Balancing and posting a double column cash book - Class 11 PDF Download

How to balance double column cash book?

Ref: https://edurev.in/question/570345/How-to-balance-double-column-cash-book-

Balancing and posting a double column cash book

Both cash column and bank column of double column cash book are totaled and balanced at the end of an appropriate period. The process of balancing and posting a cash book has been explained in detail in single column cash book article. The same process is also applicable to a double column cash book.

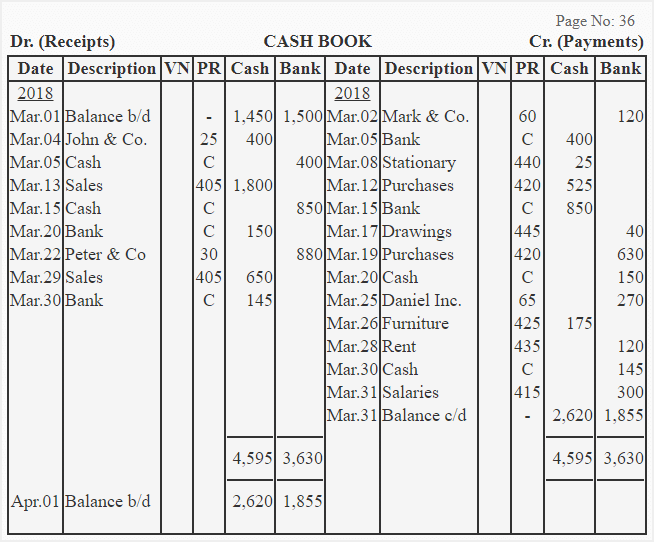

The following example summarizes the whole explanation given above.

Example

The Edward Company uses a double column cash book to record its cash and bank related transactions. It engaged in the following transactions during the month of March 2018:

- March 01: Cash balance $1,450 (Dr.), bank balance $1,500 (Dr.).

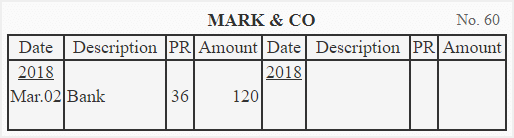

- March 02: Paid Mark & Co. by check $120.

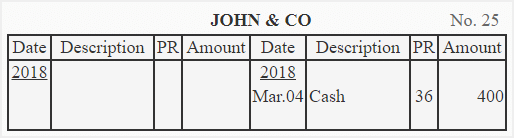

- March 04: Received from John & Co. a check amounting to $400.

- March 05: Deposited into bank the check received from John & Co. on March 04.

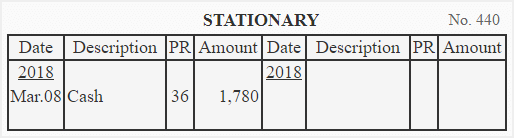

- March 08: Purchased stationary for cash, $25.

- March 12: Purchased merchandise for cash, $525.

- March 13: Sold merchandise for cash, $1,800.

- March 15: Cash deposited into bank, $850.

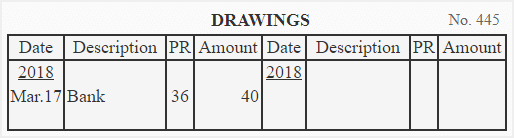

- March 17: Withdrew from bank for personal expenses, $40.

- March 19: Issued a check for merchandise purchased, $630.

- March 20: Drew from bank for office use, $150.

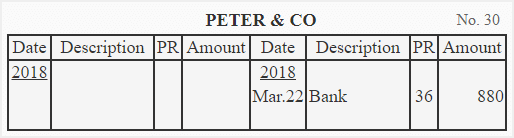

- March 22: Received a check from Peter & Co. and deposited the same into bank immediately, $880.

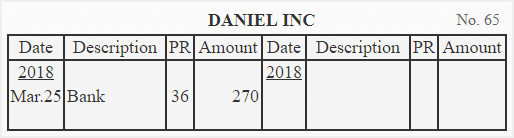

- March 25: Paid a check to Daniel Inc. for $270.

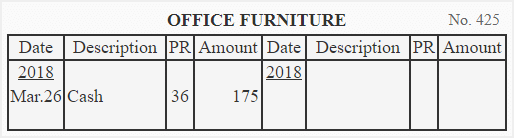

- March 26: Bought furniture for cash for office use, $175.

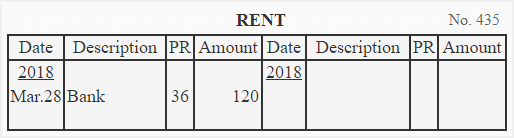

- March 28: Paid office rent by check, $120.

- March 29: Cash sales, $650.

- March 30: Withdrew from bank for office use, $145.

- March 31: Paid salary to employees by check, $300.

Required: Record the above transactions in a double column cash book and post entries therefrom into relevant ledger accounts

Solution

Cash book:

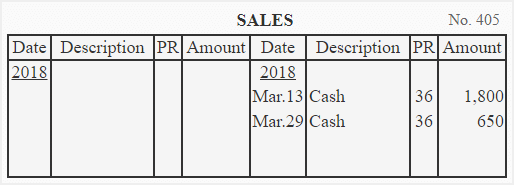

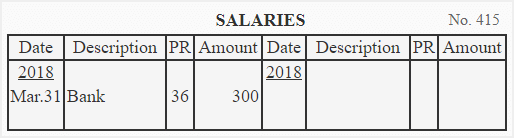

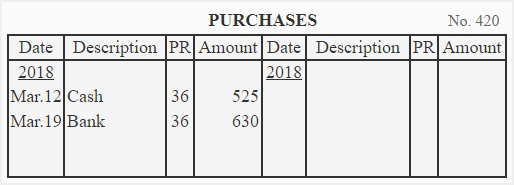

General ledger:

Accounts receivable subsidiary ledger:

Accounts payable subsidiary ledger:

FAQs on Balancing and posting a double column cash book - Class 11

| 1. How do you balance a double column cash book? |  |

| 2. What is a double column cash book? |  |

| 3. What is the purpose of a double column cash book? |  |

| 4. What is the difference between a single column cash book and a double column cash book? |  |

| 5. What are the advantages of using a double column cash book? |  |