Common Size Statements

Time – 50 mins

M.M. - 30

Q1. State the limitations of financial statement analysis? (2 marks)

Q2. Give the headings under which the following items will be shown in a company's Balance Sheet:

(a) Cash in hand (d) Debentures

(b) Land (e) Capital Redemption Reserve

(c) Sundry Debtors (f) Loose Tools

(3 marks)

Q3. The following credit balances were extracted from the books of Rama Ltd. on 31st March, 2013:

Share Capital (40,000 shares of ~ 10 each fully paid) 4,00,000

Securities Premium ...........................................................................40,000

12% Debentures .................................................................................2,00,000

Fixed Deposits from Public ................................................................35,000

Sundry Creditors ................................................................................17,500

Provision for Taxation ........................................................................7,500

Draw up the 'liabilty' side of the Balance Sheet according to the requirements of the Companies Act, 2013. Also prepare Notes. (2 marks)

Q4. The following debit balances were extracted from the books of Shruti Ltd. as on 31st March, 2013:

Land & Building 2,00,000 Debtors 1,50,000

Plant & Machinery 8,00,000 Cash at Bank 38,000

Goodwill 2,00,000 Stock-in-Trade 90,000

Investments in Properties 2,00,000 Loose Tools 5,000

Bills Receivable 50,000 Cash on Hand 17,000

Draw up the 'Assets' side of the Balance Sheet according to the requirements of the Companies Act, 2013. Also prepare notes. (3 marks)

Q5. Prepare a statement for showing the percentage changes in the performance of Lakha ltd.

Particulars 2012 2011

Revenue from operations 5,00,000 4,00,000

Cost of Revenue from operations half of the RFO

Selling expenses one tenth of cogs

Dividend received 20,000 10,000

Income tax 50 % 40 %

(4 marks)

Q6. From the following information, prepare comparative statements:

31, march 2013 31, march 2014

Revenue from operations 12 lac 16 lac

Purchase of stock in trade 7.60lac 9 lac

Change in inventory 40,000 (50,000)

Employee benefit expenses 20% of RFO 18% of RFO

Tax rate 50% 50%

(4 marks)

Q7. What is financial statement analysis and name the different tools of financial statement analysis? (2 marks)

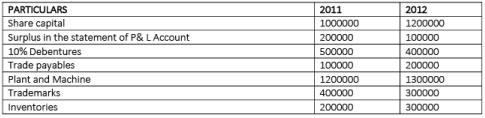

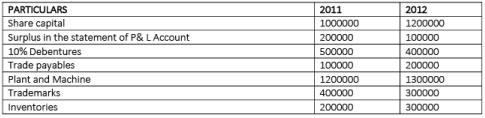

Q8. Prepare Comparative and common size Balance Sheet from the following information:

(6 marks)

Q9. Mudra Ltd. is in the process of preparing its Balance Sheet as per Schedule III, Part I of the Companies Act, 2013 and provides its true and fair view of the financial position.

(a) Under which head and sub-head will the company show ‘Stores and Spares’ in its Balance Sheet?

(b) What is the accounting treatment of ‘Stores and Spares’ when the Company will calculate its Inventory Turnover Ratio?

(c) The management of Mudra Ltd. want to analyse its Financial Statements. State any two objectives of such analysis.

(d) Identify the value being followed by Mudra Ltd.

(4 marks)