Depreciation, Provisions and Reserves Chapter Notes | Accountancy Class 11 - Commerce PDF Download

Introduction

- The matching principle states that the revenue generated in a specific time frame should be compared with the expenses incurred during the same time frame.

- This principle helps in determining the accurate amount of profit or loss for that period.

- If a cost benefits more than one accounting period, it is not correct to list the entire cost as an expense in the year it occurs.

- Instead, such costs should be distributed across the periods they benefit.

- Depreciation on fixed assets is a key example of this, as it addresses how to handle such costs.

- Sometimes, it may be challenging to accurately determine the total amount of a specific expense.

- The principle of conservatism (or prudence) suggests that rather than ignoring uncertain costs, we should make appropriate provisions and account for them in the current period's profits.

- Additionally, a portion of the profit may be kept in the business as reserves to support future growth, and expansion, or to address specific needs that may arise.

- Let's learn more about these aspects.

Depreciation

- Depreciation refers to the decline in the value offixed assetsdue to factors like usage, passage of time, or obsolescence.

- Fixed assets, also known as depreciable assets, are used in business for more than one accounting year and their value decreases over time.

- For example, when a business buys a machine, its value decreases with use. Even if the machine is not used, its value declines over time or due to the introduction of a newer model (obsolescence).

- Depreciation is an accounting term that represents the portion of a fixed assets cost that has expired due to usage and/or the passage of time. It is considered an expired cost or expense, deducted from the revenue of a specific accounting period.

- For instance, if a machine is purchased for ₹1,00,000 on April 1, 2017, with an estimated useful life of 10 years, the entire cost cannot be charged against the revenue for the year 2017-18.

- Instead, only a portion of the cost, such as ₹10,000 (one-tenth of ₹1,00,000), is charged against the revenue for 2017-18. This portion represents the expired cost or loss in the machine's value due to usage or the passage of time and is called depreciation.

- Depreciation is debited to the Income Statement(Statement of Profit and Loss) as it is a charge against profit.

Meaning of Depreciation

- Depreciation refers to the gradual and permanent decrease in the book value of fixed assets over time.

- It is based on the cost of assets used in a business, not their market value.

- According to the Institute of Cost and Management Accounting, London, depreciation is the reduction in the intrinsic value of an asset due to usage and/or the passage of time.

- Accounting Standard-6 by the Institute of Chartered Accountants of India defines depreciation as a measure of the wearing out, consumption, or loss of value of a depreciable asset. This loss can occur due to use, the passage of time, or obsolescence due to technological and market changes.

- Depreciation is allocated to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset.

- Depreciation also includes the amortization of assets with a pre-determined useful life.

AS-6 (Revised): Depreciation

- Depreciation is a measure of the reduction in value of a depreciable asset due to factors such as use, the passage of time, or obsolescence caused by technological or market changes. It is allocated to charge a fair proportion of the depreciable amount in each accounting period during the asset₹s expected useful life. Depreciation also includes the amortization of assets with a predetermined useful life.

Depreciation plays a crucial role in determining and presenting the financial position and operational results of a business. It is charged in each accounting period based on the extent of the depreciable amount.

The base for depreciation is "depreciable" assets, which are expected to be used over more than one accounting period, have a limited useful life, and are held by an enterprise for purposes such as production, supply of goods and services, rental to others, or administrative use, rather than for sale in the ordinary course of business.

The amount of depreciation depends on three factors: Cost, Useful life, and Net realizable value.

The cost of a fixed asset includes all expenses related to its acquisition, installation, commissioning, and any improvements or additions made to the depreciable asset.

The useful life of an asset is the period over which it is expected to be used by the enterprise.

There are two main methods for calculating depreciation:

(i) Straight Line Method

(ii) Written Down Value MethodThe choice of depreciation method depends on factors such as the type of asset, the nature of its use, and the prevailing circumstances in the business.

Once a depreciation method is chosen, it should be applied consistently from period to period. Changes in the depreciation method are only allowed under specific circumstances.

Depreciation plays a crucial role in determining and presenting the financial position and operational results of a business. It is charged in each accounting period based on the depreciable amount.

Depreciableassetsare those that:

- are expected to be used for more than one accounting period,

- have a limited useful life, and

- are held for production, supply, rental, or administrative purposes, not for sale in the ordinary course of business.

Examplesof depreciable assets include machines, plants, furniture, buildings, computers, trucks, vans, and equipment.

- Depreciation involves allocating the depreciable amount, which is the historical cost or a substituted amount minus the estimated salvage value.

- The expected useful life of an asset is either the period it is expected to be used or the number of similar units expected to be produced using the asset.

Features of Depreciation

- Decline in Book Value: Depreciation represents the decrease in the book value of fixed assets over time.

- Causes of Value Loss: It includes loss of value due to factors like time, usage, or obsolescence. For instance, if a business buys a machine for ₹ 1,00,000 and a newer version comes out later, the old machine's value declines due to obsolescence.

- Continuing Process: Depreciation is an ongoing process that occurs continuously over time.

- Expired Cost: Depreciation is considered an expired cost and must be deducted before calculating taxable profits. For example, if the profit before depreciation and tax is ₹ 50,000 and depreciation is ₹ 10,000, the profit before tax would be ₹ 40,000 (₹ 50,000 - ₹ 10,000).

- It is a non-cash expense. It does not involve any cash outflow. It is the process of writing off the capital expenditure already incurred.

Depreciation and other Similar Terms

Depletion and Amortisation:

- Depletion refers to the reduction in the quantity of natural resources, such as minerals or fossil fuels, due to extraction. For example, when a coal mine is purchased for ₹ 10,00,000, its value decreases as coal is extracted. This decline is called depletion. While depletion and depreciation differ in focus—depletion concerns the exhaustion of economic resources and depreciation relates to the usage of an asset—they are treated similarly in accounting because both involve the reduction of resource volume and service potential.

- Amortisation involves writing off the cost of intangible assets like patents, copyrights, trademarks, franchises, and goodwill over a specified period. The process for amortisation is similar to that of depreciation for fixed assets. For instance, if a patent is bought for ₹ 10,00,000 with an estimated useful life of 10 years, the business must write off ₹ 10,00,000 over 10 years, and this written-off amount is referred to as amortisation.

Causes of Depreciation

- Wear and Tear due to Use or Passage of Time:Wear and tear refers to the deterioration and reduction in an asset's value resulting from its use in business operations to generate revenue. It diminishes the asset's technical capacity to serve its intended purpose.

- An asset also undergoes physical deterioration simply with time, even if it is not being used. This is especially true for assets exposed to the elements such as weather, wind, and rain.

- Expiration of Legal Rights: Certain assets lose their value when the legal agreement governing their use expires after a predetermined period. Examples include patents, copyrights, and leases, whose utility to a business ceases immediately upon the removal of legal backing.

- Obsolescence: Obsolescence occurs when an existing asset becomes outdated due to the availability of a better type of asset. This can result from factors such as technological advancements, improvements in production methods, changes in market demand, or legal regulations.

- Abnormal Factors: A decline in an asset's usefulness may be caused by abnormal factors such as accidents, fires, earthquakes, or floods. While accidental loss is permanent, it is not gradual or continuing. For instance, a car that has been repaired after an accident will not fetch the same market price, even if it has not been used since.

Need for Depreciation

- Matching of Costs and Revenue: Depreciation is necessary because fixed assets are used to generate revenue, and these assets naturally experience wear and tear, losing value over time. Just like other business expenses such as salaries and postage, depreciation is a cost that needs to be accounted for. It is deducted from revenue to determine net profit, following Generally Accepted Accounting Principles (GAAP).

- Consideration of Tax: Depreciation is a cost that can be deducted for tax purposes. However, the rules for calculating depreciation for tax reasons may differ from current business practices.

- True and Fair Financial Position: If depreciation is not accounted for, assets will be overvalued, and the balance sheet will not accurately reflect the company’s financial position. This practice is not allowed by established accounting standards or legal requirements.

- Compliance with Law: In addition to tax regulations, certain laws require specific businesses, such as corporate enterprises, to provide for depreciation on fixed assets.

Factors Affecting the Amount of Depreciation

The determination of depreciation depends on three parameters, viz. cost, estimated useful life and probable salvage value.

Cost of Asset

- The cost of an asset includes the invoice price and other necessary costs to make the asset operational.

- Besides the purchase price, it covers freight, transportation, transit insurance, installation, registration, and any commissions paid.

- For second-hand assets, it includes initial repair costs to make the asset functional.

- According to Accounting Standard-6 of ICAI, the cost of a fixed asset encompasses all expenses related to its acquisition, installation, commissioning, and any additions or improvements.

- For example, if a photocopy machine is bought for ₹ 50,000 and ₹ 5,000 is spent on transportation and installation, the original cost would be ₹ 55,000, which will be depreciated over the machine's useful life.

Estimated Net Residual Value

- Net Residual Value, also known as scrap value or salvage value, is the estimated net realizable value of an asset at the end of its useful life, after deducting disposal expenses.

- For instance, if a machine is bought for ₹ 50,000 with a useful life of 10 years and an expected sale value of ₹ 6,000 at the end of its life, but with disposal expenses of ₹ 1,000, the net residual value would be ₹ 5,000 (₹ 6,000. ₹ 1,000 ).

Depreciable Cost

- The depreciation cost of an asset is calculated by subtracting the net residual value from the cost of the asset.

- For example, if a machine costs ₹ 50,000 and has a net residual value of ₹ 5,000, the depreciable cost would be ₹ 45,000 (₹ 50,000. ₹ 5,000 ).

- This depreciable cost is spread out and charged as a depreciation expense over the estimated useful life of the asset.

- It is crucial that the total depreciation charged over the asset's useful life equals the depreciable cost.

- If the total depreciation charged is less than the depreciable cost, it results in an under-recovery of capital expenditure, violating the principle of matching revenue and expenses properly.

Estimated Useful Life

- The useful life of an asset refers to its estimated economic or commercial lifespan, rather than its physical durability.

- An asset may still be physically intact but not economically viable for production after a certain period. For instance, a machine purchased for production may be in good condition after five years, but if the cost of using it exceeds the production costs, its useful life is considered to be five years.

- Estimating the useful life of an asset is challenging as it depends on various factors such as usage levels, maintenance, technological advancements, and market changes.

- According to Accounting Standard - 6, the useful life of an asset is typically the period expected for its use by the enterprise. Generally, the useful life is shorter than the physical life of the asset.

- The useful life can be expressed in different units, such as the number of years, units of output (like in mining), or number of working hours.

- Factors influencing useful life include:

1. Legal or contractual limits, such as in the case of leasehold assets where the useful life is the lease period.

2. Number of shifts the asset will be used.

3. Repair and maintenance policies of the organization.

4. Technological obsolescence and advancements.

5. Innovations or improvements in production methods.

6. Legal or other restrictions.

Methods of Calculating Depreciation Amount

- The depreciable amount and method of allocation determine the depreciation charge for an accounting year.

- Two main methods mandated by law in India are:

(a) Straight Line Method

(b) Written Down Value Method - Other methods include:

(a) Annuity Method

(b) Depreciation Fund Method

(c) Insurance Policy Method

(d) Sum of Years Digit Method

(e) Double Declining Method - Selection Criteria:

(a) Type of Asset

(b) Nature of Use

(c) Business Circumstances

Straight Line Method:

- The Straight Line Method is one of the earliest and most commonly used ways to calculate depreciation.

- This method assumes that an asset is used equally throughout its entire useful life.

- It's called "straight line" because when you plot the depreciation amount over time on a graph, it forms a straight line.

- This method is also known as the "fixed installment method" because the depreciation amount remains constant each year during the asset's useful life.

- Under this method, a fixed and equal amount is charged as depreciation in every accounting period throughout the lifetime of the asset.

- The annual depreciation amount is calculated to reduce the asset's original cost to its scrap value by the end of its useful life.

- This method is sometimes referred to as the "fixed percentage on original cost method" because the same percentage of the original cost (or depreciable cost) is written off as depreciation each year.

The depreciation amount to be provided under this method is computed by using the following formula:

The rate of depreciation under the straight-line method is the percentage of the total cost of the asset to be charged as deprecation during the useful lifetime of the asset. The rate of depreciation is calculated as follows:

Consider the following example, the original cost of the asset is ₹ 2,50,000. The useful life of the asset is 10 years and net residual value is estimated to be ₹ 50,000. Now, the amount of depreciation to be charged every year will be computed as given below:

The rate of depreciation will be calculated as :

From point (i), the annual depreciation amounts to ₹ 20,000.

Thus, the rate of depreciation will be

Advantages of the Straight Line Method:

- Simplicity and Ease of Understanding: The straight-line method is straightforward to comprehend, making it a popular choice in practice.

- Full Depreciable Cost Distribution: This method allows for the distribution of the full depreciable cost over the useful life of the asset, as it can be depreciated down to the net scrap value or zero value.

- Consistent Annual Charges: The same amount is charged as depreciation in the profit and loss account each year, facilitating easy comparison of profits across different years.

- Suitability for Certain Assets: The Straight Line method is appropriate for assets with an accurately estimable useful life and consistent usage from year to year, such as leasehold buildings.

Limitations of the Straight Line Method:

- Assumption of Uniform Utility: This method is based on the incorrect assumption that an asset's utility remains the same across different accounting years.

- Decreasing Work Efficiency: Over time, an asset's work efficiency declines, and repair and maintenance costs increase. As a result, the total amount charged against profit for depreciation and repairs will not be uniform throughout the asset's life; it will rise from year to year.

Written Down Value Method

- Under this method, depreciation is charged on the book value of the asset.

- Since book value keeps on reducing by the annual charge of depreciation, it is also known as ‘reducing balance method’.

- This method involves the application of a pre-determined proportion/percentage of the book value of the asset at the beginning of every accounting period, so as to calculate the amount of depreciation.

- The amount of depreciation reduces year after year.

For example, if the original cost of the asset is ₹ 2,00,000 and depreciation is charged @ 10% p.a. at written down value, then the amount of depreciation will be computed as follows:

- In this method, a fixed percentage of the asset's remaining book value is depreciated each year.

- The book value is the original cost of the asset minus any accumulated depreciation.

- As a result, the depreciation expense decreases over time because the base amount (book value) is getting smaller.

- This method reflects the idea that assets often lose value more quickly in the earlier years of their useful life.

Under written down value method, the rate of depreciation is computed by using the following formula:

Where, r = Rate of depreciation n = Expected useful life

Where, r = Rate of depreciation n = Expected useful life

s = Scrap value

c = Cost of an asset

For example, if the original cost of a truck is ₹ 9,00,000 and its net salvage value after 16 years of useful life is ₹ 50,000 then the appropriate rate of depreciation will be computed as under:

Advantages of Written Down Value Method:

- Realistic Cost Allocation: This method reflects the diminishing benefits of an asset over time, ensuring a proper allocation of cost. Higher depreciation is charged in the early years when the asset’s utility is greater, compared to later years when its effectiveness declines.

- Balanced Expense Burden: This results in a nearly equal burden of depreciation and repair expenses on the profit and loss account each year.

- Tax Acceptance: The Income Tax Act accepts this method for tax purposes, making it widely applicable.

- Reduced Obsolescence Loss: Since a large portion of the cost is written off in the earlier years, the loss due to obsolescence is minimized.

- Suitable for Long-lasting Assets: This method is appropriate for fixed assets that have a long lifespan and require increasing repair and maintenance expenses over time. It is also applicable in cases where the obsolescence rate is high.

Limitations of the Written Down Value Method:

- Incomplete Cost Recovery: Since depreciation is calculated as a fixed percentage of the written down value, the depreciable cost of the asset cannot be fully written off. This means the asset's value can never reach zero.

- Difficulty in Setting Depreciation Rate: It can be challenging to determine an appropriate rate of depreciation for the asset.

Straight Line Method and Written Down Method: A Comparative Analysis

1. Basis of Charging Depreciation:

- In the straight-line method, depreciation is calculated based on the original cost or historical cost of the asset.

- In the written down value method, depreciation is charged on the net book value, which is the original cost minus accumulated depreciation, at the beginning of the year.

2. Annual Charge of Depreciation:

- Under the straight-line method, the annual depreciation amount remains fixed or constant every year.

- In the written down value method, the annual depreciation amount is highest in the first year and decreases in subsequent years. This is due to the difference in the basis of charging depreciation: original cost in the straight line method and written down value in the latter.

3. Total Charge Against Profit and Loss Account:

- Under the straight-line method, total charges for depreciation and repair expenses increase in the later years of the asset's useful life because the annual depreciation charge remains fixed while repair expenses rise.

- In contrast, under the written down value method, the depreciation charge decreases in later years, resulting in a consistent total of depreciation and repair charges year after year.

4. Recognition by Income Tax Law:

- The straight-line method is not recognized by Income Tax Law.

- The written down value method is recognized by Income Tax Law.

5. Suitability:

- The straight-line method is suitable for assets with low repair charges, low obsolescence risk, and where scrap value depends on the time period involved, such as freehold land and buildings, patents, and trademarks.

- The written down value method is suitable for assets affected by technological changes and requiring increasing repair expenses over time, such as plant and machinery, and vehicles.

Comparison of straight line and written down value method:

Methods of Recording Depreciation

There are two methods of recording depreciation. Let's learn about them.

1. Charging Depreciation to Asset account

- In this method, depreciation is deducted from the depreciable cost of the asset.

- This means that the asset account is credited with the amount of depreciation.

- At the same time, the same amount is charged (or debited) to the profit and loss account.

3. Balance Sheet Treatment

When this method is used, the fixed asset appears at its net book value (i.e. cost less depreciation charged till date) on the asset side of the balance sheet and not at its original cost (also known as historical cost).

2. Creating Provision for Depreciation Account/Accumulated Depreciation Account

The provision for depreciation account, also known as the accumulated depreciation account, is a method used to record and track the depreciation of an asset over time. This method involves accumulating the depreciation in a separate account, rather than adjusting the asset account directly. Here are some key points about this method:

- The asset account remains at its original cost throughout the asset's useful life.

- Depreciation is accumulated in a separate account, which allows the asset account to remain unchanged.

- This method provides a clear picture of the asset's value and the total depreciation accumulated over time.

- It is useful for businesses to track the depreciation of their assets without affecting the asset's recorded value.

Characteristics of Provision for Depreciation Method:

- Original Cost: The asset account shows the asset at its original cost throughout its entire life.

- Separate Accumulation: Depreciation is accumulated in a separate account, not adjusted in the asset account.

The following journal entries are recorded under this method:

3. Balance sheet treatment

In the balance sheet, the fixed asset continues to appear at its original cost on the asset side. The depreciation charged till that date appears in the provision for depreciation account, which is shown either on the “liabilities side” of the balance sheet or by way of deduction from the original cost of the asset concerned on the asset side of the balance sheet.

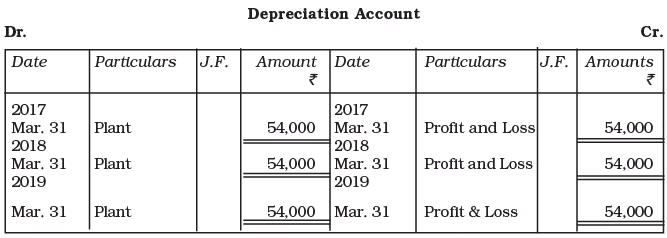

Example: M/s Singhania and Bros. purchased a plant for ₹ 5,00,000 on April 01, 2017, and spent ₹ 50,000 for its installation. The salvage value of the plant after its useful life of 10 years is estimated to be ₹ 10,000. Record journal entries for the year 2016-17 and draw up Plant Account and Depreciation Account for first three years given that the depreciation is charged using straight line method if :

(i) The books of account close on March 31 every year; and

(ii) The firm charges depreciation to the asset account.

Ans:

Workings Notes:

Workings Notes:

(1) Calculation of original cost

(2) Depreciation amount

(2) Depreciation amount

Disposal of Asset

Disposal of an asset can take place either (a) at the end of its useful life or (b) during its useful life (due to obsolescence or any other abnormal factor).

If it is sold at the end of its useful life, the amount realised on account of the sale of the asset as scrap should be credited to the asset account and the balance is transferred to the profit and loss account. In this regard, the following journal entries are recorded.

In case, however, the provision for depreciation account has been in use for recording the depreciation, then before passing the above entries transfer the balance of the provision for depreciation account to the asset account by recording the following journal entry:

For example,R.S. Limited purchased a vehicle for ₹ 4,00,000. After 4 years its salvage value is estimated at ₹ 40,000. To find out the amount of depreciation to be charged every year based on a straight-line basis, and show as to how the vehicle account would appear for four years assuming it is sold for ₹ 50,000 at the end when (a) depreciation is charged to the asset account, and (b) provision for depreciation account is maintained.

For example,R.S. Limited purchased a vehicle for ₹ 4,00,000. After 4 years its salvage value is estimated at ₹ 40,000. To find out the amount of depreciation to be charged every year based on a straight-line basis, and show as to how the vehicle account would appear for four years assuming it is sold for ₹ 50,000 at the end when (a) depreciation is charged to the asset account, and (b) provision for depreciation account is maintained.

Consider the following entries in the book of account of R.S. Limited

(a) When depreciation is charged to assets account

(b) When Provision for depreciation account is maintained.

Use of Asset Disposal Account:

- The Asset Disposal Account is used to provide a clear and comprehensive view of all transactions involved in the sale of an asset.

- Keyfactorsconsidered in this account include:

1. Original cost of the asset

2. Accumulated depreciation up to the date of sale

3. The sale price of the asset

4. Value of any retained parts of the asset

5. Resultant profit or loss on disposal - The balance of this account is transferredto the profit and loss account.

- This method is typically used when a part of the asset is sold and there is a provision for a depreciation account.

- A new account called the Asset Disposal Accountis opened.

- The original cost of the asset being sold is debited to this account.

- Accumulated depreciation related to the asset up to the date of disposal is credited to the account.

- The net amount realized from the sale of the asset is also credited to this account.

- The balance in the Asset Disposal Account indicates profit or loss, which is then transferred to the profit and loss account.

- This method offers the advantage of presenting all transactions related to asset disposal in one place.

- Journal entries required for preparing the Asset Disposal Account include:

Asset Disposal Account may ultimately show a debit or credit balance. The debit balance on the account indicates loss on disposal and would be dealt with as follows:

The credit balance of the account, profit on disposal and would be closed by the following journal entry:

For example,Karan Enterprises has the following balances in its books as on March 31, 2017

For example,Karan Enterprises has the following balances in its books as on March 31, 2017

Machinery (gross value): ₹ 6,00,000

Provision for depreciation: ₹ 2,50,000

A machine purchased for ₹ 1,00,000 on November 01, 2013, having accumulated depreciation amounting to ₹ 60,000 was sold on April 1, 2017 for ₹ 35,000. The Asset Disposal account will be prepared in the following manner:

Working Notes:

Example: On January 01, 2015, Khosla Transport Co. purchased five trucks for ₹ 20,000 each.

Depreciation has been provided at the rate of 10% p.a. using straight line method and accumulated in provision for depreciation acount. On January 01, 2016, one truck was sold for ₹ 15,000. On July 01, 2017, another truck (purchased for ₹ 20,000 on Jan, 01, 2014) was sold for ₹ 18,000. A new truck costing ₹ 30,000 was purchased on October 01, 2016. You are required to prepare trucks account, Provision for depreciation account and Truck disposal account for the years ended on December 2015, 2016 and 2017 assuming that the firm closes its accounts in December every year.

Ans:

Working Notes:

Effect of any Addition or Extension to the Existing Asset

Additions/Extensions to Existing Assets- When an existing asset needs additions or extensions to be operational, the costs incurred are capitalised and depreciated over the asset's life.

- This is separate from regular repair and maintenance expenses.

AS-6 (Revised) Guidelines:

- If an addition or extension becomes an integral part of the asset, it should be depreciated over the asset's useful life.

- Depreciation for such additions/extensions can be at the same rate as the existing asset.

- If an addition or extension retains its separate identity and can be used after the asset is disposed of, it should be depreciated independently based on its own useful life.

Example: M/s Digital Studio bought a machine for ₹ 8,00,000 on April 01, 2013. Depreciation was provided on straight-line basis at the rate of 20% on original cost. On April 01, 2015 a substantial modification was made in the machine to make it more efficient at a cost of ₹ 80,000. This amount is to be depreciated @ 20% on straight line basis. Routine maintenance expenses during the year 2013-14 were ₹ 2,000.

Draw up the Machine account, Provision for depreciation account and charge to profit and loss account in respect of the accounting year ended on March 31, 2016.

Ans:

Working Notes:

1. Cost of modification is capitalised but routine repair expenses are treated as revenue expenditure.

2. Calculation of balance of provision for depreciation account on 01.04.2014. 3. Depreciation for the year 2015-16 is calculated as under:

3. Depreciation for the year 2015-16 is calculated as under: 4. Amount to be charged to profit and loss account

4. Amount to be charged to profit and loss account

Provisions and Reserve

What are Provisions?

- Provisions are made for expenses or losses that are related to the current accounting period but whose amounts are not certain because they have not yet been incurred.

- For example, a trader knows that some customers will not pay their debts in full, so they create a Provision for Doubtful Debts to account for this expected loss.

- Similarly, provisions can be made for expected repairs and renewals of fixed assets.

Examples of Provisions

- Provision for depreciation

- Provision for bad and doubtful debts

- Provision for taxation

- Provision for discount on debtors

- Provision for repairs and renewals

Importance of Provisions

- Provisions are necessary to ensure the proper matching of revenue and expenses, which is essential for calculating true profits.

- They are considered a charge against the revenue of the current period.

How Provisions are Created

- Provisions are created by debiting the profit and loss account.

- In the balance sheet, provisions can be shown either:

- As a deduction from the concerned asset on the assets side (e.g., provision for doubtful debts is deducted from sundry debtors).

- On the liabilities side of the balance sheet along with current liabilities (e.g., provision for taxes and provision for repairs and renewals).

Accounting Treatment for Provisions

- Good Debtors: These are debtors from whom the collection of debt is certain.

- Bad Debts: These are debtors from whom collection is not possible, resulting in a certain loss for the business.

- Doubtful Debts: These are debtors who may or may not pay the full amount owed. Based on business experience, a certain percentage of these debtors are unlikely to pay, necessitating a provision for doubtful debts.

- To account for the potential loss from non-payment by some debtors, it is common practice to make a provision for doubtful debts when determining the true profit or loss of the business.

- The provision for doubtful debts is typically calculated as a percentage of the total amount due from sundry debtors, after deducting known bad debts.

- This provision is also referred to as "Provision for Bad and Doubtful Debts."

- To create this provision, the required amount is debited to the profit and loss account and credited to the provision for doubtful debts account.

For creating a provision for doubtful debts the following journal entry is recorded:

This is explained with the help of the following example Observe an extract of the trial balance from the books of Trehan Traders on March 31, 2014 is given below:

This is explained with the help of the following example Observe an extract of the trial balance from the books of Trehan Traders on March 31, 2014 is given below:

Additional Information

- Bad debts proved bad but not recorded amounted to ₹ 8,000

- Provision is to be maintained at 10% of debtors.

In order to create the provision for doubtful debts, the following journal entries will be recorded:

Working Notes:

Provision for doubtful debts @10% of sundry debtors i.e. ₹ 68,000 – ₹ 8000 = ₹ 60,000

Reserves

- A portion of the profit may be set aside and retained in the business to provide for certain future needs like growth and expansion or to meet future contingencies such as workmen's compensation.

- Unlike provisions, reserves are the appropriations of profit to strengthen the financial position of the business.

- Reserve is not a charge against profit as it is not meant to cover any known liability or expected loss in future.

- However, retention of profits in the form of reserves reduces the amount of profits available for distribution among the owners of the business.

- It is shown under the head Reserves and Surpluses on the liabilities side of the balance sheet after capital.

- Examples of reserves are:

1. General reserve;

2. Workmen compensation fund;

3. Investment fluctuation fund;

4. Capital reserve;

5. Dividend equalisation reserve;

6. Reserve for the redemption of a debenture.

Difference between Reserve and Provision

- Basic Nature: provision is an expense deducted from profit, while a reserve is a portion of profit set aside. Provisions must be accounted for before calculating net profit, whereas reserves are established after net profit is determined.

- Purpose: Provisions are made for known liabilities or expenses in the current accounting period, though the exact amount is uncertain. Reserves, on the other hand, are created to strengthen the financial position of the business and may be legally mandatory in some cases.

- Presentation in Balance Sheet: Provisions are presented either by deducting from the related asset item or on the liabilities side with current liabilities. Reserves are shown on the liabilities side, after capital.

- Effect on Taxable Profits: Provisions reduce taxable profits as they are deducted before calculating them. Reserves, created from profit after tax, do not impact taxable profit.

- Element of Compulsion: Creating a provision is necessary to ensure a true and fair profit or loss, following the 'Prudence' or 'Conservatism' principle. Provisions must be made even in the absence of profits. In contrast, reserves are typically at the management's discretion, although specific reserves like Debenture Redemption Reserve are legally required. Reserves can only be created when there are profits.

- Use for Dividend Payment: Provisions cannot be used for dividend distribution, whereas general reserves can be utilized for this purpose.

Types of Reserves

A reserve is formed by retaining the profits of a business and can be designated for either a general or specific purpose.

- General Reserve: When the purpose of creating the reserve is not specified, it is known as a General Reserve. It is also called a free reserve because the management can use it for any purpose. General reserves enhance the financial position of the business.

- Specific Reserve: A specific Reserve is created for a particular purpose and can only be used for that purpose. Examples include:

- Dividend Equalisation Reserve: This reserve stabilizes the dividend rate by transferring amounts during high-profit years to maintain the dividend rate during low-profit years.

- Workmen Compensation Fund: This fund is established to cover claims made by workers due to accidents or other incidents.

- Investment Fluctuation Fund: This fund addresses declines in the value of investments due to market fluctuations.

- Debenture Redemption Reserve: This reserve is set up to provide funds for redeeming debentures.

Reserves are also categorized into revenue reserves and capital reserves based on the nature of the profit from which they are created.

(a) Revenue Reserves: These are created from revenue profits arising from the normal operating activities of the business and are generally available for distribution as dividends. Examples include:

- General Reserve

- Workmen Compensation Fund

- Investment Fluctuation Fund

- Dividend Equalisation Reserve

- Debenture Redemption Reserve

(b) Capital Reserves: These are created from capital profits that do not arise from normal operating activities and are not available for distribution as dividends. Capital reserves can be used for writing off capital losses or issuing bonus shares. Examples of capital profits include:

- Premium on the issue of shares or debentures

- Profit on the sale of fixed assets

- Profit on the redemption of debentures

- Profit on the revaluation of fixed assets and liabilities

- Profits prior to incorporation

- Profit on the reissue of forfeited shares

Difference between Revenue and Capital Reserve

- Source of Creation:

- Revenue Reserve: Created from revenue profits, which come from the normal operating activities of the business and are available for dividend distribution.

- Capital Reserve: Created from capital profits, which do not arise from regular business activities and are not available for dividend distribution. However, revenue profits can also be used to create capital reserves.

- Purpose:

- Revenue Reserve: Established to strengthen the financial position, address unforeseen contingencies, or for specific purposes.

- Capital Reserve: Set up to comply with legal requirements or accounting practices.

- Usage:

- Revenue Reserve:. specific revenue reserve can only be used for its designated purpose, while a general reserve can be used for any purpose, including dividend distribution.

- Capital Reserve: Can be used for specific purposes as per the law, such as writing off capital losses or issuing bonus shares.

Importance of Reserves

- A business firm may consider it proper to set up some mechanism to protect itself from the consequences of unknown expenses and losses, it may be required to bear in future.

- It may also regard it as more appropriate in certain cases to reduce the amount that can be drawn by the proprietors as profit in order to conserve business resource to meet certain significant demands in future.

- An example of such a demand is the much-needed expansion in the scale of business operations.

- This is presented as the justification for reserves in business activities and in accounting.

- The amount so set aside may be meant for the purpose of:

1. Meeting a future contingency

2. Strengthening the general financial position of the business;

3. Redeeming a long-term liability like debentures, etc.

Secret Reserve

- A secret reserve is a hidden reserve that is not shown in the balance sheet.

- It can help reduce disclosed profits and tax liability.

- During lean periods, secret reserves can be merged with profits to show improved financial results.

- Management may create secret reserves by charging higher depreciation than necessary.

- It is called a "secret" reserve because it is not known to external stakeholders.

- Secret reserves can also be created by:

1. Undervaluing inventories or stock.

2. Charging capital expenditure to the profit and loss account.

3. Making excessive provisions for doubtful debts.

4. Showing contingent liabilities as actual liabilities. - Creating secret reserves within reasonable limits is justifiable for reasons of expediency, prudence, and preventing competition from other firms.

|

61 videos|154 docs|35 tests

|

FAQs on Depreciation, Provisions and Reserves Chapter Notes - Accountancy Class 11 - Commerce

| 1. What is depreciation and why is it important in accounting? |  |

| 2. What are the main causes of depreciation for an asset? |  |

| 3. What are the different methods for calculating depreciation amounts? |  |

| 4. How is depreciation recorded in financial statements? |  |

| 5. What happens to the depreciation of an asset when it is disposed of? |  |