Relationship between Book-Keeping, Accounting and Accountancy - Class 11 PDF Download

What are the relationship between accountancy,accounting and book keeping ?

Ref: https://edurev.in/question/662753/What-are-the-relationship-between-accountancy-accounting-and-book-keeping-

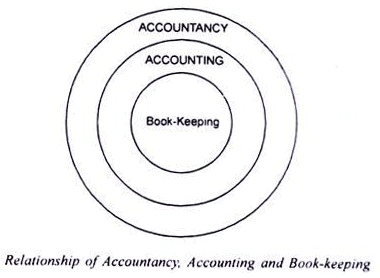

For a layman, these words are used by him interchangeably thinking that all of them have the same meaning. However, fundamentally this is not correct.

Book-Keeping:

Book-keeping is a primary and basic function in the process of accounting and concerned with recording and maintenance of books of accounts only.

In this process the following basic activities are considered essential:

(i) Identification of the transactions from the various business transactions, which have financial character;

(ii) Measurement of those transactions in terms of money;

(iii) Recording those transactions in the books of original entry;

(iv) Classification of the transactions keeping in view the respective ledger accounts.

Accounting:

Accounting is the secondary function and it starts where function of book-keeping ends.

In this process the following basic activities are considered essential:

(i) Summarisation of the classified transactions in the shape of final accounts;

(ii) Analysis and interpretation of the results disclosed by final accounts and drawing meaningful conclusions;

(iii) Communicating the required information to all the concerned parties.

Accountancy:

Accountancy is a study of systematic knowledge and contains those rules, regulations, procedures, principles, concepts, conventions and techniques, which are to be applied in the process of accounting. In this sense, we can say that accountancy is a broader term that acts as a guide for the preparation of books of accounts, summarisation of information and communicating the results to all the concerned parties.

FAQs on Relationship between Book-Keeping, Accounting and Accountancy - Class 11

| 1. What is the difference between bookkeeping, accounting, and accountancy? |  |

| 2. What are the main objectives of bookkeeping? |  |

| 3. What are the key responsibilities of an accountant? |  |

| 4. What skills are required to become a successful accountant? |  |

| 5. What is the career scope in the field of accountancy? |  |

|

Explore Courses for Class 11 exam

|

|