Worksheet Solutions: National Income Accounting- 1 | Economics Class 12 - Commerce PDF Download

MCQ Questions

Q1: Which of the following is an example of normal residents of India?

(a) Foreign worker working in WHO located in India

(b) The German working as director in IMD office located in India

(c) Ambassador in India from the rest of the world

(d) Ambassador of India in rest of the world

Ans: d

Q2: . Which of the given pair is incorrectly matched?

Column I Column II

A. Land (i) Rent

B. Labour (ii) Wages and salaries

C. Capital (iii) Interest

D. Entrepreneur (iv) Dividend

Codes

(a) A – (i)

(b) B – (ii)

(c) C – (iii)

(d) D – (iv)

Ans: d

Q3:. Factor payment received by the households for rendering their services as employees of the producing unit is called

(a) Compensation of employees

(b) Rent

(c) Interest

(d) Profit

Ans: a

Q4: Operating Surplus =

(a) Compensation of Employees + Rent + Interest +Profit

(b) Rent + Interest + Profit

(c) Compensation of Employees + Mixed Income of Self-employed

(d) Compensation of Employees + Rent + Interest + Profit +Mixed Income of Self-employed

Ans: b

Q5. Which of the following is included in the estimation of national income?

(a) Expenses on electricity by a factory

(b) Gifts from abroad

(c) Free services by the government

(d) Financial help to earthquake victims

Ans: c

Q6: Which of the following statements is/are correct?

(i) Value added and value of output are identical concepts.

(ii) Sum total of value added by all the producing units within the domestic territory of the country is equal to national product.

Alternatives

(a) Both are true

(b) Both are false

(c) (i) is true, but (ii) is false

(d) (i) is false, but (ii) is true

Ans: b

Q7. Which of the following is not included in the estimation of national income?

(a) Brokerage on sale of bonds

(b) Imputed value of production for self-consumption

(c) Leisure-time activities

(d) Employer’s contribution to provident fund

Ans: c

Q8: Inventory investment is used as a component to calculate national income in which of the following methods?

(a) Product method and income method

(b) Income method and expenditure method

(c) Product method and expenditure method

(d) Product method, income method and expenditure method

Ans: c

Q9: National income is the sum of factor incomes accruing to

(a) nationals

(b) economic territory

(c) residents

(d) Both residents and non-residents

Ans: c

Q10. If gross domestic capital formation is ` R.s.3,000, net domestic fixed capital formation is `R.s. 2,000 and inventory investment is ` R.s.150, what will be the value of consumption of fixed capital?

(a) R.s. 1,000

(b) R.s. 850

(c) R.s. 150

(d) Can’t be determined

Ans: b

Q11: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Real GDP shows change in the level of economic activity and facilitates inter-regional and international comparison.

Reason (R) It is an inflation adjusted index and account for an increase in the level of production in response to the price changes.

Ans: a

Q12: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Payment of uniforms for nurses by a hospital is not included in the estimation of national income.

Reason (R) Uniforms are provided by the hospital at the time of work. It is to be treated as an intermediate consumption.

Ans: a

Q13: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) GDP as an index of welfare may underestimate or overestimate the welfare.

Reason (R) It does not consider the non-monetary exchanges and does not take into consideration the positive or negative aspects associated with an economic activity.

Ans: a

Q14: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Financial help received by the flood victims should not be included while estimating national income.

Reason (R) Financial help is a transfer payment and should not be included.

Ans: a

Q15: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Money received from the sale of second hand car will be considered while estimating national income.

Reason (R) Their value is already included and it does not contribute to the current flow of goods and services.

Ans: d

Q16. Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Imputed value of owner-occupied lands are a part of both domestic income and national income.

Reason (R) Factors of production are bound to give its services regardless of the fact that it is giving its services to the owner or an outsider.

Ans: a

Q17: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Public goods possess the characteristics of non-rivalry and non-excludability.

Reason (R) Non-rival means consumption by one person does not reduces consumption for another person whereas non-excludability implies that no one can be excluded in terms of benefitting from the consumption of public goods.

Ans: a

Short Answer Type Questions

Q1: ‘Subsidies to the producers, should be treated as transfer payments’. Defend or refute the given statement with valid reason.

Ans: This statement is refuted because subsidies given to the producers should not be treated as transfer payments.

Subsidies are given to reduce the market price of socially desirable goods such as fertilisers, LPG gas, etc. So, that they can be afforded by the poor section of society.

Transfer payments, on the other hand, are given to fulfill social objectives. Examples of transfer payments are old age pension, unemployment allowance, etc.

Also, transfer payments are not taken into account while computing the GDP of the country, but subsidies are considered in the computation of GDP.

Q2: Suppose the GDP at market price of a country in a particular year was R.s. 1,100 crore. Net factor income from abroad was R.s.100 crore. The value of Indirect taxes – Subsidies was R.s.150 crore and national income was R.s.850 crore. Calculate the aggregate value of depreciation.

Ans: NNPMP NNPFC NIT = +

= 850 + 150 = R.s 1,000 crore

GNPMP NFIA GDPMP = +

= 100 + 1,100

=`R.s. 1,200 crore

Depreciation=GNPMP NNPMP −

= 1,200 – 1,000 = 200 crore

Therefore, depreciation = `R.s.200 crore

Q3: ‘Domestic services (household services) performed by a woman are not considered as an economic activity. Defend or refute the given statement with valid reason.

Ans: The given statement is refuted on the basis of the following reasons

(i) Domestic services are performed by woman out of love and affection.

(ii) Such services do not add to the flow of goods and services in the economy.

(iii) These services are for self-consumption, not for economy.

Q4: In a single day Raju, the barber collects R.s. 500 from haircuts; over this day, his equipment depreciates in value by R.s. 50. Of the remaining R.s. 450, Raju pays sales tax worth R.s.30, takes home 200 and retains 220 for improvement and buying of new equipment. He further pays R.s.20 as income tax from his income. Based on this information, complete Raju’s contribution to the following measures of income (i) Gross domestic product, (ii) NNP at market price and (iii) NNP at factor cost.

Ans: Assuming intermediate consumption= 0 and Change in stock = 0

(i) GVAMP = R.s.500 (Raju’s contribution to GDP)

(ii) NVAMP =GVAMP – Depreciation = 500 – 50 = R.s. 450 (Raju’s contribution toNNPMP )

(iii) NVAFC NVAMP – = Net Indirect Taxes = 450 – 30 = R.s.420 (Raju’s contribution to NNPFC)

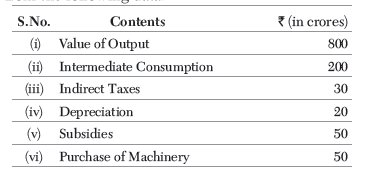

Q5: Calculate Net Value Added at Factor Cost (NVA FC) from the following data.

Ans: GVAMP = Value of Output − Intermediate Consumption = 800 − 200 = `R.s. 600 crores

NVAFC = GVAMP − Depreciation − Indirect Tax + Subsidies

NVAFC = 600 − 20 − 30 + 50 = ` R.s.600 crores

Q7: GNP is the estimated value of the total worth of production and services earned by the normal residents of a country. But to find out NNP, GNP deducts depreciation, why should we deduct depreciation from GNP?

Ans: The productive power of physical capital stock of a country diminishes gradually because of the wear and tear in the process of production. When the machine becomes totally unproductive, it has to be replaced by new machine. So, a sum of money is set aside every year into depreciation account and new machine can be purchased by utilising this accumulated sum.

So, depreciation is deducted from GNP in order to get more accurate measure of the sustainable production of goods and services in a country in a given year.

Q8: Which of the following factor incomes be included in domestic factor income of India? Give reasons for your answer.

(i) Compensation of employees to the residents of Japan working in Indian embassy in Japan.

(ii) Rent received by an Indian resident from Russian embassy in India.

(iii) Profits earned by a branch of State Bank of India in England.

Ans: (i) Compensation of employees to the residents of Japan working in Indian embassy in Japan is a part of factor income of India because Indian embassy in Japan is a part of domestic territory of India.

(ii) Rent received by an Indian resident from Russian embassy in India is not a part of domestic factor income of India because Russian embassy in India is not a part of domestic territory of India.

(iii) Profits earned by a branch of State Bank of India in England is not a part of domestic factor income of India because the branch of SBI in England is not a part of domestic territory of India.

Q9: How will the following be treated while estimating national income of India? Give reasons.

(i) Value of bonus shares received by shareholders of a company.

(ii) Capital gains to Indian residents from sale of shares of a foreign company.

(iii) Fees received from students.

Ans: (i) Value of bonus shares received by shareholders of a company is not included in the estimation of national income of India because these are just financial transactions (leading to change of ownership of financial assets), not contributing to the flow of goods and services in the economy.

(ii) Capital gains to Indian residents from sale of shares of a foreign company is not included in the national income of India because it is a part of financial transactions corresponding to which there is no flow of goods and services in the economy.

(iii) From the students’ point of view, expenditure on fees is to be treated as part of private final consumption expenditure. Accordingly, it is to be included in the estimation of national income of India when expenditure method is used to estimate it. However, from the schools’ point of view, fee received is just a revenue from the sale of services.

Q10: Giving reason state how the following are treated in estimation of national income.

(i) Payment of interest by banks to its depositors.

(ii) Expenditure on old age pensions by government.

(iii) Expenditure on engine oil by car service station.

Ans: (i) Payment of interests by bank to its depositors should be included in estimation of national income as it will be treated as factor income.

(ii) Expenditure on old age pensions by government is not a part of national income as it is a transfer payment.

(iii) Expenditure on engine oil by car service station is not a part of national income as it is an intermediate cost.

Q10: “Management of a water polluting oil refinery says that it (oil refinery) ensures welfare through its contribution to gross domestic product.” Defend or refute the argument of management with respect to GDP as a welfare measure of the economy.

Ans: The above argument is refuted with respect to GDP as a welfare measure of the economy. It is because GDP is not a good measure of welfare as it fails to take in to the effect of externalities.

Externality means good or bad impact of an activity without paying the price or penalty for that impact of externalities is not accounted in the index of social welfare in terms of GDP.

For example, oil refinery may pollute the nearby source of water. Such harmful effects to people and marine life is not be penalised. Thus it is not ensuring the welfare of the economy through GDP.

Q11: Social welfare may not increase even when real GDP increases. Explain.

Ans: Increase in GDP may not cause increase in welfare in a situation when distribution of income becomes skewed (unequal). If, along with an increase in GDP, the percentage of population below poverty line happens to increase, it implies a situation of deprivation on one hand and concentration of economic power on the other. It is a situation when a rising percentage of GDP is being pocketed by a smaller percentage of population. The bulk of population suffers poverty, while only a small segment of the society enjoys prosperity owing to a rise in GDP. The rise in GDP is achieved at the cost of social welfare.

Q12: Sale of petrol and diesel cars is rising particularly in big cities. Analyse its impact on gross domestic product and welfare.

Ans: As the sale of petrol and diesel cars rises, it implies that the private consumption expenditure is also rising.

A rise in private consumption expenditure leads to a rise in the gross domestic product.

So, an increase in the sale of petrol and diesel cars will lead to an increase in the gross domestic product of the country.

However, it will not lead to an increase in the welfare of the people because of the below mentioned reasons

(i) As the sale of petrol and diesel cars rises, then the level of pollution will also rise in the big cities.

(ii) With a rise in the number of cars, the traffic congestion on the roads will worsen.

(iii) A rise in the number of cars will increase the demand for petrol and diesel. This will lead to a rise in the prices of petrol and diesel.

(iv) The already depleted reserves of petrol and diesel will be subjected to further depletion.

Long Answer Type Questions

Q1: Define the problem of double counting in the estimation of national income. Discuss two approaches to correct the problem of double counting.

Ans: The counting of the value of commodity more than once is called double counting. This leads to overestimation of the value of goods and services produced. Thus, the importance of avoiding double counting lies in avoiding overestimating the value of domestic product.

For example, a farmer produces one ton of wheat and sells it for 400 in the market to a flour mill. The flour mill sells it for 600 to the baker. The baker sells the bread to a shopkeeper for 800. The shopkeeper sells the entire bread to the final consumers for 900. Thus, Value of Output = 400 + 600 + 800 + 900 = 2,700 In fact, the value of the wheat is counted four times, the value of services of the miller thrice and the value of services by the baker twice. In other words, the value of wheat and value of services of the miller and of the baker have been counted more than once. The counting of the value of the commodity more than once is called double counting.

To avoid the problem of double counting, two methods are used

(i) Final Output Method According to this method, the value of intermediate goods is not considered. Only the value of final goods and services are considered.

In the above example, the value of final goods i.e., bread is 900.

(ii) Value Added Method Another method to avoid the problem of double counting is to estimate the total value added at each stage of production. In the above example, the value added at each stage of production is 400 + 200 + 200 + 100 = 900

Q2: Explain the treatment assigned to the following while estimating national income. Give reasons.

(i) Family members working free on the farm owned by the family.

(ii) Rent free house from an employer.

(iii) Expenditure on free services provided by the government.

Ans: (i) Family members working free on the farm owned by the family are engaged in the value addition process.

Imputed value of their farm output is included in the estimation of national income. Accordingly, income generated by the farming family would be treated as mixed income of self-employed, which includes compensation of labour.

(ii) Rent free house from an employer is included in the estimation of national income because it is a kind of wages in kind and therefore, a part of compensation of employees.

(iii) Expenditure on free services provided by the government should be included in the estimation of national income because expenditure on these services is a part of government final consumption expenditure.

|

64 videos|308 docs|51 tests

|

FAQs on Worksheet Solutions: National Income Accounting- 1 - Economics Class 12 - Commerce

| 1. What is national income accounting? |  |

| 2. Why is national income accounting important? |  |

| 3. What are the main components of national income accounting? |  |

| 4. How is national income calculated using the expenditure approach? |  |

| 5. What are the limitations of national income accounting? |  |