Worksheet: Depreciation, Provisions and Reserves | Accountancy Class 11 - Commerce PDF Download

Fill In The Blanks

Q1: Depreciation is a non- cash expenditure because it does not involve any ____.

Q2: Land is not depreciated as its useful life is ____.

Q3: Depletion is done in case of _____.

Q4: The amount of depreciation charged on machinery is debited to _____.

Q5: Providing depreciation reduces the amount of profit available for _____.

Q6: Depreciation is a process of ______.

Q7: In the event of an asset being sold, a new account titled ______ is opened.

Q8: The asset which is an exception from depreciation is _________.

Q9: The book value of an asset is Rs. 85,000 and the original cost is Rs.1,00,000. If the asset is sold at a loss of Rs. 8000, the sale proceeds will be _________.

Q10: The book value of an asset is Rs. 93,000 and the original cost is Rs. 1,20,000. After earning a profit of Rs. 5000, the asset is sold at Rs. ________.

Q11: If the depreciable cost of an asset is Rs. 90,000 and its scrap value is Rs. 9000, then the original cost of an asset is _____.

Q12: Reduction in the book value of an asset over a period of time is called ______.

Q13: Cost of an asset minus scrap value /life of an asset is the formulae for calculating depreciation under _____________ method.

MCQs

Q1: Depreciation is calculated from the date of:

(a) Purchase of an asset

(b) Receipt of an asset at business premises

(c) Asset put to use

(d) Asset installed UND

Q2: Amortisation refers to writing off

(a) Depleting Asset

(b) Wasting asset

(c) Intangible Asset

(d) Fictitious asset Rem

Q3: Which one of the following is not an objective of providing depreciation

(a) For ascertaining the true profit and loss

(b) Showing the True And Fair view of financial statement

(c) For avoiding overpayment of income tax

(d) Depreciation is a gradual and continuing process.

Q4: Depreciation is a

(a) Reserve

(b) Provision

(c) Both a. and b.

(d) None of these

Q5: An asset was purchased for Rs. 1,00,000 and as per Reducing Balance Method, 10 % depreciation is charged every year. What is the value of asset at the end of 4 years.

(a) Rs.65,610

(b) Rs. 65,680

(c) Rs.75,610

(d) Rs.75,630

Q6: The value of machinery as on April1, 2018 is Rs. 64,000 which was purchased on April 1, 2016 for Rs.1,00,000 was sold on October1, 2018 and depreciation charged thereon @ 20% p.a. under Written Down Value Method. The total Depreciation Provided on the Machinery Sold is

(a) Rs. 42,300

(b) Rs.42,400

(c) Rs. 42,000

(d) Rs. 42,600

Q7: This charge is used in case of exhaustion of wasting asset

(a) Depreciation

(b) Amortisation

(c) Depletion

(d) None

Q8: The balance of Machinery Account as on March 31, 2018 is Rs.1,08,000. The machinery was purchased on April 1, 2017. Depreciation is charged @10% p.a. by Diminishing Balance Method. What is the original cost of an asset purchased on April1, 2017.

(a) Rs. 1,30,000

(b) Rs.1,25,000

(c) Rs. 1,20,000

(d) None

Q9: The Written Down Value of an asset after 3 years of depreciation on Reducing Balance Method @20% p.a. is Rs.64,000. Its original cost is:

(a) Rs. 1,25,000

(b) Rs. 1,26,000

(c) Rs. 80,000

(d) None

Q10: Diminishing Value Method means a method by which

(a) The rate of depreciation falls year to year

(b) The amount on which depreciation is calculated falls year to year.

(c) The Rate as well as the amount to which it is applied falls year by year

(d) None of the above Ana

Q11: When an Organisation Follows Written Down value Method , in the Balance sheet the asset will be represented at

(a) Net Book Value

(b) Historical cost

(c) Cost or market price, whichever is less Ana

(d) None

Q12: The loss on sale of asset is debited to

(a) Reserves

(b) Depreciation fund

(c) Profit and Loss Account

(d) None of the Above.

Q13: Which of the following is objective of provision?

(a) To meet anticipated losses and liabilities

(b) To meet unknown losses and liabilities

(c) To hoard funds

(d) None of the above

Q14: Provision is a charge against profit and is created by crediting profit and loss account.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q15: In the balance sheet, the amount of provision may be shown as

(i) by way of deduction from the concerned asset on the assets side.

(ii) on the liabilities side of the balance sheet along with current liabilities.

(a) Only (i)

(b) Only (ii)

(c) Either (i) or (ii)

(d) Neither (i) nor (ii)

Q16: Provisions are created according to the principle of prudence or conservatism.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q17: ____ are the appropriations of profit to strengthen the financial position of the business.

(a) Reserve

(b) Provision

(c) Contingency fund

(d) None of the above

Q18: Reserve is a charge against profit.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q19: Reserves are shown under the head ‘Reserves and Surpluses’ on the liabilities side of the balance sheet.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q20: Which of the following correctly differentiates between provision and reserves?

(a) A provision is a charge against profit whereas reserve is an appropriation of profit.

(b) Provision is made for a known liability or expense the amount of which is not certain whereas reserve is created for strengthening the financial position of the business.

(c) Provision is deducted before calculating taxable profits whereas a reserve is created from profit after tax and therefore it has no effect on taxable profit.

(d) All of the above

Q21: Provision can be used for distribution as dividends.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q22: When the purpose for which reserve is created is not specified, it is called ____.

(a) General reserve

(b) Specific reserve

(c) Revenue reserve

(d) Capital reserves

Q23: General reserve is also termed as free reserve because the management can freely utilise it for any purpose.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q24: ____ is the reserve, which is created for some specific purpose and can be utilised only for that purpose.

(a) General reserve

(b) Specific reserve

(c) Revenue reserve

(d) Capital reserve

Q25: Identify specific reserves from the following

(i) Dividend equalisation reserve

(ii) Provision for depreciation

(iii) Workmen compensation fund

(iv) Investment fluctuation fund

(a) (i) and (iii)

(b) (i) and (ii)

(c) (i), (ii) and (iv)

(d) (i), (iii) and (iv)

Q26: Reserve created for maintaining a stable rate of dividend is termed as………

(a) Dividend equalisation reserve

(b) Provision for depreciation

(c) Workmen compensation fund

(d) Investment fluctuation fund

Q27: ____ are created from revenue/profits which arise out of the normal operating activities of the business and are otherwise freely available for distribution as dividend.

(a) General reserve

(b) Specific reserve

(c) Revenue reserve

(d) Capital reserve

Q28: Capital reserves are created out of capital profits which do not arise from the normal operating activities.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q29: Which of the following does not correctly differentiate between revenue reserve and capital reserve?

(a) Revenue reserve is created out of revenue profits where as capital reserve is created primarily out of capital profit.

(b) Revenue reserve is created to strengthen the financial position, to meet unforeseen contingencies or for some specific purposes.Whereas capital reserve is created for compliance of legal requirements or accounting practices.

(c) Revenue reserve can be utilised only for a specific purpose whereas capital reserve can be utilised for any purpose.

(d) None of the above

Q30: Reserves can be meant for the purpose of

(a) meeting a future contingency

(b) strengthening the general financial position of the business

(c) redeeming a long-term liability

(d) All of the above

Q31: Creation of reserve reduces taxable profits of the business.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q32: ____ is a reserve which does not appear in the balance sheet.

(a) General reserve

(b) Specific reserve

(c) Secret reserve

(d) Capital reserve

Q33: Secret reserve is called such as it is not known to outside stakeholders.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q34: Making excessive provision for doubtful debts builds up the secret reserve in the business.

(a) True

(b) False

(c) Can’t say

(d) Partially true

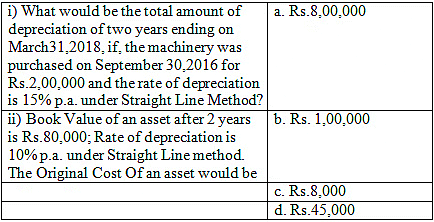

Match The Following

Q1:

Q2:

Q3:

Q4:

Q5:

Q6:

Q7:

Q8:

MCQs

Q1: Direction Read the following case study and answer question on the basis of the same.

Q2: By using which of the following statements would you explain the concept of depreciation to the owner?

(a) Depreciation is a measure of the wearing out, consumption or other loss of value of depreciable asset arising from use, effluxion of time or obsolescence through technology and market-change

(b) Depreciation is a measure of the wearing out, consumption or other loss of value of depreciable asset arising from use or obsolescence

(c) Depreciation is reduction in the value of assets

(d) None of the above

Q3: Which of the following factors that affect the amount of depreciation would you point out to the owner to keep in mind?

(a) Historical cost of asset

(b) Estimated net residual value

(c) Depreciable cost

(d) All of the above

Q4: Using which of the following statement would you explain the importance of straight line method of depreciation to owner?

(a) It results into almost equal burden of depreciation and repair expenses taken together every year on profit and loss account

(b) Income Tax Act accept this method for tax purposes

(c) As a large portion of cost is written-off in earlier years, loss due to obsolescence gets reduced

(d) This method makes it possible to distribute full depreciable cost over useful life of the asset

Q5: Using which of the following statement would you explain the importance of written down value method of depreciation to owner?

(a) This method is suitable for fixed assets which last for long and which require increased repair and maintenance expenses with passage of time

(b) Income Tax Act accepts this method for tax purposes

(c) As a large portion of cost is written-off in earlier years, loss due to obsolescence gets reduced

(d) All of the above

Q6: What will be the amount of depreciation charged annually using straight line method?

(a) Rs50,000

(b) Rs54,000

(c) Rs55,000

(d) None of these

Direction Read the following case study and answer questions on the basis of the same.

On 1st April, 2017, X Ltd. purchased a machinery for Rs 12,00,000. On 1st October, 2019 a part of the machinery purchased on 1st April, 2017 for Rs 80,000 was sold for Rs 45,000 and a new machinery at the cost of Rs 1,58,000 was purchased and installed on the same date. The company has adopted the method of providing 10% p.a. depreciation on the diminishing balance of the machinery. X Ltd. maintains provision for depreciation and machinery disposal account. You are required to answer the following questions.

Q1: Which of the following points need to be kept in mind when provision for depreciation account is maintained?

(a) Asset account continues to appear at its original cost year after year over its entire life

(b) Depreciation is accumulated on a separate account instead of being adjusted in the asset account at the end of each accounting period

(c) Both (a) and (b)

(d) None of the above

Q2: What is the balance carried in the machinery account in March, 2018?

(a) Rs12,00,000

(b) Rs10,80,000

(c) Rs9,60,000

(d) None of these

Q3: What is the accumulated depreciation on the machinery worth Rs 80,000 that was sold?

(a) Rs8,000

(b) Rs7,200

(c) Rs18,440

(d) None of these

Q4: What is the gain or loss on the sale of machinery worth Rs 80,000?

(a) Rs16,560 profit

(b) Rs16,560 loss

(c) Rs35,000 loss

(d) Rs35,000 profit

Q5: Provision for depreciation will be shown as a current asset by X Ltd. in the balance sheet.

(a) True

(b) False

(c) Partially true

(d) Can’t say

|

64 videos|152 docs|35 tests

|

FAQs on Worksheet: Depreciation, Provisions and Reserves - Accountancy Class 11 - Commerce

| 1. What is depreciation? |  |

| 2. How is depreciation calculated? |  |

| 3. What is the purpose of provisions and reserves? |  |

| 4. How are provisions and reserves different from each other? |  |

| 5. What is the impact of depreciation, provisions, and reserves on financial statements? |  |

|

Explore Courses for Commerce exam

|

|