Unit Cost: What is it, Types Formula, Calculation & Applications | Cost and Management Accounting for CA Intermediate PDF Download

Introduction

Unit cost is a crucial concept in the realms of business and economics. It holds significant sway over various decisions concerning production, pricing strategies, and the analysis of profitability. Beyond being merely a numerical figure, it serves as a valuable tool for gaining insights that aid in making well-informed decisions and crafting strategic plans.

This article delves into the essence of unit cost, covering all facets that demand your attention. By dissecting its fundamental principles and delving into its practical applications, we embark on a comprehensive exploration to shed light on its pragmatic utility for your enterprise.

So, let's delve into how the cost per unit assumes a pivotal role in managing your organization's expenses, enhancing production efficiencies, and formulating pricing tactics.

What is the meaning of unit cost?

What is the meaning of unit cost?

- Unit cost refers to the price that a business incurs for each unit of a product or service during its purchase, sale, or storage. This metric is crucial for shaping procurement strategies and fostering beneficial partnerships with suppliers.

- Let's illustrate this concept with an example: Imagine a scenario where a startup specializing in software aims to buy licenses for a customer relationship management (CRM) software. The vendor provides a pricing model with different tiers: INR 5000 per license for 1-100 requests, INR 4500 for 101-500 requests, and INR 4000 for 501 and more.

- Here, the unit price would represent the cost per license within each tier. If the software company decides to purchase 300 licenses, the unit cost for the initial 100 licenses would be INR 5000 each, while for the subsequent 200 licenses, it would be INR 4500 each.

- Understanding these unit costs enables strategic decision-making regarding the number of licenses to procure and which pricing tier to target. Ultimately, this knowledge leads to maximizing cost efficiency while fulfilling operational requirements.

Why Understanding Unit Cost is Vital in Business?

Unit cost is a vital metric in the strategic operations of businesses across various industries. It holds significance in influencing different aspects of a business, ranging from pricing strategies to profitability analysis. Let's delve into why this metric is crucial.

Precision in Pricing:

- Understanding the cost per unit enables businesses to establish competitive yet profitable prices for their products and services. By knowing the direct costs associated with producing each unit, companies can steer clear of underpricing pitfalls that might undermine profitability or repel potential customers.

Effective Resource Allocation:

- A grasp of unit costs assists in identifying which products or services are more economically viable to manufacture. This knowledge empowers businesses to concentrate their resources on these areas, thereby enhancing overall efficiency and optimizing resource utilization.

Facilitating Informed Decision-Making:

- Unit cost plays a pivotal role in facilitating informed decision-making processes, especially when assessing the feasibility of introducing new products or considering outsourcing specific operations. A clear understanding of these costs offers valuable insights to guide strategic decision-making.

Evaluation of Performance:

- Continuous monitoring of variations in unit costs allows businesses to assess the impact of process enhancements and cost-saving initiatives within their supply chain dynamics. This monitoring mechanism enables the continuous refinement of operations and the implementation of cost-saving strategies.

Negotiation Power:

- In business-to-business (B2B) relationships, having a clear understanding of the unit cost is crucial. Knowing the production cost per unit empowers you to negotiate more effectively with suppliers. When you are well-informed about the unit cost, you can enter into contract discussions confidently, leading to securing more favorable pricing terms.

Profitability Analysis:

- Profitability analysis plays a significant role in business success. By comparing the unit cost with the sales revenue, you can determine which products or services are the most profitable. This analysis enables you to make informed decisions regarding resource allocation and product mix, ultimately enhancing your bottom line.

Understanding the Unit Cost Calculation Formula

The formula for calculating the cost of the unit is as follows:

Unit Cost = Total Cost / Total Units Produced

In this formula, “total cost” is the costs incurred in the production process, including direct costs like raw materials, direct labor, and overhead expenses. “Total units produced” is the quantity of units manufactured or during a specific time.

To understand more details about this formula, consider a manufacturing company procuring raw materials from a supplier for their production line. Let’s say the total cost of purchasing 1,000 units of raw material is INR 15,000, inclusive of all expenses. Applying the formula, the price of the unit would be:

Unit Cost = INR 15,000 / 1,000 units = INR 15 per unit

Each unit of raw material purchased from the supplier costs the manufacturing company INR 15. Knowledge of this cost-of-unit figure helps assess the viability of the procurement deal. Besides negotiating better terms, you can make informed resource allocation and production planning decisions.

Types of unit costs

Grasping the different types of unit costs is crucial for a thorough understanding of cost analysis in business. There are four types of unit costs, each playing a distinct role in financial evaluation and decision-making. Let's explore the details of these types.

Direct cost of a unit:

- The direct cost of a unit refers to the expenses directly linked to producing or purchasing a single unit of a product or service. For instance, if a company buys microchips for its electronic devices, the direct cost would encompass the cost of each microchip.

- To compute the direct cost of a unit, all direct expenses related to production or procurement are added up and divided by the total number of units obtained or manufactured. For example, if a software firm acquires 200 licenses of a specialized software solution for INR 10,00,000, the direct cost per license would be INR 10,00,000 ÷ 200 licenses = INR 5000 per license.

Indirect cost of a unit:

- The indirect cost of a unit comprises expenses that are not directly associated with a specific unit but contribute to overall operational efficiency. For example, maintenance and repair costs for machinery purchased by a manufacturing company fall under indirect costs.

- To determine the indirect cost of a unit, all indirect expenses for a specific period are totaled and then divided by the total number of units procured or produced in that period. If a company's annual administrative and facility costs amount to INR 10,00,000 and it procures 500 units of a product, the indirect cost per unit would be INR 10,00,000 ÷ 500 units = INR 2000 per unit.

Fixed Cost of a Unit:

- Fixed cost of a unit refers to expenses that stay constant regardless of the number of units produced or procured. For instance, when a shipping company rents a warehouse for storage, the lease expense becomes a fixed cost of a unit.

- To determine the fixed unit cost, you divide the total fixed expenses over a specific period by the total units procured or produced during that timeframe. For example, if a supplier's annual fixed costs are INR 50,000 and they supply 10,000 units, the fixed unit cost would be INR 50,000 ÷ 10,000 units = INR 5 per unit.

Variable Cost of a Unit:

- Variable costs vary based on the quantity of units produced or procured. For instance, direct material expenses are variable when a clothing retailer purchases fabric for garment production.

- To calculate the unit's variable cost, you sum up all variable expenditures over a specific period and divide by the total units procured or produced in that period. For example, if a manufacturer spends INR 3,00,000 on raw materials and produces 500 units, the variable cost per unit would be INR 3,00,000 ÷ 500 units = INR 60 per unit.

Importance of unit cost analysis

Cost-of-unit analysis is critical as it offers profound insights into business operations, pricing strategies, and the financial health of an organization. Let’s look at why this analytical approach holds a lot of importance.

Cost control and efficiency:

- Understanding the costs associated with producing a single unit of a product or service is crucial for managing expenses effectively. By breaking down the costs, businesses can identify areas where costs can be reduced and processes streamlined. For example, a company that manufactures smartphones can use unit cost analysis to identify if the cost of raw materials can be optimized or if production processes can be made more efficient.

Pricing strategy and profitability:

- Analyzing the costs involved in each unit enables businesses to make informed decisions about pricing their products or services. By setting prices based on a clear understanding of costs, companies can ensure that their pricing is competitive while maintaining healthy profit margins. For instance, a bakery can use unit cost analysis to determine the price of a cake that covers costs and generates a desired profit.

Financial planning and forecasting:

- Accurate cost estimation is essential for effective budgeting and forecasting. By analyzing unit costs, organizations can create realistic budgets and make informed projections about future expenses and revenues. This process helps businesses anticipate financial needs and allocate resources efficiently. For example, a software company can use unit cost analysis to estimate costs for developing a new application and plan its budget accordingly.

Identifying Cost Drivers and Efficiencies:

- Unveiling the different elements contributing to unit cost is crucial for pinpointing key cost drivers within production. This knowledge allows targeting areas for cost reduction and process enhancement. Understanding the effects of input cost variations or production volume changes aids in implementing strategies to improve operational efficiency.

How to Determine and Analyze Unit Cost?

Calculating and analyzing unit cost is vital for evaluating the cost-effectiveness of manufacturing a specific item or providing a service. Let's break it down:

Calculating and analyzing unit cost is essential for understanding the cost efficiency of producing a particular item or offering a service.

Gather Cost Data:

- Collect relevant cost data associated with the production or procurement of the product or service. This includes direct costs like materials and labor, as well as indirect costs like overhead and administrative expenses.

Identify the Type of Unit Cost:

- Determine the type of unit cost you’re calculating—whether it’s direct, indirect, fixed, or variable. This distinction will guide your calculations and subsequent analysis.

Calculate the Total Cost:

- Sum up all the relevant costs gathered in step one to calculate the total cost for the production or procurement period.

Determine Total Units:

- Find out the total number of units produced or purchased during the same period.

Apply the Unit Cost Formula:

- Use the appropriate formula based on the type of unit cost. For direct unit cost, divide the total cost by the total units. The process is similar for indirect, fixed, or variable unit costs but involves different cost components.

Analyze and Interpret the Result:

- Once you have the overall unit cost value, delve into its implications. Compare it to historical data or industry benchmarks to gauge cost efficiency. Analyze trends over time to identify fluctuations and patterns. Additionally, assess how the unit cost aligns with pricing strategies and gross profit margins.

Identify Opportunities for Improvement:

- Examine the components of the unit cost to pinpoint areas for improvement. Look for ways to reduce material costs or enhance operational efficiencies to lower labor expenses. Use this analysis to develop strategies for cost reduction and process optimization.

Incorporate Findings into Decision-Making:

- Use the insights gained from the analysis to make informed decisions. Adjust pricing strategies and streamline operations based on your findings.

Continuously Monitor and Update:

- Unit cost analysis is an ongoing process. Regularly review and update your calculations to reflect changes in cost structures and production volumes. This iterative approach ensures your decision-making remains aligned with market realities.

What is an example of a cost unit?

Let's explore an example to understand the concept better by looking at the case of packaging material for an electronics manufacturer.

Consider an electronics manufacturing company in India that specializes in producing smart devices. This company sources packaging materials for its products from a supplier. The cost unit here could be a "packaging unit." A packaging unit would contain the specific type and quantity of materials required to package one electronic device for shipping.

For instance, the packaging materials might include a cardboard box, protective foam, and a printed instruction manual. The total cost of procuring these materials, including manufacturing and shipping, is INR 100 per packaging unit. Therefore, for each electronic device produced and packaged, the cost associated with packaging is INR 100.

Using a cost unit allows the electronics manufacturer to analyze and compare packaging costs across different product lines. This analysis can help the company assess whether certain packaging designs are more cost-effective or if bulk purchasing could reduce costs. Ultimately, this empowers the manufacturer to make strategic decisions that align with cost efficiency and profitability.

Factors Affecting Unit Cost

Several factors can influence the unit cost, shaping cost structures and operational efficiencies. Let's explore these in detail:

Economies of Scale

- Economies of scale occur when the cost per unit decreases as production volume increases. By producing or procuring larger quantities, fixed costs like machinery and equipment are spread over more units, leading to lower average costs. This phenomenon is especially evident in B2B scenarios, where bulk orders can result in cost advantages.

Production Volume and Capacity Utilization

- Higher production volumes generally lead to lower unit costs due to the spreading of fixed costs. Additionally, maximizing capacity utilization ensures that resources are used optimally, minimizing idle time and reducing costs per unit.

Input Prices and Supplier Relationships

- For example, a rise in raw material costs can lead to an increase in the cost per unit. Strong supplier relationships can help negotiate favorable terms, stabilize prices, and secure discounts, ultimately influencing the unit cost.

Process Efficiency and Technology

- Efficient production processes driven by technology can significantly lower unit costs. Automation, streamlined workflows, and lean practices reduce labor and time requirements, enhancing efficiency. Investments in innovative technologies can lead to long-term cost savings.

Unit Cost in Different Industries

Unit cost manifests uniquely across various industries, reflecting the specific intricacies and dynamics of each sector. Let's explore how unit cost operates in a few distinct industries.

Manufacturing

- In manufacturing, the unit cost helps assess production efficiency. It includes expenses for raw materials, direct labor, machinery, and other production-related costs. Calculating unit costs aids manufacturers in setting pricing strategies, optimizing production volumes, and identifying cost-saving opportunities.

Retail

- For retailers, the unit cost is the expense of procuring products for resale. It includes the cost of goods purchased from suppliers, shipping, handling, and potential markups. The unit cost guides pricing decisions, ensuring competitive yet profitable pricing structures for better financial health.

Service

- In the service sector, the unit cost represents the price of delivering a single service. It includes employee wages, time spent, and overhead costs related to service provision. Understanding unit costs helps service providers evaluate service packages and set appropriate pricing.

Healthcare

- In healthcare, the unit cost pertains to providing medical care. It includes expenses for patient treatment, such as personnel, medical supplies, facility maintenance, and administrative costs. Analyzing unit costs helps healthcare institutions balance quality patient care with financial sustainability.

Technology

- The technology sector involves the production or procurement of tech products, from software licenses to hardware components. For example, in software development, cost analysis factors in coding time, testing efforts, and potential licensing fees. Understanding these costs is essential for product pricing and profitability assessment.

Construction

- For construction companies, the unit cost covers everything from materials to direct labor and equipment required for building projects. Assessing these costs helps in project estimation, budgeting, and bidding strategies.

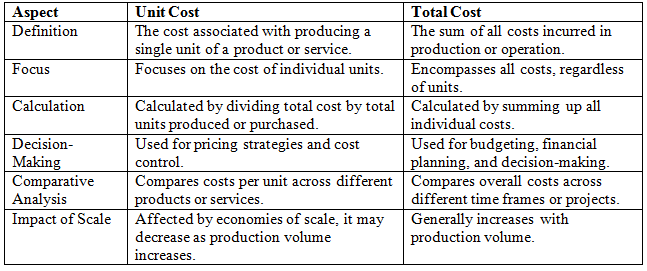

Difference between unit cost and total cost

Let’s delve into the key differences between the two concepts.

Best Practices for Effective Unit Cost Management

Effective management of unit costs aids in making prudent financial decisions and achieving operational excellence. Here are some best practices to guide you:

Detailed Cost Tracking:

- Maintain a comprehensive record of all production, procurement, and operational costs, including direct, indirect, fixed, and variable costs. Accurate cost tracking provides a solid foundation for cost analysis.

Regular Analysis and Review:

- Regularly review and update your cost calculations to reflect changes in input prices, production volumes, and market conditions. Timely analysis helps identify trends, anomalies, and areas for improvement.

Accurate Allocation of Costs:

- Ensure costs are accurately allocated to the appropriate units or products. Misallocation can lead to distorted insights and erroneous decision-making. Use precise cost allocation methods that align with your organization’s operations.

Benchmarking and Industry Comparisons:

- Benchmark your unit costs against industry standards and competitors. This provides insights into your cost competitiveness and highlights areas where adjustments may be needed to remain competitive.

Consider Economies of Scale:

- Strategically leverage economies of scale by optimizing production volumes. Bulk purchasing and higher production quantities often lead to lower costs due to the spreading of fixed expenses.

Supplier Collaboration:

- Develop strong relationships with suppliers. Effective collaboration can lead to favorable terms, discounts, and stable pricing, positively influencing costs.

Process Efficiency Improvements:

- Focus on enhancing operational efficiency by streamlining processes, reducing waste, and exploring technology-driven solutions to lower labor and time requirements.

Pricing Strategy Alignment:

- Ensure your pricing strategies align with the unit costs. Avoid underpricing, which can erode profitability, and overpricing, which can deter customers. Your pricing should reflect both cost realities and market demand.

Scenario Analysis:

- Conduct scenario analysis to assess the impact of changes in variables such as input prices, production volumes, and market demand on unit costs. This proactive approach helps you plan for different eventualities.

Limitations and Challenges of Unit Cost Analysis

While unit cost analysis is a valuable tool for financial decision-making, it’s important to recognize its limitations and challenges. Awareness of these constraints ensures a balanced perspective in the analysis.

Here are some challenges to consider:

Simplification of Costs

- The analysis might oversimplify the complex nature of costs by aggregating various components into a single figure, ignoring nuances and intricacies within different cost categories.

Ignoring Fixed Costs

- The analysis often focuses on variable costs, potentially overlooking fixed costs that remain constant irrespective of production volume. Ignoring fixed costs can lead to incomplete insights.

Changing Cost Structures

- Unit costs can change rapidly due to fluctuations in input prices, technological advancements, or shifts in market conditions. This dynamic nature requires continuous monitoring and adjustment.

Does Not Consider Revenue

- The analysis doesn’t directly consider revenue generation. A product with a low unit cost might not be profitable if its sales price doesn’t cover other expenses and provide a reasonable gross profit margin.

Neglecting Quality and Value

- Solely focusing on unit costs could compromise product quality or perceived value. Cutting costs without considering quality implications can harm customer satisfaction and brand reputation.

Incomplete Allocation Methods

- Allocating costs to specific units or products might involve assumptions that don’t accurately represent the actual consumption of resources, leading to skewed figures.

Difficulty in Cross-Industry Comparisons

- Comparing costs across different industries can be challenging due to variations in production processes, resource requirements, and market dynamics.

Limited in Strategic Decision-Making

- While valuable for short-term decisions, unit cost analysis might not be sufficient for complex strategic choices that require a broader perspective and consideration of long-term implications.

Complexity in Overhead Allocation

- Allocating indirect costs, particularly overhead, can be complex. Various methods exist, each with pros and cons, making it challenging to choose the most accurate approach.

Doesn’t Capture External Factors

- The analysis often focuses on internal factors within a business and might not capture external factors like regulatory changes and macroeconomic shifts that can impact costs.

|

24 videos|50 docs|17 tests

|

FAQs on Unit Cost: What is it, Types Formula, Calculation & Applications - Cost and Management Accounting for CA Intermediate

| 1. What is unit cost in business? |  |

| 2. What are the types of unit cost? |  |

| 3. How is unit cost calculated? |  |

| 4. What are the applications of unit cost in business? |  |

| 5. How can businesses use unit cost to improve their operations? |  |

|

24 videos|50 docs|17 tests

|

|

Explore Courses for CA Intermediate exam

|

|