Uttar Pradesh Budget Analysis 2024-25 | Course for UPPSC Preparation - UPPSC (UP) PDF Download

| Table of contents |

|

| UP Budget 2024-25 |

|

| Uttar Pradesh’s Economy |

|

| Budget Estimates for 2024-25 |

|

| Expenditure in 2024-25 |

|

| Receipts in 2024-25 |

|

| Outstanding Government Guarantees |

|

UP Budget 2024-25

The Finance Minister of Uttar Pradesh, Mr. Suresh Kumar Khanna, presented the budget for the financial year 2024-25 on February 5, 2024.

Budget Highlights

GSDP Projection: The Gross State Domestic Product (GSDP) of Uttar Pradesh for 2024-25 (at current prices) is projected at Rs 24,99,076 crore, with a growth rate of 5.8% over 2023-24.Expenditure:

- Total expenditure (excluding debt repayment) is estimated at Rs 6,96,632 crore, a 14% increase over the revised estimates of 2023-24.

- Additionally, the state will repay a debt of Rs 39,806 crore.

Receipts:

- Receipts (excluding borrowings) for 2024-25 are estimated to be Rs 6,10,101 crore, representing a 15% increase from the revised estimate of 2023-24.

Revenue Surplus:

- Estimated at 3% of GSDP (Rs 74,147 crore) for 2024-25, similar to the revised estimates for 2023-24. In 2022-23, the state had a revenue surplus of 1.7%.

Fiscal Deficit:

- Targeted at 3.46% of GSDP (Rs 86,531 crore) for 2024-25. For 2023-24, the fiscal deficit is expected to be 3.49% of GSDP, as per revised estimates.

Policy Highlights

Women and Child Welfare:

- Rs 4,073 crore allocated for the welfare of widows.

- Rs 5,129 crore allocated for providing nutritious food to women and children.

Youth Empowerment:

- Under the Swami Vivekananda Youth Empowerment Scheme, smartphones and tablets will be distributed.

- Rs 4,000 crore allocated for the initiative, with 25 lakh tablets already distributed.

Green Energy:

- The government signed a Rs 4,000 crore MoU with Hero Future Energies to invest in clean and renewable energy.

- A target to increase forest and tree cover by 15% by 2030 has been set.

Power Subsidy:

- Rs 2,400 crore allocated to ensure uninterrupted power supply to private tubewells used by farmers.

Agriculture:

- Three new schemes to promote agriculture in gram panchayats:

- State Agriculture Development Scheme

- World Bank Assisted UP Agri Scheme

- Automatic Weather Station-Automatic Rain Gauge Scheme

- Total allocation under these schemes: Rs 460 crore.

Housing:

- Under the Chief Ministers’ Urban Expansion/New Cities Initiative, Rs 3,000 crore has been allocated for the development of new townships.

This budget aims at a balanced approach, focusing on economic growth, welfare schemes, green energy, and infrastructure development, while managing the fiscal deficit within sustainable limits.

Uttar Pradesh’s Economy

GSDP Growth:- In 2022-23, Uttar Pradesh's GSDP (at constant prices) grew by 8.3%, compared to a growth of 10.2% in 2021-22.

- National GDP growth in 2022-23 is estimated at 7.2%.

Sectoral Contribution:

- Agriculture: Grew by 10% in 2022-23 (at current prices), compared to 14% in 2021-22. The growth in 2021-22 was over a low base.

- Manufacturing: The sector saw robust growth of 22% in 2022-23.

- Services: Grew by 12% in 2022-23.

In 2022-23, the estimated sectoral contribution to the economy (at constant prices) is as follows:

- Agriculture: 24%

- Manufacturing: 30%

- Services: 46%

Per Capita GSDP:

In 2022-23, the per capita GSDP of Uttar Pradesh (at current prices) is estimated at Rs 96,193, reflecting an annual growth of 8% since 2017-18.

This reflects the state's focus on a balanced growth trajectory across sectors, with notable progress in manufacturing and services while maintaining a strong agricultural base.

Budget Estimates for 2024-25

- Total expenditure (excluding debt repayment) in 2024-25 is targeted at Rs 6,96,632 crore. This is an increase of 14% over the revised estimate of 2023-24. This expenditure is proposed to be met through receipts (excluding borrowings) of Rs 6,10,101 crore and net borrowings of Rs 71,427 crore. Total receipts for 2024-25 (other than borrowings) are expected to register an increase of 15.4% over the revised estimate of 2023-24.

- Revenue surplus in 2024-25 is estimated to be 3% of GSDP (Rs 74,147 crore), roughly the same as the revised estimates for 2023-24. Revenue surplus in 2022-23 was 1.7% of the GSDP. Fiscal deficit for 2024-25 is targeted at 3.46% of GSDP (Rs 86,531 crore), marginally lower than the revised estimates for 2023-24 (3.49% of GSDP).

Table 1 : Budget 2024-25 - Key figures (in Rs crore)

Note: BE is Budget Estimates; RE is Revised Estimates.

Sources: Annual Financial Statement, Uttar Pradesh Budget 2024-25; PRS.

Expenditure in 2024-25

Revenue Expenditure:

- The revenue expenditure for 2024-25 is projected at Rs 5,32,655 crore, which represents a 17% increase compared to the revised estimates of 2023-24.

- This expenditure covers salaries, pensions, interest payments, grants, and subsidies.

- A 62% increase is projected for the revenue component of the education sector in 2024-25.

Capital Outlay:

- The capital outlay, which represents expenditure on asset creation, is expected to be Rs 1,54,747 crore for 2024-25, marking a 6% increase over the revised estimate for 2023-24.

Loans and Advances:

- Loans and advances by the state are expected to be Rs 9,229 crore in 2024-25, a 9% decrease from the revised estimates of 2023-24.

Subsidy Expenditure

Total Subsidies:

- Uttar Pradesh has allocated Rs 28,000 crore for subsidies in 2024-25, which accounts for 5% of the state’s revenue receipts.

- Subsidy expenditure has remained between 4-6% of revenue receipts since 2018-19.

Future Projections:

- Subsidy expenditure is expected to rise to Rs 37,268 crore by 2027-28, maintaining about 4% of revenue receipts.

Subsidy Trends:

- In 2021-22, subsidies increased sharply by 73% to Rs 20,145 crore, driven primarily by higher subsidies for the power sector.

- In 2021-22, compensatory grants of Rs 13,388 crore were given to the Uttar Pradesh Power Corporation Limited (UPPCL), with the power sector accounting for 76% of the state’s total subsidy expenditure.

Table 2 : Expenditure budget 2024-25 (in Rs crore)

Sources: Annual Financial Statement, Uttar Pradesh Budget 2024-25; PRS.

Committed expenditure

Committed expenditure of a state typically includes expenditure on payment of salaries, pensions, and interest. A larger proportion of budget allocated for committed expenditure items limits the state’s flexibility to decide on other expenditure priorities such as capital outlay. In 2024-25, Uttar Pradesh is estimated to spend Rs 3,21,021 crore on committed expenditure, which is 53% of its estimated revenue receipts. This comprises spending on salaries (30% of revenue receipts), pension (14%), interest payments (9%). In 2023-24, the revised estimate for salary expenditure is estimated to be 23% lower than the budget estimate. However, it is projected to be 42% higher in 2024-25. Committed expenditure was Rs 2,21,041 crore in 2022-23, 53% of the revenue receipts.

Table 3 : Committed Expenditure in 2024-25 (in Rs crore)

Sources: Annual Financial Statement, Uttar Pradesh Budget 2024-25; PRS.

Sector-wise expenditure: The sectors listed below account for 60% of the total expenditure on sectors by the state in 2024-25. A comparison of Uttar Pradesh’s expenditure on key sectors with that by other states is shown in Annexure 1.

Table 4 : Sector-wise expenditure under Uttar Pradesh Budget 2024-25 (in Rs crore)

Sources: Annual Financial Statement, Uttar Pradesh Budget 2024-25; PRS.

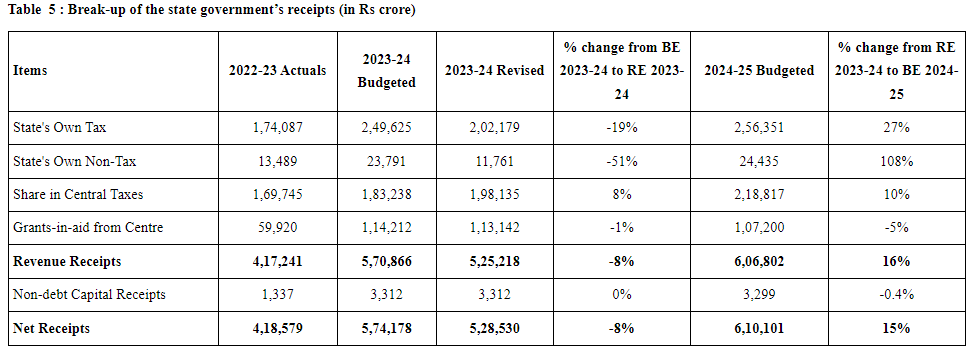

Receipts in 2024-25

Total revenue receipts for 2024-25 are estimated to be Rs 6,06,802 crore, an increase of 16% over the revised estimate of 2023-24. Of this, Rs 2,80,786 crore (46%) will be raised by the state through its own resources, and Rs 3,26,017 crore (54%) will come from the centre. Resources from the centre include state’s share in central taxes (36% of revenue receipts) and grants (18% of revenue receipts).

Devolution: In 2024-25, state’s share in central taxes is estimated at Rs 2,18,817 crore, an increase of 10% over the revised estimate of 2023-24.

Grants from the centre in 2024-25 are estimated at Rs 1,07,200 crore, a decrease of 5% over the revised estimates for 2023-24.

State’s own tax revenue: Uttar Pradesh’s total own tax revenue is estimated to be Rs 2,56,351 crore in 2024-25, an increase of 27% over the revised estimate of 2023-24. Own tax revenue as a percentage of GSDP is estimated at 10.3% in 2024-25, higher than the revised estimates for 2023-24 (8.6%). As per the actual figures for 2022-23, own tax revenue as a percentage of GSDP was 7.7%.

BE is Budget Estimates; RE is Revised Estimates.

Sources: Annual Financial Statement, Uttar Pradesh Budget 2024-25; PRS.

- In 2024-25, State GST is estimated to be the largest source of own tax revenue (39% share). SGST revenue is estimated to increase by 30% over the revised estimates of 2023-24. However, SGST revenue is estimated to be 19% lower in 2023-24, over that year’s budget estimates.

- Revenue from Stamps Duty and Registration fees in 2024-25 is expected to see a 30% increase over the revised estimates of 2023-24. The revised estimate was 21% lower than budget estimates for 2023-24.

Table 6 : Major sources of state’s own-tax revenue (in Rs crore)

Deficits, Debt, and FRBM Targets for 2024-25

Deficits, Debt, and FRBM Targets for 2024-25

The Uttar Pradesh Fiscal Responsibility Act, 2004 mandates the state to progressively reduce outstanding liabilities, revenue deficit, and fiscal deficit.

Fiscal Deficit

- Fiscal Deficit is the excess of total expenditure over total receipts, typically filled by government borrowings, which increase the total liabilities.

- For 2024-25, the fiscal deficit is projected to be 3.46% of GSDP.

- The central government has allowed states a fiscal deficit of up to 3% of GSDP, with an additional 0.5% available if states undertake power sector reforms.

- In 2023-24, the fiscal deficit is estimated to be 3.5% of GSDP (as per revised estimates), similar to the original budget estimate.

- Fiscal deficit is expected to decrease to 2.8% of GSDP by 2027-28.

Revenue Surplus

- Revenue Surplus is the difference between revenue expenditure and revenue receipts. It indicates whether the state’s current revenue can meet its operational needs.

- For 2024-25, the state is expected to have a revenue surplus of Rs 74,147 crore (or 3% of GSDP).

- A revenue surplus along with a fiscal deficit suggests that state borrowings are likely to be directed towards creating capital assets, rather than covering operational shortfalls.

Impact of Discom Losses and Debt on State Finances

- The poor financial health of power distribution companies (discoms) in Uttar Pradesh poses a risk to state finances.

- In 2021-22, Uttar Pradesh discoms reported financial losses of Rs 6,492 crore.

- Besides financial losses, the state also bears contingent liabilities due to outstanding debt of discoms. As of March 2022, discom debt stood at 4.2% of GSDP.

- Historical schemes like UDAY transferred discom losses to the state, increasing debt and deficit.

Borrowing Guarantees

- States often guarantee loans taken by other entities. As of March 2023, Uttar Pradesh had guaranteed outstanding borrowings worth Rs 1,65,557 crore, equivalent to 7% of its GSDP.

- Of this, 74% of the guarantees were allocated to the power sector.

- The central government has advised states to limit incremental guarantees to 0.5% of GSDP.

Outstanding Government Guarantees

State governments often guarantee borrowings by State Public Sector Enterprises (SPSEs) from financial institutions. These guarantees are contingent liabilities, meaning they may need to be honored by the state in case of default.

- As of March 31, 2023, Uttar Pradesh's outstanding guarantees are estimated at Rs 1,65,557 crore, which is approximately 7% of the state's GSDP for 2022-23.

- A substantial portion (79%) of these guarantees is allocated to the power sector.

Annexure 1: Comparison of States' Expenditure on Key Sectors (2024-25)

The following is a comparison of Uttar Pradesh's sectoral expenditure with the average expenditure by 31 states based on their budget estimates for 2023-24.

Education:

- Uttar Pradesh has allocated 14.6% of its total expenditure to education in 2024-25.

- This is close to the average 14.7% allocation by other states.

Health:

- Uttar Pradesh's health expenditure stands at 6.2% of its total budget, which is the same as the national average of 6.2%.

Rural Development:

- 5.2% of Uttar Pradesh's expenditure is devoted to rural development, slightly higher than the average allocation of 5%.

Energy:

- Uttar Pradesh has allocated 6.7% of its expenditure to the energy sector, which is higher than the national average of 4.7%.

Agriculture:

- The state has allocated 3.1% towards agriculture, which is significantly lower than the national average of 5.9%.

Roads and Bridges:

- Uttar Pradesh has earmarked 5.9% for roads and bridges, which is higher than the average allocation of 4.6% by other states.

This sectoral analysis shows that Uttar Pradesh prioritizes infrastructure (energy, roads) and rural development but lags behind in agriculture investment compared to other states.

|

113 videos|360 docs|105 tests

|

FAQs on Uttar Pradesh Budget Analysis 2024-25 - Course for UPPSC Preparation - UPPSC (UP)

| 1. उत्तर प्रदेश का 2024-25 का बजट कितने रुपये का है ? |  |

| 2. उत्तर प्रदेश के बजट में मुख्य व्यय क्षेत्र कौन से हैं ? |  |

| 3. 2024-25 के बजट में राज्य सरकार की आय के प्रमुख स्रोत क्या हैं ? |  |

| 4. उत्तर प्रदेश सरकार के द्वारा जारी किए गए गारंटी की स्थिति क्या है ? |  |

| 5. उत्तर प्रदेश के बजट 2024-25 में किस क्षेत्र पर विशेष ध्यान दिया गया है ? |  |

|

Explore Courses for UPPSC (UP) exam

|

|