Chapter 13 - Proft, Loss, Discount and Value Added Tax (VAT) (Part -2), Class8 RD Sharma Solutions | RD Sharma Solutions for Class 8 Mathematics PDF Download

PAGE NO 13.26:

Question 1:

Find the S.P. if

(i) M.P. = Rs 1300 and Discount = 10%

(ii) M.P. = Rs 500 and Discount = 15%

ANSWER:

(i) We know that SP = MP−Discount

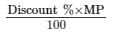

Discount% = Discount/MP × 100

Discount =

So, SP = Rs.(1300−(10/100 × 1300))

= 1300−130 = Rs. 1170

(ii) We know that SP = MP− Discount

Discount % = Discount/MP × 100

Discount =

So, SP = Rs.( 500−(15/100 × 500)) = Rs.(500−75)

= Rs. 425

PAGE NO 13.26:

Question 2:

Find the M.P. if

(i) S.P. = Rs 1222 and Discount = 6%

(ii) S.P. = Rs 495 and Discount = 1%

ANSWER:

(i) Given, SP = Rs 1222

Discount = 6%

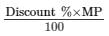

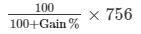

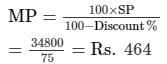

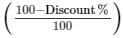

So, MP =

= Rs. 1300

(ii) Given,SP = Rs. 495

Discount = 1%

So, MP =

= Rs. 500

PAGE NO 13.26:

Question 3:

Find discount in percent when

(i) M.P. = Rs 900 and S.P. = Rs 873

(ii) M.P. = Rs 500 and S.P. = Rs 425

ANSWER:

(i) We know that SP = MP−Discount

So, 873 = 900−Discount

Therefore, Discount = Rs. (900−873)

= Rs. 27

Discount% = Discount/MP × 100%

= 27/900 × 100%

= 3%

(ii) We know that SP = MP−Discount

So, 425 = 500−Discount

Therefore, Discount = Rs.(500−425)

= Rs. 75

Discount% = Discount/MP × 100%

= 75/500 × 100%

= 15%

PAGE NO 13.26:

Question 4:

A shop selling sewing machines offers 3% discount on all cash purchases. What cash amount does a customer pay for a sewing machine the price of which is marked as Rs 650.

ANSWER:

Discount = 3%

Marked price = Rs. 650

Now, 3% of the MP = 3/100 × 650

= Rs 19.50

So, SP = MP−Discount = 650−19.50

= Rs 630.50

PAGE NO 13.26:

Question 5:

The marked price of a ceiling fan is Rs 720. During off season, it is sold for Rs 684. Determine the discount percent.

ANSWER:

Given, MP of the ceiling fan = Rs. 720 SP of the ceiling fan = Rs. 684

Since SP = MP−Discount,

Discount = MP−SP = Rs. (720−684)

= Rs. 36

Discount% = (Discount/MP) × 100%

= 36/720 × 100%

= 5%

PAGE NO 13.26:

Question 6:

On the eve of Gandhi Jayanti a saree is sold for Rs 720 after allowing 20% discount. What is its marked price?

ANSWER:

Given,SP of the saree = Rs. 720

Discount on the saree = 20%

We know, Discount% = Discount/MP × 100

Or, Discount =

Let the MP of the saree be Rs. x

Therefore, Discount = 20/100 x = Rs. 0.02 x

Since S.P = MP− Discount,

720 = x −0.20 x 720 = 0.80 x

x = 720/0.80

= Rs. 900

Thus, the MP of the saree is Rs. 900.

PAGE NO 13.26:

Question 7:

After allowing a discount of 7.5% on the marked price, an article is sold for Rs 555. Find its markd price.

ANSWER:

Given,SP of the article = Rs. 555

Discount = 7.5%

Let the MP of the article be Rs. x .

Therefore, Discount =  = Rs.7.5x/100

= Rs.7.5x/100

= Rs. 0.075 x

Since SP = MP− Discount,

555 = x −0.075 x

555 = 0.925 x

x = 555/0.925

= Rs. 600

Thus, the MP of the article is Rs. 600.

PAGE NO 13.26:

Question 8:

A shopkeeper allows his customers 10% off on the marked price of goods and still gets a profit of 25%. What is the actual cost to him of an article marked Rs 250?

ANSWER:

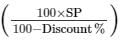

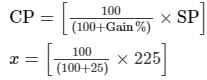

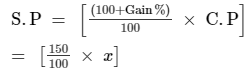

Let the CP of the article be Rs. x .

MP of the article = Rs. 250

Discount = 10%

Discount = 10% of 250 = 0.10 × 250 = Rs. 25

SP = MP−Discount = 250−25 = Rs. 225

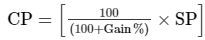

Given,Profit = 25%

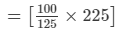

= Rs. 180

Thus, the CP of the article is Rs. 180.

PAGE NO 13.26:

Question 9:

A shopkeeper allows 20% off on the marked price of goods and still gets a profit of 25%. What is the actual cost to him of an article marked Rs 500?

ANSWER:

Given,MP of an article = Rs. 500

Discount = 20%

Therefore, Discount = 20% of 500

= 0.20 × 500

= 100

So, SP = MP−Discount

= Rs.(500−100)

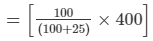

= Rs. 400

= 40000/125

= Rs. 320

Thus, the actual cost of the article is Rs. 320.

PAGE NO 13.26:

Question 10:

A tradesman marks his goods at such a price that after allowing a discount of 15%, he makes a profit of 20%. What is the marked price of an article whose cost price is Rs 170?

ANSWER:

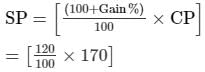

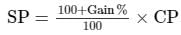

Given,CP of the article = Rs. 170

Profit = 20%

We know that,

= 20400/100

= Rs. 204

Let the MP of the article be Rs. x .

Discount = 15%

Therefore, Discount = 15% of x = 0.15 x

So, SP = MP−Discount

MP = SP + Discount

x = 204 + 0.15 x

x −0.15 x = 204

0.85 x = 204

x = Rs. 240

Thus, the marked price of the article is Rs. 240.

PAGE NO 13.26:

Question 11:

A shopkeeper marks his goods in such a way that after allowing a discount of 25% on the marked price, he still makes a profit of 50%. Find the ratio of the C.P. to the M.P.

ANSWER:

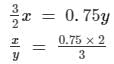

Let C.P be Rs x and M.P be Rs y.

Gain% = 50

We know that,

= 3/2 x

Discount% = 25

Discount = 25% of y

= Rs 0.25y

So, S.P = M.P − Discount

= y − 0.25y

= 0.75y

So, S.P = 0.75y

Also, S.P = 3/2 x

Comparing both values for S.P., we get:

= 1.5/3

= 1/2

Thus, C.P:M.P = 1:2

PAGE NO 13.26:

Question 12:

A cycle dealer offers a discount of 10% and still makes a profit of 26%. What is the actual cost to him of a cycle whose marked price is Rs 840?

ANSWER:

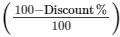

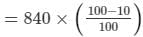

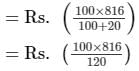

Given, MP of the cycle = Rs. 840

Discount = 10%

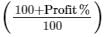

So, SP = MP ×

= Rs. 756

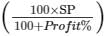

Now, SP = Rs. 756 and Gain = 26%

So, CP =

= 100/126 × 756

= Rs. 600

Hence, the actual cost of the cycle is Rs. 600.

PAGE NO 13.26:

Question 13:

A shopkeeper allows 23% commision on his advertised price and still makes a profit of 10%. If he gains Rs 56 on one item, find his advertised price.

ANSWER:

Let the CP of the item be Rs. x .

Profit = 10%

SP = CP

SP = x (110/100)

SP = Rs.1.1 x

Again, Profit = SP−CP

Therefore, Profit = Rs. (1.1 x − x ) = Rs. 0.1 x

We get,0.1 x = 56 x

= Rs. 560

Now, the advertised price = 1.1x /1−0.23

= Rs. 800

Therefore, the advertised price of the item is Rs. 800.

PAGE NO 13.26:

Question 14:

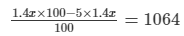

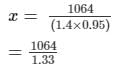

A shopkeeper marks his goods at 40% above the cost price but allows a discount of 5% for cash payment to his customers. What actual profit does he make, if he receives Rs 1064 after paying the discount?

ANSWER:

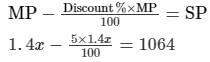

Let the original cost price of the item be Rs. x .MP = x + 40 x 100 = 1.4 x

Discount = MP−SP

So, x (1.4)(0.95) = 1064

= Rs. 800

Profit = Rs. (1064−800)

= Rs. 264

Thus, the actual profit by the shopkeeper is Rs. 264.

PAGE NO 13.26:

Question 15:

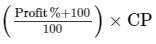

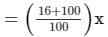

By selling a pair of earings at a discount of 25% on the marked price, a jeweller makes a profit of 16%. If the profit is Rs 48, what is the cost price? What is the marked price and the price at which the pair was eventually bought?

ANSWER:

Let the cost price of the pair of earrings be Rs. x .

Profit = 16%

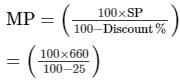

Therefore, SP =

= Rs. 116x/100

SP−CP = 48

⇒ 116x/100− x = 48

⇒ 16 x = 4800

⇒ x = Rs. 300

SP = 116x/100 = Rs. 348

= Rs. 464

Thus, CP of the pair of earrings = Rs. x = Rs. 300

SP of the pair of earrings = Rs. 348

MP of the pair of earrings = Rs. 464

PAGE NO 13.26:

Question 16:

A publisher gives 32% discount on the printed price of a book to booksellers. What does a bookseller pay for a book whose printed price is Rs 275?

ANSWER:

Discount allowed by the publisher = 32% on the printed price

Printed price = Rs. 275

So, 32% of 275

= 32/100 × 275

= Rs. 88

So, the bookseller pays = Rs. 275−Rs. 88

= Rs. 187 for a book

PAGE NO 13.26:

Question 17:

After allowing a discount of 20% on the marked price of a lamp, a trader loses 10%. By what percentage is the marked price above the cost price?

ANSWER:

Let the CP of the lamp be Rs. 100.

Loss = 10% of CP = Rs. 10

So, SP = CP−Loss = Rs. 100−Rs. 10 = Rs. 90

The trader allows a discount of 20%. This means that when the MP is Rs. 100, the SP will be Rs. 80.

Now,If Rs. 80 is the SP, the MP = Rs. 100

If Re. 1 is the SP, the M.P = Rs. 100/80

If Rs. 90 is the SP, the MP = Rs. (100/80 × 90) = Rs. 112.50

Hence, the trader marks his goods at 12.5% above the cost price.

PAGE NO 13.26:

Question 18:

The list price of a table fan is Rs 480 and it is available to a retailer at 25% discount. For how much should a retailer sell it to gain 15%?

ANSWER:

Marked price of the table fan = Rs. 480

Discount = 25%

Therefore, cost price = 25% of Rs. 480

25/100 × 480 = Rs. 360

It is given that the profit on the table fan is 15%.

Gain% = Gain/CP × 100

15 = Gain/360 × 100

Gain = Rs. 54

Gain = SP−CP

54 = SP−360

SP = Rs. 414

Thus, the retailer will sell the table fan for Rs. 414.

PAGE NO 13.27:

Question 19:

Rohit buys an item at 25% discount on the marked price. He sells it for Rs 660, making a profit of 10%. What is the marked price of the item?

ANSWER:

Given,SP of the item = Rs. 660

Discount on the item = 25%

Profit on the item = 10%

We know,

= Rs. 880

Thus, the marked price of the item is Rs. 880.

PAGE NO 13.27:

Question 20:

A cycle merchant allows 20% discount on the marked price of the cycles and still makes a profit of 20%. If he gains Rs 360 over the sale of one cycle, find the marked price of the cycle.

ANSWER:

Given,Gain on one cycle = Rs. 360

Gain = 20%

Gain% = Gain/CP × 100

20 = 360/CP × 100

CP = Rs. 1800

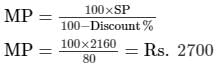

SP = 120/100 × 1800 = Rs. 2160

SP = Rs. 2160

Discount = 20%

Hence, the MP of one cycle is Rs. 2700.

PAGE NO 13.27:

Question 21:

Jyoti and Meena run a ready-made garment shop. They mark the garments at such a price that even after allowing a discount of 12.5%, they make a profit of 10%. Find the marked price of a suit which costs them Rs 1470.

ANSWER:

Given,CP of the suit = Rs. 1470

Gain = 10%So, SP = Rs.

= Rs. 1617

Now,SP = Rs. 1617

Discount = 12.5%

So, MP = Rs.

= Rs

= Rs. 1848

Therefore, the marked price of the suit is Rs. 1848.

PAGE NO 13.27:

Question 22:

What price should Aslam mark on a pair of shoes which costs him Rs 1200 so as to gain 12% after allowing a discount of 16%?

ANSWER:

Given,CP of the pair of shoes = Rs. 1470

Gain = 12%

Discount = 16%

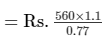

So, SP = Rs.

= Rs.

= Rs. 1344

Now,SP of the pair of shoes = Rs. 1344

Discount = 16%

So, MP = Rs.

= Rs.

= Rs. 1600

Aslam should sell the pair of shoes for Rs. 1600.

PAGE NO 13.27:

Question 23:

Jasmine allows 4% discount on the marked price of her goods and still earns a profit of 20%. What is the cost price of a shirt for her marked at Rs 850?

ANSWER:

Given, MP of the shirt = Rs. 850

Discount = 4%

Discount allowed = Rs. (4100 × 850) = Rs. 34

Thus, SP of the shirt = Rs. (850−34) = Rs. 816

Now, Profit earned by Jasmine = 20%

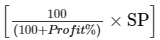

Thus, CP =

= Rs. 680

Thus, the cost price of the shirt is Rs. 680.Given,

PAGE NO 13.27:

Question 24:

A shopkeeper offers 10% off-season discount to the customers and still makes a profit of 26%. What is the cost price for the shopkeeper on a pair of shoes marked at Rs 1120?

ANSWER:

Given,MP of the pair of shoes = Rs. 1120

Discount = 10%

So, SP = MP

= 1120 × 90/100

= Rs. 1008

Now,Profit = 26%

SP = Rs. 1008

Therefore, CP =

Cost price =

= Rs. 800

The cost price of the pair of shoes will be Rs. 800.

PAGE NO 13.27:

Question 25:

A lady shopkeeper allows her customers 10% discount on the marked price of the goods and still gets a profit of 25%. What is the cost price of a fan for her marked at Rs 1250?

ANSWER:

Given,MP of the fan = Rs. 1250

Discount = 10%

So, Discount = 10% of 1250 = 0.10 × 1250

= Rs. 125

Since SP = MP−Discount,

SP = Rs. (1250−125)

= Rs. 1125

Now, SP of the fan = Rs. 1125

Profit = 25%

CP =

= [100/125]1125

= Rs. 900

Thus, the cost price of the fan is Rs. 900.

FAQs on Chapter 13 - Proft, Loss, Discount and Value Added Tax (VAT) (Part -2), Class8 RD Sharma Solutions - RD Sharma Solutions for Class 8 Mathematics

| 1. What is the formula to calculate profit? |  |

| 2. How can I calculate the discount percentage? |  |

| 3. What is Value Added Tax (VAT)? |  |

| 4. How do I calculate the selling price after applying VAT? |  |

| 5. How can I calculate the loss percentage? |  |

|

Explore Courses for Class 8 exam

|

|