Worksheet: Government Budget and the Economy- 2 | Economics Class 12 - Commerce PDF Download

| Table of contents |

|

| Multiple Choice Questions |

|

| True and False Questions |

|

| Match the Following |

|

| Very Short Answers |

|

| Short Answers |

|

Multiple Choice Questions

Q1: Which of the following is not a component of the government budget?

(a) Revenue Receipts

(b) Capital Receipts

(c) Revenue Expenditure

(d) Household Expenditure

Q2: What does a government budget show?

(a) Surplus and Deficit

(b) Only Surplus

(c) Only Deficit

(d) None of the Above

Q3: Which of the following is a capital receipt?

(a) Borrowings

(b) Tax Revenue

(c) Grants-in-Aid

(d) Interest Receipts

Q4: What is the primary deficit of the government budget?

(a) Fiscal Deficit - Interest Payments

(b) Fiscal Deficit + Interest Payments

(c) Fiscal Deficit / Interest Payments

(d) Fiscal Deficit x Interest Payments

Q5: What is the purpose of a government budget?

(a) To Control Inflation

(b) To Promote Economic Growth

(c) To Allocate Resources Efficiently

(d) All of the Above

True and False Questions

Q1: Revenue receipts are the income generated by the government through taxes and non-tax sources.

Q2: Fiscal deficit represents the total borrowing requirements of the government from all sources.

Q3: Capital expenditure includes government spending on infrastructure projects and investments.

Q4: Revenue deficit occurs when the government's total revenue expenditure exceeds its total revenue receipts.

Q5: A budget surplus occurs when government revenue exceeds government expenditure.

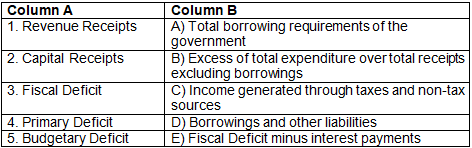

Match the Following

Q1: Match the items in Column A with the appropriate options in Column B:

Very Short Answers

Q1: Explain the concept of the government budget and its importance in the economy.

Q2: What is fiscal policy, and how does it influence the government budget?

Q3: Describe the components of government expenditure. Provide examples of each component.

Q4: Briefly explain the concept of revenue deficit and its implications for the economy.

Q5: How does the government create money through its budget? Explain the process.

Short Answers

Q1: Discuss the various types of government revenue sources, highlighting their significance in budget planning. Provide examples for each source.

Q2: Explain the concept of deficit financing. What are its advantages and disadvantages in the context of the Indian economy?

Q3: Differentiate between direct and indirect taxes. Provide examples of each type and discuss their impact on different sections of society.

Q4: Evaluate the role of the government budget in promoting economic stability and growth. Provide examples from the Indian economy to support your answer.

Q5: Analyze the challenges faced by the government in managing its budgetary resources. Discuss the measures that can be taken to overcome these challenges and ensure fiscal sustainability.

You can access the solutions to this worksheet here.

|

69 videos|380 docs|57 tests

|

FAQs on Worksheet: Government Budget and the Economy- 2 - Economics Class 12 - Commerce

| 1. What is a government budget? |  |

| 2. How does government spending affect the economy? |  |

| 3. What are the different sources of government revenue? |  |

| 4. How does the government budget impact citizens? |  |

| 5. What is the importance of a balanced government budget? |  |