Accounting & Control of Wastage - Material Cost, Cost Accounting | Cost Accounting - B Com PDF Download

Wastage, spoilage and defectives are the loss of business. Before explaining their accounting treatment, we should explain the meaning of wastage, spoilage and defectives.

Meaning of Spoilage

Spoilage is of two types. First is normal spoilage and second is abnormal spoilage.

Normal Spoilage

Normal spoilage is that wastage which is must during the production. For example, we will make the wooden tables or chairs, there will be the loss of some wood in the form of scobs. We can not stop it because it is necessary and it must happen during the cutting of suitable woods. Like this, all type of production needs some of wastage. All are normal spoilage.

Abnormal Spoilage

Any wastage which is more than normal spoilage will be abnormal spoilage. It happens due to doing the production work by unskilled person. It is also loss of business.

Meaning of Wastage

Wastage may happen during the time of production. For example, when we have made wooden 1000 tables, it is normal some wood will be the part of wastage because we can not make new tables with them.

Meaning of Defectives

When we buy large quantity of raw material for production, there is the chance of some raw material may be in defectives form which can not be returned or sometime, due to the defects in the machine, defective goods will produce. Both will be the loss of business in the form of defectives. For example, you have bought the wood of $ 30,000, out of them 10% defective which could not be returned. So, $ 3000 is defective loss.

Accounting Treatment of Wastage, Spoilage and Defectives

Normal wastage, spoilage and defective will be the part of cost of production. No, need to openseparate account for them. When we will calculate per unit cost, it will increase with normal wastage, spoilage and defectives.

For example, cost of production is $ 10,000, normal wastage, spoilage and defectives are $ 1000. Now, cost of production will be $ 11,000

Now, we need only to open the accounts of abnormal wastage, Abnormal spoilage and Abnormal Defectives which is more than normal. This loss can be transfer to costing profit and loss account. When it will in the account, we can take good steps to control it.

First we pass the journal entries, then, we tell the tips to control them.

Costing Profit and Loss Account Debit

Abnormal Spoilage Account Credit

Abnormal Wastage Account Credit

Illustration 1:

The parts of a machinery are produced to rigorous standards of accuracy. Each batch of 1,000 units is tested to discover whether the units are defective at a cost off 12.50 per unit. The defective units are then rectified and put in good order at a cost of Rs 50 per unit.

If the units are not tested, any defect would become apparent later when they are fitted in the machine. At that state it would cost Rs 100 per unit to put the parts in good working order.

Find out by calculation the minimum percentage of defective units in a batch such that it would be cheaper to test all the units in the batch instead of none of them.

Solution:

Suppose the number of defective units in a batch is X

If testing is done, cost comes to 50X+1,000× Rs 12.50 = 50X + Rs 12,500

If testing is not done, cost comes to 100X

Thus 100X = 50X+ Rs 12,500

Or

50X = Rs 12,500

Or

X = 250 units

If the number of defective units is only 250 (i.e. 25%) in a batch of 1,000 units; the total cost will be the same whether testing is done or not. Hence, it would be cheaper to test all units in the batch, if the minimum percentage of defective units in a batch is more than 25%.

Illustration 2:

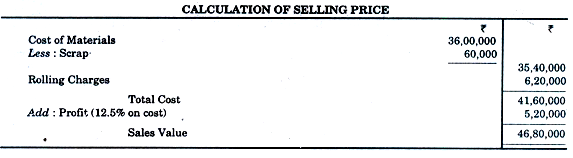

A Re-roller produced 400 metric tons of M.S. bars spending Rs 36, 00,000 towards materials and Rs 6, 20,000 towards rolling charges. Ten per cent of the output was found to be defective, which had to be sold at 10% less than the price for good production.

If the sales realization should give the firm an overall profit of 12.5% on cost, find the selling price per metric ton of both the categories of bars. The scrap arising during the rolling process fetched a realization of Rs 60,000.

Solution.

Selling price of defective output per M.T. = 0.9 x Rs. 11,818.18 = Rs. 10636.36

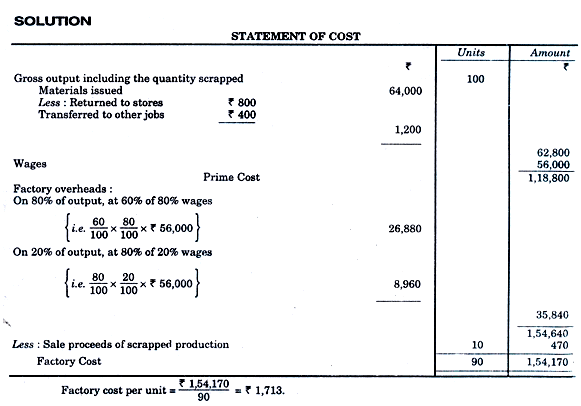

Illustration 3: Following particulars are obtained from the records of a factory. Materials issued-7 64,000

Wages paid-7 56,000

Factory overheads-60% of wages.

Out of the materials issued, Rs. 800 worth of goods has been returned to the stores and Rs. 400 transferred to other jobs.

10 per cent of the production has been scrapped as bad and a further 20 per cent has been brought up to the specification by increasing the factory overheads to 80 per cent of the wages.

If the scrapped production fetches only Rs. 470, find the production cost per unit of the finished production if the total gross output (including the quantity scrapped) be 100 units.

Illustration 4:

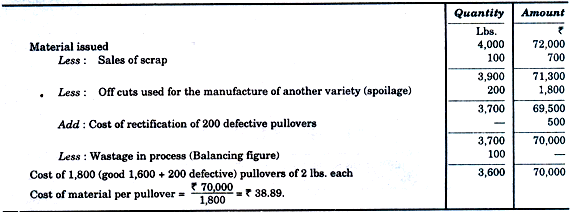

4,000 lbs. of wool costing Rs 72,000 was issued for the manufacture of 38″ size pullover. On the completion of manufacture of pullovers, the following information is furnished.

(1) 1,600 good pullovers 38″ size of 2 lbs. each were manufactured.

(2) 100 lbs. of wool is scrapped and realised X 700.

(3) 200 lbs. of off cuts were used for the manufacture of another variety of hosiery. The market value of this is Rs 1,800.

(4) 200 pullovers were found defective and were rectified at an additional material cost of Rs 500.

You are required to find out the cost of material of one pullover.

Solution.

|

106 videos|173 docs|18 tests

|

FAQs on Accounting & Control of Wastage - Material Cost, Cost Accounting - Cost Accounting - B Com

| 1. What is the importance of accounting and control of wastage in terms of material cost? |  |

| 2. What are the methods used for controlling wastage in material cost? |  |

| 3. How does accounting for wastage impact cost accounting? |  |

| 4. What are the potential consequences of not controlling wastage in terms of material cost? |  |

| 5. How can organizations effectively monitor and control wastage in material cost? |  |

|

Explore Courses for B Com exam

|

|