Introduction to Financial Reporting - Financial Analysis and Reporting | Financial Analysis and Reporting - B Com PDF Download

Introduction

- Accounting serves as a financial information system, involving processes like identifying, measuring, recording, and communicating information to relevant parties. It transforms business transactions and external events into financial statements like income statements and balance sheets, which help in decision-making. At the end of each accounting period, businesses prepare financial statements to understand their profit or loss and financial position.

- Financial statements are documents that show a business's financial situation and performance at the end of an accounting period. They typically include a balance sheet and a profit and loss account. General-purpose financial statements are meant for all users and may also include a cash flow statement and notes to financial statements.

- The objectives of preparing financial statements include showing the company's assets and liabilities, providing information to stakeholders, presenting an accurate view of the business, predicting its earning potential, assessing its creditworthiness, and making decisions about its future.

Meaning of Financial Reporting

- In any industry, whether manufacturing or service, we have multiple departments, which function day in and day out to achieve organizational goals. The functioning of these departments may or may not be interdependent, but at the end of day, they are linked together by one common thread – the Accounting & Finance department.

- The accounting & financial aspects of each and every department are recorded and reported to various stakeholders.

- There are two different types of reporting – Financial reporting for various stakeholders & Management Reporting for internal management of an organization.

- Both these reports are important and are integral parts of the Accounting & reporting system of an organization. But considering the number of stakeholders involved and statutory & other regulatory requirements, Financial Reporting is very important and critical task of an organization. It is a vital part of Corporate Governance.

>> Financial Reporting involves the disclosure of financial information to the various stakeholders about the financial performance and financial position of the organization over a specified period of time. These stakeholders include – investors, creditors, public, debt providers, governments & government agencies. In the case of listed companies, the frequency of financial reporting is quarterly & annual.

Financial Reporting is usually considered as the end product of Accounting. The typical components of financial reporting are:

- The financial statements – Balance Sheet, Profit & loss account, Cash flow statement & Statement of changes in stock holder’s equity

- The notes to financial statements

- Quarterly & Annual reports (in case of listed companies)

- Prospectus (In case of companies going for IPOs)

- Management Discussion & Analysis (In case of public companies)

The Government and the Institute of Chartered Accounts of India (ICAI) have issued various accounting standards & guidance notes which are applied for the purpose of financial reporting. This ensures uniformity across various diversified industries when they prepare & present their financial statements.

Objectives of Financial Reporting

According to the International Accounting Standard Board (IASB), the objective of financial reporting is “to provide information about the financial position, performance and changes in the financial position of an enterprise that is useful to a wide range of users in making economic decisions.”

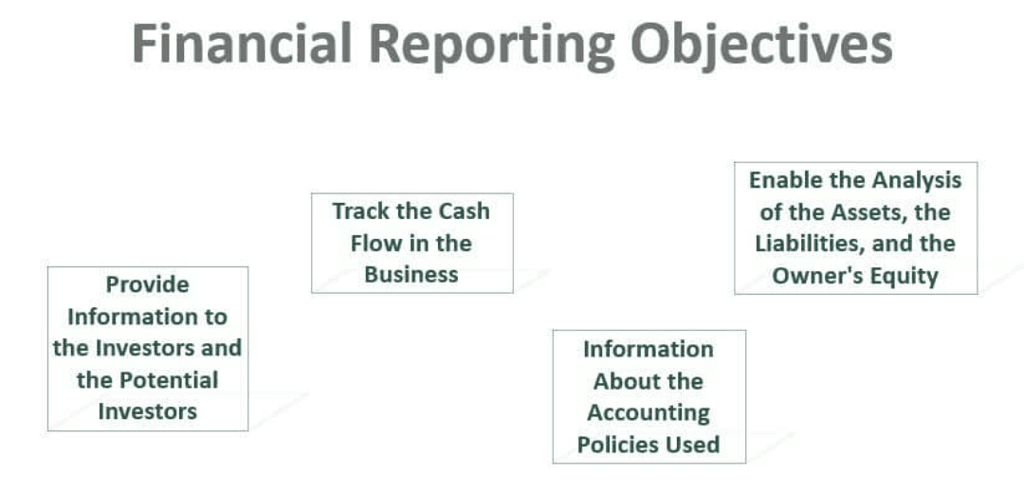

The following points sum up the objectives & purposes of financial reporting –

- Providing information to management of an organization which is used for the purpose of planning, analysis, benchmarking and decision making.

- Providing information to investors, promoters, debt providers and creditors which is used to enable them to make rational and prudent decisions regarding investment, credit etc.

- Providing information to shareholders & public at large in the case of listed companies about various aspects of an organization.

- Providing information about the economic resources of an organization's claims to those resources (liabilities & owner’s equity) and how these resources and claims have undergone change over a period of time.

- Providing information as to how an organization is procuring & using various resources.

- Providing information to various stakeholders regarding the performance of management of an organization as to how diligently & ethically they are discharging their fiduciary duties & responsibilities.

- Providing information to the statutory auditors which in turn facilitates audit.

- Enhancing social welfare by looking into the interest of employees, trade unions & Government.

Importance of Financial Reporting

The importance of financial reporting cannot be over-emphasized. It is required by each and every stakeholder for multiple reasons & purposes. The following points highlight why the financial reporting framework is important –

- It helps an organization to comply with various statutes and regulatory requirements. The organizations are required to file financial statements to ROC, Government Agencies. In the case of listed companies, quarterly as well as annual results are required to be filed to stock exchanges and published.

- It facilitates statutory audits. Statutory auditors are required to audit the financial statements of an organization to express their opinion.

- Financial Reports form the backbone for financial planning, analysis, benchmarking and decision-making. These are used for the above purposes by various stakeholders.

- Financial reporting helps organizations to raise capital both domestic as well as overseas.

- On the basis of financials, the public at large can analyze the performance of the organization as well as its management.

- For the purpose of bidding, labor contracts, government supplies etc., organizations are required to furnish their financial reports & statements.

Financial Reporting and Management Reporting

Financial reports and management reports serve distinct purposes within an organization's decision-making processes. Financial reports primarily focus on providing information to external stakeholders, such as investors and regulatory authorities, to assess the financial health and performance of the company. On the other hand, management reports are tailored for internal use, aiding management in strategic decision-making and resource allocation.

Uses of Financial Statements to Users

- For Owners: Financial statements are like a report card for owners. They show how well their business is doing financially and whether it's growing or not.

- For Management: Managers of companies need lots of information to make good decisions. Financial statements give them most of the info they need to run the company well.

- For Suppliers and Creditors: People who supply goods to the company or lend it money want to know if the company can pay them back. They look at financial statements to make decisions about whether to keep doing business with the company.

- For Customers: Customers want to know if the company is doing well because it can affect things like the quality and price of the products they buy.

- For Financial Institutions: Banks and other lenders use financial statements to decide if they should lend money to the company. They want to know if the company can pay back the loan with interest.

- For Employees and Trade Unions: Workers want to know if the company is making money and if it will stay in business. People thinking about working for the company also look at financial statements to decide if it's a good place to work.

- For Government and Agencies: Governments use financial statements to make decisions about taxes and other policies. Agencies like SEBI, RBI, and IRDA use them to keep an eye on companies and make sure they're following the rules.

- For the Public: People in the community are interested in things like new roads and job opportunities. Financial statements can show if the company is helping with these things and if it's being a good member of the community.

Benefits of Financial Reporting

- Improved Debt Management: Financial reporting assists firms in managing their debts more effectively. By providing clear insights into the company's financial position, such as its cash flow, revenue, and expenses, financial reports enable businesses to make informed decisions about borrowing and repayment strategies. This helps in optimizing debt levels and ensuring timely payments to creditors.

- Effective Liability Management: Financial reports also aid in managing liabilities by facilitating efficient loan and credit management. By tracking and analyzing liabilities, including loans, accounts payable, and other obligations, companies can better understand their financial obligations and plan accordingly. This ensures that the firm meets its financial obligations promptly and avoids defaulting on payments.

- Real-Time Account Tracking: Financial reporting allows for real-time tracking of accounts, enabling firms to effectively manage their liquidity. By providing up-to-date information on available funds and cash flow, financial reports help businesses make informed decisions about investments, expenses, and expansion plans. This ensures that the company maintains adequate liquidity to support its operations and growth initiatives.

- Trend Identification: Financial reporting facilitates the identification of past and future trends by enabling comparative analysis. By examining historical financial data and forecasting future performance, companies can identify patterns and trends that inform business decision-making. This allows firms to anticipate market changes, adapt their strategies, and capitalize on emerging opportunities.

- Business Planning: Financial reporting serves as a valuable tool in business planning by providing accurate information on capital availability. By assessing the firm's financial health and resources, businesses can develop strategic plans and make sound decisions about resource allocation, investment opportunities, and growth initiatives. This ensures that the company operates efficiently and effectively to achieve its goals.

- Enhanced Decision-Making: Financial reporting enhances the quality of business decisions made by both internal management and external stakeholders. By providing timely and accurate information, financial reports enable stakeholders to assess the company's performance, evaluate risks, and make informed decisions about investments, partnerships, and other business activities. This promotes transparency, accountability, and confidence in the company's operations.

- Transparency with Customers: Financial reporting promotes transparency with customers by providing insight into the company's financial health and stability. By disclosing relevant financial information, firms build trust and credibility with customers, demonstrating their commitment to honesty and integrity in business dealings.

- Share Price Maintenance: Financial reporting helps in maintaining the share prices of the firm and treating all investors equally. By providing transparent and accurate financial information to shareholders and the investing public, companies instill confidence and trust, which contributes to the stability and attractiveness of their stock prices.

- Employee Confidence: Financial reporting enhances employees' understanding of the company's growth potential and financial stability, thereby increasing job security and reducing employee turnover rates. By providing insight into the company's financial performance and prospects, financial reports reassure employees about the firm's viability and future prospects, fostering a positive work environment and employee loyalty.

Limitations of Financial Reporting

- Not Future-Focused: Financial reports, such as balance sheets and income statements, primarily reflect past financial performance. They provide a snapshot of the company's financial health over a specific period, usually the previous fiscal year. While these reports are essential for assessing historical performance and compliance, they don't offer insights into future trends or potential challenges. Stakeholders, including investors and creditors, often rely on forecasts and projections to make informed decisions about the company's future prospects. Since financial reports don't provide forward-looking information, they have limitations in assisting stakeholders in planning and strategizing for the future.

- Measurement, Not Action: Financial reports serve as tools for measuring and evaluating a company's financial performance. They present key financial metrics and indicators, such as revenue, expenses, and profitability, allowing stakeholders to assess the company's financial strength and stability. However, financial reports alone don't offer solutions or actionable insights for improving performance. While they highlight areas of strength or weakness, it's up to management to interpret the data and implement strategies for improvement. In this sense, financial reports act more as diagnostic tools, diagnosing the financial health of the company rather than prescribing specific actions for improvement.

- Ignoring Price Changes: Financial reports typically rely on historical cost accounting, where assets and liabilities are recorded at their original purchase price. This approach often fails to account for changes in the price level, especially in industries where prices fluctuate frequently, such as commodities or real estate. As a result, the financial results presented in these reports may not accurately reflect the economic reality of the business. Failure to adjust for price changes can lead to misleading conclusions about the company's financial performance and efficiency. While some adjustments, such as depreciation, attempt to account for changes in asset value over time, they may not fully capture the impact of price fluctuations on the company's financial position.

- Numbers Only: Financial reports primarily focus on quantifiable financial data, such as revenues, expenses, and assets. While these metrics are crucial for assessing the company's financial health, they often overlook qualitative aspects of the business, such as employee skills, customer satisfaction, or brand reputation. These intangible factors can significantly impact the company's long-term success but are not adequately captured in traditional financial reporting. As a result, financial reports may provide an incomplete picture of the company's overall performance and value creation.

- Reliability Issues: The accuracy and reliability of financial reports depend on the quality of the underlying data and the integrity of the accounting processes. If the data used to prepare these reports is incomplete, inaccurate, or manipulated, it can lead to misleading results and undermine the credibility of the financial statements. Factors such as accounting errors, fraudulent activities, or biased reporting practices can compromise the reliability of financial information. Stakeholders rely on financial reports to make critical decisions, so any doubts about their accuracy can erode trust and confidence in the company.

- Missing Intangibles: Financial reports often overlook intangible assets, such as intellectual property, brand value, or customer relationships, which can be significant drivers of value and competitive advantage for a company. While tangible assets like buildings or equipment are typically included in financial statements, intangible assets are often omitted or undervalued. This omission can distort the company's true financial position and underestimate its value. Recognizing and properly valuing intangible assets is crucial for providing a more comprehensive and accurate representation of the company's financial health and performance.

|

2 videos|51 docs|19 tests

|

FAQs on Introduction to Financial Reporting - Financial Analysis and Reporting - Financial Analysis and Reporting - B Com

| 1. What is the meaning of Financial Reporting? |  |

| 2. What are the objectives of Financial Reporting? |  |

| 3. What is the importance of Financial Reporting? |  |

| 4. How does Financial Reporting differ from Management Reporting? |  |

| 5. What are the uses of Financial Statements to Users? |  |

|

Explore Courses for B Com exam

|

|