Working Capital Management | Crash Course for UGC NET Commerce PDF Download

Introduction

Working capital management is a business approach focused on optimizing a company's working capital, which is the remaining capital after accounting for current liabilities. It ensures operational efficiency by effectively monitoring and utilizing current assets and liabilities. The effectiveness of this management can be measured through ratio analysis.

Key Points:

- Working capital management focuses on overseeing assets and liabilities to maintain enough cash flow for short-term operational expenses and debt obligations.

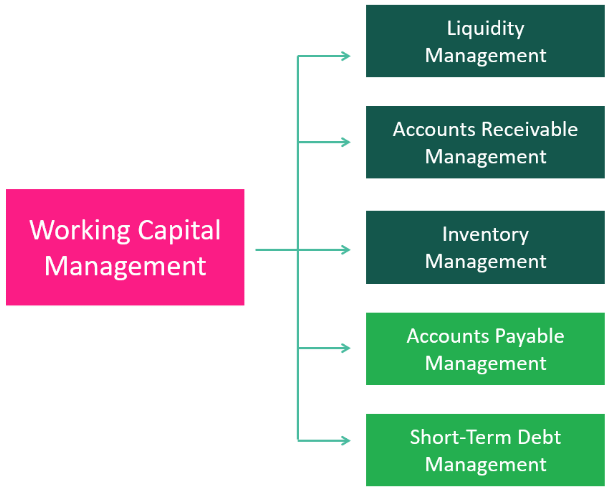

- The core components include managing accounts receivable, accounts payable, inventory, and cash.

- It relies on tracking key ratios like the working capital ratio, collection ratio, and inventory ratio.

- Efficient working capital management enhances cash flow and improves earnings quality by maximizing resource use.

- However, it can be affected by market fluctuations and may sometimes prioritize short-term gains at the expense of long-term goals.

Understanding Working Capital Management

Working capital serves as a vital indicator of a company's immediate financial health, calculated as the variance between its current assets and current liabilities. In essence, it represents the capital available once all short-term debts are settled. Working capital management embodies the strategies employed by companies to regulate their remaining cash reserves.

Current Assets and Liabilities:

Current assets encompass assets that can be swiftly converted into cash within a year, constituting highly liquid assets. Examples include cash, accounts receivable (AR), inventory, and short-term investments.

On the other hand, current liabilities denote obligations due within the subsequent 12 months, like accruals for operational expenses and imminent payments of long-term debts.

Purpose of Working Capital Management:

The principal objective of working capital management is to ensure that a company sustains enough cash flow to cover its short-term operational expenses and debt commitments. It is calculated by subtracting current liabilities from current assets.

Note: Working capital management involves monitoring cash flow, current assets, and current liabilities through ratio analysis. Some key ratios include the working capital ratio, collection ratio, and inventory turnover ratio.

Key Components of Working Capital Management

Cash Management:- Cash is at the core of working capital management, involving the monitoring of cash flow, forecasting cash needs, and optimizing inflows and outflows to ensure adequate liquidity.

- It is crucial to keep track of all cash accounts, while paying attention to any restricted or time-bound deposits.

Receivables Management:

- Managing receivables is essential for companies in the short term as they await the completion of credit sales.

- This includes setting and monitoring credit policies, tracking customer payments, and enhancing collection practices.

- Ultimately, completing a sale is futile if payment collection is ineffective.

Accounts Payable Strategies:

- Accounts payable form a crucial part of working capital management, offering companies a controllable aspect compared to other components.

- Companies can influence when and how payments are made, credit terms negotiated with suppliers, and cash outlay timing.

Inventory:

- Inventory is a critical component in working capital management for companies, often posing significant risks. When companies sell inventory, they depend on market demand and consumer preferences to convert it into cash. If this process is not swift, the company might find its short-term resources tied up in assets that are not easily convertible to cash. On the other hand, rapid sales of inventory may require substantial price reductions, impacting profitability.

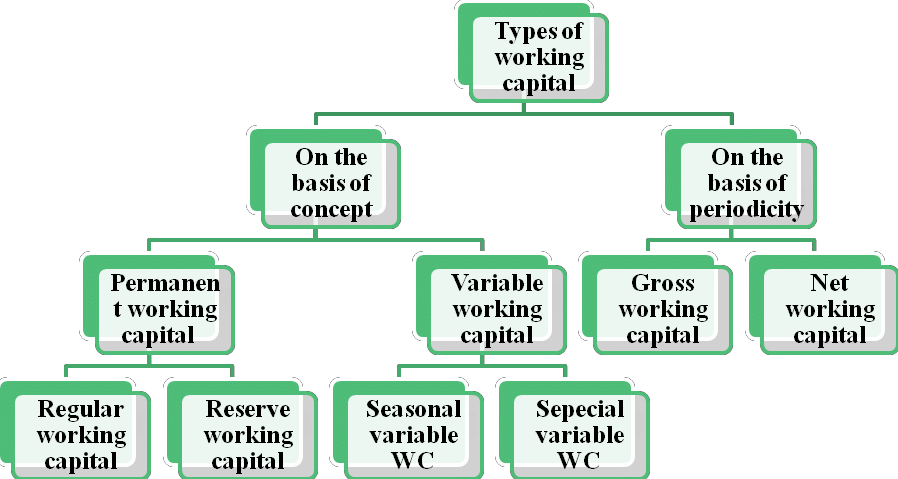

Types of Working Capital

In simple terms, working capital is the difference between a company's current assets and current liabilities. However, different types of working capital are essential for understanding a company's short-term needs.

Permanent working capital: This is the minimum level of resources a company needs to maintain continuous operations without disruption. It represents the essential short-term resources required for ongoing activities.

Regular working capital: A subset of permanent working capital, regular working capital refers to the portion needed for daily operations and forms the core part of permanent working capital.

Reserve working capital: Another component of permanent working capital, reserve working capital provides extra resources for emergencies, seasonal variations, or unforeseen events.

Fluctuating working capital: This refers to the variable portion of working capital that changes based on company needs. For example, while inventory costs fluctuate, a company may have fixed monthly liabilities, such as insurance, that are non-negotiable. Fluctuating working capital focuses on variable liabilities the company can fully control.

Gross working capital: This is the total amount of a company's current assets, without considering its short-term liabilities.

Net working capital: This is the difference between current assets and current liabilities.

Why Manage Working Capital?

- Working capital management plays a crucial role in enhancing a company's cash flow and improving the quality of earnings by effectively utilizing its resources.

- It encompasses various aspects such as inventory management, accounts receivable, and accounts payable.

- An essential part of working capital management is strategically timing accounts payable, such as extending payment periods to suppliers, which helps in conserving cash and leveraging available credit effectively.

- Besides ensuring that the company has sufficient cash to meet its financial obligations, the primary goals of working capital management include reducing the cost associated with maintaining working capital and maximizing returns on asset investments.

Working Capital Management Ratios

Three key ratios in working capital management are the working capital ratio, the collection ratio, and the inventory turnover ratio.

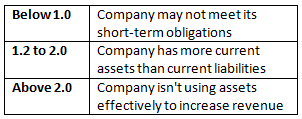

Working Capital Ratio

Also known as the current ratio, this is calculated by dividing current assets by current liabilities. It serves as a key measure of a company’s financial stability by showing its ability to meet short-term obligations.

A working capital ratio below 1.0 suggests that a company may struggle to cover its short-term debts, as its short-term liabilities exceed its short-term assets. In such cases, the company might need to sell long-term assets or secure external financing to meet its obligations.

A working capital ratio between 1.2 and 2.0 is generally seen as optimal, indicating that the company has more current assets than liabilities. However, a ratio above 2.0 may signal inefficiency, suggesting that the company is not using its assets effectively to drive growth. For instance, having excess cash on hand could indicate missed opportunities to invest in growth initiatives.

Collection Ratio (Days Sales Outstanding)

The collection ratio, also known as days sales outstanding (DSO), measures how efficiently a company manages its accounts receivable. It is calculated by multiplying the number of days in the period by the average amount of outstanding accounts receivable, then dividing that by the total net credit sales during the period. The average amount of receivables is typically found by averaging the beginning and ending balances.

This calculation reflects the average number of days it takes for a company to collect payment after a credit sale. The DSO ratio excludes cash sales. If a company’s billing department is effective, it will collect receivables quickly, giving the company quicker access to cash that can be reinvested in growth. A long collection period, on the other hand, effectively means the company is giving creditors interest-free, short-term loans.

Inventory Turnover Ratio

The inventory turnover ratio is another key metric in working capital management. It helps assess how efficiently a company manages its inventory. A company must balance having enough stock to meet customer demand while minimizing costs and avoiding excessive inventory.

The ratio is calculated by dividing the cost of goods sold (COGS) by the average inventory balance, typically found by averaging the beginning and ending inventory levels. This ratio indicates how quickly a company sells and replenishes its inventory. A low ratio compared to industry peers may signal excess inventory, leading to increased costs for insurance, storage, and security. A high ratio, on the other hand, could indicate inadequate inventory levels, risking customer dissatisfaction.

Working Capital Cycle

Alongside these ratios, companies often use the working capital cycle, or cash conversion cycle (CCC), to manage their working capital. This cycle represents the time it takes to convert net current assets and liabilities into cash. The formula is:

Working Capital Cycle (in days) = Inventory Cycle + Receivable Cycle - Payable Cycle

This cycle measures the time from when a company pays for raw materials or inventory to when it receives payment for the products or services sold. During this period, a company’s resources are tied up in obligations or awaiting conversion to cash.

Inventory Cycle: This is the time taken to acquire raw materials, convert them to finished goods, and store them until sold. During this stage, the company’s cash is tied up in inventory.

Accounts Receivable Cycle: This refers to the time it takes to collect payments from customers after sales. Although the company has parted with inventory, its working capital is tied up in accounts receivable until credit sales are collected.

Accounts Payable Cycle: This measures the time it takes to pay suppliers for goods or services received. This stage offers a short-term loan from suppliers, allowing the company to hold onto cash for longer, though it creates a liability that must be managed.

Limitations of Working Capital Management

Effective working capital management ensures a company has enough capital to operate and grow. However, it focuses only on short-term assets and liabilities, sometimes sacrificing long-term strategies for short-term benefits. Even with proper practices, working capital management cannot predict future market conditions, and unexpected changes in customer behavior, supply chain disruptions, or macroeconomic factors may affect forecasts.

Additionally, while managing working capital helps avoid financial trouble, it doesn’t inherently increase profitability, enhance product desirability, or boost market position. To improve the bottom line, companies must focus on growth strategies and cost control, with working capital management complementing these efforts.

What is Working Capital Management?

Working capital management aims to optimize the use of a company’s current assets and liabilities. The goal is to maintain sufficient cash flow to meet short-term operating costs and debt obligations while maximizing profitability. It plays a critical role in the cash conversion cycle, which measures the time it takes to turn working capital into usable cash.

Why is the Current Ratio Important?

The current ratio, also known as the working capital ratio, assesses a company’s ability to meet short-term obligations and is a key measure of liquidity. A ratio below 1.0 suggests short-term debts exceed current assets, potentially signaling financial trouble.

Why is the Collection Ratio Important?

The collection ratio (DSO) measures how effectively a company collects its accounts receivable. A lengthy collection period can indicate insufficient cash flow to meet immediate obligations, which is a key focus of working capital management.

Why is the Inventory Ratio Important?

The inventory turnover ratio shows how effectively a company manages its inventory. A low ratio suggests excess inventory, while a high ratio may indicate insufficient stock to meet demand.

The Bottom Line

Working capital management is essential to business operations. Without enough capital, companies cannot pay bills, process payroll, or invest in growth. Analyzing liquidity ratios helps ensure that short-term cash needs are consistently met, allowing for smoother operations and a stronger financial position.

|

214 videos|236 docs|166 tests

|

FAQs on Working Capital Management - Crash Course for UGC NET Commerce

| 1. What are the key components of working capital management? |  |

| 2. How can a company improve its working capital management? |  |

| 3. Why is working capital management important for businesses? |  |

| 4. What are some common working capital management metrics used by companies? |  |

| 5. How does working capital management impact a company's financial performance? |  |