Introduction

The Companies Act 2013 has laid down detailed procedure for the issue and allotment of shares which a company has to follow.

In this unit, you will learn about issue of shares at par, private placement of shares, public issue of shares, initial public offer and further public offer, rights shares and bonus shares You will also learn about that procedure including the detailed rules relating to the allotment of shares. In addition, you will study the rules relating to the issue of shares at a premium or at a discount, and the procedure for the forfeiture and reissue of forfeited shares and surrender of shares, buy back of shares and book building.

Issue of Shares at Par

A company can issue shares at face value or at a different price. When issued at face value, it is called issuing shares at par. This means the issue price matches the face value.

Although not defined in the Act, shares can be sold at a discount or premium when issued below or above face value, respectively.

Shares can be issued through:

- Public offer, which includes:

- Initial Public Offer (IPO)

- Further Public Offer (FPO)

- Rights or bonus issue

- Private placement

They are discussed in this unit.

Private Placement of Shares

A company may make a private placement of securities. As per explanation 1 to Section 42 (3) private placement means any offer or invitation to subscribe or issue of securities to a select group of persons by a company (other than by way of public offer) through private placement offer-cum-application which satisfies the conditions specified in this section.

Conditions

(a) (i) A private placement is to be made only to a select group of persons who have been identified by the Board, whose number shall not exceed fifty or such higher number as may be prescribed (presently, 200) (excluding the qualified institutional buyers and employees of the company being offered securities under the scheme of employees stock option in a financial year subject to such conditions as may be prescribed).

Qualified institutional buyer means the qualified institutional buyer as defined in the Securities and Exchange Board of India (issue of capital and disclosure requirement) Regulations 2009.

(ii) Private placement shall be made through private placement offer and application in the prescribed form. However, the private placement offer and application shall not carry any right of renunciation.

In Mrs. Proddaturi Malathi vs. SRP Logistics (P) Ltd [2018] 96 taxmann.com 565 (NCL-AT), respondent directors increased share capital of company and further allotted shares of company to R2-director and to outsider at par by preferential allotment/private placement without following necessary procedure, said increase in share capital and subsequent allotment of shares was held to be invalid and thus same was to be set aside.

(b) Any identified person interested in subscribing to a private placement must apply using the designated application form and submit the subscription amount via cheque, demand draft, or other banking channels—cash payments are not permitted.

However, the company cannot use the funds raised through private placement until the allotment is completed and the return of allotment is filed with the Registrar as per sub-section (8).

(c) A company cannot make a new offer or invitation under this section until all allotments from a previous offer or invitation are completed, withdrawn, or abandoned.

(d) A company making an offer or invitation under this section shall allot its securities within sixty days from the date of receipt of the application money for such securities and if the company is not able to allot the securities within that period, it shall repay the application money to the subscribers within fifteen days from the expiry of sixty days and if the company fails to replay the application money within the aforesaid period, it shall be liable to replay that money with interest at the rate of twelve percent per annum from the expiry of the sixteeth day.

Provided that monies received on application under this section shall be kept in a separate bank account in a scheduled bank and shall not be utilized for any purpose other than

(i) for adjustment against allotment of securities; or

(ii) for the repayment of monies where the company is unable to allot securities.

(e) A company offering securities under this section must not advertise publicly or use media, marketing platforms, distribution channels, or agents to inform the general public about the issue.

(f) A company that allots securities under this section must submit a return of allotment to the Registrar within fifteen days. This submission should contain a full list of all allottees, including their names, addresses, the number of securities allotted, and any other required details.

Penalty

(a) If a company defaults in filing the return of allotment within the period prescribed under sub-section (8), the company, its promoters and directors shall be liable to a penalty of one thousand rupees for each day during which the default continues, subject to a maximum of twenty-five lakh rupees.

(b) Subject to sub-section (a), if a company makes an offer or accepts monies in contravention of this section, the company, its promoters and directors shall be liable for a penalty which may extend to the amount raised through the private placement or rupees two crores, whichever is lower. Additionally, the company shall refund all monies with interest as specified in sub-section (6) to the subscribers within thirty days of the order imposing the penalty.

Public Issue of Shares

The term "issue" refers to shares being offered to the public, meaning they are made available broadly rather than to a specific group of individuals. In the context of a prospectus, "issued generally" implies that the offer is open to all individuals, regardless of whether they are existing members or debenture holders of the concerned corporate entity. Therefore, the term "public" includes any section of the population.

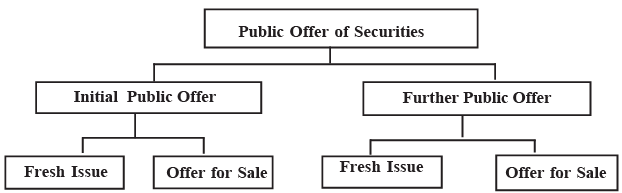

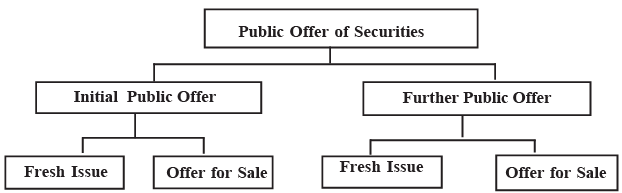

Share issues can be categorized into public offers, rights or bonus issues, and private placements. A public offer can be:

- Initial Public Offer (IPO)

- Further Public Offer (FPO)

Both IPO and FPO may involve a fresh issue of shares or an offer for sale and must be in dematerialized form. Certain company members, in coordination with the Board, may offer shares for public sale.

Initial Public Offer

A public company limited by shares can issue securities to the public through a prospectus, a process known as a public offer. The term “securities” is broad and includes shares as well as other financial instruments. A public company can issue securities through three main methods: public offer, rights or bonus issue, and private placement.

According to the explanation provided in Section 23, a public offer includes both initial public offers (IPO) and further public offers (FPO) of securities to the public by a company. Additionally, it covers the offer for sale of securities to the public by an existing shareholder through the issuance of a prospectus.

When a company issues new securities or offers its existing securities for sale for the first time to the public, this is referred to as an Initial Public Offer (IPO). However, after the first issuance, if the company subsequently issues fresh securities or offers its existing securities for sale to the public, it is known as a Further Public Offer (FPO).

SEBI (Issue of Capital and Disclosure Requirements) Regulations 2018 with respect to public issue of equity shares or any other security convertible into equity shares.

Initial Public Offer (IPO):

1. Entities not eligible to make an initial public offer

- An issuer shall not be eligible to make an initial public offer

(a) if the issuer, any of its promoter, promoter group or directors or selling shareholders are debarred from accessing the capital market by the Board (SEBI).

(b) if any of the promoters or directors of the issuer is a promoter or director of any other company which is debarred from accessing the capital market by the Board.

(c) if the issuer or any of its promoters or directors is a wilful defaulter. d) if any of its promoters or directors is a fugitive economic offender.

The restrictions under (a) and (b) above shall not apply to the persons or entities mentioned therein, who were debarred in the past by the Board and the period of debarment is already over as on the date of filing of the draft offer document with the Board.

2. An issuer shall not be eligible to make an initial public offer if there are any outstanding convertible securities or any other right which would entitle any person with any option to receive equity shares of the issuer.

However, the provisions of this sub-regulation shall not apply to:

(a) Outstanding options granted to employees, whether currently an employee or not, pursuant to an employee stock option scheme in compliance with the Companies Act, 2013;

(b) Fully paid-up outstanding convertible securities which are required to be converted on or before the date of filing of the red herring prospectus (in case of book-built issues) or the prospectus ( in case of fixed issues), as the case may be.

Eligibility requirements for an initial public offer:

1. An issuer shall be eligible to make an initial public offer only if:

(a) it has net tangible assets of at least three crore rupees, calculated on a restated and consolidated basis, in each of the preceding three full years of (of twelve months each), of which not more than fifty per cent are held in monetary assets.

If more than fifty percent of the net tangible assets are held in monetary assets, the issuer should have utilized or made firm commitments to utilize such excess monetary assets in its business or project.

Further, the limit of fifty per cent on monetary assets shall not be applicable in case the initial public offer is made entirely through an offer for sale.

(b) The company must have an average operating profit of at least fifteen crore rupees, based on restated and consolidated financials, over the last three complete financial years (each consisting of twelve months), and must have generated operating profit in each of those three years.

(c) The company should have maintained a net worth of at least one crore rupee in each of the last three completed financial years (each of twelve months), calculated on a restated and consolidated basis.

(d) If the company has undergone a name change within the past one year, then at least fifty percent of its revenue, based on restated and consolidated figures, during the immediately preceding full year must have been derived from the business activity that aligns with its new name.

2. An issuer not satisfying the condition stipulated in sub-regulation (1) shall be eligible to make an initial public offer only if the issue is made through the book-building process and the issuer undertakes to allot at least seventy five per cent of the net offer to qualified institutional buyers and to refund the full subscription money if it fails to do so.

General Conditions:

1. An issuer making an initial public offer shall ensure that:

(a) it has make an application to one or more stock exchanges to seek an in-principle approval for listing of its specified securities on such stock exchanges and has chosen one of them as the designated stock exchange.

(b) it has entered into an agreement with a depository for dematerialization of the specified securities already issued and proposed to be issued.

(c) all its specified securities held by the promoters are in dematerialized form prior to filing of an offer document.

(d) all its existing partly paid-up equity shares have either been fully paid-up or have been forfeited.

(e) it has made firm arrangements of finance through verifiable means towards seventy five per cent of the stated means of finance for a specific project proposed to be funded from the issue proceeds, excluding the amount to be raised through the proposed public issue or through identifiable internal accruals.

2. The amount for general corporate purposes, as mentioned in objects of the issue in the draft offer document and the offer document shall not exceed twenty five per cent of the amount being raised by the issuer.

Further Public Offer

Eligibility Requirements:

Entities not eligible to make a further public offer.

An issuer shall not be eligible to make a further public offer:

(a) If the issuer, any of its promoters, promoter group or directors, selling shareholders are debarred from accessing the capital market by the Board.

(b) If any of the promoter or directors of the issuer is a promoter or director of any other company which is debarred from accessing the capital market by the Board.

(c) If the issuer or any of its promoters or directors is a wilful defaulter.

(d) If any of its promoters or directors is fugitive economic offender.

The restrictions under (a) and (b) above shall not apply to persons or entities mentioned therein, who were debarred in the past by the Board and the period of debarrment is already over as on the date of filing of the draft offer document with the board.

Eligibility requirement for further public offer :

- A company may proceed with a further public offer if it has changed its name within the past year, provided that at least fifty percent of its total revenue during the immediately preceding full year was generated from the business activity reflected in its new name.

- If a company does not meet the condition mentioned in point (1), it may still make a further public offer, but only through the book-building process. Additionally, the company must commit to allotting at least seventy-five percent of the net offer to qualified institutional buyers. In case it fails to achieve this minimum allotment, it must refund the entire subscription amount to the applicants.

General Conditions:

- An issuer making a further public offer shall ensure that:

(a) It has made an application to one or more stock exchanges to seek an in-principle approval for listing of its specified securities on such stock exchanges and has chosen one of them as the designated stock exchange, in terms of schedule XIX of SBI Regulations, 2018;

(b) It has entered into an agreement with a depository for dematerialisation of specified securities already issued and proposed to be issued;

(c) All its existing partly paid-up equity shares have either been fully paidup or have been forfeited;

(d) It has made firm arrangements of finance through verifiable means towards seventy five per cent of the stated means of finance for the specific project proposed to be funded from the issue proceeds, excluding the amount to be raised through the proposed public issue or through existing identifiable internal accruals. - The amount for general corporate purposes as mentioned in objects of the issue in the draft offer document and the offer document, shall not exceed twenty five per cent of the amount being raised by the issuer.

Rights Shares

When a company, having share capital proposes to increase its subscribed capital by the issue of further shares, such shares shall be offered to the existing share holders under Section [62(1) (a)]. It is called “Rights Issue”. If such shares are offered to employees, it is called “Employees Stock Option” under Section [62 (1) (b)]. Such shares can be offered other than existing share holders or employees, on preferential basis.

Section 62 (1) reads “where at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, such shares shall be offered –

(a) to persons who, at the date of offer, are holders of equity shares of the company in proportion, as nearly as circumstances admit, to the paid-up share capital on those shares by sending a letter of offer subject to following conditions namely –

(i) the offer shall be made by notice specifying the number of shares offered and limiting a time not being less than fifteen days and not exceeding thirty days from the date of offer within which the offer, if not accepted, shall be deemed to have been declined.

(ii) unless the articles of the company otherwise provide, the existing shareholder shall have a right to renounce the shares offered to him in favour any other person who need not be a member of the company.

(iii) after the expiry of the time specified in the notice or on receipt of earlier intimation from the person to whom such notice is given that he declines to accept the share offered, “the Board of Directors may dispose off them in such a manner which is not disadvantageous to the shareholders and the company”.

Bonus Shares

As per section 63, a company may issue fully paid-up shares to its members, in any manner whatsoever, out of :

(i) its free reserves;

(ii) the securities premium account;

(iii) the capital redemption reserve account;

provided that no issue of bonus shares shall be made by capitalising reserves created by the revaluation of assets.

No company shall capitalise its profits or reserves for the purpose of issuing fully paid-up bonus shares unless–

(a) it is authorised by its articles;

(b) it has, on the recommendations of the Board, been authorised in the general meeting of the company;

(c) it has not defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it;

(d) it has not been defaulted in respect of the repayment of statutory dues of the employees, such as, contribution to provident fund, gratuity and bonus;

(e) the partly paid-up shares, if any outstanding on the date of allotment, are made fully paid-up.

The Bonus Shares shall not be issued in lieu of Dividend.

Bonus shares are not taxable in the hands of shareholders. Paid-up share capital increases with issue of bonus shares.

According to Rule 14 of Companies (share capital and debentures) Rules 2014, once the Board has recommended a bonus issue, it can not be withdrawn afterwards.

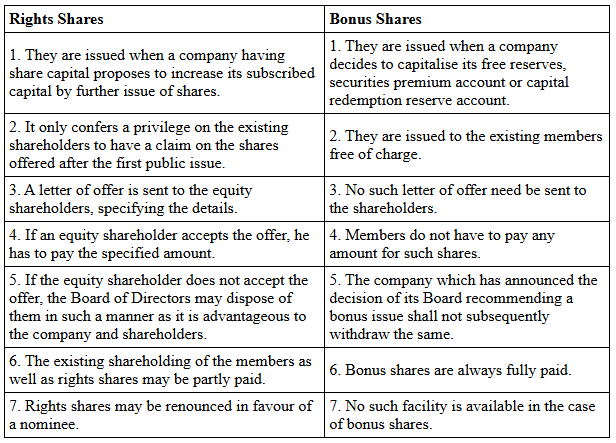

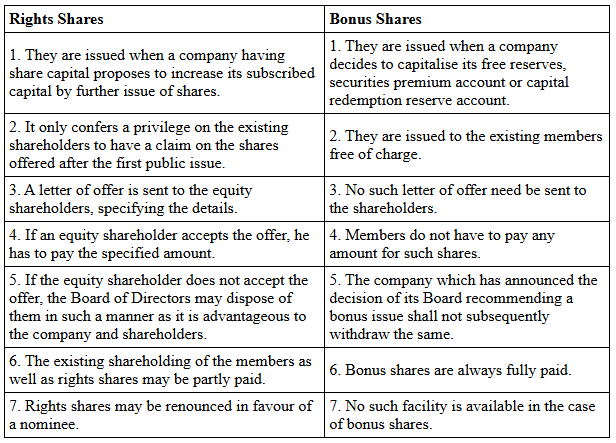

Distinction Between Rights Shares and Bonus Shares

Issue of Shares at a Discount

When a buyer of shares is required to pay an amount lower than the face value of the share—for instance, Rs. 9 for a share having a face value of Rs. 10—the share is considered to be issued or sold at a discount. The issuance of shares at a discount is governed by legal provisions. According to Section 53, a company is not permitted to issue shares at a discount, except in the specific case mentioned under Section 54. Section 54 provides an exception by allowing only the issuance of sweat equity shares at a discount, and that too subject to compliance with the prescribed conditions.

Any issuance of shares by a company at a discounted price, which is not in accordance with the law, shall be regarded as void. However, there is an exception where a company is allowed to issue shares at a discount to its creditors, particularly in cases involving the conversion of debt into equity or under a debt restructuring scheme, as per the guidelines laid down by the Reserve Bank of India (RBI).

Hence, if a company issues any shares at a discount, except for sweat equity shares as mentioned above, it shall be subject to penalties. The company can be penalized with a fine not less than one lakh rupees and which may extend up to five lakh rupees. In addition, every officer of the company who is found to be in default shall be punishable with imprisonment for a term that may extend to six months, or with a fine not less than one lakh rupees but which may extend up to five lakh rupees, or with both, as per the provisions of Section 53(3).

Issue of Shares at a Premium

A company may issue securities at a premium when it is able to sell them at a price higher than their par or face value. For instance, if a share with a face value of Rs. 100 is sold at Rs. 120, the additional Rs. 20 is considered the premium earned per share. While the Companies Act does not lay down any specific conditions or restrictions for issuing shares at a premium, it does set clear guidelines for the utilisation of the premium amount collected.

Firstly, the securities premium cannot be considered as profit, and hence, it cannot be distributed as dividends to shareholders. However, it may be capitalised and used to issue bonus shares to existing shareholders.

Secondly, whether the premium is received in cash or kind, it must be recorded in a separate ledger called the “Securities Premium Account”.

Thirdly, the amount held in the Securities Premium Account must be treated with the same level of sanctity and protection as is required for share capital.

According to Section 52(2) of the Companies Act, the securities premium collected by a company can be utilised only for the following specific purposes:

(a) Issuing fully paid bonus shares to the members of the company.

(b) Writing off the balance of preliminary expenses of the company.

(c) Writing off any commission paid, discount allowed, or expenses incurred related to the issue of shares or debentures.

(d) Providing for the premium payable on redemption of redeemable preference shares or debentures.

(e) For the buy-back of shares or securities under Section 68 of the Act.

Legal interpretations and rulings have clarified and expanded on these provisions:

In the case of Hyderabad Industries Ltd., In re [2004] 53 SCL 376 (AP), it was held that unless the articles of association of a company explicitly permit the use of the securities premium account for purposes other than those specified in Section 78(2) (now Section 52), a Company Court cannot approve a resolution to allow such usage.

However, in contrast, the Rajasthan High Court, in Mangalam Cement Ltd., In re [2008] 86 SCL 153 (Raj.), ruled that a company can utilise the credit balance in the securities premium account for the purpose of meeting deferred tax liability.

Again, in Hyderabad Industries Ltd., the court emphasized that without a reduction in share capital and a corresponding reduction in the share premium account, a company cannot write off losses against the share premium account.

It was also clarified in this case that for utilising the share premium account as per the permitted purposes under Section 78(2) [now Section 52], no approval or sanction of the Court is necessary.