Change in Profit Sharing Ratio | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Reconstitution of a Partnership Firm:

Partnership is the result of an agreement between persons for sharing the profits of a business. Any change in the partnership agreement brings to an end the existing agreement and a new agreement comes into force. In such a case, although the firm continues, it amounts to the reconstitution of the partnership firm. Reconstitution of the firm may happen in the following circumstances:

(i) Change in the profit sharing ratio among the existing partners:

For example, A and B are partners in a firm sharing profits in the ratio of 2 : 1. In future, they decide to share profits in the ratio of 3 : 1. It amounts to reconstitution of the firm.

(ii) Admission of a new partner:

For example, C and D are partners sharing profits equally. On April 1, 2004, they decided to admit E as a new partner with 1/4th share. It results into reconstitution of the firm.

(iii) Retirement of an existing partner:

For example, F, G and H are partners sharing profits in the ratio of 1 : 2 : 3. H Retires from the firm on March 31, 2004. It amounts to reconstitution of the firm.

(iv) Death of a Partner:

For example, P, Q and R are partners in a firm sharing profits in the ratio of 4 : 3 : 2. R dies on March 31, 2004. P and Q decide to share future profits equally. It also amounts to reconstitution of the firm.

(v) Amalgamation of two partnership firms:

For example, A and B are partners in a firm sharing profits in the ratio of 2 : 1. To eliminate competition they amalgamate their firm with the firm of C and D who are sharing profits in the ratio of 3 : 1. The new ratios for A, B, C and D are agreed at 2 : 1 : 3 : 1. It amounts to reconstitution of the firm of A and B on the one hand and the firm C and D on the other hand and a new reconstituted firm is formed.

Change in Profit Sharing Ratio Among the Existing Partners:

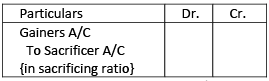

Sacrificing Ratio: Whenever there is a change in the profit sharing ratio, one or more of the existing partners have to surrender some of their old share in favour of one or more of other partners.

Sacrificing Ratio = Old Ratio — New Ratio (SON)

Gaining Ratio: As a result of change in profit sharing ratio, one or more of the existing partners gain some portion of other partners share of profit.

Gaining Ratio = New Ratio — Old Ratio

Case 1: X, Y and Z are sharing profits and losses in the ratio of 5 : 3 : 2. Calculate the sacrificing ratio if X, Y and Z decide to share future profits & losses equally.

Treatement of Reserves or Accumulated Profits at the Time of Change in Profit Sharing Ratio:

• Reserves or accumulated profits appears in the balance sheet liability side so they have a credit balance.

• When these will be distributed it be debited and partners capital account will be credited.

• These can be general reserves, p&l a/c, p&l appropriation a/c, p&l a/c (cr.)balance or any other types of reserves or a reserve fund.

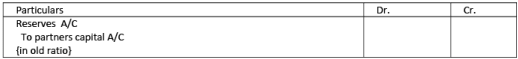

Case 1: No information- reserves will be distributed in the old ratio

Case 2: Partners decides to distribute the resrves or transfer the reserves in their capital account reserves will be distributed in the old ratio

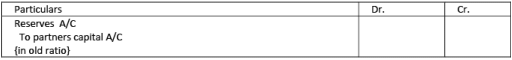

Case 3: Partners decides to not distribute\ disturb the resreves or transfer the reserves in their capital account reserves will be distributed in the sacrifing ratio

X, Y and Z are partners sharing profits in the ratio of 4:3:2. From April, 2008, they decided to share the profits equally. On that date their books showed a credit balance of Rs. 1,80,000 in the Profit and Loss Account Pass entries:

Case 1:

If there is no information.

Case II:

Partners decides to distribute the reserves.

Case III:

Partners decides not to distribute the reserves.

Treatement of Accumulated Losses at the Time of Change in Profit Sharing Ratio:

• Accumulated losses appear in the balance sheet assets side so they have a debit balance.

• When these will be distributed it will be credited and partner capital account will be debited.

• These can be accumulated losses, p&l a/c [dr.], p&l appropriation a/c[dr.],advertising suspense, Any other deferred revenue expenditures.

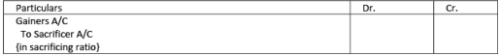

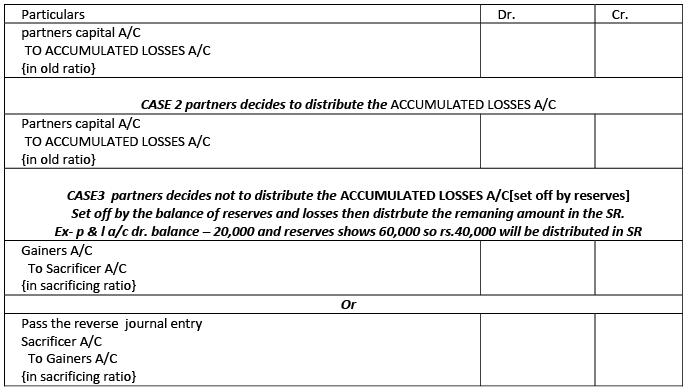

Case 1. No information - losses will be distributed in the old ratio

A and B are partners sharing profits and losses in the ratio of 2:1. From April 1, 2008, they decided to share the profits in the ratio of 3:2. On that date, profit and loss account showed a debit balance of Rs.60,000.

Pass entries-

Case 1. If there is no information.

Case 2. Partners decides to distribute the profit and loss account debit balance.

Case3. Partners decides not to distribute the profit and loss account debit balance.

Treatement of Accumulated Losses, Reserves & Goodwill at the Time of Change in Profit Sharing Ratio:

Step 1. find SR = OR – NR

Step 2. Find the net effect

Reserves +

Goodwill +

Revaluation profits +

Revaluation losses –

P & l balance ( cr. Balance ) +

P & l balance ( Dr. Balance ) +

Step 3. Pass the journal entry

A, B and C were partners in a firm sharing profits in the ratio of 1:3:2. They decided that with effect from 1st January 2003, they will share profits in the ratio of 4:6:5. For this purpose the goodwill of the firm is valued at the total of preceding three year’s profits. The profits were: Rs.

1998 40,000

1999 10,000 (Loss)

2000 80,000 (Loss)

2001 1,20,000

2002 1,40,000

Reserves, Profits and advertising suspense appeared in the balance sheet at Rs. 40,000, Rs. 60000 and Rs. 30,000 respectively. Partners neither want to show goodwill in the books nor want to distribute the reserves and profits appearing in the balance sheet. Pass a single journal entry to record the change.

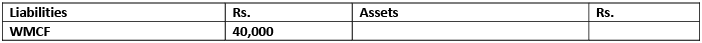

Treatement of workmen compensation fund at the Time of Change in Profit Sharing Ratio:

A,B & C are partners sharing profit in the ratio of 2:2:1 and now they want to share in 5:3:2.

• Claim for wmcf goes to the balance sheet liabilities

X, Y and Z who are presently sharing profits & losses in the ratio of 5 : 3 : 2, decide to share future profits & losses in the ratio of 2 : 3 : 5 with effect from 1st April, 2014. Workmen Compensation Reserve appears at Rs. 720 in the Balance Sheet as at 31st March, 2014.

Pass entries if -

Case I.

If there is no other information.

Case II.

If a claim on account of Workmen's Compensation is estimated at Rs. 90 only.

Case III.

If a claim on account of Workmen's Compensation is estimated at Rs. 1,350.

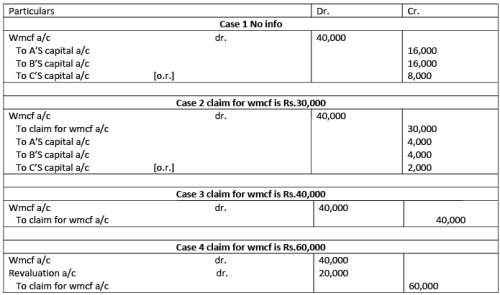

Treatement of investment fluctuation fund at the Time of Change in Profit Sharing Ratio:

A,B & C are partners sharing profit in the ratio of 2:2:1 and now they want to share in 5:3:2.

X, Y and Z who are presently sharing profits & losses in the ratio of 5 : 3 : 2, decide to share future profits & losses in the ratio of 2 : 3 : 5 with effect from 1st April, 2014. An extract of their Balance Sheet as at 31st March, 2014 is as follows:

| Liabilities | Rs. | Assets | Rs. |

| Investment Fluctuation Reserve | 900 | Investments (at cost) | 12,000 |

Required: Show the accounting treatment in each of the following alternative cases:

Case I. If there is no other information is given.

Case II. If the market value of investments is Rs. 12,000.

Case III. If the market value of investments is Rs. 11,400.

Case IV. If the market value of investments is Rs. 10,800.

Case V. If the market value of investments is Rs. 12,300.

|

79 docs|43 tests

|

FAQs on Change in Profit Sharing Ratio - Crash Course of Accountancy - Class 12 - Commerce

| 1. What is profit sharing ratio in commerce? |  |

| 2. How is the profit sharing ratio determined? |  |

| 3. Can the profit sharing ratio be changed? |  |

| 4. What are the implications of changing the profit sharing ratio? |  |

| 5. Are there any legal requirements or restrictions for changing the profit sharing ratio? |  |