Operating Leverage - Capital Structure, Accountancy and Financial Management | Accountancy and Financial Management - B Com PDF Download

Operating Leverage

The leverage associated with investment activities is called as operating leverage. It is caused due to fixed operating expenses in the company. Operating leverage may be defined as the company’s ability to use fixed operating costs to magnify the effects of changes in sales on its earnings before interest and taxes. Operating leverage consists of two important costs viz., fixed cost and variable cost. When the company is said to have a high degree of operating leverage if it employs a great amount of fixed cost and smaller amount of variable cost. Thus, the degree of operating leverage depends upon the amount of various cost structure. Operating leverage can be determined with the help of a break even analysis.

Operating leverage can be calculated with the help of the following formula:

OL = C/OP

Where,

OL = Operating Leverage

C = Contribution

OP = Operating Profits

Degree of Operating Leverage

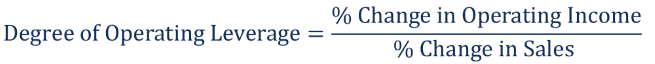

The degree of operating leverage may be defined as percentage change in the profits resulting from a percentage change in the sales. It can be calculated with the help of the following formula:

DOL = Percentage change in profits / Percentage change insales

Example :

From the following selected operating data, determine the degree of operating leverage. Which company has the greater amount of business risk? Why?

Company A Rs | Company B Rs. | |

Sales | 25,00,000 | 30,00,000 |

Fixed costs | 7,50,000 | 15,00,000 |

Variable expenses as a percentage of sales are 50% for company A and 25% for company B.

Solution

Statement of Profit

Company A Rs. | Company B Rs | |

Sales | 25,00,000 | 30,00,000 |

Variable cost | 12,50,000 | 7,50,000 |

Contribution | 12,50,000 | 22,50,000 |

Fixed cost | 7,50,000 | 15,00,000 |

Operating Profit | 5,00,000 | 7,50,000 |

Operating Leverage = Contribution/Operating Profit

“A” Company Leverage = 12,50,000/5,00,000 = 2.5

“B” Company Leverage = 2,25,000/7,50,000 = 3

Comments

Operating leverage for B Company is higher than that of A Company; B Company has a higher degree of operating risk. The tendency of operating profit may vary portionately with sales, is higher for B Company as compared to A Company.

Uses of Operating Leverage

Operating leverage is one of the techniques to measure the impact of changes in sales which lead for change in the profits of the company.

If any change in the sales, it will lead to corresponding changes in profit. Operating leverage helps to identify the position of fixed cost and variable cost.

Operating leverage measures the relationship between the sales and revenue of the company during a particular period. Operating leverage helps to understand the level of fixed cost which is invested in the operating expenses of business activities. Operating leverage describes the over all position of the fixed operating cost.

Formula for Degree of Operating Leverage

The degree of operating leverage can be calculated in several different ways. First, we can use the formula from the definition of the ratio:

Since the operating leverage ratio is closely related to the company’s cost structure, we can calculate it using its contribution margin. The contribution margin is the difference between total sales and total variable costs.

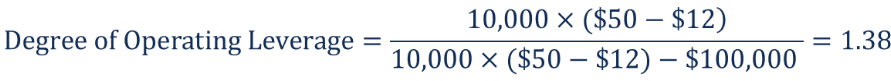

Finally, if there is available information about the cost structure of a company, we can use the following formula:

Where:

- Q – the number of units

- P – the price per unit

- V – the variable cost per unit

- F – the fixed costs

Example of Degree of Operating Leverage

The management of ABC Corp. wants to determine the company’s current degree of operating leverage. The company sells 10,000 product units at an average price of $50. The variable cost per unit is $12 while the total fixed costs are $100,000.

The company’s DOL is:

Therefore, every 1% change in the company’s sales will change the company’s operating income by 1.38%.

Problems and Solutions

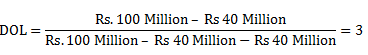

Problem 1:

Given Sales Rs.100 million, Variable cost Rs.40 Million and Fixed Cost Rs.40 Million. Find out the Degree of Operating Leverage.

Solution:

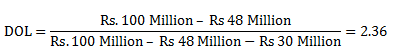

Problem 1(a):

(a) Given Sales Rs.100 million, Variable cost Rs.48 Million and Fixed Cost Rs.30 Million. Find out the Degree of Operating Leverage?

Solution:

Observation:

When the company reduces its fixed cost by increasing variable cost, it manages to reduce operating leverage.

High operating leverage produces a situation where a small change in sales can result in a large change in operating income [Sales – Variable cost – Fixed cost]. Illustration 1(b) and 1(c) compare two business situations with high and low operating leverage:

Problem 1(b):

Situation 1: Given Sales Rs.100 million, Variable cost Rs. 40 Million and Fixed Cost Rs. 40 Million.

Situation 2: Sales Rs.80 million, Variable cost Rs.32 Million and Fixed Cost Rs.40 Million. Compare operating income. Degree of Operating Leverage = 3 for the first business situation, which has already been calculated in Illustration 1.

Solution:

In situation 1 Operating income is Rs.20 million. In situation 2 is Rs.8 million. Sales declined by 20%, but operating income declined by 60% which is 3 times the change in sales.

Problem 1(c):

Situation 1: Given Sales Rs.100 million, Variable cost Rs.60 Million and Fixed Cost Rs.20 Million.

Situation 2: Sales Rs.80 million, Variable cost Rs.48 Million and Fixed Cost Rs.20 Million. Compare operating income.

Solution:

Business Situation 1

DOL = 2

Business Situation 2 as compared to Business Situation 1

Change in sales =20%

New operating income = Rs.12 million

Change in operating income = Rs.8 million

% Change in Operating Income = 40%

Problem 2:

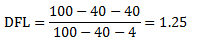

Given Sales Rs.100 million, Variable cost Rs.40 Million and Fixed Cost Rs.40 Million. Capital employed of the Company Rs.80 million with debt equity ratio 1:1. This means debts = Rs.40 million. Debt carries 10% interest. Find out the Degree of Financial Leverage?

Solution:

Interest cost = Rs.4 million.

(Figures are in Rs. Million)

DFL explains change in net profit resulting from change in operating profit. This is explained in Illustration 2(a).

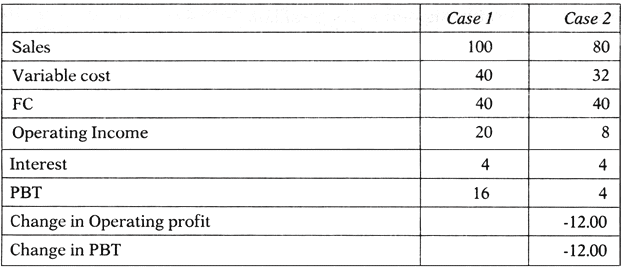

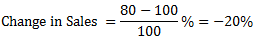

Problem 2(a):

Continue with the data given in Illustration 2. Now assume that sales change to Rs.80 million. First prepare a statement showing operating profit and PBT in both the situation and then explain the change in profits using DOL and DFL.

Solution:

Using data of Case 1:

DOL = 3, DFL = 1.25

% Change in Operating profit = % change in sales × DOL = – 20% × 3 = -60%

Check:

Operating income in case 1 Rs.20 million has been reduced by Rs.12 million which is 60% decline.

% Change in PBT = % Change in Operating profit × DFL = -60% × 1.25 = -75%

Check:

PBT has been reduced by Rs.12 million from Rs.16 million which 75% decline.

On the basis of the discussion held, we may conclude that –

% Change PBT = % Change in sales × DOL × DFL

Let us introduce a new term:

Degree of Combined Leverage (DCL) = DOL × DFL

% Change PBT = % Change in sales × DOL × DFL

= % Change in sales × DCL

Application of Operating and Financial Leverage in Capital Structure Planning: A newly established company should look into the issue of creating operating facilities and cost structure planning together with the financial structure planning. An existing company should attempt to re-structure its cost and financial structure in the light of market demand.

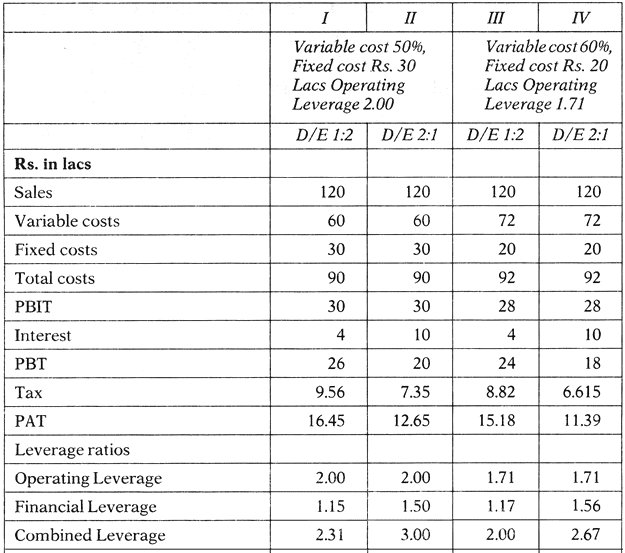

Problem 3:

Jambo Chemicals Ltd. is newly formed company.

The promoters has planned two different cost structures:

(i) Variable cost 50%, Fixed Cost Rs.30 lacs or

(ii) Variable cost 60%, Fixed cost Rs.20 lacs. Projected average sales Rs.150 lacs. The pessimistic projection of sales is Rs.120 lacs and optimistic projection is Rs.180 lacs. Its total investment has been worked out as Rs.150 lacs of which Rs.120 lacs is in fixed assets and Rs.30 lacs for working capital.

The company is considering two financing alternatives:

(i) Equity Rs.100 lacs and Debt Rs.50 Lacs, Debt – equity ratio of 1:2 or

(ii) Equity Rs.50 lacs, Debt Rs.100 lacs, Debt – Equity ratio of 2:1.

For the first alternative, interest rate is worked out to be 8% and for the second alternative it is 10%. Tax Rate is 35% and surcharge 5%. Depreciation component in the fixed costs is Rs.6 lacs.

Since there is now-a-days a provision for deferred tax liability is to be created as per Accounting Standard -22, there is no need to take care of tax depreciation. The company wants to carry out the analysis using accounting depreciation and tax benefit arising out of that.

Find out degree of operating leverage, financial leverage and combined leverage for the possible alternatives. Work out PAT, EPS and expected share value for these alternatives. Take that market return is 14%, Risk free rate 6%, Unlevered beta of the company is 0.60.

Solution:

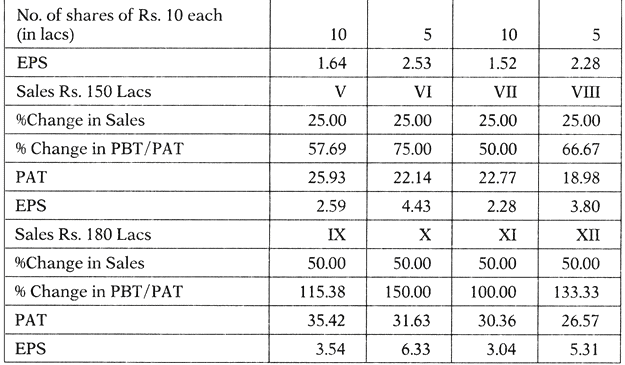

Presented below are twelve alternative EPS for different cost structure and given debt -equity ratio of 1:2 and 2:1. Financial leverage reduces on the impact of cost structure given a particular level of debt – equity ratio.

|

44 videos|75 docs|18 tests

|

FAQs on Operating Leverage - Capital Structure, Accountancy and Financial Management - Accountancy and Financial Management - B Com

| 1. What is operating leverage and how does it relate to capital structure? |  |

| 2. How is operating leverage calculated? |  |

| 3. What are the advantages of operating leverage? |  |

| 4. What are the disadvantages of operating leverage? |  |

| 5. How can a company manage its operating leverage? |  |

|

44 videos|75 docs|18 tests

|

|

Explore Courses for B Com exam

|

|