Worksheet: Financial Statements - II | Accountancy Class 11 - Commerce PDF Download

MCQs

Q1: The object of non-trading concerns ______.

(a) Social service

(b) Profit earning

(c) Both of these

(d) None of the above

Q2: Which of the following is recorded in income and expenditure accounts?

(a) Revenue items

(b) Capital items

(c) Revenue and capital items

(d) None of the above

Q3: If the rent of one month is still to be paid, the adjustment entry will be _______.

(a) Debit outstanding rent account and Credit rent account

(b) Debit profit and loss account and Credit rent account

(c) Debit rent account and Credit profit and loss account

(d) Debit rent account and Credit outstanding rent account

Q4: If a person fails to pay his debt, such an amount is considered as ______.

(a) Bad debts

(b) Bad debts recovered

(c) Provision for bad debt

(d) None of the above

Q5: If the insurance premium paid Rs. 1,000 and prepaid insurance Rs. 300. The amount of insurance premium shown in the profit and loss account will be ______.

(a) Rs. 1,300

(b) Rs. 1,000

(c) Rs. 300

(d) Rs. 700

Ans: (d) Rs. 700

Short Answer Questions

Q1: Why do we need adjustments when preparing financial statements?

Q2: What is the accrual basis of accounting?

Q3: What are outstanding expenses?

Q4: What are prepaid expenses?

Q5: What is the effect of not adjusting for accrued incomes?

Numerical Questions

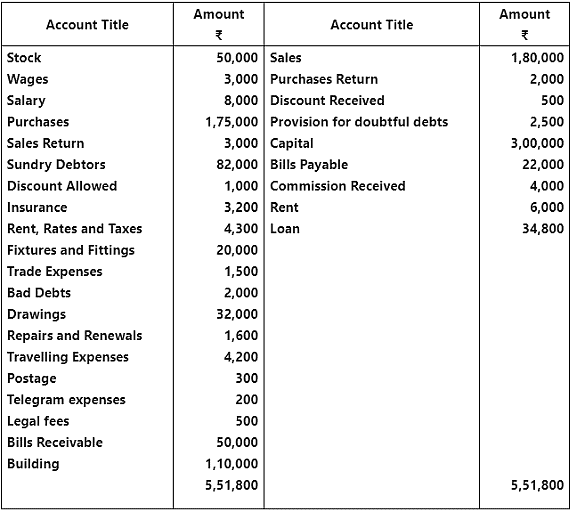

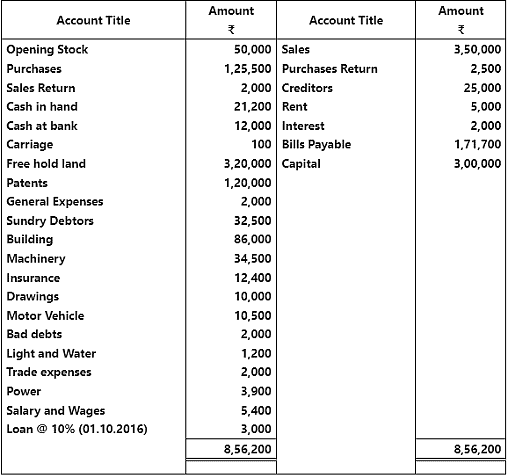

Q1: Prepare a trading and profit and loss account for the year ending March 31, 2017. from the balances extracted of M/s Rahul Sons. Also prepare a balance sheet at the end of the year.

Adjustments:

- The commission received in advance ₹ 1,000.

- Rent receivable ₹ 2,000.

- Salary outstanding ₹ 1,000 and insurance prepaid ₹ 800.

- Further bad debts ₹ 1,000 and provision for doubtful debts @ 5% on debtors and discount on debtors @ 2%.

- Closing stock ₹ 32,000.

- Depreciation on building @ 6% p.a.

Trading and Profit and Loss Account of M/s Rahul Sons for the year ending

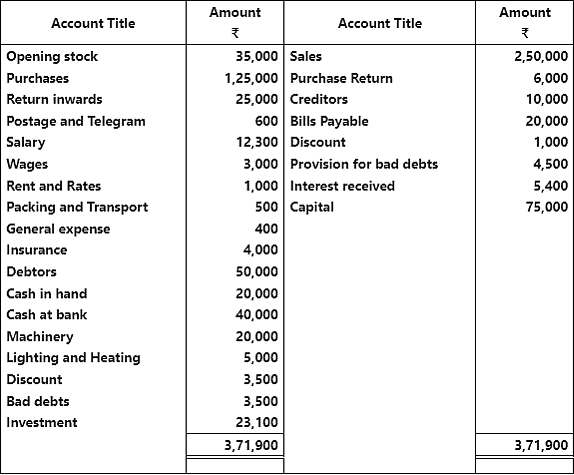

Q2: Prepare a trading and profit and loss account of M/s Green Club Ltd. for the year ending March 31, 2017. from the following figures taken from his trial balance :

Ajustments:

- Depreciation charged on machinery @ 5% p.a.

- Further bad debts ₹ 1,500, discount on debtors @ 5% and make a provision on debtors @ 6%.

- Wages prepaid ₹ 1,000.

- Interest on investment @ 5% p.a.

- Closing stock ₹ 10,000.

Trading and Profit and Loss Account of M/s Green Club Ltd. for the year ending

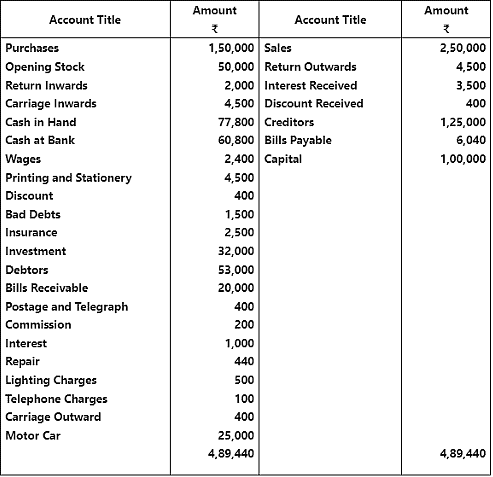

Adjustments:

- Further bad debts ₹ 1,000. Discount on debtors ₹ 500 and make a provision on debtors @ 5%.

- Interest received on investment @ 5%.

- Wages and interest outstanding ₹ 100 and ₹ 200 respectively.

- Depreciation charged on motor car @ 5% p.a.

- Closing Stock ₹ 32,500.

Q4.1: From the following Trial Balance, you are required to prepare trading and profit and loss account for the year ending March 31, 2017 and Balance Sheet on that date.

Adjustments

- Closing stock valued at ₹ 36,000.

- Private purchases amounting to ₹ 5000 debited to purchases account.

- Provision for doubtful debts @ 5% on debtors.

- Sign board costing ₹ 4,000 includes in advertising.

- Depreciate furniture by 10%.

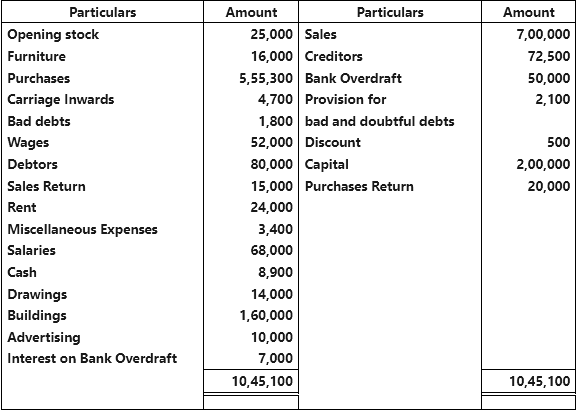

Q4.2: The following balances have been extracted from the trial of M/s Haryana Chemical Ltd. You are required to prepare a trading and profit and loss account and balance sheet as on March 31, 2017 from the given information.

Adjustments:

- Closing stock was valued at the end of the year ₹ 40,000.

- Salary amounting ₹ 500 and trade expense ₹ 300 are due.

- Depreciation charged on building and machinery are @ 4% and @ 5% respectively.

- Make a provision of @ 5% on sundry debtors.

Note:

- If you do not find this problem in the textbook, do not worry. This is from an old version of the textbook. In the current textbook, this problem is replaced with a different one (you can find it above)

- Note: In the textbook, it is giving that the Loan @ 15% (01.09.2016) (it has to be calculated for 7 months from 1-Sep-2016 to 31-Mar-2017). However, if we consider that value ,we’re getting the accrued interest on the loan as 262.50 which will make the Net profit as ₹ 1,85,672.50. To make it equal to the answer given in the book i.e. ₹ 1,85,560, we’ve considered that the Loan @10% (01.10.2016), which will make the acrued interest on loan as ₹ 150 and the answers for net profit and the balance sheet totals match.

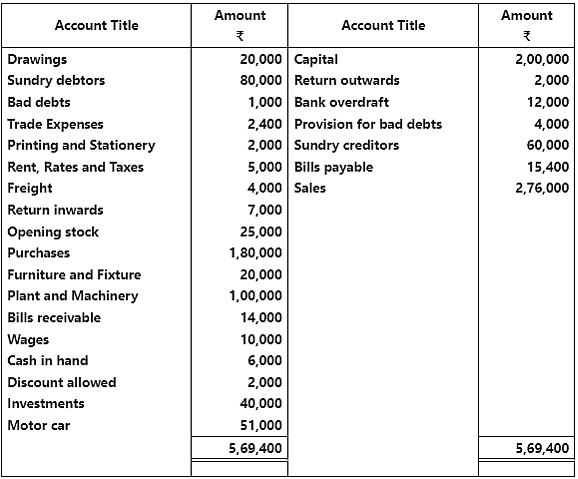

Q5: From the following information, prepare trading and profit and loss account of M/s Indian sports house for the year ending March 31, 2017.

Adjustments:

- Closing stock was ₹ 45,000.

- Provision for doubtful debts is to be maintained @ 2% on debtors.

- Depreciation charged on : furniture and fixture @ 5%, plant and Machinery @ 6% and motor car @ 10%.

- A Machine of ₹ 30,000 was purchased on July 01, 2016.

- The manager is entitled to a commission of @ 10% of the net profit after charging such commission.

You can access the solutions to this worksheet here.

|

61 videos|154 docs|35 tests

|

FAQs on Worksheet: Financial Statements - II - Accountancy Class 11 - Commerce

| 1. What are financial statements? |  |

| 2. Why are financial statements important? |  |

| 3. What is the purpose of an income statement? |  |

| 4. How does a balance sheet differ from an income statement? |  |

| 5. What is the significance of the cash flow statement? |  |