Factors Determining Capital Structure, Accountancy and Financial Management | Accountancy and Financial Management - B Com PDF Download

Factors Determining Capital Structure

The following factors are considered while deciding the capital structure of the firm.

Leverage

It is the basic and important factor, which affect the capital structure. It uses the fixed cost financing such as debt, equity and preference share capital. It is closely related to the overall cost of capital.

Cost of Capital

Cost of capital constitutes the major part for deciding the capital structure of a firm. Normally long- term finance such as equity and debt consist of fixed cost while mobilization. When the cost of capital increases, value of the firm will also decrease. Hence the firm must take careful steps to reduce the cost of capital.

(a) Nature of the business: Use of fixed interest/dividend bearing finance depends upon the nature of the business. If the business consists of long period of operation, it will apply for equity than debt, and it will reduce the cost of capital.

(b) Size of the company: It also affects the capital structure of a firm. If the firm belongs to large scale, it can manage the financial requirements with the help of internal sources. But if it is small size, they will go for external finance. It consists of high cost of capital.

(c) Legal requirements: Legal requirements are also one of the considerations while dividing the capital structure of a firm. For example, banking companies are restricted to raise funds from some sources.

(d) Requirement of investors: In order to collect funds from different type of investors, it will be appropriate for the companies to issue different sources of securities.

Government policy

Promoter contribution is fixed by the company Act. It restricts to mobilize large, longterm funds from external sources. Hence the company must consider government policy regarding the capital structure.

Factors Determining the Capital Structure:

The various factors which influence the decision of capital structure are:

1. Cash Flow Position:

The decision related to composition of capital structure also depends upon the ability of business to generate enough cash flow.

The company is under legal obligation to pay a fixed rate of interest to debenture holders, dividend to preference shares and principal and interest amount for loan. Sometimes company makes sufficient profit but it is not able to generate cash inflow for making payments.

The expected cash flow must match with the obligation of making payments because if company fails to make fixed payment it may face insolvency. Before including the debt in capital structure company must analyse properly the liquidity of its working capital.

A company employs more of debt securities in its capital structure if company is sure of generating enough cash inflow whereas if there is shortage of cash then it must employ more of equity in its capital structure as there is no liability of company to pay its equity shareholders.

2. Interest Coverage Ratio (ICR):

It refers to number of time companies earnings before interest and taxes (EBIT) cover the interest payment obligation.

ICR= EBIT/ Interest

High ICR means companies can have more of borrowed fund securities whereas lower ICR means less borrowed fund securities.

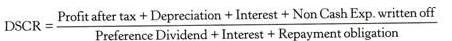

3. Debt Service Coverage Ratio (DSCR):

It is one step ahead ICR, i.e., ICR covers the obligation to pay back interest on debt but DSCR takes care of return of interest as well as principal repayment.

If DSCR is high then company can have more debt in capital structure as high DSCR indicates ability of company to repay its debt but if DSCR is less then company must avoid debt and depend upon equity capital only.

4. Return on Investment:

Return on investment is another crucial factor which helps in deciding the capital structure. If return on investment is more than rate of interest then company must prefer debt in its capital structure whereas if return on investment is less than rate of interest to be paid on debt, then company should avoid debt and rely on equity capital. This point is explained earlier also in financial gearing by giving examples.

5. Cost of Debt:

If firm can arrange borrowed fund at low rate of interest then it will prefer more of debt as compared to equity.

6. Tax Rate:

High tax rate makes debt cheaper as interest paid to debt security holders is subtracted from income before calculating tax whereas companies have to pay tax on dividend paid to shareholders. So high end tax rate means prefer debt whereas at low tax rate we can prefer equity in capital structure.

7. Cost of Equity:

Another factor which helps in deciding capital structure is cost of equity. Owners or equity shareholders expect a return on their investment i.e., earning per share. As far as debt is increasing earnings per share (EPS), then we can include it in capital structure but when EPS starts decreasing with inclusion of debt then we must depend upon equity share capital only.

8. Floatation Costs:

Floatation cost is the cost involved in the issue of shares or debentures. These costs include the cost of advertisement, underwriting statutory fees etc. It is a major consideration for small companies but even large companies cannot ignore this factor because along with cost there are many legal formalities to be completed before entering into capital market. Issue of shares, debentures requires more formalities as well as more floatation cost. Whereas there is less cost involved in raising capital by loans or advances.

9. Risk Consideration:

Financial risk refers to a position when a company is unable to meet its fixed financial charges such as interest, preference dividend, payment to creditors etc. Apart from financial risk business has some operating risk also. It depends upon operating cost; higher operating cost means higher business risk. The total risk depends upon both financial as well as business risk.

If firm’s business risk is low then it can raise more capital by issue of debt securities whereas at the time of high business risk it should depend upon equity.

10. Flexibility:

Excess of debt may restrict the firm’s capacity to borrow further. To maintain flexibility it must maintain some borrowing power to take care of unforeseen circumstances.

11. Control:

The equity shareholders are considered as the owners of the company and they have complete control over the company. They take all the important decisions for managing the company. The debenture holders have no say in the management and preference shareholders have limited right to vote in the annual general meeting. So the total control of the company lies in the hands of equity shareholders.

If the owners and existing shareholders want to have complete control over the company, they must employ more of debt securities in the capital structure because if more of equity shares are issued then another shareholder or a group of shareholders may purchase many shares and gain control over the company.

Equity shareholders select the directors who constitute the Board of Directors and Board has the responsibility and power of managing the company. So if another group of shareholders gets more shares then chance of losing control is more.

Debt suppliers do not have voting rights but if large amount of debt is given then debt-holders may put certain terms and conditions on the company such as restriction on payment of dividend, undertake more loans, investment in long term funds etc. So company must keep in mind type of debt securities to be issued. If existing shareholders want complete control then they should prefer debt, loans of small amount, etc. If they don’t mind sharing the control then they may go for equity shares also.

12. Regulatory Framework:

Issues of shares and debentures have to be done within the SEBI guidelines and for taking loans. Companies have to follow the regulations of monetary policies. If SEBI guidelines are easy then companies may prefer issue of securities for additional capital whereas if monetary policies are more flexible then they may go for more of loans.

13. Stock Market Condition:

There are two main conditions of market, i.e., Boom condition. These conditions affect the capital structure specially when company is planning to raise additional capital. Depending upon the market condition the investors may be more careful in their dealings.

During depression period in the market business is slow and investors also hesitate to take risk so at this time it is advisable to issue borrowed fund securities as these are less risky and ensure fixed repayment and regular payment of interest but if there is Boom period, business is flourishing and investors also take risk and prefer to invest in equity shares to earn more in the form of dividend.

14. Capital Structure of other Companies:

Some companies frame their capital structure according to Industrial norms. But proper care must be taken as blindly following Industrial norms may lead to financial risk. If firm cannot afford high risk it should not raise more debt only because other firms are raising.

|

44 videos|75 docs|18 tests

|

FAQs on Factors Determining Capital Structure, Accountancy and Financial Management - Accountancy and Financial Management - B Com

| 1. What is capital structure in accounting and financial management? |  |

| 2. What are the factors that determine capital structure? |  |

| 3. How does capital structure impact a company's financial performance? |  |

| 4. How do companies determine the optimal capital structure? |  |

| 5. How does a company's capital structure impact its credit rating? |  |

|

44 videos|75 docs|18 tests

|

|

Explore Courses for B Com exam

|

|