NCERT Solution - Resource Mobilization, Entrepreneurship-1 | Entrepreneurship Class 11 - Commerce PDF Download

TEXTBOOK QUESTIONS SOLVED.

Question 1. Answer in not more than 15 words:

(i) Define the term ‘resources’.

(ii) Why do entrepreneurs need resources?

(iii) What do you mean by mobilisation of resources’?

(iv) Name two state level organisations, which provide information about the infrastructural facilities.

(v) How can a professional assistance?

Answer: (i) It refers to anything or means physical tangible/non-physical-tangible required or required to support the activities of organisation to achieve pre-determined organizational goals.

(ii) Resources’ are life blood of any economic activity. Resources are needed for setting up and running of the business organisation to achieve the objectives and goals.

(iii) Resource mobilization is the process of getting resource from resource provider like landlord, financiers, labourers using different mechanisms, to implement the organization’s work for achieving the pre-determined organizational goals.

(iv) (i) DIC (District Industries Centre)

(ii) EB (Electricity Board)

(iii) LA (Local Authority)

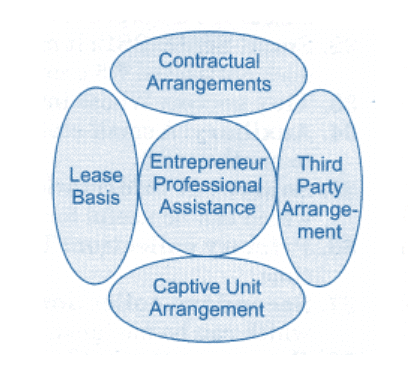

(v) Now-a-days, these services are not limited to licentiates (i.e. individuals holding professionals licenses), they may run to partnership, firms, or corporations as well as to individuals. An entrepreneur procures professional assistance according to analyse and evaluate the extent, nature and type of resource required. He can arrange any one for these types:

(v) Now-a-days, these services are not limited to licentiates (i.e. individuals holding professionals licenses), they may run to partnership, firms, or corporations as well as to individuals. An entrepreneur procures professional assistance according to analyse and evaluate the extent, nature and type of resource required. He can arrange any one for these types:

- Contractual arrangements

- Third party arrangement

- Captive unit arrangement

- Part time arrangement

- Regular basis

Question 2. Answer in not more than 50 words:

(i) What are physical resources? Give two examples.

(ii) What factors help in determining the resources required?

(iii) What basic resources are required to commence any enterprise?

(iv) Enlist any four expert professional assistance required to start a school.

(v) Name any four factors to be kept in mind while selecting physical resources.

Answer: (i) Physical resources are those that are made by human through his abilities and skills.

They are available to an organisation and it is required for running of an enterprise. For example: buildings, plants, machineries, etc.

(ii) The various factors involved in determining the resources required are:

1. The right type of resource selected by an entrepreneur and other related expert,

2. Procurement should be at right time,

3. All purchases of resources should be at right price with making right use of acquired resources and at last ensuring optimum and fuller utilization of the arranged resources.

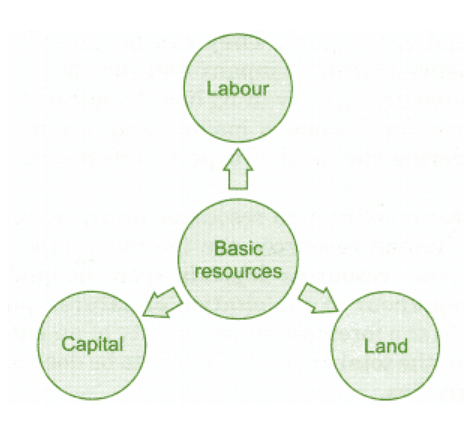

(iii) The most basic resources, for any enterprise are:

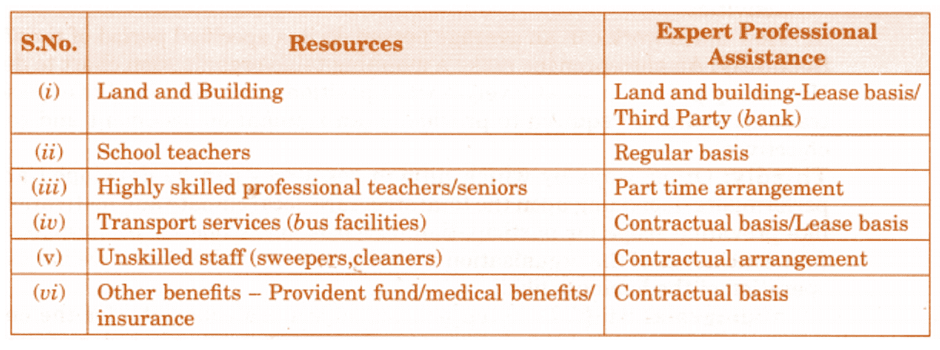

(iv) The main resources used in a school are:

(iv) The main resources used in a school are:

(v) (1) Capital Cost

(v) (1) Capital Cost

(2) Access to other resources

(3) Transport and Communication Cost

(4) Availability of manpower and its cost (wages, salaries)

(5) Cost of production

(6) Availability of other utilities like water, gas, fuel, etc.

(7) Access to market for both raw material and finished goods

Question 3. Answer in not more than 75 words:

(i) Why does an entrepreneur need expert professional services?

(ii) What is said to be an “efficient utilization of human resources”?

(iii) Why should entrepreneurs ensure that there is a “right individual at the right job”?

Answer: (i) Today is an era of specialization. Competitive advantage can be realized only when businesses become more efficient in their operations and reduce the cost of their inefficiencies. Give the best to the society.

The need of an expert professional services realized by most of the successful organizations whether small or large in the following form:

(а) Entrepreneurs alone cannot do justice to all areas and aspect of business like – production, distribution, marketing, legal, researching, accounting, human resource or product development, etc.

(b) They do not have ample expertise, resources, time and energy in their hands to meet out the never ending requirements of the enterprise.

(c) Entrepreneurs always work on a strategic plan to accomplish functional goals in an efficient and effective way, they need expert professional services.

(d) In addition to their professional expertise, these are trusted business advisors, experts and connectors. They can be considered as the most important to entrepreneurs growing company and success.

Thus, either outsourcing or availing healthy mix of various professional services from outside the firm, has become a major trend in human resources, and entrepreneur started considering the need of expert professional services as a basic need for an entrepreneur.

(ii) Efficient utilization of human resources means fuller utilization of resources. In an organization, human resources are the most important element and the effective utilization of other resources depends upon the quality of human resources. It also helps an entrepreneur in exploitation of natural, physical, financial resources in a better way. It is the foremost responsibility of an entrepreneur/human resource to:

(a) Finding out the total amount of works to be done and then dividing it into different sets of activities.

(b) The total number of tasks and jobs required to be accomplished under different activities.

(c) How much work can an average person do in a specified period of time? Secondly: An entrepreneur make a manning table/organisation chart to determine: How many people, at what level, in what positions and what kind of experience and training would be required to provide organizational environment and to meet its objectives.

Thirdly: Other ways by which human resources can be developed and led to performance depending upon the total structure, local climate and motivational factor like providing scope for participation, rewards and scope for performance and the futuristic needs of the organisation with the help of all the workforce involved in the operation of the business like:

1. Managerial Staff: Framing policies, objectives goals, etc. for the enterprise, ensuring their implementation and finally getting the work done from workers is the field area of this category.

2. Non-managerial staff: The real group which effectively converts the raw material into finished goods is ‘workers’. Nature of job decides the quality and quantity of workers to be assigned.

3. Trained Technical Manpower: This constitutes of people who have technological expertise and are frequently required for machinery selection, installation, supervision and operation.

4. Administrative Manpower: These are a group of staff which gives support services to managerial, professional and trained staff. They are not involved in production directly but only provide assisting services in the maintenance of the enterprise.

5. Professional Manpower: Chartered accountants, auditors, bankers, lawyers, who are professional experts can be outsourced by the entrepreneur if required. Small enterprises cannot afford them on their regular payrolls.

Thus, efficient utilization of human resources is only possible if the entrepreneur is able to decide:

(a) The total work to be done.

(b) The right type of people who can do the work.

(c) Employing right man at right job.

(iii) Human resource is a vital element for any enterprise and all other resources depends upon the quality of human resources. It also helps an entrepreneur in exploitation of other resources like natural, physical, financial resources in a better way. It includes skilled, unskilled and administrative staff. Growth and development of any enterprises depend on the factors like skills and talents of the employees, competency and talents of the employees, their dedication sincerity and the leadership skills of the owners. Dynamic group or team is always successful in meeting the challenges, changes, problem of the market. A joint effort of all the members of an enterprises contribute to achieve the objectives of an organisation and the feasibility of the enterprises. ‘Right man at right job at the right time’— is the mantra for successful enterprises because it ensures:

(1) Benefits of specialization to the firm

(2) Minimizes wastages of resources

(3) Reduces inefficiencies

(4) Reduces labour turnover ratio and rate of absenteeism

(5) Saves cost of production.

Question 4. Answer in not more than 150 words:

(i) Define ‘intangible resources’. What do they generally comprise of?

(ii) With reference to utilization of resources, state any four moral responsibilities of the entrepreneur.

Answer: (i) These resources are neither felt nor seen, far from being touched or preserved but helps immensely in providing a strong foothold to enterprise.

The intangible possession is a resource which enables a business to continue to earn a profit that is in excess of the normal basic rate of profit earned by other business of similar type. This category generally comprises of:

(a) Goodwill: The difference between the value of the tangible assets of the business and the actual value of the business (what someone would be prepared to pay for it).

(b) Reputation: Though it is generally not present in case of new entrepreneurs. But if he is acquiring or entering into a partnership or some alliance, he may benefit from the goodwill of his associate, if any.

(c) Brands: It is a name given to a product in order to be recognized and differentiated from other similar products.

(d) Intellectual Property: Key commercial rights protected by patents and trademarks may be an important factor to be worked out by the entrepreneur.

(ii) Resource mobilization advocates upon moral responsibilities of the entrepreneur having:

- the right type of resource

- at the right time

- at right price

- with making right use of acquired resources thus ensuring optimum utilization of the same.

Question 5. Answer in not more than 250 words:

(i) What are material resources? While planning state the important decisions to be made by the entrepreneur.

(ii) “Procurement of physical resources is not easy”. Giving reasons, state what is required to be planned for this procurement.

Answer: (i) Whether a business deals in trading business, manufacturing business or a services, certain operations are essentially carried out combining raw material, processing and assembling, machines, tools, power, etc.

Every entrepreneur must have a deep insight into the production processes is essential for effective handling of the enterprise. To successfully convert raw material into finished products with value addition, a wide range of arrangements need to be worked out by entrepreneur. Some of the important decisions are regarding:

(1) Size of the unit and its installed capacity.

(2) Identifying machinery and the technical know-how required.

(3) Technical training involved.

(4) Quality control systems required.

(5) Type of technical staff required.

(6) Maintenance Cost

(7) Availability of spare parts and support services (after sale services)

(8) Wear and tear rate of assets.

(9) The type of raw materials required.

(10) Supplies of the raw material, their number and location.

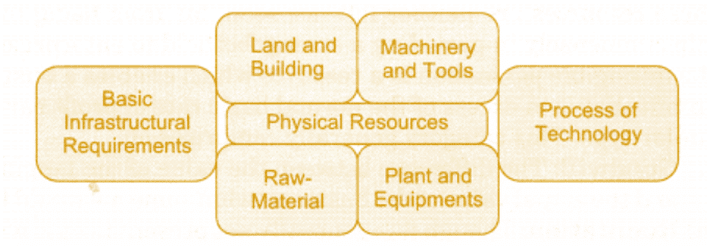

(ii) Physical resources are those that are made by human through his abilities and skills. It includes various capital equipments required by an entrepreneur at the start up stage of the businesss that he can carried out his business smoothly. They are available to an organisation in the form of:

(a) buildings, plants, machineries, etc.

(b) Raw-material required for the basic operation

(c) Other requirements depending upon the nature of the product and services for running of an enterprise like technology:

• So, the foremost concern for the entrepreneur is to assess the ‘place’ where the enterprise is going to be established.• The basic infrastructure required to be constructed is all part of physical resources.• The category of physical resources covers a wide range of operational resources concerned with the physical capability of the enterprise.

• So, the foremost concern for the entrepreneur is to assess the ‘place’ where the enterprise is going to be established.• The basic infrastructure required to be constructed is all part of physical resources.• The category of physical resources covers a wide range of operational resources concerned with the physical capability of the enterprise.

A careful selection of physical resources is essential because many allied issues are influenced by the ‘place’, selected, such as:

(1) Capital Cost: with physical resources should be within the limit laid down.

(2) Access to other resources: at initial stage availability should be assured.

(3) Transport and Communication Cost: should be within the limit.

(4) Availability of manpower and its cost: (wages, salaries)-all skilled, unskilled, administrative staff and technical expert should be available and their remuneration should be appropriate.

(5) Cost of production: should not exceed.

(6) Availability of other utilities: like water, gas, fuel, etc. The premises should be located according to the availability of various infrastructural requirement like water, gas,power, fuel, etc.

(7) Access to market: for both raw material and finished goods – within the area easily access and delaying should be avoided for both market and supply of finished goods.

(8) Pollution concerns involved: It should be cross checked and verified throughout means should not be harmful to the society .

Estimating Financial Requirement

Question 1. Answer in not more than 15 words:

(i) Define ‘Capitalisation’.

(ii) Define the term “Business Finance”.

(iii) What is meant by ‘Capital Structure’?

(iv) Name the plan that shows the inflows and utilization of funds.

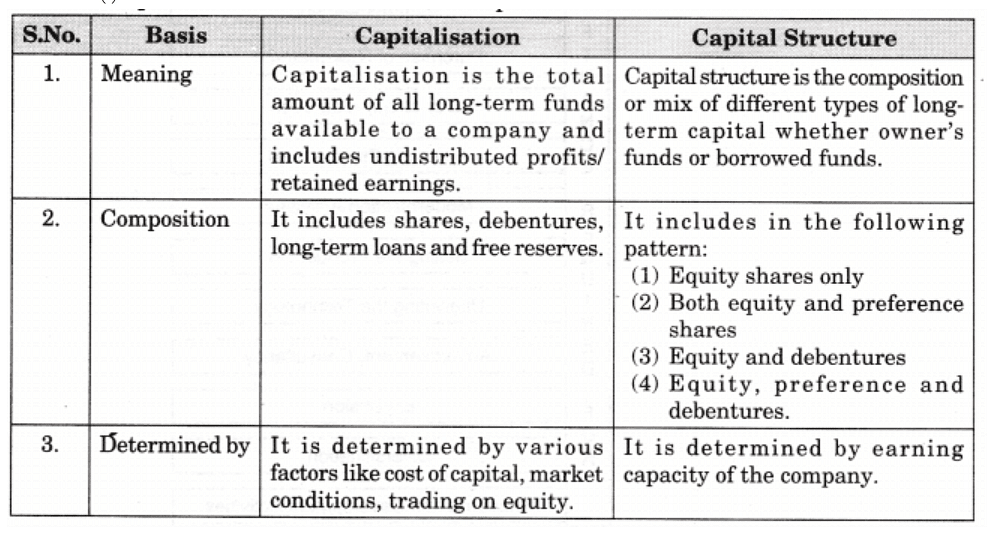

Answer: (i) “Capitalisation of a corporation comprises the ownership capital and the borrowed capital as represented by long-term indebtness. It may also mean the total accounting value of capital stock surplus in whatever form it may appear and funded long-term debt.”—Lillin Doris.

(ii) Business finance may be defined as the acquisition and utilization of capital funds in meeting the financial needs and overall objectives of a business enterprise.

(iii) It is the composition or mix of different types of long-term capital whether owned or borrowed. It includes all the long term funds consisting of share capital, debentures, bonds, loans and reserves.

(iv) Financial Planning.

Question 2. Answer in not more than 50 words:

(i) Why is finance required for business?

(ii) Enlist the major areas of financial decision-making by the entrepreneur.

(iii) The nature of business affects the requirement of fixed capital. Give two examples to support this observations.

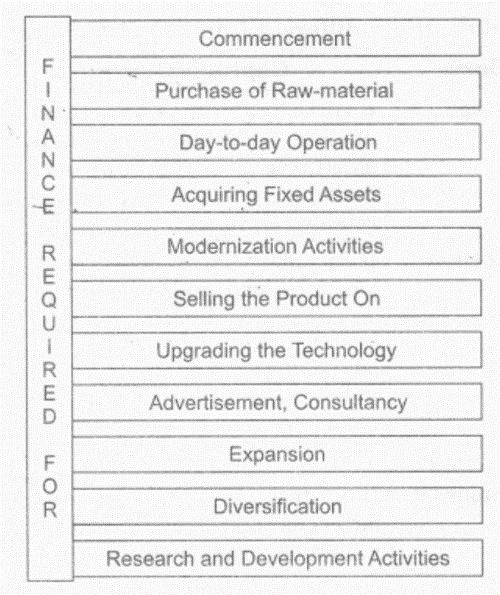

Answer: (i) Finance is the life blood of the business. It is one of the basic foundations of all kinds of economic activities. It is the master key which provides access to all the other sources for being employed in manufacturing and merchandising activities. It is required for many purpose:

(ii) The two major areas of financial decision-making, requires on part of entrepreneur to take the:(a) Funds requirement decision

(ii) The two major areas of financial decision-making, requires on part of entrepreneur to take the:(a) Funds requirement decision

(b) Financing decisions

(iii) • Fixed capital refers to that which is required in a business for meeting the

permanent or long term needs.

• The total capital is divided into two parts -a) Fixed Capital and Working capital. For the business the entrepreneur invest major part of the total capital in the business.

• Need of fixed capital depends upon the nature of business.

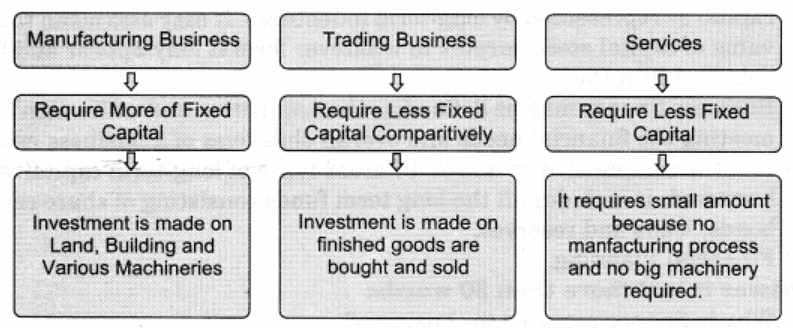

• Nature of business is of two kinds: (a) Manufacturing Business, (b) Trading Business and Services.

• In case of manufacturing business, large investment is made in land, building, machinery, etc.

The type or nature of business determines the fixed capital requirement of a concern. Manufacturing concerns require more of fixed capital as they have to invest heavily on purchase of land, plant and machinery building, furniture, other fixed assets according to type of business, etc. Various public utility undertakings like Railways, Electricity, Water supply, other facilities have to invest heavily on fixed assets. Trading organizations does not required heavy investment or it requires very less amount to invest on fixed capital..

The type or nature of business determines the fixed capital requirement of a concern. Manufacturing concerns require more of fixed capital as they have to invest heavily on purchase of land, plant and machinery building, furniture, other fixed assets according to type of business, etc. Various public utility undertakings like Railways, Electricity, Water supply, other facilities have to invest heavily on fixed assets. Trading organizations does not required heavy investment or it requires very less amount to invest on fixed capital..

Question 3. Answer in not more than 75 words:

(i) How is “Capitalisation” different from “Capital Structure”?

Answer: (i)

Question 4. Answer in not more than 150 words:

Question 4. Answer in not more than 150 words:

(i) What are the objectives of financial planning?

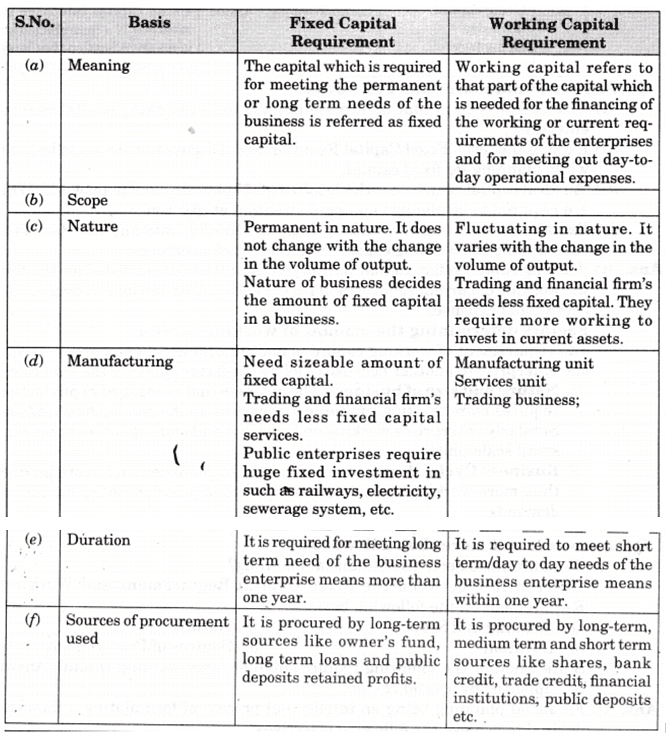

(ii) Differentiate between the Fixed Capital Requirement and Working Capital Requirement on the following basis:

(a) Meaning and Scope (b) Nature

(c) Duration (d) Sources of Procurement

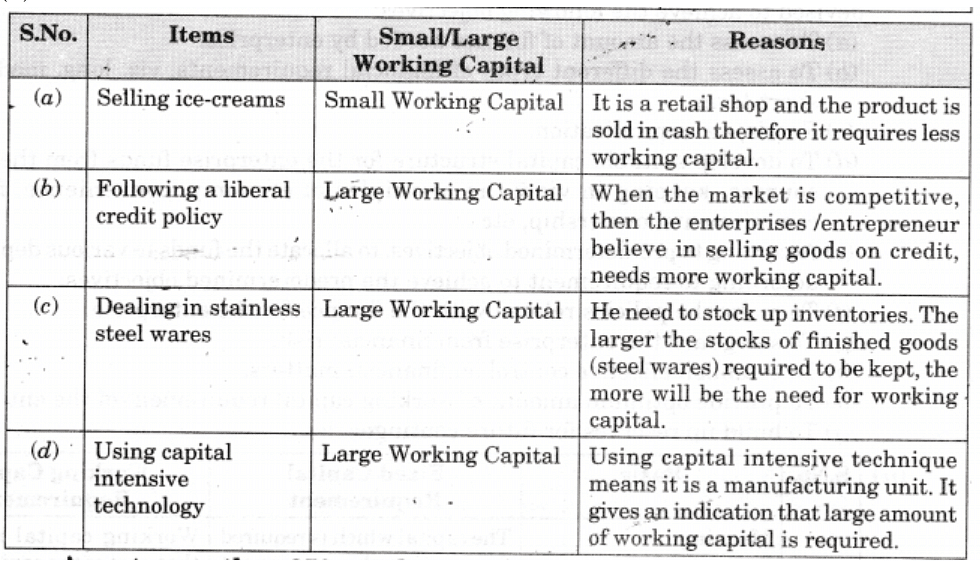

(iii) State whether the following require small or large working capital. Answer should be supported by a valid reason:

Answer: (i) Financial planning being an intellectual process of formulating a financial plan, is devised to achieve the following objectives:

(а) To assess the amount of finance needed by enterprise.

(b) To assess the different types of financial requirements, viz. long, medium and short-term.

(c) Funds, i.e. capitalization.

(d) To develop suitable capital structure for the enterprise funds from the suitable sources, keeping in view the principles of economy, convenience, financial commitments, ownership, etc.

(e) According to pre-determined objectives, to allocate the funds to various departments according to requirement to achieve the predetermined objectives.

(f) To make the policies related with the finance for the enterprise.

(g) To safeguard the enterprise from financial risk.

(h) To establish effective control on financial matters.

(i) To provide optimum amount of working capital requirement of the enterprise.

(l) To build up reserves for future contingencies.

(ii)

(iii)

Question 5. Answer in not more than 250 words:

(i) Discuss the factors that determine the amount of working capital required by an enterprise.

(ii) Explain the term ‘Fixed Capital Requirement’. Discuss the factors to be kept in mind while planning for fixed capital.

(iii) ‘An ideal capital structure is the result of great planning and team work’. What factors are required to be planned and paid attention at this time?

(iv) Explain the meaning of “Working Capital”. Briefly state any four factors that help determining the working capital requirement of a company.

Answer: (i) Working capital refers to that part of the capital which is needed for the financing of the working or current requirements of the enterprises and for meeting out day-to-day operational expenses.

Factors determining the amount of working capital:

The requirement of working capital is not uniform in all enterprises. It varies from one enterprise to another because of following factors playing the lead role:

1. Nature and size of business: The business that is engaged in production process requires more working capital in comparison to the one lending trade services.

Similarly enterprises working on large demands for higher working capital than small scale units.

2. Business Cycle: Boom period is marked by more demand, more production and thus more working capital as compared to depression phase having declaimed demands.

3. Gestation Period: Longer the time gap between commencement and end of manufacturing process, more is requirement working capital as compared to industries having shorter gestation period.

4. Volume and procurement of raw material: If amount to be spent on raw material is more in total investment, automatically, the requirement for working capital will be higher as compared to those enterprises where the raw material cost involved is smaller.

5. Manual vis Automation: In labour intensive industries, large working capital will be required than in the highly mechanized ones.

6. Need to stock up inventories: The larger the stocks of whether raw material or finished goods required to be kept, more will be the need for working capital and vice-versa.

7. Turnover of working capital: Turnover means the rate at which the working capital is recovered by the sale of finished goods enterprises where the rate is higher-less working capital is required as compared to enterprises having lesser slow rate.

8. Terms of Credit: Those enterprises who believe in selling goods on credit, needs more working capital than the ones selling goods against cash.

(ii) The capital which is required for meeting the permanent or long term needs of the business is referred as fixed capital. It is that part of the total capital of an enterprise which is invested for the purchase of fixed assets like land and building, plant and machinery, etc.

Features:

Fixed capital’exhibits the following characteristics:

(a) It is not easy to withdraw the capital from business, as it’s more like a permanent capital.

(b) Generally the fixed capital is procured through long term financial resources.

(c) It is invested in procuring fixed assets.

(d) It forms the basis for income generation capacity of the enterprise.

The assessment of fixed capital requirement for a business can be made by preparing a list of fixed assets required. At the same time, an entrepreneur should keep in mind the following factors too:

(а) Nature of his/her business: viz. trading, manufacturing, services.

(b) Size of the business: small business needs less fixed capital in comparison to

large scale enterprises. .

(c) Technology to be used in production, i.e. whether capital intensive or labour intensive.

(d) Range of production: If more diversified products are manufactured, more is

fixed capital requirement in comparison to those who deal in single type of product range. . ‘

(e) Type of product to be manufactured: It may range from being simple (e.g. soap) to a highly complicated machinery, thus demanding more investment in fixed assets.

(f) Method of acquisition of fixed assets: The option of buying a fixed asset demands more capital in comparison to acquiring an asset on lease or hire purchase system.

(iii) Following factors affect the determination of capital structure:

(a) Nature of sales: Higher is the sale of the product, greater is the turnover and consequently the fixed obligations are difficult to for fulfilling. Here the enterprise has to rely on obtaining more debt. In case the sales are low, debt is not preferred.

(b) Control: If the enterprise is willing to share the power then equity is preferred, If it does not want to dilute its control then it prefers debt, debentures etc.

(c) Flexibility: Capital structure should be flexible enough to raise additional funds without undue delay and cost.

(d) Legal factor: A enterprise has to work within the framework of the law. It has to modify and make changes with the changing laws of the country. The rules for this purpose are made by SEBI, Govt, of India, etc.

(e) Situation of market: During the period of boom, the trust is more on equity shares thus it is preferable. During the situation of depression, the trust is on debentures and also debt is not preferable.

(iv) Working capital refers to that part of the capital which is needed for the financing of the working or current requirements of the enterprises and for meeting out day-to-day operational expenses.

Factors determining the amount of working capital:

The requirement of working capital is not uniform in all enterprises. It varies from one enterprise to another because of following factors playing the lead role:

(a) Size of business: The business that is engaged in production process requires more working capital in comparison to the one lending trade services.

Larger is the size of enterprise, larger is the requirement of working capital. On the contrary, smaller is the size of enterprise, smaller is the requirement of working capital.

(b) Business Cycle: Boom period is marked by more demand, more production and thus more working capital as compared to depression phase having declaimed demands.

(c) Gestation Period: It refers to the time gap between commencement and end of manufacturing process. Longer is the length of operating cycle/gestation period larger is the requirement of working capital because it is due to the fact that more money is needed for making stocks, purchasing raw materials, etc. and if shorter the period less working capital is required.

(d) Volume and procurement of raw material: If amount to be spent on raw material is more in total investment, automatically, the requirement for working capital will be higher as compared to those enterprises where the raw material cost involved is smaller.

(e) Manual vis automation: In labour-intensive industries, large working capital will be required than in the highly mechanized ones.

(f) Need to stock up inventories: The larger the stocks of whether raw material or finished goods required to be kept, more will be the need for working capital and vice-versa.

(g) Turnover of working capital: Turnover means the rate at which the working capital is recovered by the sale of finished goods enterprises. Higher is the sales turnover, lower is the requirement of working capital. The revenue obtained from the current assets. On the other hand, lower is the sales turnover; higher is the requirement of working capital.

(h) Terms of Credit: Those enterprises who believe in selling goods on credit, needs more working capital than the ones selling goods against cash.

(i) Nature of the enterprise: Requirement of working capital is different types of enterprises. Restaurants, hotels, etc. have less working capital requirement due to cash sales. Enterprise producing heavy machines needs more working capital, as their operating cycle is longer.

Sources of Finance

Question 1. Answer in not more than 15 words:

(i) What is public financing?

(ii) Define debentures as a source of finance.

(iii) Why is equity share capital called “Risk Capital”?

(iv) From which type of capital are raw-materials purchased?

Answer: (i) It is a process of arranging finance from public by an entrepreneur. It is usually raised through shares and debentures.

(ii) Debenture is a formal document issued by an enterprise containing acknowledgement of debt. It normally have set terms and conditions. These conditions may be regarding payment of interest, time period of repayment, mode of repayment etc. According to Section 2 (12) of Indian Companies Act, 1956 debenture includes debenture stock, bonds and any other securities of the company whether constituting a charge on the company’s assets or not.

(iii) Equity shareholders are the virtual owners of the company. Thus, company is under no obligation to pay them either the principal amount or dividend and that’s make them true risk bearers. For start-up entrepreneur, accessing equity capital may be a difficult task as risk involved for investor is high.

(iv) It is working capital because working capital is a short-term capital.

Question 2. Answer in not more than 50 words:

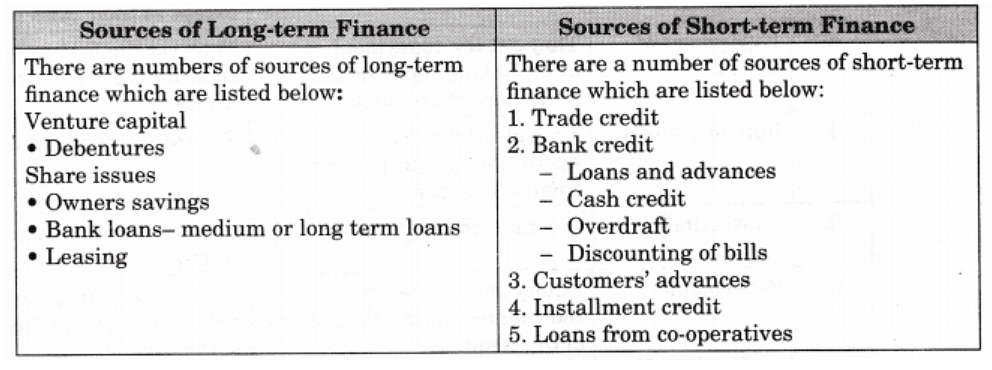

(i) On the basis of duration, classify the sources of finance.

(ii) What are the major sources of capital of a Public Limited Company?

(iii) In terms of tax benefits, which one of the two-preference shares or debentures will be preferred by the organization? Give reasons.

Answer: (i) Sources of finances can be classified on the basis of duration:

(ii) Equity.(iii) Debentures will be preferred.Reason: The interest paid on the borrowed fund is tax deductible, i.e. no tax is to be paid the entrepreneur on interest.

(ii) Equity.(iii) Debentures will be preferred.Reason: The interest paid on the borrowed fund is tax deductible, i.e. no tax is to be paid the entrepreneur on interest.

Question 3. Answer in not more than 75 words:

(i) Define ‘personal financing’. Give its sources.

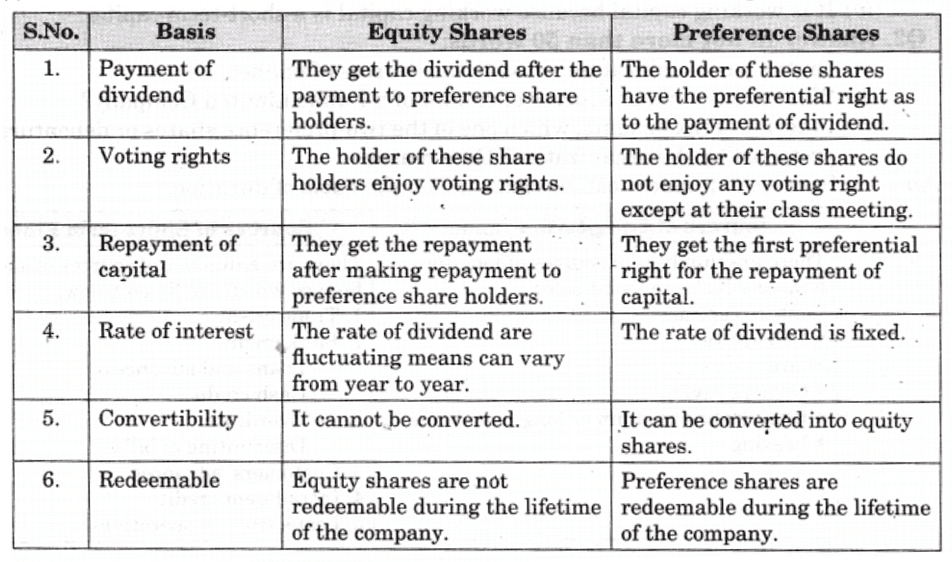

(ii) Differentiate between ‘equity shares’ and ‘preference shares’.

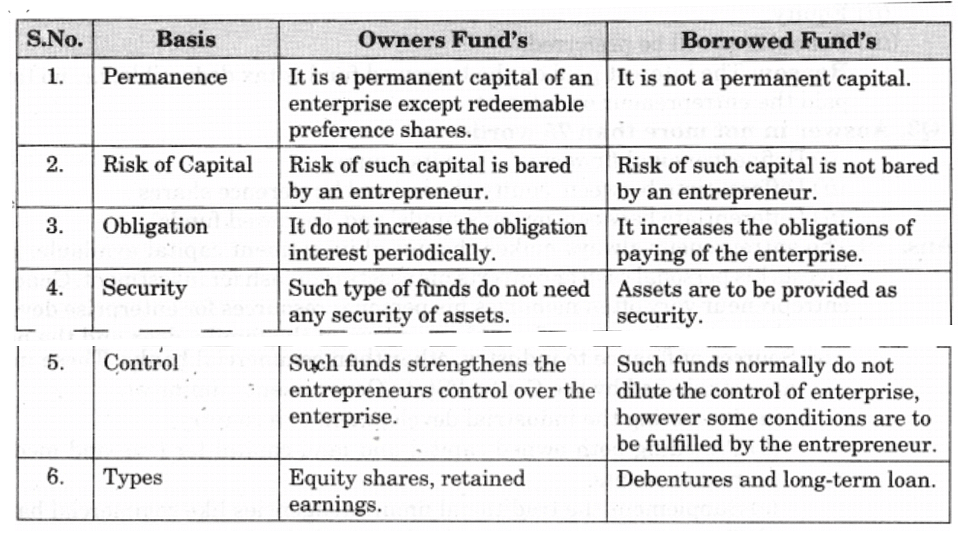

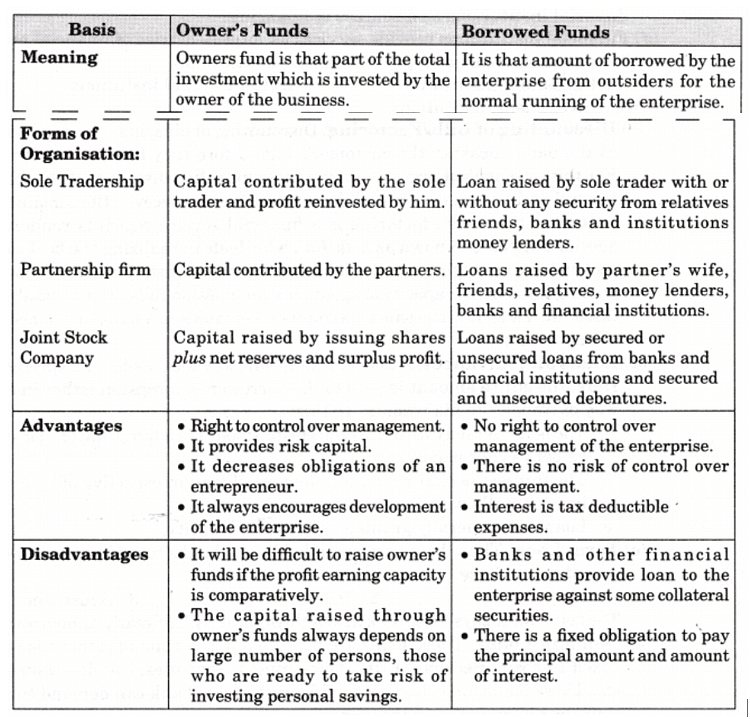

(iii) Differentiate between ‘owner’s funds’ and ‘borrowed funds’.

Answer: (i) The entrepreneur always makes the initial investment capital available. Either he invests his personal cash or converts his assets into cash for investment. Generally, the entrepreneur very often mobilizes his personal resources for enterprise development using his private assets or from his members of the family, dear and the near ones.

The investors from the family may not have a legal hold on the enterprise. They tend

to remain as silent partners extending informal assistance.

Sources

(a) Personal Savings: Past savings, if any, is the most conventional source of financing, dependable, readily available and without incurring any liability. This accumulated form of minor or major savings done by entrepreneur is an internal source and meets out small, short term requirements.

(b) Friends and Relatives: Arranging finance from near and dear ones viz. (a) friends

(b) relatives (c) known persons, in informal manner is even a popular source of financing.

(c) Chit Funds: This customary source where in some members who might be friends, or known, etc. form a type of club, committee, party, association, etc. keep paying monthly deposits privately and can claim the ‘chit’ if his sudden demand for money i.e. like ‘kitty’. This premature encashing of the deposited amount is like an internal source of financing and personal.

(d) Deposits from Dealers: When the dealers or distributors are appointed by the business firm, the dealers selected are required to give security deposits to the entrepreneurs, depending upon the reputation, goodwill and creditability of the enterprise. This can be used as a short term source of financing.

(ii)

(iii)

(iii)

Question 4. Answer in not more than 150 words:

(i) Public deposits are a good source of raising medium term finance. How?

(ii) When is it appropriate to use financial institutions as a source of financing?

(iii) Name the following:

(a) The persons who are given preference in payment of dividend and repayment of capital.

(b) The person who are owners of a company.

(c) The secured creditors of a company.

(d) The source of finance in which the right to use assets for a specific period is worked out.

Answer: (i) Public deposits are a good source of raising medium term finance

(a) It is source of investment through the general public and public are supposed to deposit their savings with his company.

(b) The company at the time of accepting the amount of deposit immediately issues a receipt mentioning the amount of loan, rate of interest and date of repayment.

(c) The deposit period should not exceeding 36 months.

(d) The existing shareholders or any employees of the company can deposit the money.

(e) The depositor will get the principal amount and the rate of return (interest).

(f) The rate of interest is generally higher than the rate applicable on bank deposits.

(g) The depositors have no rights and control over the management, and

(j) The company does-not give any guarantee of paying back of interest and loan amount.

(i) They are like unsecured creditors of the company.

(j) The deposit amount of depositer with the company are not insured with the insurance company.

(ii) Financing an enterprise-whether large or small-is a critical element for success . in business. Financing is the use and manipulation of money. Raising money for a business is one aspect of financing. All new entrepreneurs most of the time face difficult problems to arrange startup finance.

While finance is a life blood of the business and is needed throughout the life of business, the new entrepreneur faces significant difficulties in acquiring capital at start-up.

(a) The entrepreneur needs to consider all possible sources of capital and select the one that will provide the needed funds at minimal.

(b) Different sources of funds are used at various st ages in the growth and development of the venture.

(c) If an entrepreneur cannot personally supply the necessary amount of money, other option is ‘OTHER PEOPLE’S MONEY (OPM)’. It means, before seeking outside financing; an entrepreneur should first explore all methods of internal financing and the other external financing and if it suits an entrepreneur he can go for use financial institutions as a sources of financing.

(d) Financial institutions provide services as intermediaries of financial markets. There are three major types of financial institutions.

(i) Depository institutions (ii) Contractual instutions

(iii) Investment institutions

(e) Sources of finance to industry, other than commercial banks. These institutions are established by the Central/State Government, aiming at:

(a) Promoting the industrial development of a country.

(b) Providing both owned capital and land capital for long and medium term requirements.

(c) Supplement the traditional financial agencies like commercial banks.

(d) To encourage setting up of industries in backward areas.

(e) To provide technical assistance to industrial units.

(f) To develop investment markets.

(iii) (a) Preference shares (b) Sharesholders

(c) Debentures (d) Term loan.

Question 5. Answer in not more than 250 words:

(i) What is ‘venture capital’? Explain the mode of raising funds.

(ii) Discuss the various sources of financing capital through ownership.

(iii) Explain the term ‘debt financing’. How are Banks an important source of debt financing?

Answer: (i) The term venture capital is defined as a equity by which an investor supports an

entrepreneur talent with finance and business skills to exploit market opportunities and thus obtain a long term market gains. These are investors and investment companies whose specialty is financing new, high potential, high-technology oriented entrepreneurial ventures.

The mode of raising finds through venture capitalists :

(a) They are more interested in financing ventures which are in their second or third stage of development.

(b) They often provide initial equity investment to start up a business.

(c) Such ventures can be of software, biotechnology, high-potential ventures, high- technology ventures or are venture having high potential prospects and returns expected.

(d) Venture capitalists look for a high rate of return. Thus, they want equity, or some share of ownership in return for their capital.

(e) They are willing to take the higher risk of losing their capital for a chance of profit from the business’s success.

(f) The venture capitalist sells his or her percentage of the business to either another investor or back to the entrepreneur after specific number of years association or when he finds returns lowering down.

(g) Mostly small business approach to venture capitalists when they want to start or grow a business but couldn’t persuade banks to lend money.

(h) These investors have a deep insight about the fields in which they make their investment, but they behave like more or less as non-working partners do not interfere in the management of the enterprise but protect them at initial stage by keeping good contact with them.

(i) Venture capitalist more careful while investing in any venture as they know that investment is highly liquid. It means it is not subject to repayment on demand.

(ii) On the basis of ownership, finance may be classified into two categories:

(iii) Debt-financing is a financing method involving an interest-bearing instruments, usually a loan, the payment of which is only indirectly related to the sales and profits of the venture. Typically, debt financing called as asset-based financing requires that some asset, e.g. car, house, etc. be used as a collateral. Here, the entrepreneur is to pay back the amount of funds borrowed and the amount of interest.Commercial banks, generally extends short term to medium term loans to firms of all sizes and in many ways like:

(iii) Debt-financing is a financing method involving an interest-bearing instruments, usually a loan, the payment of which is only indirectly related to the sales and profits of the venture. Typically, debt financing called as asset-based financing requires that some asset, e.g. car, house, etc. be used as a collateral. Here, the entrepreneur is to pay back the amount of funds borrowed and the amount of interest.Commercial banks, generally extends short term to medium term loans to firms of all sizes and in many ways like:

(a) Overdraft: A temporary arrangement in the form of a permission granted to the customers to withdraw more than the amount standing to his/her credit.

How it works:

1. Under overdraft, the bank permits the customer to overdraw his account up to a certain limit for an agreed period.

2. To avail of this facility, a customer should have a current account with that bank.

3. Interest is charged on the amount actually overdrawn.

4. Overdraft may be allowed on the security of assets or customer’s personal security.

(b) Cash Credit: This facility is like overdraft arrangement with its features being:

1. The bank allows the borrower to borrow up to a specified limit.

2. The amount is credited to the account of the borrower.

3. The customer can withdraw this amount as and when he requires.

4. Interest is charged on the amount actually withdrawn.

5. Cash credit is usually granted on a bond or some other security.

(c) Discounting of Bills/Factoring: Discounting of bills, is an arrangement, where in the bank encashes the customer’s bills before they become due for payment. For this, the bank charges a nominal amount called discounting charges. In case the bill is dishonoured on due date, the bank can recover the amount from the customer. Similarly, factoring is a financial service which is rendered by the specialized person known as a ‘factor’, who deals in realizing the book debts, bills receivables, managing sundry debtors and sales registers of the commercial and trading firms in the capacity of agent for a commission called commercial charges or discount, Thus, it is the sale of accounts receivables to a bank or finance company or anyone else.

(d) Loans and Advances: A loan is a lump sum advance made for a specified period. Here, the entire amount is paid to the borrower in lumpsum either in cash or by way of transfer to his account. In this:

1. The borrower may withdraw the entire amount in a lumpsum or in installments as per his/her needs.

2. The interest is charged on full amount of loan irrespective of how much had been actually withdrawn.

3. Loans are generally granted against the security.

(f) Term Loan: These loans are extended by the banks to their customers for fixed period to purchase:

1. Machinery 2. Trucks, scooters 3. Houses, etc.

The borrower repays these back in monthly/quarterly/half yearly/annual installments.

(g) Demand Loans: These loans are provided by the banks against the security of Fixed Deposits Receipts (FDR), Government Securities, Life Insurance Policies, etc. These loans are called demand loans because bank can demand them at any time, by giving notice to the customer.

|

37 videos|52 docs|15 tests

|

FAQs on NCERT Solution - Resource Mobilization, Entrepreneurship-1 - Entrepreneurship Class 11 - Commerce

| 1. What is resource mobilization in entrepreneurship? |  |

| 2. How can entrepreneurs mobilize financial resources for their business? |  |

| 3. What are the challenges faced in resource mobilization for entrepreneurs? |  |

| 4. How can entrepreneurs effectively utilize their resources for business growth? |  |

| 5. How does resource mobilization contribute to the success of an entrepreneurship venture? |  |