issued in the form of a promissory note. The Reserve Bank of India introduced the commercial paper scheme in the year 1989 with a view to enabling highly rated corporate borrowers to diversify their sources of shortterm borrowings and to provide an additional instrument to investors. Subsequently, in addition to the Corporate, Primary Dealers and All India Financial Institutions have also been allowed to issue Commercial Papers. Commercial papers are issued in denominations of ₹ 5 lakhs or multiples thereof and the interest rate is generally linked to the yield on the one-year government bond.

All eligible issuers are required to get the credit rating from Credit Rating Information Services of India Ltd, (CRISIL), or the Investment Information and Credit Rating Agency of India Ltd (ICRA) or the Credit Analysis and Research Ltd (CARE) or the FITCH Ratings India Pvt. Ltd or any such other credit rating agency as is specified by the Reserve Bank of India. - Treasury Bills: Treasury bills are a class of Central Government Securities. Treasury bills, commonly referred to as T-Bills are issued by Government of India to meet short term borrowing requirements with maturities ranging between 14 to 364 days.

- Certificates of Deposit (CD): A certificate of deposit (CD) is basically a savings certificate with a fixed maturity date of not less than 15 days up to a maximum of one year.

- Bank Advances: Banks receive deposits from public for different periods at varying rates of interest. These funds are invested and lent in such a manner that when required, they may be called back. Lending results in gross revenues out of which costs, such as interest on deposits, administrative costs, etc., are met and a reasonable profit is made. A bank's lending policy is not merely profit motivated but has to also keep in mind the socio- economic development of the country.

Some of the facilities provided by banks are:

- Short Term Loans: In a loan account, the entire advance is disbursed at one time either in cash or by transfer to the current account of the borrower. It is a single advance and given against securities like shares, government securities, life insurance policies and fixed deposit receipts, etc. Except by way of interest and other charges, no further adjustments are made in this account. Repayment under the loan account is made either by way of repaying the full amount or by way of schedule of repayments agreed upon as in case of term loans.

- Overdraft: Under this facility, customers are allowed to withdraw in excess of credit balance standing in their Current Account. A fixed limit is, therefore, granted to the borrower within which the borrower is allowed to overdraw his account. Though overdrafts are repayable on demand, they generally continue for long periods by annual renewals of the limits. This is a convenient arrangement for the borrower as he is in a position to avail the limit sanctioned, according to his requirements. Interest is charged on daily balances. Since these accounts are operated in the same way as cash credit and current accounts, cheque books are provided.

- Clean Overdrafts: Request for clean advances are entertained only from parties which are financially sound and having reputation for their integrity. The bank has to rely upon the personal security of the borrowers. Therefore, while entertaining proposals for clean advances; banks exercise a good deal of restraint since they have no backing of any tangible security. If the parties are already enjoying secured advance facilities, this may be a point in favor and may be taken into account while screening such proposals. The amount of turnover in the account, satisfactory dealings for considerable period and reputation in the market are some of the factors which the bank normally see. As a safeguard, banks take guarantees from other persons who are credit worthy before granting this facility. A clean advance is generally granted for a short period and must not be continued for long.

- Cash Credits: Cash Credit is an arrangement under which a customer is allowed an advance up to certain limit against credit granted by bank. Under this arrangement, a customer need not borrow the entire amount of advance at one time; he can only draw to the extent of his requirements and deposit his surplus funds in his account. Interest is not charged on the full amount of the advance but on the amount actually availed by him. Generally cash credit limits are sanctioned against the security of tradable goods by way of pledge or hypothecation. Though these accounts are repayable on demand, banks usually do not recall such advances, unless they are compelled to do so by adverse factors.

- Advances against goods: Advances against goods occupy an important place in total bank credit. They provide a reliable source of repayment. Advances against them are safe and liquid. Also, there is a quick turnover in goods, as they are in constant demand. So a banker generally accepts them as security. Furthermore, goods are charged to the bank either by way of pledge or by way of hypothecation. The term 'goods' includes all forms of movables which are offered to the bank as security. They may be agricultural commodities or industrial raw materials or partly finished goods.

- Bills Purchased/Discounted: Under this head, banks give advances against the security of bills which may be clean or documentary. Bills are sometimes purchased from approved customers in whose favour limits are sanctioned. Before granting a limit, the banker satisfies himself as to the credit worthiness of the drawer (the one who prepared the bill of exchange, i.e. the creditor or the beneficiary or the payee). Although the term 'bills purchased' gives the impression that the bank becomes the owner or purchaser of such bills, in actual practice the bank holds the bills only as security for the advance. The bank, in addition to the rights against the parties liable on the bills, can also exercise a pledge’s rights over the goods covered by the documents.

- Financing of Export Trade by Banks: Exports play an important role in accelerating the economic growth of developing countries like India. Out of the several factors influencing export growth, credit is a very important factor which enables exporters in efficiently executing their export orders. The commercial banks provide short-term export finance mainly by way of pre and postshipment credit. Export finance is granted in Rupees as well as in foreign currency.

In view of the importance of export credit in maintaining the pace of export growth, RBI has initiated several measures in the recent years to ensure timely and hassle-free flow of credit to the export sector. These measures, inter alia, include rationalization and liberalization of export credit interest rates, flexibility in repayment/prepayment of pre-shipment credit, special financial package for large value exporters, export finance for agricultural exports, Gold Card Scheme for exporters etc. Further, banks have been granted freedom by RBI to source funds from abroad without any limit, exclusively for the purpose of granting export credit in foreign currency, which has enabled banks to increase their lending’s under export credit in foreign currency substantially during the last few years.

The advances by commercial banks for export financing are in the form of:

- Pre-shipment finance i.e., before shipment of goods.

- Post-shipment finance i.e., after shipment of goods.

Pre-Shipment Finance: This generally takes the form of packing credit facility; packing credit is an advance extended by banks to an exporter for the purpose of buying, manufacturing, processing, packing, shipping goods to overseas buyers. Any exporter, having at hand a firm export order placed with him by his foreign buyer or an irrevocable letter of credit opened in his favour, can approach a bank for availing of packing credit. An advance so taken by an exporter is required to be liquidated within 180 days from the date of its commencement by negotiation of export bills or receipt of export proceeds in an approved manner. Thus, packing credit is essentially a short-term advance.

Normally, banks insist upon their customers to lodge with them irrevocable letters of credit opened in favour of the customers by the overseas buyers. The letter of credit and firm sale contracts not only serve as evidence of a definite arrangement for realisation of the export proceeds but also indicate the amount of finance required by the exporter. Packing credit, in the case of customers of long standing, may also be granted against firm contracts entered into by them with overseas buyers.

Types of Packing Credit

- Clean packing credit: This is an advance made available to an exporter only on production of a firm export order or a letter of credit without exercising any charge or control over raw material or finished goods. It is a clean type of export advance. Each proposal is weighed according to particular requirements of the trade and credit worthiness of the exporter. A suitable margin has to be maintained. Also, Export Credit Guarantee Corporation (ECGC) cover should be obtained by the bank.

- Packing credit against hypothecation of goods: Export finance is made available on certain terms and conditions where the exporter has pledge able interest and the goods are hypothecated to the bank as security with stipulated margin. At the time of utilising the advance, the exporter is required to submit, along with the firm export order or letter of credit relative stock statements and thereafter continue submitting them every fortnight and/or whenever there is any movement in stocks.

- Packing credit against pledge of goods: Export finance is made available on certain terms and conditions where the exportable finished goods are pledged to the banks with approved clearing agents who will ship the same from time to time as required by the exporter. The possession of the goods so pledged lies with the bank and is kept under its lock and key.

- E.C.G.C. guarantee: Any loan given to an exporter for the manufacture, processing, purchasing, or packing of goods meant for export against a firm order qualifies for the packing credit guarantee issued by Export Credit Guarantee Corporation.

- Forward exchange contract: Another requirement of packing credit facility is that if the export bill is to be drawn in a foreign currency, the exporter should enter into a forward exchange contact with the bank, thereby avoiding risk involved in a possible change in the rate of exchange.

Post-shipment Finance: It takes the following forms:

- Purchase/discounting of documentary export bills: Finance is provided to exporters by purchasing export bills drawn payable at sight or by discounting usance export bills covering confirmed sales and backed by documents including documents of the title of goods such as bill of lading, post parcel receipts, or air consignment notes.

- E.C.G.C. Guarantee: Post-shipment finance, given to an exporter by a bank through purchase, negotiation or discount of an export bill against an order, qualifies for post-shipment export credit guarantee. It is necessary, however, that exporters should obtain a shipment or contracts risk policy of E.C.G.C. Banks insist on the exporters to take a contracts shipments (comprehensive risks) policy covering both political and commercial risks. The Corporation, on acceptance of the policy, will fix credit limits for individual exporters and the Corporation’s liability will be limited to the extent of the limit so fixed for the exporter concerned irrespective of the amount of the policy.

- Advance against export bills sent for collection: Finance is provided by banks to exporters by way of advance against export bills forwarded through them for collection, taking into account the creditworthiness of the party, nature of goods exported, usance, standing of drawee, etc.

- Advance against duty draw backs, cash subsidy, etc.: To finance export losses sustained by exporters, bank advance against duty draw-back, cash subsidy, etc., receivable by them against export performance. Such advances are of clean nature; hence necessary precaution should be exercised.

Bank providing finance in this manner see that the relative export bills are either negotiated or forwarded for collection through it so that it is in a position to verify the exporter's claims for duty draw-backs, cash subsidy, etc. 'An advance so availed of by an exporter is required to be liquidated within 180 days from the date of shipment of relative goods.

Other facilities extended to the exporters are as follows:

- On behalf of approved exporters, banks establish letters of credit on their overseas or up country suppliers.

- Guarantees for waiver of excise duty, etc. due performance of contracts, bond in lieu of cash security deposit, guarantees for advance payments etc., are also issued by banks to approved clients.

- To approved clients undertaking exports on deferred payment terms, banks also provide finance.

- Banks also endeavour to secure for their exporter-customers status reports of their buyers and trade information on various commodities through their correspondents.

- Economic intelligence on various countries is also provided by banks to their exporter clients.

- Inter Corporate Deposits: The companies can borrow funds for a short period, say 6 months, from other companies which have surplus liquidity. The rate of interest on inter corporate deposits varies depending upon the amount involved and the time period.

- Certificate of Deposit (CD): The certificate of deposit is a document of title similar to a time deposit receipt issued by a bank except that there is no prescribed interest rate on such funds. The main advantage of CD is that banker is not required to encash the deposit before maturity period and the investor is assured of liquidity because he can sell the CD in secondary market.

- Public Deposits: Public deposits are very important source of short-term and medium term finances particularly due to credit squeeze by the Reserve Bank of India. A company can accept public deposits subject to the stipulations of Reserve Bank of India from time to time upto a maximum amount of 35 per cent of its paid up capital and reserves.. These deposits may be accepted for a period of six months to three years. Public deposits are unsecured loans; they should not be used for acquiring fixed assets since they are to be repaid within a period of 3 years. These are mainly used to finance working capital requirements.

Other Sources of Financing

- Seed Capital Assistance: The Seed capital assistance scheme is designed by IDBI for professionally or technically qualified entrepreneurs and/or persons possessing relevant experience, skills and entrepreneurial traits but lack adequate financial resources. All the projects eligible for financial assistance from IDBI, directly or indirectly through refinance are eligible under the scheme.

The Seed Capital Assistance is interest free but carries a service charge of one per cent per annum for the first five years and at increasing rate thereafter. However, IDBI will have the option to charge interest at such rate as may be determined by IDBI on the loan if the financial position and profitability of the company so permits during the currency of the loan. The repayment schedule is fixed depending upon the repaying capacity of the unit with an initial moratorium up-to five years. - Internal Cash Accruals: Existing profit-making companies which undertake an expansion/ diversification programme may be permitted to invest a part of their accumulated reserves or cash profits for creation of capital assets. In such cases, past performance of the company permits the capital expenditure from within the company by way of disinvestment of working/invested funds. In other words, the surplus generated from operations, after meeting all the contractual, statutory and working requirement of funds, is available for further capital expenditure.

- Unsecured Loans: Unsecured loans are typically provided by promoters to meet the promoters' contribution norm. These loans are subordinate to institutional loans. The rate of interest chargeable on these loans should be less than or equal to the rate of interest on institutional loans and interest can be paid only after payment of institutional dues. These loans cannot be repaid without the prior approval of financial institutions. Unsecured loans are considered as part of the equity for the purpose of calculating debt equity ratio.

- Deferred Payment Guarantee: Many a time suppliers of machinery provide deferred credit facility under which payment for the purchase of machinery can be made over a period of time. The entire cost of the machinery is financed and the company is not required to contribute any amount initially towards acquisition of the machinery. Normally, the supplier of machinery insists that bank guarantee should be furnished by the buyer. Such a facility does not have a moratorium period for repayment. Hence, it is advisable only for an existing profit-making company.

- Capital Incentives: The backward area development incentives available often determine the location of a new industrial unit. These incentives usually consist of a lump sum subsidy and exemption from or deferment of sales tax and octroi duty. The quantum of incentives is determined by the degree of backwardness of the location.

The special capital incentive in the form of a lump sum subsidy is a quantum sanctioned by the implementing agency as a percentage of the fixed capital investment subject to an overall ceiling. This amount forms a part of the longterm means of finance for the project. However, it may be mentioned that the viability of the project must not be dependent on the quantum and availability of incentives. Institutions, while appraising the project, assess the viability of the project per se, without considering the impact of incentives on the cash flows and profitability of the project. Special capital incentives are sanctioned and released to the units only after they have complied with the requirements of the relevant scheme. The requirements may be classified into initial effective steps and final effective steps. - Deep Discount Bonds: Deep Discount Bonds is a form of zero-interest bonds. These bonds are sold at a discounted value and on maturity, face value is paid to the investors. In such bonds, there is no interest payout during lock in period.

- Secured Premium Notes: Secured Premium Notes is issued along with a detachable warrant and is redeemable after a notified period of say 4 to 7 years. The conversion of detachable warrant into equity shares will have to be done within time period notified by the company.

- Zero Interest Fully Convertible Debentures: These are fully convertible debentures which do not carry any interest. The debentures are compulsorily and automatically converted after a specified period of time and holders thereof are entitled to new equity shares of the company at predetermined price. From the point of view of company, this kind of instrument is beneficial in the sense that no interest is to be paid on it. If the share price of the company in the market is very high then the investors tends to get equity shares of the company at the lower rate.

- Zero Coupon Bonds: A Zero Coupon Bond does not carry any interest but it is sold by the issuing company at a discount. The difference between the discounted value and maturing or face value represents the interest to be earned by the investor on such bonds.

- Option Bonds: These are cumulative and non-cumulative bonds where interest is payable on maturity or periodically. Redemption premium is also offered to attract investors.

- Inflation Bonds: Inflation Bonds are the bonds in which interest rate is adjusted for inflation. Thus, the investor gets interest which is free from the effects of inflation. For example, if the interest rate is 11 per cent and the inflation is 5 per cent, the investor will earn 16 per cent meaning thereby that the investor is protected against inflation.

- Floating Rate Bonds: This as the name suggests is bond where the interest rate is not fixed and is allowed to float depending upon the market conditions. This is an ideal instrument which can be resorted to by the issuer to hedge themselves against the volatility in the interest rates. This has become more popular as a money market instrument and has been successfully issued by financial institutions like IDBI, ICICI etc.

International Financing

The essence of financial management is to raise and utilise the funds raised effectively. There are various avenues for organisations to raise funds either through internal or external sources. The sources of external financing include:

- Commercial Banks: Like domestic loans, commercial banks all over the world extend Foreign Currency (FC) loans also for international operations. These banks also provide to overdraw over and above the loan amount.

- Development Banks: Development banks offer long & medium term loans including FC loans. Many agencies at the national level offer a number of concessions to foreign companies to invest within their country and to finance exports from their countries e.g. EXIM Bank of USA.

- Discounting of Trade Bills: This is used as a short-term financing method. It is used widely in Europe and Asian countries to finance both domestic and international business.

- International Agencies: A number of international agencies have emerged over the years to finance international trade & business. The more notable among them include The International Finance Corporation (IFC), The International Bank for Reconstruction and Development (IBRD), The Asian Development Bank (ADB), The International Monetary Fund (IMF), etc.

- International Capital Markets: Today, modern organisations including MNC's depend upon sizeable borrowings in Rupees as well as Foreign Currency (FC). In order to cater to the needs of such organisations, international capital markets have sprung all over the globe such as in London. In international capital market, the availability of FC is available under the four main systems viz:

(i) Euro-currency market

(ii) Export credit facilities

(iii) Bonds issues

(iv) Financial Institutions. - The origin of the Euro-currency market was with the dollar denominated bank deposits and loans in Europe particularly in London. Euro-dollar deposits are dollar denominated time deposits available at foreign branches of US banks and at some foreign banks. Banks based in Europe accept dollar denominated deposits and make dollar denominated deposits to the clients. This forms the backbone of the Euro-currency market all over the globe. In this market, funds are made available as loans through syndicated Euro-credit of instruments such as FRN's, FR certificates of deposits.

- Financial Instruments: Some of the various financial instruments dealt with in the international market are briefly described below:

(a) External Commercial Borrowings (ECB): ECBs refer to commercial loans (in the form of bank loans, buyers credit, suppliers credit, securitised instruments (e.g. floating rate notes and fixed rate bonds) availed from non-resident lenders with minimum average maturity of 3 years. Borrowers can raise ECBs through internationally recognised sources like (i) international banks, (ii) international capital markets, (iii) multilateral financial institutions such as the IFC, ADB etc, (iv) export credit agencies, (v) suppliers of equipment, (vi) foreign collaborators and (vii) foreign equity holders.

External Commercial Borrowings can be accessed under two routes viz (i) Automatic route and (ii) Approval route. Under the Automatic route, there is no need to take the RBI/Government approval whereas such approval is necessary under the Approval route. Company’s registered under the Companies Act and NGOs engaged in micro finance activities are eligible for the Automatic Route whereas Financial Institutions and Banks dealing exclusively in infrastructure or export finance and the ones which had participated in the textile and steel sector restructuring packages as approved by the government are required to take the Approval Route.

(b) Euro Bonds: Euro bonds are debt instruments which are not denominated in the currency of the country in which they are issued e.g. a Yen note floated in Germany. Such bonds are generally issued in a bearer form rather than as registered bonds and in such cases they do not contain the investor’s names or the country of their origin. These bonds are an attractive proposition to investors seeking privacy.

(c) Foreign Bonds: These are debt instruments issued by foreign corporations or foreign governments. Such bonds are exposed to default risk, especially the corporate bonds. These bonds are denominated in the currency of the country where they are issued, however, in case these bonds are issued in a currency other than the investors home currency, they are exposed to exchange rate risks. An example of a foreign bond ‘A British firm placing Dollar denominated bonds in USA’.

(d) Fully Hedged Bonds: As mentioned above, in foreign bonds, the risk of currency fluctuations exists. Fully hedged bonds eliminate the risk by selling in forward markets the entire stream of principal and interest payments.

(e) Medium Term Notes (MTN): Certain issuers need frequent financing through the Bond route including that of the Euro bond. However, it may be costly and ineffective to go in for frequent issues. Instead, investors can follow the MTN programme. Under this programme, several lots of bonds can be issued, all having different features e.g. different coupon rates, different currencies etc. The timing of each lot can be decided keeping in mind the future market opportunities. The entire documentation and various regulatory approvals can be taken at one point of time

(f) Floating Rate Notes (FRN): These are issued up to seven years maturity. Interest rates are adjusted to reflect the prevailing exchange rates. They provide cheaper money than foreign loans.

(g) Euro Commercial Papers (ECP): ECPs are short term money market instruments. They have maturity period of less than one year. They are usually designated in US Dollars.

(h) Foreign Currency Option (FC): A FC Option is the right (and not the obligation) to buy or sell, foreign currency at a certain specified price on or before a specified date. It provides a hedge against financial and economic risks.

(i) Foreign Currency Futures: FC Futures are obligations (and not the right) to buy or sell a specified foreign currency in the present for settlement at a future date.

(j) Foreign Euro Bonds: In domestic capital markets of various countries the Bonds issues referred to above are known by different names such as Yankee Bonds in the US, Swiss Frances in Switzerland, Samurai Bonds in Tokyo and Bulldogs in UK.

(k) Euro Convertible Bonds: A convertible bond is a debt instrument which gives the holders of the bond an option to convert the bonds into a predetermined number of equity shares of the company. Usually the price of the equity shares at the time of conversion will have a premium element. These bonds carry a fixed rate of interest and if the issuer company so desires may also include a Call Option (where the issuer company has the option of calling/ buying the bonds for redemption prior to the maturity date) or a Put Option (which gives the holder the option to put/sell his bonds to the issuer company at a pre-determined date and price).

(l) Euro Convertible Zero Bonds: These bonds are structured as a convertible bond. No interest is payable on the bonds. But conversion of bonds takes place on maturity at a pre- determined price. Usually there is a five years maturity period and they are treated as a deferred equity issue.

(m) Euro Bonds with Equity Warrants: These bonds carry a coupon rate determined by market rates. The warrants are detachable. Pure bonds are traded at a discount. Fixed Income Funds Management may like to invest for the purposes of regular income in this case. - Euro Issues by Indian Companies: Indian companies are permitted to raise foreign currency resources through issue of ordinary equity shares through Global Depository Receipts(GDRs)/ American Depository Receipts (ADRs) and / or issue of Foreign Currency Convertible Bonds (FCCB) to foreign investors i.e. institutional investors or individuals (including NRIs) residing abroad. Such investment is treated as Foreign Direct Investment. The government guidelines on these issues are covered under the Foreign Currency Convertible Bonds and Ordinary Shares (through depositary receipt mechanism) Scheme, 1993 and notifications issued after the implementation of the said scheme.

(a) American Depository Receipts (ADRs): These are securities offered by non-US companies who want to list on any of the US exchange. Each ADR represents a certain number of a company's regular shares. ADRs allow US investors to buy shares of these companies without the costs of investing directly in a foreign stock exchange. ADRs are issued by an approved New York bank or trust company against the deposit of the original shares. These are deposited in a custodial account in the US. Such receipts have to be issued in accordance with the provisions stipulated by the regulator Securities Exchange Commission (SEC) of USA.

ADRs can be traded either by trading existing ADRs or purchasing the shares in the issuer's home market and having new ADRs created, based upon availability and market conditions. When trading in existing ADRs, the trade is executed on the secondary market on the New York Stock Exchange (NYSE) through Depository Trust Company (DTC) without involvement from foreign brokers or custodians. The process of buying new, issued ADRs goes through US brokers, Helsinki Exchanges and DTC as well as Deutsche Bank. When transactions are made, the ADRs change hands, not the certificates. This eliminates the actual transfer of stock certificates between the US and foreign countries.

In a bid to bypass the stringent disclosure norms mandated by the SEC for equity shares, the Indian companies have however, chosen the indirect route to tap the vast American financial market through private debt placement of GDRs listed in London and Luxembourg Stock Exchanges.

The Indian companies have preferred the GDRs to ADRs because the US market exposes them to a higher level of responsibility than a European listing in the areas of disclosure, costs, liabilities and timing. The SECs regulations set up to protect the retail investor base are somewhat more stringent and onerous, even for companies already listed and held by retail investors in their home country. The most onerous aspect of a US listing for the companies is to provide full, half yearly and quarterly accounts in accordance with, or at least reconciled with US GAAPs.

(b) Global Depository Receipts (GDRs): These are negotiable certificates held in the bank of one country representing a specific number of shares of a stock traded on the exchange of another country. These financial instruments are used by companies to raise capital in either dollars or Euros. These are mainly traded in European countries and particularly in London.

ADRs/GDRs and the Indian Scenario: Indian companies are shedding their reluctance to tap the US markets. Infosys Technologies was the first Indian company to be listed on Nasdaq in 1999. However, the first Indian firm to issue sponsored GDR or ADR was Reliance industries Limited. Beside these two companies there are several other Indian firms which are also listed in the overseas bourses. These are Wipro, MTNL, State Bank of India, Tata Motors, Dr. Reddy's Lab, Ranbaxy, Larsen & Toubro, ITC, ICICI Bank, Hindalco, HDFC Bank and Bajaj Auto.

(c) Indian Depository Receipts (IDRs): The concept of the depository receipt mechanism which is used to raise funds in foreign currency has been applied in the Indian Capital Market through the issue of Indian Depository Receipts (IDRs). IDRs are similar to ADRs/GDRs in the sense that foreign companies can issue IDRs to raise funds from the Indian Capital Market in the same lines as an Indian company uses ADRs/GDRs to raise foreign capital. The IDRs are listed and traded in India in the same way as other Indian securities are traded.

Summary

- There are several sources of finance/funds available to any company.

- All the financial needs of a business may be grouped into the long term or short-term financial needs.

- There are different sources of funds available to meet long term financial needs of the business. These sources may be broadly classified into share capital (both equity and preference) and debt.

- Another important source of long-term finance is venture capital financing. It refers to financing of new high risky venture promoted by qualified entrepreneurs who lack experience and funds to give shape to their ideas.

- Securitisation is another important source of finance and it is a process in which illiquid assets are pooled into marketable securities that can be sold to investors.

- Leasing is a very popular source to finance equipment. It is a contract between the owner and user of the asset over a specified period of time in which the asset is purchased initially by the lessor (leasing company) and thereafter leased to the user (lessee company) who pays a specified rent at periodical intervals.

- Some of the short terms sources of funding are trade credit, advances from customers, commercial paper, and bank advances etc.

- To support export, the commercial banks provide short term export finance mainly by way of pre and post-shipment credit.

- Every day new creative financial products keep on entering the market. Some of the examples are seed capital assistance, deep discount bonds, option bonds, inflation bonds etc.

- Today the businesses are allowed to source funds from international market also. Some of important products are External Commercial Borrowings (ECB), Euro Bonds, American Depository Receipts (ADR) etc.

FAQs on Types of Financing: Notes - Financial Management & Economics Finance: CA Intermediate (Old Scheme)

| 1. What are the main financial needs of a business? |  |

| 2. What are the different classifications of financial sources available to businesses? |  |

| 3. What are long-term sources of finance? |  |

| 4. What is venture capital financing? |  |

| 5. What is debt securitisation? |  |

|

17 videos|31 docs

|

|

Explore Courses for CA Intermediate exam

|

|