Basic Accounting Concepts and Conventions | Accountancy and Financial Management - B Com PDF Download

In business, lots of deals happen every day, and it's impossible for people to remember all of them. Accounting helps by keeping records of these transactions. These records help the business owner figure out if they made money or lost money, and what their financial situation is at the end of a certain time. They can then share this info with anyone who's interested.

Introduction

- In accounting statements, whether they are external "financial accounts" or internally focused "management accounts," the clear objective is to ensure that the accounts fairly reflect the true "substance" of the business and the results of its operation.

- The theory of accounting has developed the concept of a "true and fair view."

- The true and fair view is applied in ensuring and assessing whether accounts do indeed portray accurately the business' activities.

- To support the application of the "true and fair view," accounting has adopted certain concepts and conventions which help to ensure that accounting information is presented accurately and consistently.

Accounting Concepts

- The term accounting concepts refers to basic rules, assumptions, and principles which act as a primary standard for recording business transactions and maintaining books of accounts.

- The accounting concepts provide a framework and logical approach to the accounting process.

- All financial transactions are considered in light of the accounting concepts, which guide the accounting methods used.

1. Going Concern Concept

- Going concern is an accounting term for a company that has the resources needed to continue operating indefinitely until it provides evidence to the contrary.

- This term also refers to a company's ability to make enough money to stay afloat or to avoid bankruptcy.

- Accountants assume, unless there is evidence to the contrary, that a company is not going broke.

- This has important implications for the valuation of assets and liabilities.

2. Consistency Concept

- Transactions and valuation methods are treated the same way from year to year, or period to period. Users of accounts can, therefore, make more meaningful comparisons of financial performance from year to year.

- Where accounting policies are changed, companies are required to disclose this fact and explain the impact of any change.

3. Prudence Concept

- The prudence concept is a core accounting principle that means choosing conservative methods to understate assets and overstate liabilities, anticipating potential losses and recognizing them early, and only recognizing gains when certain – without estimations or presumptions.

- The prudence principle deviates from conventional accounting as it provides for all possible losses, but does not anticipate profits. As such, the company may actually be undervalued.

- This may not curry favour with shareholders. However, it can create a more realistic overview of the company’s financial health than more optimistic estimates, and ensures that the company will always be able to meet its debt obligations.

4. Matching (or "Accruals") Concept

- The accrual concept refers to recording the transactions whenever they are incurred or earned, regardless of actual outflow or inflow of cash.

- On the other hand, the matching concept specifically focuses on recognition and recording transactions of expenses in business.

- Income should be properly "matched" with the expenses of a given accounting period.

5. Business Entity Concept

- The business entity concept states that the transactions associated with a business must be separately recorded from those of its owners or other businesses.

- Doing so requires the use of separate accounting records for the organization that completely exclude the assets and liabilities of any other entity or the owner. Without this concept, the records of multiple entities would be intermingled, making it quite difficult to discern the financial or taxable results of a single business.

6. Money Measurement Concept

- This accounting concept states that only financial transactions will find a place in accounting. So only those business activities that can be expressed in monetary terms will be recorded in accounting. Any other transaction, no matter how significant, will not find a place in the financial accounts.

- So for example, if the company underwent a major management overhaul this would have no effect on the accounting records. This concept is actually one of the major drawbacks of accounting.

7. Accounting Period Concept

- Every organization, according to its needs, chooses a specific period of time to complete an accounting cycle. Generally, the time chosen is a year we call the accounting year. The time period is mentioned in the financial statements.

- So the indefinite life of an organization is divided into shorter, generally equal time period. This facilitates a comparison of performances and allows stakeholders to get timely information. Also in most cases, it is also a statutory requirement.

8. Cost Concept

- In business, transactions involve exchanging money. The price paid at the time of purchase, called cost, is what all assets are recorded at in the books. Even if an asset's market value changes later, it's still shown in the books at its original cost. However, assets like machines can lose value over time, so we reduce their value by charging depreciation each year.

- This depreciation is a fixed percentage of the original cost and doesn't consider market changes. This means assets are not shown at their current market value in the balance sheet.

- This can make it hard to know the true financial position of the business, which is a limitation of the cost concept. But it's preferred because it's time-consuming and subjective to assess market values, and inflation accounting helps overcome this limitation.

9. Dual Aspect Concept

- In accounting, there's a basic rule: every business transaction affects two things. It's often said that in business, when you receive something, you also give something, and vice versa.

- For instance, when you buy a machine for Rs. 8,000, you get the machine but you also give away Rs. 8,000. So, there's an increase in one asset (the machine) and a decrease in another asset (cash).

- Similarly, if you buy goods worth Rs. 500 on credit, you increase one asset (stock of goods) but also increase a liability (creditors). This means every transaction has two sides: what you receive and what you give.

- This idea is at the heart of double-entry bookkeeping. Following this principle strictly is called the 'Double Entry System of Bookkeeping'.

- According to the dual aspect concept in accounting, when a business owner contributes initial funds or when outsiders provide additional funds, it increases both the resources (assets) and the obligations (liabilities/equities) of the business. This means that at any given time, the total assets and total liabilities must be equal. This equality is known as the 'balance sheet equation' or 'accounting equation'.

Liabilities (Equities) = Assets

or

Capital + Outside Liabilities = Assets - Assets are the resources owned by a business, while equities represent the claims against those assets. Equities come in two types: owners' equity (or capital), which is the owners' claim, and outsiders' equity (or liabilities), which is the claim of parties like creditors. All assets of the business are claimed by either the owners or outsiders. Therefore, the total assets of a business will always be equal to its liabilities. In business transactions, changes occur to assets and liabilities in a way that maintains this equality.

- Example:

1. Mr. Abhigyan started business with Rs.50,000 cash. The cash received by the business is its asset. According to the business entity concept, business and the owner are two separate entities. Hence, the capital contributed by Mr. Abhigyan is a liability to the business. Thus

Capital = Assets

Rs. 50,000 = Rs. 50,000 (cash)2. He purchased goods on credit from Chakravarty for Rs. 5,000: This increases an asset (stock of goods) on the one hand and a liability (creditors) on the other. Now the equation will be :

Capital + Liabilities = Assets

Rs. 50,000 + Rs. 5,000 = Rs. 5,000 + Rs. 50,000

Capital Creditors Stock Cash

3. He purchased furniture worth Rs. 10,000 and paid cash: This increases one asset (furniture) and decreases another asset (cash). Now the equation will be :

Capital + Liabilities = Assets

The balance sheet always shows equal totals on both sides, regardless of how many transactions occur or which items are involved. This equality happens because every transaction affects both the assets and liabilities of the business.

10. Realisation Concept

- According to the realization accounting concept, revenue is only recognized when it is realized. Now revenue is the cash inflow for a business arising from the sale of goods or services. And we assume this revenue as realized only when it legally arises to be received.

- So in simpler terms, the profit earned will be recorded when it is actually earned.

11. Full Disclosure Concept

- This concept states that all relevant information will be disclosed in the accounting statements. A lot of external users depend on these financial statements for their information to make investing decisions.

- So no information/transactions etc of relevance to anyone of them will be omitted from these statements for the benefit of the company.

12. Conservatism Concept

- This accounting concept promotes prudence in accounting. It states that profit should not be included until it is realized. However, losses even those not realized but with the remote possibility of occurring should be included in the financial statements.

- So all losses are recognized – those that have occurred or are even likely to occur. But only realized profits are recognized.

13. Materiality Concept

- Materiality states that all material facts must be a part of the accounting process. But immaterial facts, i.e. insignificant information should be left out.

- The materiality of a transaction will depend on its nature, value and its significance to the external user. If the information can affect a person’s investing decision then it is definitely a material fact.

14. Objectivity Concept

- Objectivity in accounting means being unbiased and not influenced by personal opinions. All accounting measurements should be impartial and able to be checked independently. To achieve this, every transaction needs to be backed up by documents like invoices or receipts.

- These documents, called vouchers, are used to make entries in the accounting books and are checked by auditors later. For items like depreciation or provisions for bad debts, where there are no documents, the statements made by management serve as evidence.

Accounting Conventions

- Accounting conventions are like rules that fill in the gaps when there aren't clear guidelines in accounting standards. They help make financial reporting more consistent by supporting concepts like relevance and reliability.

- As accounting standards expand, there are fewer conventions to rely on, and they can change over time.

- The term "Accounting Conventions" refers to customs or traditions used as a guide in the preparation of accounting reports and statements.

- These conventions are derived from usage and practice.

- Accountancy bodies around the world may incorporate any of these conventions to improve the quality of accounting information.

- It's important to note that accounting conventions need not have universal application, meaning that they may vary in their use and relevance based on specific contexts or regions.

- Conventions are important because they ensure companies record transactions in similar ways, making it easier for investors to compare them.

- However, they're not perfect and can be exploited by companies to their benefit.

The following are important accounting conventions in use:

1. Materiality

- Materiality in accounting emphasizes the importance of focusing on material details while ignoring insignificant ones in financial statements.

- In the materiality principle, items with significant economic effects on the business of the enterprise should be disclosed in the financial statement.

- Materiality is a subjective term, and it relies on the judgment, common sense, and discretion of the accountant to determine which items are considered material and which are not.

- Examples of materiality in practice include stationery purchased by the organization, even if not fully used. Similarly, for small items like books and calculators, they might be fully depreciated in the year of purchase if they are used by the company for more than one year. This is because the amount of such items is very small to be shown individually on the balance sheet, even though they are considered as assets of the company.

- The materiality principle helps accountants focus on significant financial information rather than getting bogged down by immaterial details.

2. Conservatism

- Conservatism in accounting is a policy that focuses on being cautious and prudent.

- It takes into consideration all prospective losses but leaves out prospective profits when preparing financial statements.

- Anticipated profits are ignored, while anticipated losses are taken into account when drawing up the financial statements.

- This guideline advises accountants to be careful and choose lower estimates for assets and liabilities when there's uncertainty.

- It's about considering the worst possible outcome for a company's financial future.

- Examples of the application of the convention of conservatism include:

(a) Making provisions for doubtful debts and discount on debtors: This means setting aside funds to cover potential losses from customers who may not pay their debts in full or on time.

(b) Valuation of stock at cost price or market price, whichever is less: This ensures that the value of inventory is not overstated, being conservative by using the lower of cost or market value.

(c) Charging small capital items, like crockery, to revenue: Instead of capitalizing these items, they are treated as expenses, reflecting a cautious approach.

(d) Showing joint life policies at surrender value, as opposed to the actual amount paid: This approach values assets at a lower amount to account for potential decreases in their worth.

(e) Not providing for discounts on creditors: This assumes that creditors will not grant discounts, leading to a more conservative representation of the financial position.

3. Consistency

- According to the convention of consistency, accounting practices should remain unchanged from one period to another.

- This means that once working rules are chosen, they should not be changed arbitrarily without providing notice of the effects of the change to those who use the accounts.

- For instance, stock valuation should be done in the same manner every year.

- Similarly, depreciation should be charged on fixed assets using the same method year after year. Any deviation from this principle should be disclosed along with the reasons.

- The principle of consistency is particularly relevant when there are alternative accounting methods that are equally acceptable. Changing from one method to another would result in inconsistency.

- It's important to note that apparent inconsistency may arise, even when the methods are actually being consistently applied. For example, if a company values stock based on the principle "at cost or market price whichever is less," this could lead to different valuations in different years, but this is still an application of the same principle.

- An Enterprise should change its accounting policy in any of the following circumstances only:

(i) To bring the books of accounts in accordance with the issued accounting standard.

(ii) To comply with the provision of law.

(iii) When under changed circumstances it is felt that the new method will reflect a more true and fair picture in the financial statement.

4. Disclosure

- Information considered potentially important and relevant must be revealed, regardless of whether it is detrimental to the company.

- Good accounting practice, in addition to statutory requirements, calls for the disclosure of significant information in financial statements.

- These disclosures can be made through footnotes, which are additional explanations and details accompanying the main financial statements.

- The purpose of this convention is to communicate all material and relevant facts regarding the financial position and results of operations to the users of the financial statements.

- Balance sheets and profit and loss accounts have specific contents that are prescribed by law, which are designed to make disclosures of all material facts compulsory.

- The practice of appending notes related to various facts and items that may not be included in the primary accounting statements aligns with the convention of full disclosure of material facts. This ensures that important information that might not fit within the main statements is still provided to users for a complete understanding of the financial position and performance of the entity

- Example:

- Contingent liability appearing as a note.

- Market value of investments appearing as a note.

- The convention of disclosure extends to events occurring after the balance sheet date and the date on which the financial statements are authorized for issue.

- These events can include things like bad debts, destruction of plant and equipment due to natural calamities, major acquisition of another enterprise, and more.

- Such events are likely to have a substantial influence on the earnings and financial position of the enterprise. - Failing to disclose these post-balance sheet date events would affect the ability of users to make evaluations and decisions based on complete and up-to-date information about the financial status and performance of the enterprise.

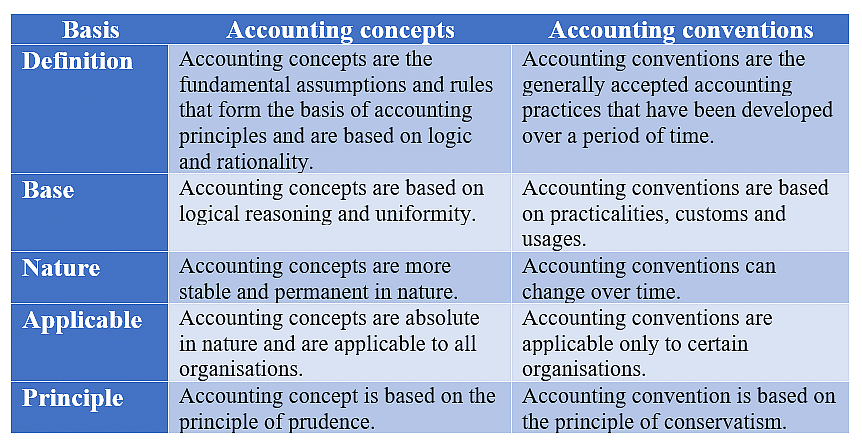

Difference Between Accounting Concept and Accounting Convention

Key Characteristics of Accounting Information

There is general agreement that, before it can be regarded as useful in satisfying the needs of various user groups, accounting information should satisfy the following criteria:

- Understandability: This implies the expression, with clarity, of accounting information in such a way that it will be understandable to users - who are generally assumed to have a reasonable knowledge of business and economic activities

- Relevance: This implies that, to be useful, accounting information must assist a user to form, confirm or maybe revise a view - usually in the context of making a decision (e.g. should I invest, should I lend money to this business? Should I work for this business?)

- Consistency: This implies consistent treatment of similar items and application of accounting policies

- Comparability: This implies the ability for users to be able to compare similar companies in the same industry group and to make comparisons of performance over time. Much of the work that goes into setting accounting standards is based around the need for comparability.

- Reliability:- This implies that the accounting information that is presented is truthful, accurate, complete (nothing significant missed out) and capable of being verified (e.g. by a potential investor).

Basic Accounting Terms

Here is a quick look at some important accounting terms.

- Accounting equation: The accounting equation, the basis for the double-entry system (see below), is written as follows:

Assets = Liabilities + Stakeholders’ equity

This means that all the assets owned by a company have been financed from loans from creditors and from equity from investors. “Assets” here stands for cash, account receivables, inventory, etc., that a company possesses. - Accounting methods: Companies choose between two methods—cash accounting or accrual accounting. Under cash basis accounting, preferred by small businesses, all revenues and expenditures at the time when payments are actually received or sent are recorded. Under accrual basis accounting, income is recorded when earned and expenses are recorded when incurred.

- Account receivable: The sum of money owed by your customers after goods or services have been delivered and/or used.

- Account payable: The amount of money you owe creditors, suppliers, etc., in return for goods and/or services they have delivered.

- Accrual accounting: See “accounting methods.”

- Assets (fixed and current): Current assets are assets that will be used within one year.

For example, cash, inventory, and accounts receivable (see above). Fixed assets (non-current) may provide benefits to a company for more than one year—for example, land and machinery. - Balance sheet: A financial report that provides a gist of a company’s assets and liabilities and owner’s equity at a given time.

- Capital: A financial asset and its value, such as cash and goods. Working capital is current assets minus current liabilities.

- Cash accounting: See “accounting methods.”

- Cash flow statement: The cash flow statement of a business shows the balance between the amount of cash earned and the cash expenditure incurred.

- Credit and debit: A credit is an accounting entry that either increases a liability or equity account, or decreases an asset or expense account. It is entered on the right in an accounting entry. A debit is an accounting entry that either increases an asset or expense account, or decreases a liability or equity account. It is entered on the left in an accounting entry.

- Double-entry bookkeeping: Under double-entry bookkeeping, every transaction is recorded in at least two accounts—as a credit in one account and as a debit in another.

For example, an automobile repair shop that collects Rs. 10,000 in cash from a customer enters this amount in the revenue credit side and also in the cash debit side. If the customer had been given credit, “account receivable” (see above) would have been used instead of “cash.” (Also see “single-entry bookkeeping,” below.) - Financial statement: A financial statement is a document that reveals the financial transactions of a business or a person. The three most important financial statements for businesses are the balance sheet, cash flow statement, and profit and loss statement (all three listed here alphabetically).

- General ledger: A complete record of financial transactions over the life of a company.

- Journal entry: An entry in the journal that records financial transactions in the chronological order.

- Profit and loss statement (income statement): A financial statement that summarizes a company’s performance by reviewing revenues, costs and expenses during a specific period.

- Single-entry bookkeeping: Under the single-entry bookkeeping, mainly used by small or businesses, incomes and expenses are recorded through daily and monthly summaries of cash receipts and disbursements.

|

44 videos|75 docs|18 tests

|

FAQs on Basic Accounting Concepts and Conventions - Accountancy and Financial Management - B Com

| 1. What are some key characteristics of accounting information? |  |

| 2. What is the difference between accounting concepts and accounting conventions? |  |

| 3. Can you provide some examples of basic accounting terms? |  |

| 4. How do accounting concepts and conventions impact the preparation of financial statements? |  |

| 5. Why is it important for accounting information to be both relevant and reliable? |  |

|

44 videos|75 docs|18 tests

|

|

Explore Courses for B Com exam

|

|