Theory Base of Accounting Chapter Notes | Accountancy Class 11 - Commerce PDF Download

| Table of contents |

|

| Introduction |

|

| Generally Accepted Accounting Principles |

|

| Systems of Accounting |

|

| Basis of Accounting |

|

| Accounting Standards |

|

Introduction

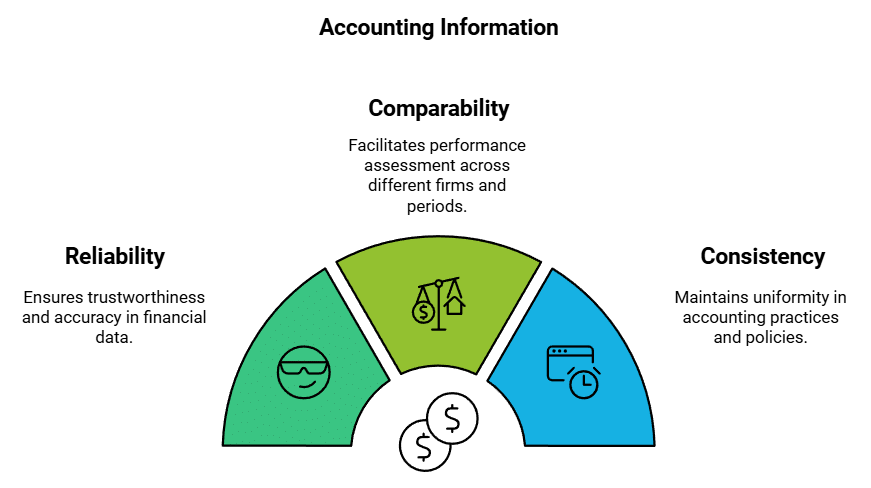

To make accounting information useful for both internal and external users, it needs to be reliable and comparable. Reliable information is accurate and trustworthy, while comparable information allows users to see patterns, trends, and differences clearly.

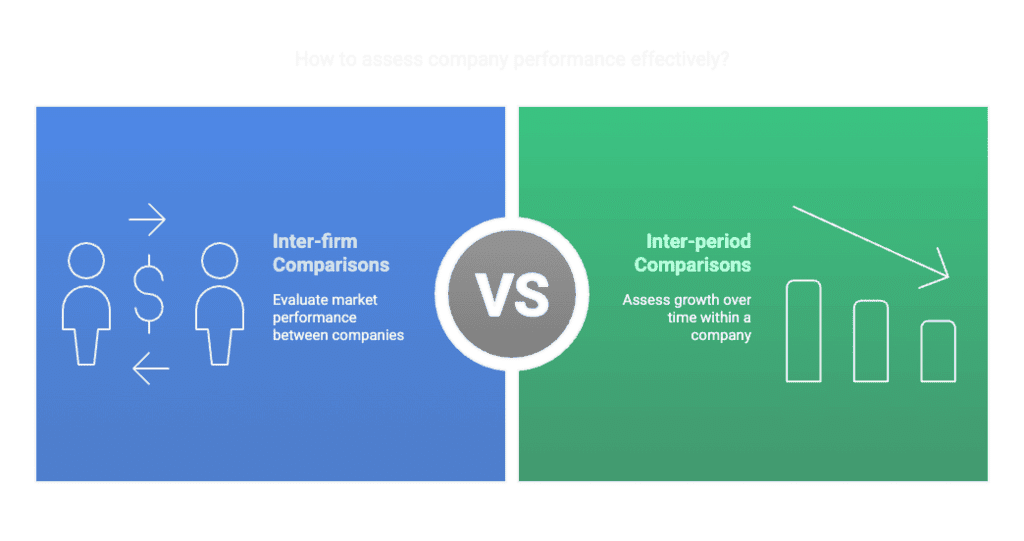

Importance of Comparability

Comparability helps users make better decisions by allowing them to compare:

- Inter-firm Comparisons: For example, comparing the sales revenue of Company A and Company B to determine which one is performing better in the market.

- Inter-period Comparisons: For example, comparing a company's profit in 2024 with its profit in 2025 to assess growth or decline.

Achieving Comparability: For comparisons to be meaningful, financial information must follow consistent accounting policies, principles, and practices.

Theory Base of Accounting

To maintain consistency, there must be a proper theory base of accounting that provides a standard framework to record, measure, and report financial information effectively.

Importance of Accounting Theory

- Accounting theory is essential for the growth of the field, as no area can advance without a solid theoretical base.

- The theoretical foundation of accounting consists of principles, concepts, rules, and guidelines that have been created over time to ensure consistency and uniformity in accounting practices.

- This theoretical base improves the usefulness of accounting information for different users.

- The Institute of Chartered Accountants of India (ICAI), which is the governing body for accounting standards in India, has established Accounting Standards to encourage uniformity in accounting practices.

- These standards are meant to be followed consistently to achieve uniformity in accounting methods.

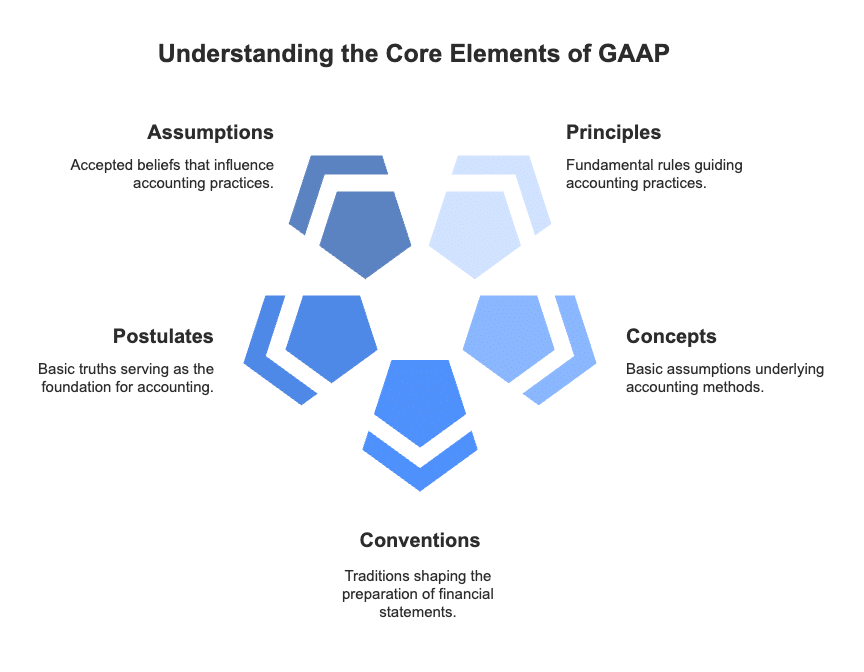

Generally Accepted Accounting Principles

Meaning of GAAP

- The word “principle” means a basic rule or guideline that helps decide how to act or practice something.

- The term “generally” indicates that something applies to many situations or people.

- Generally Accepted Accounting Principles (GAAP) are the rules used for recording and reporting business activities, ensuring that financial statements are prepared and presented consistently.

- An example of this is recording transactions based on historical cost, which can be confirmed by documents like cash receipts. This method increases objectivity and makes accounting statements more trustworthy for users.

Evolution and Nature of GAAP

- GAAP evolves based on past practices, professional judgments, and government regulations, adapting to changes in legal, social, and economic environments.

- It is dynamic, shaped by user needs and not fixed.

Concepts and Conventions

- GAAP is also referred to as concepts and conventions. Concepts are fundamental assumptions and ideas in accounting practice, while conventions are customs or traditions guiding the preparation of accounting statements.

- Different authors may use these terms interchangeably, leading to confusion among learners.

Basic Accounting Concepts

Basic accounting concepts are the fundamental ideas or assumptions that underlie the theory and practice of financial accounting. These concepts are broad working rules for all accounting activities and have been developed by the accounting profession.

Here are the important accounting concepts:

- Business Entity: Accounts are maintained separately for the business and the owner.

- Money Measurement: Only transactions that can be measured in monetary terms are recorded.

- Going Concern: Assumes that the business will continue to operate indefinitely.

- Accounting Period: Financial statements are prepared for specific periods.

- Cost: Assets are recorded at their cost price.

- Dual Aspect (or Duality): Every transaction has two aspects, debit and credit.

- Revenue Recognition (Realisation): Revenue is recognised when it is earned.

- Matching: Expenses are matched with the revenues they help to generate.

- Full Disclosure: All relevant information is disclosed in financial statements.

- Consistency: Accounting methods should be consistent over time.

- Conservatism (Prudence): Anticipate losses but not gains.

- Materiality: Only significant information should be included.

- Objectivity: Information should be based on objective evidence.

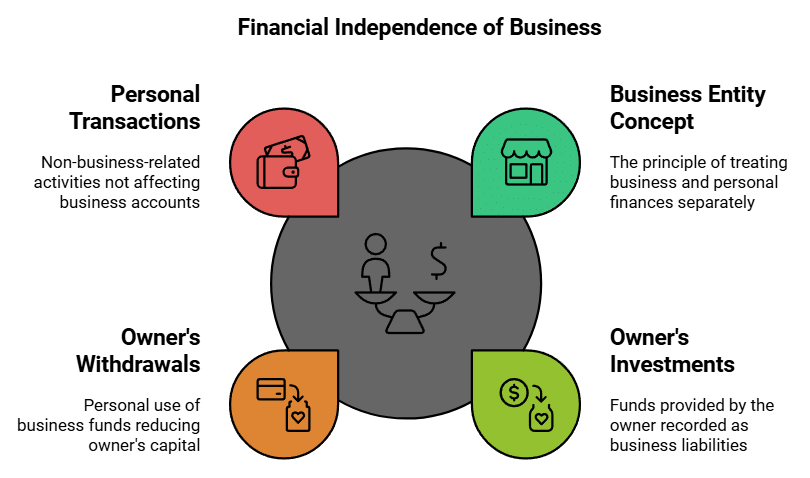

Business Entity Concept

The Business Entity Concept in accounting treats a business as a separate, independent entity from its owners. This concept ensures that the business's financial activities are recorded separately from the personal financial activities of the owner, providing clear and accurate financial reporting.

How it Works

Owner's Investment:

- When the owner invests money or assets into the business, it is recorded as a liability of the business to the owner.

- Example: If the owner invests ₹1,00,000 in the business, it is recorded as Capital in the business’s accounts, indicating the owner’s claim on the business assets.

Owner’s Withdrawals (Drawings):

- If the owner withdraws money for personal use, it reduces the owner’s capital in the business.

- Example: If the owner withdraws ₹10,000 for personal expenses, it is recorded as Drawings and subtracted from the Capital account.

No Personal Transactions in Business Accounts:

- Personal assets, liabilities, and transactions of the owner are not recorded in the business accounts unless they are related to the business.

- Example: If the owner buys a personal car, it is not recorded in the business accounts.

Why is this Concept Important?

The Business Entity Concept ensures that the financial position and performance of the business are accurately represented. It helps in maintaining a clear distinction between business finances and personal finances, making financial statements reliable and meaningful.

Money Measurement Concept

- Definition: The money measurement concept in accounting indicates that only those transactions that can be expressed in monetary terms are recorded in the books of accounts.

- Examples of Recordable Transactions: Transactions such as the sale of goods, payment of expenses, and receipt of income are recorded because they can be quantified in money.

- Non-Recordable Transactions: Happenings that cannot be expressed in monetary terms, like the appointment of a manager or the creativity of a research department, are not included in the accounting records.

- Monetary Unit: Transactions are recorded in monetary units, not physical units. For instance, assets like land, buildings, and equipment are valued and recorded in rupees, regardless of their physical measurements.

- Example of Asset Valuation: If a company has various assets like land, buildings, and equipment, these are expressed in monetary terms. For example, land worth ₹2 crore, a building worth ₹1 crore, and so on, are totalled to give a meaningful figure of the company’s worth.

- Limitations of Money Measurement: The concept has limitations, such as the changing value of money over time due to inflation. This means that adding assets purchased at different times can give a misleading picture.

- Example of Heterogeneous Values: When assets bought at different times, like a building purchased in 1995 for ₹2 crore and a plant bought in 2005 for ₹1 crore, are added, they represent heterogeneous values and do not reflect the true financial position.

Going Concern Concept

- Definition: The going concern concept in accounting assumes that a business will continue its operations indefinitely and will not be liquidated shortly.

- Importance of Assumption: This assumption is crucial as it forms the basis for valuing assets in the balance sheet. Assets are considered bundles of services, and their costs are spread over their useful lives.

- Example of Asset Valuation: When a company buys a personal computer for ₹50,000, it is purchasing the services of the computer over its estimated lifespan, say 5 years. Instead of charging the entire amount in the year of purchase, a portion is charged each year.

- Depreciation Example: Continuing with the computer example, if ₹10,000 is charged each year for 5 years from the profit and loss account, this is possible because of the going concern assumption. If the business were not assumed to continue, the entire cost would need to be charged in the year of purchase.

Accounting Period Concept

- The accounting period refers to the duration at the end of which a company's financial statements are prepared to assess its profitability and the status of its assets and liabilities.

- Financial statements are needed regularly by different users for various purposes, as companies cannot wait long to know their financial results.

- Typically, these statements are prepared annually to provide timely information, but the accounting period can vary in certain situations, such as during a partner's retirement.

- The Companies Act 2013 and the Income Tax Act mandate the annual preparation of income statements.

- However, companies listed on stock exchanges must publish quarterly results to update on profitability and financial position every three months.

Cost Concept

- Assets are recorded at their purchase price, which includes acquisition costs, transportation, installation, and preparation for use.

- For example, if a plant is bought for ₹ 50 lakh, with additional costs for transportation (₹ 10,000), repairs (₹ 15,000), and installation (₹ 25,000), the total recorded amount would be ₹ 50,50,000.

- The cost concept is historical, reflecting what was paid at the time of acquisition, and remains unchanged over time.

- This brings objectivity to recording, as purchase costs are verifiable from documents.

- However, it may not reflect the true value of a business, especially during rising prices, leading to hidden profits.

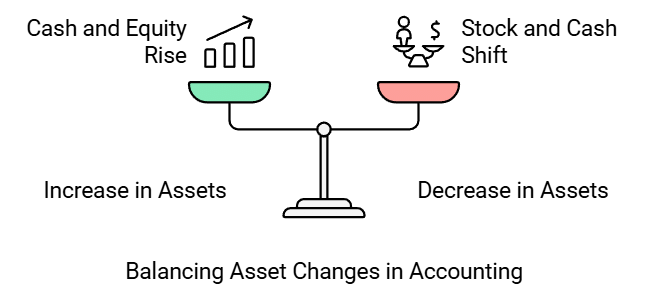

Dual Aspect Concept

- The dual aspect concept is fundamental to accounting, stating that every transaction has a twofold effect and should be recorded in at least two accounts.

- For instance, when Ram invests ₹ 50,00,000 in a business, it increases both the cash (asset) and the owner’s equity (capital) by the same amount.

- Similarly, if goods worth ₹ 10,00,000 are purchased for cash, it increases stock (asset) and decreases cash (asset).

- This principle is expressed in the Accounting Equation: Assets = Liabilities + Capital, indicating that a business’s assets are always equal to the claims of owners and outsiders.

- The dual effect of transactions must be recorded to maintain the equality of both sides of the equation, forming the core of the Double Entry System of accounting.

Revenue Recognition Concept

- Revenue is the gross inflow of cash arising from the sale of goods and services by an enterprise, and the use by others of the enterprise’s resources yielding interest, royalties and dividends.

- Revenue is assumed to be realised when a legal right to receive it arises, i.e. the point of time when goods have been sold or service has been rendered.

- Exceptions to this general rule of revenue recognition include contracts like construction work, whichyears to complete, then a proportionate amount, based on the part of the contract completed by the end of the period, is treated as realised.

- Similarly, when goods are sold on hire purchase, the amount collected in instalments is treated as realised.

Matching Concept

- The matching concept states that expenses incurred in an accounting period should be matched with revenues during that period.

- Revenue is recognised when a sale is complete or a service is rendered, rather than when cash is received. Similarly, an expense is recognised not when cash is paid but when an asset or service has been used to generate revenue.

- To calculate the profit or loss of an accounting year, we should not take the cost of all the goods produced or purchased during that period, but consider only the cost of goods that have been sold during that year.

- The matching concept, thus, implies that all revenues earned during an accounting year, whether received during that year or not and all costs incurred, whether paid during the year or not, should be taken into account to calculate profit or loss for that year.

Full Disclosure Concept

- Financial statements are used by various groups, like investors, lenders, and suppliers, to make financial decisions. In a corporate setup, those managing the enterprise are different from those owning it. Financial statements are the primary way to communicate financial information to all interested parties.

- Full Disclosure means that all material and relevant facts about an enterprise's financial performance must be disclosed in the financial statements and their footnotes. This helps users assess profitability and financial soundness accurately.

- The Indian Companies Act 1956 prescribes a format for profit and loss accounts and balance sheets to ensure proper disclosure of material accounting information. Regulatory bodies like SEBI also mandate complete disclosures for a true and fair view of profitability and financial status.

Consistency Concept

- Consistency in accounting policies and practices is crucial for making inter-firm and inter-period comparisons.

- For example, if an investor wants to compare this year's net profit with last year's, consistent accounting policies (like depreciation methods) are necessary for meaningful comparison.

- Consistency eliminates bias and ensures comparable results. It is also essential to compare the financial results of different enterprises.

- However, consistency does not prohibit changes in accounting policies. If changes are necessary, they should be fully disclosed in the financial statements along with their probable effects on financial results.

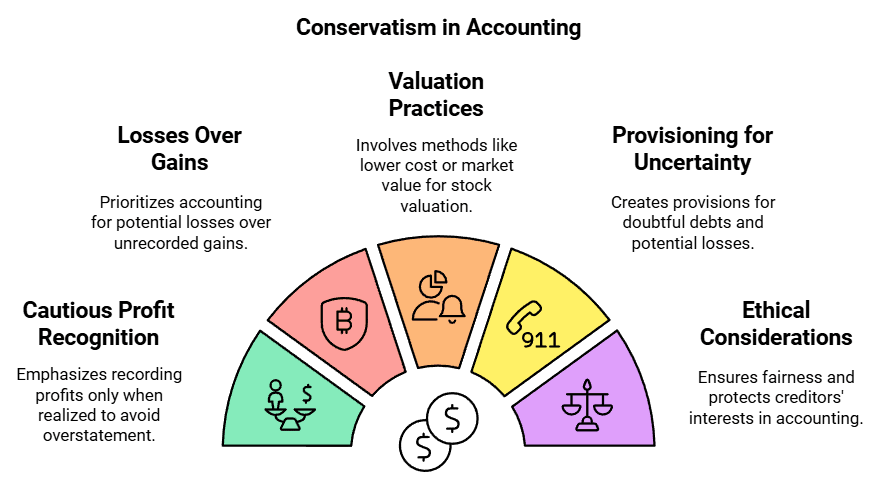

Conservatism Concept

- The conservatism concept, also known as "prudence," guides how transactions are recorded in accounting. It emphasises a cautious approach to determining income to avoid overstating profits.

- Overstating profits can lead to unfair situations, such as distributing dividends from capital, which reduces the enterprise's capital.

- According to this concept, profits should only be recorded when they are realised, while all potential losses, even unlikely ones, should be accounted for.

- Examples of conservatism include:

1. Valuing closing stock at the lower of cost or market value.

2. Creating provisions for doubtful debts and discounts on debtors.

3. Writing off intangible assets like goodwill and patents from the books. - For instance, if the market value of purchased goods has decreased, the stock will be shown at the cost price in the books. However, if the market value has increased, the gain is not recorded until the stock is sold.

- This approach of recognising losses but not gains, until realised, is called the conservatism approach.

- While it may seem pessimistic, it protects creditors' interests and prevents unwanted asset distribution.

- However, deliberately underestimating asset values to create hidden profits, known as secret reserves, should be avoided.

Materiality Concept

- The materiality concept in accounting emphasises focusing on material facts that influence the determination of income.

- Materiality depends on the nature and amount of the fact involved. A fact is considered material if its knowledge could impact the decisions of informed users of financial statements.

- For example, spending money to enhance the capacity of a theatre is material because it increases the future earning potential of the enterprise.

- Similarly, changes in depreciation methods or potential liabilities are significant information.

- Material facts should be disclosed in financial statements and accompanying notes to help users make informed decisions.

- In cases where the amount is very small, strict adherence to accounting principles may not be necessary.

- For instance, stationery items like erasers, pencils, and scales are not shown as assets, and the expenses are recorded in the profit and loss account of the period in which they are incurred.

Objectivity Concept

- The concept of objectivity in accounting means that transactions should be recorded without bias or personal judgment.

- Objectivity is achieved when each transaction is backed by verifiable documents or vouchers.

- For instance, when materials are purchased, a cash receipt is used for cash purchases, while an invoice and delivery challan are used for credit purchases.

- Similarly, a receipt for a machine purchase serves as documentary evidence for its cost, ensuring an objective basis for the transaction.

- The use of 'Historical Cost' as the basis for recording transactions supports the principle of objectivity.

- Historical Cost relies on verifiable documents, such as receipts, to establish the cost of an asset.

- In contrast, determining the market value of an asset can be subjective and varies from person to person and place to place.

- Since market value can fluctuate and is not always readily ascertainable, using it as a basis for accounting could compromise objectivity.

Systems of Accounting

- Double Entry System: This system is based on the principle of "Dual Aspect," which means that every transaction has two effects: receiving a benefit and giving a benefit.

- Each transaction involves two or more accounts and is recorded in different places in the ledger. The fundamental rule is that every debit must have a corresponding credit.

- This system is complete, accurate, and reliable, minimising the chances of fraud and misappropriation. Arithmetic errors can be checked by preparing a trial balance.

- Double-entry accounting can be used by both large and small organisations.

- Single Entry System: This system is not complete as it does not record the two-fold effect of every transaction. Only personal accounts and a cash book are maintained.

- This system lacks uniformity, recording only one aspect of some transactions while recording both aspects for others. The accounts maintained are incomplete and unreliable.

- Single-entry accounting is simple and flexible, which is why it is often used by small business firms.

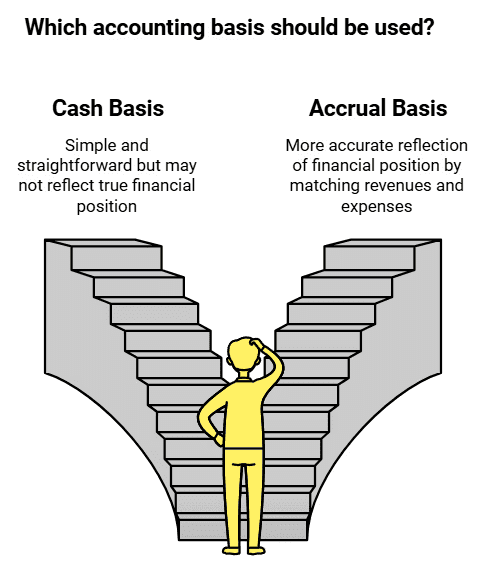

Basis of Accounting

There are two broad approaches to accounting based on the timing of recognition of revenue and costs:

- Cash Basis

- Accrual Basis

Cash Basis:

- Entries are made when cash is received or paid, not when they are due.

- For example, if office rent for December 2014 is paid in January 2015, it is recorded in January 2015.

- This method is incompatible with the matching principle, which requires matching revenue with costs in the same period.

- It is simple but inappropriate for most organisations as it calculates profit based on cash flow rather than actual transactions.

Accrual Basis:

- Revenues and costs are recognised in the period they occur, regardless of when cash is received or paid.

- A distinction is made between the receipt of cash and the right to receive cash, and payment of cash and the legal obligation to pay cash.

- This method takes into account the monetary effect of a transaction in the period it is earned, making it more appropriate for profit calculation.

- For example, raw materials consumed are matched against the cost of goods sold.

Accounting Standards

- Accounting standards, issued by the Institute of Chartered Accountants of India (ICAI), guide the recognition, measurement, treatment, presentation, and disclosure of transactions in financial statements.

- They ensure uniformity, reliability, and comparability, enhancing the credibility of financial statements.

- By providing consistent accounting policies and mandatory disclosures, standards improve data quality and enable performance assessment by users like investors and creditors.

Need for Accounting Standards: Standards ensure transparent and uniform financial information, addressing varied accounting practices to present true and fair financial statements.

Benefits of Accounting Standards

- They eliminate inconsistencies in accounting treatments, ensuring consistent and comparable financial statements within and across companies.

- Standards mandate disclosures beneficial to stakeholders, even if not legally required.

Limitations of Accounting Standards:

- They can make choosing between different accounting treatments challenging.

- The rigid application of standards may reduce flexibility in their implementation.

- Accounting standards must operate within the framework of existing laws and cannot override them.

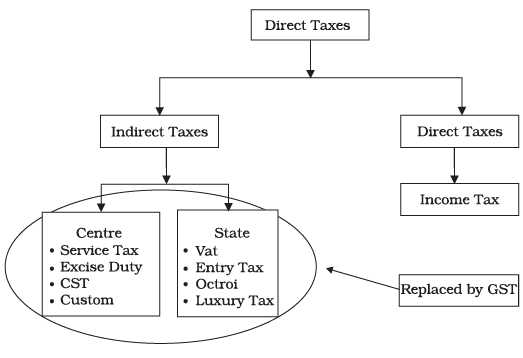

Goods and Services Tax

(One Country One Tax)

Goods and Services Tax (GST) is a tax on the consumption of goods and services, based on where they are consumed, not where they are produced. It is applied at every stage from manufacturing to final consumption, with a credit system that allows businesses to offset taxes paid at previous stages. This means that only the value added at each stage is taxed, and the final consumer bears the total tax burden.

GST is collected by the government of the state where the goods or services are consumed, known as the place of supply. The tax is levied by both the central and state governments on a common tax base.

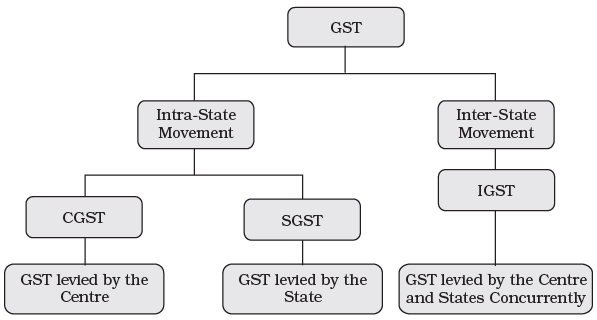

There are three main components of GST:

- CGST (Central Goods and Services Tax): This tax is collected by the central government and will replace existing central taxes like central excise duty and central sales tax.

- SGST (State Goods and Services Tax): This tax is collected by the state government and will replace state taxes like VAT and entertainment tax.

- IGST (Integrated Goods and Services Tax): This tax is applied to the transfer of goods and services between states and is also used for the import of goods and services. The revenue from IGST is shared between the central and state governments.

Example:

- If a dealer in Punjab sells goods worth ₹ 10,000 to a customer in Punjab, and the GST rate is 18% (9% CGST and 9% SGST), ₹ 900 will go to the central government and ₹ 900 will go to the Punjab government.

- If a dealer in Madhya Pradesh sells goods worth ₹ 1,000,000 to a customer in Rajasthan, the applicable GST rate is 18% (9% CGST and 9% SGST). In this case, the dealer will charge ₹ 18,000 as IGST, which goes to the central government.

India is a federal country where both the Centre and the States have been assigned the powers to levy and collect taxes through appropriate legislation. Both the levels of government have distinct responsibilities to perform according to the division of powers prescribed in the Constitution for which they need to raise resources. A dual GST will, therefore, be in keeping with the Constitutional requirement of fiscal federalism. Hence, Centre will levy and administer CGST & IGST while respective states will levy and administer SGST. The Constitution of India has been amended for this purpose.

Characteristics of Goods and Services Tax:

- Common Law and Procedure: GST is governed by a uniform law and procedure across the entire country under a single administration.

- Destination-Based Tax: GST is a destination-based tax, levied at a single point during the consumption of goods and services by the end consumer.

- Comprehensive Levy: GST is a comprehensive levy on both goods and services at the same rate, with the benefit of input tax credit or value subtraction.

- Limited Tax Rates: The minimum number of tax rates does not exceed two.

- No Additional Levies: There is no scope for levying cess, resale tax, additional tax, turnover tax, etc.

- No Multiple Taxation: GST eliminates multiple levies on goods and services, such as sales tax, entry tax, octroi, entertainment tax, or luxury tax.

Advantages of GST:

- Abolition of Multiple Taxes: GST has led to the abolition of various types of taxes on goods and services.

- Wider Tax Base: GST widens the tax base and increases revenue for both the Centre and State, reducing administrative costs for the government.

- Reduced Compliance Cost: GST reduces compliance costs and increases voluntary compliance.

- Maximum Tax Rates: GST has affected tax rates to a maximum of two floor rates.

- Elimination of Cascading Effect: GST has removed the cascading effect on taxation.

- Enhanced Manufacturing and Distribution: GST enhances manufacturing and distribution systems, affecting the cost of production, and leading to increased demand and production of goods and services.

- Economic Efficiency and Growth: GST promotes economic efficiency and sustainable long-term growth, being neutral to business processes, models, organisational structures, and geographical locations.

- Competitive Edge in International Market: GST helps extend the competitive edge in the international market for goods and services produced in the country, leading to increased exports.

|

61 videos|220 docs|39 tests

|

FAQs on Theory Base of Accounting Chapter Notes - Accountancy Class 11 - Commerce

| 1. What are Generally Accepted Accounting Principles (GAAP) and why are they important? |  |

| 2. What are the different systems of accounting? |  |

| 3. What is the difference between cash basis and accrual basis accounting? |  |

| 4. Why are accounting standards necessary in the business environment? |  |

| 5. How do accounting principles and standards impact financial reporting? |  |