Sample Questions - Admission of a Partner | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Admission Test

Time – 50 mins

M.M.- 30

Q1. A and B were partners in a firm. They admitted C as a new partner for 20% share in the profits. After all adjustments regarding general reserve, goodwill, gain or loss on revaluation, the balances in capital accounts of A and B were 3,85,000 and 4,15,000 respectively. C brought proportionate capital so as to give him 20% share in the profits. Calculate the amount of capital to be brought by C. (1 mark)

Q2. Jai & veero are partners sharing profits 3:2. They admitted om has a new partner for 1/5 share in profits one fourth of which he takes in from Jai and remaining from Veero. Ho brings stock of rs.60,000, debtors of rs.80000, land of rs.1,00,000, P&M rs.40,000 as his share of goodwill and capital. On date of Om’s admission goodwill was valued rs.6,00,000. Pass entries. (3 mark)

Q3. (i) A and B were partners in a firm who share profits in the ratio of 5:3. C is admitted for 1/10th share of half of which was gifted by A and remaining was taken by c equally from A & B, find the new ratio.

(ii) Rekha, Sunita and Teena are partners in a firm sharing profits in the ratio of 3:2:1. Samiksha joins the firm. Rekha surrenders 1/4th of her share; Sunita surrenders 1/3rd of her share and Teena 1/5th of her share in favour of Samiksha. Find the new Profit sharing ratio. (4 mark)

Q4. A, B and C are in partnership sharing profits and losses in the ratio of 5 : 4 : 1 respectively. Two new partners D and E are admitted. The profits are now to be shared in the ratio of 3 : 4 : 2 : 2 : 1 respectively. D is to pay Rs. 90,000 for his share of Goodwill but E has insufficient cash to pay for Goodwill. Both the new partners introduced Rs. 1,20,000 each as their capital. You are required to pass necessary journal entries (4 mark)

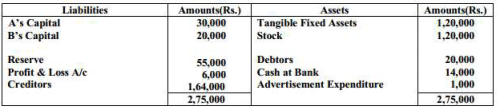

Q5. The Balance Sheet of A & B who share profits in the ratio of 3:2 as at 31/03/13 was as follows:

The following adjustments were agreed upon:

(a) C brings in 16,000 as goodwill and proportionate capital.

(b) Bad debts amounted to 3,000.

(c) Market value of investment is 4,500.

(d) Liability on account of workmen’s compensation reserve amounted to 2,000.

Prepare Revaluation A/c and Partner’s Capital A/cs. (6 mark)

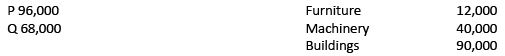

Q6. P and Q were partners in a firm sharing profits in 3; 2 ratio. R was admitted as a new partner for 1/4th share in the profits on April 1, 2015. The Balance Sheet of the firm on March 31, 2015 was as follows:

The terms of agreement on R’s admission were as follows: a) R brought in cash 60,000 for his capital and 30,000 for his share of goodwill. b) Building was valued at 1,00,000 and Machinery at 36,000. c) The capital accounts of P and Q were to be adjusted in the new profit-sharing ratio. Necessary cash was to be brought in or paid off to them as the case may be. Prepare Revaluation Account, Partner’s Capital Account and the Balance Sheet of P, Q and R. (8 mark)

|

79 docs|43 tests

|

FAQs on Sample Questions - Admission of a Partner - Crash Course of Accountancy - Class 12 - Commerce

| 1. What is the process for admitting a partner in a commerce business? |  |

| 2. Can an existing partner be removed during the admission of a new partner? |  |

| 3. How does the admission of a partner affect the ownership and control of a commerce business? |  |

| 4. What are the potential advantages of admitting a new partner in a commerce business? |  |

| 5. Are there any risks associated with admitting a new partner in a commerce business? |  |