Worksheet Solutions: Introduction to Microeconomics- 1 | Economics Class 11 - Commerce PDF Download

| Table of contents |

|

| Multiple Choice Questions |

|

| Match the Following |

|

| True or False |

|

| Very Short Answers |

|

| Short Answers |

|

| Long Answers |

|

Multiple Choice Questions

Q1: What is the primary focus of microeconomics?

(a) Individual households and firms

(b) National economy

(c) Macroeconomic factors

(d) Global trade

Ans: (a) Individual households and firms

Q2: Which of the following is a determinant of demand?

(a) Price of the product

(b) Population

(c) Government policies

(d) All of the above

Ans: (d) All of the above

Q3: In microeconomics, what does the term 'elasticity' refer to?

(a) The responsiveness of quantity demanded to a change in price

(b) The total revenue of a firm

(c) Market equilibrium

(d) Consumer surplus

Ans: (a) The responsiveness of quantity demanded to a change in price

Q4: What is the law of diminishing marginal utility?

(a) As a consumer consumes more units of a good, the additional satisfaction decreases

(b) The more a good is produced, the lower its price becomes

(c) Demand and supply always reach equilibrium

(d) Consumers always make rational decisions

Ans: (a) As a consumer consumes more units of a good, the additional satisfaction decreases

Q5: What does a production possibilities curve illustrate?

(a) The maximum combination of goods and services that a society can produce

(b) The production capacity of a single firm

(c) Consumer preferences

(d) Government regulations on production

Answer: (a) The maximum combination of goods and services that a society can produce

Match the Following

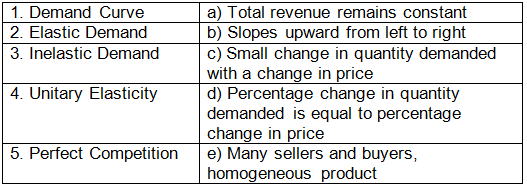

Q1:

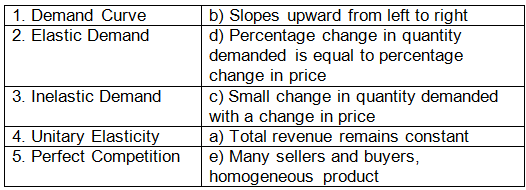

Ans:

True or False

Q1: Microeconomics studies individual economic units like households and firms.

Ans: True

Q2: Elastic demand means that quantity demanded does not change with a change in price.

Ans: False

Q3: In a perfectly competitive market, there are many sellers and differentiated products.

Ans: False

Q4: Price ceiling is a government-imposed maximum price on a good or service.

Ans: True

Q5: Scarcity refers to the situation where human wants exceed the resources available to fulfill those wants.

Ans: True

Very Short Answers

Q1: Define 'Market Demand'.

Ans: Market demand refers to the total quantity of a good or service that all consumers in a market are willing and able to buy at different prices during a specific time period.

Q2: What is a 'Price Floor'?

Ans: A price floor is the minimum price set by the government that must be paid for a good or service.

Q3: Explain 'Consumer Surplus'.

Ans: Consumer surplus is the difference between what a consumer is willing to pay for a good and what the consumer actually pays. It represents the benefit or surplus enjoyed by consumers.

Q4: Define 'Marginal Cost'.

Ans: Marginal cost is the additional cost incurred by producing one more unit of a good or service.

Q5: What is 'Elasticity of Demand'?

Ans: Elasticity of demand measures the responsiveness of quantity demanded to a change in price. It helps in understanding how sensitive consumers are to price changes.

Short Answers

Q1: Explain the concept of 'Law of Demand'.

Ans: The Law of Demand states that all other factors being equal, as the price of a good or service increases, the quantity demanded by buyers decreases, and vice versa. It demonstrates the inverse relationship between price and quantity demanded.

Q2: Discuss the factors affecting 'Elasticity of Supply'.

Ans: Elasticity of supply is influenced by factors such as production time frame, availability of resources, ease of production, and perishability of goods. In the long run, supply tends to be more elastic as producers can adjust their production methods and resources.

Q3: Describe 'Monopoly' as a market structure.

Ans: Monopoly is a market structure where there is a single seller or producer dominating the entire market for a particular good or service. The monopolist has significant control over the price and supply of the product, and there are no close substitutes available for consumers.

Q4: Explain the term 'Consumer Equilibrium'.

Ans: Consumer equilibrium refers to the situation where a consumer maximizes their total utility or satisfaction, given their budget constraint and the prices of goods and services. It occurs when the consumer allocates their income in a way that the marginal utility per dollar spent is the same for all goods and services consumed.

Q5: Discuss the impact of 'Price Elasticity of Demand' on tax incidence.

Ans: If demand is inelastic, consumers bear most of the tax burden because they continue to buy the good despite the price increase. In contrast, if demand is elastic, producers bear most of the tax burden as consumers reduce their purchases significantly due to the price increase.

Long Answers

Q1: Explain the concept of 'Production Possibility Frontier (PPF)' and its significance in economics.

Ans: Production Possibility Frontier (PPF) represents the maximum output combinations of two goods or services that an economy can produce with its available resources and technology. It illustrates the concept of scarcity, choice, and opportunity cost. Any point inside the PPF indicates inefficiency, while points outside the curve are unattainable given the current resources. PPF demonstrates the trade-offs faced by an economy and guides decision-making regarding resource allocation and economic efficiency.

Q2: Discuss the impact of government policies on market equilibrium using suitable examples.

Ans: Government policies, such as taxes, subsidies, and price controls, can significantly impact market equilibrium. For instance, imposing a tax on a product increases its price, leading to a decrease in quantity demanded and a surplus in the market. Subsidies, on the other hand, lower the cost of production, leading to an increase in supply and a surplus. Price ceilings, set below the equilibrium price, create shortages as demand exceeds supply. Price floors, set above equilibrium, result in surpluses as supply exceeds demand. These policies affect both consumers and producers and can lead to market inefficiencies.

Q3: Explain the concept of 'Elasticity of Demand' and its types with examples.

Ans: Elasticity of demand measures how responsive the quantity demanded of a good is to a change in price. There are three types: elastic, inelastic, and unitary elasticity. Elastic demand occurs when the percentage change in quantity demanded is greater than the percentage change in price (|Ed| > 1). Inelastic demand happens when the percentage change in quantity demanded is less than the percentage change in price (|Ed| < 1). Unitary elasticity occurs when the percentage change in quantity demanded is equal to the percentage change in price (|Ed| = 1). For example, luxury goods like high-end electronics often have elastic demand, while necessities like salt have inelastic demand.

Q4: Discuss the role of 'Utility' in consumer decision-making and its relationship with the law of diminishing marginal utility.

Ans: Utility refers to the satisfaction or pleasure derived from consuming a good or service. Consumers aim to maximize their utility when making purchasing decisions. The Law of Diminishing Marginal Utility states that as a consumer consumes more units of a good, the additional satisfaction (marginal utility) derived from each additional unit decreases. This law explains why consumers seek variety in their consumption. Initially, consuming a good provides high marginal utility, but as more is consumed, the marginal utility decreases, leading to the consumer's preference for different goods and experiences.

Q5: Explain the concept of 'Market Failure' and discuss its types with examples.

Ans: Market failure occurs when the market mechanism fails to allocate resources efficiently, leading to an inefficient allocation of goods and services. There are several types of market failure, including externalities, public goods, imperfect competition, and information asymmetry. Externalities, such as pollution, occur when the actions of producers or consumers affect third parties not involved in the transaction. Public goods, like street lighting, are non-excludable and non-rivalrous, leading to underproduction in the private market. Imperfect competition, such as monopolies, can lead to higher prices and reduced output. Information asymmetry occurs when one party has more information than the other, leading to issues in decision-making. Government intervention, through regulations or corrective taxes, is often necessary to address these market failures and achieve allocative efficiency.

|

59 videos|290 docs|51 tests

|

FAQs on Worksheet Solutions: Introduction to Microeconomics- 1 - Economics Class 11 - Commerce

| 1. What is microeconomics? |  |

| 2. What are some key concepts in microeconomics? |  |

| 3. How does microeconomics differ from macroeconomics? |  |

| 4. Why is microeconomics important for understanding the economy? |  |

| 5. How can I apply microeconomic principles in everyday life? |  |