ICAI Notes- Unit 1: Law of Demand- 1 - CA Foundation PDF Download

| Table of contents |

|

| Learning Outcomes |

|

| Meaning of Demand |

|

| Determinants of Demand |

|

| Demand Function |

|

| Law of Demand |

|

| Demand Schedule |

|

| Demand curve |

|

Learning Outcomes

At the end of this Unit, you should be able to:

- Explain the Meaning of Demand.

- Describe what Determines Demand. Explain the Law of Demand.

- Explain the Difference between Movement along the Demand Curve and Shift of the Demand Curve. Define and measure elasticity.

- Apply the concepts of price, cross and income elasticities. Explain the determinants of elasticity.

- Explain the importance of demand forecasting in business. Describe the various demand forecasting techniques.

Consider the following hypothetical situation:

Aroma Tea Limited is considering diversifying its business. A meeting of the board of directors is called. While discussing the matter, Rajeev Aggarwal, the CEO of Aroma Tea Limited asks, Sanjeev Bhandari, the marketing head, “What do you think Sanjeev, should we enter into green tea also? What does the market pulse say? Who all are there in this market? How will the demand for green tea affect the demand for our black tea? Is green tea a luxury good or is it a necessity now? What are the key determinants of the demand for green tea? Will coffee drinkers or soft drinkers shift to green tea? The answers to these questions will help us better understand how to price and position our brand in the market. “Before we rush into this line, I want a report on exactly why you believe green tea will be the star of our company in the coming five years?”

As an entrepreneur of a firm or as a manager of a company, you would often face situations in which you have to answer questions similar to the above. The answers to these and a thousand other questions can be found in the theory of demand and supply. The market system is governed by market mechanism. In a market system, the price of a commodity or service is determined by the forces of demand and supply. Since business firms produce goods and services to be sold in the market, they have to understand and be responsive to the needs of the customers. While buyers constitute the demand side of the market, sellers make the supply side of that market. The quantity that consumers buy at a given price determines the size of the market. As we are aware, as far as the firm is concerned, the size of the market is a significant determinant of its prospects. A thorough understanding of demand and supply theory is therefore essential for any business firm.

Meaning of Demand

- The concept ‘demand’ refers to the quantity of a good or service that consumers are willing and able to purchase at various prices during a given period of time.

- It is to be noted that demand, in Economics, is something more than the desire to purchase, though desire is one element of it.

- A beggar, for instance, may desire food, but due to lack of means to purchase it, his demand is not effective. Thus, effective demand for a thing depends on

(i) desire

(ii) means to purchase

(iii) willingness to use those means for that purchase. - Unless desire is backed by purchasing power or ability to pay, and willingness to pay, it does not constitute demand. Effective demand alone would figure in economic analysis and business decisions.

- Two things are to be noted about the quantity demanded.

1. The quantity demanded is always expressed at a given price. At different prices different quantities of a commodity are generally demanded.

2. The quantity demanded is a flow. We are concerned not with a single isolated purchase, but with a continuous flow of purchases and we must therefore express demand as ‘so much per period of time’ i.e., one thousand dozens of oranges per day, seven thousand dozens of oranges per week and so on.

In short “By demand, we mean the various quantities of a given commodity or service which consumers would buy in one market during a given period of time, at various prices, or at various incomes, or at various prices of related goods”.

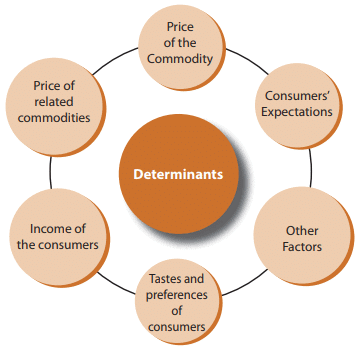

Determinants of Demand

Knowledge of the determinants of demand for a product and the nature of relationship between demand and its determinants are essential for a business firm for estimating market demand for its products. There are a number of factors which influence demand for a commodity. All these factors are not equally important. Moreover, some of these factors cannot be easily measured or quantified. The important factors that determine demand are given below.

Price of the commodity

- Ceteris paribus i.e. other things being equal, the demand for a commodity is inversely related to its price. It implies that a rise in the price of a commodity brings about a fall in the quantity purchased and vice-versa. This happens because of income and substitution effects.

Price of related commodities

- Related commodities are of two types:

(a) complementary goods

(b) competing goods or substitutes. - Complementary goods are those goods that are consumed together or simultaneously.

- For example, tea and sugar, automobile and petrol and pen and ink.

- When two commodities are complements, a fall in the price of one (other things being equal) will cause the demand for the other to rise.

- For example, a fall in the price of petrol-driven cars would lead to a rise in the demand for petrol. Similarly, a fall in the price of fountain pens will cause a rise in the demand for ink. The reverse will be the case when the price of a complement rises. Thus, we find that, there is an inverse relation between the demand for a good and the price of its complement.

- Two commodities are called competing goods or substitutes when they satisfy the same want and can be used with ease in place of one another.

- For example, tea and coffee, ink pen and ball pen, are substitutes for each other and can be used in place of one another easily.

- When goods are substitutes, a fall in the price of one (ceteris paribus) leads to a fall in the quantity demanded of its substitutes.

- For example, if the price of tea falls, people will try to substitute it for coffee and demand more of it and less of coffee i.e. the demand for tea will rise and that of coffee will fall. Therefore, there is direct or positive relation between the demand for a product and the price of its substitutes.

Income of the consumer

- Other things being constant, the demand for a commodity depends upon the money income of the consumer.

- The purchasing power of the consumer is determined by the level of his income. In most cases, the larger the average money income of the consumer, the larger is the quantity demanded of a particular good.

- The nature of the relationship between income and quantity demanded depends upon the nature of consumer goods.

- Most of the consumption goods fall under the category of normal goods. These are demanded in increasing quantities as consumers’ income increases. Household furniture, clothing, automobiles, consumer durables and semi durables etc. fall in this category.

- Essential consumer goods such as food grains, fuel, cooking oil, necessary clothing etc., satisfy the basic necessities of life and are consumed by all individuals in a society. A change in consumers’ income, although will cause an increase in demand for these necessities, but this increase will be less than proportionate to the increase in income. This is because as people become richer, there is a relative decline in the importance of food and other non durable goods in the overall consumption basket and a rise in the importance of durable goods such as a TV, car, house etc.

- There are some commodities for which the quantity demanded rises only up to a certain level of income and decreases with an increase in money income beyond this level. These goods are called inferior goods.

- The same good may be normal for one condition and may be inferior in another.

- For example, Bajra may become an inferior good for a person when his income increases above a certain level and he can now afford better substitutes such as wheat.

- Demand for luxury goods and prestige goods arise beyond a certain level of consumers’ income and keep rising as income increases.

- Business managers should be fully aware of the nature of goods which they produce (or the nature of need which their products satisfy) and the nature of the relationship of quantities demanded with changes in consumer incomes. For assessing the current as well as future demand for their products, they should also recognize the movements in the macroeconomic variables that affect the incomes of the consumers.

Tastes and preferences of consumers

- The demand for a commodity also depends upon the tastes and preferences of consumers and changes in them over a period of time.

- Goods that are modern or more in fashion command higher demand than goods that are of old design and out of fashion. Consumers may perceive a product as obsolete and discard it before it is fully utilised and prefer another good which is currently in fashion.

- For example, there is greater demand for LCD/LED televisions and more and more people are discarding their ordinary television sets even though they could have used them for some more years.

Demonstration effect or bandwagon effect

- It plays an important role in determining the demand for a product.

- An individual’s demand for LCD/LED television may be affected by his seeing one in his neighbour’s or friend’s house, either because he likes what he sees or because he figures out that if his neighbour or friend can afford it, he too can.

- A person may develop a taste or preference for wine after tasting some, but he may also develop it after discovering that serving it enhances his prestige.

- On the contrary, when a product becomes common among all, some people decrease or altogether stop its consumption. This is called ‘snob effect’.

- Highly priced goods are consumed by status seeking rich people to satisfy their need for conspicuous consumption. This is called ‘Veblen effect’ (named after the American economist Thorstein Veblen). In any case, people have tastes and preferences and these change, sometimes, due to external and sometimes, due to internal causes and influence demand.

- Knowledge regarding tastes and preferences is valuable for the manufacturers as it would help them plan production appropriately and design new models of products and services to suit the changing tastes and needs of the customers.

Consumers’ Expectations

- Consumers’ expectations regarding future prices, income, supply conditions etc. influence current demand.

- If the consumers expect increase in future prices, increase in income and shortages in supply, more quantities will be demanded.

- If they expect a fall in price, they will postpone their purchases of nonessential commodities and therefore, the current demand for them will fall.

Other Factors

Apart from the above factors, the demand for a commodity depends upon the following factors:

- Size of population: Generally, larger the size of population of a country or a region, greater is the demand for commodities in general.

- Composition of population: If there are more old people in a region, the demand for spectacles, walking sticks, etc. will be high. Similarly, if the population consists of more of children, demand for toys, baby foods, toffees, etc. will be more.

- The level of National Income and its Distribution: The level of national income is a crucial determinant of market demand. Higher the national income, higher will be the demand for all normal goods and services. The wealth of a country may be unevenly distributed so that there are a few very rich people while the majority are very poor. Under such conditions, the propensity to consume of the country will be relatively less, because the propensity to consume of the rich people is less than that of the poor people. Consequently, the demand for consumer goods will be comparatively less. If the distribution of income is more equal, then the propensity to consume of the country as a whole will be relatively high indicating higher demand for goods.

- Consumer-credit facility and interest rates: Availability of credit facilities induces people to purchase more than what their current incomes permit them. Credit facilities mostly determine the demand for durable goods which are expensive and require bulk payments at the time of purchase. Low rates of interest encourage people to borrow and therefore demand will be more. Apart from above, factors such as government policy in respect of taxes and subsidies, business conditions, wealth, socioeconomic class, group, level of education, marital status, weather conditions, salesmanship and advertisements, habits, customs and conventions also play an important role in influencing demand.

Demand Function

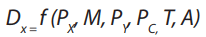

As we know, a function is a symbolic statement of a relationship between the dependent and the independent variables.The demand function states the relationship between the demand for a product (the dependent variable) and its determinants (the independent or explanatory variables). A demand function may be expressed as follows:

- Where Dx is the quantity demanded of product X

- PX is the price of the commodity

- M is the money income of the consumer

- PY is the price of its substitutes

- PC is the price of its complementary goods

- T is consumer tastes, and preferences

- A is advertisement expenditure

Law of Demand

- The law of demand is one of the most important laws of economic theory.

- The law states the nature of relationship between the quantity demanded of a product and its price.

- According to the law of demand, other things being equal, if the price of a commodity falls, the quantity demanded of it will rise and if the price of a commodity rises, its quantity demanded will decline.

- Thus, there is an inverse relationship between price and quantity demanded, ceteris paribus.

- The other things which are assumed to be equal or constant are the prices of related commodities, income of consumers, tastes and preferences of consumers, and such other factors which in uence demand. If these factors which determine demand also undergo a change, then the inverse price-demand relationship may not hold good.

- For example, if incomes of consumers increase, then an increase in the price of a commodity, may not result in a decrease in the quantity demanded of it. Thus, the constancy of these other factors is an important assumption of the law of demand.

- Definition of the Law of Demand

Prof. Alfred Marshall defined the Law as: “The greater the amount to be sold, the smaller must be the price at which it is offered in order that it may find purchasers or in other words the amount demanded increases with a fall in price and diminishes with a rise in price”

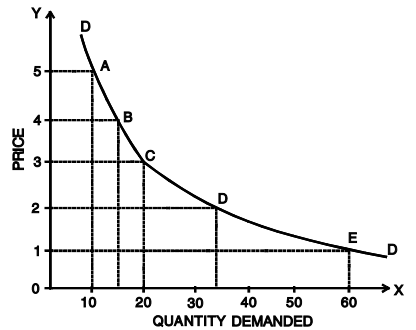

The Law of Demand may be illustrated with the help of a demand schedule and a demand curve.

Demand Schedule

A demand schedule is a table which presents the different prices of a good and the corresponding quantity demanded per unit of time. To illustrate the relation between the quantity of a commodity demanded and its price, we may take a hypothetical data for prices and quantities of commodity X. A demand schedule is drawn upon the assumption that all the other influences remain unchanged. It thus attempts to isolate the influence exerted by the price of the good upon the amount sold.Table 1 : Demand schedule of an individual consumer

| Price (in Rupees) | Quantity demanded (Units) | |

| A B C D E | 5 4 3 2 1 | 10 15 20 35 60 |

When the price of commodity X is ₹ 5 per unit, the consumer purchases 10 units of the commodity. When the price falls to ₹ 4, he purchases 15 units of the commodity. Similarly, when the price further falls, the quantity demanded by him goes on rising until at price ₹ 1, the quantity demanded by him rises to 60 units. The above table depicts an inverse relationship between price and quantity demanded; as the price of the commodity X goes on rising, its demand goes on falling.

Demand curve

A demand curve is a graphical presentation of the demand schedule. It is obtained by plotting a demand schedule. We can now plot the data from Table 1 on a graph with price on the vertical axis and quantity on the horizontal axis. In Fig. 1, we have shown such a graph and plotted the five points corresponding to each price-quantity combination shown in Table 1. Point A shows the same information as the first row of Table 1, that at ₹ 5 per unit, only 10 units of X will be demanded. Point E shows the same information as does the last row of the table, when the price is Re 1, the quantity demanded will be 60 units

Demand Curve for Commodity XWe now draw a smooth curve through these points. The curve is called the demand curve for commodity ‘X’. It has a negative slope. The curve shows the quantity of ‘X’ that a consumer would like to buy at each price; its downward slope indicates that the quantity of ‘X’ demanded increases as its price falls. Briefy put, more of a good will be purchased at lower prices. Thus the downward sloping demand curve is in accordance with the law of demand which, as stated above, describes an inverse price-demand relationship.

Demand Curve for Commodity XWe now draw a smooth curve through these points. The curve is called the demand curve for commodity ‘X’. It has a negative slope. The curve shows the quantity of ‘X’ that a consumer would like to buy at each price; its downward slope indicates that the quantity of ‘X’ demanded increases as its price falls. Briefy put, more of a good will be purchased at lower prices. Thus the downward sloping demand curve is in accordance with the law of demand which, as stated above, describes an inverse price-demand relationship.

FAQs on ICAI Notes- Unit 1: Law of Demand- 1 - CA Foundation

| 1. What is the meaning of demand? |  |

| 2. What are the determinants of demand? |  |

| 3. What is a demand function? |  |

| 4. What is the law of demand? |  |

| 5. What is a demand schedule? |  |