Types of Companies Including One Person Company (Part - 1)- Introduction, Company Law | Company Law - B Com PDF Download

Introduction

In India, businesses come in various forms, each governed by specific regulations outlined in Indian Company Law. Understanding the different types of companies recognized by this law is crucial for anyone looking to start a business, whether small or large. These classifications determine ownership, responsibility, management, and operational rules.

According to Section 2(20) of the Companies Act, 2013, a “company” refers to an entity incorporated under this Act or any previous company law. The Companies Act, 2013, which replaced the earlier Companies Act of 1956, provides the legal framework for both listed and unlisted companies in India. This new Act introduced several changes and repealed corresponding sections of the old law, marking a significant shift in how companies are regulated in the country.

India has a wide range of companies, from large corporate entities to one-person businesses. These companies can be categorized based on size, number of members, control, liability, and methods of raising capital. This article will explore these categories in detail, along with other types of companies recognized by law.

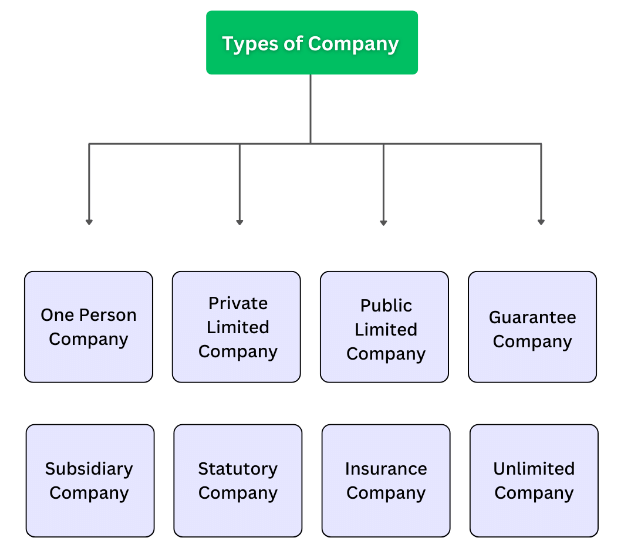

Types of Companies in Company Law

Types of Companies Based on Size or Number of Members

Private Company

- A private company, as defined in Section 2(68) of the Companies Act, 2013 (amended in 2015), is a company with a minimum paid-up share capital and restrictions on share transfer as per its articles.

- It can have a maximum of 200 members, with exceptions for one-person companies.

Key Features:

- Minimum Share Capital: Initially set at one lakh rupees, the specific minimum share capital requirement was removed in the 2015 amendment.

- Share Transfer Restrictions: The Articles of Association (AoA) of a private company restrict how shares can be sold or transferred, preventing shareholders from freely selling their shares to outsiders.

- Member Limit:. private company can have up to 200 members, excluding employees and former employees who hold shares. Joint shareholders are considered a single member.

- Public Invitation Restriction: Private companies cannot publicly invite investments in their shares or securities, ensuring a controlled and close-knit structure.

Advantages of Private Companies

- Increased Control: Owners have more authority over decisions and operations due to fewer shareholders.

- Management Flexibility: Greater freedom in management structure, business strategies, and financial choices.

- Enhanced Privacy: Less public scrutiny allows for greater confidentiality in financial matters and business activities.

- Swift Decision-Making: Ability to respond quickly to market changes and opportunities without bureaucratic delays.

- Long-Term Focus: Freedom to prioritize long-term growth without pressure for short-term earnings.

- Simplified Formation:. private company can be established by just two individuals and can start operations immediately after incorporation without waiting for a certificate of commencement.

- Reduced Legal Formalities: Fewer legal requirements compared to public companies, along with special exemptions and privileges under company law, allowing greater operational flexibility.

- Faster Decision-Making: With fewer decision-makers, obtaining consent is quicker, facilitating faster decision-making processes.

- Confidentiality of Accounts: Not required to publish accounts or file numerous documents, private companies are better positioned to maintain business secrets compared to public companies.

Private Companies: Overview, Advantages, and Disadvantages

Private companies are owned and managed by a small group of people, usually with close personal or family ties. Because of this closeness, they can make decisions quickly and keep the company's direction consistent.

Advantages of Private Companies:

- Continuity of Policy: The same core group of people who have strong relationships manages the company. Their close ties ensure mutual trust and fewer disputes, which helps maintain a consistent policy.

- Personal Touch: Private companies often have a closer relationship with employees and customers. This personal connection can lead to a more motivated workforce and loyal customers.

- Incentives for Hard Work: There is usually a greater incentive for employees and management to work hard and take initiative in a private company, which can drive the business forward more effectively.

Disadvantages of Private Companies:

- Raising Capital: Private companies may struggle to raise funds because they cannot sell shares to the public. They often rely on personal savings, bank loans, or investments from a smaller group of investors.

- Expansion Constraints: Without access to public markets, private companies might face limitations in expanding their operations or taking on large projects.

- Access to Resources: Private companies might have limited access to specialized skills and resources compared to larger public companies, which can hinder their growth and competitiveness.

- Risk of Failure: Due to limited resources and access to capital, private companies may be at a higher risk of failure, especially during economic downturns or market disruptions.

- Exiting Challenges: Selling shares or exiting a private company can be more complicated and may require the agreement of all shareholders, making it harder for investors to realize their investments.

Public Company: Definition and Characteristics

A public company, as per Section 2(71) of the Companies Act, 2013, is a company that is not classified as a private company and meets certain criteria set by law. Here are the key aspects of a public company:

- Minimum Members and Directors:. public company must have a minimum of seven members, with no maximum limit on the number of members. Additionally, it must have at least three directors.

- Name Requirement:. public company with limited liability must include the word "limited" at the end of its name. This indicates the limited liability status of the company.

- Transferability of Shares: Unlike private companies, public companies do not have restrictions on the transfer of shares. This means that shares can be freely traded, allowing for a larger number of shareholders.

- Paid-Up Share Capital: Public companies were previously required to have a minimum paid-up share capital, initially set at five lakh rupees. However, this requirement was omitted in the Amendment Act of 2015. The government may still prescribe a higher minimum capital requirement.

- Ownership by Non-Private Companies: If a company is owned by another company that is not private, such as a public company, it is treated as a public company, regardless of its classification according to its own rules.

Registration Process for Public Companies

To register a public company, several key aspects need to be considered:

- Minimum Requirements: There must be at least 7 shareholders and 3 directors to start a public limited company. Shareholders can be individuals, other companies, or Limited Liability Partnerships (LLPs), while directors must be individuals.

- Director Identification Number (DIN): Directors need a DIN, which can be obtained by applying online through the Ministry of Corporate Affairs. Indian nationals require a PAN card for this process.

- Digital Signature Certificate (DSC): All promoters and directors must have a digital signature certificate for online document submission. These certificates are issued by certifying authorities in India. For obtaining the DIN, a self-attested copy of a PAN card for Indian nationals and proof of address such as utility bills or a passport for foreign nationals are required.

- Registered Office and Authorised Capital: Choose a location for the registered office and decide on the authorised capital of the company. There is no minimum capital requirement for a public limited company. The registered office can be any identifiable address.

- Company Name: The company’s name should end with ‘Limited’. Apply for name approval from the Registrar of Companies (ROC) through the Ministry of Corporate Affairs website. Multiple names should be submitted in order of preference, ensuring compliance with guidelines.

- Memorandum and Articles of Association: Prepare the Memorandum of Association (MOA) and Articles of Association (AOA) in the prescribed format. These documents are now prepared electronically (eMOA and eAOA) and submitted to the ROC for registration.

- Certificate of Incorporation: After verification, the ROC will register the company and issue a Certificate of Incorporation (COI). Following the COI issuance, a Corporate Identification Number (CIN) will be allocated to the company.

Public Limited Company

Advantages of Public Companies

- Fundraising: Public companies can easily raise money by selling shares to the public through the stock market, which helps them grow and invest in activities like research.

- Liquidity for Investors: Investors can buy and sell shares of public companies on the stock market, making it easier for them to enter and exit their investments.

- Opportunities for Expansion: Public companies have more chances to collaborate with or acquire other companies, allowing them to expand and diversify their activities.

- Job Creation: Being larger and more visible, public companies can offer better job opportunities and higher salaries.

- Access to Mergers and Acquisitions: Public companies have greater access to mergers, acquisitions, and partnerships, which can aid in their growth and diversification.

- Visibility and Reputation: Their public visibility often enhances their reputation, making it easier to attract talent and business opportunities.

Disadvantages of Public Companies

- Complexity in Initiation: Starting a public company is challenging due to the need for a detailed prospectus and adherence to regulations when issuing shares.

- Decision-Making Process: Public companies have many directors and managers, leading to potentially lengthy decision-making processes through meetings.

- Disclosure Requirements: They must share extensive documents with the government, making their financial information public and compromising business secrecy.

- Regulatory Oversight: Public companies are subject to strict regulations, limiting their flexibility and operational freedom.

- Separation of Ownership and Management: In public companies, owners and managers are often different, which can lead to a lack of motivation for hired managers and difficulties in maintaining close relationships with customers and employees.

- Shareholder Conflicts: There may be conflicts between shareholders, lenders, and managers, complicating governance.

- Market Speculation: Daily trading of shares can attract speculators, impacting smaller shareholders.

- Short-Term Focus of Shareholders: Shareholders often seek quick financial returns, which can pressure the company to prioritize short-term profits over long-term growth.

- Loss of Control: Going public involves relinquishing some control, as shareholders and market expectations influence decisions.

- Legal Risks: Public companies may face lawsuits from shareholders or regulators, which can be costly and damage their reputation.

- Conflicts of Interest: Some investors may try to influence company decisions for their own benefit, causing disruptions in operations.

Small Companies

Definition:. small company, as per Section 2(85) of the Act, is a type of company that is not a public company. The criteria for a small company include:

- Paid-Up Share Capital: This refers to the total value of shares that have been paid for by shareholders. The paid-up share capital should not exceed a certain limit, which has been revised from fifty lakh rupees to a higher threshold, potentially up to ten crore rupees.

- Turnover: Turnover refers to the total revenue generated by a company from its business activities. For a company to be classified as small, its turnover for the previous financial year should not exceed a specific limit, which has been increased from two crore rupees to a higher threshold, such as four crore rupees or forty crore rupees.

Exceptions: Certain companies are exempt from the criteria mentioned above, including:

- Holding or Subsidiary Companies: Companies that are owned or controlled by another company, known as a holding company, are exempt from the small company criteria.

- Section 8 Companies: These are non-profit companies formed for specific purposes and are not bound by the small company criteria.

- Companies Governed by Special Acts: Companies that are governed by special laws applicable to specific sectors are exempt from the small company criteria.

Recent Changes: The definition of a small company was recently amended by the Ministry of Corporate Affairs on September 15, 2022. The amendment increased the thresholds for paid-up share capital and turnover, making it easier for companies to qualify as small. The previous limits of two crore rupees for turnover and twenty crore rupees for paid-up share capital were revised to four crore rupees for paid-up capital and forty crore rupees for turnover.

Effect of Amendment: The amendment in the definition of a small company reduces the certification requirements for e-forms submitted to the Register of Companies (ROC) by practising professionals such as Chartered Accountants, Company Secretaries, and Cost Accountants. Holding a Certificate of Practice (COP) opens up various opportunities beyond ROC compliance, including areas like intellectual property rights, litigation, and investment banking.

Role of small companies

Small companies play a vital role in the economy by contributing to its growth and development. They are registered in a similar manner to private limited companies, but their status is determined by factors such as paid-up share capital and turnover, rather than a separate registration process.

One Person Company

The Companies Act, 2013 introduces a new type of business entity called the One Person Company (OPC), where a single individual can establish and operate the entire company. This concept is akin to a "one-man army." According to Section 2(62) of the Act, an OPC is defined as a company with only one person as its member.

- Sole Ownership and Directorship: In an OPC, one individual can both set up and manage the entire company, serving as both the owner and the director.

- Director Limit: While an OPC can appoint up to 15 directors, ownership is restricted to one person.

- Resident Director Requirement: At least one director of the OPC must be an Indian resident who has lived in India for a minimum of 182 days in the preceding financial year.

- No Minimum Capital Requirement: There is no minimum capital stipulation for registering an OPC. The owner can invest any amount they choose, and government fees are based on this investment.

- Limited Liability: The owner's liability is limited to the capital invested in the business. This means that personal assets are protected in case of business losses or debts.

- Eligibility Criteria: OPCs are suitable for small businesses and startups with a turnover below Rs. 2 crores and capital investment under Rs. 50 lakhs. Only Indian citizens can register an OPC, as foreign investment is not permitted.

- Company Name: The name of the company must include "One Person Company" in brackets, as mandated by Section 3(1)(c) of the law.

Members and Directors:

- Member: An OPC can have only one member, as per Section 3(1)(c) of the Companies Act.

- Director: The sole member of the OPC is considered the first director until other directors are appointed. The company can have a minimum of one director and a maximum of fifteen directors. If the company wants to exceed fifteen directors, a special resolution is required.

- Nominee: The sole member must appoint a nominee who will take over the OPC in case the member is unable to run the company due to reasons like death or incapacity. The nominee will become a new member of the OPC, receive all the shares, and be responsible for all liabilities. The nominee's consent to act as a nominee must be obtained and submitted to the Registrar of Companies (RoC) at the time of incorporation, along with other necessary documents.

Withdrawal and Replacement of Nominee:

- The nominee can withdraw their consent by giving written notice to both the sole member and the OPC.

- Upon withdrawal, the sole member must nominate a new nominee within 15 days.

- The OPC must inform the RoC about the withdrawal of consent, name the new nominee, and obtain the written consent of the new nominee within 30 days.

- This information must be filed with the RoC using Form No. INC-4 along with the required fee, and the written consent must be submitted using Form No. INC-3.

- The nominee can be changed at any time by informing the RoC.

Limit on Multiple Memberships:

- If a person is a member of one OPC and becomes a member of another OPC as a nominee, they must choose to remain a member of only one OPC within 180 days.

- They need to withdraw their membership from one of the OPCs within this period.

Registration of OPC:

- Obtain a Digital Signature Certificate (DSC) for the proposed director by submitting necessary documents like address proof, Aadhaar card, PAN card, and contact details.

- Apply for Director Identification Number (DIN) using the SPICe+ form.

- Apply for name approval for the company using the SPICe+ application by specifying a preferred name.

- Prepare necessary documents including Memorandum of Association (MoA), Articles of Association (AoA), proof of registered office, and nominee consent.

- File these documents along with forms like INC-9 and DIR-2 with Registrar of Companies (ROC) using SPICe+ Form, SPICe-MOA, and SPICe-AOA.

- ROC issues a Certificate of Incorporation after verification, allowing the company to start operations.

- Ensure compliance with Companies (Incorporation Rules) 2014 regarding company name.

- The entire process usually takes around 10 days from DSC and DIN acquisition to receiving Certificate of Incorporation, depending on departmental approval and response times.

Advantages of One Person Company (OPC)

- Easy Setup: Setting up an OPC is straightforward and can be initiated by just one person.

- Limited Liability: An OPC provides limited liability protection to its owner, meaning personal assets are not at risk in case of business debts.

- Full Control: The owner has complete control over the company and does not have to share decision-making power with anyone else.

- Legal Entity: An OPC is recognized as a separate legal entity from its owner, enhancing its credibility and making it easier to secure funding.

- Fewer Regulations: Compared to larger companies, OPCs typically face fewer legal requirements and less paperwork, simplifying business operations.

- Tax Benefits: OPCs may qualify for government tax benefits and incentives, potentially reducing tax liabilities.

- Quick Decision-Making: With only one owner, decisions can be made swiftly without the need for consultation or approval from others, allowing for quicker adaptation to market changes.

Disadvantages of One Person Company (OPC)

- Single Ownership: OPCs can only have one owner, which may hinder growth and investment opportunities compared to larger companies with multiple owners.

- Legal Complexity: Being owned by one person comes with significant legal paperwork and regulations, which can be more complex than for other business structures.

- Perception Issues: Some individuals may perceive OPCs as less stable or reliable than larger companies with multiple owners.

- Mandatory Representation: OPCs are required to appoint a representative, which may frustrate entrepreneurs who prefer to make all decisions themselves.

- Resource Limitations: With only one owner, OPCs may struggle to access sufficient capital, expertise, or networks, making growth challenging.

- Succession Challenges: If the owner faces illness or death, it can be difficult to determine the future course of the OPC, especially without a succession plan.

- Transfer Difficulties: Selling or transferring an OPC can be complicated and may deter potential buyers or investors due to the legal intricacies involved.

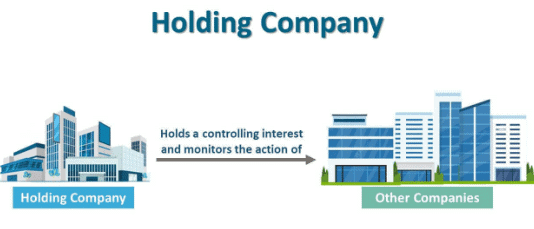

Holding Company

A holding company is a type of company that owns and controls other companies, known as subsidiary companies. The relationship between the holding company and its subsidiaries is similar to that of a parent and child, where the holding company acts as the parent, and the subsidiaries are its offspring.

- Definition of Holding Company: According to Section 2(46) of the Companies Act, 2013, a holding company is defined as a company that has one or more subsidiary companies. The law also specifies that certain classes of holding companies should not have more than a prescribed number of subsidiary layers.

- Control over Board of Directors:. company is considered to control the composition of another company’s Board of Directors if it has the power to appoint or remove a majority of the directors at its discretion. The term “company” in this context includes any body corporate, and a “layer” refers to the holding company’s subsidiary or subsidiaries.

- Becoming a Holding Company:. company can become a holding company of another company by:

- Holding more than 50% of the issued equity capital of the company.

- Holding more than 50% of the voting rights in the company.

- Holding the right to appoint the majority of the directors of the company.

- How Holding Companies Work: Holding companies can establish control over other companies by acquiring a majority of their shares or starting a new company and retaining some or all of its shares. Even a small ownership stake, such as 10%, can give a holding company significant control over another company’s decisions. The primary relationship between a holding company and its subsidiaries is known as the parent-subsidiary relationship, where the holding company is the parent and the subsidiary is the child. If the holding company owns all the shares of the subsidiary, it is referred to as a wholly-owned subsidiary.

Types of Holding Companies

- Pure Holding Company: This type of holding company solely owns shares in other companies and does not engage in any other business activities.

- Mixed Holding Company:. mixed holding company not only owns shares in other companies but also conducts its own business operations.

- Immediate Holding Company: An immediate holding company directly owns another company, even if that company is already owned by someone else.

- Intermediate Holding Company: An intermediate holding company operates as both a holding company and a subsidiary of a larger corporation. It may not be required to share financial records like a typical holding company.

Holding Company

A holding company is a type of business that owns and controls other companies, known as subsidiaries. Instead of producing goods or services itself, the holding company’s main purpose is to manage its subsidiaries and make strategic decisions for them. This can include setting company policies, overseeing financial matters, and coordinating activities among the different businesses it owns.

By consolidating control over various companies, a holding company can achieve economies of scale, reduce risks, and potentially increase overall profitability. This structure also allows for easier management of diverse businesses under one corporate umbrella.

Merits of a Holding Company

- Risk Diversification:. holding company owns various businesses, so if one struggles, the others can help, reducing overall risk.

- Cost Savings: By managing everything together, a holding company saves on costs like supplies and advertising through bulk buying.

- Strategic Investment: Holding companies can decide where to invest money, people, and technology to boost their businesses.

- Tax Benefits: They might pay less tax by balancing profits and losses across their businesses.

- Flexible Control: Holding companies can manage their businesses while allowing them some independence, which offers operational flexibility.

Demerits of a Holding Company

- Complex Management: Juggling many different businesses can be tough and slow down decision-making.

- Compliance Burden: Each business comes with its own set of rules to follow, which can be time-consuming and costly.

- Financial Risk: If one business is in trouble, it can drag down the others, worsening the situation.

- Conflicting Goals: Sometimes, what the holding company wants doesn’t align with its businesses, leading to conflicts.

Subsidiary Company

A subsidiary company is one that is owned and controlled by another company, known as the parent or holding company. The parent company may either fully own the subsidiary or share ownership with others. When a parent company owns 100% of a subsidiary, it is called a "wholly-owned subsidiary."

While a holding company primarily holds shares and assets of its subsidiaries without running its own operations, a parent company actively manages its subsidiary. For instance, a parent company might operate a business and own a subsidiary that manages the parent’s property assets, keeping liabilities separate.

Definition of Subsidiary Company

- According to Section 2(87) of the Companies Act, a subsidiary company is one that is controlled by another company, known as the holding company. For example, Tata Capital is a subsidiary of Tata Sons Limited.

- Control can be established in two ways:

- The holding company has the authority to appoint the subsidiary’s Board of Directors.

- The holding company owns more than half of the subsidiary’s shares.

- Even if control is exercised through another subsidiary, the company is still considered part of the group. For instance, if a subsidiary of the holding company controls another company, that company becomes a subsidiary as well.

Types of Subsidiary Company

- Wholly Owned Subsidiary:. subsidiary where the holding company owns 100% of the shares and voting rights.

- Deemed Subsidiary:. company considered under the control of a holding company, even if that control comes from another subsidiary of the holding company.

Determination of Subsidiary Company

- Voting Power vs. Investment: The ownership of a company is determined by the voting power of its shares, not just the money invested in them.

- One Share, One Vote: This rule applies during polls, meaning each share gives one vote.

- Special Powers in AoA: Subsidiaries fully owned by another company may have special powers in their Articles of Association (AoA) to appoint or remove directors.

- Control Assessment: Checking the AoA and other agreements between companies is crucial to understand the parent company’s control over the subsidiary.

- Agreement Significance: Agreements outlining the relationship between the parent and subsidiary companies are important, especially during mergers or acquisitions, to clarify the extent of control.

Shared Relationships Between Holding and Subsidiary Companies

- Holding companies and subsidiaries often share common grounds in their relationships, such as:

- Financial support and resource sharing.

- Strategic alignment and operational coordination.

- Compliance with regulatory requirements and corporate governance standards.

Consolidated Balance Sheet

The consolidated balance sheet reflects the financial relationship between a holding company and its subsidiary, presenting their combined assets and liabilities. It provides a comprehensive view of the financial status of the entire business enterprise, including the parent company and all its subsidiaries.

Management and Control

While a subsidiary company may appear to have autonomy, the holding company exerts significant control over its key business operations. The holding company typically prepares the by-laws governing the subsidiary, particularly regarding the hiring and appointment of senior management.

Responsibility

- The holding and subsidiary companies are distinct legal entities, and either can initiate legal action against the other or be sued by third parties.

- The parent company has a fiduciary duty to act in the best interest of the subsidiary, making decisions that favour its management and financial well-being.

- Failure to fulfil these responsibilities can lead to the holding company being found guilty of breach of fiduciary duty in court.

- If the holding company neglects its obligations to the subsidiary, they may be treated as a single entity by the court.

Investment in Holding Company

- A subsidiary company is prohibited from holding shares in its parent company.

- No company, directly or indirectly, can hold shares in its holding company, and vice versa.

- Any such share allotment or transfer from a holding company to its subsidiary is considered void, with certain exceptions, such as:

- Holding shares as a legal representative of a deceased member.

- Holding shares in a trustee capacity.

- Being a shareholder before becoming a subsidiary.

Types of Companies Based on Ownership

Companies can be classified into two categories based on ownership:

Government Company

- A "Government company" is defined under Section 2(45) of the Companies Act, 2013, as any company where not less than 51% of the paid-up share capital is held by the Central Government, any State Government, or a combination of both. This includes companies that are subsidiaries of such government companies.

- Examples of government companies include National Thermal Power Corporation Limited (NTPC), Bharat Heavy Electricals Limited (BHEL), and Steel Authority of India Limited.

Overview of Government Companies

- Compliance: Government companies must adhere to the provisions of the Companies Act, unless exempted.

- Registration: They can be registered as private or public companies, but their names must end with 'limited.' The word 'STATE' is permissible in their names.

- Share Transfer: Formalities for transferring shares or bonds held by government nominees are relaxed.

- Deposits and Meetings: Government companies can accept deposits up to a certain limit, and their annual general meetings must be held during business hours on non-national holidays.

- Annual Reports: Annual reports are tabled in Parliament and state legislatures, depending on ownership.

- Director's Report: Certain clauses regarding director appointments and remuneration are exempted in the director's report.

- Mixed Ownership: Companies managed by the government with both government and private individual shareholders are considered mixed-ownership companies.

- Section 188: Approval requirements for contracts between government companies or between a government company and another entity are relaxed. Transactions between two government companies or between an unlisted government company and another entity do not require special resolution approval, subject to prior approval by the administrative ministry or department.

Features of a Government Company

Separate Legal Entity:. government company is a separate legal entity, which allows it to operate independently and deal with legal matters more efficiently. This separation ensures that the company is not dependent on any other body, making its operations smoother and more effective.

Incorporation under the Companies Act 1956 & 2013: Government companies are incorporated under the Companies Act, 1956 & 2013. This legal framework provides boundaries for their operations, reducing the chances of fraud and ensuring better working conditions for employees.

Management as per Provisions of the Companies Act: The management of a government company is regulated by the provisions of the Companies Act. This regulation helps prevent the exploitation of employees and ensures the smooth functioning of the company.

Appointment of Employees: The appointment of employees in a government company is governed by the Memorandum of Association (MoA) and Articles of Association (AoA). This ensures that appointments are based on merit and prevents the misuse of contacts for getting jobs.

Fundraising: Government companies can raise funds from various sources, including the government, private shareholdings, and the capital market. This diverse fundraising capability reduces their financial burden and provides flexibility.

Appointment of Directors: Government companies have specific provisions regarding the appointment of directors, allowing them to have more than 15 directors without a special resolution. Independent directors can be appointed even if they have financial ties to the company, which is not typically allowed in other companies.

Merits of Government Companies

Autonomy: Government companies have the ability to make decisions on their own without constant oversight. This independence allows them to respond quickly to changes in the market or their operations, making them more agile and efficient.

Market Regulation: These companies play a crucial role in maintaining a fair and competitive local market. They do this by regulating certain business practices, such as pricing and quality standards, to prevent unfair activities like monopolies or price gouging. This helps protect consumers and ensures a level playing field for all businesses.

Resource Integration: Government companies can pool their resources and strengths with private companies to tackle complex challenges. Private firms may face issues like limited funding or difficulty in achieving their objectives. By collaborating with government companies, private firms can access additional resources, financial support, and expertise that they might lack on their own. This partnership can help both parties overcome obstacles and achieve their goals more effectively.

Limitations of Government Companies

Government Interference: Government companies often face significant interference from government authorities. The involvement of numerous government officials can slow down decision-making processes, as these companies must undergo various checks and approvals before implementing decisions. Governmental procedures are typically lengthy, which can delay actions and initiatives.

Evasion of Constitutional Responsibilities: Since government companies are financed by the government, they are not accountable to the parliament in the same way that other entities are. This allows them to evade certain constitutional responsibilities, as their funding source does not require them to answer to legislative bodies.

Government Company

- A government company is a type of company where the government owns at least 51% of the shares. This ownership can be by the central government, state governments, or a combination of both.

- These companies are created to carry out government functions and services, often in sectors like infrastructure, utilities, and public services.

- Government companies operate with more flexibility than regular government departments, allowing them to make decisions and operate in a business-like manner while still being accountable to the government and the public.

Non-Government Company

- Non-government companies are all the companies that do not fall under the category of government companies.

- These companies are owned and operated by private individuals or groups and do not have the government as a majority shareholder.

- Non-government companies can be involved in various sectors and industries, and they operate without the specific regulations that may apply to government-owned entities.

Associate Companies

- Associate companies are defined under Section 2(6) of the Companies Act, 2013, as companies in which one company holds at least 20% of the shares.

- The company holding the shares is considered to have significant influence over the other company, but it is not a subsidiary.

- Significant influence means having control over at least 20% of the voting power or having a say in important business decisions through an agreement.

- A joint venture company is also included in this definition, where two or more parties have joint control over the arrangement and share rights to the net assets.

- For example, if Company A and Company B each hold 20% of the shares in a new company, that company is considered an associate company or joint venture.

- The concept of associate companies was introduced in India through the Companies Act 2013, and it is important to note that direct shareholding of more than 20% is required, while indirect shareholding is not allowed.

- For instance, if Company A holds 22% of the shares in Company B, and Company B holds 30% of the shares in Company C, Company C is an associate of Company B but not of Company A.

Comparison of the definition of associate company with the Amendment Act 2017

- Before the amendment, an associate company was defined as a company over which another company had significant influence, measured by share capital or business decision rights. If Company A controlled 20% to 50% of Company B's shares or business decisions, Company B was an associate of Company A.

- After the Amendment Act of 2017, the focus shifted to voting power. Now, significant influence is determined by controlling 20% to 50% of voting power or having a say in business decisions. The amendment also clarified joint venture definitions, ensuring all partners are recognized. These changes aim to clarify influence levels and joint venture party recognition.

Foreign Companies

- A foreign company is defined under Section 2(42) of the Companies Act as a company incorporated outside India that has a place of business in India, either directly or through an agent, and conducts business activities in India.

- The place of business can be physical, such as an office or factory, or virtual, through electronic means. The concept of 'electronic mode' includes various digital transactions and services, regardless of the main server's location. Examples include online marketing, financial services, and data communication.

Accounts of Foreign Companies

Section 381 of the Companies Act, 2013 outlines the handling of accounts for foreign companies. Key points include:

- Foreign companies must prepare a balance sheet and profit and loss account annually, including all necessary particulars and documents as prescribed.

- These documents must be delivered to the Registrar, with the possibility of exceptions specified by the Central Government.

- If documents are not in English, a certified translation is required.

- Foreign companies must also provide a list of all their places of business in India along with the required documents.

Registration Requirements for Foreign Companies

1. Submission of Documents to Registrar

- Foreign companies are required to submit specific documents to the registrar within 30 days of establishing their place of business in India, as per Section 380 of the Companies Act.

- The documents include a certified copy of the company’s charter, statutes, or memorandum and articles, translated into English if necessary.

- Companies must also provide the full address of their registered or principal office, a list of directors and secretary with required particulars, and details of persons in India authorized to accept service of process.

- Additional documents required include the address of the company’s principal place of business in India, details of previous establishment closures, a declaration regarding the history of directors and authorized representatives, and any other prescribed documents.

2. Accounting Obligations

- Foreign companies are mandated to prepare a balance sheet and profit and loss account annually in the prescribed format and language, as per Section 381 of the Companies Act.

- These documents, along with a list of Indian business locations, must be filed with the registrar.

- If the documents are not in English, certified translations are required.

- Additionally, the accounts must be audited by a practising chartered accountant in India.

3. Name Display Requirement

- As per Section 382 of the Companies Act, foreign companies are required to display their name and country of incorporation outside all Indian offices and on business correspondence.

- If applicable, they must also indicate their limited liability status.

4. Service Process on Foreign Companies

- According to Section 383, any documents served on a foreign company must be sent to the authorized persons in India whose details are provided to the registrar.

- Electronic services are now acceptable for this purpose.

5. Other Compliance Matters

- Foreign companies are required to adhere to regulations concerning debentures, annual returns, registration of charges, and bookkeeping as per Section 384.

- Charges on properties, whether in or outside India, must be registered, and proper accounts must be maintained at their principal place of business in India.

- Inspection procedures also apply to their Indian operations.

6. Prospectus and Winding Up

- As per Section 391, foreign companies issuing prospectuses or Indian Depository Receipts must comply with relevant regulations.

- Procedures for winding up foreign companies in India are outlined, including penalties for non-compliance.

- A foreign company that ceases business in India may be wound up as an unregistered company, according to Section 376 of the Companies Act, 2013.

7. Capital Raising

- Foreign companies have the option to raise capital in India either privately or through public offerings, subject to the prospectus requirements.

- Additionally, Indian Depository Receipts (IDRs) may be issued, provided specific conditions are met.

8. Means of Registration in India

Foreign companies can register in India through various means, including:

- Private Limited Company: This is the quickest option, allowing up to 100% Foreign Direct Investment (FDI) under the automatic route.

- Joint Venture: Foreign entities can partner with local firms in India through a joint venture, which must comply with legal standards.

- Wholly-Owned Subsidiary: Foreign nationals or companies can invest 100% FDI in an Indian company, creating a wholly-owned subsidiary.

Forms of Presence for Foreign Companies in India

- Liaison Office:. Liaison Office acts as a communication link between a foreign company and its Indian counterparts. All expenses incurred by this office are covered by the parent company through foreign remittances.

- Project Office: Foreign companies can set up Project Offices in India for specific projects awarded by Indian firms. However, obtaining approval from the Reserve Bank of India (RBI) may be necessary in such cases.

- Branch Office: Large foreign enterprises with a proven track record of profitability can establish Branch Offices in India, provided they meet certain eligibility criteria.

Compliance Requirements for Foreign Companies in India

When a foreign company ceases its operations in India, it may be required to shut down in accordance with Section 376 of the Companies Act, 2013.

- Foreign companies operating in India are classified into categories such as Liaison Office (LO), Branch Office (BO), or Project Office (PO) under the Foreign Exchange Management Act (FEMA), 1999.

- Opening a Liaison or Branch Office: The company must notify the local police within five days of setting up a Liaison or Branch Office, as per FEMA regulations.

- Annual Reporting: Branch and liaison offices are required to submit an annual report along with financial statements to the Reserve Bank of India (RBI) by September 30, in compliance with FEMA rules.

- Closure Procedures: When closing a branch, liaison, or project office, the necessary documents must be submitted to a designated bank following FEMA provisions.

- Reporting for Indian Companies: Indian companies receiving or investing foreign funds must report their financials annually by July 15, as mandated by FEMA regulations.

Example: ABB, a foreign company initially focused on manufacturing electronic equipment, has diversified its operations into various sectors, including robotics, automation, and rail transport. The parent company of ABB is owned by Investor AB, associated with the Wallenberg family.

Section 8 Companies (Non-Profit Organisations)

- Section 8 Companies, as per the Companies Act, 2013, are entities aimed at promoting objectives like commerce, art, science, education, research, social welfare, religion, charity, and environmental protection.

- These companies utilise their profits for societal betterment instead of distributing dividends to their members.

- The Central Government grants licenses for registration to those intending to form such companies for profit utilisation towards these aims.

- Unlike other limited companies, registered Section 8 companies don’t need to include terms like ‘Limited’ or ‘Private Limited’ in their names.

- They are often called non-profit organisations due to their primary goal of benefiting society rather than generating profits for members.

History of Section 8 Companies

- In the past, under the Companies Act of 1913, there were guidelines for setting up companies focused on social good, which didn’t require them to include ‘limited’ or ‘private limited’ in their names.

- The Companies Act of 1956 later permitted the formation of companies dedicated to charitable activities, known as Section 25 companies.

- The Bhabha Committee proposed changes to the regulations governing company operations and charity establishments, leading to the introduction of Section 8 in 2013, replacing the old Section 25.

- This update simplified the process for forming companies aimed at societal, educational, health, or environmental improvements, disallowing profit distribution to owners.

- The Indian Constitution empowers both central and state governments to regulate charitable organisations, as seen in Entries 10 and 28 of the Concurrent List.

Characteristics of Section 8 Companies

- Section 8 Companies are established primarily for social welfare and charitable purposes, rather than for making a profit.

- These companies do not have a minimum prescribed paid-up share capital requirement, unlike other types of companies.

- Section 8 Companies are licensed by the central government under Section 8 of the Companies Act, 2013, and are required to operate for the betterment of society.

- These companies often rely on public donations to fund their welfare projects and initiatives.

- Section 8 Companies have limited liability, similar to private or public limited companies, meaning the liability of members is restricted to the amount they have subscribed to shares.

- These companies are legally prohibited from distributing dividends to their members. Instead, they can reinvest their profits to further their charitable objectives and projects.

- The objectives of a Section 8 Company should align with promoting various social causes, and the company should have a clear plan to use its profits for these purposes without distributing dividends to its members.

Introduction to Section 8 Companies

Section 8 companies are a specific type of organization in India, as per the Companies Act, 2013. They are formed with the primary goal of promoting social causes, such as arts, education, charity, and other beneficial activities. What sets these companies apart is that they are not allowed to distribute profits to their members. Instead, any profits made must be reinvested into the company’s objectives. This makes Section 8 companies similar to non-profit organizations, as their focus is on social welfare rather than profit-making.

These companies also enjoy certain privileges, such as exemption from specific provisions of the Companies Act and the ability to operate without the “Limited” or “Private Limited” suffix in their names. This makes Section 8 companies an attractive option for individuals and groups looking to make a positive impact in society while enjoying the benefits of a corporate structure.

Key Features of Section 8 Companies

- Non-Profit Motive: Section 8 companies are established with the primary objective of promoting social causes like education, art, charity, and other beneficial activities. They do not aim to make profits for their members.

- Profit Reinvestment: Any profits generated by the company must be reinvested into furthering its objectives. Members cannot receive dividends or profit shares.

- Name Flexibility: Section 8 companies can operate without the “Limited” or “Private Limited” suffix in their names, giving them more flexibility in branding.

- Corporate Structure: They enjoy the benefits of a corporate structure, such as limited liability, which protects members’ personal assets from company debts.

- Regulatory Oversight: These companies are subject to regulatory oversight but enjoy certain exemptions from specific provisions of the Companies Act.

Incorporation Process of Section 8 Companies

- 1. Select a Name: Choose a suitable name for the company and apply for its reservation using the SPICe Plus (SPICe+) form. If the name is rejected, you can try again with two new names within 15 days.

- 2. Obtain Digital Signature Certificates (DSC): Apply for a DSC for each proposed director and member. This certificate is necessary for electronically signing forms.

- 3. Fill Incorporation Application: Once the company name is approved, it is valid for 20 days. Fill out the incorporation application form online within this timeframe.

- 4. Use SPICe+ Form: The SPICe+ form combines multiple applications into one, allowing for name reservation, incorporation, DIN, TAN, PAN, EPFO, and ESIC registration simultaneously.

- 5. Provide Required Details: Include details such as the number of directors and members, authorized and paid-up capital, company address, and attach necessary documents like MOA, AOA, and EPFO/ESIC registration forms. For Section 8 companies, additional documents like physically signed MOA and AOA drafts and declarations in Form INC-14 are required.

- 6. Obtain Certificate of Incorporation: Once the incorporation application is approved, and the Certificate of Incorporation is issued by the Registrar of Companies (ROC), approval to commence business must be obtained within 180 days.

Eligibility Requirements for Registration

- Primary Aim: The main objective of the company must be to promote social welfare, arts, education, science, commerce, or provide financial assistance to underprivileged communities.

- Profit Dedication: All profits generated must be dedicated to furthering the organization’s goals and fulfilling its objectives.

- No Dividends: Members or directors cannot receive dividends, either directly or indirectly.

- No Remuneration: Directors or promoters are prohibited from receiving any form of remuneration.

- Vision and Project Plan:. clear vision and project plan for the company’s operations over the next three years are essential.

Advantages of Section 8 Companies

- Separate Legal Entity: Section 8 companies have a distinct legal identity separate from their members, protecting them from personal liability for the company’s debts.

- Limited Liability: Members’ liability is limited to their shareholding, safeguarding their personal assets from the company’s debts.

- No Minimum Capital Requirement: Section 8 companies can be incorporated without any minimum paid-up capital, making it easier to establish them.

- Minimal Stamp Duty: The incorporation of Section 8 companies incurs minimal stamp duty, as the government offers certain privileges to encourage such entities.

- Flexible Naming: Unlike other companies, Section 8 companies can choose not to include suffixes like ‘private limited’ or ‘limited’ in their names, offering flexibility in naming conventions.

- Tax Benefits: Section 8 companies can avail themselves of tax benefits by obtaining registration under Sections 80G and 12AA of the Income Tax Act.

Disadvantages of Section 8 Companies

- Profit Sharing Restriction: Section 8 companies cannot share profits with their owners, which may make it challenging to attract investors or generate income compared to regular companies.

- Regulatory Compliance: These companies must adhere to various government regulations, potentially incurring higher costs and administrative burdens to ensure compliance.

- Reliance on Donations: Section 8 companies often depend on donations or grants for funding. Insufficient donations may lead to financial difficulties.

- Limited Flexibility: The inability to share profits or pay their leaders may hinder attracting skilled individuals or adapting to changing circumstances.

- Growth Constraints: Without the ability to retain profits for reinvestment, Section 8 companies might face challenges in expanding or improving their operations as swiftly as regular companies.

Dormant Company

A dormant company refers to a company that is not currently engaged in any significant business activities or operations. In India, a company may be considered dormant under the Companies Act, 2013, if it meets certain criteria. Typically, a company is deemed dormant if it has not conducted any business activities for a continuous period of two financial years. Additionally, if a company fails to file its financial statements or annual returns for two consecutive years, it may also be classified as dormant. This status is often used to maintain the legal existence of a company that is temporarily inactive but may resume operations in the future.

A dormant company is one that is still registered but not actively engaged in any business activities. This status is defined under the Companies Act 2013 as an ‘inactive company.’ Companies may choose to become dormant for various reasons, such as waiting to start a new project, holding assets, or temporarily pausing operations.

Despite being dormant, these companies still have certain responsibilities, such as maintaining a minimum number of directors, filing specific documents, and paying any required fees to uphold their dormant status. If a dormant company wishes to become active again, it can apply to the registrar and meet the necessary requirements, which may include submitting financial documents and settling any outstanding fees.

Registration of a Dormant Company

To register a dormant company, the following steps are typically involved:

- Application: The company must apply to the registrar, providing necessary details and justifications for its dormant status.

- Review: The registrar reviews the application to ensure it meets the criteria for dormant status.

- Granting Status: If approved, the registrar grants dormant status, issuing a certificate to confirm this.

- Record Keeping: The registrar maintains a list of all dormant companies for official records.

- Automatic Dormancy: If a company fails to file financial documents for two consecutive years, the registrar may send a notice and subsequently list the company as dormant if compliance is not met.

Requirements to Maintain Dormant Status

To maintain dormant status, a company must meet certain requirements, including:

- Director Requirements: Maintain a minimum number of directors as per legal regulations.

- Document Submission: Submit specific documents as required by the registrar to demonstrate compliance.

- Fee Payment: Pay any necessary fees to the registrar to keep the dormant status active.

Removal from Dormant Register

- A company can be removed from the dormant register if it fails to meet the requirements or comply with the rules set by the registrar. This ensures that only companies adhering to the dormant status regulations remain on the list.

Annual Return

- Dormant companies are required to file an annual return, specifically the Dormant Company (MSC-3) return, within 30 days from the end of each financial year. This return should be accompanied by audited financial statements.

Board Meetings

- Dormant companies must hold at least one board meeting every six months. There should be a gap of at least 90 days between two consecutive board meetings.

Application for Active Status

- To apply for active status, companies need to use Form MSC-4 along with the MSC-3 return for the financial year.

Striking Off Process

- If a company remains dormant for five consecutive years, the registrar may initiate the process to strike off its name from the register. If a dormant company resumes operations, it must file an application for active status within seven days.

Inquiry and Status Revocation

- If the registrar suspects that a dormant company is operating, an inquiry may be initiated. If confirmed, the company’s dormant status may be revoked.

Merits of the Dormant Company

- Legal Existence: Dormant status allows the company to remain registered and legally existent without engaging in active business operations, facilitating future use without re-registration.

- Asset Holding: Companies can hold assets like properties, intellectual property rights, or investments during the dormant period, even without active business operations.

- Business Name Retention: Maintaining dormant status helps retain the business name, preventing others from registering a company with the same name.

- Simplified Revival: Reviving a dormant company is generally quicker and simpler than starting a new one, enabling faster resumption of business activities.

- Reputation Preservation: Keeping the company dormant helps preserve its market reputation and goodwill, avoiding negative perceptions associated with closure.

- Future Flexibility: Dormant status provides the flexibility to engage in future business ventures or projects by activating the company when needed, without undergoing a new incorporation process.

Nidhi Companies

Nidhi companies are a specific category of Non-Banking Financial Institutions (NBFCs) recognized under the Companies Act, 2013. These companies primarily focus on lending and borrowing activities among their members. Nidhi companies operate as mutual benefit societies, meaning they are owned and governed by their members, who contribute to and benefit from the company’s activities. The main objective of a Nidhi company is to promote the habit of thrift and savings among its members and to provide them with loans for their mutual benefit.

Section 406 of the Companies Act grants the Central Government the authority to modify the application of the Act to Nidhi companies. According to this section:

- A Nidhi is established to encourage thrift and savings among its members.

- It collects deposits from and lends to its members exclusively for their mutual benefit, adhering to guidelines set by the Central Government.

Nidhi Companies under the Companies Act

Central Government's Authority

- The Central Government has the power to decide which parts of the Companies Act apply to Nidhi companies.

- It can make exceptions, modifications, or adaptations specifically for these companies through official notifications.

Parliamentary Review

- Before issuing notifications, a draft must be presented to both Houses of Parliament for review.

- This draft should be available for a total of thirty days during parliamentary sessions.

- If both Houses disapprove or suggest changes within this period, the notification will either not be issued or modified.

Characteristics of Nidhi Companies

- Restricted Activities: Nidhi companies are limited to lending and borrowing activities among their members only. They cannot engage in any other type of financial business or deal with the public.

- Registration Requirements: To establish a Nidhi company, one must register as a public company under the Companies Act, 2013, and fulfill specific criteria set by the Ministry of Corporate Affairs.

- Compliance Obligations: Nidhi companies must adhere to regulations outlined by the government to maintain their status and operate within the legal framework.

- Membership Restrictions: Membership in a Nidhi company is limited to individuals only. Other entities, such as companies or trusts, are not eligible to become members.

- Deposit and Loan Restrictions: Nidhi companies cannot accept deposits or loans from individuals who are not members. This ensures that their activities are focused solely on the mutual benefit of their members.

Doctrine of Ultra Vires

The Memorandum of Association (MoA) is the foundational document of a company, outlining its scope and activities. The term "ultra vires" is Latin for "beyond the powers." In legal terms, the Doctrine of Ultra Vires is a core principle of Company Law, stating that a company's actions must align with the MoA and not exceed its provisions. Any act or contract is considered void and illegal if it goes beyond the powers specified in the MoA. To avoid falling under this doctrine, companies must operate within the MoA's limits. A company cannot be bound by an ultra vires contract, and concepts like estoppel or ratification cannot make it intra vires. However, if a company's members pass a resolution, they can ratify an act that is ultra vires the directors but intra vires the company. Similarly, an act that is ultra vires the Articles of Association (AoA) can be ratified by a special resolution at a general meeting.

Disadvantages of the Doctrine of Ultra Vires

- The Doctrine of Ultra Vires can hinder a company's ability to pivot towards potentially profitable activities that all members agree upon.

- This is because the MoA's clauses restrict the company from pursuing such directions.

- However, if the directors undertake an action that violates the MoA, it is possible to amend the MoA by passing a resolution.

- This would retroactively make the action intra vires with respect to the MoA.

- Such a possibility undermines the essence of the doctrine, as it allows for any action to be taken by simply amending the MoA's clauses at any time.

Transition from Private Limited to Public Limited Company

A private limited company is often favored by entrepreneurs due to the specific advantages it enjoys. In such companies, capital is raised from close friends, family, and acquaintances rather than from the general public. As a result, the Companies Act of 1956 imposes less stringent rules and regulations on private limited companies compared to their public counterparts. However, there are certain situations in which a private limited company may be required to transition into a public company.

Circumstances for Conversion

1. Conversion by Default

A private limited company automatically becomes a public company if it violates any of the following conditions:

- Restricting the right to transfer shares

- Limiting the maximum number of members to 50

- Prohibiting public invitations for the subscription of shares or debentures

2. Conversion by Operation of Law

A private company is deemed to be a public company by operation of law under the following circumstances:

- When 25% or more of its paid-up share capital is held by one or more public companies

- When its average total turnover exceeds Rs. 25 crore for three consecutive years

- When it holds more than 25% of the paid-up share capital of a public company

- When it invites, accepts, or renews deposits from the public

3. Conversion by Choice or Option

A private company can voluntarily choose to convert into a public company, typically when it seeks to expand and require additional capital resources. By becoming a public company, it can issue shares or debentures to the public, thereby raising the necessary capital for growth.

Steps for Conversion by Choice

If a private company decides to convert into a public company, it must make the necessary amendments to its articles of association and follow these steps:

- Call a general meeting and pass a special resolution to alter the articles

- File the copy of the resolution and amended articles with the registrar within 30 days

- Increase the number of members to at least 7

- Apply to the registrar for a fresh certificate of incorporation, removing the word ‘Private’ from the company name

Conversion of a Public Company into a Private Company

Converting a public company into a private one involves changing its legal structure and ownership from being publicly traded to privately held. Here are the steps and prerequisites for such a conversion:

Pre-requisites for Filing an Application for Conversion from Public to Private Company

- Limit of Shareholders:. public limited company has no maximum limit on shareholders. However, after converting to a private limited company, the number of shareholders must not exceed 200.

- Non-invitation of Funds from the Public: After conversion, the company cannot raise funds or capital from the general public, either through a prospectus or any other means.

- Non-listing of Company: Before conversion, the company must not be listed on a stock exchange. If it was listed, all necessary procedures for delisting must have been completed in accordance with the laws prescribed by the Securities and Exchange Board of India (SEBI).

Procedure for Conversion

Step 1: Board Meeting

- Hold a meeting of the Board of Directors to discuss the reasons for conversion and propose changes to the Memorandum of Association (MOA) and Articles of Association (AOA).

- Authorize the filing of the necessary application for conversion.

Step 2: General Meeting

- Convene a general meeting of shareholders to obtain their consent for the conversion and the proposed changes to the MOA and AOA through a special resolution.

Step 3: Filing with Registrar of Companies

- Fill out the prescribed e-form and submit it to the Registrar of Companies (ROC) within 30 days of passing the special resolution.

Step 4: Application to Adjudicating Authority

- File an application for conversion to the adjudicating authority within 60 days of passing the special resolution.

- Advertise the notice of conversion in English and regional newspapers at least 21 days before filing the application.

Step 5: Notice to Creditors and Authorities

- Serve individual notices of conversion to each creditor by registered post.

- Serve notices to the Regional Directorate (RD), ROC, or other regulatory authorities by registered post.

Step 6: Filing Application with Regional Directorate

- File the application for conversion with the RD in the prescribed e-form within 60 days from the date of passing the special resolution.

- Include the draft altered MOA and AOA, minutes of the general meeting, board resolution, declarations from directors/key management personnel, and a list of creditors.

Step 7: Approval from Regional Directorate

- The RD will approve the application within 30 days if no objections are received.

Step 8: Filing Order with Registrar of Companies

- File the RD's approval order with the ROC in the prescribed e-form within 15 days.

- The ROC will close the former registration and issue a fresh certificate of incorporation, marking the conversion.

Step 9: Update Tax Authorities and Records

- Apply for conversion in the databases of all tax authorities (PAN/TAN) and update all registrations.

- Amend letterheads, invoices, name plates, and other correspondences, and update bank records accordingly.

Conclusion

The Companies Act of 2013 is crucial for regulating various types of companies and ensuring they adhere to the rules. This legislation benefits not only the companies but also their employees, customers, and society as a whole. By providing a defined framework, the Act prevents companies from misusing their power and protects the rights of employees, ensures the quality of products for consumers, and reduces instances of corporate fraud.

The 2013 Act, which replaced the Company Law of 1956, has significantly enhanced the quality of corporate governance and ethical standards. It also promotes women’s employment in the corporate sector and mandates certain companies to invest in corporate social responsibility initiatives. Additionally, the Act established the National Company Law Tribunal (NCLT) and the National Company Law Appellate Tribunal (NCALT) to facilitate industrial and financial reconstruction, thereby easing the burden on traditional courts and providing specialized justice.

However, it is essential to weigh the advantages and disadvantages of different types of companies before determining which one aligns best with business objectives and circumstances.

|

112 docs|32 tests

|

FAQs on Types of Companies Including One Person Company (Part - 1)- Introduction, Company Law - Company Law - B Com

| 1. What is an Introduction to types of companies? |  |

| 2. What is a one person company (OPC)? |  |

| 3. What are the advantages of forming a one person company (OPC)? |  |

| 4. What are the requirements to form a one person company (OPC)? |  |

| 5. Can a one person company (OPC) be converted into a private or public limited company later? |  |