Introduction to Company Law | Company Law - B Com PDF Download

INTRODUCTION

Industrial revolution led to the emergence of large scale business organizations. These organizations require big investments and the risk involved is very high. Limited resources and unlimited liability of partners are two important limitations of partnerships of partnerships in undertaking big business. Joint Stock Company form of business organization has become extremely popular as it provides a solution to overcome the limitations of partnership business. Multinational companies like Coca-Cola and General Motors have their investors and customers spread throughout the world. The giant Indian Companies may include the names like Reliance, Talco Bajaj Auto, Infosys Technologies, Hindustan Lever Ltd., Ranbaxy Laboratories Ltd., and Larsen and Toubro etc.

MEANING OF COMPANY

- Section 3 of the Companies Act, 1956 defines a company as “a company formed and registered under this Act or an existing company”. Section 3 Of the act states that “an existing company means a company formed and registered under any of the previous companies laws”. This definition does not reveal the distinctive characteristics of a company.

According to Chief Justice Marshall of USA, “A company is a person, artificial, invisible, intangible, and existing only in the contemplation of the law. Being a mere creature of law, it possesses only those properties which the character of its creation of its creation confers upon it either expressly or as incidental to its very existence”. - Another comprehensive and clear definition of a company is given by Lord Justice Lindley, “A company is meant an association of many persons who contribute money or money’s worth to a common stock and employ it in some trade or business, and who share the profit and loss (as the case may be) arising there from. The common stock contributed is denoted in money and is the capital of the company. The persons who contribute it, or to whom it belongs, are members. The proportion of capital to which each member is entitled is his share. Shares are always transferable although the right to transfer them is often more or less restricted”.

- According to Haney, “Joint Stock Company is a voluntary association of individuals for profit, having a capital divided into transferable shares. The ownership of which is the condition of membership”.

From the above definitions, it can be concluded that a company is a registered association which is an artificial legal person, having an independent legal entity with a perpetual succession, a common seal for its signatures, a common capital comprised of transferable shares and carrying limited liability.

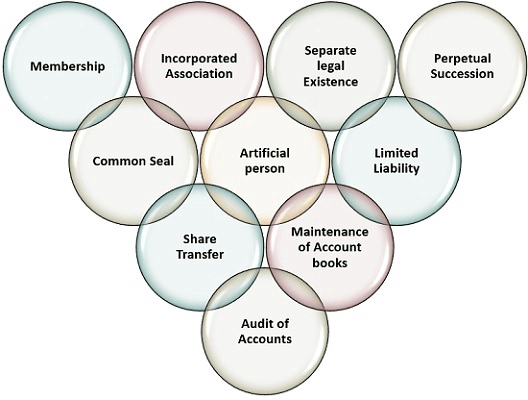

CHARACTERISTICS OF A COMPANY The main characteristics of a company are:

The main characteristics of a company are:

1. Incorporated association: A company is created when it is registered under the Companies Act. It comes from the date mentioned in the certificate of incorporation. It may be noted in this connection that Section 11 provides that an association of more than ten persons carrying on business in banking or an association or more than twenty persons carrying on any other type of business must be registered under the Companies Act and is deemed to be an illegal association, if it is not so registered.

For forming a public company at least seven persons and for a private company at least two persons are required. These persons will subscribe their names to the Memorandum of association and also comply with other legal requirements of the Act in respect of registration to form and incorporate a company, with or without limited liability.

2. Artificial legal person: A company is an artificial person. Negatively speaking, it is not a natural person. It exists in the eyes of the law and cannot act on its own. It has to act through a board of directors elected by shareholders. It was rightly pointed out in Bates V Standard Land Co. that “The board of directors are the brains and the only brains of the company, which is the body and the company can and does act only through them”.

But for many purposes, a company is a legal person like a natural person. It has the right to acquire and dispose of the property, to enter into contract with third parties in its own name, and can sue and be sued in its own name.

However, it is not a citizen as it cannot enjoy the rights under the Constitution of India or Citizenship Act. In State Trading Corporation of India C.T.O (1963 SCJ 705), it was held that neither the provisions of the Constitution nor the Citizenship Act apply to it. It should be noted that though a company does not possess fundamental rights, yet it is a person in the eyes of law. It can enter into contracts with its Directors, its members, and outsiders.

Justice Hidayatullah once remarked that if all the members are citizens of India, the company does not become a citizen of India.

3. Separate Legal Entity: A company has a legal distinct entity and is independent of its members. The creditors of the company can recover their money only from the company and the property of the company. They cannot sue individual members. Similarly, the company is not in any way liable for the individual debts of its members. The property of the company is to be used for the benefit of the company and nor for the personal benefit of the shareholders. On the same grounds, a member cannot claim any ownership rights in the assets of the company either individually or jointly during the existence of the company or in its winding up. At the same time the members of the company can enter into contracts with the company in the same manner as any other individual can.

Separate legal entity of the company is also recognized by the Income Tax Act. Where a company is required to pay Income-tax on its profits and when these profits are distributed to shareholders in the form of dividend, the shareholders have to pay income-tax on their dividend of income. This proves that a company that a company and its shareholders are two separate entities.

The principle of separate legal entities was explained and emphasized in the famous case of Salomon v Salomon & Co. Ltd.

The facts of the case are as follows : Mr. Saloman, the owner of a very prosperous shoe business, sold his business for the sum of $ 39,000 to Salomon and Co. Ltd. which consisted of Saloman himself, his wife, his daughter and his four sons. The purchase consideration was paid by the company by allotment of $ 20,000 shares and $ 10,000 debentures and the balance in cash to Mr. Saloman. The debentures carried a floating charge on the assets of the company. One share of $ 1 each was subscribed by the remaining six members of his family.

Saloman and his two sons became the directors of this company. Saloman was the managing Director. After a short duration, the company went into liquidation. At that time the statement of affairs’ was like this: Assets :$ 6000, liabilities; Saloman as debenture holder $ 10,000 and unsecured creditors $ 7,000. Thus its assets were running short of its liabilities $11,000. The unsecured creditors claimed a priority over the debenture holder on the ground that company and Saloman were one and the same person. But the House of Lords held that the existence of a company is quite independent and distinct from its members and that the assets of the company must be utilized in payment of the debentures first in priority to unsecured creditors.

Saloman’s case established beyond doubt that in law a registered company is an entity distinct from its members, even if the person holds all the shares in the company. There is no difference in principle between a company consisting of only two shareholders and a company consisting of two hundred members. In each case the company is a separate legal entity.

The principle established in Saloman’s case also been applied in the following: Lee V. Lee’s Air forming Ltd. (1961) A.C. 12 Of the 3000 shares in Lee’s Air Farming Ltd., Lee held 2999 shares. He voted himself the managing Director and also became Chief Pilot of the company on a salary. He died in an aircrash while working for the company. His wife was granted compensation for the husband in the course of employment. Court held that Lee was a separate person from the company he formed, and compensation was due to the widow. Thus, the rule of corporate personality enabled Lee to be the master and servant at the same time.

The principle of separate legal entity of a company has been, in fact recognized much earlier than in Saloman’s case. In Re Kondoli Tea Co Ltd. (1886 ILR 13 Cal 43), it was held by Calcutta High Court that a company was a separate person, a separate body altogether from its Shareholders. In Re. Sheffield etc. Society - 22 OBD 470), it has been held that a corporation is a legal person, just as much in individual but with no physical existence.

The characteristic of separate corporate personality of a company was also emphasized by Chief Justice Marshall of USA when he defined a company “as a person, artificial, invisible, intangible and existing only in the eyes of the law. Being a mere creation of law, it possesses only those properties which the charter of its creation confers upon it either expressly or as an accident to its very existence”. [Trustees of Dartmouth College v woodward (1819) 17 US 518)

4. Perpetual Existence: A company is a stable form of business organization. Its life does not depend upon the death, insolvency or retirement of any or all shareholders (s) or director (s). Law creates it and law alone can dissolve it. Members may come and go but the company can go on forever. “During the war all the members of one private company , while in general meeting, were killed by a bomb. But the company survived; not even a hydrogen bomb could have destroyed it”. The company may be compared with a flowing river where the water keeps on changing continuously, still the identity of the river remains the same. Thus, a company has a perpetual existence, irrespective of changes in its membership.

5. Common Seal: As was pointed out earlier, a company being an artificial person has no body similar to a natural person and as such it cannot sign documents for itself. It acts through natural people who are called its directors. But having a legal personality, it can be bound by only those documents which bear its signature. Therefore, the law has provided for the use of common seal, with the name of the company engraved on it, as a substitute for its signature. Any document bearing the common seal of the company will be legally binding on the company. A company may have its own regulations in its Articles of Association for the manner of affixing the common seal to a document. If the Articles are silent, the provisions of Table-A (the model set of articles appended to the Companies Act) will apply. As per regulation 84 of Table-A the seal of the company shall not be affixed to any instrument except by the authority of a resolution of the Board or a Committee of the Board authorized by it in that behalf, and except in the presence of at least two directors and of the secretary or such other person as the Board may appoint for the purpose, and those two directors and the secretary or other person aforesaid shall sign every instrument to which the seal of the company is so affixed in their presence.

6. Limited Liability: A company may be a company limited by shares or a company limited by guarantee. In a company limited by shares, the liability of members is limited to the unpaid value of the shares. For example, if the face value of a share in a company is Rs. 10 and a member has already paid Rs. 7 per share, he can be called upon to pay not more than Rs. 3 per share during the lifetime of the company. In a company limited by guarantee the liability of members is limited to such amount as the member may undertake to contribute to the assets of the company in the event of its being wound up.

7. Transferable Shares: In a public company, the shares are freely transferable. The right to transfer shares is a statutory right and it cannot be taken away by a provision in the articles. However, the articles shall prescribe the manner in which such transfer of shares will be made and it may also contain bonafide and reasonable restrictions on the right of members to transfer their shares. But absolute restrictions on the rights of members to transfer their shares shall be ultra vires. However, in the case of a private company, the articles shall restrict the right of members to transfer their shares in companies with its statutory definition.

In order to make the right to transfer shares more effective, the shareholder can apply to the Central Government in case of refusal by the company to register a transfer of shares.

8. Separate Property: As a company is a legal person distinct from its members, it is capable of owning, enjoying and disposing of property in its own name. Although its capital and assets are contributed by its shareholders, they are not the private and joint owners of its property. The company is the real person in which all its property is vested and by which it is controlled, managed and disposed of.

9. Delegated Management: A joint stock company is an autonomous, self governing and self-controlling organization. Since it has a large number of members, all of them cannot take part in the management of the affairs of the company. Actual control and management is, therefore, delegated by the shareholders to their elected representatives, known as directors. They look after the day-to-day working of the company. Moreover, since shareholders, by majority of votes, decide the general policy of the company, the management of the company is carried on democratic lines. Majority decision and centralized management compulsorily bring about unity of action.

|

81 docs|44 tests

|

FAQs on Introduction to Company Law - Company Law - B Com

| 1. What are the key provisions of the Companies Act related to corporate governance? |  |

| 2. How does Company Law regulate the formation and dissolution of companies? |  |

| 3. What are the legal requirements for holding annual general meetings (AGMs) under Company Law? |  |

| 4. How does Company Law protect the interests of shareholders in a company? |  |

| 5. What role does the Registrar of Companies play in enforcing Company Law regulations? |  |

|

Explore Courses for B Com exam

|

|