Very Short Answer Questions - Basic Accounting Terms - Commerce PDF Download

Q1. What is a Cash Transaction?

A cash transaction is a financial transaction or event that has been settled in cash.

Q2. What is a Credit Transaction?

A credit transaction is a financial transaction or event that has not been settled in cash, i.e., is agreed to be settled later.

Q3. Briefly explain Expenditure.

Expenditure is the amount spent or liability incurred for acquiring assets, goods, or services.

Q4. Briefly explain the term 'Goods'.

Goods are the physical items of trade.

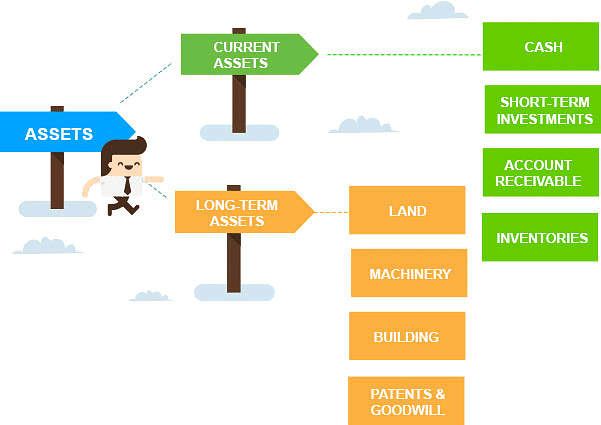

Q5. What are Assets?

An asset is a property (land, machine, goods, patents, etc.) or legal right (patents, copyright, etc.) owned by an individual or business which can be measured in money terms.

Q6. What are Fixed Assets?

Fixed Assets are the assets that are acquired not with the purpose of reselling but with the purpose of increasing the earning capacity of the business.

Q7. Name four Fixed Assets.

The four fixed assets are Land, Building, Plant and Machinery, and Computers.

Q8. What are Current Assets?

Current Assets include Cash and other assets which are expected to be converted into Cash within a short period (normally within one year).

Q9. Give two examples of Current Assets.

(i) Cash

(ii) Stock

Q10. Briefly explain Tangible Assets.

Tangible Assets are assets that have a physical existence, i.e., they can be seen and touched.

Q11. Give two examples of Tangible Assets.

(i) Land and Building

(ii) Stock

Q12. Briefly explain Intangible Assets.

Intangible Assets are assets that do not have a physical existence, i.e. they cannot be seen or touched.

Q13. Give two examples of Intangible Assets.

(i) Goodwill

(ii) Prepaid Expenses

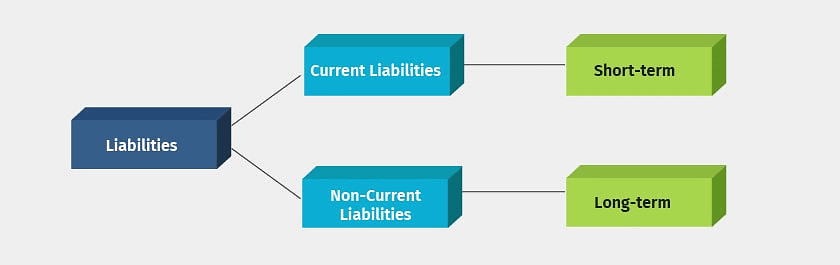

Q14. What are Liabilities?

It refers to the amount which the firm owes to outsiders (expecting the amount owed to proprietors).

Q15. What are the main classes of Liabilities?

Non-current Liabilities and Current Liabilities.

Q16. What are Current Liabilities?

Current liabilities refer to those liabilities which are to be paid in near future (normally within one year).

Q17. Give two examples of Current Liabilities.

(i) Creditors

(ii) Bills Payable

Q18. Name two Long-term Liabilities.

Long-term loans and Debentures.

Q19. What is a Capital?

Capital is the amount invested by the proprietor or the partner in the business.

Q20. Who is a Debtor?

A debtor is a person who owes an amount to the business on account of credit sales of goods or services.

Q21. Who is a Creditor?

A creditor is a person to whom an amount is owed on account of credit purchases of goods or services.

Q22. What are Drawings? Or define Drawings with examples.

Drawings are the amount of money or value of goods that the proprietor or partner withdraws for personal use. For example, withdrawal of cash by the proprietor for personal use.

Q23. Define Voucher.

A voucher is evidence of a business transaction. A voucher is a document on the basis of which transactions are first recorded in the books.

Q24. Define Merchandise.

Merchandise means goods for resale.

Q25. What is an expense?

Expense is the cost incurred in production and selling the goods and services.

Q26. What is Revenue? Or define Revenue with an example.

Revenue is the amount that, as a result of operations, is added to capital. For example, Cash Sales.

Q27. What is income?

Excess revenue over expenses is called income.

Income = Revenue - Expenses

Q28. A firm earns revenue of Rs.21,000, and the expenses to earn this revenue are Rs.15,000. Calculate its income.

Income = Revenue - Expense

= Rs.21,000 - Rs.15,000

= Rs.6,000

Q29. What is meant by Purchases?

The term purchases are used for buying goods for resale or use in the manufacturing process. the term purchases includes both Cash and Credit purchases of goods.

Q30. What is meant by Sales?

The term sales are used for the amount of sale of goods and services rendered. The term sales include both Cash and Credit Sales.

Q31. What is Trade Discount?

When a discount is allowed by a seller to its customers at a fixed percentage on the list or catalog price of the goods, it is called a trade discount. It is not recorded in the books of accounts.

Q32. What is Cash Discount?

When a discount is allowed to the customers for making a prompt payment, it is called a cash discount. It is always recorded in the books of accounts.

FAQs on Very Short Answer Questions - Basic Accounting Terms - Commerce

| 1. What is accounting? |  |

| 2. What are the basic accounting terms? |  |

| 3. What is the difference between assets and liabilities? |  |

| 4. Why is accounting important for businesses? |  |

| 5. What are the different financial statements in accounting? |  |